0001123494

HARVARD BIOSCIENCE INC

false

--12-31

FY

2023

November 23, 2023

James Green

Chairman, President and Chief Executive Officer

true

false

240,000

false

false

January 21, 2024

0.01

0.01

5,000,000

5,000,000

0.01

0.01

80,000,000

80,000,000

43,394,509

43,394,509

42,081,707

42,081,707

137

566

0

0

0

60

4

15

0

0

1

4

0

0

0

0

0

Weighted average life in years as of September 30, 2022

Updated dimension from: "Debt Securities [Member]".

00011234942023-01-012023-12-31

iso4217:USD

00011234942023-06-30

xbrli:shares

00011234942024-03-01

thunderdome:item

00011234942023-11-232023-12-31

00011234942023-12-31

00011234942022-12-31

iso4217:USDxbrli:shares

00011234942022-01-012022-12-31

0001123494us-gaap:CommonStockMember2021-12-31

0001123494us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001123494us-gaap:RetainedEarningsMember2021-12-31

0001123494us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

00011234942021-12-31

0001123494us-gaap:CommonStockMember2022-01-012022-12-31

0001123494us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-31

0001123494us-gaap:RetainedEarningsMember2022-01-012022-12-31

0001123494us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-31

0001123494us-gaap:CommonStockMember2022-12-31

0001123494us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001123494us-gaap:RetainedEarningsMember2022-12-31

0001123494us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0001123494us-gaap:CommonStockMember2023-01-012023-12-31

0001123494us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-31

0001123494us-gaap:RetainedEarningsMember2023-01-012023-12-31

0001123494us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-31

0001123494us-gaap:CommonStockMember2023-12-31

0001123494us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001123494us-gaap:RetainedEarningsMember2023-12-31

0001123494us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

xbrli:pure

utr:Y

0001123494us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-12-31

0001123494us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2023-12-31

0001123494hbio:ComputerEquipmentAndSoftwareMembersrt:MinimumMember2023-12-31

0001123494hbio:ComputerEquipmentAndSoftwareMembersrt:MaximumMember2023-12-31

0001123494us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-31

0001123494us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-12-31

utr:D

0001123494srt:MinimumMember2023-01-012023-12-31

0001123494srt:MaximumMember2023-01-012023-12-31

0001123494srt:MinimumMember2023-12-31

0001123494srt:MaximumMember2023-12-31

0001123494us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2023-01-012023-12-31

0001123494us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2023-01-012023-12-31

0001123494srt:RestatementAdjustmentMember2022-01-012022-12-31

0001123494srt:RestatementAdjustmentMember2021-01-012021-12-31

0001123494srt:RestatementAdjustmentMember2022-12-31

0001123494us-gaap:AccumulatedTranslationAdjustmentMember2021-12-31

0001123494us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-31

0001123494us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-31

0001123494us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-31

0001123494us-gaap:AccumulatedTranslationAdjustmentMember2022-12-31

0001123494us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-31

0001123494us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-31

0001123494us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-31

0001123494us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-31

0001123494us-gaap:AccumulatedTranslationAdjustmentMember2023-12-31

0001123494us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-31

0001123494us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-31

0001123494hbio:DistributionAgreementscustomerRelationshipsMember2023-12-31

0001123494hbio:DistributionAgreementscustomerRelationshipsMember2022-12-31

0001123494hbio:ExistingTechnologyAndSoftwareDevelopmentMember2023-12-31

0001123494hbio:ExistingTechnologyAndSoftwareDevelopmentMember2022-12-31

0001123494hbio:TradeNamesAndPatentsMember2023-12-31

0001123494hbio:TradeNamesAndPatentsMember2022-12-31

0001123494us-gaap:MachineryAndEquipmentMember2023-12-31

0001123494us-gaap:MachineryAndEquipmentMember2022-12-31

0001123494hbio:ComputerEquipmentAndSoftwareMember2023-12-31

0001123494hbio:ComputerEquipmentAndSoftwareMember2022-12-31

0001123494us-gaap:LeaseholdImprovementsMember2023-12-31

0001123494us-gaap:LeaseholdImprovementsMember2022-12-31

0001123494us-gaap:FurnitureAndFixturesMember2023-12-31

0001123494us-gaap:FurnitureAndFixturesMember2022-12-31

0001123494us-gaap:AutomobilesMember2023-12-31

0001123494us-gaap:AutomobilesMember2022-12-31

0001123494country:US2023-12-31

0001123494country:US2022-12-31

0001123494country:DE2023-12-31

0001123494country:DE2022-12-31

0001123494hbio:RestOfTheWorldMember2023-12-31

0001123494hbio:RestOfTheWorldMember2022-12-31

0001123494hbio:CostOfRevenuesMember2021-12-31

0001123494us-gaap:EmployeeSeveranceMember2021-12-31

0001123494us-gaap:OtherRestructuringMember2021-12-31

0001123494hbio:CostOfRevenuesMember2022-01-012022-12-31

0001123494us-gaap:EmployeeSeveranceMember2022-01-012022-12-31

0001123494us-gaap:OtherRestructuringMember2022-01-012022-12-31

0001123494hbio:CostOfRevenuesMember2022-12-31

0001123494us-gaap:EmployeeSeveranceMember2022-12-31

0001123494us-gaap:OtherRestructuringMember2022-12-31

0001123494hbio:CostOfRevenuesMember2023-01-012023-12-31

0001123494us-gaap:EmployeeSeveranceMember2023-01-012023-12-31

0001123494us-gaap:OtherRestructuringMember2023-01-012023-12-31

0001123494hbio:CostOfRevenuesMember2023-12-31

0001123494us-gaap:EmployeeSeveranceMember2023-12-31

0001123494us-gaap:OtherRestructuringMember2023-12-31

0001123494us-gaap:PensionPlansDefinedBenefitMember2023-12-31

0001123494us-gaap:PensionPlansDefinedBenefitMember2022-12-31

0001123494us-gaap:OtherNoncurrentLiabilitiesMember2023-12-31

0001123494us-gaap:OtherNoncurrentLiabilitiesMember2022-12-31

0001123494us-gaap:DomesticCorporateDebtSecuritiesMember2023-12-31

0001123494us-gaap:DomesticCorporateDebtSecuritiesMember2022-12-31

0001123494us-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-12-31

0001123494us-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-31

0001123494us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-31

0001123494us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-31

0001123494hbio:OtherPlanAssetsMember2023-12-31

0001123494hbio:OtherPlanAssetsMember2022-12-31

0001123494us-gaap:FairValueInputsLevel1Member2023-12-31

0001123494us-gaap:FairValueInputsLevel1Member2022-12-31

0001123494us-gaap:FairValueInputsLevel2Member2023-12-31

0001123494us-gaap:FairValueInputsLevel2Member2022-12-31

0001123494us-gaap:FairValueInputsLevel3Member2023-12-31

0001123494us-gaap:FairValueInputsLevel3Member2022-12-31

0001123494hbio:TermLoanMember2023-12-31

0001123494hbio:TermLoanMember2022-12-31

0001123494us-gaap:LineOfCreditMember2023-12-31

0001123494us-gaap:LineOfCreditMember2022-12-31

0001123494hbio:TheCreditAgreementMemberhbio:TheLendersMemberhbio:TermLoanMember2020-12-22

0001123494us-gaap:RevolvingCreditFacilityMemberhbio:TheCreditAgreementMemberhbio:TheLendersMember2020-12-22

0001123494us-gaap:LetterOfCreditMemberhbio:TheCreditAgreementMemberhbio:TheLendersMember2020-12-22

0001123494hbio:SwinglineLoanFacilityMemberhbio:TheCreditAgreementMemberhbio:TheLendersMember2020-12-22

0001123494hbio:TheCreditAgreementMember2020-12-22

0001123494us-gaap:RevolvingCreditFacilityMemberhbio:TheCreditAgreementMember2023-12-31

0001123494hbio:TheCreditAgreementMemberhbio:SecuredOvernightFinancingRateSofrMember2023-12-31

0001123494hbio:TheCreditAgreementMemberus-gaap:BaseRateMember2023-12-31

0001123494hbio:TheCreditAgreementMemberhbio:TheSOFRLoanAndPricingGridCreditAgreementMembersrt:MinimumMemberhbio:SecuredOvernightFinancingRateSofrMember2023-01-012023-12-31

0001123494hbio:TheCreditAgreementMembersrt:MaximumMemberhbio:SecuredOvernightFinancingRateSofrMember2023-01-012023-12-31

0001123494hbio:TheCreditAgreementMembersrt:MinimumMemberhbio:TheABRLoanMember2023-01-012023-12-31

0001123494hbio:TheCreditAgreementMembersrt:MaximumMemberhbio:TheABRLoanMember2023-01-012023-12-31

0001123494hbio:TheCreditAgreementMember2023-01-012023-12-31

0001123494hbio:TheCreditAgreementMember2022-01-012022-12-31

0001123494hbio:TheCreditAgreementMember2023-12-31

0001123494hbio:TheCreditAgreementMember2022-12-31

0001123494us-gaap:InterestRateSwapMember2023-12-31

0001123494us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001123494us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001123494us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001123494us-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001123494us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001123494us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001123494us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001123494us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001123494us-gaap:CostOfSalesMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-12-31

0001123494us-gaap:CostOfSalesMemberus-gaap:SegmentContinuingOperationsMember2022-01-012022-12-31

0001123494us-gaap:SellingAndMarketingExpenseMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-12-31

0001123494us-gaap:SellingAndMarketingExpenseMemberus-gaap:SegmentContinuingOperationsMember2022-01-012022-12-31

0001123494us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-12-31

0001123494us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:SegmentContinuingOperationsMember2022-01-012022-12-31

0001123494us-gaap:ResearchAndDevelopmentExpenseMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-12-31

0001123494us-gaap:ResearchAndDevelopmentExpenseMemberus-gaap:SegmentContinuingOperationsMember2022-01-012022-12-31

0001123494hbio:TwentyTwentyOneIncentivePlanMember2023-12-31

0001123494us-gaap:EmployeeStockOptionMemberhbio:BlackScholesOptionPricingModelMember2023-01-012023-12-31

0001123494us-gaap:EmployeeStockOptionMemberhbio:BlackScholesOptionPricingModelMember2022-01-012022-12-31

0001123494us-gaap:RestrictedStockUnitsRSUMember2021-12-31

0001123494hbio:MarketConditionRestrictedStockUnitsMember2021-12-31

0001123494us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-31

0001123494hbio:MarketConditionRestrictedStockUnitsMember2022-01-012022-12-31

0001123494us-gaap:RestrictedStockUnitsRSUMember2022-12-31

0001123494hbio:MarketConditionRestrictedStockUnitsMember2022-12-31

0001123494us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-31

0001123494hbio:MarketConditionRestrictedStockUnitsMember2023-01-012023-12-31

0001123494us-gaap:RestrictedStockUnitsRSUMember2023-12-31

0001123494hbio:MarketConditionRestrictedStockUnitsMember2023-12-31

00011234942023-12-312023-12-31

00011234942022-12-312022-12-31

0001123494hbio:EmployeeStockPurchasePlanMember2023-12-31

0001123494hbio:InstrumentsEquipmentSoftwareAndAccessoriesMember2023-01-012023-12-31

0001123494hbio:InstrumentsEquipmentSoftwareAndAccessoriesMember2022-01-012022-12-31

0001123494hbio:ServiceMaintenanceAndWarrantyContractsMember2023-01-012023-12-31

0001123494hbio:ServiceMaintenanceAndWarrantyContractsMember2022-01-012022-12-31

0001123494us-gaap:TransferredAtPointInTimeMember2023-01-012023-12-31

0001123494us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-31

0001123494us-gaap:TransferredOverTimeMember2023-01-012023-12-31

0001123494us-gaap:TransferredOverTimeMember2022-01-012022-12-31

0001123494country:US2023-01-012023-12-31

0001123494country:US2022-01-012022-12-31

0001123494srt:EuropeMember2023-01-012023-12-31

0001123494srt:EuropeMember2022-01-012022-12-31

0001123494hbio:GreaterChinaMember2023-01-012023-12-31

0001123494hbio:GreaterChinaMember2022-01-012022-12-31

0001123494hbio:RestOfTheWorldMember2023-01-012023-12-31

0001123494hbio:RestOfTheWorldMember2022-01-012022-12-31

0001123494us-gaap:ServiceMember2023-12-31

0001123494us-gaap:ServiceMember2022-12-31

0001123494us-gaap:ServiceMember2023-01-012023-12-31

0001123494us-gaap:ServiceMember2021-12-31

0001123494us-gaap:ServiceMember2022-01-012022-12-31

0001123494hbio:CustomerAdvancesMember2023-12-31

0001123494hbio:CustomerAdvancesMember2022-12-31

0001123494hbio:CustomerAdvancesMember2023-01-012023-12-31

0001123494hbio:CustomerAdvancesMember2021-12-31

0001123494hbio:CustomerAdvancesMember2022-01-012022-12-31

0001123494us-gaap:StateAndLocalJurisdictionMemberhbio:ExpireBetween2024And2043Member2023-12-31

0001123494us-gaap:ForeignCountryMember2023-12-31

0001123494hbio:Expire2024Member2023-12-31

0001123494us-gaap:ForeignCountryMemberus-gaap:ResearchMember2023-12-31

0001123494srt:SubsidiariesMemberus-gaap:NonUsMember2023-12-31

0001123494srt:SubsidiariesMemberus-gaap:NonUsMember2022-12-31

0001123494srt:DirectorMemberhbio:IndemnificationAgreementsMember2023-12-31

0001123494hbio:CaseInSuffolkSuperiorCourtMemberus-gaap:ConvertiblePreferredStockMember2022-06-102022-06-10

00011234942022-06-10

0001123494hbio:HarvardApparatusRegenerativeTechnologyIncHartMember2023-12-31

0001123494hbio:HarvardApparatusRegenerativeTechnologyIncHartMember2023-01-012023-12-31

0001123494us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberhbio:HoeferProductLineMember2023-02-17

0001123494us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberhbio:HoeferProductLineMember2023-02-172023-02-17

0001123494hbio:ProgramsEstablishedToOffsetTheImpactOfCOVIDMember2023-01-012023-12-31

0001123494hbio:ProgramsEstablishedToOffsetTheImpactOfCOVIDMember2022-01-012022-12-31

0001123494hbio:PaycheckProtectionProgramCaresActMemberus-gaap:SubsequentEventMember2024-02-012024-02-29

0001123494hbio:BlackScholesOptionPricingModelMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2023

or

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 001-33957

HARVARD BIOSCIENCE, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 04-3306140 |

| (State or other jurisdiction of Incorporation or organization) | (I.R.S. Employer Identification No.) |

84 October Hill Road, Holliston, Massachusetts 01746

(Address of Principal Executive Offices, including zip code)

(508) 893-8999

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

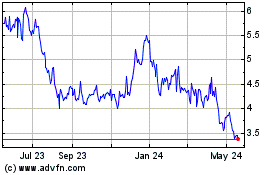

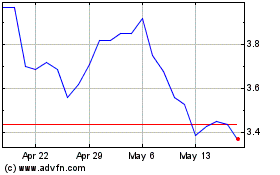

| Common Stock, $0.01 par value | HBIO | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☒ |

| | |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| | |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes ☐ No ☒

The aggregate market value of shares of voting common equity held by non-affiliates of the registrant as of June 30, 2023 was approximately $219.4 million based on the closing sales price of the registrant’s common stock, par value $0.01 per share on that date. At March 1, 2024, there were 43,399,291 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s definitive Proxy Statement in connection with the 2024 Annual Meeting of Stockholders (the “Proxy Statement”), to be filed within 120 days after the end of the Registrant’s fiscal year, are incorporated by reference into Part III of this Form 10-K. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part hereof.

HARVARD BIOSCIENCE, INC.

TABLE OF CONTENTS

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2023

INDEX

This Annual Report on Form 10-K contains statements that are not statements of historical fact and are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), each as amended. The forward-looking statements are principally, but not exclusively, contained in “Item 1: Business” and “Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to, statements about management’s confidence or expectations, our business strategy, our ability to raise capital or borrow funds to consummate acquisitions and the availability of attractive acquisition candidates, our expectations regarding future costs of product revenues, our anticipated compliance with the covenants contained in our credit facility, the adequacy of our financial resources and our plans, objectives, expectations and intentions that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “seek,” “expects,” “plans,” “aim,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “intends,” “think,” “strategy,” “potential,” “objectives,” “optimistic,” “new,” “goal” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in detail under the heading “Item 1A. Risk Factors” beginning on page 7 of this Annual Report on Form 10-K. You should carefully review all of these factors, as well as other risks described in our public filings, and you should be aware that there may be other factors, including factors of which we are not currently aware, that could cause these differences. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this report. We may not update these forward-looking statements, even though our situation may change in the future, unless we have obligations under the federal securities laws to update and disclose material developments related to previously disclosed information. Harvard Bioscience, Inc. is referred to herein as “we,” “our,” “us,” and “the Company.”

PART I

Overview

Harvard Bioscience, Inc., a Delaware corporation, is a leading developer, manufacturer and seller of technologies, products and services that enable fundamental advances in life science applications, including research, pharmaceutical and therapy discovery, bioproduction and preclinical testing for pharmaceutical and therapy development. Our products and services are sold globally to customers ranging from renowned academic institutions and government laboratories to the world’s leading pharmaceutical, biotechnology and contract research organizations (“CROs”). With operations in the United States, Europe and China, we sell through a combination of direct and distribution channels to customers around the world.

Our History and Strategy

Our business began in 1901, under the name Harvard Apparatus. It was founded by Dr. William T. Porter, a Professor of Physiology at Harvard Medical School and a pioneer of physiology education. We have grown over the years with the development and evolution of modern life science research and education. Our early inventions included ventilators based on Dr. Porter’s design, the mechanical syringe pump for drug infusion in the 1950s, and the microprocessor-controlled syringe pump in the 1980s.

In 1996, a group of investors acquired a majority of the then existing business of our predecessor, Harvard Apparatus, Inc. Following this acquisition, our focus was redirected to acquiring complementary companies with innovative technologies while continuing to grow the existing business through internal product development. Harvard Bioscience, Inc. was incorporated in the State of Delaware in September 2000 and became the successor entity to Harvard Apparatus, Inc. by merger in November 2000.

From 1996 to 2018, we completed multiple business or product line acquisitions related to our continuing operations. In 2018, we acquired Data Sciences International, Inc. (“DSI”), a global leader in products, services and solutions focused on preclinical testing. The DSI product portfolio, which is largely complementary to our cellular and molecular technology (“CMT”) product portfolio, expanded our product portfolio to address the continuum from research and discovery to preclinical testing with principal applications in pharmaceutical and therapy testing.

During 2021, we completed a restructuring program to improve operational efficiency and reduce costs which entailed consolidating and downsizing several sites and reducing headcount in Europe and North America. During 2022, we reviewed our business and product portfolio and identified opportunities to rationalize our product portfolio, improve our cost structure and optimize our sales organization. In connection with this review, we identified certain non-strategic products for discontinuation and further reduced our headcount in Europe and North America. We believe that these actions will allow us to focus on product opportunities that drive sustainable revenue growth with attractive gross margins and improved profitability.

Our strategy for driving sustainable revenue growth is focused on four areas. The first is to maintain and strengthen our existing competitive position in the areas of therapy research and pre-clinical testing, which we believe provides a base for expanding our products and technologies to address additional growth opportunities. The second is to expand our product offerings to higher-volume industrial customers such as CROs, biotechnology and pharmaceutical companies, and government laboratories engaged in the development and testing of new therapeutics, where the ability to reduce costs and improve cycle times in pre-clinical testing has the potential to drive additional demand. Third, we are expanding our product offerings for biotechnology and pharmaceutical customers in the field of bioproduction, where we believe there are opportunities to provide innovative products and services that bridge from research and development to production in applications that scale with production volume. Fourth, we are expanding our product offerings for academic, biotechnology, and pharmaceutical customers engaged in therapy, discovery, development and testing, especially in the area of streamlined in vitro testing from cell lines to organoids early in the development cycle.

Our Products

As noted above, our products, consumables, software and services enable fundamental advances in life science applications, including research, pharmaceutical and therapy discovery, bioproduction and preclinical testing.

We have organized our product line activities into two product families, CMT and Preclinical.

Our CMT product family is primarily composed of products supporting research related to molecular, cellular, organ and organoid technologies. Our CMT products also have application in the emerging field of bioproduction of pharmaceuticals and therapeutics as well as in in vitro testing of cell lines and organoids in the therapy development. The principal customers for our CMT products include academic and government laboratories, biotechnology and pharmaceutical companies, and CROs.

Our Preclinical product family includes products that support the preclinical research and testing phase for drug development, and in particular testing related to data collection and analysis for safety and regulatory compliance. Preclinical products are primarily sold to pharmaceutical, biotechnology and CROs, as well as larger academic labs.

We sell our products under several brand names, including Harvard Apparatus, DSI, Buxco, Biochrom, BTX, Heka, Hugo Sachs, Multichannel Systems MCS GmbH (“MCS”) and Panlab.

Our solutions range from simple to complex, and generally consist of hardware/firmware and software products, augmented with consumables, options, upgrades and post-sales (scientific, installation and data) services. Sales prices of these products and services range typically from $1,000 to over $100,000. Our products include spectrophotometers that analyze light to detect and quantify a wide range of molecules as well as cell analysis and electroporation and electrofusion systems to influence and/or analyze cellular processes. Other products and services focus on tissue and organ responses to new drugs and encompass wireless monitors, and signal acquisition and analysis functionality. We also feature products that monitor physiological processes in living organisms to study behavior. Many of our proprietary products are leaders in their fields.

In addition to our proprietarily manufactured products, we distribute products developed by other manufacturers. These distributed products accounted for approximately 13% and 15% of our revenues for the years ended December 31, 2023 and 2022, respectively. Resale of such products enables us to act as a single source for our customers’ research needs. They consist of a large variety of complementing instruments or accessories as well as consumables used in experiments involving fluid handling, molecular and cell analysis and tissue, organ and animal research.

Below is a description of each product family.

Cellular and Molecular Technologies Product Family

Our CMT product family includes products designed primarily to support the discovery phase of new drug development. The CMT product family includes the Harvard Apparatus, Biochrom, BTX, Heka, Hugo Sachs, and MCS brands. CMT products include:

| |

● |

electroporation and electrofusion instruments, including the bioproduction configuration of our BTX electroporation system, introduced in 2022, which leverages our electroporation technology to bridge from therapy to production in the emerging field of bioproduction; |

| |

|

|

| |

● |

amino acid analyzers, spectrophotometers, and other equipment which primarily support molecular level testing and research; |

| |

|

|

| |

● |

high precision syringe and peristaltic infusion pump product lines; |

| |

|

|

| |

● |

precision scientific measuring instrumentation and equipment in the field of electrophysiology such as: data acquisition systems with custom amplifier configurations for cellular analysis, complete micro electrode array solutions for in vivo recordings and in vitro systems for extracellular recordings; and |

| |

|

|

| |

● |

our new Mesh MEA™ platform, launched in 2023, builds on our existing micro-electrode array technology to support streamlined in vitro testing from cell lines to organoids early in the therapy development cycle. |

Our CMT product family made up approximately 49% and 51% of our global revenues for the years ended December 31, 2023 and 2022, respectively.

Preclinical Product Family

Our Preclinical product family provides a complete platform to assess physiological data from organisms for research ranging from basic research to drug discovery, and drug development services. The Preclinical product family includes the DSI, Panlab and Buxco brands. It includes:

| |

● |

implantable and externally worn telemetry systems, which are commonly used in research to collect cardiovascular, central nervous system, respiratory, metabolic data; |

| |

|

|

| |

● |

behavioral products; isolated organ and surgical products, a broad range of instruments and accessories for tissue, organ-based lab research, including surgical products, infusion systems, and behavior research systems; |

| |

|

|

| |

● |

turn-key respiratory system solutions encompassing plethysmograph chambers, data acquisition hardware, physiological signal analysis software, and final report generation; |

| |

|

|

| |

● |

inhalation and exposure systems providing precise, homogenous aerosol delivery for up to 42 subjects, while integrating respiratory parameters for the ultimate delivered dose system; |

| |

|

|

| |

● |

powerful GLP-capable data acquisition and analysis systems, capable of integrating third party sensors for a more comprehensive study design; and |

| |

|

|

| |

● |

our new VivaMars™ behavioral monitoring system, launched in 2023, which is directed to the high throughput testing needs of higher-volume industrial customers such as CROs, biotechnology and pharmaceutical companies, and government laboratories engaged in the development and testing of new therapeutics. |

Our Preclinical product family made up approximately 51% and 49% of our global revenues for the years ended December 31, 2023 and 2022, respectively.

Customers

Our end-user customers are primarily research and development scientists and engineers at pharmaceutical and biotechnology companies, universities, hospitals, government laboratories, including the United States National Institutes of Health (“NIH”), U.S. Army and CROs. Our pharmaceutical and biotechnology customers include pharmaceutical companies and research laboratories such as Abbott, Amgen, AstraZeneca, Bayer, Glaxo Smith Kline, Johnson & Johnson, Merck, Novartis, Pfizer and Regeneron. Our academic customers include major colleges and universities such as Baylor College of Medicine, Cambridge University, Harvard University, Imperial College of London, Johns Hopkins University, Stanford, the University of California system, University of Pennsylvania, University of Pittsburgh, University of Texas and Yale University. Our CRO customers include Charles River Laboratories, Labcorp and Wuxi AppTec. We have a wide range of diverse customers worldwide, and no customer accounted for more than 10% of our revenues in 2023.

Sales

We conduct direct sales and through distributors in the United States, China and major European markets. We sell primarily through distributors in other countries. For the year ended December 31, 2023, revenues from direct sales to end-users represented approximately 65% of our revenues; and revenues from sales of our products through distributors represented approximately 35% of our revenues.

Direct Sales

We have a global sales organization managing both direct sales and distributors. Our websites and marketing collateral serve as the primary sales tool for our product lines, which includes both proprietary manufactured products and complementary products from various suppliers.

Sales through Distributors

We engage distributors for the sales of our own branded and private label products in certain areas of the world and for certain product lines.

Marketing

Our marketing activities encompass product management and marketing communications. Marketing maintains value-proposition based product roadmaps, collaborates with research and development on timing and investment for new products, develops marketing and sales strategies, supports direct and distributor sales activities, and sets the global pricing of our products. Our marketing team also maintains digital presence across the web and social media platforms, creates electronic leads and analyzes opportunities for new product portfolio extensions.

Research and Development

Our research and development activities are focused primarily on maintaining and strengthening our existing product and technology portfolio and expanding our portfolio to support new opportunities consistent with our growth strategy. We maintain development staff in many of our manufacturing facilities to design and develop new products and to re-engineer existing products to bring them to the next generation. Our research and development expenses were approximately $11.8 million and $12.3 million for the years ended December 31, 2023 and 2022, respectively. We anticipate that we will continue to make investments in research and development activities to advance our position in the industry as a provider of life science equipment, software and services. We plan to continue to pursue a balanced development portfolio strategy of originating new products from internal research and acquiring products and technologies through business and technology acquisitions or collaborations, as appropriate.

Manufacturing

We manufacture and test the majority of our products in our principal manufacturing facilities located in the United States, Germany and Spain. We have considerable manufacturing flexibility at our various facilities, and each facility can manufacture multiple products at the same time. We maintain in-house manufacturing expertise, technologies and resources. We seek to maintain multiple suppliers for key components that are not manufactured in-house, and while some of our products are dependent on sole-source suppliers, we have made investments in new talent in procurement and other functions to reduce exposures related to sole-source suppliers, and are accelerating these efforts given the dynamics of the global supply chain in recent years. Our manufacturing operations primarily involve assembly and testing activities along with some machine-based processes. Going forward we will continue to evaluate our manufacturing facilities and operations in order to optimize our manufacturing footprint.

See “Part I, Item 2. Properties” of this report for additional information regarding our manufacturing facilities.

Competition

The markets into which we sell our products are highly competitive, and we expect the intensity of competition to continue or increase. We compete with many companies engaged in developing and selling tools for life science research. Many of our competitors have greater financial, operational, sales and marketing resources and more experience in research and development and commercialization than we have. Moreover, our competitors may have broader product offerings and greater name recognition than we do, and many offer discounts as a competitive tactic. These competitors and other companies may have developed or could in the future develop new technologies that compete with our products, which could render our products obsolete. We cannot provide assurance that we will be able to make the enhancements to our technologies necessary to compete successfully with newly emerging technologies. While we provide a broad selection of differentiated products, we have numerous competitors across our product lines. We believe that we compete favorably with our competitors on the basis of product performance, including quality, reliability, speed, technical support, price and delivery time.

We compete with several companies that provide products for life science research including Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, Emka Technologies, Eppendorf AG, Instem plc, Kent Scientific Corporation, Lonza Group Ltd., PerkinElmer, Inc., Thermo Fisher Scientific, Inc. and TSE Systems.

We cannot forecast if or when these or other companies may develop competitive products. We expect that other products will compete with our products and potential products based on efficacy, safety, cost and intellectual property positions. While we believe that these will be the primary competitive factors, other factors include, in certain instances, availability of supply, manufacturing, marketing and sales expertise and capability.

Seasonality

Sales and earnings in our third quarter are usually flat or down from the second quarter primarily because there are a large number of holidays and vacations during such quarter, especially in Europe. Our fourth quarter revenues and earnings are often the highest in any fiscal year compared to the other three quarters, primarily because many of our customers tend to spend budgeted money before their own fiscal year ends.

Intellectual Property

To establish and protect our proprietary technologies and products, we rely on a combination of patent, copyright, trademark and trade secret laws, as well as confidentiality provisions in our contracts. Patents or patent applications cover certain of our new technologies. Most of our product lines are protected principally by trade names and trade secrets.

We have implemented a patent strategy designed to provide us with freedom to operate and facilitate commercialization of our current and future products. Our success depends, to a significant degree, upon our ability to develop proprietary products and technologies. We intend to continue to file patent applications covering new products and technologies where it is appropriate to do so taking into account factors such as the likely scope of coverage, strategic value, and cost.

Patents provide some degree of protection for our intellectual property. However, the assertion of patent protection involves complex legal and factual determinations and is therefore uncertain. The scope of any of our issued patents may not be sufficiently broad to offer meaningful protection. In addition, our issued patents or patents licensed to us may be successfully challenged, invalidated, circumvented or unenforceable so that our patent rights would not create an effective competitive barrier. Moreover, the laws of some foreign countries may protect our proprietary rights to a greater or lesser extent than the laws of the United States. In addition, the laws governing patentability and the scope of patent coverage continue to evolve, particularly in areas of interest to us. As a result, there can be no assurance that patents will be issued from any of our patent applications or from applications licensed to us. As a result of these factors, our intellectual property positions bear some degree of uncertainty.

We also rely in part on trade secret protection of our intellectual property. We attempt to protect our trade secrets by entering into confidentiality agreements with third parties, employees and consultants. Our employees and consultants also sign agreements requiring that they assign to us their interests in patents and copyrights arising from their work for us. Although many of our United States employees have signed agreements not to compete unfairly with us during their employment and after termination of their employment, through the misuse of confidential information, soliciting employees, soliciting customers and the like, the enforceability of these provisions varies from jurisdiction to jurisdiction and, in some circumstances, they may not be enforceable. In addition, it is possible that these agreements may be breached or invalidated and if so, there may not be an adequate corrective remedy available. Despite the measures we have taken to protect our intellectual property, we cannot provide assurance that third parties will not independently discover or invent competing technologies or reverse engineer our trade secrets or other technologies. Therefore, the measures we are taking to protect our proprietary rights may not be adequate.

We do not believe that our products infringe on the intellectual property rights of any third party. We cannot assure, however, that third parties will not claim such infringement by us or our licensors with respect to current or future products. We expect that product developers in our market will increasingly be subject to such claims as the number of products and competitors in our market segment grows and the product functionality in different market segments overlaps. In addition, patents on production and business methods are becoming more common and we expect that more patents will be issued in our technical field. Any such claims, with or without merit, could be time-consuming, result in costly litigation and diversion of management’s attention and resources, cause product shipment delays or require us to enter into royalty or licensing agreements. Moreover, such royalty or licensing agreements, if required, may not be on terms advantageous to us, or acceptable at all, which could seriously harm our business or financial condition.

“Harvard” is a registered trademark of Harvard University. The marks “Harvard Apparatus” and “Harvard Bioscience” are being used pursuant to a license agreement entered into in December 2002 between us and Harvard University.

Government Regulation

We are generally not subject to direct governmental regulation other than the laws and regulations generally applicable to businesses in the domestic and foreign jurisdictions in which we operate. In particular, other than our amino acid analyzer product, our current products are not subject to pre-market approval by the United States Food and Drug Administration for use on human clinical patients. In addition, we believe we are materially in compliance with all relevant environmental laws.

Employees

As of December 31, 2023, we employed 416 employees, which included 391 full-time employees. Some of our employees in Europe have statutory collective bargaining rights. We have never experienced a general work stoppage or strike, and management believes that our relations with our employees are good. Additional information about our employees follows:

| Country |

|

Full-time |

|

|

Part-time |

|

| United States |

|

|

248 |

|

|

|

9 |

|

| Germany |

|

|

55 |

|

|

|

14 |

|

| United Kingdom |

|

|

35 |

|

|

|

2 |

|

| Spain |

|

|

26 |

|

|

|

- |

|

| China |

|

|

17 |

|

|

|

- |

|

| Rest of World |

|

|

10 |

|

|

|

- |

|

| Total |

|

|

391 |

|

|

|

25 |

|

| Function |

|

Full-time |

|

|

Part-time |

|

| Manufacturing |

|

|

153 |

|

|

|

6 |

|

| Sales and marketing |

|

|

135 |

|

|

|

6 |

|

| Research and development |

|

|

49 |

|

|

|

9 |

|

| General and administrative |

|

|

54 |

|

|

|

4 |

|

| Total |

|

|

391 |

|

|

|

25 |

|

We make employment decisions without regard to age, color, national origin, citizenship status, physical or mental disability, race, religion, creed, gender, sex, sexual orientation, gender identity and/or expression, genetic information, marital status, status with regard to public assistance, veteran and military status or any other characteristic protected by federal, state or local law. We take steps to employ and advance in employment qualified protected veterans and qualified individuals with disabilities.

Geographic Area

Financial information regarding geographic areas in which we operate is provided in Notes 5 and 13 to the Consolidated Financial Statements included in “Part IV, Item 15. Exhibits, Financial Statement Schedules” of this report.

Available Information and Website

Our website address is www.harvardbioscience.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and exhibits and amendments to those reports filed or furnished with the Securities and Exchange Commission pursuant to Section 13(a) of the Exchange Act are available for review on our website and the Securities and Exchange Commission’s website at www.sec.gov. Any such materials that we file with, or furnish to, the SEC in the future will be available on our website as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information on our website is not incorporated by reference into this Annual Report on Form 10-K.

The following factors should be reviewed carefully, in conjunction with the other information contained in this Annual Report on Form 10-K. As previously discussed, our actual results could differ materially from our forward-looking statements. Our business faces a variety of risks. These risks include those described below and may include additional risks and uncertainties not presently known to us or that we currently deem immaterial. If any of the events or circumstances described in the following risk factors occur, our business operations, performance and financial condition could be adversely affected, and the trading price of our common stock could decline.

Risks Related to Our Industry

The life sciences industry is very competitive.

We expect to encounter increased competition from both established and development-stage companies that continually enter the market. These include companies developing and marketing life science instruments, systems and lab consumables, health care companies that manufacture laboratory-based tests and analyzers, diagnostic and pharmaceutical companies, analytical instrument companies, and companies developing life science or drug discovery technologies. Currently, our principal competition comes from established companies that provide products that perform many of the same functions for which we market our products. Many of our competitors have substantially greater financial, operational, marketing and technical resources than we do. Moreover, these competitors may offer broader product lines and tactical discounts and may have greater name recognition. In addition, we may face competition from new entrants into the field. We may not have the financial resources, technical expertise or marketing, distribution or support capabilities to compete successfully in the future. In addition, we face changing customer preferences and requirements, including increased customer demand for more environmentally friendly products.

The life sciences industry is also subject to rapid technological change and discovery. The development of new or improved products, processes or technologies by other companies may render our products or proposed products obsolete or less competitive. In some instances, our competitors may develop or market products that are more effective or commercially attractive than our current or future products. To meet the evolving needs of customers, we must continually enhance our current products and develop and introduce new products. However, we may experience difficulties that may delay or prevent the successful development, introduction and marketing of new products or product enhancements. In addition, our product lines are based on complex technologies that are subject to change as new technologies are developed and introduced in the marketplace. We may have difficulty in keeping abreast of the changes affecting each of the different markets we serve or intend to serve, and our new products may not be accepted by the marketplace or may generate lower than anticipated revenues. Our failure to develop and introduce products in a timely manner in response to changing technology, market demands, or the requirements of our customers could cause our product sales to decline, and we could experience significant losses.

We offer, and plan to continue to offer, a broad range of products and have incurred, and expect to continue to incur, substantial expenses for the development of new products and enhancements to our existing products. The speed of technological change in our market may prevent us from being able to successfully market some or all of our products for the length of time required to recover development costs. Failure to recover the development costs of one or more products or product lines could decrease our profitability or cause us to experience significant losses.

A portion of our revenues is derived from customers in the pharmaceutical and biotechnology industries and is subject to the risks faced by those industries. Such risks may adversely affect our financial results.

We derive a significant portion of our revenues from pharmaceutical companies, biotechnology companies, and CROs serving these companies. We expect that pharmaceutical companies, biotechnology companies and CROs will continue to be a significant source of our revenues for the foreseeable future, including in our CMT and Preclinical product families. As a result, we are subject to risks and uncertainties that affect the pharmaceutical and biotechnology industries, such as government regulation, ongoing consolidation, uncertainty of technological change, and reductions and delays in research and development expenditures by companies in these industries.

In particular, the biotechnology industry is largely dependent on raising capital to fund its operations. If biotechnology companies that are our customers are unable to obtain the financing necessary to purchase our products, our business and results of operations could be adversely affected. In addition, we are dependent, both directly and indirectly, upon general health care spending patterns, particularly in the research and development budgets of the pharmaceutical and biotechnology industries, as well as upon the financial condition and purchasing patterns of various governments and government agencies. As it relates to both the biotechnology and pharmaceutical industries, many companies have significant patents that have expired or are about to expire, which could result in reduced revenues for those companies. If pharmaceutical or biotechnology companies that are our customers suffer reduced revenues as a result of these patent expirations, they may be unable to purchase our products, and our business and results of operations could be adversely affected.

Changes in governmental regulations may reduce demand for our products, adversely impact our revenues, or increase our expenses.

We operate in many markets in which we and our customers must comply with federal, state, local and international regulations. We develop, configure and market our products to meet customer needs created by, and in compliance with, those regulations. These requirements include, among other things, regulations regarding manufacturing practices, product labeling, and advertising and post marketing reporting. We must incur expense and spend time and effort to ensure compliance with these complex regulations. Possible regulatory actions for non-compliance could include warning letters, fines, damages, injunctions, civil penalties, recalls, seizures of our products, and criminal prosecution. These actions could result in, among other things, substantial modifications to our business practices and operations; refunds, recalls, or seizures of our products; a total or partial shutdown of production in one or more of our facilities while we or our suppliers remedy the alleged violation; and withdrawals or suspensions of current products from the market. Any of these events could disrupt our business and have a material adverse effect on our revenues, profitability and financial condition.

Risks Related to Our Business

Reductions in customers’ research budgets or government funding may adversely affect our business.

Many of our customers are universities, government research laboratories, private foundations and other institutions that are dependent on grants from government agencies, such as the NIH, for funding. These customers represent a significant source of our revenue. Research and development spending by our customers may fluctuate based on spending priorities and general economic conditions. The level of government funding for research and development is unpredictable. In the past, NIH grants have been frozen or otherwise made unavailable for extended periods or directed to certain products. Reductions or delays in governmental spending could cause customers to delay or forego purchases of our products. If government funding necessary for the purchase of our products were to decrease, our business and results of operations could be materially, adversely affected. Spending by some of these customers fluctuates based on budget allocations and the timely passage of the annual federal budget. An impasse in federal government budget decisions could lead to substantial delays or reductions in federal spending.

Our business is subject to economic, political and other risks associated with international revenues and operations.

We manufacture and sell our products worldwide and as a result, our business is subject to risks associated with doing business internationally. A substantial amount of our revenues is derived from international operations, and we anticipate that a significant portion of our sales will continue to come from outside the United States in the future. We anticipate that revenues from international operations will likely continue to increase as a result of our efforts to expand our business in markets abroad. In addition, a number of our manufacturing facilities and suppliers are located outside the United States.

Our foreign operations subject us to certain risks, including: effects of fluctuations in foreign currency exchange rates; the impact of local economic conditions; fluctuations or reductions in economic growth in overseas markets including Asia and Europe; local product preferences and seasonality and product requirements; local difficulty to effectively establish and expand our business and operations in international markets; disruptions of capital and trading markets; restrictions and potentially negative tax implications of transfer of capital across borders; differing labor regulations; other factors beyond our control, including potential political instability, terrorism, acts of war, natural disasters and diseases, including COVID-19 discussed below; unexpected changes and increased enforcement of regulatory requirements and various state, federal and international, intellectual property, environmental, antitrust, anti-corruption, fraud and abuse (including anti-kickback and false claims laws) and employment laws; interruption to transportation flows for delivery of parts to us and finished goods to our customers; and laws and regulations on foreign investment in the United States under the jurisdiction of the Committee on Foreign Investment in the United States, or CFIUS, and other agencies, including the Foreign Investment Risk Review Modernization Act, or FIRRMA, adopted in August 2018.

A small percentage of our products are subject to export control regulations administered by the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) and by the Export Administration Regulations administered by the U.S. Department of Commerce’s Bureau of Industry and Security (“BIS”). Based on the nature of the product, its ultimate end use and country of destination, we are sometimes subject to foreign assets control and economic sanctions regulations administered by OFAC, which restrict or prohibit our ability to transact with certain foreign countries, certain individuals and entities identified on the Treasury Department’s “Denied Parties List.” Under the OFAC regulations, the sale or transfer of certain equipment to a location outside the United States may require prior approval in the form of an export license issued by the BIS or the U.S. Department of State’s Directorate of Defense Trade Controls. Some potential international transactions may also be restricted or prohibited based on the location, nationality or identity of the potential end user, customer or other parties to the transaction or may require prior authorization in the form of an OFAC license. These risks may be exacerbated by geopolitical tensions in various regions of the world such as China, the Asia-Pacific region and the Middle East. Any delay in obtaining required governmental approvals could affect our ability to conclude a sale or timely commence a project, and the failure to comply with all such controls could result in criminal and/or civil penalties. These international transactions may otherwise be subject to tariffs and import/export restrictions from the United States or other governments.

Our overall success as a global business depends, in part, upon our ability to succeed in differing economic, social and political conditions. In order to continue to succeed in our international sales strategy, we must continue developing and implementing policies and strategies that are effective in each location where we do business, which could negatively affect our profitability.

Rising inflation and interest rates could negatively impact our revenues, profitability and borrowing costs. In addition, if our costs increase and we are not able to correspondingly adjust our commercial relationships to account for this increase, our net income would be adversely affected, and the adverse impact may be material.

Inflation rates, particularly in the U.S., have increased recently to levels not seen in years. Sustained or increased inflation may result in decreased demand for our products, increased operating costs (including our labor costs), reduced liquidity, and limitations on our ability to access credit or otherwise raise debt and equity capital. In addition, the United States Federal Reserve has raised interest rates in response to concerns about inflation. Increases in interest rates have had, and could continue to have, a material impact on our borrowing costs. In an inflationary environment, we may be unable to raise the sales prices of our products at or above the rate at which our costs increase, which could reduce our profit margins and have a material adverse effect on our financial results and net income. We also may experience lower than expected sales if there is a decrease in spending on products in our industry in general or a negative reaction to our pricing. A reduction in our revenue would be detrimental to our profitability and financial condition and could also have an adverse impact on our future growth.

We have substantial debt and other financial obligations, and we may incur even more debt. Any failure to meet our debt and other financial obligations or maintain compliance with related covenants could harm our business, financial condition and results of operations.

Our credit agreement provides for a term loan of $40.0 million and a $25.0 million senior revolving credit facility (collectively, the “Credit Agreement”) and will mature on December 22, 2025. As of December 31, 2023, we had outstanding borrowings of $37.1 million under the Credit Agreement.

Pursuant to the terms of the Credit Agreement, we are subject to various covenants, including negative covenants that restrict our ability to engage in certain transactions, which may limit our ability to respond to changing business and economic conditions. Such negative covenants include, among other things, limitations on our ability and the ability of our subsidiaries to incur debt or liens, make investments (including acquisitions), sell assets, and pay dividends on our capital stock. In addition, the Credit Agreement contains certain financial covenants, including a maximum consolidated net leverage ratio and a minimum consolidated fixed charge coverage ratio, each of which will be tested at the end of each fiscal quarter of the Company.

If we are not able to maintain compliance with the covenants under the Credit Agreement, as amended, or are unsuccessful in obtaining waivers or amendments for any covenant defaults in the future, in addition to other actions our lenders may require, the amounts outstanding under the Credit Agreement may become immediately due and payable. This immediate payment may negatively impact our financial condition. In addition, any failure to make scheduled payments of interest and principal on our outstanding indebtedness would likely harm our ability to incur additional indebtedness on acceptable terms. Our cash flow and capital resources may be insufficient to pay interest and principal on our debt in the future. If that should occur, our capital raising or debt restructuring measures may be unsuccessful or inadequate to meet our scheduled debt service obligations, which could cause us to default on our obligations and further impair our liquidity.

Further, based upon our actual performance levels, our covenants relating to leverage and fixed charges could limit our ability to incur additional debt, which could hinder our ability to execute our current business strategy.

Our ability to make scheduled payments on our debt and other financial obligations and comply with financial covenants depends on our financial and operating performance. Our financial and operating performance will continue to be subject to prevailing economic conditions and to financial, business and other factors, some of which are beyond our control. Failure within any applicable grace or cure periods to make such payments, comply with the financial covenants, or any other non-financial or restrictive covenant, would create a default under our Credit Agreement. Our cash flow and existing capital resources may be insufficient to repay our debt at maturity, in which such case prior thereto we would have to extend such maturity date, or otherwise repay, refinance and or restructure the obligations under the Credit Agreement, including with proceeds from the sale of assets, and additional equity or debt capital. If we are unsuccessful in obtaining such extension, or entering into such repayment, refinance or restructure prior to maturity, or any other default existed under the Credit Agreement, our lenders could accelerate the indebtedness under the Credit Agreement, foreclose against their collateral or seek other remedies, which would jeopardize our ability to continue our current operations.

Ethical concerns surrounding the use of our products and misunderstanding of the nature of our business could adversely affect our ability to develop and sell our existing products and new products.

Some of our products may be used in areas of research involving animal research and other techniques presently being explored in the life science industry. These techniques have drawn negative attention in the public forum. Government authorities may regulate or prohibit any of these activities. Additionally, the public may disfavor or reject these activities.

Foreign currency exchange rate fluctuations may have a negative impact on our reported earnings.

We are subject to the risks of fluctuating foreign currency exchange rates, which could have an adverse effect on the sales price of our products in foreign markets, as well as the costs and expenses of our foreign subsidiaries. A substantial amount of our revenues is derived from international operations, and we anticipate that a significant portion of revenues will continue to come from outside the United States in the future. As a result, currency fluctuations among the United States dollar, British pound, euro and the other currencies in which we do business have caused and will continue to cause foreign currency translation and transaction gains and losses. We have not used forward exchange contracts to hedge our foreign currency exposures. We attempt to manage foreign currency risk through the matching of assets and liabilities. In the future, we may undertake to manage foreign currency risk through hedging methods, including foreign currency contracts. We recognize foreign currency gains or losses arising from our operations in the period incurred. We cannot guarantee that we will be successful in managing foreign currency risk or in predicting the effects of exchange rate fluctuations upon our future operating results because of the number of currencies involved, the variability of currency exposure and the potential volatility of currency exchange rates. We cannot predict with any certainty changes in foreign currency exchange rates or the degree to which we can address these risks.

Failure or inadequacy of our information technology infrastructure or software could adversely affect our day-to-day operations and decision-making processes and have an adverse effect on our performance.

We depend on accurate and timely information and numerical data from key software applications to aid our day-to-day business, financial reporting and decision-making and, in many cases, proprietary and custom-designed software is necessary to operate our business.

Disruption caused by the failure of these systems, the underlying equipment, or communication networks could delay or otherwise adversely impact day-to-day business and decision making, could make it impossible for us to operate critical equipment, and could have an adverse effect on our performance. Our disaster recovery plans may not fully mitigate the effect of any such disruption. Disruptions could be caused by a variety of factors, such as catastrophic events or weather, power outages, or cyber-attacks on our systems by outside parties.

We review our information technology (“IT”) systems regularly to assess and implement opportunities to improve or upgrade our enterprise resource planning (“ERP”) or other information systems required to operate our business effectively. Our ERP systems are critical to our ability to accurately maintain books and records, record transactions, provide important information to our management and prepare our financial statements. The implementation of any IT systems, including ERP systems, has required in the past, and may continue to require, the investment of significant financial and human resources. In addition, we may not be able to successfully complete the implementation of the ERP systems without experiencing difficulties. Any disruptions, delays or deficiencies in the design and implementation of any IT system, including ERP systems could adversely affect our ability to process orders, ship products, provide services and customer support, send invoices and track payments, fulfill contractual obligations or otherwise operate our business.

An information security incident, including a cybersecurity breach, could have a negative impact on our business or reputation.

To meet business objectives, we rely on both internal IT systems and networks, and those of third parties and their vendors, to process and store sensitive data, including confidential research, business plans, financial information, intellectual property, and personal data that may be subject to legal protection. The extensive information security and cybersecurity threats, which affect companies globally, pose a risk to the security and availability of these IT systems and networks, and the confidentiality, integrity, and availability of our sensitive data. We continually assess these threats and make investments to increase internal protection, detection, and response capabilities, as well as ensure our third-party providers have the required capabilities and controls to address this risk. While we have been, and may continue to be, subject to cybersecurity risks and incidents related to our business, to date, we have not experienced any material impact to the business or operations resulting from information or cybersecurity incidents; however, because of the frequently evolving tactics adopted by threat actors, along with the increased volume and sophistication of attacks by such threat actors, there is the potential for us to be materially adversely impacted in the future. This impact could result in reputational, competitive, operational or other business harm as well as financial costs and regulatory action. Additionally, the California Consumer Privacy Act of 2018 (the “CCPA”), which became effective on January 1, 2020, provides private rights of action for data breaches and requires companies that process information on California residents to make new disclosures to consumers about their data collection, use and sharing practices and allow consumers to opt out of certain data sharing with third parties. Compliance with the CCPA and other current and future applicable privacy, cybersecurity and related laws can be costly and time-consuming. Significant capital investments and other expenditures could also be required to remedy cybersecurity problems and prevent future breaches, including costs associated with additional security technologies, personnel, experts and credit monitoring services for those whose data has been breached. These costs, which could be material, could adversely impact our results of operations in the period in which they are incurred and may not meaningfully limit the success of future attempts to breach our information technology systems.

We may be unable to renew leases or enter into new leases on favorable terms.

Our facilities are located in leased premises. Several of our leases will expire in 2024 and we may be unable to renew such leases or enter into new leases on favorable terms and conditions or at all. A significant rise in real estate prices or real property taxes could also result in an increase in lease cost, and thereby negatively impacting the Company’s results of operations and cash flow. As a result, we may incur additional costs including increased rent and other costs related to our renegotiation of lease terms for our facilities or for a new lease in a desirable location.

We may incur additional restructuring costs or not realize the expected benefits of our initiatives to reduce operating expenses in the future.

We may not be able to implement all of the actions that we intend to take in the restructuring of our operations, and we may not be able to fully realize the expected benefits from such realignment and restructuring plans or other similar restructurings in the future. In addition, we may incur additional restructuring costs in implementing such realignment and restructuring plans or other similar future plans in excess of our expectations. The implementation of our restructuring efforts, including the reduction of our workforce, may not improve our operational and cost structure or result in greater efficiency of our organization; and we may not be able to support sustainable revenue growth and profitability following such restructurings.

If we are not able to manage our growth, our operating profits may be adversely impacted.

Our success will depend on the expansion of our operations through organic growth, and we may execute acquisitions in the future to augment this growth. Effective growth management will place increased demands on our management team, operational and financial resources and expertise. To manage growth, we must optimize our operational, financial and management processes and systems, and information technology infrastructure and hire and train additional qualified personnel. While we are currently in the process of evaluating potential improvements to and consolidation of many of our processes and systems, we may not be able to implement these changes in an efficient or timely manner. Failure to manage our growth effectively, including failure to improve our systems and processes timely or efficiently, could impair our ability to generate revenues or could cause our expenses to increase more rapidly than revenues, resulting in operating losses or reduced profitability.

We may incur a variety of costs in connection with acquisitions we may seek to consummate in the future, and we may never realize the anticipated benefits of our acquisitions due in part to difficulties integrating the businesses, operations and product lines.

Our business strategy has historically included the acquisition of businesses, technologies, services or products that we believe are a strategic fit with our business. If we were to undertake future acquisitions, the process of integrating the acquired business, technology, service and/or product(s) may result in unforeseen operating difficulties and expenditures and potentially absorb significant management attention that would otherwise be available for ongoing development of our business. Moreover, we may fail to realize the anticipated benefits of an acquisition as rapidly as expected, or at all. Such transactions are inherently risky, and any such recent or future acquisitions could reduce stockholders’ ownership, cause us to incur debt, expose us to future liabilities and result in amortization expenses related to intangible assets with definite lives, which may adversely impact our ability to undertake future acquisitions on substantially similar terms. We may also incur significant expenditures in anticipation of an acquisition that is never realized.

Our ability to achieve the benefits of acquisitions depends in part on the integration and leveraging of technology, operations, sales and marketing channels and personnel. Integration is a complex, time-consuming and expensive process and may disrupt our business if not completed in a timely and efficient manner. We may have difficulty successfully integrating acquired businesses, and their domestic and foreign operations or product lines, and as a result, we may not realize any of the anticipated benefits of the acquisitions we make. We cannot assure that our growth rate will equal the growth rates that have been experienced by us, and these other acquired companies, respectively, operating as separate companies in the past.

Failure to raise additional capital or generate the significant capital necessary to expand our operations, invest in new products, or pursue acquisitions or other business development opportunities could reduce our ability to compete and result in less revenues.