false

--12-31

0001718405

0001718405

2023-11-09

2023-11-09

0001718405

HYMC:ClassCommonStockParValue0.0001PerShareMember

2023-11-09

2023-11-09

0001718405

HYMC:WarrantsToPurchaseCommonStockMember

2023-11-09

2023-11-09

0001718405

HYMC:WarrantsToPurchaseCommonStockOneMember

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): November 9, 2023

HYCROFT

MINING HOLDING CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38387 |

|

82-2657796 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

4300

Water Canyon Road, Unit 1, Winnemucca, Nevada 89445

(Address

of principal executive offices)

(775)

304-0260

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A common stock, par value $0.0001 per share |

|

HYMC |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

HYMCW |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

HYMCL |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

November 9, 2023, Hycroft Mining Holding Corporation (the “Company”) filed a certificate of amendment (the “Amendment”)

with the Secretary of State of the State of Delaware relating to a 1-for-10 reverse stock split (the “Reverse Stock Split”)

of the outstanding shares of the Company’s Class A common stock (“Common Stock”). The Reverse Stock Split is expected

to become effective after the close of trading on the Nasdaq Capital Market (“Nasdaq”) on November 14, 2023 and the Common

Stock is expected to begin trading on Nasdaq on a Reverse Stock Split-adjusted basis on November 15, 2023 at market open. The Company’s

stockholders previously approved the reverse stock split and granted the board of directors the authority to determine the exact split

ratio and when to proceed with the reverse stock split at the Company’s Annual Meeting of Stockholders held on May 24, 2023. The

Company’s board of directors approved the Reverse Stock Split in the ratio of 1-for-10 on October 24, 2023.

The

par value and other terms of the Common Stock were not affected by the Reverse Stock Split. The Company’s post-Reverse Stock Split

Common Stock CUSIP number will be 44862P208.

A

copy of the Amendment is attached to this Current Report on Form 8-K as Exhibit 3.1 and is incorporated by reference herein.

Item

7.01. Regulation FD Disclosure.

The

Company issued a press release (the “Press Release”) on November 9, 2023 regarding the Reverse Stock Split. The information

included in the Press Release shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall

be expressly set forth by specific reference in such a filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Hycroft

Mining Holding Corporation |

| |

|

|

| Dated:

November 9, 2023 |

By: |

/s/

Diane R. Garrett, Ph.D. |

| |

|

Diane

R. Garrett, Ph.D. |

| |

|

Chief

Executive Officer |

Exhibit 3.1

Exhibit 99.1

Hycroft Mining Announces 1-For-10

Reverse Stock Split

WINNEMUCCA, NV, November

9, 2023 – Hycroft Mining Holding Corporation (Nasdaq: HYMC) (“Hycroft” or “the Company”) today

announced that the Company’s board of directors has resolved to effectuate a reverse stock split of Hycroft’s issued and outstanding

Class A common stock (“Common Stock”) and has determined the ratio to be 1-for-10. Hycroft’s stockholders previously

approved the reverse stock split and granted the board of directors the authority to determine the exact split ratio and when to proceed

with the reverse stock split at the Company’s Annual Meeting of Stockholders held on May 24, 2023.

The reverse stock split will

become effective on November 14, 2023, at 4:00 p.m., Eastern Time, (“Effective Time”) and the Company’s Common

Stock is expected to begin trading on a reverse stock split-adjusted basis on the Nasdaq Capital Market (“Nasdaq”) as of the

open of trading on November 15, 2023, under the existing ticker symbol, “HYMC.” The reverse stock split is intended to

increase the price per share of the Company’s Common Stock to allow the Company to demonstrate compliance with the $1.00 minimum

bid price requirement for continued listing on Nasdaq.

As of the Effective Time,

every 10 shares of the Company’s issued and outstanding Common Stock will be combined into one issued and outstanding share of Common

Stock. The par value per share of our Common Stock will remain unchanged at $0.0001. Proportional adjustments will be made to the

number of shares of Common Stock issuable upon the exercise of the Company’s outstanding warrants, options and restricted stock

units, and the number of shares authorized and reserved for issuance pursuant to the Company’s equity incentive plans. The total

number of authorized shares of Common Stock and preferred stock will not be reduced and remain at 1,400,000,000 and 10,000,000 shares,

respectively. No fractional shares will be issued as a result of the reverse stock split; rather, the Company’s transfer agent will

aggregate all fractional shares remaining after the reverse stock split and sell them on the open market on behalf of those stockholders

who would otherwise be entitled to receive a fractional share, and after the transfer agent’s completion of such sale, stockholders

will receive a cash payment (without interest or deduction) from the transfer agent in an amount equal to their respective pro rata share

of the total net proceeds of that sale.

The Company’s transfer

agent, Continental Stock & Trust Company, will serve as the exchange agent for the reverse stock split. Registered stockholders

holding pre-reverse stock split shares of Common Stock electronically in book-entry form are not required to take any action to receive

post-reverse stock split shares. Those stockholders who hold their shares in brokerage accounts or in “street name” will have

their positions automatically adjusted to reflect the reverse stock split, subject to each broker’s particular processes, and will

not be required to take any action in connection with the reverse stock split.

Additional information about the reverse stock split

can be found in Hycroft’s definitive proxy statement filed with the Securities and Exchange Commission on April 13, 2023,

a copy of which is available at www.sec.gov.

About Hycroft Mining Holding Corporation

Hycroft Mining Holding Corporation is a US-based gold

and silver company developing the Hycroft Mine, one of the world’s largest precious metals deposits located in northern Nevada,

a Tier-One mining jurisdiction. After a long history of oxide heap leaching operations, the Company is focused on completing the technical

studies to transition the Hycroft Mine into a large-scale milling operation for processing the sulfide ore. In addition, the Company is

engaged in a robust exploration drill program to unlock the full potential of our expansive +64,000-acre land package, of which less than

10% has been explored.

For further information, please contact:

Fiona Grant Leydier

Vice President, Investor Relations

E: info@hycroftmining.com

T: +1 (775) 437-5912 x 101

www.hycroftmining.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains

“forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section

21E of the United States Securities Exchange Act of 1934, as amended, or the United States Private Securities Litigation Reform Act of

1995. All statements, other than statements of historical facts, included herein and public statements by our officers or representatives,

that address activities, events or developments that our management expects or anticipates will or may occur in the future, are forward-looking

statements, including but not limited to such things as future business strategy, plans and goals, competitive strengths and expansion

and growth of our business. The words “estimate”, “plan”, “anticipate”, “expect”, “intend”,

“believe” “target”, “budget”, “may”, “can”, “will”, “would”,

“could”, “should”, “seeks”, or “scheduled to” and similar words or expressions, or negatives

of these terms or other variations of these terms or comparable language or any discussion of strategy or intention identify forward-looking

statements. Forward-looking statements address activities, events, or developments that the Company expects or anticipates will or may

occur in the future and are based on current expectations and assumptions. Forward-looking statements include, but are not limited

to (i) risks related to changes in our operations at the Hycroft Mine, including risks associated with the cessation of mining operations

at the Hycroft Mine; uncertainties concerning estimates of mineral resources; risks related to a lack of a completed feasibility study;

and risks related to our ability to re-establish commercially feasible mining operations; (ii) industry related risks including fluctuations

in the price of gold and silver; the commercial success of, and risks related to, our exploration and development activities; uncertainties

and risks related to our reliance on contractors and consultants; availability and cost of equipment, supplies, energy, or reagents. The

exploration target does not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve, as ranges

of potential tonnage and grade (or quality) of the exploration target are conceptual in nature; there has been insufficient exploration

of the relevant property or properties to estimate a mineral resource; and it is uncertain if further exploration will result in the estimation

of a mineral resource. These risks may include the following, and the occurrence of one or more of the events or circumstances alone or

in combination with other events or circumstances may have a material adverse effect on the Company’s business, cash flows, financial

condition, and results of operations. Please see our “Risk Factors” outlined in our Annual Report on Form 10-K for the year

ended December 31, 2022, our Quarterly Report on Form 10-Q for the periods ended June 30, 2023, and other reports filed with

the SEC for more information about these and other risks. You are cautioned against attributing undue certainty to forward-looking statements.

Although we have attempted to identify important factors that could cause actual results to differ materially from those described in

forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Although these

forward-looking statements were based on assumptions that the Company believes are reasonable when made, you are cautioned that forward-looking

statements are not guarantees of future performance and that actual results, performance, or achievements may differ materially from those

made in or suggested by the forward-looking statements in this news release. In addition, even if our results, performance, or achievements

are consistent with the forward-looking statements contained in this news release, those results, performance or achievements may not

be indicative of results, performance or achievements in subsequent periods. Given these risks and uncertainties, you are cautioned not

to place undue reliance on these forward-looking statements. Any forward-looking statements made in this news release speak only as of

the date of those statements. We undertake no obligation to update those statements or publicly announce the results of any revisions

to any of those statements to reflect future events or developments.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_WarrantsToPurchaseCommonStockOneMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

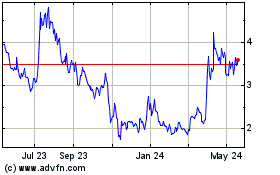

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Feb 2025 to Mar 2025

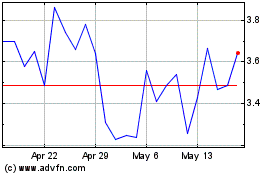

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Mar 2024 to Mar 2025