Gulf Island Fabrication, Inc. (NASDAQ: GIFI) (“Gulf Island”

or the “Company”), a leading steel fabricator and service

provider to the industrial and energy sectors, today announced

results for the second quarter 2024.

SECOND QUARTER 2024 SUMMARY

- Consolidated revenue of $41.3 million

- Consolidated net income of $1.9 million; EBITDA of $2.5

million

- Services division operating income of $2.2 million; EBITDA of

$2.7 million

- Fabrication division operating income of $1.1 million; EBITDA

of $1.8 million

- Cash and short-term investments balance of $63.1 million at

June 30, 2024

- Revising full-year 2024 financial guidance

Consolidated revenue for the second quarter 2024

was $41.3 million, compared to consolidated revenue of $39.3

million for the prior year period. Consolidated net income for the

second quarter 2024 was $1.9 million, compared to consolidated net

income of $1.1 million for the prior year period. Consolidated

EBITDA for the second quarter 2024 was $2.5 million, compared to

consolidated EBITDA of $2.1 million for the prior year period (and

consolidated adjusted EBITDA for the prior year period of $4.1

million, which excludes losses of $1.9 million for the Shipyard

division). See “Non-GAAP Measures” below for the Company’s

definition of EBITDA and adjusted EBITDA and reconciliations of the

relevant amounts to the most comparable GAAP measures.

MANAGEMENT COMMENTARY

“We delivered another period of stable,

profitable operating results and made continued progress on our

strategic objectives during the second quarter,” said Richard Heo,

Gulf Island’s President and Chief Executive Officer. “While our

second quarter results were negatively impacted by customer driven

project delays in our Services division, consolidated revenue still

increased nearly 5% compared to the prior year period, driven by a

27% year-over-year increase in Fabrication division revenue on the

continued strength of small-scale fabrication. We experienced a

less favorable project mix in our Fabrication division during the

quarter, which impacted margins; however, we remain encouraged by

the trends in the division and remain on track for our full-year

Fabrication division EBITDA guidance.”

“We continue to benefit from strength in the

offshore services market; however, our second quarter Services

results were impacted by customer driven project delays and our

incremental investment spending in certain growth initiatives,”

continued Heo. “The delays were primarily related to project

opportunities for Spark Safety, and while we are working hard to

make up for the impact of these delays, it is difficult to quickly

recover from project slippage given the nature of our Services

business. These delays, combined with our incremental investment

spending, both of which will continue into the second half of the

year, are expected to cause us to fall short of our prior full-year

Services division EBITDA guidance. As a result, we are revising our

initial $14 million full-year Services division EBITDA guidance to

a range of $11 to $13 million. Despite revising our Services

division guidance, we remain optimistic by the outlook for our

Services division, especially as we continue to invest in new

growth businesses. To that end, during the second quarter we

launched our cleaning and environmental services (“CES”) business

line, which expands our services offerings to better support

de-commissioning activity in the Gulf of Mexico. We are looking for

a potential contribution from these activities during the second

half of the year with a more significant ramp up during 2025.”

“We generated another quarter of positive free

cash flow, and as a result, our cash and short-term investments

balance totaled approximately $63 million at quarter end,” stated

Westley Stockton, Gulf Island’s Chief Financial Officer. “Our

balance sheet provides us ample financial flexibility to pursue our

growth objectives, which includes investments in organic

initiatives such as Spark Safety and our new CES offering, as well

as potential strategic opportunities.”

“We have significantly improved the

predictability and stability of our financial results in recent

years, but in our business, project timing and mix will always be a

factor in our quarterly operating performance. So, while short-term

factors negatively impacted our second quarter results and

full-year outlook, we remain confident in the long-term

opportunities for Gulf Island. We have established a stable, cash

generative base business that is well positioned for profitable

growth and provides us with the ability to invest in new growth

opportunities and other complementary businesses. We continue to

see an active bidding environment for large fabrication projects,

and our base of services customers are projecting increased capital

spending in 2025. These factors, combined with our strong financial

position, provide us with several avenues for potential value

creation, and as we continue to execute on our strategic plan, we

are confident in our ability to deliver shareholder value in the

coming years,” concluded Heo.

DIVISION RESULTS FOR SECOND QUARTER

2024

Services Division – Revenue for

the second quarter 2024 was $22.8 million, a decrease of $1.7

million, or 7.0%, compared to the second quarter 2023. The decrease

was primarily due to lower new project awards driven by delayed

timing of certain project opportunities.

New project awards were $22.4 million for the

second quarter 2024, an 8.0% year-over-year decrease, and backlog

totaled $0.1 million at June 30, 2024. The decline in new

awards was primarily due to lower offshore services work driven by

delayed timing of certain project opportunities. See “Non-GAAP

Measures” below for the Company’s definition of new project awards

and backlog.

Operating income was $2.2 million for the second

quarter 2024, compared to $3.3 million for the second quarter 2023.

EBITDA for the second quarter 2024 was $2.7 million (or 11.7% of

revenue), down from $3.8 million (or 15.4% of revenue) for the

prior year period, primarily due to lower revenue, a less favorable

project margin mix and investments associated with the start-up of

the division’s CES business line. See “Non-GAAP Measures” below for

the Company’s definition of EBITDA and a reconciliation of the

Services division’s operating income to EBITDA.

Fabrication Division – Revenue

for the second quarter 2024 was $18.7 million, an increase of $4.0

million, or 27.0%, compared to the second quarter 2023. The

increase was primarily due to higher small-scale fabrication

activity.

New project awards were $17.6 million for the

second quarter 2024, a 31.0% year-over-year increase, and backlog

totaled $11.8 million at June 30, 2024. The increase in new

awards was primarily due to higher small-scale fabrication work.

See “Non-GAAP Measures” below for the Company’s definition of new

project awards and backlog.

Operating income was $1.1 million for the second

quarter 2024, compared to $1.3 million for the second quarter 2023.

EBITDA for the second quarter 2024 was $1.8 million, down from $2.1

million for the prior year period, primarily due to a less

favorable project margin mix, partially offset by higher revenue

and improved utilization of facilities and resources associated

with increased small-scale fabrication activity. See “Non-GAAP

Measures” below for the Company’s definition of EBITDA and a

reconciliation of the Fabrication division’s operating income to

EBITDA.

Shipyard Division – Revenue for

the second quarter 2024 was not significant, compared to $0.4

million for the second quarter 2023, and was related to the

division’s seventy-vehicle ferry and forty-vehicle ferry projects.

Operating income was break-even for the second quarter 2024,

compared to an operating loss of $1.9 million for the prior year

period. The wind down of the Shipyard segment operations was

substantially completed in the fourth quarter 2023, with final

completion anticipated to occur upon completion of the warranty

periods for the ferries.

Corporate Division – Operating

loss was $2.0 million for the second quarter 2024, compared to an

operating loss of $1.9 million for the second quarter 2023. EBITDA

for the second quarter 2024 was a loss of $2.0 million, versus a

loss of $1.8 million for the prior year period. See “Non-GAAP

Measures” below for the Company’s definition of EBITDA and a

reconciliation of the Corporate division’s operating loss to

EBITDA.

BALANCE SHEET AND LIQUIDITY

The Company’s cash and short-term investments

balance at June 30, 2024 was $63.1 million, including $1.5

million of restricted cash associated with outstanding letters of

credit. At June 30, 2024, the Company had total debt of $20.0

million, bearing interest at a fixed rate of 3.0% per annum, with

principal and interest payable in 15 equal annual installments of

approximately $1.7 million, beginning on December 31, 2024 and

ending on December 31, 2038. The estimated present value of the

debt is $13.4 million based on an estimated market rate of

interest.

2024 FINANCIAL OUTLOOK

Gulf Island is revising its full-year 2024

Services division EBITDA guidance, which is expected to be

approximately $11.0 million to $13.0 million, a reduction from

prior guidance of $14.0 million. The reduction is primarily due to

delays in the timing of project opportunities for the Spark Safety

business line and incremental investment spending on growth

initiatives.

Full-year 2024 EBITDA guidance for the

Fabrication division and Corporate division are unchanged from

prior guidance:

- Fabrication division adjusted

EBITDA is expected to be approximately $8.0 million, and assumes

year-over-year growth in the small-scale fabrication business. The

adjusted EBITDA forecast continues to exclude the potential benefit

of any large project award and excludes a gain of $2.9 million in

the first quarter 2024 from the sale of property that was held for

sale at December 31, 2023.

- Corporate division EBITDA is

expected to be a loss of approximately $8.0 million, which is

consistent with recent historical experience.

This forward-looking guidance reflects

management’s current expectations and beliefs as of August 6, 2024,

and is subject to change. See “Cautionary Statement” below for

further discussion of the factors that may affect the Company’s

future performance, “Non-GAAP Measures” below for the Company’s

definition of EBITDA and adjusted EBITDA, and “2024 Financial

Outlook - Division and Consolidated EBITDA and Adjusted EBITDA

Reconciliations” below for reconciliations of division and

consolidated EBITDA and adjusted EBITDA to the most comparable GAAP

measures.

SECOND QUARTER 2024 CONFERENCE CALL

Gulf Island will hold a conference call on

Tuesday, August 6, 2024 at 4:00 p.m. Central Time (5:00 p.m.

Eastern Time) to discuss the Company’s financial results. The call

will be available by webcast and can be accessed on Gulf Island’s

website at www.gulfisland.com. Participants may also join the call

by dialing 1.877.704.4453 and requesting the “Gulf Island”

conference call. A replay of the webcast will be available on the

Company’s website for seven days after the call.

ABOUT GULF ISLAND

Gulf Island is a leading fabricator of complex

steel structures and modules and provider of specialty services,

including project management, hookup, commissioning, repair,

maintenance, scaffolding, coatings, welding enclosures, civil

construction and cleaning and environmental services to the

industrial and energy sectors. The Company’s customers include U.S.

and, to a lesser extent, international energy producers; refining,

petrochemical, LNG, industrial and power operators; and EPC

companies. The Company is headquartered in The Woodlands, Texas and

its primary operating facilities are located in Houma,

Louisiana.

NON-GAAP MEASURES

This release includes certain non-GAAP measures,

including earnings before interest, taxes, depreciation and

amortization (“EBITDA”), adjusted EBITDA, adjusted revenue,

adjusted gross profit, new project awards and backlog. The Company

believes EBITDA is a useful supplemental measure as it reflects the

Company’s operating results and expectations of future performance

excluding the non-cash impacts of depreciation and amortization.

The Company believes adjusted EBITDA is a useful supplemental

measure as it reflects the Company’s EBITDA adjusted to remove

certain nonrecurring items (including a gain from the sale of

assets held for sale and gains from the impact of insurance

recoveries and costs associated with damage previously caused by

Hurricane Ida) and the operating results for the Company’s Shipyard

division (the wind down of which was substantially complete in the

fourth quarter 2023). The Company believes adjusted revenue and

adjusted gross profit are useful supplemental measures as they

reflect the Company’s revenue and gross profit or loss, adjusted to

remove revenue and gross profit or loss, for the Company’s Shipyard

division (the wind down of which was substantially complete in the

fourth quarter 2023). Reconciliations of EBITDA, adjusted EBITDA,

adjusted revenue and adjusted gross profit to the most comparable

GAAP measures are presented under “Consolidated Results of

Operations,” “Results of Operations by Division” and “2024

Financial Outlook – Division and Consolidated EBITDA and Adjusted

EBITDA Reconciliations” below.

The Company believes new project awards and

backlog are useful supplemental measures as they represent work

that the Company is obligated to perform under its current

contracts. New project awards represent the expected revenue value

of new contract commitments received during a given period,

including scope growth on existing contract commitments. Backlog

represents the unrecognized revenue value of new project awards,

and at June 30, 2024, was consistent with the value of

remaining performance obligations for contracts as determined under

GAAP.

Non-GAAP measures are not intended to be

replacements or alternatives to GAAP measures, and investors are

urged to consider these non-GAAP measures in addition to, and not

in substitution for, measures prepared in accordance with GAAP. The

Company may present or calculate non-GAAP measures differently from

other companies.

CAUTIONARY STATEMENT

This release contains forward-looking statements

in which the Company discusses its potential future performance,

operations and projects. Forward-looking statements, within the

meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995, are all statements other

than statements of historical facts, such as projections or

expectations relating to operating results, including 2024

full-year guidance; diversification and entry into new end markets;

industry outlook; timing of investment decisions and new project

awards; cash flows and cash balance; capital expenditures;

liquidity; and execution of strategic initiatives. The words

“anticipates,” “may,” “can,” “plans,” “believes,” “estimates,”

“expects,” “projects,” “intends,” “likely,” “will,” “to be,”

“potential” and any similar expressions are intended to identify

those assertions as forward-looking statements. The timing and

amount of any share repurchases will be at the discretion of

management and will depend on a variety of factors including, but

not limited to, the Company’s operating performance, cash flow and

financial position, the market price of its common stock and

general economic and market conditions. The share repurchase

program may be modified, increased, suspended or terminated at any

time at the Board’s discretion.

The Company cautions readers that

forward-looking statements are not guarantees of future performance

and actual results may differ materially from those anticipated,

projected or assumed in the forward-looking statements. Important

factors that can cause its actual results to differ materially from

those anticipated in the forward-looking statements include: supply

chain disruptions, inflationary pressures, economic slowdowns and

recessions, natural disasters, public health crises, labor costs

and geopolitical conflicts, and the related volatility in oil and

gas prices and other factors impacting the global economy; cyclical

nature of the oil and gas industry; competition; reliance on

significant customers; competitive pricing and cost overruns on its

projects; performance of subcontractors and dependence on

suppliers; timing and its ability to secure and commence execution

of new project awards, including fabrication projects for refining,

petrochemical, LNG, industrial and sustainable energy end markets;

its ability to maintain and further improve project execution;

nature of its contract terms and customer adherence to such terms;

suspension or termination of projects; changes in contract

estimates; customer or subcontractor disputes; operating dangers,

weather events and availability and limits on insurance coverage;

operability and adequacy of its major equipment; its ability to

raise additional capital; its ability to amend or obtain new debt

financing or credit facilities on favorable terms; its ability to

generate sufficient cash flow; its ability to resolve any material

legal proceedings; its ability to execute its share repurchase

program and enhance shareholder value; its ability to obtain

letters of credit or surety bonds and ability to meet any

indemnification obligations thereunder; consolidation of its

customers; financial ability and credit worthiness of its

customers; adjustments to previously reported profits or losses

under the percentage-of-completion method; its ability to employ a

skilled workforce; loss of key personnel; utilization of facilities

or closure or consolidation of facilities; failure of its safety

assurance program; barriers to entry into new lines of business;

weather impacts to operations; any future asset impairments;

changes in trade policies of the U.S. and other countries;

compliance with regulatory and environmental laws; lack of

navigability of canals and rivers; systems and information

technology interruption or failure and data security breaches;

performance of partners in any future joint ventures and other

strategic alliances; shareholder activism; and other factors

described under “Risk Factors” in Part I, Item 1A of the Company’s

annual report on Form 10-K for the year ended December 31, 2023, as

updated by subsequent filings with the SEC.

Additional factors or risks that the Company

currently deems immaterial, that are not presently known to the

Company or that arise in the future could also cause the Company’s

actual results to differ materially from its expected results.

Given these uncertainties, investors are cautioned that many of the

assumptions upon which the Company’s forward-looking statements are

based are likely to change after the date the forward-looking

statements are made, which it cannot control. Further, the Company

may make changes to its business plans that could affect its

results. The Company cautions investors that it undertakes no

obligation to publicly update or revise any forward-looking

statements, which speak only as of the date made, for any reason,

whether as a result of new information, future events or

developments, changed circumstances, or otherwise, and

notwithstanding any changes in its assumptions, changes in business

plans, actual experience or other changes.

COMPANY INFORMATION

|

Richard W. Heo |

Westley S. Stockton |

|

Chief Executive Officer |

Chief Financial Officer |

|

713.714.6100 |

713.714.6100 |

Consolidated Results of

Operations(1) (in thousands, except per share data)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

New project awards(2) |

|

$ |

39,810 |

|

|

$ |

43,818 |

|

|

$ |

37,274 |

|

|

$ |

83,628 |

|

|

$ |

74,902 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

41,262 |

|

|

$ |

42,881 |

|

|

$ |

39,326 |

|

|

$ |

84,143 |

|

|

$ |

101,494 |

|

| Cost of revenue |

|

|

37,104 |

|

|

|

36,757 |

|

|

|

34,845 |

|

|

|

73,861 |

|

|

|

91,979 |

|

|

Gross profit(3) |

|

|

4,158 |

|

|

|

6,124 |

|

|

|

4,481 |

|

|

|

10,282 |

|

|

|

9,515 |

|

| General and administrative expense(4) |

|

|

3,354 |

|

|

|

3,484 |

|

|

|

3,736 |

|

|

|

6,838 |

|

|

|

8,803 |

|

| Other (income) expense, net(5) |

|

|

(479 |

) |

|

|

(3,068 |

) |

|

|

(4 |

) |

|

|

(3,547 |

) |

|

|

(365 |

) |

|

Operating income |

|

|

1,283 |

|

|

|

5,708 |

|

|

|

749 |

|

|

|

6,991 |

|

|

|

1,077 |

|

| Interest (expense) income, net |

|

|

603 |

|

|

|

542 |

|

|

|

340 |

|

|

|

1,145 |

|

|

|

660 |

|

|

Income before income taxes |

|

|

1,886 |

|

|

|

6,250 |

|

|

|

1,089 |

|

|

|

8,136 |

|

|

|

1,737 |

|

| Income tax (expense) benefit |

|

|

3 |

|

|

|

(10 |

) |

|

|

13 |

|

|

|

(7 |

) |

|

|

6 |

|

|

Net income |

|

$ |

1,889 |

|

|

$ |

6,240 |

|

|

$ |

1,102 |

|

|

$ |

8,129 |

|

|

$ |

1,743 |

|

| Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic income per share |

|

$ |

0.12 |

|

|

$ |

0.38 |

|

|

$ |

0.07 |

|

|

$ |

0.50 |

|

|

$ |

0.11 |

|

|

Diluted income per share |

|

$ |

0.11 |

|

|

$ |

0.37 |

|

|

$ |

0.07 |

|

|

$ |

0.48 |

|

|

$ |

0.11 |

|

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

16,415 |

|

|

|

16,215 |

|

|

|

16,201 |

|

|

|

16,315 |

|

|

|

16,098 |

|

|

Diluted |

|

|

16,864 |

|

|

|

16,755 |

|

|

|

16,349 |

|

|

|

16,810 |

|

|

|

16,354 |

|

Consolidated Adjusted Revenue(2) Reconciliation

(in thousands)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue |

|

$ |

41,262 |

|

|

$ |

42,881 |

|

|

$ |

39,326 |

|

|

$ |

84,143 |

|

|

$ |

101,494 |

|

| Less: Shipyard revenue |

|

|

(36 |

) |

|

|

(409 |

) |

|

|

(382 |

) |

|

|

(445 |

) |

|

|

(1,729 |

) |

|

Adjusted revenue |

|

$ |

41,226 |

|

|

$ |

42,472 |

|

|

$ |

38,944 |

|

|

$ |

83,698 |

|

|

$ |

99,765 |

|

Consolidated Adjusted Gross Profit(2)

Reconciliation (in thousands)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Gross

profit |

|

$ |

4,158 |

|

|

$ |

6,124 |

|

|

$ |

4,481 |

|

|

$ |

10,282 |

|

|

$ |

9,515 |

|

| Add (less): Shipyard gross loss (profit) |

|

|

(31 |

) |

|

|

(319 |

) |

|

|

1,184 |

|

|

|

(350 |

) |

|

|

1,599 |

|

|

Adjusted gross profit |

|

$ |

4,127 |

|

|

$ |

5,805 |

|

|

$ |

5,665 |

|

|

$ |

9,932 |

|

|

$ |

11,114 |

|

Consolidated EBITDA and Adjusted EBITDA(2)

Reconciliations (in thousands)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net

income |

|

$ |

1,889 |

|

|

$ |

6,240 |

|

|

$ |

1,102 |

|

|

$ |

8,129 |

|

|

$ |

1,743 |

|

| Less: Income tax (expense) benefit |

|

|

3 |

|

|

|

(10 |

) |

|

|

13 |

|

|

|

(7 |

) |

|

|

6 |

|

| Less: Interest (expense) income, net |

|

|

603 |

|

|

|

542 |

|

|

|

340 |

|

|

|

1,145 |

|

|

|

660 |

|

|

Operating income |

|

|

1,283 |

|

|

|

5,708 |

|

|

|

749 |

|

|

|

6,991 |

|

|

|

1,077 |

|

| Add: Depreciation and amortization |

|

|

1,240 |

|

|

|

1,193 |

|

|

|

1,392 |

|

|

|

2,433 |

|

|

|

2,725 |

|

|

EBITDA |

|

|

2,523 |

|

|

|

6,901 |

|

|

|

2,141 |

|

|

|

9,424 |

|

|

|

3,802 |

|

| Less: Gain on property sale(5) |

|

|

- |

|

|

|

(2,880 |

) |

|

|

- |

|

|

|

(2,880 |

) |

|

|

- |

|

| Add (Less): Hurricane insurance charges (gains)(5) |

|

|

- |

|

|

|

- |

|

|

|

17 |

|

|

|

- |

|

|

|

(171 |

) |

| Add (less): Shipyard operating loss (income) |

|

|

(9 |

) |

|

|

(342 |

) |

|

|

1,948 |

|

|

|

(351 |

) |

|

|

4,151 |

|

|

Adjusted EBITDA |

|

$ |

2,514 |

|

|

$ |

3,679 |

|

|

$ |

4,106 |

|

|

$ |

6,193 |

|

|

$ |

7,782 |

|

_________________

|

(1) |

See “Results of Operations by Division” below for results by

division. |

|

(2) |

New projects awards, adjusted revenue, adjusted gross profit,

EBITDA and adjusted EBITDA are non-GAAP measures. See “Non-GAAP

Measures” above for the Company’s definition of new project awards,

adjusted revenue, adjusted gross profit, EBITDA and adjusted

EBITDA. |

|

(3) |

Gross profit (loss) for the Shipyard division for each of the three

and six months ended June 30, 2023, includes project charges of

$0.8 million, and for the three and six months ended June 30, 2023,

includes vessel holding costs of $0.2 million and $0.5 million,

respectively, associated with the Company’s previous MPSV

Litigation. |

|

(4) |

General and administrative expense for the Shipyard division for

the three and six months ended June 30, 2023, includes legal and

advisory fees of $0.5 million and $2.3 million, respectively,

associated with the Company’s previous MPSV Litigation. |

|

(5) |

Other (income) expense for the Fabrication division for each of the

three months ended March 31, 2024 and six months ended June 30,

2024, includes a gain of $2.9 million from the sale of assets held

for sale, and for the six months ended June 30, 2023, includes

gains of $0.2 million from the net impact of insurance recoveries

and costs associated with damage previously caused by Hurricane

Ida. Such amounts have been removed from EBITDA to derive adjusted

EBITDA. |

|

|

|

Results of Operations by Division

(including Reconciliations of EBITDA and Adjusted EBITDA)

(in thousands)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| Services Division |

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

New project awards(1) |

|

$ |

22,392 |

|

|

$ |

25,468 |

|

|

$ |

24,330 |

|

|

$ |

47,860 |

|

|

$ |

45,802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

22,767 |

|

|

$ |

25,534 |

|

|

$ |

24,470 |

|

|

$ |

48,301 |

|

|

$ |

46,057 |

|

| Cost of revenue |

|

|

19,879 |

|

|

|

21,921 |

|

|

|

20,369 |

|

|

|

41,800 |

|

|

|

38,969 |

|

|

Gross profit |

|

|

2,888 |

|

|

|

3,613 |

|

|

|

4,101 |

|

|

|

6,501 |

|

|

|

7,088 |

|

| General and administrative expense |

|

|

687 |

|

|

|

743 |

|

|

|

792 |

|

|

|

1,430 |

|

|

|

1,502 |

|

| Other (income) expense, net |

|

|

12 |

|

|

|

3 |

|

|

|

40 |

|

|

|

15 |

|

|

|

(24 |

) |

|

Operating income |

|

$ |

2,189 |

|

|

$ |

2,867 |

|

|

$ |

3,269 |

|

|

$ |

5,056 |

|

|

$ |

5,610 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

2,189 |

|

|

$ |

2,867 |

|

|

$ |

3,269 |

|

|

$ |

5,056 |

|

|

$ |

5,610 |

|

| Add: Depreciation and amortization |

|

|

486 |

|

|

|

480 |

|

|

|

496 |

|

|

|

966 |

|

|

|

938 |

|

|

EBITDA |

|

$ |

2,675 |

|

|

$ |

3,347 |

|

|

$ |

3,765 |

|

|

$ |

6,022 |

|

|

$ |

6,548 |

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| Fabrication Division |

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

New project awards(1) |

|

$ |

17,610 |

|

|

$ |

18,272 |

|

|

$ |

13,438 |

|

|

$ |

35,882 |

|

|

$ |

30,144 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

18,727 |

|

|

$ |

17,138 |

|

|

$ |

14,741 |

|

|

$ |

35,865 |

|

|

$ |

54,403 |

|

| Cost of revenue |

|

|

17,488 |

|

|

|

14,946 |

|

|

|

13,177 |

|

|

|

32,434 |

|

|

|

50,377 |

|

|

Gross profit |

|

|

1,239 |

|

|

|

2,192 |

|

|

|

1,564 |

|

|

|

3,431 |

|

|

|

4,026 |

|

| General and administrative expense |

|

|

545 |

|

|

|

441 |

|

|

|

470 |

|

|

|

986 |

|

|

|

990 |

|

| Other (income) expense, net(2) |

|

|

(435 |

) |

|

|

(2,970 |

) |

|

|

(201 |

) |

|

|

(3,405 |

) |

|

|

(503 |

) |

|

Operating income |

|

$ |

1,129 |

|

|

$ |

4,721 |

|

|

$ |

1,295 |

|

|

$ |

5,850 |

|

|

$ |

3,539 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA and Adjusted EBITDA(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

1,129 |

|

|

$ |

4,721 |

|

|

$ |

1,295 |

|

|

$ |

5,850 |

|

|

$ |

3,539 |

|

| Add: Depreciation and amortization |

|

|

674 |

|

|

|

635 |

|

|

|

825 |

|

|

|

1,309 |

|

|

|

1,647 |

|

|

EBITDA |

|

|

1,803 |

|

|

|

5,356 |

|

|

|

2,120 |

|

|

|

7,159 |

|

|

|

5,186 |

|

| Less: Gain on property sale(2) |

|

|

- |

|

|

|

(2,880 |

) |

|

|

- |

|

|

|

(2,880 |

) |

|

|

- |

|

| Add (Less): Hurricane insurance charges (gains)(2) |

|

|

- |

|

|

|

- |

|

|

|

17 |

|

|

|

- |

|

|

|

(171 |

) |

|

Adjusted EBITDA |

|

$ |

1,803 |

|

|

$ |

2,476 |

|

|

$ |

2,137 |

|

|

$ |

4,279 |

|

|

$ |

5,015 |

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| Shipyard Division |

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

New project awards(1) |

|

$ |

76 |

|

|

$ |

278 |

|

|

$ |

(227 |

) |

|

$ |

354 |

|

|

$ |

(349 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

36 |

|

|

$ |

409 |

|

|

$ |

382 |

|

|

$ |

445 |

|

|

$ |

1,729 |

|

| Cost of revenue |

|

|

5 |

|

|

|

90 |

|

|

|

1,566 |

|

|

|

95 |

|

|

|

3,328 |

|

|

Gross profit (loss)(3) |

|

|

31 |

|

|

|

319 |

|

|

|

(1,184 |

) |

|

|

350 |

|

|

|

(1,599 |

) |

| General and administrative expense(4) |

|

|

- |

|

|

|

- |

|

|

|

537 |

|

|

|

- |

|

|

|

2,250 |

|

| Other (income) expense, net |

|

|

22 |

|

|

|

(23 |

) |

|

|

227 |

|

|

|

(1 |

) |

|

|

302 |

|

|

Operating income (loss) |

|

$ |

9 |

|

|

$ |

342 |

|

|

$ |

(1,948 |

) |

|

$ |

351 |

|

|

$ |

(4,151 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

$ |

9 |

|

|

$ |

342 |

|

|

$ |

(1,948 |

) |

|

$ |

351 |

|

|

$ |

(4,151 |

) |

| Add: Depreciation and amortization |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

EBITDA |

|

$ |

9 |

|

|

$ |

342 |

|

|

$ |

(1,948 |

) |

|

$ |

351 |

|

|

$ |

(4,151 |

) |

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| Corporate Division |

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| New project

awards (eliminations)(1) |

|

$ |

(268 |

) |

|

$ |

(200 |

) |

|

$ |

(267 |

) |

|

$ |

(468 |

) |

|

$ |

(695 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue (eliminations) |

|

$ |

(268 |

) |

|

$ |

(200 |

) |

|

$ |

(267 |

) |

|

$ |

(468 |

) |

|

$ |

(695 |

) |

| Cost of revenue |

|

|

(268 |

) |

|

|

(200 |

) |

|

|

(267 |

) |

|

|

(468 |

) |

|

|

(695 |

) |

|

Gross profit |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| General and administrative expense |

|

|

2,122 |

|

|

|

2,300 |

|

|

|

1,937 |

|

|

|

4,422 |

|

|

|

4,061 |

|

| Other (income) expense, net |

|

|

(78 |

) |

|

|

(78 |

) |

|

|

(70 |

) |

|

|

(156 |

) |

|

|

(140 |

) |

|

Operating loss |

|

$ |

(2,044 |

) |

|

$ |

(2,222 |

) |

|

$ |

(1,867 |

) |

|

$ |

(4,266 |

) |

|

$ |

(3,921 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

$ |

(2,044 |

) |

|

$ |

(2,222 |

) |

|

$ |

(1,867 |

) |

|

$ |

(4,266 |

) |

|

$ |

(3,921 |

) |

| Add: Depreciation and amortization |

|

|

80 |

|

|

|

78 |

|

|

|

71 |

|

|

|

158 |

|

|

|

140 |

|

|

EBITDA |

|

$ |

(1,964 |

) |

|

$ |

(2,144 |

) |

|

$ |

(1,796 |

) |

|

$ |

(4,108 |

) |

|

$ |

(3,781 |

) |

_________________

|

(1) |

New projects awards, EBITDA and adjusted EBITDA are non-GAAP

measures. See “Non-GAAP Measures” above for the Company’s

definition of new project awards, EBITDA and adjusted EBITDA. |

|

(2) |

Other (income) expense for the Fabrication division for each of the

three months ended March 31, 2024 and six months ended June 30,

2024, includes a gain of $2.9 million from the sale of assets held

for sale, and for the six months ended June 30, 2023, includes

gains of $0.2 million from the net impact of insurance recoveries

and costs associated with damage previously caused by Hurricane

Ida. Such amounts have been removed from EBITDA to derive adjusted

EBITDA. |

|

(3) |

Gross profit (loss) for the Shipyard division for each of the three

and six months ended June 30, 2023, includes project charges of

$0.8 million, and for the three and six months ended June 30, 2023,

includes vessel holding costs of $0.2 million and $0.5 million,

respectively, associated with the Company’s previous MPSV

Litigation. |

|

(4) |

General and administrative expense for the Shipyard division for

the three and six months ended June 30, 2023, includes legal and

advisory fees of $0.5 million and $2.3 million, respectively,

associated with the Company’s previous MPSV Litigation. |

|

|

|

Consolidated Balance Sheets (in thousands)

|

|

|

June 30,2024 |

|

|

December 31,2023 |

|

| |

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,509 |

|

|

$ |

38,176 |

|

|

Restricted cash |

|

|

1,475 |

|

|

|

1,475 |

|

|

Short-term investments |

|

|

52,115 |

|

|

|

8,233 |

|

|

Contract receivables and retainage, net |

|

|

33,433 |

|

|

|

36,298 |

|

|

Contract assets |

|

|

2,221 |

|

|

|

2,739 |

|

|

Prepaid expenses and other assets |

|

|

4,257 |

|

|

|

6,994 |

|

|

Inventory |

|

|

2,331 |

|

|

|

2,072 |

|

|

Assets held for sale |

|

|

— |

|

|

|

5,640 |

|

|

Total current assets |

|

|

105,341 |

|

|

|

101,627 |

|

| Property, plant and equipment,

net |

|

|

24,535 |

|

|

|

23,145 |

|

| Goodwill |

|

|

2,217 |

|

|

|

2,217 |

|

| Other intangibles, net |

|

|

628 |

|

|

|

700 |

|

| Other noncurrent assets |

|

|

542 |

|

|

|

739 |

|

|

Total assets |

|

$ |

133,263 |

|

|

$ |

128,428 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

9,017 |

|

|

$ |

8,466 |

|

|

Contract liabilities |

|

|

4,129 |

|

|

|

5,470 |

|

|

Accrued expenses and other liabilities |

|

|

12,884 |

|

|

|

14,836 |

|

|

Long-term debt, current |

|

|

1,075 |

|

|

|

1,075 |

|

|

Total current liabilities |

|

|

27,105 |

|

|

|

29,847 |

|

| Long-term debt, noncurrent |

|

|

18,925 |

|

|

|

18,925 |

|

| Other noncurrent liabilities |

|

|

551 |

|

|

|

685 |

|

|

Total liabilities |

|

|

46,581 |

|

|

|

49,457 |

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, no par value, 5,000 shares authorized, no shares

issuedand outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, no par value, 30,000 shares authorized, 16,516 shares

issuedand outstanding at June 30, 2024 and 16,258 at December

31, 2023 |

|

|

11,688 |

|

|

|

11,729 |

|

|

Additional paid-in capital |

|

|

108,238 |

|

|

|

108,615 |

|

|

Accumulated deficit |

|

|

(33,244 |

) |

|

|

(41,373 |

) |

|

Total shareholders’ equity |

|

|

86,682 |

|

|

|

78,971 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

133,263 |

|

|

$ |

128,428 |

|

Consolidated Cash Flows (in thousands)

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

1,889 |

|

|

$ |

6,240 |

|

|

$ |

1,102 |

|

|

$ |

8,129 |

|

|

$ |

1,743 |

|

|

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,240 |

|

|

|

1,193 |

|

|

|

1,392 |

|

|

|

2,433 |

|

|

|

2,725 |

|

|

Change in allowance for doubtful accounts and credit losses |

|

|

— |

|

|

|

(28 |

) |

|

|

(200 |

) |

|

|

(28 |

) |

|

|

(200 |

) |

|

(Gain) loss on sale or disposal of assets held for sale and fixed

assets, net |

|

|

(701 |

) |

|

|

(3,241 |

) |

|

|

31 |

|

|

|

(3,942 |

) |

|

|

(33 |

) |

|

Gain on insurance recoveries |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(245 |

) |

|

Stock-based compensation expense |

|

|

532 |

|

|

|

506 |

|

|

|

444 |

|

|

|

1,038 |

|

|

|

953 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract receivables and retainage, net |

|

|

(6,541 |

) |

|

|

9,434 |

|

|

|

7,430 |

|

|

|

2,893 |

|

|

|

(7,110 |

) |

|

Contract assets |

|

|

2,684 |

|

|

|

(2,166 |

) |

|

|

(1,124 |

) |

|

|

518 |

|

|

|

(1,823 |

) |

|

Prepaid expenses, inventory and other current assets |

|

|

50 |

|

|

|

2,102 |

|

|

|

808 |

|

|

|

2,152 |

|

|

|

955 |

|

|

Accounts payable |

|

|

2,251 |

|

|

|

(1,712 |

) |

|

|

(9,393 |

) |

|

|

539 |

|

|

|

8,742 |

|

|

Contract liabilities |

|

|

2,389 |

|

|

|

(3,730 |

) |

|

|

(1,323 |

) |

|

|

(1,341 |

) |

|

|

(5,131 |

) |

|

Accrued expenses and other current liabilities |

|

|

(419 |

) |

|

|

(1,422 |

) |

|

|

(2,455 |

) |

|

|

(1,841 |

) |

|

|

(2,393 |

) |

|

Noncurrent assets and liabilities, net |

|

|

(96 |

) |

|

|

(157 |

) |

|

|

(201 |

) |

|

|

(253 |

) |

|

|

(376 |

) |

|

Net cash provided by (used in) operating activities |

|

|

3,278 |

|

|

|

7,019 |

|

|

|

(3,489 |

) |

|

|

10,297 |

|

|

|

(2,193 |

) |

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(1,013 |

) |

|

|

(2,553 |

) |

|

|

(569 |

) |

|

|

(3,566 |

) |

|

|

(1,056 |

) |

|

Proceeds from sale of property and equipment |

|

|

720 |

|

|

|

8,894 |

|

|

|

— |

|

|

|

9,614 |

|

|

|

106 |

|

|

Recoveries from insurance claims |

|

|

— |

|

|

|

326 |

|

|

|

— |

|

|

|

326 |

|

|

|

245 |

|

|

Purchases of short-term investments |

|

|

(35,167 |

) |

|

|

(22,170 |

) |

|

|

(177 |

) |

|

|

(57,337 |

) |

|

|

(15,260 |

) |

|

Maturities of short-term investments |

|

|

10,405 |

|

|

|

3,050 |

|

|

|

— |

|

|

|

13,455 |

|

|

|

10,000 |

|

|

Net cash used in investing activities |

|

|

(25,055 |

) |

|

|

(12,453 |

) |

|

|

(746 |

) |

|

|

(37,508 |

) |

|

|

(5,965 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments on Insurance Finance Arrangements |

|

|

— |

|

|

|

— |

|

|

|

(126 |

) |

|

|

— |

|

|

|

(1,129 |

) |

|

Tax payments for vested stock withholdings |

|

|

(1,183 |

) |

|

|

— |

|

|

|

(301 |

) |

|

|

(1,183 |

) |

|

|

(482 |

) |

|

Repurchases of common stock |

|

|

— |

|

|

|

(273 |

) |

|

|

— |

|

|

|

(273 |

) |

|

|

— |

|

|

Net cash used in financing activities |

|

|

(1,183 |

) |

|

|

(273 |

) |

|

|

(427 |

) |

|

|

(1,456 |

) |

|

|

(1,611 |

) |

| Net decrease in cash, cash

equivalents and restricted cash |

|

|

(22,960 |

) |

|

|

(5,707 |

) |

|

|

(4,662 |

) |

|

|

(28,667 |

) |

|

|

(9,769 |

) |

| Cash, cash equivalents and

restricted cash, beginning of period |

|

|

33,944 |

|

|

|

39,651 |

|

|

|

29,717 |

|

|

|

39,651 |

|

|

|

34,824 |

|

| Cash, cash equivalents and

restricted cash, end of period |

|

$ |

10,984 |

|

|

$ |

33,944 |

|

|

$ |

25,055 |

|

|

$ |

10,984 |

|

|

$ |

25,055 |

|

2024 Financial Outlook - Division and Consolidated

EBITDA and Adjusted EBITDA(1) Reconciliations (in

thousands)

| |

|

Twelve Months Ending December 31, 2024 |

|

| |

|

Services |

|

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

| |

|

Low |

|

|

High |

|

|

Fabrication |

|

|

Shipyard |

|

|

Corporate |

|

|

Low |

|

|

High |

|

| Net income

(loss) |

|

$ |

9,000 |

|

|

$ |

11,000 |

|

|

$ |

8,080 |

|

|

$ |

351 |

|

|

$ |

(6,200 |

) |

|

$ |

11,231 |

|

|

$ |

13,231 |

|

| Less: Income tax (expense) benefit |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Less: Interest (expense) income, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,100 |

|

|

|

2,100 |

|

|

|

2,100 |

|

|

Operating income (loss) |

|

|

9,000 |

|

|

|

11,000 |

|

|

|

8,080 |

|

|

|

351 |

|

|

|

(8,300 |

) |

|

|

9,131 |

|

|

|

11,131 |

|

| Add: Depreciation and amortization |

|

|

2,000 |

|

|

|

2,000 |

|

|

|

2,800 |

|

|

|

- |

|

|

|

300 |

|

|

|

5,100 |

|

|

|

5,100 |

|

|

EBITDA |

|

|

11,000 |

|

|

|

13,000 |

|

|

|

10,880 |

|

|

|

351 |

|

|

|

(8,000 |

) |

|

|

14,231 |

|

|

|

16,231 |

|

| Less: Gain on property

sale(2) |

|

|

- |

|

|

|

- |

|

|

|

(2,880 |

) |

|

|

- |

|

|

|

- |

|

|

|

(2,880 |

) |

|

|

(2,880 |

) |

| Less: Shipyard operating

income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(351 |

) |

|

|

- |

|

|

|

(351 |

) |

|

|

(351 |

) |

|

Adjusted EBITDA |

|

$ |

11,000 |

|

|

$ |

13,000 |

|

|

$ |

8,000 |

|

|

$ |

- |

|

|

$ |

(8,000 |

) |

|

$ |

11,000 |

|

|

$ |

13,000 |

|

_________________

|

(1) |

EBITDA and adjusted EBITDA are non-GAAP measures. See “Non-GAAP

Measures” above for the Company’s definition of EBITDA and adjusted

EBITDA. |

|

(2) |

Reflects a gain on the sale of property that was held for sale at

December 31, 2023. |

|

|

|

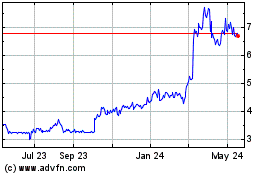

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

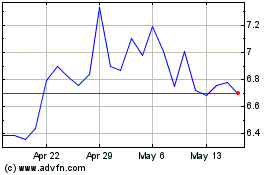

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Dec 2023 to Dec 2024