UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

KEURIG DR PEPPER INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-33829 | 98-0517725 |

(State or other jurisdiction

of incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification Number) |

53 South Avenue

Burlington, Massachusetts 01803

(781) 418-7000

(Address of registrant’s principal executive office) (Zip Code)

Anthony Shoemaker

Chief Legal Officer and General Counsel

53 South Avenue

Burlington, Massachusetts 01803

(781) 418-7000

(Name and telephone number, including area code, of person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this applies:

| | | | | |

| ý | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

| ☐ | Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended December 31, 2023. |

Section 1 - Conflict Minerals Disclosure

Items 1.01 and 1.02 Conflict Minerals Disclosure and Report, Exhibit

Conflict Minerals Disclosure

A copy of Keurig Dr Pepper Inc.’s ("KDP's") Conflict Minerals Report for the reporting period January 1, 2023 to December 31, 2023 is provided as Exhibit 1.01 hereto and is publicly available at our website at https://keurigdrpepper.com/corporate-reports/ and http://investors.keurigdrpepper.com/sec-filings.*

Section 2 - Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not applicable.

Section 3 - Exhibits

Item 3.01 Exhibits

The following exhibit is filed as part of this report.

| | | | | |

| Exhibit No. | Description |

| Conflict Minerals Report for the reporting period January 1, 2023 to December 31, 2023. |

_____________________________

* The references to KDP’s website are provided for convenience only, and the website's contents are not incorporated by reference into this Form SD nor the Conflicts Minerals Report nor deemed filed with the U.S. Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | | | | | | | |

| KEURIG DR PEPPER INC. | | | |

| | | | |

| By: | /s/ Anthony Shoemaker | | | May 31, 2024 |

| Anthony Shoemaker | | | (Date) |

| Chief Legal Officer, Corporate General Counsel and Secretary | |

Keurig Dr Pepper Inc.

Conflict Minerals Report

For the reporting period from January 1, 2023 to December 31, 2023

Introduction

Keurig Dr Pepper Inc. (the “Company,” “KDP,” “we,” “us” or “our”) is committed to sourcing products, components and materials from companies that share our values regarding respect for human rights, ethics and environmental responsibility. We are committed to the ethical sourcing of minerals including tin, tantalum, tungsten and gold. There is concern that these “Conflict Minerals” could originate from certain mines in the Democratic Republic of the Congo (“DRC”) or an adjoining country which are controlled by armed militias who use the proceeds from the sale of these minerals to fund ongoing conflict in the region.

KDP has prepared this Conflict Minerals Report (this “Report”) pursuant to Rule 13p-1 (the “Rule”) under the Securities Exchange Act of 1934, as amended, for the reporting period from January 1, 2023 to December 31, 2023 (the “Reporting Period”).

This Report describes KDP’s due diligence process and compliance with the Rule’s requirements. The Rule requires disclosure of certain information when a reporting company manufactures, or contracts to manufacture, products which contain the minerals specified in the Rule, if those minerals are necessary to the functionality or production of such products. The specified minerals, which the Company collectively refers to in this Report as “3TG,” are gold, as well as tin, tantalum, and tungsten, the derivatives of cassiterite, columbite-tantalite, and wolframite. The “Covered Countries” for the purposes of the Rule and this Report are the Democratic Republic of the Congo, the Congo Republic, the Central African Republic, Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia and Angola.

Reporting Scope

As described in this Report, certain 3TG are necessary to the functionality or production of products that the Company contracted to manufacture, or manufactured, during the Reporting Period. These products are the Company’s Keurig brewers, milk frothers, and brewer accessories (such in-scope products, collectively, the “Covered Products”). There are no additional products that KDP contracted to manufacture, or manufactured, during the Reporting Period which are considered in-scope products according to the Rule.

Our Approach

KDP uses components and materials containing 3TG in its Covered Products but does not purchase 3TG directly from mines, smelters, or refiners. Therefore, we collaborate with suppliers, industry peers, and other stakeholders as described in this Report to conduct appropriate due diligence on our upstream supply chains.

KDP is a member of the Responsible Minerals Initiative (“RMI”), a multi-industry initiative addressing Conflict Minerals issues in the supply chain (unique member code KEUR). The RMI’s Conflict Minerals Reporting Template (“CMRT”) is a widely-used standard form to collect information from the supply chain, including the names of 3TG smelters or refiners (“SORs”).

RMI also manages the Responsible Minerals Assurance Process (“RMAP”), which uses independent third-party audits to assess whether 3TG SORs have systems in place to source 3TG in conformance with the Organisation for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas Third Edition (“OECD Guidance”) 1. We use the CMRT to survey our suppliers and identify SORs in our supply chain, and the RMAP to determine the country of origin and conformance status of minerals.

In accordance with the Rule, KDP has in good faith conducted a reasonable country of origin inquiry (“RCOI”) regarding 3TG. This country of origin inquiry was designed to determine whether any of the 3TG used in the Covered Products originated in the Covered Countries and whether any of such 3TG may be from recycled or scrap sources. The Company also performed due diligence on the source and chain of custody of such 3TG based on the OECD Guidance and as described in more detail below.

Reasonable Country of Origin Inquiry

In 2023, KDP identified its direct suppliers believed or known to have provided materials, components or products which may contain Conflict Minerals, (such direct suppliers collectively, the “Suppliers”). KDP requested that each Supplier submit information to KDP using the CMRT.

The information submitted by KDP’s Suppliers in their CMRTs included information gathered by those Suppliers about the smelters and refiners identified in their own supply chains which KDP utilized to conduct further due diligence. As described in more detail below, KDP’s Responsible Sourcing team reviewed and analyzed each CMRT received.

KDP compared the list of SORs reported by Suppliers against the RMI’s Smelter Database2 to determine which of the reported entities are known to be true SORs of 3TG (“Eligible SORs”). The list of Eligible SORs that our Suppliers reported as being in their supply chains is set forth in Annex I. The list of countries from which KDP believes the 3TG in its Covered Products may have originated is set forth in Annex II. This information was obtained through KDP’s membership in the RMI, using the RCOI report dated April 29, 2024. Note that the RMI RCOI report only includes information for SORs that are “Conformant” according to RMAP. Through our RCOI, we found that:

–Some 3TG is sourced through SORs that are not yet RMAP-Conformant and therefore we have not yet determined the country of origin of those minerals;

–Some 3TG is sourced from RMAP-Conformant SORs, including SORs that source responsibly from the Covered Countries; and

–Some 3TG also may have originated from recycled or scrap sources.

Ultimately, KDP relies on the RMI RCOI data as the most accurate information for our RCOI.

1 OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas Third Edition, 2016; https://www.oecd.org/daf/inv/mne/OECD-Due-Diligence-Guidance-Minerals-Edition3.pdf

2 The RMI Smelter Database was exported and referenced as of our cutoff date of April 29, 2024, available to members at: http://www.responsiblemineralsinitiative.org/members/smelter-database/

The information obtained from our Suppliers indicated that a portion of 3TG used in the Covered Products may have originated in the Covered Countries and were not exclusively from recycled or scrap sources, triggering the due diligence steps described in the following sections.

Due Diligence

Design of Due Diligence

KDP designed its due diligence measures in accordance with the OECD Guidance.

The OECD Guidance utilizes a five-step process for due diligence:

Step 1: Establish Strong Company Management Systems

Step 2: Identify and Assess Risks in the Supply Chain

Step 3: Design and Implement a Strategy to Respond to Identified Risks

Step 4: Carry Out Independent Third-Party Audit of Smelters’ and Refiners’ Due Diligence Practices

Step 5: Report Annually on Supply Chain Due Diligence

Below is a description of KDP’s due diligence measures performed for the Reporting Period.

Due Diligence Measures Performed

Step 1: Establish Strong Company Management Systems:

The Company has adopted a policy relating to 3TG incorporating the standards set forth in the OECD Guidance (the “Conflict Minerals Policy”). The Conflict Minerals Policy is available on KDP’s website at https://keurigdrpepper.com/wp-content/uploads/2024/03/KDP-Conflict-Minerals-Policy-FINAL.pdf.

KDP’s Conflict Minerals Policy states that KDP is committed to: (1) supporting the aims and objectives of the U.S. legislation on the disclosure of 3TG; (2) not knowingly procuring 3TG that originates from facilities in the Covered Countries that are not considered conflict free; and (3) ensuring compliance with the KDP Conflict Minerals Policy.

Members from the Company’s Supply Chain, Legal, and Sustainability Teams were involved in the due diligence process, which was led by the Company’s Responsible Sourcing Team. Members of our Executive Leadership Team were briefed on the Company’s due diligence procedures and results, and reviewed and approved this Report.

Requirements related to Conflict Minerals and related due diligence activities are generally included in our most significant supplier contracts relating to Covered Products.

KDP has established a system of controls and transparency to determine the SORs in its 3TG supply chain by creating a process to engage Suppliers. KDP uses a third-party software platform to collect, store, analyze and aggregate Supplier data for reporting purposes. It is also used to send automated reminders to Suppliers throughout the due diligence process.

KDP provided Suppliers with links to the RMI e-learning academy and other resources. Throughout the due diligence process, KDP also engaged in ongoing communication and provided support to its Suppliers to facilitate the completion of their CMRTs.

In addition to the above, Suppliers and employees are encouraged to report any ethical concerns or violations by any KDP employee or agent acting on behalf of the supplier or KDP. Concerns or violations may be reported in the following ways:

•Online: KDRP.ethicspoint.com

•Mail: Attn: General Counsel | Keurig Dr Pepper | 6425 Hall of Fame Lane | Frisco, TX 75034

•Phone: U.S. & Canada: 800-349-4248 Outside of the U.S. & Canada: Dial your country’s AT&T direct access code available from http://www.business.att.com/collateral/access.html. Then, once prompted, dial 800-349-4248.

KDP retains Conflict Minerals documentation materials for five years after receipt.

Step 2: Identify and Assess Risks in the Supply Chain:

As described above, as part of its due diligence process KDP identified in scope Suppliers and requested that the Suppliers submit a completed CMRT.

Via our software platform, KDP then reviewed Suppliers’ completed CMRTs against a set of internally developed criteria for completeness and consistency.

For Suppliers that indicated in their responses that they or a supplier in their supply chain did use 3TG in their part(s) and/or product(s) during the Reporting Period and provided the applicable smelter or refiner information, the Company reconciled the reported SORs against the RMI Smelter Database, which contains RMAP SOR Conformance status. (Available to RMI members at http://www.responsiblemineralsinitiative.org/members/smelter-database/)

Step 3: Design and Implement a Strategy to Respond to Identified Risks:

Where SORs were reported that are not RMAP-Conformant or Active (engaged in the RMAP program but not yet audited), KDP sent a notice via the platform asking applicable Suppliers to either work with their supply-chain to request the smelter to participate in the RMAP audit program, and/or work to transition away from the smelter, depending on level of identified risk. There were also instances where inaccurate or outdated SOR information was reported to us, for example: smelters no longer in operation, or entities that could not be identified as known SORs. In these cases, we sent a notification to Suppliers asking them to work with their supply chain to obtain accurate smelter information. Our smelter action requests specified that we expect to see continuous improvement year over year in the reported smelter information.

In addition to the above, we also review our Suppliers’ CMRTs for due diligence activities, such as whether they have their own Conflict Minerals Policy. See the Due Diligence Results section below where we report on the number of Suppliers who provided a policy that indicates a commitment to reasonably ensuring that only conflict-free materials and components are used in products/parts that are sold to KDP.

Lastly, recognizing that the complexity of this issue requires a collaborative and cross-industry approach, we actively participate in the RMI’s China Smelter Engagement Team (the “China SET”). China SET’s purpose is to conduct coordinated outreach to SORs to encourage them to participate in RMAP or other equivalent third-party validation schemes. As a member of China SET, we work as the Single Point of Contact for five smelters to facilitate their engagement with RMI, including to communicate RMAP requirements to them, and to encourage them to maintain their status on the Conformant Smelter List.

Step 4: Carry Out Independent Third-Party Audit of Smelters’ and Refiners’ Due Diligence Practices:

As a member of the RMI, KDP leverages information from the independent third-party audits of the SORs facilitated by initiatives such as the RMI’s RMAP and the London Bullion Market Association (LBMA), or Responsible Jewelry Council (RJC).

Step 5: Report Annually on Supply Chain Due Diligence:

As discussed above, KDP is reporting on supply chain due diligence by publishing a Conflict Minerals Report for the Reporting Period on KDP’s corporate website.

Due Diligence Results

2023 Reporting Season Smelter Overview

The total number of unique entities reported as SORs by the KDP supply base was 329. The following analysis will focus on the 251 SORs that have been confirmed by RMI as either conformant or non-conformant to RMAP standards. The remaining 78 SORs (24%) were in various forms of communication with RMI about becoming conformant at the time of report publication.

•223 (68%) SORs were conformant to RMAP standards.

•28 (9%) SORs were not conformant to RMAP standards.

Figure 1: Three Year Comparison: Smelter Conformance/Non-Conformance

A list of all 251 conformant and non-conformant SORs identified during the due diligence process is included in Annex I to this Report.

Figure 2: Three Year Comparison: Conformance % by Metal Type

In 2023, we saw a decrease in compliant Tungsten and Gold smelters. One tungsten supplier and 6 gold suppliers previously classified as compliant by RMI were re-classified as non-compliant within the reporting year because they failed to progress with RMAP's compliance assessment in a timely manner.

Through RMI, we have reached out to all 7 smelters and stressed the importance of re-establishing their conformant status.

We also requested Suppliers provide a policy indicating their commitment to reasonably ensuring that only conflict free materials and components are used in products/parts sold to KDP. 100% of Suppliers provided a policy that meets this criterion.

Future Due Diligence Improvements

KDP plans to continue to improve its due diligence measures by taking the following steps, among others:

–Continuing to engage with Suppliers to obtain current, accurate and complete information about our supply chain;

–Continuing to partner with Suppliers to improve their own due diligence processes including their own conflict minerals policy; and

–Continuing to encourage Suppliers to request non-conformant smelters and/or smelters in different stages of engagement with RMI to participate in the RMAP audit program, and/or work to transition away from such SORs.

Because we rely on Suppliers to provide accurate and up to date SOR disclosures, it is critical for the success of KDP’s Conflict Minerals program that Suppliers also have “Established and Strong Management Systems” in accordance with the OECD Due Diligence Guidance for Responsible Mineral Supply Chains from Conflict-Affected and High-Risk Areas. To further evolve our program, in 2022 we asked one of our key contract manufacturers of Covered Products to pilot the RMI’s Downstream Assessment Program (DAP)3. Facilities participating in the DAP are asked to demonstrate that their mineral sourcing strategies are aligned with the OECD Due Diligence Guidance for Responsible Mineral Supply Chains from Conflict-Affected and High-Risk Areas, and to provide validated information about their due diligence activities. A sample of the results of this assessment were as follows:

•According to RMI’s assessment, there is no reason to believe goods directly or indirectly financed or benefited armed groups that are perpetrators of serious human rights abuses in the DRC or an adjoining country.

•However, the assessment also highlighted areas in which the Supplier’s program was not aligned with the OECD guidance. Areas of opportunity include:

◦Strengthening of Supplier’s Conflict Minerals policy, program management and due diligence, including, but not limited to, additional oversight of due diligence process by Supplier leadership.

◦Incorporation of Conflict Minerals policy into upstream supplier contracts and better upstream communication about Supplier’s mineral supply chain due diligence expectations.

3 https://www.responsiblemineralsinitiative.org/responsible-minerals-assurance-process/downstream-program/

The findings listed above have been addressed by the supplier. We expect our plan to conduct similar assessments of our two remaining Tier 1 suppliers4 to be executed in 2024.

Determination

Based on the information obtained pursuant to the due diligence process described above, KDP believes that the SORs that may have been used to process the 3TG in KDP products include the SORs listed in Annex I below. The list of countries from which KDP believes the 3TG in their products may have originated, as well as any materials from recycled and scrap sources, is set forth in Annex II. The SOR information collected from our Suppliers continued to include a number of SORs that had not been audited and determined to be RMAP Conformant by the RMI, or any other recognized organization.

KDP has provided information as of the date of this Report. Subsequent events, such as the inability or unwillingness of any suppliers, smelters or refiners to comply with KDP’s Conflict Minerals Policy, may affect KDP’s future determinations.

4 Tier 1 suppliers defined as KDP's final assembly manufacturers.

ANNEX I

List of Smelters and Refiners

The table below represents a consolidated list of conformant and non-conformant SORs (251 in total) identified by KDP’s Suppliers. The results are based on:

•Information provided by KDP’s Suppliers in their CMRTs; and

•The Conformance status indicated in the RMI Smelter Database as of April 29, 2024

“SOR Country” refers to the location of the SOR, not the source of minerals. Refer to Annex II for the list of countries from which 3TG may have originated.

SORs that have been validated by the RMAP program as Conformant (223 SORs):

| | | | | | | | | | | |

| Metal | Smelter Name | Country | Smelter ID |

| Gold | Abington Reldan Metals, LLC | United States Of America | CID002708 |

| Gold | Agosi AG | Germany | CID000035 |

| Gold | Aida Chemical Industries Co., Ltd. | Japan | CID000019 |

| Gold | Almalyk Mining and Metallurgical Complex (AMMC) | Uzbekistan | CID000041 |

| Gold | AngloGold Ashanti Corrego do Sitio Mineracao | Brazil | CID000058 |

| Gold | Argor-Heraeus S.A. | Switzerland | CID000077 |

| Gold | Asahi Pretec Corp. | Japan | CID000082 |

| Gold | Asahi Refining Canada Ltd. | Canada | CID000924 |

| Gold | Asahi Refining USA Inc. | United States Of America | CID000920 |

| Gold | Asaka Riken Co., Ltd. | Japan | CID000090 |

| Gold | Aurubis AG | Germany | CID000113 |

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | Philippines | CID000128 |

| Gold | Boliden Ronnskar | Sweden | CID000157 |

| Gold | C. Hafner GmbH + Co. KG | Germany | CID000176 |

| Gold | CCR Refinery - Glencore Canada Corporation | Canada | CID000185 |

| Gold | Chimet S.p.A. | Italy | CID000233 |

| Gold | Chugai Mining | Japan | CID000264 |

| Gold | Daye Non-Ferrous Metals Mining Ltd. | China | CID000343 |

| Gold | Dowa | Japan | CID000401 |

| Gold | DSC (Do Sung Corporation) | Korea, Republic Of | CID000359 |

| Gold | Eco-System Recycling Co., Ltd. East Plant | Japan | CID000425 |

| Gold | Eco-System Recycling Co., Ltd. North Plant | Japan | CID003424 |

| Gold | Eco-System Recycling Co., Ltd. West Plant | Japan | CID003425 |

| | | | | | | | | | | |

| Gold | Gold by Gold Colombia | Colombia | CID003641 |

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd. | China | CID002243 |

| Gold | Great Wall Precious Metals Co., Ltd. of CBPM | China | CID001909 |

| Gold | Heimerle + Meule GmbH | Germany | CID000694 |

| Gold | Heraeus Germany GmbH Co. KG | Germany | CID000711 |

| Gold | Heraeus Metals Hong Kong Ltd. | China | CID000707 |

| Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | China | CID000801 |

| Gold | Ishifuku Metal Industry Co., Ltd. | Japan | CID000807 |

| Gold | Istanbul Gold Refinery | Turkey | CID000814 |

| Gold | Italpreziosi | Italy | CID002765 |

| Gold | Japan Mint | Japan | CID000823 |

| Gold | Jiangxi Copper Co., Ltd. | China | CID000855 |

| Gold | JX Nippon Mining & Metals Co., Ltd. | Japan | CID000937 |

| Gold | Kazzinc | Kazakhstan | CID000957 |

| Gold | Kennecott Utah Copper LLC | United States Of America | CID000969 |

| Gold | KGHM Polska Miedz Spolka Akcyjna | Poland | CID002511 |

| Gold | Kojima Chemicals Co., Ltd. | Japan | CID000981 |

| Gold | Korea Zinc Co., Ltd. | Korea, Republic Of | CID002605 |

| Gold | L'Orfebre S.A. | Andorra | CID002762 |

| Gold | LS MnM Inc. | Korea, Republic Of | CID001078 |

| Gold | LT Metal Ltd. | Korea, Republic Of | CID000689 |

| Gold | Materion | United States Of America | CID001113 |

| Gold | Matsuda Sangyo Co., Ltd. | Japan | CID001119 |

| Gold | Metal Concentrators SA (Pty) Ltd. | South Africa | CID003575 |

| Gold | Metalor Technologies (Hong Kong) Ltd. | China | CID001149 |

| Gold | Metalor Technologies (Singapore) Pte., Ltd. | Singapore | CID001152 |

| Gold | Metalor Technologies (Suzhou) Ltd. | China | CID001147 |

| Gold | Metalor Technologies S.A. | Switzerland | CID001153 |

| Gold | Metalor USA Refining Corporation | United States Of America | CID001157 |

| Gold | Metalurgica Met-Mex Penoles S.A. De C.V. | Mexico | CID001161 |

| Gold | Mitsubishi Materials Corporation | Japan | CID001188 |

| Gold | Mitsui Mining and Smelting Co., Ltd. | Japan | CID001193 |

| Gold | MKS PAMP SA | Switzerland | CID001352 |

| Gold | MMTC-PAMP India Pvt., Ltd. | India | CID002509 |

| Gold | Nadir Metal Rafineri San. Ve Tic. A.S. | Turkey | CID001220 |

| Gold | Navoi Mining and Metallurgical Combinat | Uzbekistan | CID001236 |

| Gold | NH Recytech Company | Korea, Republic Of | CID003189 |

| Gold | Nihon Material Co., Ltd. | Japan | CID001259 |

| Gold | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | Austria | CID002779 |

| Gold | Ohura Precious Metal Industry Co., Ltd. | Japan | CID001325 |

| | | | | | | | | | | |

| Gold | Planta Recuperadora de Metales SpA | Chile | CID002919 |

| Gold | PT Aneka Tambang (Persero) Tbk | Indonesia | CID001397 |

| Gold | PX Precinox S.A. | Switzerland | CID001498 |

| Gold | Rand Refinery (Pty) Ltd. | South Africa | CID001512 |

| Gold | REMONDIS PMR B.V. | Netherlands | CID002582 |

| Gold | Royal Canadian Mint | Canada | CID001534 |

| Gold | SAFINA A.S. | Czechia | CID002290 |

| Gold | SEMPSA Joyeria Plateria S.A. | Spain | CID001585 |

| Gold | Shandong Gold Smelting Co., Ltd. | China | CID001916 |

| Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | China | CID001622 |

| Gold | Sichuan Tianze Precious Metals Co., Ltd. | China | CID001736 |

| Gold | Solar Applied Materials Technology Corp. | Taiwan, Province Of China | CID001761 |

| Gold | Sumitomo Metal Mining Co., Ltd. | Japan | CID001798 |

| Gold | SungEel HiMetal Co., Ltd. | Korea, Republic Of | CID002918 |

| Gold | T.C.A S.p.A | Italy | CID002580 |

| Gold | Tanaka Kikinzoku Kogyo K.K. | Japan | CID001875 |

| Gold | Tokuriki Honten Co., Ltd. | Japan | CID001938 |

| Gold | TOO Tau-Ken-Altyn | Kazakhstan | CID002615 |

| Gold | Torecom | Korea, Republic Of | CID001955 |

| Gold | Umicore S.A. Business Unit Precious Metals Refining | Belgium | CID001980 |

| Gold | United Precious Metal Refining, Inc. | United States Of America | CID001993 |

| Gold | Valcambi S.A. | Switzerland | CID002003 |

| Gold | WEEEREFINING | France | CID003615 |

| Gold | Western Australian Mint (T/a The Perth Mint) | Australia | CID002030 |

| Gold | WIELAND Edelmetalle GmbH | Germany | CID002778 |

| Gold | Yamakin Co., Ltd. | Japan | CID002100 |

| Gold | Yokohama Metal Co., Ltd. | Japan | CID002129 |

| Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | China | CID002224 |

| Total | | | 91 |

| | | | | | | | | | | |

| Metal | Smelter Name | Country | Smelter ID |

| Tantalum | AMG Brasil | Brazil | CID001076 |

| Tantalum | D Block Metals, LLC | United States Of America | CID002504 |

| Tantalum | F&X Electro-Materials Ltd. | China | CID000460 |

| Tantalum | FIR Metals & Resource Ltd. | China | CID002505 |

| Tantalum | Global Advanced Metals Aizu | Japan | CID002558 |

| Tantalum | Global Advanced Metals Boyertown | United States of America | CID002557 |

| | | | | | | | | | | |

| Tantalum | Guangdong Rising Rare Metals-EO Materials Ltd. | China | CID000291 |

| Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd. | China | CID002492 |

| Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | China | CID002512 |

| Tantalum | Jiangxi Tuohong New Raw Material | China | CID002842 |

| Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd. | China | CID000914 |

| Tantalum | Jiujiang Tanbre Co., Ltd. | China | CID000917 |

| Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | China | CID002506 |

| Tantalum | KEMET de Mexico | Mexico | CID002539 |

| Tantalum | Materion Newton Inc. | United States of America | CID002548 |

| Tantalum | Metallurgical Products India Pvt., Ltd. | India | CID001163 |

| Tantalum | Minercao Taboca S.A. | Brazil | CID001175 |

| Tantalum | Mitsui Mining and Smelting Co., Ltd. | Japan | CID001192 |

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | China | CID001277 |

| Tantalum | NPM Silmet AS | Estonia | CID001200 |

| Tantalum | PowerX Ltd. | Rwanda | CID004054 |

| Tantalum | QuantumClean | United States of America | CID001508 |

| Tantalum | Resind Industria e Comercio Ltda. | Brazil | CID002707 |

| Tantalum | RFH Yancheng Jinye New Material Technology Co., Ltd. | China | CID003583 |

| Tantalum | Taki Chemical Co., Ltd. | Japan | CID001869 |

| Tantalum | TANIOBIS Co., Ltd. | Thailand | CID002544 |

| Tantalum | TANIOBIS GmbH | Germany | CID002545 |

| Tantalum | TANIOBIS Japan Co., Ltd. | Japan | CID002549 |

| Tantalum | TANIOBIS Smelting GmbH & Co. KG | Germany | CID002550 |

| Tantalum | Telex Metals | United States Of America | CID001891 |

| Tantalum | Ulba Metallurgical Plant JSC | Kazakhstan | CID001969 |

| Tantalum | XIMEI RESOURCES (GUANGDONG) LIMITED | China | CID000616 |

| Tantalum | XinXing HaoRong Electronic Material Co., Ltd. | China | CID002508 |

| Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd. | China | CID001522 |

| Total | | | 34 |

| | | | | | | | | | | |

| Metal | Smelter Name | Country | Smelter ID |

| Tin | Alpha | United States Of America | CID000292 |

| Tin | Aurubis Beerse | Belgium | CID002773 |

| Tin | Aurubis Berango | Spain | CID002774 |

| Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | China | CID000228 |

| Tin | Chifeng Dajingzi Tin Industry Co., Ltd. | China | CID003190 |

| Tin | China Tin Group Co., Ltd. | China | CID001070 |

| Tin | CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda | Brazil | CID003486 |

| Tin | CRM Synergies | Spain | CID003524 |

| Tin | CV Ayi Jaya | Indonesia | CID002570 |

| Tin | CV Venus Inti Perkasa | Indonesia | CID002455 |

| Tin | Dowa | Japan | CID000402 |

| Tin | DS Myanmar | Myanmar | CID003831 |

| Tin | EM Vinto | Bolivia (Plurinational State Of) | CID000438 |

| Tin | Estanho de Rondonia S.A. | Brazil | CID000448 |

| Tin | Fabrica Auricchio Industria e Comercio Ltda. | Brazil | CID003582 |

| Tin | Fenix Metals | Poland | CID000468 |

| Tin | Gejiu Non-Ferrous Metal Processing Co., Ltd. | China | CID000538 |

| Tin | Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | China | CID003116 |

| Tin | HuiChang Hill Tin Industry Co., Ltd. | China | CID002844 |

| Tin | Jiangxi New Nanshan Technology Ltd. | China | CID001231 |

| Tin | Luna Smelter, Ltd. | Rwanda | CID003387 |

| Tin | Magnu's Minerais Metais e Ligas Ltda. | Brazil | CID002468 |

| Tin | Malaysia Smelting Corporation (MSC) | Malaysia | CID001105 |

| Tin | Metallic Resources, Inc. | United States Of America | CID001142 |

| Tin | Mineracao Taboca S.A. | Brazil | CID001173 |

| Tin | Mining Minerals Resources SARL | Congo, Democratic Republic of the | CID004065 |

| Tin | Minsur | Peru | CID001182 |

| Tin | Mitsubishi Materials Corporation | Japan | CID001191 |

| Tin | O.M. Manufacturing (Thailand) Co., Ltd. | Thailand | CID001314 |

| Tin | O.M. Manufacturing Philippines, Inc. | Philippines | CID002517 |

| Tin | Operaciones Metalurgicas S.A. | Bolivia (Plurinational State Of) | CID001337 |

| Tin | PT Aries Kencana Sejahtera | Indonesia | CID000309 |

| Tin | PT Artha Cipta Langgeng | Indonesia | CID001399 |

| Tin | PT ATD Makmur Mandiri Jaya | Indonesia | CID002503 |

| Tin | PT Babel Inti Perkasa | Indonesia | CID001402 |

| Tin | PT Babel Surya Alam Lestari | Indonesia | CID001406 |

| Tin | PT Bangka Prima Tin | Indonesia | CID002776 |

| | | | | | | | | | | |

| Tin | PT Bangka Serumpun | Indonesia | CID003205 |

| Tin | PT Belitung Industri Sejahtera | Indonesia | CID001421 |

| Tin | PT Bukit Timah | Indonesia | CID001428 |

| Tin | PT Cipta Persada Mulia | Indonesia | CID002696 |

| Tin | PT Menara Cipta Mulia | Indonesia | CID002835 |

| Tin | PT Mitra Stania Prima | Indonesia | CID001453 |

| Tin | PT Mitra Sukses Globalindo | Indonesia | CID003449 |

| Tin | PT Premium Tin Indonesia | Indonesia | CID000313 |

| Tin | PT Prima Timah Utama | Indonesia | CID001458 |

| Tin | PT Putera Sarana Shakti (PT PSS) | Indonesia | CID003868 |

| Tin | PT Rajawali Rimba Perkasa | Indonesia | CID003381 |

| Tin | PT Rajehan Ariq | Indonesia | CID002593 |

| Tin | PT Refined Bangka Tin | Indonesia | CID001460 |

| Tin | PT Sariwiguna Binasentosa | Indonesia | CID001463 |

| Tin | PT Stanindo Inti Perkasa | Indonesia | CID001468 |

| Tin | PT Sukses Inti Makmur (SIM) | Indonesia | CID002816 |

| Tin | PT Timah Tbk Kundur | Indonesia | CID001477 |

| Tin | PT Timah Tbk Mentok | Indonesia | CID001482 |

| Tin | PT Tinindo Inter Nusa | Indonesia | CID001490 |

| Tin | PT Tommy Utama | Indonesia | CID001493 |

| Tin | Resind Industria e Comercio Ltda. | Brazil | CID002706 |

| Tin | Rui Da Hung | Taiwan, Province Of China | CID001539 |

| Tin | Super Ligas | Brazil | CID002756 |

| Tin | Thaisarco | Thailand | CID001898 |

| Tin | Tin Smelting Branch of Yunnan Tin Co., Ltd. | China | CID002180 |

| Tin | Tin Technology & Refining | United States Of America | CID003325 |

| Tin | White Solder Metalurgia e Mineracao Ltda. | Brazil | CID002036 |

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | China | CID002158 |

| Tin | Yunnan Yunfan Non-ferrous Metals Co., Ltd | China | CID003397 |

| Total | | | 66 |

| | | | | | | | | | | |

| Metal | Smelter Name | Country | Smelter ID |

| Tungsten | A.L.M.T. Corp. | Japan | CID000004 |

| Tungsten | Asia Tungsten Products Vietnam Ltd. | Viet Nam | CID002502 |

| Tungsten | China Molybdenum Tungsten Co., Ltd. | China | CID002641 |

| Tungsten | Chongyi Zhangyuan Tungsten Co., Ltd. | China | CID000258 |

| Tungsten | Cronimet Brasil Ltda | Brazil | CID003468 |

| Tungsten | Fujian Xinlu Tungsten Co., Ltd. | China | CID003609 |

| Tungsten | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | China | CID002315 |

| Tungsten | Ganzhou Seadragon W & Mo Co., Ltd. | China | CID002494 |

| | | | | | | | | | | |

| Tungsten | Global Tungsten & Powders LLC | United States Of America | CID000568 |

| Tungsten | Guangdong Xianglu Tungsten Co., Ltd. | China | CID000218 |

| Tungsten | H.C. Starck Tungsten GmbH | Germany | CID002541 |

| Tungsten | Hubei Green Tungsten Co., Ltd. | China | CID003417 |

| Tungsten | Hunan Chenzhou Mining Co., Ltd. | China | CID000766 |

| Tungsten | Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch | China | CID002513 |

| Tungsten | Japan New Metals Co., Ltd. | Japan | CID000825 |

| Tungsten | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | China | CID002551 |

| Tungsten | Jiangxi Gan Bei Tungsten Co., Ltd. | China | CID002321 |

| Tungsten | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | China | CID002318 |

| Tungsten | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | China | CID002317 |

| Tungsten | Jiangxi Yaosheng Tungsten Co., Ltd. | China | CID002316 |

| Tungsten | Kennametal Fallon | United States Of America | CID000966 |

| Tungsten | Kennametal Huntsville | United States Of America | CID000105 |

| Tungsten | Lianyou Metals Co., Ltd. | Taiwan, Province Of China | CID003407 |

| Tungsten | Malipo Haiyu Tungsten Co., Ltd. | China | CID002319 |

| Tungsten | Masan High-Tech Materials | Viet Nam | CID002543 |

| Tungsten | Niagara Refining LLC | United States Of America | CID002589 |

| Tungsten | Philippine Chuangxin Industrial Co., Inc. | Philippines | CID002827 |

| Tungsten | TANIOBIS Smelting GmbH & Co. KG | Germany | CID002542 |

| Tungsten | Tungsten Vietnam Joint Stock Company | Vietnam | CID003993 |

| Tungsten | Wolfram Bergbau und Hutten AG | Austria | CID002044 |

| Tungsten | Xiamen Tungsten (H.C.) Co., Ltd. | China | CID002320 |

| Tungsten | Xiamen Tungsten Co., Ltd. | China | CID002082 |

| Total | | | 32 |

SORs that have been validated by the RMAP program as Non-Conformant (28 SORs):

| | | | | | | | | | | |

| Metal | Smelter Name | Country | Smelter ID |

| Gold | 8853 S.p.A. | Italy | CID002763 |

| Gold | Al Etihad Gold Refinery DMCC | United Arab Emirates | CID002560 |

| Gold | Alexy Metals | United States of America | CID003500 |

| Gold | AU Traders and Refiners | South Africa | CID002850 |

| Gold | Augmont Enterprises Private Limited | India | CID003461 |

| Gold | Cendres + Metaux S.A. | Switzerland | CID000189 |

| Gold | Emirates Gold DMCC | United Arab Emirates | CID002561 |

| | | | | | | | | | | |

| Gold | GGC Gujrat Gold Centre Pvt. Ltd. | India | CID002852 |

| Gold | Kyrgyzaltyn JSC | Kyrgyzstan | CID001029 |

| Gold | Marsam Metals | Brazil | CID002606 |

| Gold | Modeltech Sdn Bhd | Malaysia | CID002857 |

| Gold | SAAMP | France | CID002761 |

| Gold | Safimet S.p.A | Italy | CID002973 |

| Gold | Samduck Precious Metals | Korea, Republic Of | CID001555 |

| Gold | Singway Technology Co., Ltd. | Taiwan, Province Of China | CID002516 |

| Gold | Umicore Precious Metals Thailand | Thailand | CID002314 |

| Total | | | 16 |

| | | | | | | | | | | |

| Metal | Smelter Name | Country | Smelter ID |

| Tin | Dongguan CiEXPO Environmental Engineering Co., Ltd. | China | CID003356 |

| Tin | Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy JSC | Viet Nam | CID002572 |

| Tin | Gejiu Kai Meng Industry and Trade LLC | China | CID000942 |

| Tin | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | China | CID001908 |

| Tin | Gejiu Zili Mining And Metallurgy Co., Ltd. | China | CID000555 |

| Tin | Ma'anshan Weitai Tin Co., Ltd. | China | CID003379 |

| Tin | Melt Metais e Ligas S.A. | Brazil | CID002500 |

| Tin | Modeltech Sdn Bhd | Malaysia | CID002858 |

| Total | | | 8 |

| | | | | | | | | | | |

| Metal | Smelter Name | Country | Smelter ID |

| Tungsten | ACL Metais Eireli | Brazil | CID002833 |

| Tungsten | Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. | Brazil | CID003427 |

| Tungsten | Hunan Jintai New Material Co., Ltd. | China | CID000769 |

| Tungsten | Unecha Refractory metals plant | Russian Federation | CID002724 |

| Total | | | 4 |

Annex II:

Countries from which the minerals in the Covered Products may have originated

Based on RMI’s Reasonable County of Origin Inquiry report, dated April 29, 2024, the countries of origin of 3TG processed by SORs listed in Annex I are believed to include the countries identified below. Note that the RMI RCOI report only includes information for SORs that are “Conformant” according to RMAP.

| | | | | | | | | | | | | | | | | | | | |

| Gold |

| | | | | | |

| Andorra | | Czechia | | Korea, Republic Of | | Sweden |

| Australia | | France | | Mexico | | Switzerland |

| Austria | | Germany | | Netherlands | | Taiwan, Province of China |

| Belgium | | India | | Philippines | | Thailand |

| Brazil | | Indonesia | | Poland | | Turkey |

| Canada | | Italy | | Singapore | | United Arab Emirates |

| Chile | | Japan | | South Africa | | United States of America |

| China | | Kazakhstan | | Spain | | Uzbekistan |

| | | | | | |

| Tantalum |

| | | | | | |

| Brazil | | Germany | | Kazakhstan | | United States of America |

| China | | India | | Mexico | | |

| Estonia | | Japan | | Russian Federation | | |

| | | | | | |

| Tin |

| | | | | | |

| Belgium | | Indonesia | | Philippines | | Taiwan, Province of China |

| Bolivia | | Japan | | Poland | | Thailand |

| Brazil | | Malaysia | | Russian Federation | | United States of America |

| China | | Peru | | Spain | | Vietnam |

| | | | | | |

| Tungsten |

| | | | | | |

| Austria | | China | | Korea, Republic Of | | United States of America |

| Brazil | | Germany | | Philippines | | Vietnam |

| China | | Japan | | Russian Federation | | |

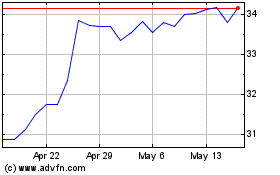

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From May 2024 to Jun 2024

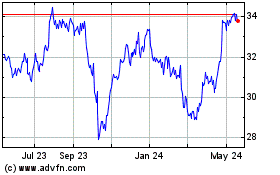

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From Jun 2023 to Jun 2024