false

0001873875

0001873875

2024-10-21

2024-10-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date of

earliest event reported): October 21, 2024

Incannex Healthcare

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-41106 |

|

93-2403210 |

(State or other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Suite 105, 8 Century Circuit Norwest,

NSW 2153 Australia |

|

Not applicable |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone

Number, including Area Code: +61 409 840 786

(Former Name or

Former Address, if Changed Since Last Report): Not Applicable

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

IXHL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Effective October 21,

2024 (the “Effective Date”), Incannex Healthcare Inc. (the “Company”) entered into an employment agreement

(the “Employment Agreement”) with Luigi M. Barbato, M.D., to serve as the Company’s Chief Medical Officer.

The Employment

Agreement provides that Dr. Barbato will receive an annual base salary of $375,000, a target annual incentive of up to 20% of base

salary, long-term incentive plan and employee benefit plan participation, and the reimbursement of business expenses. Dr. Barbato

was granted restricted stock units under the Company’s 2023 Equity Incentive Plan (the “Plan”) representing the

contingent right to receive up to 100,476 shares of the Company’s common stock, which will vest in three equal installments on

the first, second, and third anniversary of the Effective Date, subject to his continued service to the Company pursuant to the

terms of his Employment Agreement.

There are (a) no understandings

or arrangements between Dr. Barbato and any other person pursuant to which he was appointed as Chief Medical Officer of the Company and

(b) Dr. Barbato has no material interest in any transaction or proposed transaction in which the Company is or is to be a party. Dr. Barbato

has no family relationship with any director or executive officer of the Company.

Biographical information

for Dr. Barbato is set forth below:

Dr. Barbato served as

Global Medical Lead for several clinical-stage therapeutic programs addressing neurological disorders at Jazz Pharmaceuticals from May

2023 until October 2024. Prior to joining Jazz, Dr. Barbato served as Global Senior Medical Director at AbbVie from July 2015 until May

2023, and, prior to his service with AbbVie, he held leadership roles at Biogen Idec, Novartis, Stiefel Laboratories (GSK), Forest Research

Institute, and Solvay Pharmaceuticals. Dr. Barbato served as a Clinical Assistant Professor of Psychiatry and Behavioral Science at Emory

University School of Medicine, and has authored or co-authored more than 65 papers and presentations. Dr. Barbato earned his M.D. from

St. George’s University School of Medicine and B.S. in Biology at St. Peter’s University.

The foregoing description

of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Employment

Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

| * | Management Compensation

Plan or Arrangement. |

| ^ | Certain schedules to

this exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. Copies of the omitted schedules will be furnished to the

SEC upon request. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Incannex Healthcare Inc. |

| |

|

|

| Date: October 24, 2024 |

|

/s/ Joel Latham |

| |

Name: |

Joel Latham |

| |

Title: |

Chief Executive Officer and President |

3

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement

(this “Agreement”) is effective as of October 21, 2024 (the “Effective Date”) by and between Incannex Healthcare,

Inc. a Delaware corporation (the “Company”), and Lou Barbato (“Employee”). The Company and Employee may hereinafter

collectively be referred to the the “Parties,” and individually referred to as a “Party.”

1.

Roles and Duties. Subject to the terms and conditions of this Agreement, the Company shall employ Employee as its Chief Medical

Officer (“CMO”), reporting to the Company’s President and Chief Executive Officer (collectively, the “CEO”).

Employee shall have such duties and responsibilities as are reasonably determined by the CEO and the Company’s Board of Directors

(the “Board”) and are consistent with the duties customarily performed by an executive of a similarly situated company in

the United States with a similar position. Employee accepts such employment upon the terms and conditions set forth herein, and agrees

to perform such duties and discharge such responsibilities to the best of Employee’s ability. During Employee’s employment,

Employee shall devote all of Employee’s business time and energies to the business and affairs of the Company. Notwithstanding the

foregoing, nothing herein shall preclude Employee from (i) performing services for such other companies as the Company may designate or

permit; (ii) serving as a member of the boards of directors or advisory boards (or their equivalents in the case of a non-corporate entity)

of non-competing businesses or charitable, educational or civic organizations; (iii) engaging in charitable activities and community affairs;

and (iv) managing Employee’s personal investments and affairs; provided, however, that the activities set out in clauses (i), (ii),

(iii) and (iv) shall be limited by Employee so as not to materially interfere, individually or in the aggregate, with the performance

of Employee’s duties and responsibilities hereunder.

2.

Term of Employment.

(a) Term. Subject

to the terms hereof, Employee’s employment hereunder shall be at will and shall continue until terminated hereunder by either

party (such term of employment referred to herein as the “Term”).

(b) Termination.

Notwithstanding anything else contained in this Agreement, Employee’s employment hereunder shall terminate upon thirty

days’ advance written notice by the terminating party. Pay in lieu of notice is permitted for the Company.

3.

Compensation.

(a) Base Salary.

The Company shall pay Employee a base salary (the “Base Salary”) at the annual rate of Three Hundred and Seventy-Five

Thousand Dollars ($375,000). The Base Salary shall be payable in substantially equal periodic installments in accordance with the

Company’s payroll practices as in effect from time to time. The Company shall deduct from each such installment all amounts

required to be deducted or withheld under applicable law or under any employee benefit plan in which Employee participates. The

Board or an appropriate committee thereof may, on an annual basis, review the Base Salary, which may be adjusted upward (but not

downward) at the Company’s discretion.

(b) Short-Term

Incentive Bonus. Employee shall be eligible to receive a short-term incentive bonus (the “Incentive Bonus”), with

the target amount of Incentive Bonus equal to twenty percent (20%) of Employee’s Base Salary in the year to which the

Incentive Bonus relates. For avoidance of doubt, Employee shall become eligible for the Incentive Bonus beginning as of the

Effective Date, but such Incentive Bonus shall not be determined until twelve (12) months after the Effectie Date, and which shall

become payable, if at all, in December of 2025, subject to this Agreement. The Incentive Bonus shall be based on performance and

achievement of Company goals and objectives as defined by the CEO and/or Board or Compensation Committee; provided, however, that

the CEO reserves the right to deny payment of the Incentive Bonus if Employee’s performance fails to meet Company

expectations. The amount of the Incentive Bonus shall be determined by the CEO in his sole discretion, and shall be paid to Employee

no later than December of the calendar year in which earning is determined. Employee must be employed by the Company on the date

that the Incentiver Bonus is paid to Employee in order to be eligible for, and to be deemed as having earned, such Incentive Bonus.

The Company shall deduct from the Incentive Bonus all amounts required to be deducted or withheld under applicable law or under any

employee benefit plan in which Employee participates.

(c) Equity. Subject

to the approval of the Company’s Board of Directors, on the Effective Date, Employee will be granted that number of restricted

stock units (“RSUs”) equal to US$200,000 divided by the volume weighted average price per share of the Company’s

common stock as reported on Nasdaq over the five trading days prior to the Effective Date. The RSUs will be issued under the

Company’s 2023 Equity Incentive Plan and shall vest in three equal installments on the first, second and third anniversary of

the Effective Date, contingent upon Employee’s continued employment by the Company.

(d) Paid Time Off.

Employee is permitted unlimited discretionary paid time off for vacation and personal leave, (i) provided that this does not

negatively impact Employee’s duties to Company (contemplated in Section 1 of this Agreement) in a material manner, (ii)

subject to limitations for short and long-term disability, and (iii) to the extent such benefit continues to be extended to other

employees of the Company. Employee shall not accrue any paid time off and no such paid time off shall be paid/owed to Employee at

the time of termination—regardless of the circumstances of Employee’s termination of employment.

(e) Fringe

Benefits. Employee shall be entitled to participate in any benefit/welfare plans and fringe benefits the Company decides to

provide for its senior executives. Employee understands that, except when prohibited by applicable law, the Company’s benefit

plans and fringe benefits may be amended by the Company from time to time in its sole discretion. The terms of any such benefits

shall be governed by the applicable plan documents and Company policies in effect from time to time (and, to the extent this

Agreement conflicts with such terms, the terms of such benefit plans shall govern).

(f) Reimbursement

of Expenses. The Company shall reimburse Employee for all ordinary and reasonable out-of-pocket business expenses incurred by Employee

in furtherance of the Company’s business in accordance with the Company’s policies with respect thereto as in effect from

time to time. Employee must submit any request for reimbursement no later than ninety (90) days following the date that such business

expense is incurred. All reimbursements provided under this Agreement shall be made or provided in accordance with the requirements of

Section 409A including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during Employee’s

lifetime (or during a shorter period of time specified in this Agreement); (ii) the amount of expenses eligible for reimbursement during

a calendar year may not affect the expenses eligible for reimbursement in any other calendar year; (iii) the reimbursement of an eligible

expense shall be made no later than the last day of the calendar year following the year in which the expense is incurred; and (iv) the

right to reimbursement or in-kind benefits is not subject to liquidation or exchange for another benefit.

(g) Indemnification. Employee shall be entitled to indemnification

with respect to Employee’s services provided hereunder pursuant to Delaware law, the terms and conditions of the Company’s

certificate of incorporation and/or by-laws. Employee shall be entitled to coverage under the Company’s Directors’ and Officers’

(“D&O”) insurance policies that it may hold now or in the future to the same extent and in the same manner (i.e., subject

to the same terms and conditions) to which the Company’s other executive officers are entitled to coverage under any of the Company’s

D&O insurance policies.

(h) Forfeiture/Clawback.

All compensation shall be subject to any forfeiture or clawback policy established by the Company generally for senior executives

from time to time and any other such policy required by applicable law.

4.

Proprietary Information. Employee expressly acknowledges that: (a) there are competitive and proprietary aspects of the business

of the Company; (b) during the course of Employee’s employment, the Company shall furnish, disclose or make available to Employee

confidential and proprietary information and may provide Employee with unique and specialized training; (c) such confidential information

and training have been developed and shall be developed by the Company through the expenditure of substantial time, effort and money,

and could be used by Employee to compete with the Company; and (d) in the course of Employee’s employment, Employee shall be introduced

to customers and others with important relationships to the Company, and any and all “goodwill” created through such introductions

belongs exclusively to the Company, including, but not limited to, any goodwill created as a result of direct or indirect contacts or

relationships between Employee and any customers of the Company. In light of the foregoing acknowledgements, and as a condition of continued

employment hereunder, Employee hereby agrees to execute the Proprietary Information and Inventions Assignment Agreement attached as Exhibit

A entered into on the date hereof as a binding obligation of Employee, enforceable in accordance with its terms.

5.

Property and Records. Upon the termination of Employee’s employment hereunder for any reason or for no reason, or if

the Company otherwise requests, Employee shall: (a) return to the Company all tangible business information and copies thereof (regardless

how such confidential information or copies are maintained), and (b) deliver to the Company any property of the Company which may be in

Employee’s possession, including, but not limited to, devices, smart phones, laptops, cell phones (the foregoing, “electronic

devices”), products, materials, memoranda, notes, records, reports or other documents or photocopies of the same. Employee may retain

copies of any exclusively personal data contained in or on the Company-owned electronic devices returned to the Company pursuant to the

foregoing. The foregoing notwithstanding, Employee understands and agrees that the Company property belongs exclusively to the Company,

it should be used for Company business, and Employee has no reasonable expectation of privacy on any Company property or with respect

to any information stored thereon.

6.

Cooperation. During and after Employee’s employment, Employee shall fully cooperate with the Company to the extent reasonable

in the defense or prosecution of any claims or actions now in existence or which may be brought in the future against or on behalf of

the Company (other than claims directly or indirectly against Employee) which relate to events or occurrences that transpired while Employee

was employed by the Company. Employee’s cooperation in connection with such claims or actions shall include, but not be limited

to, being available to meet with counsel to prepare for discovery or trial and to act as a witness on behalf of the Company at mutually

convenient times. During and after Employee’s employment, Employee also shall fully cooperate with the Company to the extent reasonable

in connection with any investigation or review of any federal, state or local regulatory authority as any such investigation or review

relates to events or occurrences that transpired while Employee was employed by the Company. The Company shall reimburse Employee for

any reasonable out-of-pocket expenses incurred in connection with Employee’s performance of obligations pursuant to this section.

7. General.

(a) Notices. Except

as otherwise specifically provided herein, any notice required or permitted by this Agreement shall be in writing and shall be

delivered as follows with notice deemed given as indicated: (i) by personal delivery when delivered personally; (ii) by overnight

courier upon written verification of receipt; (iii) by telecopy or electronic mail transmission provided acknowledgment of receipt

of electronic transmission is provided; or (iv) by certified or registered mail, return receipt requested, upon verification of

receipt.

Notices to Employee shall be sent to the last known address

in the Company’s records or such other address as Employee may specify in writing.

Notices to the Company shall be sent to:

Incannex Healthcare, Inc.

Attn: CEO

Suite 105

8 Century Circuit

NSW 2153

Norwest

Australia

(b)

Modifications and Amendments. The terms and provisions of this Agreement may be modified or amended only by written agreement

executed by the parties hereto.

(c)

Waivers and Consents. The terms and provisions of this Agreement may be waived, or consent for the departure therefrom granted,

only by a written document executed by the party entitled to the benefits of such terms or provisions. No such waiver or consent shall

be deemed to be or shall constitute a waiver or consent with respect to any other terms or provisions of this Agreement, whether or not

similar. Each such waiver or consent shall be effective only in the specific instance and for the purpose for which it was given and shall

not constitute a continuing waiver or consent.

(d)

Assignment. The Company may assign its rights and obligations hereunder to any person or entity that succeeds to all or

substantially all of the Company’s business or that aspect of the Company’s business in which Employee is principally involved.

Employee may not assign Employee’s rights and obligations under this Agreement without the prior written consent of the Company.

(e)

Governing Law/Dispute Resolution. This Agreement and the rights and obligations of the parties hereunder shall be construed

in accordance with and governed by the law of the State of Florida without giving effect to the conflict of law principles thereof. The

parties agree that any disputes relating to this Agreement or Employee’s employment shall be litigated in the state or Federal courts

located in Florida, and the parties agree to waive any trial by jury in such matters.

(f) Entire

Agreement. This Agreement, together with the other agreements specifically referenced herein, embodies the entire agreement and

understanding between the parties hereto with respect to the subject matter hereof and supersedes all prior oral or written

agreements and understandings relating to the subject matter hereof including any prior agreements between Employee and any

predecessor companies or its affiliates. No statement, representation, warranty, covenant or agreement of any kind not expressly set

forth in this Agreement shall affect, or be used to interpret, change or restrict, the express terms and provisions of this

Agreement.

| |

Incannex Healthcare, Inc. |

| |

|

|

|

| |

By: |

/s/ Joel Latham |

| |

|

Name: |

Joel Latham |

| |

|

Title: |

President & CEO |

| |

|

|

|

| |

EMPLOYEE |

|

| |

|

|

|

| |

By: |

/s/ Lou Barbato |

| |

|

Lou Barbato |

5

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

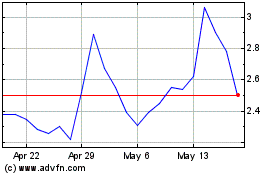

Incannex Healthcare (NASDAQ:IXHL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Incannex Healthcare (NASDAQ:IXHL)

Historical Stock Chart

From Jan 2024 to Jan 2025