UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 8)*

Hollysys Automation Technologies Ltd.

(Name of Issuer)

Ordinary Shares, par value $0.001 per share

(Title of Class of Securities)

G45667105

(CUSIP Number)

Mengyun Tang

c/o Advanced Technology (Cayman)

Limited

Suite 3501, 35/F, Jardine House

1 Connaught Place, Central

Hong Kong, China

+852-2165-9000

With Copies To:

Marcia Ellis Rongjing Zhao Morrison & Foerster LLP Edinburgh Tower, 33/F The Landmark, 15 Queen’s Road

Central Hong Kong, China +852-2585-0888 | |

Spencer Klein Mitchell Presser John Owen Morrison & Foerster LLP 250 West 55th Street New York, NY 10019-9601 +1-212-468-8000 |

July 18, 2024

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Liang Meng |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Hong Kong Special Administrative Region of People’s Republic

of China |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

IN |

| |

|

|

|

|

|

|

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III GP Limited |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

CO |

| |

|

|

|

|

|

|

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III GP, L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

PN |

| |

|

|

|

|

|

|

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III, L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

PN |

| |

|

|

|

|

|

|

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Skyline Automation Technologies L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

British Virgin Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

PN |

| |

|

|

|

|

|

|

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Advanced Technology (Cayman) Limited |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

WC |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

CO |

| |

|

|

|

|

|

|

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

EXPLANATORY NOTE

This Amendment No. 8 (this “Schedule

13D Amendment”) to the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on November 6,

2023 (the “Original Schedule 13D” and, as amended by Amendment No. 1 filed with the SEC on November 24, 2023,

Amendment No. 2 filed with the SEC on December 13, 2023 (“Amendment No. 2”), Amendment No. 3 filed

with the SEC on January 2, 2024, Amendment No. 4 filed with the SEC on February 5, 2024, Amendment No. 5 filed with

the SEC on February 9, 2024, Amendment No. 6 filed with the SEC on July 1, 2024, Amendment No. 7 filed with the SEC

on July 12, 2024 and this Schedule 13D Amendment, the “Schedule 13D”) is being filed by Mr. Liang Meng, Ascendent

Capital Partners III GP Limited (“GPGP”), Ascendent Capital Partners III GP, L.P. (“GPLP”), Ascendent

Capital Partners III, L.P. (“ACP III”), Skyline Automation Technologies L.P. (“Superior Fund”)

and Advanced Technology (Cayman) Limited (“Advanced Technology” and, together with Mr. Meng, GPGP, GPLP, ACP III

and Superior Fund, the “Reporting Persons”), with respect to Ordinary Shares, $0.001 par value per share (the “Ordinary

Shares”), of Hollysys Automation Technologies Ltd., a company organized under the laws of the British Virgin Islands (the “Issuer”).

The Reporting Persons are filing this Schedule 13D Amendment to disclose

a press release of the Issuer related to the expected timing of the closing of the Merger (as defined in Amendment No. 2).

Other than as set forth below, all Items in the Original Schedule 13D

are materially unchanged. Capitalized terms used in this Schedule 13D Amendment which are not defined herein have the meanings given to

them in the Original Schedule 13D.

| Item

4. |

Purpose of Transaction. |

Item 4 of the Schedule 13D is hereby amended and supplemented to include

the following:

On July 18, 2024, the Issuer issued a press release providing

an update on the expected timing of the closing of the Merger.

The foregoing description of the press release is a summary only and

is qualified in its entirety by reference to the press release attached hereto as Exhibit 99.16, which is incorporated herein by

reference.

| Item 7. |

Material to be Filed as Exhibits. |

Item

7 of the Schedule 13D is hereby amended and supplemented to include the following:

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete and correct.

Dated: July 19, 2024

| |

Liang Meng |

| |

|

|

| |

/s/ Liang Meng |

| |

|

|

| |

Ascendent Capital Partners III GP Limited |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Ascendent Capital Partners III GP, L.P. |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Ascendent Capital Partners III, L.P. |

| |

By: Ascendent Capital Partners III GP, L.P., its General Partner |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Skyline Automation Technologies L.P. |

| |

By: Ascendent Capital Partners III GP, L.P., its General Partner |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Advanced Technology (Cayman) Limited |

| |

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

Exhibit 99.16

Hollysys Announces

Expected Completion Date of Merger Transaction with Ascendent Capital Partners

Jul 18, 2024

BEIJING, July 18,

2024 /PRNewswire/ -- Hollysys Automation Technologies Ltd. (NASDAQ: HOLI) ("Hollysys" or the "Company")

today announced that it expects to complete its merger transaction with a buyer controlled by Ascendent Capital Partners as soon as July 25,

2024.

The parties have successfully

obtained all necessary approvals and expect to satisfy (or obtain waiver of) all closing conditions by this anticipated closing date.

The Company has notified Nasdaq of its intention to delist its shares from the NASDAQ Global Select Market on that date or shortly thereafter.

About Hollysys Automation

Technologies Ltd.

Hollysys is a leading

automation control system solutions provider in China, with overseas operations in eight other countries and regions throughout Asia.

Leveraging its proprietary technology and deep industry know-how, Hollysys empowers its customers with enhanced operational safety, reliability,

efficiency, and intelligence which are critical to their businesses. Hollysys derives its revenues mainly from providing integrated solutions

for industrial automation and rail transportation. In industrial automation, Hollysys delivers the full spectrum of automation hardware,

software, and services spanning field devices, control systems, enterprise manufacturing management and cloud-based applications. In rail

transportation, Hollysys provides advanced signaling control and SCADA (Supervisory Control and Data Acquisition) systems for high-speed

rail and urban rail (including subways). Founded in 1993, with technical expertise and innovation, Hollysys has grown from a research

team specializing in automation control in the power industry into a group providing integrated automation control system solutions for

customers in diverse industry verticals. As of June 30, 2023, Hollysys had cumulatively carried out more than 45,000 projects

for approximately 23,000 customers in various sectors including power, petrochemical, high-speed rail, and urban rail, in which Hollysys

has established leading market positions.

About Ascendent Capital

Partners

Ascendent Capital Partners,

headquartered in Hong Kong, is a private equity investment management firm managing assets for global institutional investors, including

sovereign wealth funds, endowments, pensions and foundations.

Ascendent has successfully

led and executed a large number of innovative and ground-breaking private equity investments, generating strong risk-adjusted returns

for investors and business growth for our portfolio companies. Ascendent has established a consistent track record in providing advice

and solution capital to entrepreneurs, business owners and management teams, building long-lasting relationships through in-depth collaboration.

For additional information about Ascendent, please visit Ascendent's website at www.ascendentcp.com.

Safe Harbor Statements

This release contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements

of historical fact included herein are "forward-looking statements," including statements regarding the ability of the Company

to achieve its commercial objectives; the business strategy, plans and objectives of the Company; growth in financial and operational

performance of the Company; and any other statements of non-historical information. These forward-looking statements are often identified

by the use of forward-looking terminology such as "will," "expects," "anticipates," "future,"

"intends," "plans," "believes," "estimates," "target," "confident," or similar

expressions involve known and unknown risks and uncertainties. Such forward-looking statements, based upon the current beliefs and expectations

of Hollysys' management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking

statements. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, they do

involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance

on these forward-looking statements, which speak only as of the date of this press release. The Company's actual results could differ

materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed

in the Company's reports that are filed with the Securities and Exchange Commission and available on its website (http://www.sec.gov).

All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety

by these factors. Other than as required under the securities laws, the Company does not assume a duty to update these forward-looking

statements.

Contact Information

Company Contact:

Hollysys Automation Technologies Ltd.

www.hollysys.com

+8610-5898-1386

investors@hollysys.com

Media Contacts (Hong Kong and New

York):

Brunswick Group

hollysys@brunswickgroup.com

Daniel Del Re (Hong Kong)

ddelre@brunswickgroup.com

+852 9255 5136

Libby Lloyd (New York)

llloyd@brunswickgroup.com

+1 347 283 3871

SOURCE Hollysys Automation

Technologies Ltd

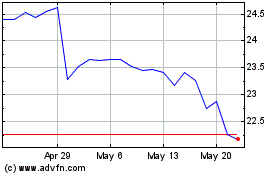

Hollysys Automation Tech... (NASDAQ:HOLI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hollysys Automation Tech... (NASDAQ:HOLI)

Historical Stock Chart

From Jan 2024 to Jan 2025