Iterum Therapeutics plc (Nasdaq: ITRM) (the “Company”), a

clinical-stage pharmaceutical company focused on developing next

generation oral and IV antibiotics to treat infections caused by

multi-drug resistant pathogens in both community and hospital

settings, today announced that it has commenced its previously

disclosed rights offering (the “Rights Offering”).

Pursuant to the Rights Offering, the Company is

distributing, at no charge, subscription rights to the Company’s

shareholders and holders of warrants that have contractual rights

to participate in the Rights Offering which have not been waived

(each, an “eligible warrant” and collectively, the “eligible

warrants”) as of 5:00 p.m., Eastern Time, on July 16, 2024 (the

“Record Date”), non-transferable subscription rights to purchase an

aggregate of 8,503,800 units (“Units”) at a subscription price of

$1.21 per whole unit. As of July 19, 2024, one holder of eligible

warrants to purchase 56,606 ordinary shares, nominal value $0.01

per share (the “ordinary shares”) had waived their contractual

right to participate in the Rights Offering.

Each shareholder and holder of eligible warrants

will receive one subscription right for every ordinary share owned

and every ordinary share issuable upon exercise of eligible

warrants at 5:00 p.m., Eastern Time, on the Record Date. Each whole

Unit will consist of (a) one ordinary share, (b) a warrant to

purchase 0.50 ordinary shares, at an exercise price of $1.21 per

whole ordinary share from the date of issuance through its

expiration one year from the date of issuance (the “1-year

warrants”) and (c) a warrant to purchase one ordinary share, at an

exercise price of $1.21 per whole ordinary share from the date of

issuance through its expiration five years from the date of

issuance (the “5-year warrants” and, together with the 1-year

warrants, the “warrants”). Each subscription right will entitle its

holder to purchase 0.50 Units, at a subscription price of $0.605

per 0.50 Units (the “Subscription Price”), consisting of (i) 0.50

ordinary shares (ii) a 1-year warrant to purchase 0.25 ordinary

shares and (iii) a 5-year warrant to purchase 0.50 ordinary shares,

which the Company refers to as the “basic subscription right.”

Holders who fully exercise their basic subscription rights will be

entitled to subscribe for additional Units that remain unsubscribed

as a result of any unexercised basic subscription rights (the

“over-subscription privilege” and, together with the basic

subscription right, the “subscription rights”). If

over-subscription privilege requests exceed the remaining Units

available, the remaining Units will be allocated pro-rata among

holders who over-subscribe based on the number of ordinary shares

and/or eligible warrants held by all holders exercising the

privilege. Any excess subscription payment received by

Computershare Trust Company, N.A., the subscription agent for the

Rights Offering, will be returned, without interest or penalty, as

soon as practicable following the expiration of the Rights

Offering. If every holder of our ordinary shares and eligible

warrants on the Record Date exercise their subscription right in

full, we would issue a maximum of 8,503,800 Units, consisting of an

aggregate of (a) 8,503,800 ordinary shares, (b) 1-year warrants to

purchase up to 4,251,900 ordinary shares and (c) 5-year warrants to

purchase up to 8,503,800 ordinary shares, in connection with the

Rights Offering.

No fractional subscription rights are being

distributed and no fractional Units will be issued upon the

exercise of any subscription rights in the Rights Offering.

Shareholders and/or eligible warrant holders must exercise

subscription rights for at least one whole Unit to participate in

the Rights Offering. Further, warrants received by a shareholder

and/or eligible warrant holder may only be exercised to purchase

whole numbers of ordinary shares and may not be exercised in

respect of any fractional ordinary shares. As a result,

shareholders holding less than two ordinary shares and/or eligible

warrant holders with eligible warrants exercisable for less than

two ordinary shares may not be able to participate in the Rights

Offering and shareholders holding less than four ordinary shares

and/or eligible warrant holders with eligible warrants exercisable

for less than four ordinary shares may not be able to acquire any

exercisable 1-year warrants in the Rights Offering. Fractional

Units resulting from the exercise of basic subscription rights

and/or over-subscription privileges will be eliminated by rounding

down to the nearest whole Unit.

The subscription period for the Rights Offering

commenced on July 22, 2024 and ends at 5:00 p.m., Eastern Time, on

August 6, 2024, unless extended by the Company (the “Subscription

Period”). The subscription rights are non-transferable and will

only be exercisable during the Subscription Period. Subscription

rights not exercised during the Subscription Period will expire and

will hold no value. Once holders have exercised their Rights, such

exercise may not be revoked, canceled, or changed, even if holders

subsequently learn information about the Company or its business,

financial position, results of operations or cash flows that is

material or adverse or that the holders otherwise consider to be

unfavorable. The Company may cancel, modify or amend the Rights

Offering at any time and for any reason prior to the expiration of

the Subscription Period.

The Company has engaged Maxim Group LLC as

dealer-manager for the proposed rights offering. Questions about

the rights offering or requests for copies of the final prospectus

may be directed to Maxim Group LLC at 300 Park Avenue, New York, NY

10022, Attention Syndicate Department, or via email at

syndicate@maximgrp.com or telephone at (212) 895-3745.

A registration statement on Form S-1 (File No.

333-280045) (as amended, the “Registration Statement”) relating to

the Rights Offering has been filed with and declared effective by

the U.S. Securities and Exchange Commission (the “SEC”). The Rights

Offering is being made only by means of a prospectus, copies of

which will be delivered to shareholders and eligible warrant

holders of record as of 5:00 p.m., Eastern Time, on the Record Date

and can be accessed through the SEC’s website at www.sec.gov. A

copy of the Registration Statement and prospectus may also be

obtained from the information agent for the Rights Offering,

Georgeson LLC, by calling (866) 920-4401 (toll free in the U.S. and

Canada) or (781) 896-6947 (for calls outside the U.S. and

Canada).

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any subscription

rights, Units, ordinary shares, warrants or any other securities,

nor will there be any sale of subscription rights, Units, ordinary

shares, warrants or any other securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction, including under

the sanctions laws and regulations of the European Union or the

United States of America.

About Iterum Therapeutics

plc

Iterum Therapeutics plc is a clinical-stage

pharmaceutical company dedicated to developing differentiated

anti-infectives aimed at combatting the global crisis of multi-drug

resistant pathogens to significantly improve the lives of people

affected by serious and life-threatening diseases around the world.

Iterum Therapeutics is advancing the development of its first

compound, sulopenem, a novel penem anti-infective compound, with an

oral formulation and IV formulation. Sulopenem has demonstrated

potent in vitro activity against a wide variety of gram-negative,

gram-positive and anaerobic bacteria resistant to other

antibiotics. Iterum Therapeutics has submitted an NDA for oral

sulopenem for the treatment of uncomplicated urinary tract

infections in adult women, which has been accepted for review by

the U.S. Food and Drug Administration and has received Qualified

Infectious Disease Product (QIDP) and Fast Track designations for

its oral and IV formulations of sulopenem in seven indications.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995. These forward-looking statements include,

without limitation, statements regarding the Company’s plans,

strategies and prospects for its business, including the

development, therapeutic and market potential of sulopenem, the

planned Subscription Period for the Rights Offering, the terms of

the subscription rights, the Units, the 1-year warrants and the

5-year warrants, the level of participation and completion of the

Rights Offering. In some cases, forward-looking statements can be

identified by words such as “may,” “believes,” “intends,” “seeks,”

“anticipates,” “plans,” “estimates,” “expects,” “should,”

“assumes,” “continues,” “could,” “would,” “will,” “future,”

“potential” or the negative of these or similar terms and phrases.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the Company’s actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. Forward-looking

statements include all matters that are not historical facts.

Actual future results may be materially different from what is

expected due to factors largely outside the Company’s control,

including whether the conditions for the closing of the Rights

Offering will be satisfied, the uncertainties inherent in the

initiation and conduct of clinical and non-clinical development,

changes in regulatory requirements or decisions of regulatory

authorities, the timing of approval of any submission, changes in

public policy or legislation, commercialization plans and

timelines, if oral sulopenem is approved, the actions of

third-party clinical research organizations, suppliers and

manufacturers, the accuracy of the Company’s expectations regarding

how far into the future the Company’s cash on hand will fund the

Company’s ongoing operations, the sufficiency of the Company’s cash

resources and the Company’s ability to continue as a going concern,

the Company’s ability to maintain listing on the Nasdaq Capital

Market, risks and uncertainties concerning the outcome, impact,

effects and results of the Company’s pursuit of strategic

alternatives, including the terms, timing, structure, value,

benefits and costs of any strategic process and the Company’s

ability to complete one, whether on attractive terms or at all, the

price of the Company’s securities, the expected use of proceeds

from the Rights Offering and other risks and uncertainties

discussed under the caption “Risk Factors” in its Quarterly Report

on Form 10-Q for the quarterly period ended March 31, 2024 filed

with the SEC, and other documents filed with the SEC from time to

time. Forward-looking statements represent the Company’s beliefs

and assumptions only as of the date of this press release. Except

as required by law, the Company assumes no obligation to update

these forward-looking statements publicly, or to update the reasons

actual results could differ materially from those anticipated in

the forward-looking statements, even if new information becomes

available in the future.

Investor Contact: Judy Matthews

Chief Financial Officer 312-778-6073 IR@iterumtx.com

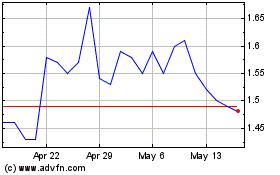

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Jan 2024 to Jan 2025