Highlights

- Net business wins in the quarter of $2,328 million. Reflects a

net book to bill in the quarter of 1.15, and a trailing twelve

month net book to bill of 1.21.

- Closing backlog of $24.3 billion, an increase of 2.1% on

quarter two 2024 and 9.4% on quarter three 2023.

- Quarter three revenue of $2,030.0 million. Quarter three

adjusted EBITDA of $418.8 million or 20.6% of revenue.

- GAAP net income for the quarter of $197.1 million or $2.36 per

diluted share, an increase of 19.8% on quarter three 2023 diluted

earnings per share.

- Quarter three adjusted net income was $279.2 million or $3.35

per diluted share, an increase of 1.5% on quarter three 2023

adjusted diluted earnings per share.

- Net debt balance of $2.7 billion at September 30, 2024 with net

debt to adjusted EBITDA ratio of 1.6x.

- Cash generated from operating activities for the quarter was

$402.7 million, an increase of 17.9% on quarter three 2023.

- $100.0 million worth of stock repurchased at an average price

of $297.

- Updating full-year 2024 financial revenue guidance in the range

of $8,260 - $8,300 million, representing a year over year increase

of 1.7% to 2.2%. Updating full-year 2024 adjusted earnings per

share* guidance in the range of $13.90 - $14.10, representing a

year over year increase of 8.7% to 10.2%. Adjusted earnings per

share to exclude amortization, stock compensation, restructuring,

foreign exchange and transaction-related / integrated-related

adjustments.

ICON plc (NASDAQ: ICLR), a world-leading healthcare intelligence

and clinical research organization, today reported its financial

results for the third quarter ended September 30, 2024.

CEO, Dr. Steve Cutler commented, “ICON’s results for the third

quarter did not meet the expectations we had previously provided

due to specific customer and division-level impacts. Our revenue

shortfall was attributable to more material headwinds from two

large customers undergoing budget cuts and changes in their

development model, lower than anticipated vaccine-related activity,

and ongoing cautiousness from biotech customers resulting in award

and study delays.

We expect these impacts to continue into quarter four, and as a

result, we are taking decisive action to realign our resources to

forecasted activity. With these actions, we are updating our full

year adjusted earnings per share guidance to between $13.90 and

$14.10, representing year over year growth of 8.7% to 10.2%.

The fundamentals of our business remain strong and we saw

further success in the quarter with a new top 10 pharma strategic

partnership win, which has already started contributing to our

pipeline of awards. This win, coupled with other recently executed

partnerships, supports our outlook for growth over the medium

term.”

Third Quarter 2024 Results

Gross business wins in the third quarter were $2,832 million and

cancellations were $504 million. This resulted in net business wins

of $2,328 million and a book to bill of 1.15.

Revenue for the third quarter was $2,030 million. This

represents a decrease of 1.2% on prior year revenue or 1.0% on a

constant currency basis.

GAAP net income was $197.1 million resulting in $2.36 diluted

earnings per share in quarter three 2024 compared to $1.97 diluted

earnings per share in quarter three 2023, an increase of 19.8% year

over year. Adjusted net income for the quarter was $279.2 million

resulting in an adjusted diluted earnings per share of $3.35

compared to $3.30 per share for the third quarter 2023.

Adjusted EBITDA for the third quarter was $418.8 million or

20.6% of revenue, a year-on-year decrease of 3.2%.

The effective tax rate on adjusted net income in quarter three

2024 was 16.5%.

Cash generated from operating activities for the quarter was

$402.7 million. During the quarter $43.3 million was spent on

capital expenditure. At September 30, 2024, the Group had cash and

cash equivalents of $695.5 million, compared to cash and cash

equivalents of $506.6 million at June 30, 2024 and $313.1 million

at September 30, 2023. $100.0 million worth of stock was

repurchased at an average price of $297. $50.0 million of the

revolving credit facility was drawn down in the quarter and $50.0

million was repaid. Additionally, $7.4 million of Term Loan B

payments were made during the quarter. Net indebtedness as at

September 30, 2024 was $2.7 billion.

Year to date 2024 Results

Gross business wins year to date were $9,017 million and

cancellations were $1,457 million. This resulted in net business

wins of $7,560 million and a book to bill of 1.21.

Year to date revenue was $6,240.6 million. This represents a

year on year increase of 3.1% or 3.2% on a constant currency

basis.

GAAP net income year to date was $531.5 million resulting in

$6.38 diluted earnings per share compared to $4.79 per share for

the equivalent prior year period. This represents an increase of

33.2%. Adjusted net income was $880.3 million resulting in an

adjusted diluted earnings per share of $10.57 compared to $9.31 per

share for the equivalent prior year period. This represents an

increase of 13.5%.

Adjusted EBITDA year to date was $1,313.2 million or 21.0% of

revenue, a year on year increase of 5.4%.

Other Information

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), this press

release contains certain non-GAAP financial measures, including

adjusted EBITDA, adjusted net income and adjusted diluted earnings

per share. Adjusted EBITDA, adjusted net income and adjusted

diluted earnings per share exclude amortization, stock

compensation, foreign exchange gains and losses, restructuring and

transaction-related / integration-related adjustments. While

non-GAAP financial measures are not superior to or a substitute for

the comparable GAAP measures, ICON believes certain non-GAAP

information is useful to investors for historical comparison

purposes.

ICON will hold a conference call on October 24, 2024 at 08:00

EDT [13:00 Ireland & UK]. This call and linked slide

presentation can be accessed live from our website at

http://investor.iconplc.com. A recording will also be available on

the website for 90 days following the call. In addition, a calendar

of company events, including upcoming conference presentations, is

available on our website, under “Investors”. This calendar will be

updated regularly.

This press release contains forward-looking statements,

including statements about our financial guidance. These statements

are based on management's current expectations and information

currently available, including current economic and industry

conditions. These statements are not guarantees of future

performance or actual results, and actual results, developments and

business decisions may differ from those stated in this press

release. The forward-looking statements are subject to future

events, risks, uncertainties and other factors that could cause

actual results to differ materially from those projected in the

statements, including, but not limited to, the ability to enter

into new contracts, maintain client relationships, manage the

opening of new offices and offering of new services, the

integration of new business mergers and acquisitions, as well as

other economic and global market conditions and other risks and

uncertainties detailed from time to time in SEC reports filed by

ICON, all of which are difficult to predict and some of which are

beyond our control. For these reasons, you should not place undue

reliance on these forward-looking statements when making investment

decisions. The word "expected" and variations of such words and

similar expressions are intended to identify forward-looking

statements. Forward-looking statements are only as of the date they

are made and we do not undertake any obligation to update publicly

any forward-looking statement, either as a result of new

information, future events or otherwise. More information about the

risks and uncertainties relating to these forward-looking

statements may be found in SEC reports filed by ICON, including its

Form 20-F, F-1, F-4, S-8, F-3 and certain other reports, which are

available on the SEC's website at http://www.sec.gov.

* Our full-year 2024 guidance adjusted earnings per share

measures are provided on a non-GAAP basis because the company is

unable to predict with a reasonable degree of certainty certain

items contained in the GAAP measures without unreasonable efforts.

For the same reasons, the company is unable to address the probable

significance of the unavailable information.

ICON plc is a world-leading healthcare intelligence and clinical

research organization. From molecule to medicine, we advance

clinical research providing outsourced services to pharmaceutical,

biotechnology, medical device and government and public health

organizations. We develop new innovations, drive emerging therapies

forward and improve patient lives. With headquarters in Dublin,

Ireland, ICON employed approximately 42,250 employees in 106

locations in 55 countries as at September 30, 2024. For further

information about ICON, visit: www.iconplc.com.

ICON/ICLR-F

ICON plc

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

FOR THE THREE AND NINE MONTHS

ENDED SEPTEMBER 30, 2024 AND SEPTEMBER 30, 2023

(UNAUDITED)

Three Months Ended

Nine Months Ended

September 30,

2024

September 30,

2023

September 30,

2024

September 30,

2023

(in thousands except share and

per share data)

Revenue

$

2,030,030

$

2,055,099

$

6,240,575

$

6,053,928

Costs and expenses:

Direct costs (excluding depreciation and

amortization)

1,438,616

1,449,136

4,403,583

4,274,222

Selling, general and administrative

205,095

185,187

576,903

572,999

Depreciation and amortization

93,029

146,032

391,845

436,217

Transaction and integration related

7,856

10,433

21,667

34,516

Restructuring

—

—

45,789

45,390

Total costs and expenses

1,744,596

1,790,788

5,439,787

5,363,344

Income from operations

285,434

264,311

800,788

690,584

Interest income

2,434

1,273

5,601

3,294

Interest expense

(53,303

)

(83,908

)

(185,808

)

(255,665

)

Income before income tax expense

234,565

181,676

620,581

438,213

Income tax expense

(37,437

)

(18,011

)

(89,105

)

(41,913

)

Income before share of losses from equity

method investments

197,128

163,665

531,476

396,300

Share of losses from equity method

investments

—

—

—

(383

)

Net income

$

197,128

$

163,665

$

531,476

$

395,917

Net income per Ordinary Share:

Basic

$

2.38

$

1.99

$

6.43

$

4.83

Diluted

$

2.36

$

1.97

$

6.38

$

4.79

Weighted average number of Ordinary Shares

outstanding:

Basic

82,831,300

82,215,627

82,716,842

82,001,500

Diluted

83,445,827

82,972,888

83,305,441

82,737,073

ICON plc

CONDENSED CONSOLIDATED BALANCE

SHEETS

AS AT SEPTEMBER 30, 2024 AND

DECEMBER 31, 2023

(UNAUDITED)

September 30,

2024

December 31,

2023

ASSETS

(in thousands)

Current assets:

Cash and cash equivalents

$

695,507

$

378,102

Available for sale investments

—

1,954

Accounts receivable, net of allowance for

credit losses

1,396,080

1,790,322

Unbilled revenue

1,361,198

951,936

Other receivables

82,760

65,797

Prepayments and other current assets

140,536

132,105

Income taxes receivable

102,931

91,254

Total current assets

$

3,779,012

$

3,411,470

Non-current assets:

Property, plant and equipment

365,726

361,184

Goodwill

9,085,447

9,022,075

Intangible assets

3,605,814

3,855,865

Operating right-of-use assets

156,955

140,333

Other receivables

88,445

78,470

Deferred tax asset

75,993

73,662

Investments in equity

53,720

46,804

Total Assets

$

17,211,112

$

16,989,863

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

106,172

$

131,584

Unearned revenue

1,585,257

1,654,507

Other liabilities

1,045,134

915,399

Income taxes payable

52,585

13,968

Current bank credit lines, loan facilities

and notes

29,762

110,150

Total current liabilities

$

2,818,910

$

2,825,608

Non-current liabilities:

Non-current bank credit lines, loan

facilities and notes

3,402,368

3,665,439

Lease liabilities

145,714

126,321

Non-current other liabilities

50,157

45,998

Non-current income taxes payable

201,135

186,654

Deferred tax liability

818,329

899,100

Commitments and contingencies

—

—

Total Liabilities

$

7,436,613

$

7,749,120

Shareholders' Equity:

Ordinary shares, par value 6 euro cents

per share; 100,000,000 shares authorized,

82,559,366 shares issued and outstanding

at September 30, 2024 and

82,495,086 shares issued and outstanding

at December 31, 2023

6,703

6,699

Additional paid‑in capital

7,011,547

6,942,669

Other undenominated capital

1,184

1,162

Accumulated other comprehensive loss

(110,062

)

(143,506

)

Retained earnings

2,865,127

2,433,719

Total Shareholders' Equity

$

9,774,499

$

9,240,743

Total Liabilities and Shareholders'

Equity

$

17,211,112

$

16,989,863

ICON plc

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED

SEPTEMBER 30, 2024 AND SEPTEMBER 30, 2023

(UNAUDITED)

Nine Months Ended

September 30,

2024

September 30,

2023

(in thousands)

Cash flows provided by operating

activities:

Net income

$

531,476

$

395,917

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expense

391,845

436,217

Impairment of operating right-of-use

assets and related property, plant and equipment

12,559

8,845

Reduction in carrying value of operating

right-of-use assets

29,820

33,979

Loss on equity method investments

—

383

Acquisition-related gain

—

(6,160

)

Amortization of financing costs and debt

discount

22,066

12,485

Stock compensation expense

41,183

47,303

Deferred tax benefit

(86,579

)

(114,487

)

Unrealized foreign exchange movements

34,018

(7,670

)

Other non-cash items

26,828

21,966

Changes in operating assets and

liabilities:

Accounts receivable

352,795

(139,096

)

Unbilled revenue

(423,533

)

14,370

Unearned revenue

(72,930

)

158,269

Other net assets

88,790

(141,425

)

Net cash provided by operating

activities

948,338

720,896

Cash flows used in investing

activities:

Purchase of property, plant and

equipment

(106,772

)

(87,980

)

Purchase of subsidiary undertakings (net

of cash acquired)

(85,629

)

(5,100

)

Movement of available for sale

investments

1,954

(241

)

Proceeds from investments in equity

2,671

—

Purchase of investments in equity

(10,131

)

(10,829

)

Net cash used in investing activities

(197,907

)

(104,150

)

Cash flows used in financing

activities:

New Notes issue costs

(12,678

)

—

Drawdown of credit lines and loan

facilities

2,242,480

305,000

Repayment of credit lines and loan

facilities

(2,595,323

)

(930,000

)

Proceeds from exercise of equity

compensation

32,379

36,517

Share issue costs

(17

)

(14

)

Repurchase of ordinary shares

(100,000

)

—

Share repurchase costs

(68

)

—

Net cash used in financing activities

(433,227

)

(588,497

)

Effect of exchange rate movements on

cash

201

(3,952

)

Net increase in cash and cash

equivalents

317,405

24,297

Cash and cash equivalents at beginning of

period

378,102

288,768

Cash and cash equivalents at end of

period

$

695,507

$

313,065

ICON plc

RECONCILIATION OF NON-GAAP

MEASURES

FOR THE THREE AND NINE MONTHS

ENDED SEPTEMBER 30, 2024 AND SEPTEMBER 30, 2023

(UNAUDITED)

Three Months Ended

Nine Months Ended

September 30,

2024

September 30,

2023

September 30,

2024

September 30,

2023

(in thousands except share and

per share data)

Adjusted EBITDA

Net income

$

197,128

$

163,665

$

531,476

$

395,917

Share of losses from equity method

investments

—

—

—

383

Income tax expense

37,437

18,011

89,105

41,913

Net interest expense

50,869

82,635

180,207

252,371

Depreciation and amortization

93,029

146,032

391,845

436,217

Stock-based compensation expense (a)

13,038

16,465

41,183

47,822

Foreign currency losses/(gains), net

(b)

19,434

(4,706

)

11,960

(2,465

)

Oncacare (gain) (g)

—

—

—

(6,160

)

Restructuring (c)

—

—

45,789

45,390

Transaction and integration related costs

(d)

7,856

10,433

21,667

34,516

Adjusted EBITDA

$

418,791

$

432,535

$

1,313,232

$

1,245,904

Adjusted net income and adjusted

diluted net income per Ordinary Share

Net income

$

197,128

$

163,665

$

531,476

$

395,917

Income tax expense

37,437

18,011

89,105

41,913

Amortization

58,026

114,573

291,013

343,868

Stock-based compensation expense (a)

13,038

16,465

41,183

47,822

Foreign currency losses/(gains), net

(b)

19,434

(4,706

)

11,960

(2,465

)

Restructuring (c)

—

—

45,789

45,390

Oncacare (gain) (g)

—

—

—

(6,160

)

Transaction and integration related costs

(d)

7,856

10,433

21,667

34,516

Transaction-related financing costs

(e)

1,462

4,587

22,066

12,486

Adjusted tax expense (f)

(55,173

)

(49,100

)

(173,953

)

(142,617

)

Adjusted net income

$

279,208

$

273,928

$

880,306

$

770,670

Diluted weighted average number of

Ordinary Shares outstanding

83,445,827

82,972,888

83,305,441

82,737,073

Adjusted diluted net income per

Ordinary Share

$

3.35

$

3.30

$

10.57

$

9.31

(a)

Stock-based compensation expense

represents the amount of recurring expense related to the company’s

equity compensation programs (inclusive of employer related

taxes).

(b)

Foreign currency losses/(gains),

net relates to gains or losses that arise in connection with the

revaluation, or settlement, of non-US dollar denominated assets and

liabilities. We exclude these gains and losses from adjusted EBITDA

and adjusted net income because fluctuations from period- to-

period do not necessarily correspond to changes in our operating

results.

(c)

Restructuring relates to charges

incurred in connection with the company's realignments of its

workforce, with the elimination of redundant positions as well as

reviewing its global office footprint and optimizing its locations

to best fit the requirements of the company.

(d)

Transaction and integration

related costs include expenses associated with our acquisitions and

any other costs incurred directly related to the integration of

these acquisitions.

(e)

Transaction-related financing

costs includes costs incurred in connection with changes to our

long-term debt and amortization of financing fees. We exclude these

costs from adjusted EBITDA and adjusted net income because they

result from financing decisions rather than from decisions made

related to our ongoing operations.

(f)

Represents the tax effect of

adjusted pre-tax income at our estimated effective tax rate.

(g)

On April 20, 2023, the Company

completed the purchase of the majority investor’s 51% majority

voting share capital of Oncacare Limited (“Oncacare”). This gave

rise to an acquisition-related gain of $6.2 million. This gain was

excluded from adjusted EBITDA and adjusted net income.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023957406/en/

Investor Relations +1 888 381 7923 Brendan Brennan Chief

Financial Officer Kate Haven Vice President Investor Relations +1

888 381 7923 http://www.iconplc.com

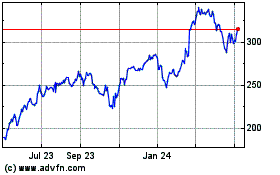

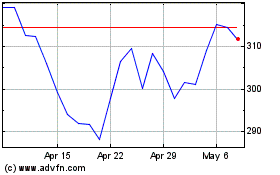

ICON (NASDAQ:ICLR)

Historical Stock Chart

From Mar 2025 to Apr 2025

ICON (NASDAQ:ICLR)

Historical Stock Chart

From Apr 2024 to Apr 2025