Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 04 2023 - 3:18PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the Month of May 2023

001-36345

(Commission

File Number)

GALMED

PHARMACEUTICALS LTD.

(Exact

name of Registrant as specified in its charter)

16

Tiomkin St.

Tel

Aviv 6578317, Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover

Form

20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

On

May 4, 2023, Galmed Pharmaceuticals Ltd. (the “Company”) entered into a definitive agreement (the “Agreement”)

for a $1.5 million equity investment in OnKai Inc. (“OnKai”), a US-based technology company developing an AI-based

platform to advance healthcare for underserved populations across the United States by facilitating alignment between healthcare stakeholders.

The Company led an investment round of $6 million (the “Investment Round”) in OnKai.

The

signing of the definitive agreement follows an announcement that the Company made in January 2023 that it had entered into a non-binding

termsheet for an equity investment in OnKai. The Agreement provides that the Company will invest $1.5 million in exchange for

series seed preferred shares of OnKai (which is in addition to a $1.5 million investment that was made by the Company in OnKai through

a Simple Agreement for Future Equity and which will convert at a 15% discount into series seed preferred shares upon consummation of

the Investment Round). Following the Investment Round, the Company will hold approximately 18% of the outstanding share capital

of OnKai on an as-converted and fully diluted basis.

The

Agreement further provides that the Company shall have the right to appoint a member to OnKai’s board of directors. Initially,

it is contemplated that Allen Baharaff will serve as a board member of OnKai while continuing to serve as CEO of the Company. Under the

terms of the Agreement, during the three year period following the closing of the Investment Round the Company shall have the right to

merge with OnKai subject to the approval of the boards of directors of each of the Company and OnKai and applicable law and based on

valuations that will be prepared by an independent valuator elected jointly by the Company and OnKai and approved by OnKai’s board

of directors. The Agreement and other transaction documentation further contemplate, among other things, that the Company is granted

certain customary pre-emptive rights as well as registration rights, first refusal rights, co-sale rights and broad based weighted average

anti-dilution rights, a board seat, and certain customary protective provisions. The closing of the Investment Round is subject, among

other things, to customary closing conditions.

In

connection with the Agreement, the Company’s wholly-owned subsidiary, Galmed Research and Development Ltd. (“GRD”),

entered into a services agreement (the “Services Agreement”) with OnKai. The Services Agreement provides that GRD shall on

a non-exclusive basis (i) provide support services to OnKai relating to finance, business development, strategic planning, execution

and others; and (ii) lend its experience to OnKai in building a strategy and for the development of treatments for the underserved and

that OnKai shall on a non-exclusive basis (i) take part in plan preparation to serve GDR’s vision of developing drugs for the underserved

population and (ii) when relevant, design a process on the clinical trial dashboard that could potentially serve GDR’s future trial.

On

May 4, 2023, the Company issued a press release entitled “Galmed Pharmaceuticals forms a Strategic Partnership with OnKai”.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This

Report does not constitute an offer to sell or the solicitation of an offer to buy securities, and shall not constitute an offer, solicitation

or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of that jurisdiction. Any securities that may be offered related to the Investment Round have not been registered

under the Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements.

Cautionary

Note Regarding Forward-Looking Statements

The

information in this Form 6-K may include forward-looking statements. Forward-looking statements may include, but are not limited to,

statements relating to Galmed’s objectives, plans and strategies, as well as statements, other than historical facts, that address

activities, events or developments that Galmed intends, expects, projects, believes or anticipates will or may occur in the future, including

statements relating to the Investment Round, including as to the entry into of definitive documents and consummation of the Investment

Round described above. These statements are often characterized by terminology such as “believes,” “hopes,” “may,”

“anticipates,” “should,” “intends,” “plans,” “will,” “expects,”

“estimates,” “projects,” “positioned,” “strategy” and similar expressions and are based

on assumptions and assessments made in light of management’s experience and perception of historical trends, current conditions,

expected future developments and other factors believed to be appropriate. Forward-looking statements are not guarantees of future performance

and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such

statements. Many factors could cause Galmed’s actual activities or results to differ materially from the activities and results

anticipated in forward-looking statements. Galmed discusses many of these risks in its Annual Report on Form 20-F for the year ended

December 31, 2022 filed with the SEC on March 29, 2023 in greater detail under the heading “Risk Factors” and elsewhere in

the Annual Report, in our Report on Form 6-K filed with the SEC on March 30, 2023 and this press release. Given these uncertainties,

you should not rely upon forward-looking statements as predictions of future events. All forward-looking statements attributable to Galmed

or persons acting on its behalf speak only as of the date hereof and are expressly qualified in their entirety by the cautionary statements

included in this Report. Galmed undertakes no obligations to update or revise forward-looking statements to reflect events or circumstances

that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating forward-looking statements, you should

consider these risks and uncertainties.

This

Form 6-K is incorporated by reference into the Company’s Registration Statements on Form S-8 (Registration No. 333-206292 and 333-227441)

and the Company’s Registration Statement on Form F-3 (Registration No. 333-254766).

Exhibit Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Galmed

Pharmaceuticals Ltd. |

| |

|

| Date:

May 4, 2023 |

By: |

/s/

Allen Baharaff |

| |

|

Allen

Baharaff |

| |

|

President

and Chief Executive Officer |

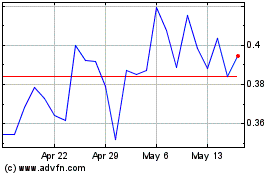

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Jan 2025 to Feb 2025

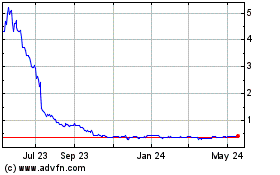

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Feb 2024 to Feb 2025