Kaixin Holdings Announces Receipt of Nasdaq Delisting Determination and Submission of Appeal

August 22 2024 - 3:00PM

Kaixin Holdings (“Kaixin” or the “Company”) (NASDAQ: KXIN), a

leading new energy vehicle manufacturer and sales platform in

China, today announced that it received a letter from The Nasdaq

Stock Market LLC (“Nasdaq”) dated August 19, 2024, indicating that

the Company was not in compliance with Nasdaq Listing Rule

5810(c)(3)(A)(iii), as the Company’s securities had a closing bid

price of $0.10 or less for ten consecutive trading days (the

“Letter”). The Letter indicated that, as a result, the Nasdaq staff

has determined to delist the Company’s securities from The Nasdaq

Capital Market (the “Delisting Determination”).

As previously reported, on February 1, 2024, Nasdaq notified the

Company that the bid price of its listed securities had closed at

less than $1 per share over the previous 30 consecutive business

days, and, as a result, did not comply with Listing Rule 5550(a)(2)

(the “Rule”). In accordance with Listing Rule 5810(c)(3)(A), the

Company was provided 180 calendar days, or until July 30, 2024, and

on July 31, 2024, the Company was provided an additional 180

calendar days, or until January 27, 2025, to regain compliance with

the Rule.

The Letter indicates that unless the Company requests an appeal

of the Delisting Determination by August 26, 2024, trading of the

Company’s ordinary shares will be suspended at the opening of

business on August 28, 2024, and a Form 25-NSE will be filed with

the Securities and Exchange Commission (the “SEC”), which will

remove the Company’s securities from listing and registration on

the Nasdaq.

The Company has submitted a request for a hearing to appeal the

Delisting Determination to a Hearings Panel of the Nasdaq (the

“Panel”) on August 21, 2024. As notified by the Panel, a hearing is

scheduled to be held on October 3, 2024. The hearing request has

stayed the suspension of the Company’s securities and the filing of

the Form 25-NSE pending the Panel’s decision.

The Company is considering all potential options available to

regain compliance with the aforementioned rules, including seeking

stockholder approval for a reverse stock split. As previously

reported on the Form 6-K filed with the SEC on August 13, 2024, the

Company has scheduled to hold an extraordinary general meeting of

shareholders on October 1, 2024 to vote upon a reverse stock split,

with the consolidation to take effect upon the completion of

administrative procedures pursuant to listing exchange

requirements.

About Kaixin Holdings

Kaixin Holdings is a leading new energy vehicle manufacturer in

China, equipped with professional teams with rich experience in

R&D, production, marketing, and production facilities with the

capacity for stamping, welding, painting, and assembly operations.

Kaixin produces multiple electric passenger and logistics vehicle

models. The Company is committed to building up a competitive

international market position that integrates online and offline

presence and diversified business operations. Leveraging the

expertise of its professional teams and driven by the inspiration

for innovation and sustainability, Kaixin aims to contribute to

achieving the goals of “peak carbon emissions and carbon

neutrality”.

Safe Harbor Statement

This announcement may contain forward-looking statements. These

statements are made under the "safe harbor" provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

"will," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates" or other similar expressions. Statements

that are not historical facts, including statements about Kaixin’s

beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: our goals

and strategies; our future business development, financial

condition and results of operations; our expectations regarding

demand for and market acceptance of our services; our expectations

regarding the retention and strengthening of our relationships with

auto dealerships; our plans to enhance user experience,

infrastructure and service offerings; competition in our industry

in China; and relevant government policies and regulations relating

to our industry. Further information regarding these and other

risks is included in our other documents filed with the SEC. All

information provided in this announcement and in the attachments is

as of the date of this announcement, and Kaixin does not undertake

any obligation to update any forward-looking statement, except as

required under applicable law.

For more information, please contact:

Kaixin HoldingsInvestor

RelationsEmail: ir@kaixin.com

SOURCE: Kaixin Holdings

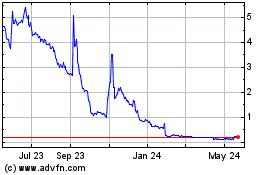

Kaixin (NASDAQ:KXIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

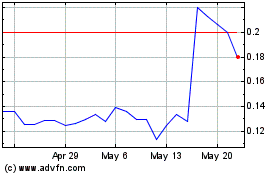

Kaixin (NASDAQ:KXIN)

Historical Stock Chart

From Jan 2024 to Jan 2025