false000149838200014983822024-05-132024-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 14, 2024

KINTARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada |

|

001-37823 |

|

99-0360497 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

9920 Pacific Heights Blvd, Suite 150 San Diego, CA |

|

|

|

92121 |

(Address of principal executive office) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 350-4364

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock |

|

KTRA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Kintara Therapeutics, Inc. (“Kintara”) issued a press release on May 14, 2024, disclosing financial information and operating metrics for the third fiscal quarter ended March 31, 2024, and providing a corporate update. A copy of Kintara’s press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

See “Item 2.02 Results of Operation and Financial Condition” above.

The information in this Current Report on Form 8-K under Items 2.02 and 7.01, including the information contained in Exhibit 99.1, is being furnished to the Securities and Exchange Commission, and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by a specific reference in such filing.

Additional Information about the Proposed Merger and Where to Find It

This Current Report on Form 8-K does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This Current Report on Form 8-K relates to the proposed merger (the “Merger”) of Kintara Therapeutics, Inc. (“Kintara”) and TuHURA Biosciences, Inc. (“TuHURA”). In connection with the proposed Merger, Kintara has filed a Registration Statement on Form S-4, which includes a preliminary proxy statement and a preliminary prospectus of Kintara (the “proxy statement/prospectus”). This registration statement has not yet been declared effective and Kintara has filed or may file other documents regarding the proposed Merger with the SEC. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING THE PROPOSED MERGER. A definitive proxy statement/prospectus will be sent to Kintara’s stockholders once available. Investors and security holders will be able to obtain these documents (when available) free of charge from the SEC’s website at www.sec.gov. In addition, investors and stockholders should note that Kintara communicates with investors and the public using its website (www.kintara.com), the investor relations website (https://www.kintara.com/investors) where anyone will be able to obtain free copies of the proxy statement/prospectus and other documents filed by Kintara with the SEC, and stockholders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed Merger.

Participants in the Solicitation

Kintara, TuHURA and their respective directors and executive officers and other members of management and employees and certain of their respective significant stockholders may be deemed to be participants in the solicitation of proxies from Kintara and TuHURA stockholders in respect of the proposed Merger. Information about Kintara’s directors and executive officers is available in Kintara’s proxy statement, which was filed with the SEC on September 11, 2023 for the 2023 Annual Meeting of Stockholders, Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, which was filed with the SEC on September 18, 2023. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holding or otherwise, have been and will be contained in the preliminary proxy statement/prospectus and other relevant materials filed with the SEC regarding the proposed Merger when they

become available. Investors should read the definitive proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the SEC and Kintara as indicated above.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Forward-Looking Statements

This Current Report on Form 8-K and the press release attached hereto as Exhibit 99.1 contain forward-looking statements based upon Kintara’s and TuHURA’s current expectations. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “should,” “would,” “project,” “plan,” “expect,” “goal,” “seek,” “future,” “likely” or the negative or plural of these words or similar expressions. These statements are only predictions. Kintara and TuHURA have based these forward-looking statements largely on their then-current expectations and projections about future events, as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond each of Kintara’s and TuHURA’s control, and actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: (i) the risk that the conditions to the closing or consummation of the proposed Merger are not satisfied, including the failure to obtain stockholder approval for the proposed Merger; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Kintara and TuHURA to consummate the transactions contemplated by the proposed Merger; (iii) risks related to Kintara’s and TuHURA’s ability to correctly estimate their respective operating expenses and expenses associated with the proposed Merger, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the proposed Merger by either Kintara or TuHURA; (v) the effect of the announcement or pendency of the proposed Merger on Kintara’s or TuHURA’s business relationships, operating results and business generally; (vi) costs related to the proposed Merger; (vii) the outcome of any legal proceedings that may be instituted against Kintara, TuHURA, or any of their respective directors or officers related to the Merger Agreement or the transactions contemplated thereby; (vii) the ability of Kintara or TuHURA to protect their respective intellectual property rights; (viii) competitive responses to the proposed Merger; (ix) unexpected costs, charges or expenses resulting from the proposed Merger; (x) whether the combined business of TuHURA and Kintara will be successful; (xi) legislative, regulatory, political and economic developments; and (xii) additional risks described in the “Risk Factors” section of Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, and the registration statement on Form S-4 related to the proposed Merger filed with the SEC. Additional assumptions, risks and uncertainties are described in detail in Kintara’s registration statements, reports and other filings with the SEC, which are available on Kintara’s website, and at www.sec.gov. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Neither Kintara nor TuHURA can assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. Except as required by applicable law or regulation, Kintara and TuHURA undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KINTARA THERAPEUTICS, INC. |

|

|

|

Date: May 14, 2024 |

|

By: |

|

/s/ Robert E. Hoffman |

|

|

|

|

Name: Robert E. Hoffman |

|

|

|

|

Title: Chief Executive Officer |

Exhibit 99.1

Kintara Therapeutics Announces Fiscal 2024 Third Quarter Financial Results

SAN DIEGO, May 14, 2024/PRNewswire/ -- Kintara Therapeutics, Inc. (Nasdaq: KTRA) (“Kintara” or the “Company”), a biopharmaceutical company focused on the development of new solid tumor cancer therapies, today announced financial results for its fiscal third quarter ended March 31, 2024, and recent corporate developments.

Recent Corporate Developments

•Announced that Kintara had entered into a definitive merger agreement (the “Merger Agreement”) with TuHURA Biosciences, Inc. ("TuHURA"), a Phase 3 registration-stage immune-oncology company developing novel technologies to overcome resistance to cancer immunotherapy, and Kayak Mergeco, Inc., Kintara’s wholly-owned subsidiary, whereby Kayak Mergeco will merge with and into TuHURA with TuHURA surviving the merger and becoming Kintara’s direct, wholly-owned subsidiary(the “Merger”). Pursuant to the terms of the Merger, stockholders of TuHURA will receive shares of Kintara common stock. Kintara’s existing stockholders will receive contingent value rights (“CVR”), entitling them to receive shares of common stock upon achievement of enrollment of a minimum of 10 patients in the REM-001 study, with such patients each completing 8 weeks of follow-up on or before December 31, 2025. Under the terms of the Merger Agreement, on a pro forma basis, Kintara’s stockholders post-Merger are expected to collectively own approximately 2.85%, or approximately 5.45% including the shares underlying the CVR if the milestone is achieved, of the common stock of the post-Merger combined company on a fully-diluted basis. The transaction is expected to close in the third quarter of 2024. (April 2024)

•Announced the expansion of the inclusion criteria in the open label 15-patient REM-001 study in cutaneous metastatic breast cancer (CMBC) to include patients receiving pembrolizumab (KEYTRUDA®) for at least three months at screening. (March 2024)

•Announced the initiation of an open label 15-patient study in CMBC patients which is evaluating REM-001, a second-generation photodynamic therapy (PDT) photosensitizer agent, and is designed to test the 0.8 mg dose as well as optimize the study design in advance of a Phase 3 trial initiation. The primary endpoint in the study is Best Overall Objective Response Rate (bORR) (complete response or partial response) of the target treatment fields at any time from treatment up to, and including, week 24. The majority of the costs to run this study will be covered by the $2.0 million Small Business Innovation Research (SBIR) grant Kintara was awarded from the National Institutes of Health (NIH). (February 2024)

•Announced that Kintara received a letter from The Nasdaq Stock Market LLC stating it had regained compliance with Nasdaq’s minimum stockholders’ equity requirement. (February 2024)

Summary of Financial Results for Fiscal Year 2023 Third Quarter Ended March 31, 2024

As of March 31, 2024, Kintara had cash and cash equivalents of approximately $6.35 million.

For the three months ended March 31, 2024, Kintara reported a net loss of approximately $2.0 million, or $0.05 per share, compared to a net loss of approximately $3.3 million, or $1.94 per share, for the three months ended March 31, 2023. The decreased net loss for the three months ended March 31, 2024, compared to the three months ended March 31, 2023, was largely attributed to lower research and development expenses which was primarily due to lower clinical development costs. General and administrative costs were higher during the same period primarily due to an increase in professional fees related to the proposed transaction with TuHURA.

Selected Balance Sheet Data (in thousands)

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

June 30, 2023 |

|

|

|

$ |

|

|

$ |

|

Cash and cash equivalents |

|

|

6,351 |

|

|

|

1,535 |

|

Working capital |

|

|

5,414 |

|

|

|

188 |

|

Total assets |

|

|

7,446 |

|

|

|

3,979 |

|

Total stockholders’ equity |

|

|

5,922 |

|

|

|

731 |

|

Selected Statement of Operations Data (in thousands, except per share data)

For the three months ended

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

$ |

|

|

$ |

|

Research and development |

|

|

592 |

|

|

|

2,005 |

|

General and administrative |

|

|

1,493 |

|

|

|

1,297 |

|

Other loss (income) |

|

|

(74) |

|

|

|

(38) |

|

Net loss for the period |

|

|

(2,011) |

|

|

|

(3,264) |

|

Series A Preferred cash dividend |

|

|

(2) |

|

|

|

(2) |

|

Net loss for the period attributable to common stockholders |

|

|

(2,013) |

|

|

|

(3,266) |

|

Basic and fully diluted weighted average number of shares |

|

|

44,562 |

|

|

|

1,681 |

|

Basic and fully diluted loss per share |

|

|

(0.05) |

|

|

|

(1.94) |

|

For the nine months ended

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

$ |

|

|

$ |

|

Research and development |

|

|

2,562 |

|

|

|

7,235 |

|

General and administrative |

|

|

3,054 |

|

|

|

4,212 |

|

Other loss (income) |

|

|

(70) |

|

|

|

(133) |

|

Net loss for the period |

|

|

(5,996) |

|

|

|

(11,314) |

|

Series A Preferred cash dividend |

|

|

(6) |

|

|

|

(6) |

|

Series C Preferred stock dividend |

|

|

(173) |

|

|

|

(362) |

|

Net loss for the period attributable to common stockholders |

|

|

(6,175) |

|

|

|

(11,682) |

|

Basic and fully diluted weighted average number of shares |

|

|

16,772 |

|

|

|

1,596 |

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted loss per share |

|

|

(0.37) |

|

|

|

(7.32) |

|

Kintara’s financial statements as filed with the U.S. Securities Exchange Commission can be viewed on the Company’s website at: http://ir.kintara.com/sec-filings.

About Kintara

Located in San Diego, California, Kintara is dedicated to the development of novel cancer therapies for patients with unmet medical needs. Kintara is developing therapeutics for clear unmet medical needs with reduced risk development programs. The Company's lead program is REM-001 Therapy for cutaneous metastatic breast cancer (CMBC).

Kintara has a proprietary, late-stage photodynamic therapy platform that holds promise as a localized cutaneous, or visceral, tumor treatment as well as in other potential indications. REM-001 Therapy, which consists of the laser light source, the light delivery device, and the REM-001 drug product, has been previously studied in four Phase 2/3 clinical trials in patients with CMBC who had previously received chemotherapy and/or failed radiation therapy. In CMBC, REM-001 has a clinical efficacy to date of 80% complete responses of CMBC evaluable lesions and an existing robust safety database of approximately 1,100 patients across multiple indications.

For more information, please visit www.kintara.com or follow us on X at @Kintara_Thera, Facebook and LinkedIn.

About TuHURA Biosciences, Inc.

TuHURA Biosciences is a Phase 3 registration-stage immuno-oncology company developing novel technologies to overcome resistance to cancer immunotherapy. TuHURA's lead personalized cancer vaccine candidate, IFx-2.0, is designed to overcome primary resistance to checkpoint inhibitors. TuHURA is preparing to initiate a single randomized placebo-controlled Phase 3 registration trial of IFx-2.0 administered as an adjunctive therapy to Keytruda® (pembrolizumab) in first line treatment for advanced Merkel Cell Carcinoma.

In addition to its cancer vaccine product candidates, TuHURA is leveraging its Delta receptor technology to develop first-in-class bi-functional antibody drug conjugates (ADCs), targeting Myeloid Derived Suppressor Cells (MDSCs) to inhibit their immune suppressing effects on the tumor microenvironment to prevent T cell exhaustion and acquired resistance to checkpoint inhibitors and cellular therapies.

For more information, please visit tuhurabio.com and connect with TuHURA on Facebook, X, and LinkedIn.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any proxy, consent, authorization, vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of the U.S. Securities Act of 1933, as amended.

Additional Information About the Proposed Transaction for Investors and Shareholders

In connection with the proposed transaction between Kintara and TuHURA (the “Proposed Transaction”), Kintara has filed relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 that contains a preliminary proxy statement and preliminary prospectus of Kintara (the “proxy statement/prospectus”). This registration statement has not yet been declared effective and Kintara has filed or may file other documents regarding the Proposed Transaction with the SEC. This press release is not a substitute for the registration statement or for any other document that Kintara has filed or may file with the SEC in connection with the Proposed Transaction. KINTARA URGES INVESTORS AND STOCKHOLDERS TO READ THE REGISTRATION STATEMENT, THE PRELIMINARY PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN AND THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT KINTARA, TUHURA, THE PROPOSED TRANSACTION AND RELATED MATTERS. A definitive proxy statement/prospectus will be sent to Kintara’s stockholders once available. Investors and stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed by Kintara with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders should note that Kintara communicates with investors and the public using its website (www.kintara.com), the investor relations website (https://www.kintara.com/investors) where anyone will be able to obtain free copies of the preliminary proxy statement/prospectus and other documents filed by Kintara with the SEC, and stockholders are urged to read the definitive proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the Proposed Transaction.

Participants in the Solicitation

Kintara, TuHURA and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the Proposed Transaction. Information about Kintara’s directors and executive officers including a description of their interests in Kintara is included in Kintara’s most recent Annual Report on Form 10-K, including any information incorporated therein by reference, as filed with the SEC. Additional information regarding these persons and their interests in the transaction has been and will be included in the preliminary proxy statement/prospectus and other relevant materials filed with the SEC when they become available relating to the Proposed Transaction. These documents can be obtained free of charge from the sources indicated above.

Safe Harbor Statement

This news release contains forward-looking statements that are not historical facts within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and other future conditions. In some cases you can identify these statements by forward-looking words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “should,” “would,” “project,” “plan,” “expect,” “goal,” “seek,” “future,” “likely” or the negative or plural of these words or similar

expressions. Examples of such forward-looking statements include but are not limited to express or implied statements regarding Kintara’s or TuHURA’s management team’s expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding: the Proposed Transaction and the expected effects, perceived benefits or opportunities and related timing with respect thereto, expectations regarding clinical trials and research and development programs, in particular with respect to TuHURA’s IFx-Hu2.0 product candidate and its TME modulators development program, and any developments or results in connection therewith; the anticipated timing of the results from those studies and trials; expectations regarding the use of capital resources, including the net proceeds from the financing that closed in connection with the signing of the definitive agreement, and the time period over which the combined company’s capital resources will be sufficient to fund its anticipated operations; and the expected trading of the combined company’s stock on the Nasdaq Capital Market. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. You are cautioned that such statements are not guarantees of future performance and that actual results or developments may differ materially from those set forth in these forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include: the risk that the conditions to the closing or consummation of the Proposed Transaction are not satisfied, including the failure to obtain stockholder approval for the Proposed Transaction; uncertainties as to the timing of the consummation of the Proposed Transaction and the ability of each of Kintara and TuHURA to consummate the transactions contemplated by the Proposed Transaction; risks related to Kintara’s and TuHURA’s ability to correctly estimate their respective operating expenses and expenses associated with the Proposed Transaction, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Proposed Transaction by either company; the effect of the announcement or pendency of the Proposed Transaction on Kintara’s or TuHURA’s business relationships, operating results and business generally; costs related to the Merger; the outcome of any legal proceedings that may be instituted against Kintara, TuHURA, or any of their respective directors or officers related to the Merger Agreement or the transactions contemplated thereby; the ability of Kintara or TuHURA to protect their respective intellectual property rights; competitive responses to the Proposed Transaction; unexpected costs, charges or expenses resulting from the Proposed Transaction; whether the combined business of TuHURA and Kintara will be successful; legislative, regulatory, political and economic developments; and additional risks described in the “Risk Factors” section of Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, and the registration statement on Form S-4 related to the Proposed Transaction filed with the SEC. Additional assumptions, risks and uncertainties are described in detail in our registration statements, reports and other filings with the SEC, which are available on Kintara’s website, and at www.sec.gov.

You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. The

forward-looking statements and other information contained in this news release are made as of the date hereof and Kintara does not undertake any obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Nothing herein shall constitute an offer to sell or the solicitation of an offer to buy any securities.

CONTACTS

Investors

Robert E. Hoffman

Kintara Therapeutics

rhoffman@kintara.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

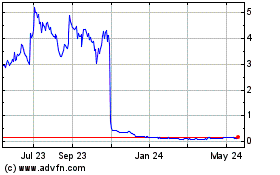

Kintara Therapeutics (NASDAQ:KTRA)

Historical Stock Chart

From Oct 2024 to Oct 2024

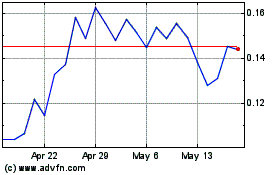

Kintara Therapeutics (NASDAQ:KTRA)

Historical Stock Chart

From Oct 2023 to Oct 2024