HMN Financial, Inc. (NASDAQ:HMNF): Third Quarter Highlights Net

interest income up $757,000, or 8.5%, over third quarter of 2005

Net interest margin of 4.06%, up 27 basis points over third quarter

of 2005 Provision for loan losses up $5.1 million, or 533.0%, over

third quarter of 2005 Net income of $74,000, down $2.2 million, or

96.8%, from third quarter of 2005 Diluted earnings per share of

$0.02, down $0.55, or 96.5%, from third quarter of 2005 Year to

Date Highlights Net interest income up $2.4 million, or 9.4%, over

first nine months of 2005 Net interest margin of 4.08%, up 32 basis

points over first nine months of 2005 Provision for loan losses up

$5.0 million, or 201.4%, over first nine months of 2005 Net income

of $5.8 million, down $1.8 million, or 24.2%, from first nine

months of 2005 Diluted earnings per share of $1.43, down $0.46, or

24.3%, from first nine months of 2005 EARNINGS SUMMARY Three Months

Ended Nine Months Ended September 30, September 30, 2006 2005 2006

2005 Net income $73,512� 2,276,401� $5,757,288� 7,590,918� Diluted

earnings per share 0.02� 0.57� 1.43� 1.89� Return on average assets

0.03� 0.92% 0.78� 1.03% Return on average equity 0.30� 10.02% 8.07�

11.51% Book value per share $21.21� 19.97� $21.21� 19.97� HMN

Financial, Inc. (HMN) (NASDAQ:HMNF), the $991 million holding

company for Home Federal Savings Bank (the Bank), today reported

net income of $74,000 for the third quarter of 2006, down $2.2

million, or 96.8%, from net income of $2.3 million for the third

quarter of 2005. Diluted earnings per common share for the third

quarter of 2006 were $0.02, down $0.55, or 96.5%, from $0.57 for

the third quarter of 2005. The decrease in net income is due to a

$5.1 million increase in the loan loss provision between the

periods as a result of increased commercial loan charge offs. Third

Quarter Results Net Interest Income Net interest income was $9.7

million for the third quarter of 2006, an increase of $757,000, or

8.5%, compared to $8.9 million for the third quarter of 2005.

Interest income was $17.2 million for the third quarter of 2006, an

increase of $2.0 million, or 12.7%, from $15.2 million for the same

period in 2005. Interest income increased because of an increase in

the average interest rates earned on loans and investments.

Interest rates increased primarily because of the 150 basis point

increase in the prime interest rate between the periods. Increases

in the prime rate, which is the rate that banks charge their prime

business customers, generally increase the rates on adjustable rate

consumer and commercial loans in the portfolio and new loans

originated. The increase in interest income due to increased rates

was partially offset by a $59 million decrease in the average

outstanding loan portfolio balance between the periods due to an

increase in commercial loan prepayments and a decrease in loan

originations. The average yield earned on interest-earning assets

was 7.19% for the third quarter of 2006, an increase of 74 basis

points from the 6.45% yield for the third quarter of 2005. Interest

expense was $7.5 million for the third quarter of 2006, an increase

of $1.2 million, or 18.8%, compared to $6.3 million for the third

quarter of 2005. Interest expense increased primarily because of

higher interest rates paid on deposits which were caused by the 150

basis point increase in the federal funds rate between the periods.

Increases in the federal funds rate, which is the rate that banks

charge other banks for short term loans, generally increase the

rates banks pay for deposits. The increase in deposit rates was

partially offset by a change in the mix of funding sources between

the periods. The average outstanding balances of brokered deposits

and Federal Home Loan Bank advances of $86 million were replaced

with other less expensive deposits. The average interest rate paid

on interest-bearing liabilities was 3.34% for the third quarter of

2006, an increase of 52 basis points from the 2.82% paid for the

third quarter of 2005. Net interest margin (net interest income

divided by average interest earning assets) for the third quarter

of 2006 was 4.06%, an increase of 27 basis points, compared to

3.79% for the third quarter of 2005. Provision for Loan Losses The

provision for loan losses was $6.0 million for the third quarter of

2006, an increase of $5.1 million, or 533.0%, from $952,000 for the

third quarter of 2005. The provision for loan losses increased

primarily because $7.4 million in related commercial real estate

development loans were charged off during the quarter. Most of the

charged off loans had been downgraded to substandard and classified

as non-accruing in the second quarter of 2006 due to

nonperformance. During the third quarter, it was determined that

the properties securing the loans, primarily developed and

undeveloped single family home lots and a golf course, would be

sold at auction in order to liquidate the assets and repay the

loans. The properties were sold late in the third quarter at

amounts substantially less than the recorded amounts due to an

unanticipated decrease in the values of the properties. The loans

were personally guaranteed and the Company is continuing to pursue

repayment from the guarantors. The amounts charged off represent an

estimate of the loss incurred after considering the auction

proceeds and reviewing each guarantor�s financial position and

assessing their ability to repay their personal obligations. Of the

$14.4 million principal balance of these loans at June 30, 2006,

$4.2 million is recorded as non-accruing at September 30, 2006. The

Company does not anticipate making any material future cash

expenditures in connection with these loans except for those

relating to possible collection costs associated with enforcement

of the personal guarantees. The increase in the provision related

to loan charge offs was partially offset by a $22 million decrease

in outstanding commercial loans during the third quarter of 2006.

Total non-performing assets were $10.3 million at September 30,

2006, a decrease of $3.2 million, or 23.7%, from $13.5 million at

June 30, 2006. Non-performing loans decreased $3.1 million and

foreclosed, repossessed, and other assets decreased $96,000. The

decrease in non-performing loans during the quarter relates

primarily to the charge off of $6.9 million in commercial real

estate development loans described above that were previously

classified as non-performing. The decrease related to the charge

offs was partially offset by an increase in other non-performing

commercial real estate loans of $1.3 million, a $524,000 increase

in non-performing commercial business loans, an $895,000 increase

in non-performing single family loans, and a $1.1 million increase

in non-performing consumer loans. Non-Interest Income and Expense

Non-interest income was $1.7 million for the third quarter of 2006,

an increase of $14,000, or 0.8%, from $1.7 million for the same

period in 2005. Fees and service charges increased $114,000 between

the periods primarily because of increased retail deposit account

activity and fees. Gains on sales of loans decreased $144,000 due

to a decrease in the single-family mortgage loans that were sold

and a decrease in the profit margins realized on the loans that

were sold. Competition in the single-family loan origination market

remained strong and profit margins were decreased in order to

remain competitive. Other non-interest income increased $59,000

primarily because of a decrease in the losses on the sale of

repossessed assets in the third quarter of 2006 when compared to

the same period in 2005. Non-interest expense was $5.4 million for

the third quarter of 2006, a decrease of $110,000, or 2.0%, from

$5.5 million for the same period of 2005. Compensation expense

decreased $75,000 between the periods due to a decrease in

incentive compensation that was partially offset by increased

pension costs. Occupancy expense increased $88,000 primarily

because of the additional costs associated with the new branch and

loan origination offices opened in Rochester in the first quarter

of 2006. Data processing costs increased $28,000 primarily because

of an increase in internet and other banking services provided by a

third party processor between the periods. Other operating expenses

decreased $97,000 primarily because of decreased mortgage loan and

commercial foreclosure costs in the third quarter of 2006 when

compared to the same period in 2005. Because of the pre-tax loss

for the quarter, an income tax benefit of $102,000 was recorded for

the third quarter of 2006, a decrease of $2.0 million, or 105.4%,

compared to $1.9 million in expense for the same period of 2005.

Return on Assets and Equity Return on average assets for the third

quarter of 2006 was 0.03%, compared to 0.92% for the third quarter

of 2005. Return on average equity was 0.30% for the third quarter

of 2006, compared to 10.02% for the same period of 2005. Book value

per common share at September 30, 2006 was $21.21, compared to

$19.97 at September 30, 2005. Nine Month Period Results Net Income

Net income was $5.8 million for the nine-month period ended

September 30, 2006, a decrease of $1.8 million, or 24.2%, compared

to $7.6 million for the nine-month period ended September 30, 2005.

Diluted earnings per common share for the nine-month period in 2006

were $1.43, down $0.46, or 24.3%, from $1.89 for the same period in

2005. Net Interest Income Net interest income was $28.8 million for

the first nine months of 2006, an increase of $2.4 million, or

9.4%, from $26.4 million for the same period in 2005. Interest

income was $50.2 million for the nine-month period ended September

30, 2006, an increase of $6.0 million, or 13.5%, from $44.2 million

for the same period in 2005. Interest income increased primarily

because of an increase in the average interest rates earned on

loans and investments. Interest rates increased primarily because

of the 150 basis point increase in the prime interest rate between

the periods. The increase in interest income due to increased rates

was partially offset by a $40 million decrease in the average

outstanding loan portfolio balance between the periods due to an

increase in commercial loan prepayments and a decrease in loan

originations. The yield earned on interest-earning assets was 7.10%

for the first nine months of 2006, an increase of 80 basis points

from the 6.30% yield for the same period in 2005. Interest expense

was $21.3 million for the nine-month period ended September 30,

2006, an increase of $3.5 million, or 19.5%, from $17.8 million for

the same period in 2005. Interest expense increased primarily

because of higher interest rates paid on deposits which were caused

by the 150 basis point increase in the federal funds rate between

the periods. The increase in deposit rates was partially offset by

a change in the mix of funding sources between the periods. The

average outstanding balances of brokered deposits and Federal Home

Loan Bank advances of $45 million were replaced with other less

expensive deposits. The average interest rate paid on

interest-bearing liabilities was 3.22% for the first nine-months of

2006, an increase of 53 basis points from the 2.69% paid for the

same period of 2005. Net interest margin (net interest income

divided by average interest earning assets) for the first nine

months of 2006 was 4.08%, an increase of 32 basis points, compared

to 3.76% for the same period of 2005. Provision for Loan Losses The

provision for loan losses was $7.5 million for the first

nine-months of 2006, an increase of $5.0 million, or 201.4%, from

$2.5 million for the same nine-month period in 2005. The provision

for loan losses increased primarily because $7.4 million in related

commercial real estate development loans were charged off during

the third quarter as more fully described above in the third

quarter �Provision for Loan Losses� discussion. The increase in the

provision related to loan charge offs was partially offset by the

$45 million decrease in outstanding commercial loans during the

first nine months of 2006. Total non-performing assets were $10.3

million at September 30, 2006, an increase of $6.4 million, or

165.1%, from $3.9 million at December 31, 2005. Non-performing

loans increased $6.9 million and foreclosed, repossessed and other

nonperforming assets decreased $477,000 during the first nine

months of 2006. The increase in non-performing loans during the

nine month period relates primarily to a $4.3 million increase in

non-performing commercial real estate loans, a $573,000 increase in

non-performing commercial business loans, a $583,000 increase in

non-performing single-family mortgage loans, and a $879,000

increase in non-performing consumer loans. A reconciliation of the

Company�s allowance for loan losses for the nine-month periods

ended September 30, 2006 and 2005 is summarized as follows: (in

thousands) 2006� 2005� Balance at January 1, $8,777,655�

$8,995,892� Provision 7,521,000� 2,495,000� Charge offs: Commercial

loans (7,373,569) (2,614,530) Consumer loans (234,323) (195,020)

Single family mortgage loans 0� (230,934) Recoveries 55,172�

182,921� Balance at September 30, $8,745,935� $8,633,329�

Non-Interest Income and Expense Non-interest income was $5.0

million for the first nine months of 2006, an increase of $265,000,

or 5.6%, from $4.7 million for the same period in 2005. Fees and

service charges increased $336,000 between the periods primarily

because of increased retail deposit account activity and fees.

Security gains increased $48,000 due to increased security sales.

Gains on sales of loans decreased $212,000 between the periods due

to a decrease in the number of single-family mortgage loans sold

and a decrease in the profit margins realized on the loans that

were sold. Competition in the single-family loan origination market

remained strong and profit margins were lowered in order to remain

competitive. Other non-interest income increased $100,000 primarily

because of a decrease in the losses recognized on repossessed

assets in the first nine months of 2006 when compared to the same

period of 2005. Non-interest expense was $17.1 million for the

first nine months of 2006, an increase of $781,000, or 4.8%, from

$16.4 million for the same period in 2005. Compensation expense

increased $743,000 primarily because of increases in payroll due to

annual pay increases and pension costs. Occupancy expense increased

$255,000 primarily because of the additional costs associated with

new branch and loan origination offices opened in Rochester in the

first quarter of 2006. Data processing costs increased $121,000

primarily because of an increase in internet and other banking

services provided by a third party processor between the periods.

Other non-interest expense decreased $269,000 primarily because of

a decrease in mortgage loan expenses and professional fees. Income

tax expense was $3.4 million for the first nine months of 2006, a

decrease of $1.2 million, or 26.5%, compared to $4.6 million for

the same period of 2005. Income tax expense decreased primarily

because of a decrease in taxable income. Return on Assets and

Equity Return on average assets for the nine-month period ended

September 30, 2006 was 0.78%, compared to 1.03% for the same period

in 2005. Return on average equity was 8.07% for the nine-month

period ended September 30, 2006, compared to 11.51% for the same

period in 2005. President�s Statement �The financial results for

the third quarter were negatively impacted by the commercial loan

charge offs that were recognized,� said HMN President Michael

McNeil. �While we strive to maintain the highest credit quality in

our loan portfolio, unintended results can occur due to changing

credit and market conditions. The charged off loans related to one

real estate development and we believe are not indicative of the

overall commercial loan portfolio. We remain confident in our

business strategy and look forward to improved financial results.�

General Information HMN Financial, Inc. and Home Federal Savings

Bank are headquartered in Rochester, Minnesota. The Bank operates

ten full service offices in southern Minnesota located in Albert

Lea, Austin, LaCrescent, Rochester, Spring Valley and Winona and

two full service offices in Iowa located in Marshalltown and

Toledo. Home Federal Savings Bank also operates loan origination

offices located in Sartell and Rochester, Minnesota. Eagle Crest

Capital Bank, a division of Home Federal Savings Bank, operates

branches in Edina and Rochester, Minnesota. Safe Harbor Statement

This press release may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to those

relating to the Company�s financial expectations for earnings and

revenues. A number of factors could cause actual results to differ

materially from the Company�s assumptions and expectations. These

factors include possible legislative changes and adverse economic,

business and competitive developments such as shrinking interest

margins; reduced collateral values; deposit outflows; reduced

demand for financial services and loan products; changes in

accounting policies and guidelines, changes in monetary and fiscal

policies of the federal government or changes in tax laws.

Additional factors that may cause actual results to differ from the

Company�s assumptions and expectations include those set forth in

the Company�s most recent filings on form 10-K and Form 10-Q with

the Securities and Exchange Commission. All forward-looking

statements are qualified by, and should be considered in

conjunction with, such cautionary statements. HMN FINANCIAL, INC.

AND SUBSIDIARIES Consolidated Balance Sheets � � � � September 30,

December 31, 2006� 2005� � (unaudited) � � � Assets Cash and cash

equivalents $71,239,159� 47,268,795� Securities available for sale:

Mortgage-backed and related securities (amortized cost $6,806,874

and $7,428,504) 6,220,609� 6,879,756� Other marketable securities

(amortized cost $139,850,065 and $113,749,841) 139,787,337�

112,778,813� 146,007,946� 119,658,569� � Loans held for sale

4,216,500� 1,435,141� Loans receivable, net 729,381,119�

785,678,461� Accrued interest receivable 4,659,303� 4,460,014� Real

estate, net 1,033,111� 1,214,621� Federal Home Loan Bank stock, at

cost 7,955,700� 8,364,600� Mortgage servicing rights, net

2,139,158� 2,653,635� Premises and equipment, net 11,674,555�

11,941,863� Investment in limited partnerships 118,989� 141,048�

Goodwill 3,800,938� 3,800,938� Core deposit intangible 134,367�

219,760� Prepaid expenses and other assets 6,697,618� 1,854,948�

Deferred tax asset 2,199,400� 2,544,400� Total assets $991,257,863�

991,236,793� � � Liabilities and Stockholders� Equity Deposits

$741,617,758� 731,536,560� Federal Home Loan Bank advances

150,900,000� 160,900,000� Accrued interest payable 1,434,822�

2,085,573� Customer escrows 1,090,363� 1,038,575� Accrued expenses

and other liabilities 4,150,742� 4,947,816� Total liabilities

899,193,685� 900,508,524� Commitments and contingencies

Stockholders� equity: Serial preferred stock: ($.01 par value)

authorized 500,000 shares; issued and outstanding none 0� 0� Common

stock ($.01 par value): authorized 11,000,000; issued shares

9,128,662 91,287� 91,287� Additional paid-in capital 57,786,780�

58,011,099� Retained earnings, subject to certain restrictions

101,911,810� 98,951,777� Accumulated other comprehensive loss

(391,792) (917,577) Unearned employee stock ownership plan shares

(4,205,988) (4,350,999) Unearned compensation restricted stock

awards 0� (182,521) Treasury stock, at cost 4,785,198 and 4,721,402

shares (63,127,919) (60,874,797) Total stockholders� equity

92,064,178� 90,728,269� Total liabilities and stockholders� equity

$991,257,863� 991,236,793� HMN FINANCIAL, INC. AND SUBSIDIARIES

Consolidated Statements of Income (unaudited) � Three Months Ended

Nine Months Ended September 30, September 30, � 2006 � 2005 � 2006

� 2005 Interest income: Loans receivable $14,962,250� 14,385,320�

44,746,541� 41,487,679� Securities available for sale:

Mortgage-backed and related 66,408� 78,645� 205,839� 252,701� Other

marketable 1,511,616� 645,871� 3,723,794� 1,941,809� Cash

equivalents 545,550� 114,872� 1,254,410� 342,812� Other 89,337�

13,525� 238,142� 182,285� Total interest income 17,175,161�

15,238,233� 50,168,726� 44,207,286� � Interest expense: Deposits

5,813,416� 4,456,305� 16,197,525� 12,358,727� Federal Home Loan

Bank advances 1,659,472� 1,836,269� 5,130,207� 5,485,461� Total

interest expense 7,472,888� 6,292,574� 21,327,732� 17,844,188� Net

interest income 9,702,273� 8,945,659� 28,840,994� 26,363,098�

Provision for loan losses 6,026,000� 952,000� 7,521,000� 2,495,000�

Net interest income after provision for loan losses 3,676,273�

7,993,659� 21,319,994� 23,868,098� � Non-interest income: Fees and

service charges 820,075� 706,337� 2,330,661� 1,994,291� Mortgage

servicing fees 291,157� 305,417� 896,091� 901,760� Securities

gains, net 0� 0� 48,122� 0� Gain on sales of loans 481,209�

624,947� 1,029,794� 1,242,436� Losses in limited partnerships

(6,500) (6,500) (22,059) (20,710) Other 149,479� 90,957� 705,106�

604,711� Total non-interest income 1,735,420� 1,721,158� 4,987,715�

4,722,488� � Non-interest expense: Compensation and benefits

2,706,431� 2,781,366� 9,083,004� 8,340,048� Occupancy 1,130,755�

1,042,417� 3,334,439� 3,079,131� Deposit insurance premiums 23,348�

34,679� 79,337� 97,204� Advertising 108,013� 101,775� 346,172�

291,448� Data processing 306,542� 278,880� 882,300� 761,719�

Amortization of mortgage servicing rights, net 208,202� 256,763�

661,293� 766,885� Other 956,490� 1,053,536� 2,756,276� 3,025,033�

Total non-interest expense 5,439,781� 5,549,416� 17,142,821�

16,361,468� Income (loss) before income tax expense (28,088)

4,165,401� 9,164,888� 12,229,118� Income tax (benefit) expense

(101,600) 1,889,000� 3,407,600� 4,638,200� Net income $73,512�

2,276,401� 5,757,288� 7,590,918� Basic earnings per share $0.02�

0.59� 1.50� 1.98� Diluted earnings per share $0.02� 0.57� 1.43�

1.89� HMN FINANCIAL, INC. AND SUBSIDIARIES Selected Consolidated

Financial Information (unaudited) Three Months Ended Nine Months

Ended SELECTED FINANCIAL DATA: September 30, September 30, (Dollars

in thousands, except per share data) 2006 � 2005 � 2006 � 2005 I.

OPERATING DATA: Interest income $17,175� 15,238� 50,169� 44,207�

Interest expense 7,473� 6,292� 21,328� 17,844� Net interest income

9,702� 8,946� 28,841� 26,363� � II. AVERAGE BALANCES: Assets (1)

991,379� 983,244� 989,291� 981,123� Loans receivable, net 747,261�

807,046� 764,322� 804,585� Mortgage-backed and related securities

(1) 6,916� 8,266� 7,144� 8,790� Interest-earning assets (1)

947,529� 937,400� 945,385� 937,715� Interest-bearing liabilities

887,037� 884,155� 886,403� 885,675� Equity (1) 96,248� 90,129�

95,339� 88,205� � III. PERFORMANCE RATIOS: (1) Return on average

assets (annualized) 0.03% 0.92% 0.78% 1.03% Interest rate spread

information: Average during period 3.85� 3.63� 3.88� 3.61� End of

period 3.97� 3.51� 3.97� 3.51� Net interest margin 4.06� 3.79�

4.08� 3.76� Ratio of operating expense to average total assets

(annualized) 2.18� 2.24� 2.32� 2.23� Return on average equity

(annualized) 0.30� 10.02� 8.07� 11.51� Efficiency 47.56� � 52.03� �

50.68� 52.63� Sept. 30, Dec. 31, Sept. 30, 2006� � 2005� � 2005�

IV. ASSET QUALITY: Total non-performing assets $10,294� 3,883�

4,651� Non-performing assets to total assets 1.04% 0.39% 0.47%

Non-performing loans to total loans receivable, net 1.26% 0.30%

0.37% Allowance for loan losses $8,746� 8,778� 8,633� Allowance for

loan losses to total loans receivable, net 1.20% 1.11% 1.06%

Allowance for loan losses to non-performing loans 94.89� 376.88�

289.51� � V. BOOK VALUE PER SHARE: Book value per share $21.21� �

20.59� � 19.97� Nine Months Year Nine Months Ended Ended Ended Sept

30, 2006 � Dec 31, 2005 � Sept 30, 2005 VI. CAPITAL RATIOS:

Stockholders� equity to total assets, at end of period 9.29% 9.15%

8.96% Average stockholders� equity to average assets (1) 9.64�

9.05� 8.99� Ratio of average interest-earning assets to average

interest-bearing liabilities (1) 106.65� � 105.96� � 105.88� Sept.

30, Dec. 31, Sept. 30, 2006 � 2005 � 2005 VII. EMPLOYEE DATA:

Number of full time equivalent employees 207� � 208� � 206� � � (1)

Average balances were calculated based upon amortized cost without

the market value impact of SFAS 115. HMN Financial, Inc.

(NASDAQ:HMNF): Third Quarter Highlights -- Net interest income up

$757,000, or 8.5%, over third quarter of 2005 -- Net interest

margin of 4.06%, up 27 basis points over third quarter of 2005 --

Provision for loan losses up $5.1 million, or 533.0%, over third

quarter of 2005 -- Net income of $74,000, down $2.2 million, or

96.8%, from third quarter of 2005 -- Diluted earnings per share of

$0.02, down $0.55, or 96.5%, from third quarter of 2005 Year to

Date Highlights -- Net interest income up $2.4 million, or 9.4%,

over first nine months of 2005 -- Net interest margin of 4.08%, up

32 basis points over first nine months of 2005 -- Provision for

loan losses up $5.0 million, or 201.4%, over first nine months of

2005 -- Net income of $5.8 million, down $1.8 million, or 24.2%,

from first nine months of 2005 -- Diluted earnings per share of

$1.43, down $0.46, or 24.3%, from first nine months of 2005 -0- *T

EARNINGS SUMMARY Three Months Ended Nine Months Ended September 30,

September 30, --------------------- --------------------- 2006 2005

2006 2005 --------------------- --------------------- Net income

$73,512 2,276,401 $5,757,288 7,590,918 Diluted earnings per share

0.02 0.57 1.43 1.89 Return on average assets 0.03 0.92% 0.78 1.03%

Return on average equity 0.30 10.02% 8.07 11.51% Book value per

share $21.21 19.97 $21.21 19.97 *T HMN Financial, Inc. (HMN)

(NASDAQ:HMNF), the $991 million holding company for Home Federal

Savings Bank (the Bank), today reported net income of $74,000 for

the third quarter of 2006, down $2.2 million, or 96.8%, from net

income of $2.3 million for the third quarter of 2005. Diluted

earnings per common share for the third quarter of 2006 were $0.02,

down $0.55, or 96.5%, from $0.57 for the third quarter of 2005. The

decrease in net income is due to a $5.1 million increase in the

loan loss provision between the periods as a result of increased

commercial loan charge offs. Third Quarter Results Net Interest

Income Net interest income was $9.7 million for the third quarter

of 2006, an increase of $757,000, or 8.5%, compared to $8.9 million

for the third quarter of 2005. Interest income was $17.2 million

for the third quarter of 2006, an increase of $2.0 million, or

12.7%, from $15.2 million for the same period in 2005. Interest

income increased because of an increase in the average interest

rates earned on loans and investments. Interest rates increased

primarily because of the 150 basis point increase in the prime

interest rate between the periods. Increases in the prime rate,

which is the rate that banks charge their prime business customers,

generally increase the rates on adjustable rate consumer and

commercial loans in the portfolio and new loans originated. The

increase in interest income due to increased rates was partially

offset by a $59 million decrease in the average outstanding loan

portfolio balance between the periods due to an increase in

commercial loan prepayments and a decrease in loan originations.

The average yield earned on interest-earning assets was 7.19% for

the third quarter of 2006, an increase of 74 basis points from the

6.45% yield for the third quarter of 2005. Interest expense was

$7.5 million for the third quarter of 2006, an increase of $1.2

million, or 18.8%, compared to $6.3 million for the third quarter

of 2005. Interest expense increased primarily because of higher

interest rates paid on deposits which were caused by the 150 basis

point increase in the federal funds rate between the periods.

Increases in the federal funds rate, which is the rate that banks

charge other banks for short term loans, generally increase the

rates banks pay for deposits. The increase in deposit rates was

partially offset by a change in the mix of funding sources between

the periods. The average outstanding balances of brokered deposits

and Federal Home Loan Bank advances of $86 million were replaced

with other less expensive deposits. The average interest rate paid

on interest-bearing liabilities was 3.34% for the third quarter of

2006, an increase of 52 basis points from the 2.82% paid for the

third quarter of 2005. Net interest margin (net interest income

divided by average interest earning assets) for the third quarter

of 2006 was 4.06%, an increase of 27 basis points, compared to

3.79% for the third quarter of 2005. Provision for Loan Losses The

provision for loan losses was $6.0 million for the third quarter of

2006, an increase of $5.1 million, or 533.0%, from $952,000 for the

third quarter of 2005. The provision for loan losses increased

primarily because $7.4 million in related commercial real estate

development loans were charged off during the quarter. Most of the

charged off loans had been downgraded to substandard and classified

as non-accruing in the second quarter of 2006 due to

nonperformance. During the third quarter, it was determined that

the properties securing the loans, primarily developed and

undeveloped single family home lots and a golf course, would be

sold at auction in order to liquidate the assets and repay the

loans. The properties were sold late in the third quarter at

amounts substantially less than the recorded amounts due to an

unanticipated decrease in the values of the properties. The loans

were personally guaranteed and the Company is continuing to pursue

repayment from the guarantors. The amounts charged off represent an

estimate of the loss incurred after considering the auction

proceeds and reviewing each guarantor's financial position and

assessing their ability to repay their personal obligations. Of the

$14.4 million principal balance of these loans at June 30, 2006,

$4.2 million is recorded as non-accruing at September 30, 2006. The

Company does not anticipate making any material future cash

expenditures in connection with these loans except for those

relating to possible collection costs associated with enforcement

of the personal guarantees. The increase in the provision related

to loan charge offs was partially offset by a $22 million decrease

in outstanding commercial loans during the third quarter of 2006.

Total non-performing assets were $10.3 million at September 30,

2006, a decrease of $3.2 million, or 23.7%, from $13.5 million at

June 30, 2006. Non-performing loans decreased $3.1 million and

foreclosed, repossessed, and other assets decreased $96,000. The

decrease in non-performing loans during the quarter relates

primarily to the charge off of $6.9 million in commercial real

estate development loans described above that were previously

classified as non-performing. The decrease related to the charge

offs was partially offset by an increase in other non-performing

commercial real estate loans of $1.3 million, a $524,000 increase

in non-performing commercial business loans, an $895,000 increase

in non-performing single family loans, and a $1.1 million increase

in non-performing consumer loans. Non-Interest Income and Expense

Non-interest income was $1.7 million for the third quarter of 2006,

an increase of $14,000, or 0.8%, from $1.7 million for the same

period in 2005. Fees and service charges increased $114,000 between

the periods primarily because of increased retail deposit account

activity and fees. Gains on sales of loans decreased $144,000 due

to a decrease in the single-family mortgage loans that were sold

and a decrease in the profit margins realized on the loans that

were sold. Competition in the single-family loan origination market

remained strong and profit margins were decreased in order to

remain competitive. Other non-interest income increased $59,000

primarily because of a decrease in the losses on the sale of

repossessed assets in the third quarter of 2006 when compared to

the same period in 2005. Non-interest expense was $5.4 million for

the third quarter of 2006, a decrease of $110,000, or 2.0%, from

$5.5 million for the same period of 2005. Compensation expense

decreased $75,000 between the periods due to a decrease in

incentive compensation that was partially offset by increased

pension costs. Occupancy expense increased $88,000 primarily

because of the additional costs associated with the new branch and

loan origination offices opened in Rochester in the first quarter

of 2006. Data processing costs increased $28,000 primarily because

of an increase in internet and other banking services provided by a

third party processor between the periods. Other operating expenses

decreased $97,000 primarily because of decreased mortgage loan and

commercial foreclosure costs in the third quarter of 2006 when

compared to the same period in 2005. Because of the pre-tax loss

for the quarter, an income tax benefit of $102,000 was recorded for

the third quarter of 2006, a decrease of $2.0 million, or 105.4%,

compared to $1.9 million in expense for the same period of 2005.

Return on Assets and Equity Return on average assets for the third

quarter of 2006 was 0.03%, compared to 0.92% for the third quarter

of 2005. Return on average equity was 0.30% for the third quarter

of 2006, compared to 10.02% for the same period of 2005. Book value

per common share at September 30, 2006 was $21.21, compared to

$19.97 at September 30, 2005. Nine Month Period Results Net Income

Net income was $5.8 million for the nine-month period ended

September 30, 2006, a decrease of $1.8 million, or 24.2%, compared

to $7.6 million for the nine-month period ended September 30, 2005.

Diluted earnings per common share for the nine-month period in 2006

were $1.43, down $0.46, or 24.3%, from $1.89 for the same period in

2005. Net Interest Income Net interest income was $28.8 million for

the first nine months of 2006, an increase of $2.4 million, or

9.4%, from $26.4 million for the same period in 2005. Interest

income was $50.2 million for the nine-month period ended September

30, 2006, an increase of $6.0 million, or 13.5%, from $44.2 million

for the same period in 2005. Interest income increased primarily

because of an increase in the average interest rates earned on

loans and investments. Interest rates increased primarily because

of the 150 basis point increase in the prime interest rate between

the periods. The increase in interest income due to increased rates

was partially offset by a $40 million decrease in the average

outstanding loan portfolio balance between the periods due to an

increase in commercial loan prepayments and a decrease in loan

originations. The yield earned on interest-earning assets was 7.10%

for the first nine months of 2006, an increase of 80 basis points

from the 6.30% yield for the same period in 2005. Interest expense

was $21.3 million for the nine-month period ended September 30,

2006, an increase of $3.5 million, or 19.5%, from $17.8 million for

the same period in 2005. Interest expense increased primarily

because of higher interest rates paid on deposits which were caused

by the 150 basis point increase in the federal funds rate between

the periods. The increase in deposit rates was partially offset by

a change in the mix of funding sources between the periods. The

average outstanding balances of brokered deposits and Federal Home

Loan Bank advances of $45 million were replaced with other less

expensive deposits. The average interest rate paid on

interest-bearing liabilities was 3.22% for the first nine-months of

2006, an increase of 53 basis points from the 2.69% paid for the

same period of 2005. Net interest margin (net interest income

divided by average interest earning assets) for the first nine

months of 2006 was 4.08%, an increase of 32 basis points, compared

to 3.76% for the same period of 2005. Provision for Loan Losses The

provision for loan losses was $7.5 million for the first

nine-months of 2006, an increase of $5.0 million, or 201.4%, from

$2.5 million for the same nine-month period in 2005. The provision

for loan losses increased primarily because $7.4 million in related

commercial real estate development loans were charged off during

the third quarter as more fully described above in the third

quarter "Provision for Loan Losses" discussion. The increase in the

provision related to loan charge offs was partially offset by the

$45 million decrease in outstanding commercial loans during the

first nine months of 2006. Total non-performing assets were $10.3

million at September 30, 2006, an increase of $6.4 million, or

165.1%, from $3.9 million at December 31, 2005. Non-performing

loans increased $6.9 million and foreclosed, repossessed and other

nonperforming assets decreased $477,000 during the first nine

months of 2006. The increase in non-performing loans during the

nine month period relates primarily to a $4.3 million increase in

non-performing commercial real estate loans, a $573,000 increase in

non-performing commercial business loans, a $583,000 increase in

non-performing single-family mortgage loans, and a $879,000

increase in non-performing consumer loans. A reconciliation of the

Company's allowance for loan losses for the nine-month periods

ended September 30, 2006 and 2005 is summarized as follows: -0- *T

(in thousands) 2006 2005 ----------- ----------- Balance at January

1, $8,777,655 $8,995,892 Provision 7,521,000 2,495,000 Charge offs:

Commercial loans (7,373,569) (2,614,530) Consumer loans (234,323)

(195,020) Single family mortgage loans 0 (230,934) Recoveries

55,172 182,921 ----------- ----------- Balance at September 30,

$8,745,935 $8,633,329 =========== =========== *T Non-Interest

Income and Expense Non-interest income was $5.0 million for the

first nine months of 2006, an increase of $265,000, or 5.6%, from

$4.7 million for the same period in 2005. Fees and service charges

increased $336,000 between the periods primarily because of

increased retail deposit account activity and fees. Security gains

increased $48,000 due to increased security sales. Gains on sales

of loans decreased $212,000 between the periods due to a decrease

in the number of single-family mortgage loans sold and a decrease

in the profit margins realized on the loans that were sold.

Competition in the single-family loan origination market remained

strong and profit margins were lowered in order to remain

competitive. Other non-interest income increased $100,000 primarily

because of a decrease in the losses recognized on repossessed

assets in the first nine months of 2006 when compared to the same

period of 2005. Non-interest expense was $17.1 million for the

first nine months of 2006, an increase of $781,000, or 4.8%, from

$16.4 million for the same period in 2005. Compensation expense

increased $743,000 primarily because of increases in payroll due to

annual pay increases and pension costs. Occupancy expense increased

$255,000 primarily because of the additional costs associated with

new branch and loan origination offices opened in Rochester in the

first quarter of 2006. Data processing costs increased $121,000

primarily because of an increase in internet and other banking

services provided by a third party processor between the periods.

Other non-interest expense decreased $269,000 primarily because of

a decrease in mortgage loan expenses and professional fees. Income

tax expense was $3.4 million for the first nine months of 2006, a

decrease of $1.2 million, or 26.5%, compared to $4.6 million for

the same period of 2005. Income tax expense decreased primarily

because of a decrease in taxable income. Return on Assets and

Equity Return on average assets for the nine-month period ended

September 30, 2006 was 0.78%, compared to 1.03% for the same period

in 2005. Return on average equity was 8.07% for the nine-month

period ended September 30, 2006, compared to 11.51% for the same

period in 2005. President's Statement "The financial results for

the third quarter were negatively impacted by the commercial loan

charge offs that were recognized," said HMN President Michael

McNeil. "While we strive to maintain the highest credit quality in

our loan portfolio, unintended results can occur due to changing

credit and market conditions. The charged off loans related to one

real estate development and we believe are not indicative of the

overall commercial loan portfolio. We remain confident in our

business strategy and look forward to improved financial results."

General Information HMN Financial, Inc. and Home Federal Savings

Bank are headquartered in Rochester, Minnesota. The Bank operates

ten full service offices in southern Minnesota located in Albert

Lea, Austin, LaCrescent, Rochester, Spring Valley and Winona and

two full service offices in Iowa located in Marshalltown and

Toledo. Home Federal Savings Bank also operates loan origination

offices located in Sartell and Rochester, Minnesota. Eagle Crest

Capital Bank, a division of Home Federal Savings Bank, operates

branches in Edina and Rochester, Minnesota. Safe Harbor Statement

This press release may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to those

relating to the Company's financial expectations for earnings and

revenues. A number of factors could cause actual results to differ

materially from the Company's assumptions and expectations. These

factors include possible legislative changes and adverse economic,

business and competitive developments such as shrinking interest

margins; reduced collateral values; deposit outflows; reduced

demand for financial services and loan products; changes in

accounting policies and guidelines, changes in monetary and fiscal

policies of the federal government or changes in tax laws.

Additional factors that may cause actual results to differ from the

Company's assumptions and expectations include those set forth in

the Company's most recent filings on form 10-K and Form 10-Q with

the Securities and Exchange Commission. All forward-looking

statements are qualified by, and should be considered in

conjunction with, such cautionary statements. -0- *T HMN FINANCIAL,

INC. AND SUBSIDIARIES Consolidated Balance Sheets

----------------------------------------------------------------------

September 30, December 31, 2006 2005 (unaudited)

----------------------------------------------------------------------

Assets Cash and cash equivalents................... $71,239,159

47,268,795 Securities available for sale: Mortgage-backed and

related securities (amortized cost $6,806,874 and

$7,428,504)............................. 6,220,609 6,879,756 Other

marketable securities (amortized cost $139,850,065 and

$113,749,841)..... 139,787,337 112,778,813 -------------

------------ 146,007,946 119,658,569 ------------- ------------

Loans held for sale......................... 4,216,500 1,435,141

Loans receivable, net....................... 729,381,119

785,678,461 Accrued interest receivable................. 4,659,303

4,460,014 Real estate, net............................ 1,033,111

1,214,621 Federal Home Loan Bank stock, at cost....... 7,955,700

8,364,600 Mortgage servicing rights, net.............. 2,139,158

2,653,635 Premises and equipment, net................. 11,674,555

11,941,863 Investment in limited partnerships.......... 118,989

141,048 Goodwill.................................... 3,800,938

3,800,938 Core deposit intangible..................... 134,367

219,760 Prepaid expenses and other assets........... 6,697,618

1,854,948 Deferred tax asset.......................... 2,199,400

2,544,400 ------------- ------------ Total

assets..............................$991,257,863 991,236,793

============= ============ Liabilities and Stockholders' Equity

Deposits....................................$741,617,758

731,536,560 Federal Home Loan Bank advances.............

150,900,000 160,900,000 Accrued interest

payable.................... 1,434,822 2,085,573 Customer

escrows............................ 1,090,363 1,038,575 Accrued

expenses and other liabilities...... 4,150,742 4,947,816

------------- ------------ Total

liabilities......................... 899,193,685 900,508,524

------------- ------------ Commitments and contingencies

Stockholders' equity: Serial preferred stock: ($.01 par value)

authorized 500,000 shares; issued and outstanding

none......................... 0 0 Common stock ($.01 par value):

authorized 11,000,000; issued shares 9,128,662...... 91,287 91,287

Additional paid-in capital.................. 57,786,780 58,011,099

Retained earnings, subject to certain

restrictions............................... 101,911,810 98,951,777

Accumulated other comprehensive loss........ (391,792) (917,577)

Unearned employee stock ownership plan

shares..................................... (4,205,988) (4,350,999)

Unearned compensation restricted stock

awards..................................... 0 (182,521) Treasury

stock, at cost 4,785,198 and 4,721,402

shares........................... (63,127,919) (60,874,797)

------------- ------------ Total stockholders'

equity................ 92,064,178 90,728,269 -------------

------------ Total liabilities and stockholders'

equity..$991,257,863 991,236,793 ============= ============ *T -0-

*T HMN FINANCIAL, INC. AND SUBSIDIARIES Consolidated Statements of

Income (unaudited)

----------------------------------------------------------------------

Three Months Ended Nine Months Ended September 30, September 30,

2006 2005 2006 2005

----------------------------------------------------------------------

Interest income: Loans receivable....$14,962,250 14,385,320

44,746,541 41,487,679 Securities available for sale:

Mortgage-backed and related..... 66,408 78,645 205,839 252,701

Other marketable. 1,511,616 645,871 3,723,794 1,941,809 Cash

equivalents.... 545,550 114,872 1,254,410 342,812

Other............... 89,337 13,525 238,142 182,285 ------------

----------- ----------- ----------- Total interest income..........

17,175,161 15,238,233 50,168,726 44,207,286 ------------

----------- ----------- ----------- Interest expense:

Deposits............ 5,813,416 4,456,305 16,197,525 12,358,727

Federal Home Loan Bank advances...... 1,659,472 1,836,269 5,130,207

5,485,461 ------------ ----------- ----------- ----------- Total

interest expense.......... 7,472,888 6,292,574 21,327,732

17,844,188 ------------ ----------- ----------- ----------- Net

interest income........... 9,702,273 8,945,659 28,840,994

26,363,098 Provision for loan losses............... 6,026,000

952,000 7,521,000 2,495,000 ------------ ----------- -----------

----------- Net interest income after provision for loan

losses...... 3,676,273 7,993,659 21,319,994 23,868,098 ------------

----------- ----------- ----------- Non-interest income: Fees and

service charges............ 820,075 706,337 2,330,661 1,994,291

Mortgage servicing fees............... 291,157 305,417 896,091

901,760 Securities gains, net................ 0 0 48,122 0 Gain on

sales of loans.............. 481,209 624,947 1,029,794 1,242,436

Losses in limited partnerships....... (6,500) (6,500) (22,059)

(20,710) Other............... 149,479 90,957 705,106 604,711

------------ ----------- ----------- ----------- Total non-interest

income........... 1,735,420 1,721,158 4,987,715 4,722,488

------------ ----------- ----------- ----------- Non-interest

expense: Compensation and benefits........... 2,706,431 2,781,366

9,083,004 8,340,048 Occupancy........... 1,130,755 1,042,417

3,334,439 3,079,131 Deposit insurance premiums........... 23,348

34,679 79,337 97,204 Advertising......... 108,013 101,775 346,172

291,448 Data processing..... 306,542 278,880 882,300 761,719

Amortization of mortgage servicing rights, net........ 208,202

256,763 661,293 766,885 Other............... 956,490 1,053,536

2,756,276 3,025,033 ------------ ----------- -----------

----------- Total non-interest expense.......... 5,439,781

5,549,416 17,142,821 16,361,468 ------------ -----------

----------- ----------- Income (loss) before income tax

expense.......... (28,088) 4,165,401 9,164,888 12,229,118 Income

tax (benefit) expense.............. (101,600) 1,889,000 3,407,600

4,638,200 ------------ ----------- ----------- ----------- Net

income........ $73,512 2,276,401 5,757,288 7,590,918 ============

=========== =========== =========== Basic earnings per

share................ $0.02 0.59 1.50 1.98 ============ ===========

=========== =========== Diluted earnings per share................

$0.02 0.57 1.43 1.89 ============ =========== ===========

=========== *T -0- *T HMN FINANCIAL, INC. AND SUBSIDIARIES Selected

Consolidated Financial Information (unaudited) Three Months Ended

Nine Months Ended SELECTED FINANCIAL DATA: September 30, September

30, (Dollars in thousands, except per share data) 2006 2005 2006

2005

----------------------------------------------------------------------

I. OPERATING DATA: Interest income............. $17,175 15,238

50,169 44,207 Interest expense............ 7,473 6,292 21,328

17,844 Net interest income......... 9,702 8,946 28,841 26,363 II.

AVERAGE BALANCES: Assets (1).................. 991,379 983,244

989,291 981,123 Loans receivable, net....... 747,261 807,046

764,322 804,585 Mortgage-backed and related securities

(1)............. 6,916 8,266 7,144 8,790 Interest-earning assets

(1). 947,529 937,400 945,385 937,715 Interest-bearing liabilities

887,037 884,155 886,403 885,675 Equity (1).................. 96,248

90,129 95,339 88,205 III. PERFORMANCE RATIOS: (1) Return on average

assets (annualized)............... 0.03% 0.92% 0.78% 1.03% Interest

rate spread information: Average during period.... 3.85 3.63 3.88

3.61 End of period............ 3.97 3.51 3.97 3.51 Net interest

margin......... 4.06 3.79 4.08 3.76 Ratio of operating expense to

average total assets (annualized)............... 2.18 2.24 2.32

2.23 Return on average equity (annualized)............... 0.30

10.02 8.07 11.51 Efficiency.................. 47.56 52.03 50.68

52.63 ---------------------------- Sept. 30, Dec. 31, Sept. 30,

2006 2005 2005 ---------------------------- IV. ASSET QUALITY:

Total non-performing assets. $10,294 3,883 4,651 Non-performing

assets to total assets............... 1.04% 0.39% 0.47%

Non-performing loans to total loans receivable, net 1.26% 0.30%

0.37% Allowance for loan losses... $8,746 8,778 8,633 Allowance for

loan losses to total loans receivable, net 1.20% 1.11% 1.06%

Allowance for loan losses to non-performing loans....... 94.89

376.88 289.51 V. BOOK VALUE PER SHARE: Book value per share........

$21.21 20.59 19.97 ---------------------------- Nine Nine Months

Year Months Ended Ended Ended Sept 30, Dec 31, Sept 30, 2006 2005

2005 ---------------------------- VI. CAPITAL RATIOS: Stockholders'

equity to total assets, at end of period..................... 9.29%

9.15% 8.96% Average stockholders' equity to average assets

(1)...... 9.64 9.05 8.99 Ratio of average interest- earning assets

to average interest-bearing liabilities (1)............ 106.65

105.96 105.88 ---------------------------- Sept. 30, Dec. 31, Sept.

30, 2006 2005 2005 ---------------------------- VII. EMPLOYEE DATA:

Number of full time equivalent employees....... 207 208 206

----------------------------------------------------------------------

*T (1) Average balances were calculated based upon amortized cost

without the market value impact of SFAS 115.

HMN Financial (NASDAQ:HMNF)

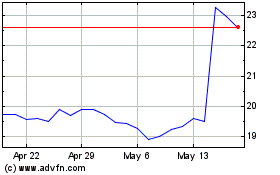

Historical Stock Chart

From Jun 2024 to Jul 2024

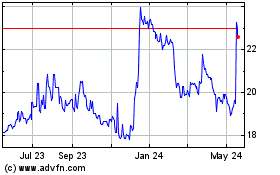

HMN Financial (NASDAQ:HMNF)

Historical Stock Chart

From Jul 2023 to Jul 2024