false000150380200015038022025-01-022025-01-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 2, 2025

Karyopharm Therapeutics Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-36167 |

|

26-3931704 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

85 Wells Avenue, 2nd Floor Newton, Massachusetts |

|

02459 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 658-0600

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.0001 par value |

|

KPTI |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 12, 2024, the Board of Directors (“Board”) of Karyopharm Therapeutics Inc. (the “Company”) approved, and the Company publicly announced on January 2, 2025, the election of Lori Macomber, age 54, to the position of Executive Vice President, Chief Financial Officer and Treasurer of the Company, effective January 3, 2025. Ms. Macomber served in various positions at Legend Biotech Corporation, a public biotechnology company, including as Chief Financial Officer from May 2022 to January 2025, as Vice President, Finance from March 2021 to May 2022 and as Vice President of Supply Chain Finance and Controller from September 2019 to March 2021. Prior to Legend Biotech Corporation, Ms. Macomber served as Business Unit Controller at Ametek PDS, a leading supplier of components and systems for the aerospace and defense industries, from 2018 to 2019 and as U.S. Chief Financial Officer and Controller of Cello Health from 2017 until 2018. Prior to 2018, Ms. Macomber held various financial positions of increasing responsibilities within the pharmaceutical industry at Eli Lily and Company and Pfizer Inc. (formerly Pharmacia Corporation). Ms. Macomber holds a Bachelor of Science in Accounting from Pennsylvania State University and is a Certified Public Accountant.

Additionally, Ms. Macomber has been designated as the Company’s principal financial officer, effective on January 3, 2025, and Kristin Abate, Vice President, Chief Accounting Officer and Assistant Treasurer, who previously assumed the responsibilities as the Company’s principal financial officer on an interim basis, will relinquish her role as interim principal financial officer effective January 3, 2025.

In connection with her employment with the Company, pursuant to the terms of an offer letter dated December 19, 2024 (the “Offer Letter”), Ms. Macomber will receive an annual base salary of $475,000. Ms. Macomber is also eligible for an annual bonus (commencing with 2025) that targets forty-five percent (45%) of her annualized base salary based upon the achievement of certain performance goals and corporate milestones established by the Company. The achievement of the goals and milestones will be determined in the sole discretion of the Board or the Compensation Committee of the Board (the “Compensation Committee”).

In addition, pursuant to the Offer Letter, the Compensation Committee granted to Ms. Macomber, effective as of the Grant Date (as defined below) and as a material inducement to Ms. Macomber entering into employment with the Company, inducement awards consisting of (i) a non-statutory stock option to purchase 650,000 shares of the Company’s Common Stock, $.0001 par value per share (the “Common Stock”) (the “Option Award”) and (ii) 160,000 restricted stock units (the “RSU Award”). These awards were granted pursuant to the Company’s 2022 Inducement Stock Incentive Plan, as amended (the “2022 Inducement Plan”). The Option Award’s exercise price per share will be equal to the closing price per share of the Common Stock on the Nasdaq Global Select Market on January 31, 2025, which is the final day of the month in which Ms. Macomber will commence employment with the Company (the “Grant Date”). The Option Award will vest as to 25% of the shares underlying the Option Award on the first anniversary of the date Ms. Macomber commences employment and as to an additional 1/48th of the total number of shares underlying the Option Award monthly thereafter, subject to Ms. Macomber’s continuous service through each vesting date. The RSU Award will vest as to 33 1/3% of the total number of RSUs granted to Ms. Macomber on each of the three (3) consecutive anniversaries of the Grant Date, subject to Ms. Macomber’s continuous service through each vesting date. Under the terms of the applicable stock option and restricted stock unit agreements (the “Equity Agreements”), if within one year following a Change in Control Event (as defined in each of the respective Equity Agreements) Ms. Macomber’s employment is terminated by her for Good Reason or by the Company or its successor without Cause (each as defined in the 2022 Inducement Plan), the Option Award and RSU Award will be immediately vested and/or exercisable, as applicable, in full.

The Offer Letter also provides that, if Ms. Macomber’s employment is terminated without Cause or she resigns for Good Reason (other than within one year following the consummation of a Change in Control (as defined in the Offer Letter)), she will be entitled to severance pay equal to one month of her then-current base salary for every one month of employment with the Company, not to exceed a total of twelve months of base salary. If Ms. Macomber’s employment is terminated without Cause or she resigns for Good Reason within one year following the consummation of a Change in Control, she will, in lieu of the severance benefits described above, be entitled to receive the following severance benefits: (i) a lump sum payment equivalent to twelve months of Ms. Macomber's base salary as of the date of her termination from employment and (ii) an amount equal to 100% of her target annual bonus for the year in which the termination occurs. In addition, if in connection with the termination of Ms. Macomber’s employment, she elects to continue her and her eligible dependents’ participation in the Company’s medical and dental benefit plans pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1986, the Company will pay the premiums to continue such coverage for the lesser of (i) twelve months or (ii) the end of the calendar month in which she becomes eligible to receive group health plan coverage under

another employee benefit plan. In addition, under the terms of the Offer Letter, Ms. Macomber will also be eligible to participate in healthcare related, retirement and other benefits available to other employees of the Company.

The foregoing descriptions are qualified in their entirety by the full text of the Offer Letter, which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

There are no family relationships between Ms. Macomber and any director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company. There are no transactions in which Ms. Macomber has an interest requiring disclosure under Item 404(a) of Regulation S-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KARYOPHARM THERAPEUTICS INC. |

|

|

|

|

Date: January 2, 2025 |

|

|

|

By: |

|

/s/ Michael Mano |

|

|

|

|

|

|

Michael Mano |

|

|

|

|

|

|

Senior Vice President, General Counsel and Secretary |

85 Wells Ave., Suite 210 | Newton, MA 02459

December 18, 2024

Lori Macomber

Dear Lori,

I am pleased to offer you the position of Executive Vice President, Chief Financial Officer and Treasurer with Karyopharm Therapeutics Inc. (the "Company"), reporting directly to Richard Paulson. This is an important position in the Company, and I know it will be a challenging and exciting one. We anticipate your start date to be on or around 1/3/2025. Please review the details of your offer of employment below.

a) Base Salary. Your semi-monthly base salary will be $19,791.67 ($475,000.00, if annualized), subject to all applicable taxes and withholdings, to be paid in accordance with the Company's regular payroll practices. Such base salary may be adjusted upwards from time to time in accordance with normal business practices and in the sole discretion of the Company. This position is classified as Exempt according to the Fair Labor Standards Act (FLSA).

b) Bonus Program. Following the end of each calendar year, beginning with the calendar year-ended 2025, and subject to the approval of the Company's Board of Directors, you may be eligible for a cash based annual performance bonus of up to 45% of your annualized base salary, based on your performance and the Company’s performance during the applicable calendar year, as determined by the Company in its sole discretion. In any event, you must be an active full-time employee as of September 30 of the applicable calendar year as well as the date the bonus is paid (on or before March 15 of the following calendar year) in order to be eligible to earn any bonus award, as it also serves as an incentive to remain employed by the Company.

c) New Hire Equity Grants. Subject to the approval of the Compensation Committee of the Board of Directors of the Company (the “Compensation Committee”) or the Board of Directors, the Company will grant you a nonstatutory stock option to purchase 650,000 shares of the Company's common stock, (the “Common Stock”), at an exercise price per share equal to the closing price per share of the Common Stock on the Nasdaq Global Select Market on the date of grant, which shall be, subject to the discretion of the Compensation Committee, on or about the last day of the month in which your employment with the Company commences (the “Grant Date”). The stock option will vest over four years at the rate of 25% on the one-year anniversary of the date your employment commences, with the remaining shares to vest monthly over the following three years, subject to your continued engagement with the Company on each vesting date.

Subject to the approval of the Compensation Committee or the Board of Directors, the Company will grant you 160,000 restricted stock units (“RSUs”) on the Grant Date. The RSUs will vest over three years at the rate of 33 1/3% on each of the three (3) consecutive anniversaries of the grant date, subject to your continued engagement with the Company on each vesting date.

The stock options and RSUs will be granted pursuant to the Company’s 2022 Inducement Stock Incentive Plan, as amended (the “2022 Inducement Plan”), as an inducement that is material to your entering into employment with the Company. The stock options and RSUs shall be subject to such other terms and conditions set forth in the 2022 Inducement Plan and in the applicable stock option or RSU agreement.

You may be eligible to receive such future equity grants as the Board of Directors of the Company shall deem appropriate.

d) Flexible Time Off. You will be eligible for paid time off in accordance with Company policy. Currently, the Company has a Flexible Time Off Policy, which, subject to the terms and conditions of the policy, provides employees with flexibility in taking time off for vacation, sickness, and personal time as needed. In addition, you will also receive paid holidays according to the Company’s holiday schedule.

e) Benefits. Commencing on your first day of employment (subject to eligibility criteria and waiting periods associated with each individual plan), you may participate in all company benefits as outlined in the Benefits at a Glance Overview which accompanies this offer letter, subject to the terms and conditions of any applicable plan documents for such benefits. The benefit programs made available by the Company, and the rules, terms and conditions for participation in such benefit plans, may be changed by the Company at any time without advance notice, provided, however, that you will be eligible to participate in all benefit plans to the same extent as offered to similarly-situated executives of the Company.

f) Severance Benefits. If your employment is terminated without Cause (as defined below), or you resign for Good Reason, the Company will, provided that you timely execute a severance and release of claims agreement in a form to be provided by the Company (which will include, at a minimum, a release of all releasable claims, non-disparagement, confidentiality, and cooperation obligations, and a reaffirmation of your continuing obligations under the Non-Disclosure, Inventions Assignment, Non-Competition, and Non-Solicitation Agreement) (the “release agreement”) provide you with the following severance package: (a) pay you, as severance pay, the equivalent of one (1) month of your base salary as of the date of your termination from employment for every one (1) month of employment with the Company, not to exceed a total of twelve (12) months of base salary (the “Severance Period”); and (b) provided you elect to continue your and your eligible dependents' participation in the Company's medical and dental benefit plans pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1986 ("COBRA"), the Company will pay the full monthly premium to continue such coverage for the lesser of (i) the Severance Period and (ii) the end of the calendar month in which you become eligible to receive group health plan coverage under another employee benefit plan, which is substantially similar to the group health plan coverage provided by the Company.

Notwithstanding the foregoing, if the Company (which, for the purposes of this paragraph, includes any successor entity) terminates your employment without Cause, or you resign for Good Reason, each within one year following the consummation of a Change in Control, then the Company (or its successor entity) will (a) pay you, as severance pay, the equivalent of twelve (12) months of your base salary as of the date of your termination from employment (or such greater amount specified in any Company severance plan under which you are eligible), provided that you timely execute the release agreement. In each case, the release agreement must be executed and any revocation period with respect to such release agreement must expire no later than 60 days following your termination of employment. Any severance pay will be paid in as a lump sum, with payments beginning in the first pay period beginning after the release agreement becomes binding, provided that if the foregoing sixty (60) day period would end in a calendar year subsequent to the year in which Employee’s employment ends, payments will not begin before the first payroll period of the subsequent year; (b) pay to you an amount equal to 100% of your target annual bonus for the year in which your termination occurs, which amount shall be payable in a lump sum on the

date that the first continued salary payment is made to you under your currently effective agreement with the Company; and (c) provided you elect to continue your and your eligible dependents' participation in the Company's medical and dental benefit plans pursuant to COBRA, the Company will pay the monthly premium to continue such coverage for the lesser of (i) the Severance Period and (ii) the end of the calendar month in which you become eligible to receive group health plan coverage under another employee benefit plan.

"Cause” shall mean (i) your conviction by a court of competent jurisdiction of, or pleading “guilty” or “no contest” to, (a) a felony, (b) fraud, embezzlement, or theft of business assets or (c) any other criminal charge that the Company determines in its sole discretion has, or could be reasonably expected to have, a material adverse impact on the Company or the performance of your duties, and/or (ii) a determination by the Company in its reasonable discretion of (w) an act or acts of fraud, material dishonesty, or other material willful misconduct by you (including violations of law or government regulation and/or violation of the Company’s policies against harassment, discrimination, and retaliation) in the course of your employment by the Company, (x) willful, repeated and material failure to perform, or gross negligence in the performance of, the duties which are reasonably and lawfully assigned to you by the Company, (y) material breach of any agreement to which you and the Company are party and/or (z) failure to fully participate in a Company investigation as may be reasonably requested by the Company provided, however, that the conditions described immediately above in clauses (x) through (z) shall not give rise to a termination for Cause, unless the Company has notified you in writing within thirty (30) days of the first occurrence of the facts and circumstances claimed to provide a basis for the termination for Cause, you have failed to correct the condition within thirty (30) days after your receipt of such written notice, and the Company actually terminates your employment within sixty (60) days of the first occurrence of the condition.

“Good Reason” shall mean (i) the assignment to you of any duties inconsistent in any adverse, material respect with your position, authority, duties or responsibilities as then constituted, or any other action by the Company which results in a material diminution in such position, authority, duties or responsibilities, (ii) a material reduction in your base compensation except to the extent that any such benefit is replaced with a comparable benefit, or a reduction in scope or value thereof , or (iii) a requirement that you, without your prior consent, regularly report to work at a location that is thirty (30) miles or more away from your then current place of work; provided, however , that the conditions described immediately above in clauses (i) through (iii) shall not give rise to a termination for Good Reason, unless you have notified the Company in writing within thirty (30) days of the first occurrence of the facts and circumstances claimed to provide a basis for the termination for Good Reason, the Company has failed to correct the condition within thirty (30) days after the Company’s receipt of such written notice, and you actually terminate employment with the Company within sixty (60) days of the first occurrence of the condition. For the avoidance of doubt, your required travel on the Company’s business shall not be deemed a relocation of your principal office under clause (iii), above.

“Change in Control” shall mean the sale of all or substantially all of the outstanding shares of capital stock, assets or business of the Company, by merger, consolidation, sale of assets or otherwise (other than a transaction in which all or substantially all of the individuals and entities who were beneficial owners of the capital stock of the Company immediately prior to such transaction beneficially own, directly or indirectly, more than 50% of the outstanding securities (on an as-converted to Common Stock basis) entitled to vote generally in the election of directors of the (i) resulting, surviving or acquiring corporation in such transaction in the case of a merger, consolidation or sale of outstanding shares, or (ii) acquiring corporation in the case of a sale of assets; provided that, where required for compliance with Section 409A, the event described above is also a change in control event as set forth in Treas. Reg. Section 1.409A-3(i)(5).

Section 409A. It is intended that this letter agreement comply with or be exempt from Section 409A of the Internal Revenue Code of 1986, and the Treasury Regulations and IRS guidance thereunder (collectively referred to as “Section 409A”), and notwithstanding anything to the contrary herein, it shall be administered, interpreted, and construed in a manner consistent with Section 409A. To the extent that any reimbursement, fringe benefit, or other, similar plan or arrangement in which you participate provides for a “deferral of compensation” within the meaning of Section 409A, (a) the amount of expenses eligible for reimbursement provided to you during any calendar year shall not affect the amount of expenses eligible for reimbursement or in-kind benefits provided to you in any other calendar year, (b) the reimbursements for expenses for which you are entitled to be reimbursed shall be made on or before the last day of the calendar year following the calendar year in which the applicable expense is incurred, (c) the right to payment or reimbursement or in-kind benefits hereunder may not be liquidated or exchanged for any other benefit, and (d) the reimbursements shall be made pursuant to objectively determinable and nondiscretionary Company policies and procedures regarding such reimbursement of expenses.

Withholding. The Company shall withhold from any compensation or benefits payable under this letter agreement any federal, state, and local income, employment or other similar taxes as may be required to be withheld pursuant to any applicable law or regulation.

If you accept the terms of this offer, your employment with the Company constitutes at-will employment, and you are free to resign at any time, and for any or no reason. Similarly, the Company is free to terminate its employment relationship with you at any time, with or without cause. Although your job duties, title, compensation, and benefits, as well as the Company's personnel policies and procedures, may change from time to time, the “at-will” nature of your employment may only be changed by a written agreement signed by you and the Company’s Chief Executive Officer or General Counsel, which expressly states the intention to modify the at-will nature of your employment. Similarly, nothing in this letter shall be construed as an agreement, either express or implied, to pay you any compensation or grant you any benefit beyond the end of your employment with the Company, except as expressly set forth herein. We request that, in the event of resignation, you provide a notice period of at least two weeks.

Your offer is contingent upon the successful completion of an employment and criminal background check (which will require you to complete and sign all necessary consent forms authorizing the Company or its designee to perform these background inquiries). The Company may also require that you provide names and contact information so we may conduct reference checks about your past employment.

For purposes of federal immigration law, you will be required to provide to the Company documentary evidence of your identity and eligibility for employment in the United States. Such documentation must be provided to us within three (3) business days of your date of hire, or our employment relationship with you will be terminated.

As a condition of your employment, you are also required to sign and comply with a Non-Disclosure, Inventions Assignment, Non-Competition, and Non-Solicitation Agreement (the "Restrictive Covenant Agreement") effective your first day of employment. A copy of that agreement accompanies this offer letter. Please address any concerns you may have with this agreement prior to your first day of employment at the Company. You acknowledge that your receipt of the grant of equity set forth in this offer letter is contingent upon your agreement to the non-competition provisions set forth in the Restrictive Covenant Agreement, and that such consideration has been mutually agreed upon by you and the Company and is fair and reasonable in exchange for your compliance with such non-competition obligations.

In return for the compensation payments set forth in this letter, you agree to devote your full business time, best efforts, skill, knowledge, attention, and energies to the advancement of the Company's business and interests and to the performance of your duties and responsibilities as an employee of the Company and not to engage in any other business activities without prior approval from the Company.

As an employee of the Company, you will be required to comply with all Company policies and procedures. Violations of the Company's policies may lead to immediate termination of your employment. Further, the Company's premises, including all workspaces, furniture, documents, and other tangible materials, and all information technology resources of the Company (including computers, data and other electronic files, and all internet and email) are subject to oversight and inspection by the Company at any time. Company employees should have no expectation of privacy with regard to any Company premises, materials, resources, or information.

To accept the Company's offer, please sign and date this letter in the space provided. By signing this letter, you are representing that you have full authority to accept this position and perform the duties of the position without conflict with any other legal or contractual obligations, and that you are not involved in any situation that might create, or appear to create, a conflict of interest with respect to your loyalty to or duties for the Company. You additionally represent and warrant that you have not taken or shared with the Company any confidential or proprietary information belonging to any former employer or other third party, and that you will at no time during the course of your employment with the Company use or disclose any such confidential or proprietary information of another party without that party’s express consent.

This letter, together with the other documents and agreements referenced herein, sets forth all of the terms of your employment with the Company, and supersedes any prior representations or agreements including, but not limited to, any representations made during your recruitment, interviews or pre-employment negotiations, whether written or oral. This letter may not be modified or amended except by a written agreement signed by the Company and you. The resolution of any disputes under this letter will be governed by the laws of the Commonwealth of Massachusetts. This offer of employment will terminate if it is not accepted, signed, and returned by close of business on Thursday, 12/19/2024.

We look forward to your favorable reply and to working with you at Karyopharm!

Sincerely,

|

/s/ Lisa DiPaolo |

Lisa DiPaolo |

Chief Human Resources Officer |

The foregoing correctly sets forth the terms of my employment by Karyopharm Therapeutics Inc. I am not relying on any representations pertaining to my employment other than those set forth above.:

|

|

Signature: |

/s/ Lori Macomber |

Printed Name: |

Lori Macomber |

|

|

Date: December 19, 2024 |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

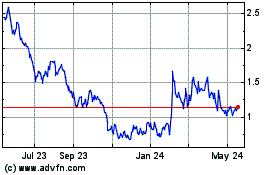

Karyopharm Therapeutics (NASDAQ:KPTI)

Historical Stock Chart

From Feb 2025 to Mar 2025

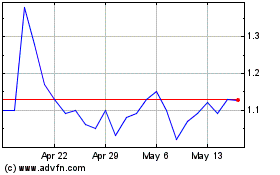

Karyopharm Therapeutics (NASDAQ:KPTI)

Historical Stock Chart

From Mar 2024 to Mar 2025