Form 8-K - Current report

September 30 2024 - 6:16AM

Edgar (US Regulatory)

false 0001537054 0001537054 2024-09-29 2024-09-29 0001537054 us-gaap:CommonStockMember 2024-09-29 2024-09-29 0001537054 us-gaap:PreferredStockMember 2024-09-29 2024-09-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2024 (September 29, 2024)

GOGO INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35975 |

|

27-1650905 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 105 Edgeview Dr., Suite 300 Broomfield, CO |

|

80021 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

303-301-3271

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common stock, par value $0.0001 per share |

|

GOGO |

|

NASDAQ Global Select Market |

| Preferred Stock Purchase Rights |

|

GOGO |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 29, 2024, Gogo Direct Holdings, LLC, a Delaware limited liability company (“Gogo Direct”) and indirect wholly owned subsidiary of Gogo Inc., a Delaware corporation (the “Company”), entered into a Purchase Agreement (the “Purchase Agreement” and the transactions contemplated by the Purchase Agreement, the “Transactions”), by and among Satcom Direct Holdings, Inc., a Delaware corporation (“SD Seller”), SDHC Holdings, Inc., a Delaware corporation (“SDHC Seller”), Satcom Direct Government Holdings, Inc., a Delaware corporation (“Satcom Government Seller”), ndtHost Holdings, Inc., a Delaware corporation (“ndtHost Seller” and, together with SD Seller, SDHC Seller and Satcom Government Seller, each a “Seller” and collectively, “Sellers”), Satcom Direct, Inc., a Florida corporation (“Satcom Direct”), Satcom Direct Holding Company, LLC, a Florida limited liability company (“SDHC”), Satcom Direct Government, Inc., a Florida corporation (“Satcom Government”), ndtHost, LLC, a Florida limited liability company (“ndtHost” and, together with Satcom Direct, SDHC, and Satcom Government, each a “Parent Company” and collectively, the “Parent Companies”), solely for purposes of Section 8.8 and Section 8.9 of the Purchase Agreement, James W. Jensen, in his individual capacity, and solely for purposes of Section 2.5 and Section 13.20, the Company. Pursuant to the Purchase Agreement, on the terms and subject to the conditions set forth therein, Gogo Direct will, among other matters, purchase from Sellers all of the issued and outstanding equity interests of the Parent Companies (collectively, the “Purchased Equity”), in exchange for the consideration contemplated thereby.

Subject to the terms and conditions set forth in the Purchase Agreement, at the closing of the transaction (the “Closing”), Gogo Direct will acquire the Purchased Equity in exchange for: (i) an aggregate cash purchase amount of $375,000,000, subject to customary purchase price adjustments, (ii) the issuance at Closing of 5,000,000 restricted shares of common stock of the Company to SD Seller (the “Closing Date Stock Consideration”), and (iii) up to an additional $225,000,000 in payments of cash and common stock of the Company tied to realizing certain financial performance milestones over the next four years.

The Purchase Agreement contains customary representations, warranties and covenants, as well as indemnification provisions subject to specified limitations. Among other things, Sellers and Parent Companies have agreed, subject to certain exceptions, to, and to cause each of its subsidiaries to, conduct its business in the ordinary course, consistent with past practice, from the date of the Purchase Agreement until the Closing, and not to take certain actions prior to the closing of the transaction without the prior written consent of Gogo Direct. Sellers and the Parent Companies have made certain additional customary covenants, including, among others and subject to certain exceptions, not to solicit proposals relating to acquisition proposals and not to participate in discussions concerning, or furnish information in connection with, acquisition proposals.

In addition, subject to the terms of the Purchase Agreement, Gogo Direct, Sellers and Parent Companies are required to use reasonable best efforts to obtain all required regulatory approvals, including, among others, certain regulatory approvals with the Federal Trade Commission, Antitrust Division of the United States Department of Justice, Federal Communications Commission and certain international governmental authorities.

The transaction is expected to close in the fourth quarter of 2024 and is subject to customary closing conditions, including, among others, (i) the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), (ii) the absence of legal restraints preventing the consummation of the transaction, (iii) the obtaining of the Communications Authorizations (as defined the Purchase Agreement), (iv) the accuracy of the representations and warranties contained in the Purchase Agreement (subject to certain qualifications), (v) the performance by the parties of their respective obligations under the Purchase Agreement in all material respects and (vi) with respect to the obligations of Gogo Direct to consummate the Transactions, the absence of a Material Adverse Effect (as defined in the Purchase Agreement). Gogo Direct’s obligation to consummate the transaction is not subject to any condition related to the availability of financing. In connection with and concurrently with the entry into the Purchase Agreement, the Company and Gogo Intermediate Holdings LLC (“Intermediate”) has entered into a debt commitment letter that provides for, among other things, $275 million of incremental term loans under Intermediate’s existing credit facility to fund a portion of the cash purchase price.

The Purchase Agreement contains certain customary termination rights for Gogo Direct and Sellers, including the right to terminate the Purchase Agreement if the transaction has not been consummated before March 28, 2025. In

addition to the remedy of specific performance, the Purchase Agreement also provides that, upon termination of the Purchase Agreement under certain specified circumstances Sellers and the Parent Companies may elect, by notifying the Company, either that (i) the Company shall pay a termination fee of $20,000,000 to Sellers or (ii) Sellers shall pursue damages for willful and material breach of the Purchase Agreement against the Company with an aggregate monetary liability of the Company of no more than $75,000,000.

The foregoing description of the Purchase Agreement is qualified in its entirety by reference to the full text of the Purchase Agreement, a copy of which will be filed as an exhibit to a future Current Report on Form 8-K of the Company.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in response to this Item 3.02. The issuance of the Closing Date Stock Consideration will be completed in reliance upon the exemption from the registration requirements of the Securities Act of 1933, as amended, provided by Section 4(a)(2) thereof as a transaction by an issuer not involving any public offering.

Item 7.01. Regulation FD Disclosure.

On September 30, 2024, the Company and affiliates of Sellers issued a joint press release announcing the execution of the Purchase Agreement. A copy of the joint press release announcing the proposed transaction is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

On September 30, 2024, the Company made available an investor presentation and fact sheet on its website at http://ir.gogoair.com. Copies of the investor presentation and fact sheet are furnished herewith as Exhibit 99.2 and 99.3, respectively, and are incorporated herein by reference.

The information in this Item 7.01, including Exhibits 99.1, 99.2 and 99.3 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in this Item 7.01, including the exhibits incorporated by reference herein, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), regardless of any incorporation by reference language in any such filing, except as shall be expressly set forth by specific reference in such a filing. The furnishing of the joint press release, investor presentation and fact sheet is not intended to, and does not, constitute a determination or admission by the Company that the information in the joint press release is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company or any of its affiliates.

Forward Looking Statements

Certain disclosures in this report include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding the Transactions, the Company’s business outlook, industry, business strategy, plans, goals and expectations concerning the Company’s market position, international expansion, future technologies, future operations, margins, profitability, future efficiencies, capital expenditures, liquidity and capital resources and other financial and operating information. When used in this discussion, the words “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “future” and the negative of these or similar terms and phrases are intended to identify forward-looking statements in this report. Forward-looking statements reflect the Company’s current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Although the Company believes the expectations reflected in the forward-looking statements are reasonable, the Company can give you no assurance these expectations will prove to have been correct. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. Actual events, results and outcomes may differ materially from the Company’s expectations due to a variety of known and unknown risks, uncertainties and other factors. Although it is not possible to identify all of these risks and factors, they include, among others, our ability to effectively evaluate and pursue strategic opportunities. Additional information concerning these and other factors can be found under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with

the Securities and Exchange Commission (the “SEC”) on February 28, 2024, and in the Company’s Quarterly Reports on Form 10-Q as filed with the SEC on May 7, 2024 and August 7, 2024. Any one of these factors or a combination of these factors could materially affect the Company’s financial condition or future results of operations and could influence whether any forward-looking statements contained in this report ultimately prove to be accurate. The Company’s forward-looking statements are not guarantees of future performance, and you should not place undue reliance on them. All forward-looking statements speak only as of the date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

| By: |

|

/s/ Crystal L. Gordon |

|

|

Crystal L. Gordon |

|

|

Executive Vice President, General Counsel, Chief Administrative Officer, and Secretary |

Date: September 30, 2024

Exhibit 99.1

Gogo to Acquire Satcom Direct

Establishes the only multi-orbit, multi-band, global in-flight connectivity provider serving the

fast-growing business aviation and military/government mobility markets

Immediately accretive transaction delivers scale benefits

and significant cost synergies for enhanced value creation

BROOMFIELD, Colo., September 30, 2024—Gogo Inc. (NASDAQ: GOGO)

(“Gogo” or the “Company”) and Satcom Direct today announced entry into a definitive agreement under which Gogo will acquire Satcom Direct to create the only in-flight connectivity provider

able to satisfy the performance and cost needs of every segment of the global business aviation (BA) and military/government mobility markets.

Under the

terms of the agreement, Satcom Direct will receive $375 million in cash and five million shares of Gogo stock at closing, and up to an additional $225 million in payments tied to realizing certain performance thresholds over the next four

years.

Satcom Direct has an extensive international sales and service footprint and is the leading global BA geostationary (GEO) satellite in-flight connectivity service provider. In 2024, Satcom Direct is expected to generate approximately $485 million in revenue with EBITDA margins of approximately 17% on a pro forma adjusted basis. Satcom

Direct generates approximately 80% of its revenue from the BA market, and approximately 20% from the military/government mobility market.

“This

transaction accelerates our growth strategies of expanding our total addressable market to include the 14,000 business aircraft outside North America, and delivering solutions that meet the needs of every segment of the BA market,” said

Oakleigh Thorne, Gogo Chairman and CEO. “Together, Gogo and Satcom Direct will offer integrated GEO-LEO satellite solutions that provide the highest performance of any satellite solution, along with the

world-class customer support that the global heavy jet segment demands.”

“This transaction also uniquely positions us to sell our Galileo LEO

solution integrated into Satcom Direct’s GEO and L-band offerings as part of a multi-band, multi-orbit solution for the fast-growing military/government mobility market,” Thorne said. “We look

forward to welcoming the world-class Satcom Direct team to Gogo.”

“Satcom Direct is thrilled to be joining forces with Gogo, a company that

shares our focus on delivering outstanding service and leading innovation,” said Chris Moore, Satcom Direct President. “Our businesses have highly complementary core competencies, and our combined financial strength and expertise unlocks

opportunities to invest in new technology and deliver significant long-term value creation.”

Strategic and Financial Benefits

| |

• |

|

Establishes a unique

LEO-GEO-ATG product line for BA. Unmatched offerings for all segments of the BA market expected to drive revenue growth – from North America ATG to

meet basic connectivity needs, to integrated multi-orbit LEO-GEO solutions via combination of Gogo Galileo and Satcom’s Plane Simple GEO solutions. |

| |

• |

|

Combines two respected BA-focused companies. Activates a

global BA-fluent sales force and white-glove customer support team to serve Gogo and Satcom Direct customers worldwide and drive global sales of Gogo Galileo. |

| |

• |

|

Provides Gogo entry into the large and fast-growing military/government mobility vertical.

Satcom Direct’s existing products and expertise immediately diversify Gogo’s revenue, and when combined with Gogo Galileo, create a growth opportunity with unique integrated LEO-GEO products to

serve military and government customers. |

| |

• |

|

Expands platform for the sale and service of new products as technology evolves. A combined

installed base of 12,000 unique global customers creates an advantageous pathway to sell upgrades to new technologies that can be installed faster and more cost-effectively than competitors’ products. |

| |

• |

|

Complementary OEM and aftermarket positions will drive enhanced recurring revenue with

long customer lifetimes. The combined company will be linefit offerable on more OEM aircraft models than any competitor, and have the largest aftermarket dealer network and fractional, charter and managed fleets relationships in the world.

|

| |

• |

|

Unlocks immediate accretion and significant cost savings. The transaction is expected to be

immediately accretive to earnings and free cash flow per share and is expected to generate $25-30 million in annual run-rate cost synergies in the two years

following closing. |

| |

• |

|

Strengthens financial profile with enhanced scale, attractive margins and greater cash flows.

Expected pro forma 2024 revenue of approximately $890 million, adjusted EBITDA margin of approximately 24% and free cash flow of more than $100 million. Including the anticipated launch of Gogo Galileo, the combined company

is expected to deliver long-term annual revenue growth in the 10% range, adjusted EBITDA margins in the mid-20% range and significant free cash flow accretion, which will support strategic investments, de-levering and return of capital to shareholders. |

Transaction Details

Under the terms of the agreement, Gogo will acquire Satcom Direct for $375 million in cash, subject to customary adjustments, and five million shares of

Gogo stock at closing. The agreement also provides for potential additional consideration, capped at $225 million, based on retaining and growing broadband customers above certain performance thresholds in the form of:

| |

• |

|

A royalty earnout from 2025-2028; and |

| |

• |

|

A buyout earnout based on 2028 results. |

The transaction will be financed with a combination of cash-on-hand and

$275 million in committed new debt. Gogo expects net leverage to be in the 4x range post-closing and anticipates returning to its target net leverage range of 2.5-3.5x two years post-closing.

The transaction has been unanimously approved by the Board of Directors of Gogo and remains subject to regulatory approvals and customary closing conditions

and is expected to close by the end of 2024.

Kirkland & Ellis LLP and Hogan Lovells LLP are serving as legal advisors to Gogo. BofA Securities

and Morgan Stanley & Co. LLC are serving as financial advisors to Gogo. Morgan Stanley Senior Funding, Inc., BofA Securities and Deutsche Bank Securities Inc. provided financing commitments to support the acquisition. Haynes Boone, LLP is

serving as legal advisor, and J.P. Morgan is serving as financial advisor to Satcom Direct.

Conference Call and Webcast Details

Gogo will host a conference call to discuss the transaction today at 9 a.m. ET. The call will be webcast live and available for replay at

https://edge.media-server.com/mmc/p/r5j6sy6b.The accompanying slide presentation will be available online on the Investor Relations section of the Company’s investor website at https://ir.gogoair.com.

Participants can use the below link to retrieve your unique conference ID to use to access the conference call.

https://register.vevent.com/register/BIba0db10ad1a8456dbfb694312a7b3fe7

About Gogo

Gogo is a leading provider of broadband connectivity services for the business aviation market. We offer a customizable suite of smart cabin systems for highly

integrated connectivity, inflight entertainment, and voice solutions. Gogo’s products and services are installed on thousands of business aircraft of all sizes and mission types from turboprops to the largest global jets, and are utilized by

the largest fractional ownership operators, charter operators, corporate flight departments and individuals.

As of June 30, 2024, Gogo reported

7,031 business aircraft flying with its broadband ATG systems onboard, 4,215 of which are flying with a Gogo AVANCE L5 or L3 system; and 4,247 aircraft with narrowband satellite connectivity installed. Connect with us at www.gogoair.com.

About Satcom Direct

Satcom Direct (SD) is founded on a

core belief in understanding the value of time and the importance of maximizing it. The company mobilizes the most cutting-edge technologies to enable connection wherever you might be. SD’s proprietary technologies span business aviation and

government sectors, with the singular goal of leading connectivity industry standards.

Harnessing a powerful combination of tools, SD delivers

consistent, reliable connectivity globally. Proprietary software, hardware, terrestrial infrastructure, cybersecurity solutions and award-winning customer support create tailored data services for each individual customer mission. The aim is to

enhance the passenger and ownership experience, improve efficiencies and give back precious time by providing connectivity beyond all expectations.

SD

World Headquarters is located at the heart of the Space Coast in Melbourne, Florida, with 14 additional locations in 11 countries, including the UK, UAE, Switzerland, Singapore, Australia, and Brazil, plus a hardware development and manufacturing

base in Ottawa, Canada. For more information regarding SD, visit www.satcomdirect.com, e-mail sales@satcomdirect.com, or call U.S. +1.321.777.3000 or UK +44.1252.554.460

|

|

|

|

|

| Investor Relations Contact |

|

Media Relations Contacts: |

| Gogo

Will Davis +1 917-519-6994 wdavis@gogoair.com |

|

Gogo

Dave Mellin +1 720-840-4788 dmellin@gogoair.com

Bryan Locke / Lindsay Molk FGS Global

Gogo@fgsglobal.com |

|

Satcom Direct

Jane Stanbury +44 7803 296 046

+1 438 998 1668

Jane@arenagroupassociates.com |

Cautionary Note Regarding Forward-Looking Statements

Certain disclosures in this press release include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, without limitation, statements regarding our business outlook, industry, business strategy, plans, goals and expectations concerning our market position, international expansion, future technologies, future

operations, margins, profitability, future efficiencies, capital expenditures, liquidity and capital resources and other financial and operating information. When used in this discussion, the words “anticipate,” “assume,”

“believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” “future” and the negative of these or similar terms and phrases are intended to identify forward-looking statements in this press release.

Forward-looking statements are based on our current expectations regarding future events, results or outcomes. These expectations may or may not be realized.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. Some of these expectations may be based upon assumptions, data or

judgments that prove to be incorrect. Actual events, results and outcomes may differ materially from our expectations due to a variety of known and unknown risks, uncertainties and other factors. Although it is not possible to identify all of these

risks and factors, they include, among others, our ability to effectively evaluate and pursue strategic opportunities.

Additional information concerning these and other factors can be found under the caption “Risk

Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2024, and in

subsequent Quarterly Reports on Form 10-Q as filed with the SEC on May 7, 2024 and August 7, 2024.

Any one of these factors or a combination of these factors could materially affect our financial condition or future results of operations and could influence

whether any forward-looking statements contained in this report ultimately prove to be accurate. Our forward-looking statements are not guarantees of future performance, and you should not place undue reliance on them. All forward-looking statements

speak only as of the date made and we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Exhibit 99.2 Gogo to Acquire Satcom Direct © 2024 Gogo Inc. All

trademarks are the property of their respective owners.

Forward-Looking Statements This document contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned against relying on forward-looking statements as it is very difficult to predict the impact of known factors and it is impossible to anticipate

all factors that could affect actual results. These forward-looking statements include, without limitation, statements regarding the Company’s business outlook, industry, business strategy, plans, goals and expectations concerning the

Company’s market position, international expansion, future technologies, future operations, margins, profitability, future efficiencies, capital expenditures, liquidity and capital resources and other financial and operating information. When

used in this document, the words “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “future” and the negative of these or similar terms and phrases

are intended to identify forward-looking statements in this document. Forward-looking statements reflect the Company’s current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Although

the Company believes the expectations reflected in the forward-looking statements are reasonable, the Company can give you no assurance these expectations will prove to have been correct. Some of these expectations may be based upon assumptions,

data or judgments that prove to be incorrect. Actual events, results and outcomes may differ materially from the Company’s expectations due to a variety of known and unknown risks, uncertainties and other factors. Although it is not possible

to identify all of these risks and factors, they include, among others, our ability to effectively evaluate and pursue strategic opportunities. Additional information concerning these and other factors can be found under the caption “Risk

Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2024, and in the Company’s Quarterly Reports on

Form 10-Q as filed with the SEC on May 7, 2024 and August 7, 2024. In light of these risks, uncertainties and assumptions, the forward-looking statements contained in this report document may not be realized and you are cautioned against relying

thereon. All forward-looking statements attributable to the company or persons acting on the company’s behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made,

and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. 2

Establishing the only multi-orbit, multi-band global IFC provider for

the BA and military/government mobility markets Unique LEO, GEO, L-band, ATG and Flight Deck offering able to satisfy performance, resiliency and cost needs of all BA segments Combines two respected business aviation-focused companies Expands

platform for the sale and service of new products across combined installed base of 12,000 unique global customers Accelerates adoption of Gogo’s LEO connectivity solution with Satcom Direct’s global sales and support network

Complementary OEM and aftermarket positions to drive enhanced recurring revenue with long customer lifetimes Provides Gogo entry into the large and fast-growing military/government mobility vertical Brings together world-class talent with

complementary expertise Delivers scale benefits, immediate accretion and significant cost synergies Enhances Gogo’s strategic, competitive and financial positions for greater long-term shareholder and customer value creation 3

Satcom Direct: a leading GEO satellite in-flight connectivity service

provider Company Profile Approximate Revenue Splits by Vertical ~$485M ~17% 13% 20% 2024E Adj. EBITDA 2021A-2024E Business Aviation Revenue* Margin* Revenue* CAGR Mil/Gov 6000 100+ 13 1997 80% Aircraft in Countries with Global Founded 1 service

customers offices SD Serves Highly Complementary BA Customers Strong talent with deep satellite connectivity expertise 1300 Heavy Jets 1,300 World-class customer service & support globally with broadband connectivity via multi-bearer SDR router

~5000 Strong GS OEM relationship drives UOL growth • Segment generates ~50% of Total total SD revenue • Only 175 customers in this Complementary customer-centric, innovative culture segment overlap with Gogo 1 SD BA Aircraft in Service

*On a pro forma adjusted basis 1 Unique aircraft 4

Establishing an unmatched BA offering GEO Multi-orbit (GEO, LEO, ATG)

LEO B2B enterprise Forthcoming network reliability AVANCE SDR Multi-bearer routers Solutions for all BA aircraft sizes Software strength from SD Pro DASH aircraft tip to tail & FDF North America Rest of World Complementary (ATG) (Satellite)

geographies Global sales force and customer service 5

Advances Gogo’s strategy for long-term value creation 1§

Satcom Direct’s leading ex.-NAM service and support infrastructure provides an immediate launchpad for Gogo Galileo § Satcom Direct’s 1,300 SDR-enabled jets are prime candidates for adding Gogo Galileo Expand TAM to include §

Unique opportunity in the military/government mobility vertical 14,000 ex-NA aircraft 2 § Complementary OEM and aftermarket positions to support broader AVANCE and SDR penetration; long customer lifetimes § Combined installed base of

approximately 12,000 unique global customers to sell upgrades to Driving AVANCE new technologies with easy, cost-effective installation penetration 3 § Creates unique LEO, GEO, L-band and ATG offering able to serve every segment of the BA

market with the very best solutions – from North America ATG to meet basic connectivity needs, to integrated multi-orbit LEO-GEO solutions Serve all segments of § Ability to satisfy the most demanding customers the global BA market

6

Well-positioned to catalyze growth with LEO in two attractive and

underpenetrated market verticals Military/Government Mobility Business Aviation* Strong demand growth driven by cloud computing, U.S. Mil/Gov mobility satcom spend $1.5B, and growing streaming and video conferencing rapidly as departments install,

or upgrade connectivity Highly unpenetrated market: LEO/ESA is the Long-term government contracts that are resilient to catalyst for dramatic penetration rate acceleration changes in market dynamics Uniquely positioned to: Only 34% of BA jets have

broadband IFC today § Offer both integrated LEO, GEO, ATG networks to the Total Global BA Jets US Government Galileo FDX to target ~7k heavy jets, § Fulfills government PACE requirements including add-ons in ~1300 Satcom § Service

global government customers wanting to utilize Direct heavy jet fleet 7k their own GEO assets 11k Galileo HDX targeting § ~5k mid/lite jets with no broadband § Gain immediate government customer access for Gogo solution outside the US, 6k

Leo offering as SD a prime contractor on significant § Large portion of 12K US mid/lite, that PLEO contract fly regional, or desire high capacity Heavy Medium/Super-Mid Lite *Excluding turboprops 7

Unlocks near- and long-term financial benefits Strong Long-Term Pro

Forma Combined Company 2024E Financial Profile + ~10% ~$890M $100M ~24% Expected Long-term Annual Revenue Free Cash Flow Adj. EBITDA Margin Revenue Growth Mid-20% Expected Long-term Adj. EBITDA Margin Expected Annual Run-Rate Cost Synergies 2 years

Significant $25-30M post-closing Free Cash Flow Accretion Immediately accretive to earnings and free cash flow per share 8

Transaction summary § $375 million in cash (subject to customary

adjustments) and 5 million shares of Gogo stock issued at transaction closing § Shares subject to certain lock-up provisions § Additional potential consideration capped at $225 million, based on retaining and growing broadband customers

above certain Consideration performance thresholds in the form of: § Royalty earnout from 2025 –2028; and § Buyout earnout based on 2028 results. § Combination of cash-on-hand and $275M committed new debt Financing §

Anticipate net leverage ratio of ~4x at closing; expect to return to target net leverage range of 2.5-3.5x 2 years post-closing § Bringing together the best products, processes and people Organization § Expect members of the Satcom Direct

leadership team to join Gogo at closing Closing§ Expect to close by the end of 2024, subject to regulatory approvals and other customary closing conditions 9

Q&A © 2024 Gogo Inc. All trademarks are the property of their

respective owners.

Exhibit 99.3

SD Sitcom direct. Gogo to Acquire Satcom Direct Establishes the only multi-orbit, multi-band, global

in-flight connectivity provider serving the fast-growing business aviation and military/government mobility markets Delivers Significant Strategic and Financial Benefits Establishing an Unmatched BA Offering

GEO LEO Forthcoming AVANCE SDR DASHSD Pro & FDF North America Rest of World (ATG) (Satellite) Establishes a unique LEO-GEO-ATG product line for BA Combines two

respected BA-focused companies Provides Gogo entry into the large and fast-growing military/government mobility vertical Expands platform for the sale and service of new products as technology evolves

Complementary OEM and aftermarket positions will drive enhanced recurring revenue with long customer lifetimes Pro Forma Combined Company 2024E ~$890M ~24% Revenue Adj. EBITDA Margin Expected Annual Run-Rate $25-30M Cost Synergies Strong Long-Term Financial Profile Expected Long-term Adj. EBITDA MarginMid-20%Free Cash Flow AccretionSignificant~10%Expected Long-term Annual Revenue

Growth $100M+ Free Cash Flow 2 years post-closing Multi-orbit (GEO, LEO, ATG) B2B enterprise network reliability Multi-bearer routers Solutions for all BA aircraft sizes Software strength from aircraft tip to tail Complementary geographies Global

sales force and customer service

SD Sitcom direct. Financial Overview1Serving Attractive Verticals~$485M2024E Revenue13%2021A-2024E Revenue CAGR~17% Adjusted EBITDA

Margin 20% Approximate 80%Military/Revenue Splits Business by Vertical Aviation Government Complementary Business Profile100+ Countries with customers13Global offices1997Founding year6,000Aircrafts in service Strong talent with deep satellite

connectivity expertise Strong OEM relationships drive UOL growth World-class customer service & support globally Customer-centric, innovative culture Transaction Details Expected by the end of 2024 subject to regulatory approvals and other

customary closing conditionsClosing$375M cash2 and 5M Gogo shares at closing Additional potential consideration of up to $225M, based on retaining and growing broadband customers above certain thresholds Consideration 1.On a pro forma adjusted basis

2.Subject to customary adjustments Forward Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned against relying on forward-looking

statements as it is very difficult to predict the impact of known factors and it is impossible to anticipate all factors that could affect actual results. These forward-looking statements include, without limitation, statements regarding the

Company’s business outlook, industry, business strategy, plans, goals and expectations concerning the Company’s market position, international expansion, future technologies, future operations, margins, profitability, future efficiencies,

capital expenditures, liquidity and capital resources and other financial and operating information. When used in this document, the words “anticipate,” “assume,” “believe,” “budget,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,”

“future” and the negative of these or similar terms and phrases are intended to identify forward-looking statements in this document. Forward-looking statements reflect the Company’s current expectations regarding future events,

results or outcomes. These expectations may or may not be realized. Although the Company believes the expectations reflected in the forward-looking statements are reasonable, the Company can give you no assurance these expectations will prove to

have been correct. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. Actual events, results and outcomes may differ materially from the Company’s expectations due to a variety of known and

unknown risks, uncertainties and other factors. Although it is not possible to identify all of these risks and factors, they include, among others, our ability to effectively evaluate and pursue strategic opportunities. Additional information

concerning these and other factors can be found under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the

Securities and Exchange Commission (the “SEC”) on February 28, 2024, and in the Company’s Quarterly Reports on Form 10-Q as filed with the SEC on May 7, 2024 and August 7, 2024.

In light of these risks, uncertainties and assumptions, the forward-looking statements contained in this report document may not be realized and you are cautioned against relying thereon. All forward-looking statements attributable to the company or

persons acting on the company’s behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and the Company undertakes no obligation to update or revise publicly

any forward-looking statements, whether as a result of new information, future events or otherwise. © 2024 Gogo Inc.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

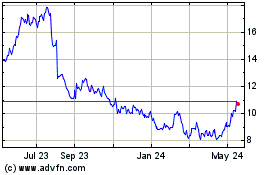

Gogo (NASDAQ:GOGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

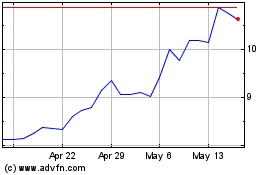

Gogo (NASDAQ:GOGO)

Historical Stock Chart

From Nov 2023 to Nov 2024