Current Report Filing (8-k)

May 26 2023 - 4:12PM

Edgar (US Regulatory)

0001451448

false

--06-30

MT

0001451448

2023-05-22

2023-05-22

0001451448

us-gaap:CommonStockMember

2023-05-22

2023-05-22

0001451448

GMBL:CommonStockPurchaseWarrantsMember

2023-05-22

2023-05-22

0001451448

GMBL:Sec10.0SeriesCumulativeRedeemableConvertiblePreferredStockMember

2023-05-22

2023-05-22

0001451448

GMBL:CommonStockPurchaseWarrantsOneMember

2023-05-22

2023-05-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): May 22, 2023

ESPORTS

ENTERTAINMENT GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39262 |

|

26-3062752 |

| (State

or other jurisdiction of |

|

(Commission |

|

(IRS

Employer |

| incorporation

or organization) |

|

File

Number) |

|

Identification

No.) |

BLOCK

6,

TRIQ

PACEVILLE,

ST.

JULIANS STJ 3109

MALTA

(Address

of principal executive offices)

356

2713 1276

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

GMBL |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

GMBLW |

|

The

Nasdaq Stock Market LLC |

10.0%

Series A Cumulative Redeemable

Convertible Preferred Stock |

|

GMBLP |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

GMBLZ |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry Into a Material Definitive Agreement.

The

information included in Item 3.02 and Item 5.03 of this Current Report are incorporated by reference into this Item 1.01 of this Current

Report to the extent required.

Item

2.02 Results of Operations and Financial Condition.

On

May 22, 2023, Esports Entertainment Group, Inc. (the “Company”) issued a press release providing a business update for

the third quarter ended March 31, 2023. The text of the press release is furnished as Exhibit 99.1 and incorporated herein by

reference. The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the

Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth

by specific reference in such filing.

Item 3.02. Unregistered Sales of Equity Securities.

On May 1, 2023, the Company had previously announced

on Form 8-K, that on April 30, 2023, it had entered into a securities purchase agreement (the “Securities Purchase Agreement”)

with an institutional investor (the “Investor”) for a direct offering to the Investor of (i) 4,300 shares of new Series D

Convertible Preferred Stock (the “Series D Preferred Stock”), $0.001 par value per share, for a price of $1,000 per share,

(ii) common warrants to purchase 1,433,333 shares of our Common Stock at a price of $1.96 per share (the “Common Warrants”),

and (iii) preferred warrants to purchase 4,300 shares of our Series D Preferred Stock at a price of $1,000 per share (the “Preferred

Warrants”).

On May 22, 2023, the Company closed the transactions

contemplated by the Securities Purchase Agreement with an accredited investor, Alto Opportunity Master Fund, SPC – Segregated Master

Portfolio B, the holder of the Company’s outstanding Series C Convertible Preferred Stock.

The securities were offered and issued pursuant

to the exemption from registration provided by Section 4(a)(2) of the Securities Act.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

On May 22, 2023, the Company filed a certificate

of designations (the “Series D Certificate of Designations”), with the Secretary of State of the State of Nevada regarding

the Company’s shares of preferred stock, par value $0.001 per share, designated as Series D Convertible Stock, to amend certain

powers, designations, preferences and other rights set forth therein, effective as of May 22, 2023. We urge you to read the Series D

Certificate of Designations, which is attached to this Form 8-K as Exhibit 3.1, in full because it defines the rights of the holder of

Series D Preferred Stock and the relative rights of the holder to the rights of the holders of our common stock.

In connection with the Securities

Purchase Agreement, the Company’s Board of Directors approved the designation of 10,000 shares of preferred stock as Series

D Preferred Stock, with a par value of $0.001 per share, as set forth in the Certificate of Designations.

Summaries of the Certificate of Designations

and the material terms of the Series D Preferred Stock (including the material terms of conversion of the Series D Preferred Stock),

Securities Purchase Agreement, Common Warrants, Preferred Warrants and the Registration

Rights Agreement were previously reported on a Current Report on Form 8-K filed with the Securities and Exchange Commission on May 1,

2023. Such summaries, however, are qualified in their entirety by reference to the forms of such agreements, which are filed as exhibits

to this Current Report and incorporated herein by reference.

Item

7.01 Regulation FD Disclosure.

The

information set forth in Item 2.02 of this Current Report on Form 8-K is incorporated by reference into this Item 7.01.

Forward-Looking

Statements

The

information contained herein includes forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “plans,” “predicts,” “projects,” “will be,”

“will continue,” “will likely result,” and similar expressions. These statements relate to future events or to

our strategies, targeted markets, and future financial performance, and involve known and unknown risks, uncertainties and other factors

that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by these forward-looking statements, including, the ability to effectuate

debt for equity exchanges, the conversion prices, the timing and other terms of such exchanges. You should not place undue reliance on

forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond

our control and which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Factors

that could cause or contribute to such differences include, but are not limited to, those discussed in our most recent Annual Report

on Form 10-K and subsequent Quarterly Reports on Form 10-Q, and those discussed in other documents we file with the SEC, including our

ability to regain compliance with Nasdaq Listing Rules and stay listed on Nasdaq, our obligations under our preferred stock outstanding,

and our ability to continue as a going concern. Any forward-looking statement reflects our current views with respect to future events

and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy

and liquidity. We assume no obligation to publicly update or revise these forward-looking statements for any reason, or to update the

reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes

available in the future, unless required by law. The safe harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995 protects companies from liability for their forward-looking statements if they comply with the requirements of such

Act.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

Date:

May 26, 2023

| |

ESPORTS

ENTERTAINMENT GROUP, INC. |

| |

|

|

| |

By: |

/s/

Michael Villani |

| |

Name:

|

Michael

Villani |

| |

Title: |

Interim

Chief Financial Officer and Controller |

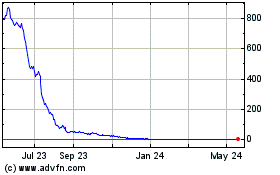

Esports Entertainment (NASDAQ:GMBL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Esports Entertainment (NASDAQ:GMBL)

Historical Stock Chart

From Feb 2024 to Feb 2025