Gaming and Leisure Properties Inc. Announces 2024 Distribution Tax Treatment

January 24 2025 - 6:00AM

Gaming and Leisure Properties, Inc. (NASDAQ: GLPI) (the

“Company”) announced the income tax allocation for federal income

tax purposes of its aggregate distributions in 2024

of $3.04 per share of common stock (CUSIP: 36467J108).

Gaming and Leisure Properties’ tax return for

the year ended December 31, 2024, has not yet been

filed. As a result, the income tax allocation for the

distributions noted below have been calculated using the best

available information as of the date of this press release.

| |

|

Box 1a |

Box 1b |

Box 2a |

Box 2b |

Box 2f |

Box 3 |

Box 5 |

|

Record Date |

Payable Date |

Total Distribution Per Share |

Total Ordinary Dividends |

Qualified Dividends (1) |

Total Capital Gain Distribution |

Unrecaptured 1250 Gain (2) |

Section 897 Capital Gain |

Nondividend Distributions (3) |

Section 199A Dividends (4) |

|

03/15/2024 |

03/29/2024 |

$0.760000 |

$0.739603 |

$0.000000 |

$0.004452 |

$0.000000 |

$0.000000 |

$0.015945 |

$0.739603 |

|

06/07/2024 |

06/21/2024 |

$0.760000 |

$0.739603 |

$0.000000 |

$0.004452 |

$0.000000 |

$0.000000 |

$0.015945 |

$0.739603 |

|

09/13/2024 |

09/27/2024 |

$0.760000 |

$0.739603 |

$0.000000 |

$0.004452 |

$0.000000 |

$0.000000 |

$0.015945 |

$0.739603 |

|

12/06/2024 |

12/20/2024 |

$0.760000 |

$0.739603 |

$0.000000 |

$0.004452 |

$0.000000 |

$0.000000 |

$0.015945 |

$0.739603 |

|

|

Totals |

$3.040000 |

$2.958412 |

$0.000000 |

$0.017808 |

$0.000000 |

$0.000000 |

$0.063780 |

$2.958412 |

|

|

|

|

|

|

|

|

|

|

|

| |

(1 |

) |

Amounts in Box 1b

are included in Box 1a |

|

| |

(2 |

) |

Amounts in Box 2b

are included in Box 2a |

|

| |

(3 |

) |

Amounts in Box 3 are

also known as Return of Capital |

|

|

| |

(4 |

) |

Amounts in Box 5 are

included in Box 1a |

|

| |

|

|

|

|

|

|

|

|

Please note that federal tax laws affect

taxpayers differently, and the information in this release is not

intended as advice to shareholders on how distributions should be

reported on their tax returns. Also, note that state and

local taxation of real estate investment trust distributions varies

and may not be the same as the taxation under the federal

rules. Shareholders are encouraged to consult with their own

tax advisors as to their specific federal, state, and local income

tax treatment of the Company’s distributions.

About Gaming and Leisure

PropertiesGLPI is engaged in the business of acquiring,

financing, and owning real estate property to be leased to gaming

operators in triple-net lease arrangements, pursuant to which the

tenant is responsible for all facility maintenance, insurance

required in connection with the leased properties and the business

conducted on the leased properties, taxes levied on or with respect

to the leased properties and all utilities and other services

necessary or appropriate for the leased properties and the business

conducted on the leased properties.

Contact:Gaming and Leisure Properties,

Inc.

Matthew Demchyk, Chief Investment

Officer610/401-2900investorinquiries@glpropinc.com

Investor Relations Joseph Jaffoni, Richard Land, James Leahy at

JCIR212/835-8500glpi@jcir.com

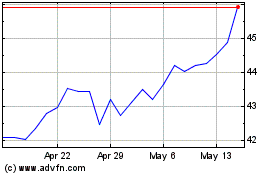

Gaming and Leisure Prope... (NASDAQ:GLPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

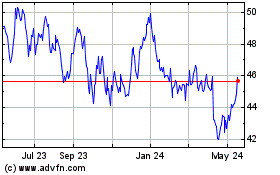

Gaming and Leisure Prope... (NASDAQ:GLPI)

Historical Stock Chart

From Jan 2024 to Jan 2025