iSpecimen Inc. (Nasdaq: ISPC) (“iSpecimen”

or the “Company”), an online global marketplace that

connects scientists in need of biospecimens for medical research

with a network of healthcare specimen providers, today reported its

financial and operating results for the twelve-month period ended

December 31, 2022.

“At the beginning of the fourth quarter of 2022,

I stepped into the role of interim CEO, and together with the

Board, undertook an in depth review of iSpecimen’s operations.

Based on our initial findings, the team quickly implemented several

improvements that we believe contributed to our record revenue of

$3.2 million for the fourth quarter of 2022, up 28%

year-over-year,” said Tracy Curley, CEO and CFO. “Throughout the

remainder of the quarter and into 2023, we continued with our

strategic corporate review, in which we discovered a significant

imbalance within our supplier network, specifically, high levels of

utilization across a small subsection of suppliers. Today, I am

pleased to report that with several initiatives underway by our

site development department, we are gaining a much better

understanding of our suppliers and their capabilities. Armed with

this information, I am confident that during 2023 we will be able

to materially increase our supplier utilization rates, which will

allow us to increase fulfillment and ultimately result in increased

revenue opportunities in 2023 and beyond.”

“In 2023 we plan to have a record level of

investment in our technology, demonstrating continued commitment to

our vision of our online marketplace to be transformational in our

industry. Additionally, we are excited by the progress of several

revenue enhancement projects, in areas that include sequencing,

remnants and normal blood, as well as new initiatives with

suppliers to facilitate improved coordination and utilization. We

will continue to invest where necessary throughout 2023 to

accelerate these revenue growth initiatives. We look forward to

keeping the investment community apprised as we continue to improve

our operations,” concluded Ms. Curley.

Financial & Operational

Highlights

- Revenue increased 28% to $3.2

million for Q4 2022, compared to $2.5 million for Q4 2021.

- Unique supplier organizations under

agreement were 217 as of December 31, 2022.

- Unique customer organizations who

have purchased from iSpecimen totaled 513 as of December 31, 2022,

an increase of 24% from 415 at the end of 2021.

- iSpecimen Marketplace had nearly

6,703 registered research and supplier users as of December 31,

2022, up 29% over Q4 2021.

Recent Corporate Updates

- Launched the new self-service Open

Feasibilities Dashboard on iSpecimen Marketplace®, allowing

supplier partners to review potential future research projects at

any time and initiate their interest by submitting a proposal.

- Appointed Joseph J. Basile to Board

of Directors. Mr. Basile is a sought-after strategic advisor, an

accomplished business leader, a skilled negotiator, a trained

mediator and a recognized expert in M&A, restructuring and

governance.

- Named Tracy Curley as permanent

Chief Executive Officer. Ms. Curley was previously appointed

Interim CEO in September 2022.

- Appointed Eric Langlois as Chief

Revenue Officer. Mr. Langlois will manage a restructured commercial

team aimed at executing on Company initiatives.

- Added and onboarded seven new

biospecimen providers to the iSpecimen Marketplace®, for both

banked and prospectively collected specimens. These new suppliers

will allow iSpecimen to improve global access to vital biospecimens

and data needed to help advance research in oncology, autoimmune

diseases, infectious diseases, cardiovascular diseases and

more.

- Named to Fast Company‘s annual list

of the World’s Most Innovative Companies as part of the biotech

category for 2023.

Financial Results for the Full Year

2022

Revenue for the full year 2022 was approximately

$10.4 million, compared to approximately $11.1 million for the full

year 2021. The reduction in revenue year-to-year was primarily due

to a decrease in COVID revenue, which was partially offset by an

increase in non-COVID revenue.

Cost of revenue was approximately $4.8 million

for the full year 2022, compared to approximately $5.2 million for

the full year 2021. The decrease was primarily attributable to the

31% decrease in average cost per specimen from $252 for the year

ended December 31, 2021 to $173 for the year ended December 31,

2022.

General and administrative expenses were

approximately $6.9 million for the full year 2022, compared to

approximately $5.6 million for the full year 2021. The increase was

primarily attributable to increases in executive severance costs,

payroll and related expenses, taxes and insurance, software and

subscriptions costs, utilities and facilities expenses, marketing

and advertising costs, other general expenses, offset by decreases

in bad debt and depreciation and amortization expenses.

Net loss was approximately $10.2 million, or

$(1.16) per share, for the full year 2022, compared to net loss of

approximately $9.0 million, or $(2.09) per share, for the full year

2021.

Cash was approximately $15.3 million as of

December 31, 2022, compared to approximately $27.7 million as of

December 31, 2021. Average cash burn per quarter for 2022 was $2.2

million, excluding a loan repayment of $3.5 million.

*The financial information presented in this

press release is based on preliminary unaudited financial

statements prepared by management, for the year ended December 31,

2022, and is fully qualified by the section in this press release

entitled ‘Disclaimer Regarding Financial Information.’

Conference Call and Webcast

Information

The Company will host a conference call and audio webcast today,

March 14, 2023 at 8:30 a.m. Eastern Time featuring remarks by Tracy

Curley, CEO.

|

Event: |

iSpecimen Full Year 2022 Results Conference Call |

| Date: |

Tuesday, March 14, 2023 |

| Time: |

8:30 a.m. Eastern Time |

| Live

Call: |

+1-844-826-3033 (U.S. Toll

Free) or +1-412-317-5185 (International) |

| Webcast: |

https://viavid.webcasts.com/starthere.jsp?ei=1597531&tp_key=8e160f088e |

| |

|

For interested individuals unable to join the conference call, a

replay will be available through March 28, 2023, at +1-844-512-2921

(U.S. Toll Free) or +1-412-317-6671 (International). Participants

must use the following code to access the replay of the call:

10175632. An archived version of the webcast will also be available

on iSpecimen’s Investor Relations

site: https://investors.ispecimen.com/presentations/.

About iSpecimeniSpecimen (Nasdaq: ISPC) offers

an online marketplace for human biospecimens, connecting scientists

in commercial and non-profit organizations with healthcare

providers that have access to patients and specimens needed for

medical discovery. Proprietary, cloud-based technology enables

scientists to intuitively search for specimens and patients across

a federated partner network of hospitals, labs, biobanks, blood

centers and other healthcare organizations. For more information,

please visit www.ispecimen.com.

Forward Looking StatementsThis press release

may contain forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Such

forward-looking statements are characterized by future or

conditional verbs such as "may," "will," "expect," "intend,"

"anticipate," believe," "estimate" and "continue" or similar words.

You should read statements that contain these words carefully

because they discuss future expectations and plans, which contain

projections of future results of operations or financial condition

or state other forward-looking information.

Forward-looking statements are predictions, projections and

other statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this press

release, including but not limited to the risks factors contained

in the Company's filings with the Securities and Exchange

Commission, which are available for review at www.sec.gov.

Forward-looking statements speak only as of the date they are made.

New risks and uncertainties arise over time, and it is not possible

for the Company to predict those events or how they may affect the

Company. If a change to the events and circumstances reflected in

the Company's forward-looking statements occurs, the Company's

business, financial condition and operating results may vary

materially from those expressed in the Company's forward-looking

statements.

Readers are cautioned not to put undue reliance on

forward-looking statements, and the Company assumes no obligation

and do not intend to update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

Disclaimer Regarding Financial InformationThe

financial information presented in this press release is based on

preliminary, unaudited financial statements prepared by management,

for the year ended December 31, 2022. Accordingly, such financial

information may be subject to change. All information contained in

this press release will be qualified with reference to the audited

financial results for the year ended December 31, 2022, which will

be released on or before March 21, 2023, and will be posted on

www.sec.gov. While the Company does not expect there to be any

material changes to the financial information provided in this

press release, any variation between the Company’s actual results

and the preliminary financial information set forth herein may be

material.

For further information, please contact:

Investor ContactKCSA Strategic

CommunicationsAllison SossiSpecimen@kcsa.com

Media ContactsKCSA Strategic

CommunicationsRaquel Cona / Shana MarinoiSpecimen@kcsa.com

iSpecimen Inc.Condensed

Balance Sheets

| |

|

December 31, |

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

|

|

Unaudited |

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash |

|

$ |

15,308,710 |

|

|

$ |

27,738,979 |

|

|

Accounts receivable - unbilled |

|

|

2,327,789 |

|

|

|

1,739,020 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$230,999 and $269,170 at December 31, 2022 and 2021,

respectively |

|

|

1,597,915 |

|

|

|

3,002,442 |

|

|

Prepaid expenses and other current assets |

|

|

300,434 |

|

|

|

327,035 |

|

|

Tax credit receivable, current portion |

|

|

140,873 |

|

|

|

140,873 |

|

|

Total current assets |

|

|

19,675,721 |

|

|

|

32,948,349 |

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

225,852 |

|

|

|

32,781 |

|

|

Internally developed software, net |

|

|

4,503,787 |

|

|

|

2,710,867 |

|

|

Operating lease right-of-use asset |

|

|

184,692 |

|

|

|

— |

|

|

Security deposits |

|

|

27,601 |

|

|

|

27,601 |

|

|

Total assets |

|

$ |

24,617,653 |

|

|

$ |

35,719,598 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,459,063 |

|

|

$ |

832,678 |

|

|

Accrued expenses |

|

|

1,531,238 |

|

|

|

1,009,803 |

|

|

Accrued interest |

|

|

— |

|

|

|

8,167 |

|

|

Operating lease - current obligation |

|

|

158,451 |

|

|

|

— |

|

|

Deferred revenue |

|

|

132,335 |

|

|

|

654,746 |

|

|

Total current liabilities |

|

|

4,281,087 |

|

|

|

2,505,394 |

|

|

|

|

|

|

|

|

|

|

|

| Operating lease long - term

obligation |

|

|

27,396 |

|

|

|

— |

|

| Term loan |

|

|

— |

|

|

|

3,422,616 |

|

|

Total liabilities |

|

|

4,308,483 |

|

|

|

5,928,010 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (See Note 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

Common stock, $0.0001 par value, 200,000,000 shares authorized,

8,956,808 issued and 8,925,808 outstanding at December 31,

2022, and 8,764,479 issued and 8,733,479 outstanding at

December 31, 2021 |

|

|

892 |

|

|

|

873 |

|

|

Additional paid-in capital |

|

|

68,573,774 |

|

|

|

67,810,289 |

|

|

Treasury stock, 31,000 shares at December 31, 2022 and

2021, at cost |

|

|

(172 |

) |

|

|

(172 |

) |

|

Accumulated deficit |

|

|

(48,265,324 |

) |

|

|

(38,019,402 |

) |

|

Total stockholders’ equity |

|

|

20,309,170 |

|

|

|

29,791,588 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

24,617,653 |

|

|

$ |

35,719,598 |

|

|

|

|

|

|

|

|

|

|

|

iSpecimen Inc.Condensed Statements of

Operations

| |

|

Years Ended December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

10,402,303 |

|

|

$ |

11,135,303 |

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

Cost of revenue |

|

|

4,756,965 |

|

|

|

5,249,013 |

|

|

Technology |

|

|

2,656,287 |

|

|

|

1,837,882 |

|

|

Sales and marketing |

|

|

3,445,344 |

|

|

|

2,422,743 |

|

|

Supply development |

|

|

801,125 |

|

|

|

573,913 |

|

|

Fulfillment |

|

|

1,995,937 |

|

|

|

1,363,522 |

|

|

General and administrative |

|

|

6,932,727 |

|

|

|

5,613,476 |

|

|

Total operating expenses |

|

|

20,588,385 |

|

|

|

17,060,549 |

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(10,186,082 |

) |

|

|

(5,925,246 |

) |

|

|

|

|

|

|

|

|

| Other expense, net |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Interest expense |

|

|

(238,963 |

) |

|

|

(2,102,681 |

) |

|

Change in fair value of derivative liability on convertible

notes |

|

|

— |

|

|

|

(271,000 |

) |

|

Change in fair value of derivative liability on bridge notes and

bridge notes, related parties |

|

|

— |

|

|

|

1,582,700 |

|

|

Loss on extinguishment of bridge notes and bridge notes, related

parties |

|

|

— |

|

|

|

(2,740,425 |

) |

|

Loss on extinguishment of convertible notes and convertible notes,

related parties |

|

|

— |

|

|

|

(260,185 |

) |

|

Gain on extinguishment of note payable |

|

|

— |

|

|

|

788,156 |

|

|

Other income (expense), net |

|

|

9,778 |

|

|

|

(44,531 |

) |

|

Interest income |

|

|

169,345 |

|

|

|

11,397 |

|

| Total other expense, net |

|

|

(59,840 |

) |

|

|

(3,036,569 |

) |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(10,245,922 |

) |

|

$ |

(8,961,815 |

) |

|

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

|

$ |

(1.16 |

) |

|

$ |

(2.09 |

) |

|

|

|

|

|

|

|

|

|

Weighted average shares of common stock outstanding - basic and

diluted |

|

|

8,844,307 |

|

|

|

4,287,424 |

|

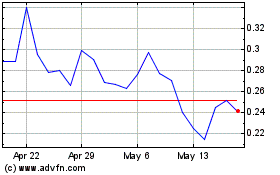

iSpecimen (NASDAQ:ISPC)

Historical Stock Chart

From Dec 2024 to Jan 2025

iSpecimen (NASDAQ:ISPC)

Historical Stock Chart

From Jan 2024 to Jan 2025