Locafy Reports Fiscal First Half 2023 Results

March 16 2023 - 3:10PM

Locafy Limited

(Nasdaq: LCFY) (“Locafy” or the

“Company”), a globally recognized software-as-a-service

technology company specializing in local search engine marketing,

today reported financial results for the 2023 fiscal first half

ended December 31, 2022.

Recent Operational Highlights

- Announced an

updated profitability timeline, highlighted by significant

reductions in operational expenditures and the launch of Locafy

Brand Boost and Keystone products. Locafy management now projects

that the Company will reach profitability during the 2023 fiscal

fourth quarter.

- Named as a finalist

in the 2022-2023 Cloud Awards in the Best Software as a

Service (Outside USA) category, specifically for its Proximity

Network and Proximity Booster technologies. The Cloud Awards

includes more than 30 software categories that recognize excellence

in the cloud across industry verticals.

Management Commentary“For the first half of our

fiscal year, we navigated our business to best position Locafy for

scale and planned profitability in the coming months,” said Locafy

CEO Gavin Burnett. “With Jimmy Kelley Digital fully integrated into

our platform, we upgraded Brand Boost and launched Keystone, two

product sets that we expect to be pillars of our offering moving

forward. Even as the sales benefits of these updates are yet to be

fully realized, they helped us drive both 58% revenue growth

compared to last year’s first half and a 40% increase in MRR over

the year-ago period. In addition, our reseller count was up 94%

over last year’s second quarter and our total page count eclipsed

93,000, both strong indicators of future recurring revenue.

“As we move into the 2023 fiscal second half, we are confident

in the software solutions that we provide for our clients and in

the opportunity ahead for us to capture additional market share and

scale our business. Still, we believe it prudent to balance these

efforts with initiatives to optimize our cost structure, and have

already made several strides that we expect to help us reach and

maintain profitability. These initiatives included adjusting our

operations and R&D investments to manage towards a leaner

organizational structure, in line with our focus on driving

adoption of our existing products with an emphasis on our higher

margin products. Overall, we remain committed to our growth

strategy, and look forward to what’s ahead for Locafy.”

2023 Fiscal First Half Financial ResultsResults

compare 2023 fiscal first half end (December 31, 2022) to 2022

fiscal first half end (December 31, 2021) unless otherwise

indicated. All financial results are reported in Australian Dollars

(AUD).

- Total operating

revenue increased 58% to $2.8 million from $1.8 million in

the comparable year-ago period. The increase in total revenue was

mainly driven by an increase in subscription sales and an increase

in revenues derived from data partners.

- Subscription

revenue increased 69% to $2.1 million from $1.2 million in

the comparable year-ago period. The increase in subscription

revenue was primarily attributable to the growth in the Company’s

reseller customer base, particularly in North America, together

with revenues associated with new products resulting from the Jimmy

Kelley Digital acquisition.

- Advertising revenue

increased 3% to $167,000 from $161,000 in the comparable year-ago

period. The increase in advertising revenue was primarily

attributable to an increase in website search traffic to our owned

online properties.

- Data revenue

increased 48% to $451,000 from $304,000 in the comparable year-ago

period. The increase was primarily attributable to sales to new

data partners.

- Services revenue

remained steady at $49,000 in both the current and comparable

year-ago period.

- Cost of sales

increased 26% to $888,000 from $704,000 in the comparable year-ago

period. The increase in cost of sales was mainly driven by the use

of third-party software required to deliver the Company’s bundled

Proximity solutions. Locafy is currently developing alternative

technologies that will reduce reliance on third-party software and

accordingly reduce costs.

- Gross margin for

the second quarter of 2023 increased to 67.9% compared to 57.0% for

the second quarter of 2022. The increase in gross margin was mainly

due to a shift towards selling higher margin subscription products,

together with an increase in advertising and data partner

revenues.

- Net loss was $4.0

million, or $3.93 per diluted share, compared to a net loss of $1.3

million, or $1.49 per diluted share, in the comparable year-ago

period.

- As of December 31, 2022, the Company

had $1.0 million in cash and cash

equivalents, compared to $2.3 million as of September 30,

2022.

Key Performance Indicators (KPIs)Unless

otherwise specified, KPI data has been recorded as of the 2023

fiscal second quarter end (December 31, 2022). All financial

results are reported in Australian Dollars (AUD).

- Monthly Recurring Revenue

(MRR) for the 2023 fiscal second quarter was $464,000 a

40% increase compared to $329,000 for the year-ago period, and a 2%

increase compared to $456,000 for the quarter ended September 30,

2022.

- Total Active Reseller

Count for the period ended December 31, 2022 was 134, a

94% increase compared to 69 as of December 31, 2021, and steady

compared to September 30, 2022.

- Total End User

Count for the period ended December 31, 2022 was 1,268, a

79% increase compared to 708 as of December 31, 2021, and a 12%

decrease compared to 1,440 as of September 30, 2022. The decrease

from September 30, 2022 is as a result of an internal review

leading to the termination of delinquent accounts.

- Average Page Performance

(Page One), an indicator of the percentage of Locafy pages

that appear on Page One of their respective searches, was 59% in

the quarter ended December 31, 2022.

- Average Page Performance

(Positions 1-3), an indicator of the percentage of Locafy

pages that appear within the first three positions on Page One of

their respective searches, was 41% in the quarter ended December

31, 2022. While the Company does not expect page performance

metrics to grow every quarter, Locafy believes these measurements

to be a consistent indicator for technology performance at any

given time.

For more information, please see Locafy’s 6-K filed on March 16,

2023.

About LocafyFounded in 2009, Locafy's (Nasdaq:

LCFY, LCFYW) mission is to revolutionize the US$700 billion SEO

sector. We help businesses and brands increase search engine

relevance and prominence in a specific proximity using a fast,

easy, and automated approach. For more information, please visit

www.locafy.com.

About Key Performance IndicatorsWe define MRR

as the value of all recurring subscription contracts with active

entitlements as at the end of each month. MRR across a period is

the average of each month’s MRR within that period.

Forward-Looking StatementsThis press release

contains “forward-looking statements” that are subject to

substantial risks and uncertainties. All statements, other than

statements of historical fact, contained in this press release are

forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as

“subject to”, “believe,” “anticipate,” “plan,” “expect,” “intend,”

“estimate,” “project,” “may,” “will,” “should,” “would,” “could,”

“can,” the negatives thereof, variations thereon and similar

expressions, or by discussions of strategy, although not all

forward-looking statements contain these words. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, they do involve

assumptions, risks, and uncertainties, and these expectations may

prove to be incorrect. You should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company’s actual results could differ materially

from those anticipated in these forward-looking statements as a

result of a variety of factors, including those discussed in the

Company’s periodic reports that are filed with the Securities and

Exchange Commission and available on its website

(http://www.sec.gov). All forward-looking statements attributable

to the Company or persons acting on its behalf are expressly

qualified in their entirety by these factors. Other than as

required under the securities laws, the Company does not assume a

duty to update these forward-looking statements.

Investor Relations ContactTom Colton or Chris

Adusei-PokuGateway Investor Relations(949)

574-3860LCFY@gatewayir.com

-Financial Tables to Follow-

Locafy Limited

Consolidated Statement of Profit or Loss and Other

Comprehensive Income

| |

|

Consolidated Group |

|

|

|

6 months to31 Dec 2022AUD

$ |

|

6 months to31 Dec 2021AUD

$ |

|

| Revenue |

|

2,839,089 |

|

1,795,821 |

|

| Other income |

|

164,817 |

|

386,245 |

|

| Technology expense |

|

(1,036,224 |

) |

(776,023 |

) |

| Employee benefits expense |

|

(4,396,441 |

) |

(2,098,756 |

) |

| Occupancy expense |

|

(60,586 |

) |

(23,167 |

) |

| Advertising expense |

|

(158,891 |

) |

(39,379 |

) |

| Consultancy expense |

|

(530,086 |

) |

(352,609 |

) |

| Depreciation and amortization

expense |

|

(494,786 |

) |

(200,544 |

) |

| Other expenses |

|

(65,792 |

) |

(40,670 |

) |

| Impairment of financial

assets |

|

(259,888 |

) |

- |

|

| Operating

loss |

|

(3,998,788 |

) |

(1,349,082 |

) |

| Financial cost |

|

(45,900 |

) |

(24,530 |

) |

| Loss before income

tax |

|

(4,044,688 |

) |

(1,373,612 |

) |

| Income tax expense |

|

- |

|

- |

|

| Loss for the

year |

|

(4,044,688 |

) |

(1,373,612 |

) |

| |

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

| Items that will be

reclassified subsequently to profit and loss |

|

|

|

|

|

| Exchange differences on

translating foreign operations |

|

7,438 |

|

(18,050 |

) |

| Total comprehensive

loss for the year |

|

(4,052,126 |

) |

(1,391,662 |

) |

| |

|

|

|

|

|

| Earnings per

share |

|

|

|

|

|

| Basic loss per share |

|

(3.93 |

) |

(1.49 |

) |

| Diluted loss per share |

|

(3.93 |

) |

(1.49 |

) |

Locafy Limited

Consolidated Statement of Financial Position

| |

|

Consolidated Group |

|

|

|

6 months to31 Dec 2022AUD

$ |

|

Year to30 Jun 2022AUD

$ |

|

| Assets |

|

|

|

|

|

| Cash and cash equivalents |

|

1,005,191 |

|

4,083,735 |

|

| Trade and other

receivables |

|

1,100,346 |

|

1,203,249 |

|

| Other assets |

|

204,406 |

|

230,094 |

|

| Current

assets |

|

2,309,943 |

|

5,517,078 |

|

| Property, plant and

equipment |

|

347,943 |

|

395,999 |

|

| Right of use assets |

|

360,635 |

|

406,673 |

|

| Intangible assets |

|

2,997,804 |

|

2,235,180 |

|

| Non-current

assets |

|

3,706,382 |

|

3,037,852 |

|

| Total

assets |

|

6,016,325 |

|

8,554,930 |

|

| |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

| Trade and other payables |

|

1,986,464 |

|

1,454,241 |

|

| Borrowings |

|

301,600 |

|

308,100 |

|

| Provisions |

|

504,302 |

|

473,006 |

|

| Accrued expenses |

|

1,103,260 |

|

511,848 |

|

| Lease liabilities |

|

49,693 |

|

32,672 |

|

| Contract and other

liabilities |

|

165,826 |

|

137,342 |

|

| Current

liabilities |

|

4,111,145 |

|

2,917,209 |

|

| Trade and other payables |

|

128,268 |

|

- |

|

| Lease liabilities |

|

389,787 |

|

417,744 |

|

| Provisions |

|

35,387 |

|

25,988 |

|

| Accrued expenses |

|

76,504 |

|

76,504 |

|

| Non-current

liabilities |

|

629,946 |

|

520,236 |

|

| Total

liabilities |

|

4,741,091 |

|

3,437,445 |

|

| Net assets /

(liabilities) |

|

1,275,234 |

|

5,117,485 |

|

| |

|

|

|

|

|

| Equity |

|

|

|

|

|

| Issued capital |

|

45,038,037 |

|

45,038,037 |

|

| Reserves |

|

5,508,912 |

|

5,306,475 |

|

| Accumulated losses |

|

(49,271,715 |

) |

(45,227,027 |

) |

| Total equity /

(deficiency) |

|

1,275,234 |

|

5,117,485 |

|

Locafy Limited

Consolidated Statement of Cash Flows

| |

|

6 months to31 Dec 2022AUD

$ |

|

6 months to31 Dec 2021AUD

$ |

| Cash flows from

operating activities |

|

|

|

|

|

Receipts from customers |

|

2,743,777 |

|

1,267,516 |

|

| Payments to suppliers and

employees |

|

(4,753,048 |

) |

(2,949,753 |

) |

| R&D Tax Incentive |

|

164,817 |

|

386,245 |

|

| Financial cost |

|

(45,900 |

) |

(24,530 |

) |

| Net cash used by

operating activities |

|

(1,890,354 |

) |

(1,320,522 |

) |

| |

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

| Purchase of intellectual

property |

|

(1,161,145 |

) |

(261,737 |

) |

| Purchase of property, plant

and equipment |

|

(2,170 |

) |

(33,827 |

) |

| Net cash used by

investing activities |

|

(1,163,315 |

) |

(295,564 |

) |

| |

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

| Proceeds from issue of

shares |

|

- |

|

- |

|

| Payment for share issue

costs |

|

- |

|

- |

|

| Repayment of borrowings |

|

(6,500 |

) |

1,747,000 |

|

| Leasing liabilities |

|

(10,936 |

) |

(18,906 |

) |

| Net cash from

financing activities |

|

(17,436 |

) |

1,728,094 |

|

| |

|

|

|

|

| Net increase in cash and cash

equivalents |

|

(3,071,105 |

) |

112,008 |

|

| Net foreign exchange

difference |

|

(7,438 |

) |

- |

|

| Cash and cash equivalents at

the beginning of the year |

|

4,083,735 |

|

650,731 |

|

| Cash and cash

equivalents at the end of the year |

|

1,005,191 |

|

762,739 |

|

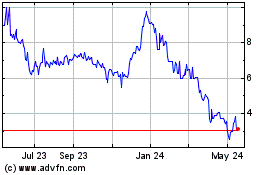

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Oct 2024 to Nov 2024

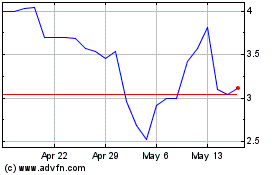

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Nov 2023 to Nov 2024