false

0001711754

0001711754

2024-10-31

2024-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 31, 2024

INMUNE BIO INC.

(Exact name of registrant as specified in charter)

| Nevada |

|

001-38793 |

|

47-5205835 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

225 NE Mizner Blvd., Suite 640

Boca Raton, Florida 33432

(Address of Principal Executive Offices) (Zip Code)

(858) 964 3720

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, If Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

INMB |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results

of Operations and Financial Condition.

On October 31, 2024,

INmune Bio Inc. issued a press release announcing its financial results and to provide a business update for the quarter ended September

30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference in

this Item 2.02.

The information furnished

under this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section and shall not be

deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise

expressly stated by specific reference in any such filing.

Item 9.01 Financial statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INMUNE BIO INC. |

| |

|

| Date: November 1, 2024 |

By: |

/s/ David Moss |

| |

|

David Moss |

| |

|

Chief Financial Officer |

2

Exhibit 99.1

INmune

Bio Inc. Announces Third Quarter 2024 Results and Provides Business Update

BOCA RATON, Fla., Oct. 31, 2024 (GLOBE NEWSWIRE)

-- INmune Bio Inc. (NASDAQ: INMB) (the “Company”), a clinical-stage inflammation and immunology company

focused on developing treatments that harness the patient’s innate immune system to fight disease, today announces its financial

results for the quarter ended September 30, 2024 and provides a business update.

Q3 2024 and Recent

Corporate Highlights

DN-TNF Platform Highlights (XPro™):

| ● | Announced

completion enrollment for its Phase 2 Alzheimer’s Disease (“AD”) trial on Friday, 27 September. This global, blinded,

randomized Phase 2 trial (the “AD02 trial”) is focused on patients with Early AD and biomarkers of elevated neuroinflammation.

Enrollment of new patients into the trial was concluded after the Company determined that there are sufficient patients currently in

screening to meet the trial’s target of 201 patients. All patients currently in the screening process will remain eligible to participate

in AD02, which will likely result in modest over-enrollment. |

| ● | Announced

that results of interim analysis of blinded data from its AD02 trial demonstrated exceptional performance of the novel cognitive measure

EMACC, as well as highly significant correlation between EMACC and the Clinical Dementia Rating-Sum of Boxes (CDR-SB), an accepted endpoint

for AD trials. Key findings of the analysis included: |

| ● | Statistical

Correlation: An independent review confirmed a highly significant correlation (p<0.001) between baseline scores on EMACC and CDR-SB,

the secondary endpoint in the AD02 trial. CDR-SB is the clinical rating scale most used in AD registration studies. |

| ● | Reliability:

The correlation of EMACC when measured during the screening process and again at the first study visit before treatment was found to

be 0.93. Higher precision produces results that are more robust and replicable with smaller sample sizes. |

| ● | Differentiation

Capability: The difference in EMACC performance between patients with CDR global ratings of 0.5 (prodromal AD) and those rated 1.0 (mild

dementia) was very large, with an effect size (Cohen’s d) of 0.87 (p<.0001). This demonstrates EMACC's ability to accurately

differentiate between disease stages, highlighting its sensitivity and precision. |

| ● | Announced

publication in Cell Reports, “Microglia Regulate Cortical Remyelination via ΤNFR1-Dependent Phenotypic Polarization.”

Myelin is necessary for fast and efficient communication between neurons. Loss of myelin compromises neuron function and communication

and is a key step in the neurodegenerative process of many CNS diseases, including Alzheimer’s Disease. Data from the publication

identifies soluble TNF as a critical cytokine checkpoint that converts microglia from a reparative, remyelinating cell to a damaging,

demyelinating cell. These data suggest that blocking soluble TNF is a promising strategy for treating demyelinating diseases. |

| ● | Announced

Webinar on Cognitive Testing using EMACC and CSD-SB to be held on November 7, 2024, at 1PM ET. Click Here to Register |

INKmune™ Platform:

| ● | Announced

that INKmune™ demonstrates excellent safety and increased NK-Cell activity in first dosing cohort, in a Phase I/II trial (the “CaRe

PC” trial) for men with metastatic Castration-Resistant Prostate Cancer (mCRPC). Blinded analysis of the monitoring blood samples

from the first three patients showed changes in the phenotype and function of the patient’s NK cells. Although this is the lowest

dose cohort, 2 of 3 patients showed an increase in circulating activated NK cells and all three showed increased NK cell function sustained

for more than 40 days after the final INKmune™ infusion. One patient showed a transient 21% decrease in PSA associated with the

increase in NK cell activity and function. |

| ● | There

have been 21 administrations of INKmune™ in the mCRPC study given on an out-patient basis, with no significant adverse events

including zero cases of cytokine release syndrome (CRS). Combining the experience with INKmune™ from the MDS/AML and mCRPC trials,

over 30 infusions of INKmune™ have been given safely without the need for conditioning therapy, pre-medication, or cytokine support. |

| ● | The

CaRe PC trial has recently dosed the first patient in the highest dose cohort and opened the phase II enrolment for subjects in the intermediate

dose group. The dose of INKmune™ in the intermediate and high dose cohorts is 3 and 5 times the dose of INKmune™ in the first

cohort. All eight clinical sites are now open and additional results from the trial will be released from the higher dose cohorts as

they become available. |

| ● | Published

landmark paper in Journal Immunotherapy of Cancer led by Mark Lowdell, PhD, INmune’s Chief Scientific Officer, titled, Proteomic

and phenotypic characteristics of memory-like Natural Killer cells for cancer immunotherapy. The study demonstrates that memory-like

natural killer (mlNK) cells, generated by either cytokine or INKmuneTM priming, show increased cytotoxicity against multiple

tumor types, offering promising potential for cancer immunotherapy. Importantly, while most studies are conducted on NK cells from healthy

volunteers, this study demonstrated that mlNK from cancer patients are equally as potent as those generated from healthy volunteers further

supporting INKmune’s in vivo treatment methodology. The research also provides new insights into the metabolic and physiological

mechanisms underlying NK cell memory, paving the way for innovative treatments in both hematological malignancies and solid tumors. |

| ● | Announced

new formulation of INKmune™ that supports highest trial dose with single bag administration and expansion of bioreactor capacity

in preparation of scalable manufacturing. An IND amendment with the improved formulation has been submitted to the FDA that also includes

additional validation data supporting an alternative critical reagent used in INKmune™ manufacturing, improving supply chain redundancy. |

Corporate:

| ● | Executed securities purchase agreements with new and existing

institutional investors and certain directors and officers and employees of the Company for gross proceeds of approximately $13.0 million. |

| ● | Added to the broad-market Russell 3000® Index at the conclusion

of the 2024 Russell US Indexes annual reconstitution, effective as of Monday, July 1st, 2024. |

| ● | Received a $2.5 million research and development rebate from

Australia in July. |

Upcoming Events and Milestones:

| ● | Top-line data from the Phase 2 Alzheimer’s trial is expected

in the second quarter of 2025. |

| ● | Initiate a Phase II trial of XPro™ in patients with

Treatment-Resistant Depression 2H 2024. |

| ● | Expect to complete enrollment in the Phase I portion of INKmune™

in metastatic castration-resistant prostate cancer trial by year-end. The Phase II portion is expected to complete enrollment in Q2,

2025, however we expect to provide periodic updates on the immunologic and therapeutic response to INKmune™ as data becomes available. |

Financial Results for the Third

Quarter Ended September 30, 2024:

| ● | Net loss attributable to common stockholders for the quarter

ended September 30, 2024 was approximately $12.1 million, compared to approximately $8.6 million during the quarter ended September 30,

2023. |

| ● | Research and development expenses totaled approximately $10.1

million for the quarter ended September 30, 2024, compared to approximately $6.0 million during the quarter ended September 30, 2023. |

| ● | General and administrative expenses were approximately $2.2

million for the quarter ended September 30, 2024, compared to approximately $2.6 million during the quarter ended September 30, 2023. |

| ● | As of September 30, 2024, the Company had cash and cash equivalents

of approximately $33.6 million. |

| ● | As of October 31, 2024, the Company had approximately 22.2 million

common shares outstanding. |

Earnings Call Information

To participate in this event, dial approximately

5 to 10 minutes before the beginning of the call. Please ask for the INmune Bio Second Quarter Conference Call when reaching an operator.

Date: October 31, 2024

Time: 4:30 PM Eastern Time

Participant Dial-in: 1-800-343-4136

Participant Dial-in (international): 1-203-518-9843

Conference ID: INMUNE

A live audio webcast of the call can be accessed

by clicking here or using this link: INmune Bio, Inc. Third Quarter 2024 Earnings Call - 1692115

A transcript will follow approximately 24

hours from the scheduled call. A replay will also be available through August 8, 2024, by dialing 1-844-512-2921 or 1-412-317-6671 (international)

and entering PIN no. 11156467.

About XPro™

XPro™ is a next-generation inhibitor

of tumor necrosis factor (TNF) that is currently in clinical trial and acts differently than currently available TNF inhibitors in that

it neutralizes soluble TNF (sTNF), without affecting trans-membrane TNF (tmTNF) or TNF receptors. XPro™ could have potential substantial

beneficial effects in patients with neurologic disease by decreasing neuroinflammation. For more information about the importance of targeting

neuroinflammation in the brain to improve cognitive function and restore neuronal communication visit this section of the INmune Bio’s website.

About INKmune™

INKmune™ is a pharmaceutical-grade,

replication-incompetent human tumor cell line which conjugates to resting NK cells and delivers multiple, essential priming signals to

convert the cancer patient’s resting NK cells into tumor killing memory-like NK cells (mlNK cells). INKmune™ treatment

converts the patient’s own NK cells into mlNK cells. In patients, INKmune™ primed tumor killing NK cells have persisted for

more than 100 days. These cells function in the hypoxic TME because due to upregulated nutrient receptors and mitochondrial survival proteins.

INKmune™ is a patient friendly drug

treatment that does not require pre-medication, conditioning or additional cytokine therapy to be given to the patients. INKmune™

is easily transported, stored and delivered to the patient by a simple intravenous infusion as an out-patient. INKmune™ is tumor

agnostic; it can be used to treat many types of NK-resistant tumors including leukemia, lymphoma, myeloma, lung, ovarian, breast, renal

and nasopharyngeal cancer. INKmune™ is treating patients in an open label Phase I/II trial in metastatic castration-resistant

prostate cancer in the US this year.

About INmune Bio Inc.

INmune Bio Inc. is

a publicly traded (NASDAQ: INMB), clinical-stage biotechnology company focused on developing treatments that target the innate immune

system to fight disease. INmune Bio has two product platforms that are both in clinical trials: The Dominant-Negative Tumor Necrosis Factor

(DN-TNF) product platform utilizes dominant-negative technology to selectively neutralize soluble TNF, a key driver of innate immune dysfunction

and a mechanistic driver of many diseases. DN-TNF product candidates are in clinical trials to determine if they can treat cancer (INB03™),

Mild Alzheimer’s disease, Mild Cognitive Impairment and treatment-resistant depression (XPro™). The Natural Killer Cell Priming

Platform includes INKmune™ developed to prime a patient’s NK cells to eliminate minimal residual disease in patients with

cancer. INmune Bio’s product platforms utilize a precision medicine approach for the treatment of a wide variety of hematologic

and solid tumor malignancies, and chronic inflammation. To learn more, please visit www.inmunebio.com.

Forward Looking Statements

Clinical trials are in early stages and there

is no assurance that any specific outcome will be achieved. Any statements contained in this press release that do not describe historical

facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995.

Any statements contained in this press release that do not describe historical facts may constitute forward-looking statements as that

term is defined in the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are based on

current expectations but are subject to a number of risks and uncertainties. Actual results and the timing of certain events and circumstances

may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. INB03™,

XPro1595 (XPro™), and INKmune™ are still in clinical trials or preparing to start clinical trials and have not been approved

by the US Food and Drug Administration (FDA) or any regulatory body and there cannot be any assurance that they will be approved by the

FDA or any regulatory body or that any specific results will be achieved. The factors that could cause actual future results to differ

materially from current expectations include, but are not limited to, risks and uncertainties relating to the Company’s ability

to produce more drug for clinical trials; the availability of substantial additional funding for the Company to continue its operations

and to conduct research and development, clinical studies and future product commercialization; and, the Company’s business, research,

product development, regulatory approval, marketing and distribution plans and strategies. These and other factors are identified and

described in more detail in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual

Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q and the Company’s Current Reports on Form 8-K. The Company

assumes no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the

date of this release.

David Moss

Co-founder and Chief Financial Officer

(858) 964-3720

info@inmunebio.com

Daniel Carlson

Head of Investor Relations

(415) 509-4590

dcarlson@inmunebio.com

Investor Contact:

Mike Moyer

Managing Director – LifeSci Advisors

mmoyer@lifesciadvisors.com

The following tables summarize our results

of operations for the periods indicated:

INMUNE BIO INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

(Unaudited)

| | |

September 30,

2024 | | |

December 31,

2023 | |

| ASSETS | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash and cash equivalents | |

$ | 33,552 | | |

$ | 35,848 | |

| Research and development tax credit receivable | |

| 1,109 | | |

| 1,905 | |

| Other tax receivable | |

| 311 | | |

| 537 | |

| Prepaid expenses and other current assets | |

| 864 | | |

| 1,510 | |

| Prepaid expenses – related party | |

| 15 | | |

| 142 | |

| TOTAL CURRENT ASSETS | |

| 35,851 | | |

| 39,942 | |

| | |

| | | |

| | |

| Operating lease – right of use asset | |

| 335 | | |

| 414 | |

| Other assets | |

| 82 | | |

| 131 | |

| Acquired in-process research and development intangible assets | |

| 16,514 | | |

| 16,514 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 52,782 | | |

$ | 57,001 | |

| | |

| | | |

| | |

| LIABILITIES, REDEEMABLE COMMON STOCK AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 10,590 | | |

$ | 7,901 | |

| Accounts payable and accrued liabilities – related parties | |

| 55 | | |

| 35 | |

| Deferred liabilities | |

| 549 | | |

| 489 | |

| Current portion of long-term debt | |

| 2,494 | | |

| 9,921 | |

| Operating lease, current liability | |

| 135 | | |

| 119 | |

| TOTAL CURRENT LIABILITIES | |

| 13,823 | | |

| 18,465 | |

| | |

| | | |

| | |

| Long-term operating lease liability | |

| 284 | | |

| 397 | |

| TOTAL LIABILITIES | |

| 14,107 | | |

| 18,862 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| Redeemable common stock, $0.001 par value; no shares and 75,697 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively (Note 9) | |

| - | | |

| 799 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized, 0 shares issued and outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value, 200,000,000 shares authorized, and 22,172,451 and 17,950,776 shares issued and outstanding, respectively | |

| 22 | | |

| 18 | |

| Additional paid-in capital | |

| 193,575 | | |

| 159,143 | |

| Accumulated other comprehensive loss | |

| (1,036 | ) | |

| (799 | ) |

| Accumulated deficit | |

| (153,886 | ) | |

| (121,022 | ) |

| TOTAL STOCKHOLDERS’ EQUITY | |

| 38,675 | | |

| 37,340 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES, REDEEMABLE COMMON STOCK AND STOCKHOLDERS’ EQUITY | |

$ | 52,782 | | |

$ | 57,001 | |

INMUNE BIO INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except share and per share amounts)

(Unaudited)

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| REVENUE | |

$ | - | | |

$ | 43 | | |

$ | 14 | | |

$ | 127 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 2,219 | | |

| 2,586 | | |

| 7,369 | | |

| 7,223 | |

| Research and development | |

| 10,067 | | |

| 5,985 | | |

| 25,813 | | |

| 14,266 | |

| Total operating expenses | |

| 12,286 | | |

| 8,571 | | |

| 33,182 | | |

| 21,489 | |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS FROM OPERATIONS | |

| (12,286 | ) | |

| (8,528 | ) | |

| (33,168 | ) | |

| (21,362 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE), NET | |

| 193 | | |

| (35 | ) | |

| 304 | | |

| (238 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

$ | (12,093 | ) | |

$ | (8,563 | ) | |

$ | (32,864 | ) | |

$ | (21,600 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share – basic and diluted | |

$ | (0.60 | ) | |

$ | (0.48 | ) | |

$ | (1.71 | ) | |

$ | (1.20 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding – basic and diluted | |

| 20,185,676 | | |

| 18,008,295 | | |

| 19,176,853 | | |

| 17,966,990 | |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE LOSS | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (12,093 | ) | |

$ | (8,563 | ) | |

$ | (32,864 | ) | |

$ | (21,600 | ) |

| Other comprehensive loss – foreign currency translation | |

| (323 | ) | |

| (23 | ) | |

| (237 | ) | |

| (36 | ) |

| Total comprehensive loss | |

$ | (12,416 | ) | |

$ | (8,586 | ) | |

$ | (33,101 | ) | |

$ | (21,636 | ) |

INMUNE BIO INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| Net loss | |

$ | (32,864 | ) | |

$ | (21,600 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 5,848 | | |

| 5,489 | |

| Accretion of debt discount | |

| 73 | | |

| 179 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Research and development tax credit receivable | |

| 796 | | |

| 6,012 | |

| Other tax receivable | |

| 226 | | |

| 186 | |

| Prepaid expenses | |

| 646 | | |

| 2,492 | |

| Prepaid expenses – related party | |

| 127 | | |

| 34 | |

| Other assets | |

| 49 | | |

| (30 | ) |

| Accounts payable and accrued liabilities | |

| 2,689 | | |

| (1,531 | ) |

| Accounts payable and accrued liabilities – related parties | |

| 20 | | |

| 70 | |

| Deferred liabilities | |

| 60 | | |

| (120 | ) |

| Accrued liability – long-term | |

| - | | |

| 254 | |

| Operating lease liabilities | |

| (18 | ) | |

| (14 | ) |

| Net cash used in operating activities | |

| (22,348 | ) | |

| (8,579 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Net proceeds from sale of common stock and warrants | |

| 27,789 | | |

| 775 | |

| Repayments of debt | |

| (7,500 | ) | |

| (2,500 | ) |

| Net cash provided by financing activities | |

| 20,289 | | |

| (1,725 | ) |

| | |

| | | |

| | |

| Impact on cash from foreign currency translation | |

| (237 | ) | |

| (36 | ) |

| | |

| | | |

| | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | |

| (2,296 | ) | |

| (10,340 | ) |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | |

| 35,848 | | |

| 52,153 | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | |

$ | 33,552 | | |

$ | 41,813 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOWS INFORMATION: | |

| | | |

| | |

| Cash paid for income taxes | |

$ | - | | |

$ | - | |

| Cash paid for interest expense | |

$ | 661 | | |

$ | 1,394 | |

9

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

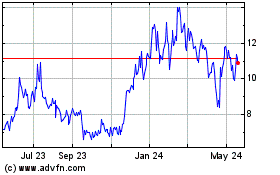

INmune Bio (NASDAQ:INMB)

Historical Stock Chart

From Dec 2024 to Jan 2025

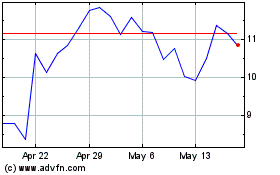

INmune Bio (NASDAQ:INMB)

Historical Stock Chart

From Jan 2024 to Jan 2025