UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 2)*

GoHealth,

Inc.

(Name

of Issuer)

Class

A Common Stock, par value $0.0001 per share

(Title

of Class of Securities)

38046W105

(CUSIP

Number)

Clinton

P. Jones

214

West Huron St.

Chicago,

IL 60654

(312)

386-8200

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

With

copies to:

Patrick

Croke

Croke

Fairchild Duarte & Beres LLC

180

N LaSalle Street, Ste. 3400

Chicago,

IL 60601

(312)

650-8650

August

24, 2023

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b)

for other parties to whom copies are to be sent.

| | | |

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing

on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1 |

Names

of Reporting Persons

NVX

Holdings, Inc. |

| 2 |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☐ (b) ☒ |

| 3 |

SEC Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

6,232,352 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

6,232,352 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

6,232,352 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13 |

Percent

of Class Represented by Amount in Row (11)

39.6% |

| 14 |

Type

of Reporting Person

CO |

| |

|

|

|

| 1 |

Names

of Reporting Persons

Brandon

M. Cruz |

| 2 |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☐ (b) ☒ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

|

| |

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

Citizenship

or Place of Organization

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

|

208,197 |

| 8 |

Shared

Voting Power

6,247,139 |

9

|

Sole

Dispositive Power

208,197

|

| |

10

|

Shared

Dispositive Power

6,247,139 |

| |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

6,455,336 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13 |

Percent

of Class Represented by Amount in Row (11)

41.1% |

| 14 |

Type

of Reporting Person

IN |

| |

|

|

|

| 1 |

Names

of Reporting Persons

Clinton

P. Jones |

| 2 |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☐ (b) ☒ |

| 3 |

SEC Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

|

| 6 |

Citizenship

or Place of Organization

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

208,197

|

| 8 |

Shared

Voting Power

6,247,139 |

| 9 |

Sole

Dispositive Power

208,197

|

| 10 |

Shared

Dispositive Power

6,247,139 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

6,455,336 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13 |

Percent

of Class Represented by Amount in Row (11)

41.1% |

| 14 |

Type

of Reporting Person

IN |

| |

|

|

|

| 1 |

Names

of Reporting Persons

BCCJ,

LLC |

| 2 |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☐ (b) ☒ |

| 3 |

SEC Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

14,787 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

14,787 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

14,787 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13 |

Percent

of Class Represented by Amount in Row (11)

0.2% |

| 14 |

Type

of Reporting Person

OO

(Limited Liability Company) |

| |

|

|

|

Explanatory

Note

This

Amendment No. 2 to Schedule 13D (“Amendment No. 2”) amends and supplements the Schedule 13D originally filed with the

United States Securities and Exchange Commission on November 25, 2022 (as amended to date, the “Schedule 13D”), relating

to the shares of Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”), of GoHealth, Inc., a

Delaware corporation (the “Issuer”). Capitalized terms used herein without definition shall have the meanings set forth

in the Schedule 13D.

Item

4. Purpose of Transaction.

Item

4 of the Schedule 13D is hereby amended and supplemented as follows:

On

the evening of May 18, 2023, the Reporting Persons and CCP III Cayman GP Ltd., CB Blizzard Holdings C, L.P., Centerbridge Associates

III, L.P., CCP III AIV VII Holdings, L.P., CB Blizzard Co-Invest Holdings, L.P., CB Blizzard Lower Holdings GP A, LLC, CB Blizzard Lower

Holdings A, L.P., Blizzard Aggregator, LLC, CB Blizzard Lower Holdings GP B, LLC, CB Blizzard Lower Holdings B, L.P., and Jeffrey H.

Aronson (collectively, the “CB Stockholders”) delivered a non-binding proposal (the “Proposal”) to the Board

of Directors (the “Board”) of the Issuer offering to acquire all of the outstanding shares of Class A Common Stock and LLC

Interests that the Reporting Persons and the CB Stockholders do not already own for a price per share or LLC Interest equal to $20.00

(the “Proposed Transaction”).

In response to feedback from the special committee

of the Board (the “Special Committee”) that it will not pursue a transaction with the Reporting Persons and the CB Stockholders

under the terms set forth in the Proposal, the Reporting Persons and the CB Stockholders have informed the Special Committee on the

evening of August 24, 2023 that they would withdraw the Proposal and cease to pursue the Proposed Transaction.

Notwithstanding the withdrawal of the Proposal, the Reporting

Persons intend to continue to engage in discussions with, among others, management, the Board, stockholders (including the CB Stockholders)

and other stakeholders of the Issuer or its subsidiaries, and/or third parties, including potential acquirers, service providers and

debt and equity financing sources, and other relevant parties and may take other actions concerning any extraordinary corporate transaction

(including but not limited to a merger, reorganization or liquidation, asset sales or other asset transactions or purchases or repurchases

of stock, debt or other securities and instruments) or the business, operations, assets, strategy, future plans, prospects, corporate

structure, capital structure (including financings, refinancings and amendments, extensions or other modifications of the existing

debt facilities of the Issuer or its subsidiaries), Board composition, management, capitalization, dividend policy, charter, bylaws,

corporate documents, agreements, de-listing or de-registration of the Issuer, which discussions may include proposing or considering

new proposals

Notwithstanding

the withdrawal of the Proposal, the Reporting

Persons intend to regularly review their investment and continue to manage their holdings in the Issuer and GoHealth

Holdings, LLC on a continuing basis and may from time to time and at any time in the future depending on various factors, including,

without limitation, any limitations imposed by the Issuer’s financial position and strategic direction, actions taken by the

Board, price levels of the Issuer’s securities or debt instruments, other investment opportunities available to the Reporting

Persons, conditions in the securities market and general economic and industry conditions, take such actions with respect to the

investment in the Issuer and GoHealth Holdings, LLC as they deem appropriate. These actions may include, (i) acquiring additional

shares of Class A Common Stock and/or other equity, term loans, revolving loans, other debt, notes, other securities, or derivative

or other instruments that are based upon or relate to the value of securities or debt instruments of the Issuer or its subsidiaries

(collectively, “Interests”) in the open market or otherwise; (ii) exercising or refraining from exercising any rights or

obligations with respect to such Interests; (iii) disposing of any or all of their Interests in the open market or otherwise; (iv)

engaging in any hedging or similar transactions with respect to the Interests; or (v) proposing or considering one or more of the

actions described in subsections (a) through (j) of Item 4 of Schedule 13D.

Although

the foregoing reflects activities presently contemplated by the Reporting Persons, the foregoing is subject to change at any time, and

the Reporting Persons reserve their right to change their plans and intentions with respect to the Issuer, including in connection with

any of the actions discussed in this Item 4. Any action taken by the Reporting

Persons may be effected at any time and from time to time, subject to any applicable limitations imposed by any applicable laws.

Item

5. Interest in Securities of the Issuer.

Item

5 of the Schedule 13D is hereby amended and restated in its entirety as follows:

(a)

– (b)

The

following sets forth, as of the date of this Schedule 13D, the aggregate number of shares of Class A Common Stock and percentage of Class

A Common Stock beneficially owned by each of the Reporting Persons, as well as the number of shares of Class A Common Stock as to which

each Reporting Person has the sole power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose

or to direct the disposition of, or shared power to dispose or to direct the disposition of, as of the date hereof, based on 9,511,860

shares of Class A Common Stock outstanding as of August 2, 2023, as provided by the Issuer in the Quarterly Report on Form 10-Q filed

by the Issuer on August 10, 2023, plus, as applicable, 6,178,532 and 2,921 shares of Class A Common Stock underlying the LLC Interests held

of record by NVX and BCCJ, respectively:

| Reporting Person | |

Amount

beneficially owned | | |

Percent of class | | |

Sole

power to vote or to direct the vote | | |

Shared

power to vote or to direct the vote | | |

Sole

power to dispose or to direct the disposition | | |

Shared

power to dispose or to direct the disposition | |

| NVX Holdings, Inc. | |

| 6,232,352 | | |

| 39.6 | % | |

| 0 | | |

| 6,232,352 | | |

| 0 | | |

| 6,232,352 | |

| Brandon M. Cruz | |

| 6,455,336 | | |

| 41.1 | % | |

| 208,197 | | |

| 6,247,139 | | |

| 208,197 | | |

| 6,247,139 | |

| Clinton P. Jones | |

| 6,455,336 | | |

| 41.1 | % | |

| 208,197 | | |

| 6,247,139 | | |

| 208,197 | | |

| 6,247,139 | |

| BCCJ, LLC | |

| 14,787 | | |

| 0.2 | % | |

| 0 | | |

| 14,787 | | |

| 0 | | |

| 14,787 | |

NVX

is the record holder of 53,820 shares of Class A Common Stock and 6,178,532 LLC Interests. BCCJ is the record holder of 11,866 shares

of Class A Common Stock and 2,921 LLC Interests. Each of Messrs. Jones and Cruz is the record holder of 4,967 shares of Class A Common

Stock.

Messrs.

Jones and Cruz are the Chief Executive Officer and President of NVX, respectively, and are members of the Board of Managers of BCCJ.

As a result, each of Messrs. Jones and Cruz may be deemed to beneficially own the securities held by each of NVX and BCCJ.

In

addition, each of Messrs. Jones and Cruz may be deemed to beneficially own: (i) 5,016 shares of Class A Common Stock underlying stock

options, (ii) 3,925 shares of Class A Common Stock underlying restricted stock units and (iii) 194,289 shares of Class A Common Stock

underlying Blizzard Management Feeder LLC Interests, in each case that are currently vested or will vest within 60 days.

By

virtue of the agreements made pursuant to the Stockholders Agreement and the matters described in Item 4 above, the Reporting

Persons and the CB Stockholders may constitute a “group” within the meaning of Section 13(d)(3) of the Securities

Exchange Act of 1934 (the “Exchange Act”), which group may be deemed to collectively beneficially own 16,007,486 shares

of Class A Common Stock of the Issuer, constituting approximately 75.9% of the 9,511,860 shares of the Class A Common Stock

outstanding, plus the 5,386,178 shares of Class A Common Stock underlying the LLC Interests held of record by CB Blizzard B and the

6,181,453 shares of Class A Common Stock underlying the LLC Interests held of record by certain of the Reporting Persons, as

calculated on the basis of Rule 13d-3 of the Exchange Act. However, the Reporting Persons expressly disclaim beneficial ownership of

the 9,566,028 shares of Class A Common Stock (including 5,386,178 shares of Class A Common Stock underlying LLC Interests held of

record by CB Blizzard B) beneficially owned by the CB Stockholders. The CB Stockholders have filed a

separate Schedule 13D with respect to their interests in the Issuer and the Proposal.

(c)

During the past 60 days, the Reporting Persons have not effected any transactions with respect to the Class A Common Stock.

(d)

None.

(e)

Not applicable.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item

6 of the Schedule 13D is hereby supplemented as follows:

The

information set forth in Item 4 of this Schedule 13D is incorporated herein by reference.

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Date:

August 25, 2023

| |

NVX Holdings,

Inc. |

| |

|

|

| |

By: |

/s/

Brandon M. Cruz |

| |

Name: |

Brandon

M. Cruz |

| |

Title: |

President |

| |

|

|

| |

Clinton

P. Jones |

| |

|

|

| |

By: |

/s/ Clinton P. Jones |

| |

|

|

| |

Brandon

M. Cruz |

| |

|

|

| |

By: |

/s/ Brandon M. Cruz |

| |

|

|

| |

BCCJ, LLC |

| |

|

|

| |

By: |

/s/

Brandon M. Cruz |

| |

Name: |

Brandon M. Cruz |

| |

Title: |

Manager |

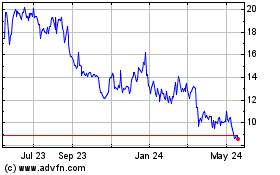

GoHealth (NASDAQ:GOCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

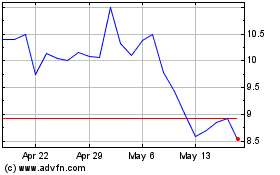

GoHealth (NASDAQ:GOCO)

Historical Stock Chart

From Dec 2023 to Dec 2024