Israel Acquisitions Corp. (NASDAQ: ISRL, ISRLU, ISRLW), (“ISRL”), a

publicly-traded special purpose acquisition company, and Gadfin

Ltd. (“Gadfin”), an Israeli technology company specializing in

all-weather, long range, heavy-duty, drone delivery for essential

cargo, today announced the entry into a definitive business

combination agreement reflecting a total equity value of Gadfin of

up to $200 million USD (the “Business Combination Agreement”). The

combined company will trade on Nasdaq and leverage Gadfin’s

innovative technology augmented with the expertise of the ISRL

team.

Through Gadfin’s patented technology, its

unmanned aerial vehicles which are powered by hydrogen fuel cells

can deliver medical supplies and other heavy-duty cargo to

long-range destinations and in harsh weather conditions. Gadfin’s

technology makes it possible to significantly improve logistics

delivery in both civil uses and combat zones. Gadfin is

well-positioned to be a leading player in drone cargo delivery.

Upon completion of the transaction, Gadfin aims

to achieve a great growth plan based on existing contracts and

potential new wins.

Transaction Details:

- The Board of Directors of both ISRL

and Gadfin have unanimously approved the Business Combination

Agreement and signed voting support agreements in favor of the

transaction.

- Minimum net cash condition

precedent to closing of $15 million.

- The combined company’s staggered

Board of Directors will initially be comprised of up to seven

directors, of which one director will be nominated by ISRL and up

to four directors will be nominated by Gadfin. Up to two additional

directors will be mutually agreed. Existing Gadfin management will

operate the combined company.

- The parties anticipate completing

the business combination in the second half of 2025, contingent

upon satisfying all closing conditions, including shareholder

approvals, regulatory consents, and compliance with legal and tax

requirements.

- Gadfin’s officers, directors, and

>5% shareholders, as well as ISRL’s sponsor will enter into a

6-month lock-up agreement, followed by a gradual release mechanism,

from the closing of the business combination.

- At the closing of the transaction,

Gadfin will be listed on Nasdaq in the United States.

Izhar Shay, Chairman of ISRL's Board of

Directors: “This business combination agreement marks

a significant milestone, aligning well with the vision we set forth

when launching our SPAC. Gadfin's innovative hydrogen-powered

drones, capable of long-range, zero-emission deliveries, position

the company to seize numerous growth opportunities in the drone

logistics industry, both in the U.S. and globally. We believe this

is an exceptional company to take to the Nasdaq.”

Eyal Regev, Gadfin's Founder and

CEO: “We are thrilled to announce this business

combination, marking a pivotal milestone for Gadfin and

underscoring the confidence placed in us by leaders in the hi-tech

and financial sectors in Israel and the United States. We deeply

appreciate the trust and business expertise of the ISRL team,

particularly Ziv Elul and Izhar Shay, whose strategic guidance and

proven ability to scale businesses will be invaluable in driving

Gadfin’s growth. Together, we are committed to accelerating

technological innovation and expanding Gadfin’s global presence.

Our gratitude also extends to the dedicated teams at Gadfin and

ISRL for their tireless efforts in advancing this merger.”

Advisors:

Tiberius Capital Markets, a division of Arcadia

Securities is acting as financial advisor to Israel Acquisitions

Corp, with Reed Smith LLP, and Stuarts Humpries acting as legal

advisors.

Herzog, Fox, and Neeman is acting as legal

advisor to Gadfin.

About Gadfin Ltd.:

Gadfin is a pioneering technology company

revolutionizing the logistics and cargo delivery industry with its

innovative hydrogen-powered drones. Specializing in long-range,

heavy-duty, zero-emission aerial delivery, Gadfin provides

cutting-edge solutions for time-critical, essential cargo

transport, especially to less accessible areas. Gadfin’s

proprietary technology is designed to address the evolving needs of

sectors such as healthcare, logistics, and industrial supply

chains, enabling efficient, sustainable, and reliable deliveries

across urban and remote areas.

Led by Eyal Regev, one of the earliest pioneers

of the vertical take-off and landing (“VTOL”) cargo delivery

vision, Gadfin’s comprehensive approach includes innovative VTOL

design, state-of-the-art drone manufacturing, advanced operational

platforms, and tailored support services, ensuring seamless

integration into its clients’ logistics frameworks. Headquartered

in Israel, Gadfin is pioneering the way in transforming how goods

are transported, helping its partners meet the demands of the

modern world while reducing environmental impact. Backed by

prominent investors, SIBF VC (www.sibf.vc) and Gehr Group

(www.gehr.com), Gadfin is poised to lead the charge in sustainable

and efficient logistics solutions.

About Israel Acquisitions

Corp.:

Israel Acquisitions Corp is a Cayman Islands

exempted company incorporated as a blank-check company. Formed for

the purpose of entering into a merger, share exchange, asset

acquisition, stock purchase, recapitalization, reorganization or

similar business combination with one or more businesses or

entities. The Company intends to focus on high-growth technology

companies that are domiciled in Israel, and that either carry out

all or a substantial portion of their activities in Israel or have

some other significant Israeli connection. The management team is

led by Chairman, Izhar Shay, Chief Executive Officer, Ziv Elul, and

Chief Financial Officer, Sharon Barzik Cohen.

Forward-Looking Statements:

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

present or historical fact included herein, regarding the proposed

business combination ISRL and Gadfin, ISRL and Gadfin’s ability to

consummate the transaction, the expected closing date for the

transaction, the benefits of the transaction and the public

company’s future financial performance following the transaction,

as well as ISRL’s and Gadfin’s strategy, future operations,

financial position, estimated revenues, and losses, projected

costs, prospects, plans and objectives of management are forward

looking statements. When used herein, including any oral statements

made in connection herewith, the words “anticipates,”

“approximately,” “believes,” “continues,” “could,” “estimates,”

“expects,” “forecast,” “future, ” “intends,” “may,” “outlook,”

“plans,” “potential,” “predicts,” “propose,” “should,” “seeks,”

“will,” or the negative of such terms and other similar expressions

are intended to identify forward-looking statements, although not

all forward-looking statements contain such identifying words. Such

forward-looking statements are subject to risks, uncertainties, and

other factors, which could cause actual results to differ

materially from those expressed or implied by such forward-looking

statements. These forward-looking statements are based upon

estimates and assumptions that, while considered reasonable by both

ISRL and its management, and Gadfin and its management, as the case

may be, are inherently uncertain. Except as otherwise required by

applicable law, ISRL disclaims any duty to update any

forward-looking statements, all of which are expressly qualified by

the statements in this section, to reflect events or circumstances

after the date hereof. ISRL cautions you that these forward-looking

statements are subject to risks and uncertainties, most of which

are difficult to predict and many of which are beyond the control

of ISRL. There may be additional risks that neither ISRL nor Gadfin

presently know of or that ISRL or Gadfin currently believe are

immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. Nothing in this

communication should be regarded as a representation by any person

that the forward-looking statements set forth herein will be

achieved or that any of the contemplated results of such

forward-looking statements will be achieved. You should not place

undue reliance on forward-looking statements, which speak only as

of the date they are made. Author and any of their affiliates,

directors, officers and employees expressly disclaim any obligation

or undertaking to disseminate any updates or revisions to any

forward-looking statement to reflect events or circumstances after

the date on which such statement is being made, or to reflect the

occurrence of unanticipated events.

Additional Information and Where to Find

It:

Additional information about the proposed

business combination, including a copy of the business combination

agreement, is disclosed in the Current Report on Form 8-K that ISRL

filed with the SEC on January 27, 2025 and is available at

www.sec.gov. In connection with the proposed transaction, the

Company intends to file a registration statement, which will

include a preliminary proxy statement/prospectus with the SEC. The

proxy statement/prospectus will be sent to the stockholders of the

Company. The Company and Gadfin also will file other documents

regarding the proposed transaction with the SEC. Before making any

voting decision, investors and security holders of the Company are

urged to read the proxy statement/prospectus and all other relevant

documents filed or that will be filed with the SEC in connection

with the proposed transaction as they become available because they

will contain important information about the proposed

transaction.

No Offer or Solicitation:

This communication is for informational purposes

only and shall not constitute a solicitation of a proxy, consent or

authorization with respect to any securities or in respect of the

Business Combination. This communication shall also not constitute

an offer to sell or the solicitation of an offer to buy any

securities, or a solicitation of any vote or approval, nor shall

there be any sale of securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act, or an exemption therefrom.

Investor Contact:

contact@israelspac.com

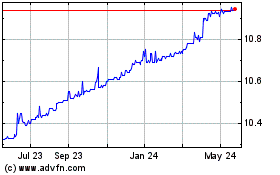

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From Feb 2025 to Mar 2025

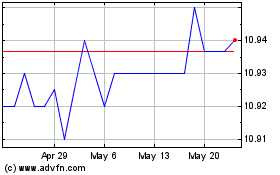

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From Mar 2024 to Mar 2025