Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258340

PROSPECTUS SUPPLEMENT NO. 73

(to prospectus dated August 10, 2021)

Up to 19,300,751 Shares of Class A Common Stock Issuable Upon the Exercise of Warrants Up to 77,272,414 Shares of Class A Common Stock Up to 8,014,500 Warrants to Purchase Class A Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated August 10, 2021 (as supplemented or amended from time to time, the “Prospectus”), with the information contained in our Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on August 13, 2024 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of 19,300,751 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), which consists of (i) up to 8,014,500 shares of Class A Common Stock that are issuable upon the exercise of 8,014,500 warrants (the “private placement warrants”) issued in a private placement in connection with the initial public offering of Decarbonization Plus Acquisition Corporation (“DCRB”) and upon the conversion of a working capital loan by the Sponsor (as defined in the Prospectus) to DCRB and (ii) up to 11,286,251 shares of Class A Common Stock that are issuable upon the exercise of 11,286,251 warrants originally issued in DCRB’s initial public offering. The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus, or their permitted transferees, of (i) up to 77,272,414 shares of Class A Common Stock (including up to 5,293,958 shares of Class A Common Stock issuable upon the satisfaction of certain triggering events (as described in the Prospectus) and up to 326,048 shares of Class A Common Stock that may be issued upon exercise of the Ardour Warrants (as defined in the Prospectus)) and (ii) up to 8,014,500 private placement warrants.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

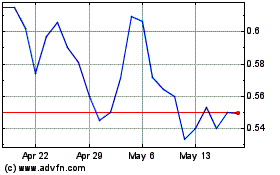

Our Class A Common Stock and warrants are traded on the Nasdaq Capital Market under the symbols “HYZN” and “HYZNW,” respectively. On August 13, 2024 the closing price of our Class A Common Stock was $0.08 and the closing price for our public warrants was $0.02.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 7 of the Prospectus, as well as those risk factors contained in any amendments or supplements to the Prospectus and the documents included or incorporated by reference herein or therein.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August 13, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 10-Q

______________________

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

______________________

Hyzon Motors Inc.

(Exact name of registrant as specified in its charter)

______________________

| | | | | | | | |

| Delaware | 001-39632 | 82-2726724 |

(State or other jurisdiction of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | |

599 South Schmidt Road

Bolingbrook, IL | 60440 |

| (Address of principal executive offices) | (Zip Code) |

(585)-484-9337

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

______________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | HYZN | | NASDAQ Capital Market |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | HYZNW | | NASDAQ Capital Market |

______________________

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | o |

| | | | | |

| Non-accelerated filer | x | | Smaller reporting company | x |

| | | | | |

| | | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 2, 2024, there were approximately 271,550,918 shares of the registrant’s common stock outstanding, par value $0.0001 per share, outstanding.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements include, without limitation, statements regarding the financial position, business strategy, and plans and objectives of management for future operations, and any statements that refer to characterizations of future events or circumstances, including any underlying assumptions. These statements constitute projections, forecasts, and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this report, the words “could,” “should,” “will,” “may,” “anticipate,” “believe,” “expect,” “estimate,” “intend,” “plan,” “project,” “seeks,” as well as the negative of such terms and other similar expressions are intended to identify forward looking statements, although not all forward-looking statements contain such identifying words. Such forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events.

Forward-looking statements are subject to a number of risks and uncertainties including, but not limited to, those described below and under the section entitled “Risk Factors” in our Annual Report filed on Form 10-K for the year ended December 31, 2023, and in subsequent reports that we file with the SEC, including this Form 10-Q for the quarter ended June 30, 2024:

•our ability to continue as a going concern;

•our ability to raise capital in the future;

•the possibility that we may need to seek bankruptcy protection;

•our ability to maintain our listing on The Nasdaq Capital Market;

•our ability to successfully execute on our strategic alternatives and avoid filing for bankruptcy;

•our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans;

•developments and projections relating to our competition and industry;

•our ability to execute our business model, including market acceptance of our planned products and services;

•our ability to execute our corporate restructuring and manage the associated headcount reduction;

•our ability to maintain or extend our technological innovation in hydrogen fuel cells, proton exchange membranes and membrane exchange assemblies;

•our business, expansion plans and opportunities;

•our ability to profitably expand into new markets;

•our ability to realize our projected timelines for the development of our business;

•our ability to retain or recruit, or changes required in, our officers, key employees or directors;

•our ability to protect, defend, or enforce intellectual property on which we depend;

•our ability to implement our business plans and strategies;

•our ability to procure and/or supply hydrogen at competitive prices;

•our ability to obtain customers, obtain product orders, and convert our non-binding pre-orders into binding orders or sales; and

•our ability to address other factors detailed in this report in the section entitled “Risk Factors”.

We have based these forward-looking statements on our current expectations, assumptions, beliefs, estimates, projections, intentions and strategies regarding future events and on currently available information as to the outcome and timing of future events. While we believe these expectations, assumptions, beliefs, estimates, projections, intentions and strategies are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. Actual results and timing of certain events may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth in the section entitled “Risk Factors” in this report. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements, which speak only as of the date of this report. We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this report, except as may be required under applicable securities laws.

Hyzon Motors, Inc.

Quarterly Report on Form 10-Q

Table of Contents

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

HYZON MOTORS INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

(unaudited)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 34,720 | | | $ | 112,280 | |

| Short-term investments | 20,418 | | | — | |

| Accounts receivable | 720 | | | 498 | |

| 93 | | | 1,599 | |

| | | |

| Inventory | 7,786 | | | 28,811 | |

| Prepaid expenses and other current assets | 3,644 | | | 9,335 | |

| Total current assets | 67,381 | | | 152,523 | |

| Property, plant, and equipment, net | 15,150 | | | 18,569 | |

| Right-of-use assets | 3,762 | | | 4,741 | |

| Equity method investments | 8,315 | | | 8,382 | |

| Investments in equity securities | 763 | | | 763 | |

| Other assets | 6,142 | | | 6,157 | |

| Total Assets | $ | 101,513 | | | $ | 191,135 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 2,969 | | | $ | 1,479 | |

| Accrued liabilities | 23,948 | | | 30,116 | |

| Related party payables | 588 | | | 265 | |

| Contract liabilities | 4,777 | | | 8,872 | |

| Current portion of lease liabilities | 1,570 | | | 1,821 | |

| Total current liabilities | 33,852 | | | 42,553 | |

| Long term liabilities | | | |

| Lease liabilities | 4,859 | | | 5,733 | |

| Private placement warrant liability | 160 | | | 160 | |

| Earnout liability | 1,321 | | | 1,725 | |

| | | |

| Accrued SEC settlement | 8,174 | | | 8,000 | |

| Other liabilities | 1,318 | | | 2,964 | |

| Total Liabilities | $ | 49,684 | | | $ | 61,135 | |

| Commitments and contingencies (Note 14) | | | |

| Stockholders’ Equity | | | |

Common stock, $0.0001 par value; 400,000,000 shares authorized, 248,554,855 and 245,081,497 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively. | 25 | | | 25 | |

Treasury stock, at cost; 3,769,592 shares as of June 30, 2024 and December 31, 2023, respectively. | (6,446) | | | (6,446) | |

| Additional paid-in capital | 387,010 | | | 380,261 | |

| Accumulated deficit | (327,655) | | | (242,640) | |

| Accumulated other comprehensive loss | (358) | | | (514) | |

| Total Hyzon Motors Inc. stockholders’ equity | 52,576 | | | 130,686 | |

| Noncontrolling interest | (747) | | | (686) | |

| Total Stockholders’ Equity | 51,829 | | | 130,000 | |

| Total Liabilities and Stockholders’ Equity | $ | 101,513 | | | $ | 191,135 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

HYZON MOTORS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 313 | | | $ | — | | | $ | 10,296 | | | $ | — | |

| Operating expense: | | | | | | | |

| Cost of revenue | 18,415 | | | 2,410 | | | 26,231 | | | 3,248 | |

| Research and development | 9,817 | | | 12,597 | | | 20,646 | | | 21,937 | |

| Selling, general, and administrative | 25,516 | | | 49,098 | | | 47,044 | | | 79,955 | |

| Restructuring and related charges | 2,663 | | | — | | | 3,164 | | | — | |

| Total operating expenses | 56,411 | | | 64,105 | | | 97,085 | | | 105,140 | |

| Loss from operations | (56,098) | | | (64,105) | | | (86,789) | | | (105,140) | |

| Other income (expense): | | | | | | | |

| Change in fair value of private placement warrant liability | 481 | | | 160 | | | — | | | 801 | |

| Change in fair value of earnout liability | 4,231 | | | 916 | | | 404 | | | 7,336 | |

| | | | | | | |

| Foreign currency exchange gain (loss) and other expense, net | (156) | | | 280 | | | (683) | | | 1,430 | |

| Investment income and interest income, net | 752 | | | 2,494 | | | 1,976 | | | 5,060 | |

| Total other income (expense) | 5,308 | | | 3,850 | | | 1,697 | | | 14,627 | |

| Loss before income taxes | $ | (50,790) | | | $ | (60,255) | | | $ | (85,092) | | | $ | (90,513) | |

Income tax expense | — | | | — | | | — | | | — | |

| Net loss | $ | (50,790) | | | $ | (60,255) | | | $ | (85,092) | | | (90,513) | |

| Less: Net loss attributable to noncontrolling interest | — | | | (7) | | | (77) | | | (17) | |

| Net loss attributable to Hyzon | $ | (50,790) | | | $ | (60,248) | | | $ | (85,015) | | | $ | (90,496) | |

| | | | | | | |

| Comprehensive loss: | | | | | | | |

| Net loss | $ | (50,790) | | | $ | (60,255) | | | $ | (85,092) | | | $ | (90,513) | |

| Foreign currency translation adjustment | (313) | | | (931) | | | 172 | | | (1,735) | |

| Net change in unrealized gain (loss) on short-term investments | — | | | (691) | | | — | | | (988) | |

| Comprehensive loss | $ | (51,103) | | | $ | (61,877) | | | $ | (84,920) | | | $ | (93,236) | |

| Less: Comprehensive income (loss) attributable to noncontrolling interest | 4 | | | 22 | | | (61) | | | 5 | |

| Comprehensive loss attributable to Hyzon | $ | (51,107) | | | $ | (61,899) | | | $ | (84,859) | | | $ | (93,241) | |

| Net loss per share attributable to Hyzon: | | | | | | | |

| Basic | $ | (0.21) | | | $ | (0.25) | | | $ | (0.34) | | | $ | (0.37) | |

| Diluted | $ | (0.21) | | | $ | (0.25) | | | $ | (0.34) | | | $ | (0.37) | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 246,788 | | | 244,628 | | | 247,293 | | | 244,585 | |

| Diluted | 246,788 | | | 244,628 | | | 247,293 | | | 244,585 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

HYZON MOTORS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock

Class A | | Treasury Stock | | Additional

Paid-in

Capital | |

Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | Total Hyzon

Motors Inc.

Stockholders’

Equity | | Noncontrolling

Interest | | Total

Stockholders’

Equity |

| | Shares | | Amount | | Shares | | Amount | | | | | | |

| Balance as of December 31, 2023 | | 245,081,497 | | | $ | 25 | | | 3,769,592 | | | $ | (6,446) | | | $ | 380,261 | | | $ | (242,640) | | | $ | (514) | | | $ | 130,686 | | | $ | (686) | | | $ | 130,000 | |

| Stock-based compensation | | — | | | — | | | — | | | — | | | 2,502 | | | — | | | — | | | 2,502 | | | — | | | 2,502 | |

| Vesting of RSUs | | 133,280 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net share settlement of equity awards | | — | | | — | | | — | | | — | | | (94) | | | — | | | — | | | (94) | | | — | | | (94) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net loss attributable to Hyzon | | — | | | — | | | — | | | — | | | — | | | (34,225) | | | — | | | (34,225) | | | — | | | (34,225) | |

| Net loss attributable to noncontrolling interest | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (77) | | | (77) | |

| Foreign currency translation income | | — | | | — | | | — | | | — | | | — | | | — | | | 473 | | | 473 | | | 12 | | | 485 | |

| Balance as of March 31, 2024 | | 245,214,777 | | | $ | 25 | | | 3,769,592 | | | $ | (6,446) | | | $ | 382,669 | | | $ | (276,865) | | | $ | (41) | | | $ | 99,342 | | | $ | (751) | | | $ | 98,591 | |

| | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | — | | | — | | | — | | | — | | | 5,136 | | | — | | | — | | | 5,136 | | | — | | | 5,136 | |

| Vesting of RSUs | | 3,340,078 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net share settlement of equity awards | | — | | | — | | | — | | | — | | | (795) | | | — | | | — | | | (795) | | | — | | | (795) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net loss attributable to Hyzon | | — | | | — | | | — | | | — | | | — | | | (50,790) | | | — | | | (50,790) | | | — | | | (50,790) | |

| Net loss attributable to noncontrolling interest | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Foreign currency translation loss | | — | | | — | | | — | | | — | | | — | | | — | | | (317) | | | (317) | | | 4 | | | (313) | |

Balance as of June 30, 2024 | | 248,554,855 | | | $ | 25 | | | 3,769,592 | | | $ | (6,446) | | | $ | 387,010 | | | $ | (327,655) | | | $ | (358) | | | $ | 52,576 | | | $ | (747) | | | $ | 51,829 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

HYZON MOTORS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock

Class A | | Treasury Stock | | Additional

Paid-in

Capital | |

Accumulated

Deficit | | Accumulated Other Comprehensive Loss | | Total Hyzon Motors Inc. Stockholders’ Equity | | Noncontrolling

Interest | | Total Stockholders’ Equity |

| | Shares | | Amount | | Shares | | Amount | | | | | | |

| Balance as of December 31, 2022 | | 244,509,208 | | $ | 25 | | | 3,769,592 | | | $ | (6,446) | | | $ | 372,942 | | | $ | (58,598) | | | $ | (153) | | | $ | 307,770 | | | $ | (711) | | | $ | 307,059 | |

| | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | — | | | — | | | — | | | — | | | 1,359 | | | — | | | — | | | 1,359 | | | — | | | 1,359 | |

| Vesting of RSUs | | 51,863 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net share settlement of equity awards | | — | | | — | | | — | | | — | | | (58) | | | — | | | — | | | (58) | | | — | | | (58) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Available-for-sale short-term investments: | | | | | | | | | | | | | | | | | | | | |

| Unrealized net gain on short-term investments | | — | | | — | | | — | | | — | | | — | | | — | | | 462 | | | 462 | | | — | | | 462 | |

| Reclassification to net loss | | — | | | — | | | — | | | — | | | — | | | — | | | (759) | | | (759) | | | — | | | (759) | |

| Net loss attributable to Hyzon | | — | | | — | | | — | | | — | | | — | | | (30,248) | | | — | | | (30,248) | | | — | | | (30,248) | |

| Net loss attributable to noncontrolling interest | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (10) | | | (10) | |

| Foreign currency translation loss | | — | | | — | | | — | | | — | | | — | | | — | | | (797) | | | (797) | | | (7) | | | (804) | |

Balance as of March 31, 2023 | | 244,561,071 | | | $ | 25 | | | 3,769,592 | | | $ | (6,446) | | | $ | 374,243 | | | $ | (88,846) | | | $ | (1,247) | | | $ | 277,729 | | | $ | (728) | | | $ | 277,001 | |

Exercise of stock options | | | | — | | | — | | | — | | | | | — | | | — | | | — | | | — | | | — | |

Stock-based compensation | | — | | | — | | | — | | | — | | | 1,628 | | | — | | | — | | | 1,628 | | | — | | | 1,628 | |

Vesting of RSUs | | 147,048 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Net share settlement of equity awards | | — | | | — | | | — | | | — | | | (53) | | | — | | | — | | | (53) | | | — | | | (53) | |

Common stock issued for the cashless exercise of warrants | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Available-for-sale short-term investments: | | | | | | | | | | | | | | | | | | | | |

Unrealized net gain on short-term investments | | — | | | — | | | — | | | — | | | — | | | — | | | 154 | | | 154 | | | — | | | 154 | |

Reclassification to net loss | | | | | | | | | | | | | | (845) | | | (845) | | | | | (845) | |

Net loss attributable to Hyzon | | — | | | — | | | — | | | — | | | — | | | (60,248) | | | — | | | (60,248) | | | — | | | (60,248) | |

Net loss attributable to noncontrolling interest | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (7) | | | (7) | |

Foreign currency translation loss | | — | | | — | | | — | | | — | | | — | | | — | | | (960) | | | (960) | | | 29 | | | (931) | |

| Balance as of June 30, 2023 | | 244,708,119 | | | $ | 25 | | | 3,769,592 | | | $ | (6,446) | | | $ | 375,818 | | | $ | (149,094) | | | $ | (2,898) | | | $ | 217,405 | | | $ | (706) | | | $ | 216,699 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

HYZON MOTORS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited) | | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| Cash Flows from Operating Activities: | | | |

Net loss | $ | (85,092) | | | $ | (90,513) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 1,915 | | | 2,193 | |

| Stock-based compensation | 7,638 | | | 2,987 | |

| Foreign currency transaction loss/(gain) | 535 | | | (1,620) | |

| | | |

| Fair value adjustment of private placement warrant liability | — | | | (801) | |

| Fair value adjustment of earnout liability | (404) | | | (7,336) | |

| | | |

| Inventory write-downs | 18,357 | | | 2,106 | |

| | | |

| Impairment of property and equipment, ROU asset | 1,322 | | | 1,090 | |

| | | |

| Accretion of discount on available-for-sale debt securities | — | | | (1,424) | |

| | | |

| | | |

| | | |

| Gain on sales of property and equipment | 187 | | | — | |

| Other | (386) | | | 7 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (221) | | | (919) | |

| Unbilled receivable | 1,506 | | | — | |

| Inventory | 2,713 | | | (10,500) | |

| Prepaid expenses and other current assets | 5,243 | | | 6,764 | |

| Other assets | 237 | | | 305 | |

| Accounts payable | 1,496 | | | (5,995) | |

| Accrued liabilities | (6,158) | | | (1,986) | |

| Related party payables, net | 323 | | | 5,988 | |

| Contract liabilities | (5,798) | | | 2,711 | |

| Other liabilities | (125) | | | 14,885 | |

| Net cash used in operating activities | (56,712) | | | (82,058) | |

| Cash Flows from Investing Activities: | | | |

| Purchases of property and equipment | (2,328) | | | (2,684) | |

| | | |

| Proceeds from sales of property and equipment | 2,883 | | | — | |

| Purchases of short-term investments | (30,000) | | | (16,594) | |

| Proceeds from maturities of short-term investments | 10,000 | | | 129,905 | |

| Proceeds from sale of short-term investments | — | | | 50,021 | |

| | | |

| Net cash provided by (used in) investing activities | (19,445) | | | 160,648 | |

| Cash Flows from Financing Activities: | | | |

| | | |

| Payment of finance lease liability | — | | | (237) | |

| | | |

| | | |

Net share settlement of equity awards

| (889) | | | (111) | |

| | | |

| | | |

| Net cash used in financing activities | (889) | | | (348) | |

| Effect of exchange rate changes on cash | (288) | | | (2) | |

| Net change in cash, cash equivalents, and restricted cash | (77,334) | | | 78,240 | |

| Cash, cash equivalents, and restricted cash — Beginning | 118,101 | | | 66,790 | |

| Cash, cash equivalents, and restricted cash — Ending | $ | 40,767 | | | $ | 145,030 | |

| | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

HYZON MOTORS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1. Nature of Business and Basis of Presentation

Description of Business

Hyzon Motors Inc. (“Hyzon” or the “Company”), headquartered in Bolingbrook, Illinois, is commercializing its proprietary heavy-duty (“HD”) fuel cell technology through assembling and upfitting HD hydrogen fuel cell electric vehicles (“FCEVs”) in the United States. In addition, Hyzon seeks to build and foster a clean hydrogen supply ecosystem with leading partners from feedstocks through production and dispensing.

Strategic Realignment

In June 2024, the Company announced that it had started realigning its strategic priorities to focus on the Company’s North American Class 8 and refuse truck markets and as a part of these efforts, the Company announced in July 2024 that it would wind down its operations in the Netherlands and Australia (see Note 4. Restructuring and Related Charges).

Basis of Presentation

The accompanying unaudited interim consolidated financial statements and related disclosures have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) pursuant to the requirements and rules of the Securities and Exchange Commission (“SEC”). Any reference in these notes to applicable guidance refers to U.S. GAAP as found in U.S. Accounting Standards Codification ("ASC") and Accounting Standards Update ("ASU") of the Financial Accounting Standards Board ("FASB"). Certain notes or other information that are normally required by U.S. GAAP have been omitted if they substantially duplicate the disclosures contained in the Company’s annual audited consolidated financial statements. Accordingly, the unaudited interim consolidated financial statements should be read in connection with the Company’s audited consolidated financial statements and related notes included in the Company’s Annual Report filed on Form 10-K for the year ended December 31, 2023.

The Company’s unaudited interim consolidated financial statements include the accounts and operations of the Company and its wholly owned subsidiaries including variable interest entity arrangements in which the Company is the primary beneficiary. All intercompany accounts and transactions are eliminated in consolidation. In the opinion of management, the accompanying unaudited interim consolidated financial statements include all normal and recurring adjustments necessary for a fair presentation for the periods presented. Results of operations reported for interim periods presented are not necessarily indicative of results for the entire year or any other periods.

Liquidity and Going Concern

These unaudited interim consolidated financial statements have been prepared by management in accordance with U.S. GAAP and this basis assumes that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. These unaudited interim consolidated financial statements do not include any adjustments that may result from the outcome of the uncertainties described below.

In accordance with ASC 205-40, Presentation of Financial Statements - Going Concern (“ASC 205-40”), the Company evaluates whether there are certain conditions and events, considered in the aggregate, which raise substantial doubt about the Company’s ability to continue as a going concern. In accordance with ASC 205-40, the Company’s analysis can only include the potential mitigating impact of the plans that have not been fully implemented as of the issuance date of these unaudited interim consolidated financial statements if (a) it is probable that these plans will be effectively implemented within one year after the date that the financial statements are issued, and (b) it is probable that the plans, when implemented, will alleviate the relevant conditions or events that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are issued.

The Company has incurred net losses since inception. Net cash used in operating activities was $56.7 million and $82.1 million for the six months ended June 30, 2024 and 2023, respectively. As of June 30, 2024, the Company has $34.7 million in unrestricted cash and cash equivalents, $20.4 million in short-term investments, and $6.0 million in restricted cash. The Company incurred net losses of $50.8 million and $60.3 million for the three months ended June 30, 2024 and 2023, respectively. The Company incurred net losses of $85.1 million and $90.5 million for the six months ended June 30,

2024 and 2023, respectively. Accumulated deficit amounted to $327.7 million and $242.6 million as of June 30, 2024 and December 31, 2023, respectively.

The Company has concluded that at the time of this filing, substantial doubt exists about its ability to continue as a going concern as the Company believes that its financial resources, existing cash resources, and additional sources of liquidity are insufficient to support planned operations beyond the next 12 months. We are also continuing to evaluate the need to pursue bankruptcy protection or other in-court relief if our financing efforts or other strategic alternatives are not successful.

In order to reduce the cash used in operating activities, the Company implemented certain cost savings initiatives, including a restructuring plan in July 2023, as further discussed in our Annual Report filed on Form 10-K for the year ended December 31, 2023. Additionally, in June 2024, the Company announced that it had started realigning its strategic priorities to focus on the Company’s North American Class 8 and refuse truck markets and as a part of these efforts, the Company announced in July 2024 that it would wind down its operations in the Netherlands and Australia. While these plans are anticipated to reduce cash outflows when compared to prior periods, the Company’s continued existence is primarily dependent upon its ability to obtain additional financing, as well as to attain and maintain profitable operations by entering into profitable sales or service contracts and generating sufficient cash flow to meet its obligations on a timely basis. The Company’s business will require significant additional funding to execute its long-term business plans notwithstanding its requirements for additional current funding. If the Company fails to raise additional funding in time or in a sufficient amount to meet its requirements, the Company may be required or compelled to pursue additional restructuring initiatives to preserve cash, working capital, and optionality, including pursuing bankruptcy protection or other in-court relief.

The Company plans to improve its liquidity through a combination of equity and/or debt financing, alliances or other partnership agreements with entities interested in our technologies, and the liquidation of certain inventory balances. If the Company raises funds in the future by issuing equity securities, dilution to stockholders will occur and may be substantial, and the Company may be required to seek shareholder approval for issuance of equity securities. Any equity securities issued may also provide for rights, preferences, or privileges senior to those of common stockholders. If the Company raises funds in the future by issuing debt securities, these debt securities could have rights, preferences, and privileges senior to those of common stockholders. The terms of any debt securities or borrowings could impose significant restrictions on the Company’s operations. The capital markets have experienced in the past, and may experience in the future, periods of uncertainty that could impact the availability and cost of equity and debt financing. In addition, federal fund rates set by the Federal Reserve, which serve as a benchmark for rates on borrowing, will continue to impact the cost of debt financing.

There can be no assurance that any such financing can be realized by the Company, or if realized, what the terms thereof may be, or that any amount that the Company is able to raise will be adequate to support the Company’s ongoing operations, working capital requirements, and/or fuel cell technology advancement. If the Company cannot raise additional funds when needed or on acceptable terms, the financial condition, business prospects, and results of operations could be materially adversely affected, and we may be required to pursue bankruptcy protection or other in-court relief. In addition, the Company is subject to, and may become a party to, a variety of litigation, other claims, suits, indemnity demands, regulatory actions, and government investigations and inquiries in the ordinary course of business. The outcome of litigation and other legal proceedings, including the other claims described under Legal Proceedings in Note 14. Commitments and Contingencies, are inherently uncertain, and adverse judgments or settlements in some or all of these legal disputes may result in materially adverse monetary damages or injunctive relief against us, which may not be covered in full or in part by insurance.

Reclassifications

Certain items previously reported in specific financial statement captions have been reclassified to conform to the current presentation in the unaudited interim consolidated financial statements and the accompanying notes.

Note 2. Summary of Significant Accounting Policies

The Company’s significant accounting policies are described in Note 2. Summary of Significant Accounting Policies, in the Company’s consolidated financial statements included in the Company’s Annual Report filed on Form 10-K for the year ended December 31, 2023.

There have been no material changes to the significant accounting policies for the six months ended June 30, 2024.

Note 3. Revenue

The following table shows disaggregated revenue from contracts with customers by region (in thousands). The Company did not generate revenue for the three and six months ended June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | Six Months Ended June 30, 2024 |

| | U.S. | | | | Australia | | China | | Total | | U.S. | | Australia | | China | | Total |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Revenue by region | | $ | 153 | | | | | $ | 160 | | | $ | — | | | $ | 313 | | | $ | 766 | | | $ | 8,474 | | | $ | 1,056 | | | $ | 10,296 | |

Revenue represents product sales, leasing and other sources. Product sales are derived from the sales of the Company’s products and services including fuel cell systems, FCEVs, parts, product support, and other related services. The majority of the product sales recognized for the three and six months ended June 30, 2024 relate to vehicle deployments that occurred in prior periods. Leasing revenue is generated from customer contracts when the end customer has a significant economic incentive to exercise the trade-in or buyback option at contract inception. As of June 30, 2024, the Company had deferred $1.1 million of upfront lease related payments, $0.4 million of which was recorded in Contract liabilities and $0.7 million of which was recorded in Other liabilities in the unaudited interim Consolidated Balance Sheets. The upfront lease related payments will be recognized on a straight-line basis over the individual lease term.

In 2022, the Company delivered a total of 82 FCEVs to two customers in China. In consideration of the customers’ limited operating history and extended payment terms in their contracts, the Company determined the collectability criterion was not met with respect to contract existence under ASC 606 for these customers, and therefore, an alternative method of revenue recognition had been applied to each arrangement. In 2024, the Company entered into supplemental agreements with those Chinese customers. The supplemental agreements resulted in the payment of $1.1 million to the Company and the termination of the standard warranty obligations in the contracts. The $1.1 million was received by the Company in February 2024.

Contract Balances

Contract liabilities relate to the advance consideration invoiced or received from customers for products and services prior to satisfying a performance obligation or in excess of amounts allocated to a previously satisfied performance obligation.

The current portion of contract liabilities is recorded within Contract liabilities in the unaudited interim Consolidated Balance Sheets and totaled $4.8 million and $8.9 million as of June 30, 2024 and December 31, 2023, respectively. The long-term portion of contract liabilities is recorded within Other liabilities in the unaudited interim Consolidated Balance Sheets and totaled $1.3 million and $3.0 million as of June 30, 2024 and December 31, 2023, respectively. Certain customer contract liability balances may be refunded for cancelled contracts or unsuccessful FCEV trials, including up to $4.3 million in the current portion of the Contract liabilities associated with customer contracts in Europe and Australia. As part of efforts to exit certain customer contracts, the Company refunded $0.3 million to customers during the six months ended June 30, 2024. An additional $1.0 million was paid back to customers in July 2024.

Note 4. Restructuring and Related Charges

In July 2023, the Company’s board of directors approved a restructuring plan (the “2023 Restructuring Program”) to improve operational effectiveness and cost reduction, including with respect to its workforce. The 2023 Restructuring Program is expected to be completed by the end of the third quarter of 2024.

In June 2024, the Company announced that it had started realigning its strategic priorities to focus on the Company’s North American Class 8 and refuse truck markets and as a part of these efforts, the Company announced in July 2024 that it would wind down its operations in the Netherlands and Australia (collectively the “Strategic Realignment”).

In connection with the Strategic Realignment during the second quarter of 2024 the Company has incurred and expects to incur restructuring and related charges including (a) employee-related charges such as severance, retention and stock-based compensation, (b) asset-related charges such as impairments of property plant and equipment and right-of-use asset, and (c) other exit related costs including contract termination costs. The employee-related charges arise from the on-going benefit arrangements in the Netherlands and Australia which require accrual when the related payments are probable. The impairment related charges arise from the determination that triggering events had occurred in the Netherlands and Australia as of June 30, 2024, and that the Company’s long-lived assets at those locations should be written down to fair value, which was generally salvage value.

In the U.S., the Company entered into a purchase and sale agreement with Fulcrum Holdings LLC (the “Buyer”) to sell its Rochester, NY facility for $3.1 million. The sale closed and the Company moved its headquarters from Rochester, NY to Bolingbrook, IL in March 2024.

The Company did not record restructuring and related charges for the three and six months ended June 30, 2023. For the three and six months ended June 30, 2024, costs by type associated with these initiatives consisted of the following (in thousands):

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | Six Months Ended

June 30, 2024 | | | | |

Asset-related | | $ | 1,273 | | | $ | 1,273 | | | | | |

Employee-related | | 1,390 | | | 1,822 | | | | | |

Other Costs | | — | | | 69 | | | | | |

Total | | $ | 2,663 | | | $ | 3,164 | | | | | |

Note 5. Inventory

Inventory consisted of the following (in thousands):

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

Raw materials | | $ | 5,437 | | | $ | 11,380 | |

Work in process | | 2,135 | | | 9,918 | |

Finished Goods | | 214 | | | 7,513 | |

Total inventory | | $ | 7,786 | | | $ | 28,811 | |

The Company writes down inventory for any excess or obsolescence, or when the Company believes that the net realizable value of inventories is less than the carrying value. A total of $17.3 million and $18.4 million in inventory write-downs was recognized for the three and six months ended June 30, 2024, respectively, primarily related to the Strategic Realignment (see Note 4. Restructuring and Related Charges). A total of $1.8 million and $2.1 million in inventory write-downs was recognized for the three and six months ended June 30, 2023, respectively.

Note 6. Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in thousands):

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| Deposit for fuel cell components (Note 17) | | $ | 460 | | | $ | 2,927 | |

| Vehicle inventory deposits | | 152 | | | 262 | |

| Production equipment deposits | | 260 | | | 623 | |

| Other prepaid expenses | | 1,806 | | | 1,333 | |

| Prepaid insurance | | 640 | | | 3,827 | |

| VAT receivable from government | | 326 | | | 363 | |

| | | | |

| Total prepaid expenses and other current assets | | $ | 3,644 | | | $ | 9,335 | |

Note 7. Property, Plant, and Equipment, net

Property, plant, and equipment, net consisted of the following (in thousands):

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| Land and building | | $ | — | | | $ | 2,823 | |

| Machinery and equipment | | 11,821 | | | 12,420 | |

| Software | | 3,293 | | | 3,403 | |

| Leasehold improvements | | 3,544 | | | 3,306 | |

| Construction in progress | | 3,233 | | | 2,652 | |

| Total Property, plant, and equipment | | 21,891 | | | 24,604 | |

| Less: Accumulated depreciation and amortization | | (6,741) | | | (6,035) | |

| Property, plant and equipment, net | | $ | 15,150 | | | $ | 18,569 | |

Depreciation and amortization expense totaled $1.0 million and $1.9 million for the three and six months ended June 30, 2024, respectively. Depreciation and amortization expense totaled $0.7 million and $2.2 million for the three and six months ended June 30, 2023, respectively.

The Company recognized impairment charges of $1.3 million during the three and six months ended June 30, 2024, respectively, primarily related to property, plant and equipment impairment in Hyzon Australia (see Note 4. Restructuring and Related Charges). There were no property, plant and equipment impairment charges for the three and six months ended June 30, 2023.

Note 8. Accrued Liabilities

Accrued liabilities consisted of the following (in thousands):

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| Payroll and payroll related expenses | | $ | 6,543 | | | $ | 5,261 | |

| Accrued professional fees | | 3,444 | | | 2,411 | |

Accrued product warranty costs | | 1,412 | | | 840 | |

Accrued contract manufacturer costs | | — | | | 1,424 | |

Accrued contract termination costs (Note 14) | | 1,204 | | | 470 | |

| | | | |

| Accrued SEC settlement (Note 14) | | 8,684 | | | 17,000 | |

| Other accrued expenses | | 2,661 | | | 2,710 | |

| Accrued liabilities | | $ | 23,948 | | | $ | 30,116 | |

Note 9. Investments in Equity Securities

The Company owns common shares, participation rights, and options to purchase additional common shares in certain private companies. On a non-recurring basis, the carrying value is adjusted for changes resulting from observable price changes in orderly transactions for identical or similar investments in the same issuer or for an impairment.

The investment in equity securities in the unaudited interim Consolidated Balance Sheets as of June 30, 2024 represents the equity investment in common shares and options of Raven SR, Inc. (“Raven”). During the first quarter of 2024, there was an observable transaction in the price of Raven’s common shares and options, which was essentially equal to the fair value determined as part of the quantitative measurement of the investments at December 31, 2023. Accordingly, there was no gain or loss on equity securities in the unaudited interim Consolidated Statements of Operations and Comprehensive Loss for the three and six months ended June 30, 2024. There was no observable transaction and no gain or loss on equity securities for the three and six months ended June 30, 2023.

The following table summarizes the total carrying value of held securities, measured as the total initial cost plus cumulative net gain (loss) (in thousands):

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

Total initial cost basis | $ | 4,948 | | | $ | 4,948 | |

Adjustments: | | | |

Cumulative unrealized gain | 12,530 | | | 12,530 | |

Cumulative impairment | (16,715) | | | (16,715) | |

Carrying amount, end of period | $ | 763 | | | $ | 763 | |

Note 10. Equity Method Investments

Raven SR S1 LLC

In December 2022, the Company, via its subsidiary, Hyzon Zero Carbon, Inc. (“HZCI”), entered into an agreement with Chevron and Raven SR, to invest in Raven SR S1 LLC (“Raven S1”). Raven S1 intends to develop, construct, operate and maintain a solid waste-to hydrogen generation production facility located in Richmond, California. The Company invested $8.5 million at closing, and the remaining $1.5 million is scheduled to be paid upon when construction of the facility is at least 50% complete and pre-commissioning activities have been initiated. The total $10.0 million investment represents approximately 20% ownership of Raven S1.

The Company’s equity method investment in Raven S1 does not have a readily determinable fair value. Such investments are evaluated for impairment when events and conditions occur that may have a significant adverse effect on the investment's fair value. Based on an assessment of these criteria, the Company determined that the investment in Raven S1 was not impaired as of June 30, 2024. The Raven S1 facility continues to experience certain permitting and construction delays and over-runs and has not yet been successful in attracting additional financing or achieving the milestones associated with remaining committed financing. However, Raven S1 has made progress towards achieving certain objectives and the Company continues to expect the Raven S1 project to be completed. The Company continues to monitor and evaluate the status of the Raven S1 project on an ongoing basis, and should an impairment be identified, the Company will evaluate whether such impairment is other-than-temporary. If Raven S1 management is not successful in achieving objectives such as fundraising the additional capital required to complete the project or in obtaining the required permits, a future impairment of the investment is reasonably possible.

Note 11. Short-term Investments

The following table summarizes the Company’s short-term investments as of June 30, 2024 (in thousands). The Company did not have any short term investments as of December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of June 30, 2024 |

| | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| Short-term investments | | | | | | | | |

| Certificates of deposit | | $ | 20,000 | | | $ | 418 | | | $ | — | | | $ | 20,418 | |

| Total short-term investments | | $ | 20,000 | | | $ | 418 | | | $ | — | | | $ | 20,418 | |

Note 12. Income Taxes

The Company recorded no income tax expense during the three and six months ended June 30, 2024 and 2023, respectively.

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The Company assesses all available evidence, both positive and negative, to determine the amount of any required valuation allowance within each taxing jurisdiction. The Company continues to be in a net operating loss and net deferred tax asset position, before valuation allowances. Full valuation allowances have been established for the Company’s operations in all jurisdictions.

There were no unrecognized tax benefits and no amounts accrued for interest and penalties as of June 30, 2024 and December 31, 2023. The Company is currently not aware of any issues under review that could result in significant payments, accruals or material deviation from its positions. The Company is subject to income tax examinations by taxing authorities in the countries in which it operates since inception.

Note 13. Fair Value Measurements

The Company follows the guidance in ASC 820, Fair Value Measurement. For assets and liabilities measured at fair value on a recurring and nonrecurring basis, a three-level hierarchy of measurements based upon observable and unobservable inputs is used to arrive at fair value. The Company uses valuation approaches that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible. The Company determines fair value based on assumptions that market participants would use in pricing an asset or liability in the principal or most advantageous market. When considering market participant assumptions in fair value measurements, the following fair value hierarchy distinguishes between observable and unobservable inputs, which are categorized in one of the following levels:

•Level 1 inputs: Unadjusted quoted prices in active markets for identical assets or liabilities accessible to the reporting entity at the measurement date.

•Level 2 inputs: Other than quoted prices included in Level 1 inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the asset or liability.

•Level 3 inputs: Unobservable inputs for the asset or liability used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at measurement date.

As of June 30, 2024, and December 31, 2023, the carrying amounts of accounts receivable, prepaid expenses and other current assets, accounts payable, and accrued liabilities approximate estimated fair value due to their relatively short maturities.

The following tables present information about the Company’s assets and liabilities that are measured at fair value on a recurring basis and indicate the fair value hierarchy of the valuation inputs the Company utilized to determine such fair value (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of June 30, 2024 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | |

| | | | | | | | |

| Short-term investments: | | | | | | | | |

| Certificates of deposit | | $ | — | | | $ | 20,418 | | | $ | — | | | $ | 20,418 | |

| Liabilities: | | | | | | | | |

| Warrant liability – Private Placement Warrants | | $ | — | | | $ | 160 | | | $ | — | | | $ | 160 | |

| Earnout shares liability | | $ | — | | | $ | — | | | $ | 1,321 | | | $ | 1,321 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2023 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | |

| Cash equivalents: | | $ | 75,312 | | | $ | — | | | $ | — | | | $ | 75,312 | |

| Liabilities: | | | | | | | | |

| Warrant liability – Private Placement Warrants | | $ | — | | | $ | 160 | | | $ | — | | | $ | 160 | |

| Earnout shares liability | | $ | — | | | $ | — | | | $ | 1,725 | | | $ | 1,725 | |

Cash Equivalents

The Company’s cash equivalents consist of short-term, highly liquid financial instruments that are readily convertible to cash with original maturities of three months or less. As of June 30, 2024, the Company did not have any cash equivalents. As of December 31, 2023, the Company had $75.3 million invested in certificates of deposit. The Company classifies its investments in certificates of deposit as Level 2 because they are valued using inputs other than quoted prices which are directly or indirectly observable in the market, including readily available pricing sources for the identical underlying security which may not be actively traded.

Short-term Investments

The Company’s short-term investments consist of certificates of deposit with original maturities greater than three months. The Company classifies its investments in certificates of deposit as Level 2 because they are valued using inputs other than quoted prices which are directly or indirectly observable in the market, including readily available pricing sources for the identical underlying security which may not be actively traded.

Earnout to Common Stockholders

The fair value of the earnout shares was estimated by utilizing a Monte-Carlo simulation model. The inputs into the Monte-Carlo pricing model included significant unobservable inputs. The following table provides quantitative information regarding Level 3 fair value measurement inputs:

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Stock price | $ | 0.32 | | $ | 0.90 |

| Risk-free interest rate | 4.7 | % | | 4.1 | % |

| Volatility | 145.0 | % | | 91.0 | % |

| Remaining term (in years) | 2.04 | | 2.54 |

The following table presents the changes in the liabilities for Private Placement Warrants and Earnout for the six months ended June 30, 2024 (in thousands):

| | | | | | | | | | | |

| Private Placement Warrants | | Earnout |

| Balance as of December 31, 2023 | $ | 160 | | | $ | 1,725 | |

| Change in estimated fair value | — | | | (404) | |

Balance as of June 30, 2024 | $ | 160 | | | $ | 1,321 | |

The Company performs routine procedures such as comparing prices obtained from independent sources to ensure that appropriate fair values are recorded.

Note 14. Commitments and Contingencies

Legal Proceedings

The Company is subject to, and may become a party to, a variety of litigation, other claims, suits, indemnity demands, regulatory actions, and government investigations and inquiries in the ordinary course of business. The assessment as to whether a loss is probable or reasonably possible, and as to whether such loss or a range of such loss is estimable, often involves significant judgment about future events, and the outcome of litigation is inherently uncertain. The Company accrues for matters when we believe that losses are probable and can be reasonably estimated. As of June 30, 2024, the Company accrued $1.2 million in Accrued liabilities for customer and supplier disputes. In addition, the Company accrued $16.9 million related to the resolution of the SEC investigation, of which $8.7 million is recorded in Accrued liabilities and $8.2 million in Accrued SEC settlement, in the unaudited interim Consolidated Balance Sheets relating to probable and estimable losses. As of December 31, 2023, the Company accrued $0.5 million in Accrued liabilities for a customer dispute. In addition, the Company accrued $25.0 million related to the resolution of the SEC investigation, of which $17.0 million is recorded in Accrued liabilities and $8.0 million in Accrued SEC settlement.

Other than the SEC matter described below, the outcome of individual matters is not predictable with assurance, the assessments are based on the Company’s knowledge and information available at the time; thus, the ultimate outcome of any matter could require payment substantially in excess of the amount being accrued and/or disclosed. The Company is party to current legal proceedings as discussed more fully below.

Shareholder Securities and Derivative Litigation

Three related putative securities class action lawsuits were filed between September 30, 2021 and November 15, 2021, in the U.S. District Court for the Western District of New York against the Company, certain of the Company’s current and former officers and directors and certain former officers and directors of Decarbonization Plus Acquisition Corporation (“DCRB”) (Kauffmann v. Hyzon Motors Inc., et al. (No. 21- cv-06612-CJS), Brennan v. Hyzon Motors Inc., et al. (No. 21-cv-06636-CJS), and Miller v. Hyzon Motors Inc. et al. (No. 21-cv-06695-CJS)), asserting violations of federal securities laws. The complaints generally allege that the Company and individual defendants made materially false and misleading statements relating to the nature of the Company’s customer contracts, vehicle orders, and sales and earnings projections, based on allegations in a report released on September 28, 2021, by Blue Orca Capital, an investment firm that indicated that it held a short position in the Company’s stock and which has made numerous allegations about the Company. These lawsuits have been consolidated under the caption In re Hyzon Motors Inc. Securities Litigation (Case No. 6:21-cv-06612-CJS-MWP), and on March 21, 2022, the court-appointed lead plaintiff filed a consolidated amended complaint seeking monetary damages. The Company and individual defendants moved to dismiss the consolidated amended complaint on May 20, 2022, and the court-appointed lead plaintiff filed its opposition to the motion on July 19, 2022. The court-appointed lead plaintiff filed an amended complaint on March 21, 2022, and a second amended complaint on September 16, 2022. Briefing regarding the Company and individual defendants’ anticipated motion to dismiss the second amended complaint was stayed pending a non-binding mediation among the parties, which took place on May 9, 2023. The parties did not reach a settlement during the May 9, 2023 mediation. On June 20, 2023, the court granted the lead plaintiff leave to file a third amended complaint, which was filed on June 23, 2023. The third amended complaint added additional claims. The Company filed a motion to dismiss on September 13, 2023, and DCRB and former DCRB officers, directors, and its sponsor filed a motion to dismiss on the same day. The lead plaintiff filed oppositions to the motions to dismiss on October 25, 2023, and defendants filed a reply on November 22, 2023. The parties are awaiting a ruling from the court.

Between December 16, 2021, and January 14, 2022, three related shareholder derivative lawsuits were filed in the U.S. District Court for the Western District of New York (Lee v. Anderson et al. (No. 21-cv-06744-CJS), Révész v. Anderson et al. (No. 22-cv-06012-CJS), and Shorab v. Anderson et al. (No. 22-cv-06023-CJS)). These three lawsuits have been consolidated under the caption In re Hyzon Motors Inc. Derivative Litigation (Case No. 6:21-cv-06744-CJS). On February 2, 2022, a similar stockholder derivative lawsuit was filed in the U.S. District Court for the District of Delaware (Yellets v. Gu et al. (No. 22-cv-00156)). On February 3, 2022, a similar shareholder derivative lawsuit was filed in the Supreme Court of the State of New York, Kings County (Ruddiman v. Anderson et al. (No. 503402/2022)). On February 13, 2023, a similar stockholder derivative lawsuit was filed in the Delaware Court of Chancery (Kelley v. Knight et al. (C.A. No. 2023-0173)). These lawsuits name as defendants certain of the Company’s current and former directors and certain former directors of DCRB, along with the Company as a nominal defendant, and generally allege that the individual defendants breached their fiduciary duties by making or failing to prevent the misrepresentations alleged in the consolidated securities class action, and assert claims for violations of federal securities laws, breach of fiduciary duties, unjust enrichment, abuse of control, gross mismanagement, and/or waste of corporate assets. These lawsuits generally seek equitable relief and monetary damages. Each of the shareholder derivative actions has been stayed or the parties have jointly requested that it be stayed pending a decision regarding the anticipated motion to dismiss in the consolidated securities class action.

On March 18, 2022, a putative class action complaint, Malork v. Anderson et al. (C.A. No. 2022-0260- KSJM) (“Malork”), was filed in the Delaware Court of Chancery against certain officers and directors of DCRB, DCRB’s sponsor, and certain investors in DCRB’s sponsor, alleging that the director defendants and controlling stockholders of DCRB’s sponsor breached their fiduciary duties in connection with the merger between DCRB and Legacy Hyzon. The complaint seeks equitable relief and monetary damages. On May 26, 2022, the defendants in this case moved to dismiss the complaint. On August 2, 2022, the plaintiff filed an amended complaint. Defendants filed a motion to dismiss the amended complaint on August 15, 2022. Briefing on the motion to dismiss is now complete, and oral argument occurred on April 21, 2023. On July 17, 2023, the Delaware Court of Chancery denied the defendants’ motion to dismiss the complaint. In August 2023, the plaintiff in Malork subpoenaed Hyzon for various documentation in connection with the litigation against the named defendants. In December 2023, the Company paid $1.5 million dollars in legal fees on behalf of the named individual defendants pursuant to an indemnity agreement between DCRB and the named individual defendants. The Company does not expect to incur further legal fees in connection with the indemnity agreement.

On August 5, 2024, Hyzon was served by the plaintiff in Malork with a Second Amended Complaint naming the Company and its former CEO, Craig Knight, as additional defendants (individually and collectively, the “Legacy Hyzon Defendants”). The Second Amended Complaint alleges new claims that the Legacy Hyzon Defendants aided and abetted the breaches of fiduciary duty alleged against the originally named Malork defendants. The Company will defend itself in this litigation.

Between January 26, 2022 and August 22, 2022, Hyzon received demands for books and records pursuant to Section 220 of the Delaware General Corporation Law from four stockholders who state they are investigating whether to file similar derivative or stockholder lawsuits, among other purposes. On May 31, 2022, one of these four stockholders represented that he had concluded his investigation and did not intend to file a complaint. On November 18, 2022, a second of the four stockholders filed a lawsuit in the Delaware Court of Chancery (Abu Ghazaleh v. Decarbonization Plus Acquisition Sponsor, LLC et al. (C.A. No. 2022-1050)), which was voluntarily dismissed shortly thereafter on December 1, 2022. On February 13, 2023, a third of these four stockholders filed a derivative lawsuit in the Delaware Court of Chancery (Kelley v. Knight et al. (C.A. No. 2023-0173)). The complaint asserts claims for breach of fiduciary duty and generally alleges that the individual defendants breached their fiduciary duties by making or failing to prevent misrepresentations including those alleged in the consolidated securities class action and the report released by Blue Orca Capital. As with the previously filed stockholder derivative lawsuits, the complaint seeks equitable relief and monetary damages. On April 17, 2023, the Court entered an order staying this action pending a decision on the anticipated motion to dismiss in the consolidated securities class action.

On April 18, 2023, the Company received a demand for books and records pursuant to Section 220 of the Delaware General Corporation Law from a stockholder seeking to investigate possible breaches of fiduciary duty or other misconduct or wrongdoing by the Company's controlling stockholder, Hymas Pte. Ltd. (“Hymas”), Hyzon's Board of Directors (the "Board") and/or certain members of Hyzon's senior management team in connection with the Company's entrance into (i) an equity transfer agreement (the “Equity Transfer”) with certain entities affiliated with the Company, and (ii) the share buyback agreement with the Hymas (the “Share Buyback” and, together with the Equity Transfer, the “Transactions”) as reported by the Company in its Form 8-K filed on December 28, 2022.

Litigation Involving Former Officers and Directors

On June 14, 2024, the Company received a complaint and demand for arbitration from counsel for Craig Knight, the Company’s former CEO. Mr. Knight asserts that the Company breached his employment agreement by failing to pay him severance, a bonus, and a long term (equity) incentive. The Company’s Board of Directors ultimately determined in January 2023 that Craig Knight’s termination was “for cause” as disclosed in its Current Report on Form 8-K/A filed with the SEC on February 1, 2023. The Company believes Mr. Knight’s claims are without merit and will vigorously defend itself against them.

The above proceedings are subject to uncertainties inherent in the litigation process. The Company cannot predict the outcome of these matters or estimate the possible loss or range of possible loss, if any at this time.

Government Investigations

On January 12, 2022, the Company announced it received a subpoena from the SEC for production of documents and information, including documents and information related to the allegations made in the September 28, 2021 report issued by Blue Orca Capital. The Company received two additional subpoenas in connection with the SEC’s investigation on August 5, 2022 and August 10, 2022. On October 31, 2022, the U.S. Attorney’s Office for the Southern District of New York (“SDNY”) notified the Company that it was also investigating these matters. The Company has received no further communications from the SDNY.

On September 26, 2023, the Company announced a final resolution, subject to court approval, of the SEC’s investigation. On that date, the SEC filed a complaint in the U.S. District Court for the Western District of New York naming the Company, Craig Knight, the Company’s former Chief Executive Officer and a former director, and Max C.B. Holthausen, a former managing director of the Company’s European subsidiary, Hyzon Motors Europe B.V., as defendants. Without admitting or denying the allegations in the SEC’s complaint, the Company consented to the entry of a final judgment, subject to court approval, that would permanently restrain and enjoin the Company from violating certain sections of and rules under the Exchange Act and the Securities Act, and would require the Company to pay a civil penalty of $25.0 million as follows: $8.5 million within 30 days of entry of the final judgment; (2) $8.5 million by December 31, 2024; and (3) $8.0 million by January 15, 2026. Mr. Knight and Mr. Holthausen also separately consented to the entry of final judgments, subject to court approval, resolving the SEC’s allegations. On January 16, 2024, the U.S. District Court for the Western District of New York entered the final judgment as to the Company, and on January 17, 2024 entered the final judgments as to Mr. Knight and Mr. Holthausen, concluding this litigation. The Company paid the first tranche of $8.5 million in January 2024 and accrues interest on unpaid amounts due after 30 days of the entry of the final judgment at a rate equal to the weekly average 1-year constant maturity Treasury yield, as published by the Board of Governors of the Federal Reserve System.

Customer and Supplier Disputes

On July 28, 2023, Worthington Industries Poland SP.Z.O.O, a Hyzon Europe supplier, filed a complaint in the Amsterdam District Court in the Netherlands, against Hyzon Europe for breach of contract and obtained an attachment covering Hyzon Europe’s bank accounts. Accordingly, $1.1 million included in those Hyzon Europe's bank accounts are recorded as restricted cash in the unaudited interim Consolidated Balance Sheets as of June 30, 2024. The complaint seeks damages from Hyzon Europe totaling €4.6 million (approximately $4.9 million in USD). The Company intends to vigorously defend itself against this claim.

Regardless of outcome, such proceedings or claims can have an adverse impact on the Company because of legal defense and settlement costs, the Company’s obligations to indemnify third parties, diversion of resources, and other factors, and there can be no assurances that favorable outcomes will be obtained. Other than the matters disclosed above, based on the nature of these cases, the Company cannot predict the outcome of these currently outstanding customer and supplier dispute matters or estimate the possible loss or range of possible loss, if any.

Note 15. Stock-based Compensation Plans

The following table summarizes the Company’s stock option, Restricted Stock Units (“RSUs”) and Performance Stock Units (“PSUs”) activity:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Stock Options | | RSUs | | PSUs |

| | Number of Options | | Weighted Average Exercise Price | | Weighted Average Remaining Contractual (Years) | | Aggregate Intrinsic Value (in 000s) | | Number of RSUs | | Weighted Average Grant Date Fair Value | | Number of PSUs | | Weighted Average Grant Date Fair Value |

Outstanding at December 31, 2023 | | 14,773,453 | | | $ | 1.20 | | | 10.37 | | — | | | 13,682,338 | | | $ | 1.50 | | | 2,265,283 | | | $ | 0.95 | |

Granted | | — | | | $ | — | | | — | | | — | | | 11,147,848 | | | $ | 0.60 | | | 3,500,161 | | | $ | 0.76 | |

Exercised or released | | — | | | $ | — | | | — | | | — | | | (4,854,912) | | | $ | 1.08 | | | (708,468) | | | $ | 0.91 | |

Forfeited/Cancelled | | (14,176) | | | $ | 1.13 | | | — | | | — | | | (1,833,516) | | | $ | 1.30 | | | (426,373) | | | $ | 0.78 | |

Outstanding at June 30, 2024 | | 14,759,277 | | | $ | 1.20 | | | 9.88 | | — | | | 18,141,758 | | | $ | 1.08 | | | 4,630,603 | | | $ | 0.83 | |

Vested and expected to vest, June 30, 2024 | | 14,759,277 | | | $ | 1.20 | | | 9.88 | | — | | | 18,141,758 | | | $ | 1.08 | | | — | | | $ | — | |

Exercisable and vested at June 30, 2024 | | 13,265,785 | | | $ | 1.18 | | | 10.48 | | — | | | — | | | — | | | — | | | — | |

As of June 30, 2024, there was $0.4 million of unrecognized stock-based compensation expense related to unvested stock options, which is expected to be recognized over a weighted-average period of 1.33 years.

RSUs granted under the Company’s equity incentive plans typically vest over a one to four-year period beginning on the date of grant. RSUs will be settled through the issuance of an equivalent number of shares of the Company’s common stock and are equity classified.

The total fair value of RSUs and PSUs is determined based upon the stock price on the date of grant. As of June 30, 2024, unrecognized compensation costs related to unvested RSUs of $12.4 million is expected to be recognized over a remaining weighted average period of 2.23 years. As of June 30, 2024, unrecognized compensation costs related to unvested PSUs of $3.4 million is expected to be recognized over a remaining weighted average period of 1.01 years.

Note 16. Stockholders' Equity

Common Stock

As of June 30, 2024, the Company was authorized to issue 400,000,000 shares of common stock with a par value of $0.0001 per share. Holders of Class A common stock are entitled to one vote for each share. At June 30, 2024 and December 31, 2023, there were 248,554,855 and 245,081,497 shares of Class A common stock issued and outstanding, respectively.

Preferred Stock

The Company is authorized to issue 10,000,000 shares of preferred stock with a par value of $0.0001 per share. At June 30, 2024 and December 31, 2023, no preferred stock was issued and outstanding, respectively.

Warrants

At June 30, 2024 and December 31, 2023, there were 11,013,665 Public Warrants and 8,014,500 Private Placement Warrants, for a total of 19,028,165 warrants outstanding. At June 30, 2024 and December 31, 2023, there were 170,048 Ardour Warrants outstanding.

Note 17. Related Party Transactions

Horizon IP Agreement

In January 2021, the Company entered into an intellectual property agreement (the “Horizon IP Agreement”) with Jiangsu Qingneng New Energy Technologies Co., Ltd. and Shanghai Qingneng Horizon New Energy Ltd. (together, “JS Horizon”) both of which are subsidiaries of the Company’s ultimate parent, Horizon. In September 2021, Jiangsu Horizon Powertrain Technologies Co. Ltd. (“JS Powertrain”) was an added party to the agreement. Pursuant to the agreement the parties convey to each other certain rights in intellectual property relating to Hyzon’s core fuel cell and mobility product technologies, under which Hyzon was to pay JS Horizon and JS Powertrain a total fixed payment of $10.0 million. The full $10.0 million has been paid, $6.9 million was paid in 2021 and the remaining $3.1 million was paid in February 2022.

Hyzon Motors USA Inc., a subsidiary of the Company, entered into a Second Amendment (the “Second Amendment”) to the Horizon IP Agreement. The Second Amendment was effective September 22, 2023. Under the terms of the Second Amendment, the parties have agreed to certain amendments to the Horizon IP Agreement pertaining to their rights in and to hydrogen fuel cell intellectual property. The parties have also agreed to a term for the Horizon IP Agreement that shall expire on the seven-year anniversary of the effective date of the Second Amendment.

Sponsorship of Stockholm Hearts Equestrian Show Jumping Team