Genasys Inc. (NASDAQ: GNSS), the leader in Protective

Communications, today announced financial results for the Company’s

fiscal first quarter ended December 31, 2024.

Richard S. Danforth, Chief Executive Officer of Genasys, Inc.,

commented, “Fiscal 2025 is rapidly shaping up to be a year of

dramatic improvement. Not only are we progressing on schedule with

the implementation of the Early Warning System (EWS) in Puerto

Rico, but also our software solutions, particularly EVAC and

CONNECT are gaining significant awareness and traction.”

Mr. Danforth continued, “Last month’s devastating fires in Los

Angeles captured local, national and even international attention.

The scale and scope of the numerous fires fueled by near hurricane

force winds threatened multiple dense population centers

surrounding the media capital of the world. The LA County Office of

Emergency Management (OEM) with the support of both fire and law

enforcement first responders utilized Genasys Protect to affect the

timely evacuations of hundreds of thousands of residents across

multiple cities. Though the tragic structural and financial damage

was record breaking, the loss of life statistics remain

dramatically below any other major fire event that didn’t have the

evacuation capabilities provided by Genasys Protect. Throughout the

incident, Genasys experienced an unprecedented level of inbound

inquiry for both our software and hardware solutions that we expect

to convert into new bookings over the next several months.”

Fiscal 1Q 2025 Financial Summary

- Revenue of $6.9 million, versus $4.4 million in 1Q 2024

- GAAP operating loss of ($5.9) million, versus ($7.2) million in

1Q 2024.

- GAAP net loss of ($4.1) million versus ($6.7) million in 1Q

2024. GAAP net loss per share ($0.09) versus ($0.15) in 1Q

2024.

- Adjusted EBITDA of ($4.8) million, versus ($6.1) million in 1Q

2024.

Business Highlights

- Received over $10 million in cash deposits for the first two

approved groups of Puerto Rico dams

- Recorded initial ACOUSTICS orders for Riverside County in

conjunction with previously awarded Mass Notification win intended

to enhance emergency warning coverage beyond existing Genasys

Protect software implementation of EVAC and Alert

Business Outlook

With record backlog entering fiscal 2025, Genasys is poised to

deliver substantial growth to the top and bottom line, compared to

the prior fiscal year. Most of the $40 million starting backlog is

tied to the Puerto Rico project, which will primarily impact our

P&L in the second half of the fiscal year, though cash receipts

have already been meaningful. Long lead-time materials have been

ordered and their delivery will be the primary determinant of when

installation and implementation of the system can begin. Efforts

are being made to accelerate deliveries, but timing remains

uncertain. We continue to expect sequential improvement throughout

fiscal 2025 in both our software revenues and ARR, though not at

the rates of fiscal 2024.

Fiscal 1Q 2025 Financial Review

Fiscal first quarter revenue was $6.9 million, an increase of

59.1% from $4.4 million in the prior year's quarter. Software

revenue increased 63.5% while hardware revenue increased 57.1%,

compared with the fiscal 2024 first quarter. Within software,

quarterly recurring revenue increased 68.7% year over year.

Gross profit margin was 45.8%, compared with 33.9% and 40.8% in

the first and fourth quarters of fiscal 2024, respectively. The

year-over-year improvement in gross profit is primarily

attributable to higher hardware revenue in this year’s quarter and

the related improvement in overhead absorption. Additionally,

software gross margins improved approximately 9 percentage points

year over year. Sequentially, the difference is primarily

attributable to software costs of sales in the fourth quarter of

fiscal 2024 that were not incurred in the December quarter.

Operating expenses of $9.1 million increased from $8.7 million

in fiscal 1Q 2024 and decreased from $9.9 million in fiscal 4Q

2024. Selling, general and administrative expenses of $6.8 million

compares to $6.5 million and $7.5 million for in 1Q and 4Q fiscal

2024. Research and development expenses of $2.3 million increased

4.3% year over year and declined 5.8% sequentially.

GAAP net loss in the quarter was ($4.1) million, or ($0.09) per

share, compared with a GAAP net loss of ($6.7) million, or ($0.15)

per share, in the first quarter of fiscal 2024. The December 2024

quarter benefitted from a $2.5 million non-cash positive change in

the fair value adjustment to outstanding warrants.

Excluding other income and expense, net income tax expense

(benefit), depreciation, stock-based compensation and amortization

of intangibles, adjusted EBITDA was ($4.8) million for the first

quarter of fiscal 2025, compared with ($6.1) million and ($6.0)

million for the first and fourth fiscal quarters of 2024.

Cash, cash equivalents and marketable securities totaled $13.9

million as of December 31, 2024, compared with $13.1 million as of

September 30, 2024, reflecting the operational results, changes in

working capital, and the receipt of approximately $8.3 million for

the deposit on the first group of dams in Puerto Rico. Since

quarter end, the Company has received an additional $2.2 million in

deposits associated with the second group of dams for the Puerto

Rico project.

We include in this press release the non-GAAP operational

metrics of adjusted EBITDA, which we believe provide helpful

information to investors with respect to evaluating the Company’s

performance. Adjusted EBITDA represents our net loss before other

income and expense, net, income tax expense (benefit), depreciation

and amortization expense and stock-based compensation. We do not

consider these items to be indicative of our core operating

performance. The items that are non-cash include depreciation and

amortization expense and stock-based compensation. Adjusted EBITDA

is a measure used by management to understand and evaluate our core

operating performance and trends and to generate future operating

plans, make strategic decisions regarding allocation of capital and

invest in initiatives that are focused on cultivating new markets

for our solutions. In particular, the exclusion of certain expenses

in calculating Adjusted EBITDA facilitates comparisons of our

operating performance on a period-to-period basis.

Webcast and Conference Call Details

Management will host a conference call to discuss the financial

results for the first quarter of fiscal year 2025 this afternoon at

4:30 p.m. Eastern Time / 1:30 p.m. Pacific Time. To access the

conference call, dial toll-free (888) 390-3967, or international at

(862) 298-0702. A webcast will also be available at the following

link: https://app.webinar.net/9v8jG6rGOo4

Questions to management may be submitted before the call by

emailing them to: ir@genasys.com. A replay of the webcast will be

available approximately four hours after the presentation on the

page of the Company’s website.

About Genasys Inc.

Genasys Inc. (NASDAQ: GNSS) is the global leader in Protective

Communications Solutions and Systems, designed around one premise:

ensuring organizations and public safety agencies are “Ready when

it matters™”. The Company provides the Genasys Protect platform,

the most comprehensive portfolio of preparedness, response, and

analytics software and systems, as well as Genasys Long Range

Acoustic Devices® (LRAD®) that deliver directed, audible voice

messages with exceptional vocal clarity from close range to 5,500

meters. Genasys serves state and local governmental agencies, and

education (SLED); enterprise organizations in critical sectors such

as oil and gas, utilities, manufacturing, and automotive; and

federal governments and the military. Genasys Protective

Communications Solutions have diverse applications, including

emergency warning and mass notification for public safety, critical

event management for enterprise companies, de-escalation for

defense and law enforcement, and automated detection of real-time

threats like active shooters and severe weather. Protecting people

and saving lives for over 40 years, Genasys covers more than 155

million people in all 50 states and in over 100 countries

worldwide. For more information, visit genasys.com.

Forward-Looking Statements

Except for historical information contained herein, the matters

discussed are forward-looking statements within the meaning of the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. You should not place undue reliance on these

statements. We base these statements on particular assumptions that

we have made in light of our industry experience, the stage of

product and market development as well as our perception of

historical trends, current market conditions, current economic

data, expected future developments and other factors that we

believe are appropriate under the circumstances. Forward-looking

statements involve risks and uncertainties that could cause actual

results to differ materially from those suggested in any

forward-looking statement. The risks and uncertainties in these

forward-looking statements include without limitation the business

impact of geopolitical conflicts and other causes that may affect

our supply chain, and other risks and uncertainties, many of which

involve factors or circumstances that are beyond the Company’s

control. Risks and uncertainties are identified and discussed in

our filings with the Securities and Exchange Commission. These

forward-looking statements are based on information and

management’s expectations as of the date hereof. Future results may

differ materially from our current expectations. For more

information regarding other potential risks and uncertainties, see

the “Risk Factors” section of the Company’s Form 10-K for the

fiscal year ended September 30, 2024. Genasys Inc. disclaims any

intent or obligation to publicly update or revise forward-looking

statements, except as otherwise specifically stated.

Genasys Inc. Consolidated Balance Sheets

(Unaudited - in thousands) December 31,2024

September 30,2024 (Unaudited) ASSETS

Current assets: Cash and cash equivalents

$

8,469

$

4,945

Short-term marketable securities

5,146

7,945

Restricted cash

95

95

Accounts receivable, net

3,017

3,283

Inventories, net

7,500

7,313

Prepaid expenses and other

3,777

2,559

Total current assets

28,004

26,140

Long-term marketable securities

305

249

Long-term restricted cash

250

250

Property and equipment, net

1,231

1,291

Goodwill

13,165

13,329

Intangible assets, net

7,885

8,506

Operating lease right of use assets, net

2,898

3,110

Other assets

902

1,061

Total assets

$

54,640

$

53,936

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable

$

4,504

$

4,034

Accrued liabilities

15,524

9,030

Operating lease liabilities, current portion

1,025

1,021

Total current liabilities

21,053

14,085

Notes payable, at fair value

12,380

12,010

Warrant liability

4,170

6,640

Long-term deferred revenue

378

369

Operating lease liabilities, noncurrent

2,989

3,269

Total liabilities

40,970

36,373

Total stockholders' equity

13,670

17,563

Total liabilities and stockholders' equity

$

54,640

$

53,936

Genasys Inc.

Consolidated Statements of

Operations

(Unaudited - in thousands,

except per share amounts)

Three Months Ended December

31,

2024

2023

(unaudited)

(unaudited)

Revenues

$

6,940

$

4,361

Cost of revenues

3,762

2,882

Gross profit

3,178

1,479

45.8

%

33.9

%

Operating expenses

Selling, general and administrative

6,834

6,518

Research and development

2,285

2,191

Total operating expenses

9,119

8,709

Loss from operations

(5,941

)

(7,230

)

Other income, net

1,863

77

Loss before income taxes

(4,078

)

(7,153

)

Income tax benefit

—

(429

)

Net loss

$

(4,078

)

$

(6,724

)

Net loss per common share - basic and

diluted

$

(0.09

)

$

(0.15

)

Weighted average common shares

outstanding - basic and diluted

44,912

43,729

Reconciliation of GAAP measures to

non-GAAP measures

Net loss

$

(4,078

)

$

(6,724

)

Other income, net

(1,863

)

(77

)

Income tax benefit

—

(429

)

Depreciation and amortization

737

729

Stock based compensation

391

446

Adjusted EBITDA

$

(4,813

)

$

(6,055

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211791299/en/

Investor Relations Contacts

Brian Alger, CFA SVP, IR and Corporate Development

ir@genasys.com (858) 676-0582

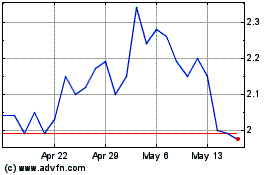

Genasys (NASDAQ:GNSS)

Historical Stock Chart

From Jan 2025 to Feb 2025

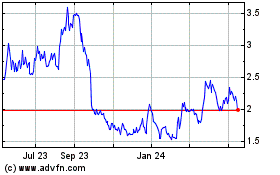

Genasys (NASDAQ:GNSS)

Historical Stock Chart

From Feb 2024 to Feb 2025