- Legend Biotech Corporation (the “Company” or Legend Biotech),

through its wholly owned subsidiary, Legend Biotech Ireland

Limited, entered into an exclusive, global license agreement with

Novartis Pharma AG. The Company granted Novartis the rights to

develop, manufacture and commercialize LB2102 (NCT05680922) and

other potential chimeric antigen receptor T-cell (CAR-T) therapies

selectively targeting Delta-like ligand 3 (DLL3).1 Subject to

closing, Novartis has agreed to pay the Company an upfront payment

of $100 million after closing the transaction and up to $1.01

billion in milestone payments, as well as tiered royalties on net

sales

- CARVYKTI® (ciltacabtagene autoleucel; cilta-cel) generated

approximately $152 million in net trade sales during the quarter,

an increase of 30 percent over the previous quarter, driven by

ongoing market launches, expanding market share and capacity

improvements

- The first patient was randomized in the Phase 3 CARTITUDE-6

(NCT05257083) clinical trial evaluating daratumumab, bortezomib,

lenalidomide and dexamethasone (DVRd) followed by cilta-cel versus

DVRd followed by autologous stem cell transplant in participants

with newly diagnosed multiple myeloma (sponsored by the European

Myeloma Network)2

- CARVYKTI® is now available in Germany, as commercial demand

continues

- The state-of-the-art facility that will manufacture cilta-cel

in Ghent has received a license from the Federal Agency for

Medicines and Health Products in Belgium to begin clinical supply

manufacturing

- In September 2023, Legend Biotech received payment for a

milestone under the Janssen Agreement in the amount of $20.0

million

- In November 2023, Legend Biotech appointed Jim Pepin as General

Counsel. Mr. Pepin has been practicing law for over two decades.

Prior to joining the Company, Mr. Pepin was Senior Vice President,

General Counsel and Corporate Secretary of Aimmune Therapeutics.

Prior to that, he also served as Vice President and General Counsel

of Nestle HealthCare Nutrition for ten years. Mr. Pepin holds a

Bachelor of Arts in Foreign Affairs from the University of Virginia

and a Juris Doctor from the University of Virginia School of

Law

- Cash and cash equivalents, deposits and short-term investments

of $1.4 billion, as of September 30, 2023, which Legend Biotech

believes will fund operating and capital expenditures through

2025

Legend Biotech Corporation (NASDAQ: LEGN) (Legend Biotech), a

global biotechnology company developing, manufacturing and

commercializing novel therapies to treat life-threatening diseases,

today reported its unaudited financial results for the three and

nine months ended September 30, 2023 and key corporate

highlights.

Legend Biotech shared the latest updates from its portfolio and

pipeline, alongside its financial performance, including detailing

Legend Biotech’s license agreement with Novartis. The license

agreement grants Novartis the exclusive, worldwide rights to

certain potential CAR-T therapies selectively targeting DLL3.

“We continuously explore the full potential of our products and

technologies. The out-license agreement with Novartis affirms that

our next-generation therapy, LB2102, has the potential to be a

differentiated treatment for eligible patients with small cell lung

cancer,” said Ying Huang, Chief Executive Officer of Legend

Biotech. “We also remain committed to meeting the demand for

CARVYKTI®, in collaboration with Janssen, and have progressively

increased manufacturing capacity, which has led to an incremental

increase in sales.”

____________________________ 1 ClinicalTrials.gov. DLL3-Directed

Chimeric Antigen Receptor T-cells in Subjects With Extensive Stage

Small Cell Lung Cancer. Available at:

https://classic.clinicaltrials.gov/ct2/show/NCT05680922. Last

accessed Aug 2023. 2 ClinicalTrials.gov. A Study of Daratumumab,

Bortezomib, Lenalidomide and Dexamethasone (DVRd) Followed by

Ciltacabtagene Autoleucel Versus Daratumumab, Bortezomib,

Lenalidomide and Dexamethasone (DVRd) Followed by Autologous Stem

Cell Transplant (ASCT) in Participants With Newly Diagnosed

Multiple Myeloma (CARTITUDE-6). Available at:

https://classic.clinicaltrials.gov/ct2/show/NCT05257083

Financial Results for Quarter Ended September 30,

2023

Cash and Cash Equivalents, Time Deposits, and Short-Term

Investments

As of September 30, 2023, Legend Biotech had approximately $1.4

billion of cash and cash equivalents, time deposits, and short-term

investments.

Revenue

License Revenue

License revenue for the three months ended September 30, 2023

was $20.1 million compared to no license revenue for the three

months ended September 30, 2022. The increase was due to the

achievement of a milestone under our collaboration and license

agreement (Janssen Agreement) with Janssen Biotech, Inc. (Janssen)

during the three months ended September 30, 2023. License revenue

for the nine months ended September 30, 2023 was $35.2 million,

compared to $50.0 million for the nine months ended September 30,

2022. This decrease of $14.8 million was primarily driven by the

nature and timing of milestones achieved as outlined in the Global

Development Plan under the Janssen Agreement for cilta-cel.

Collaboration Revenue

Collaboration revenue for the three and nine months ended

September 30, 2023 was $75.9 million and $170.4 million,

respectively, compared to $27.3 million and $39.2 million for the

three and nine months ended September 30, 2022. The increases of

$48.6 million and $131.2 million for the three and nine month

periods, respectively, were due to an increase in revenue generated

from sales of CARVYKTI® in connection with the Janssen

Agreement.

Operating Expenses

Collaboration Cost of Revenue

Collaboration cost of revenue for the three and nine months

ended September 30, 2023 was $43.5 million and $111.8 million,

respectively, compared to $25.5 million and $42.4 million for the

three and nine months ended September 30, 2022. The increases of

$18.0 million and $69.4 million for the three and nine months

periods, respectively, were a combination of Legend Biotech’s share

of the cost of sales in connection with CARVYKTI® sales under the

Janssen Agreement and expenditures to support expansion in

manufacturing capacity that could not be capitalized.

Research and Development Expenses

Research and development expenses for the three and nine months

ended September 30, 2023 were $95.9 million and $276.5 million,

respectively, compared to $104.5 million and $254.9 million for the

three and nine months ended September 30, 2022, respectively. The

decrease of $8.6 million for the three months ended September 30,

2023 compared to three months ended September 30, 2022 was due to

timing of expenses incurred in connection with the Global

Development Plan under the Janssen Agreement. The increase of $21.6

million for the nine months ended September 30, 2023 compared to

the nine months ended September 30, 2022 was primarily due to

continuous research and development activities in cilta-cel,

including higher patient enrollment for Phase 3 clinical trials for

cilta-cel, and an increase in research and development activities

for other pipeline items. The other pipeline expenses include

continued investment in Legend Biotech’s solid tumor programs,

which include two Investigational New Drug approvals that advanced

into Phase 1 development.

Administrative Expenses

Administrative expenses for the three and nine months ended

September 30, 2023 were $28.1 million and $78.1 million,

respectively, compared to $23.2 million and $54.0 million for the

three and nine months ended September 30, 2022, respectively. The

increases of $4.9 million and $24.1 million for the three and nine

month periods, respectively, were primarily due to the expansion of

administrative functions to facilitate continuous business growth

and continued investment in building Legend Biotech’s global

information technology infrastructure.

Selling and Distribution Expenses

Selling and distribution expenses for the three and nine months

ended September 30, 2023 were $21.1 million and $60.5 million,

respectively, compared to $18.9 million and $67.6 million for the

three and nine months ended September 30, 2022. The increase of

$2.2 million for the three months ended September 30, 2023 compared

to the three months ended September 30, 2022 was due to costs

associated with the commercialization of CARVYKTI®. The decrease of

$7.1 million for the nine months ended September 30, 2023 compared

to the nine months ended September 30, 2022 was primarily due to

non-recurring launch expenses incurred during the nine months ended

September 30, 2022 to support the commercial launch of CARVYKTI® in

the U.S market.

Other Income and Gains

Other income and gains for the three and nine months ended

September 30, 2023 were $35.8 million and $49.8 million,

respectively, compared to $3.9 million and $4.7 million for the

three and nine months ended September 30, 2022, respectively. The

increases of $31.9 million and $45.1 million for the three and nine

month periods, respectively, were primarily attributable to an

increase in interest income, fair value gain on financial assets

and foreign currency exchange gain.

Other Expenses

Other expenses for the three and nine months ended September 30,

2023 were $0.1 million and $0.2 million, respectively, compared to

$2.0 million and $9.5 million for the three and nine months ended

September 30, 2022. The decrease in both comparative periods was

primarily due to an unrealized foreign currency exchange gain in

2023 and an unrealized foreign currency exchange loss in 2022.

Finance Costs

Finance costs for the three and nine months ended September 30,

2023 were $5.7 million and $16.0 million, respectively, compared to

$3.2 million and $5.9 million for the three and nine months ended

September 30, 2022. The increase in both comparative periods was

primarily due to interest on advance funding, which is

interest-bearing borrowings funded by Janssen under the Janssen

Agreement and constituted of principal and applicable interests

upon such principal.

Fair Value (Loss)/Gain of Warrant Liability

There was no fair value (loss)/gain of warrant liability for the

three months ended September 30, 2023 compared to a gain of $61.2

million for the three months ended September 30, 2022, because the

warrant was exercised on May 11, 2023. Fair value loss of warrant

liability for the nine months ended September 30, 2023 was $85.8

million, compared to a fair value gain of $30.2 million for the

nine months ended September 30, 2022. The increase was due to the

fair value loss recorded on the full exercise of the warrant, which

took place on May 11, 2023.

Loss for the Period

For the three months ended September 30, 2023, net loss was

$62.2 million, or $0.17 per share, compared to net loss of $85.0

million, or $0.26 per share, for the three months ended September

30, 2022. For the nine months ended September 30, 2023, net loss

was $373.4 million, or $1.07 per share, compared to a net loss of

$310.5 million, or $0.99 per share, for the nine months ended

September 30, 2022.

Webcast/Conference Call Details:

Legend Biotech will host its quarterly earnings call and webcast

today at 8:00am ET. To access the webcast, please visit this

weblink.

A replay of the webcast will be available on Legend Biotech’s

website at

https://investors.legendbiotech.com/events-and-presentations.

About Legend Biotech

Legend Biotech is a global biotechnology company dedicated to

treating, and one day curing, life-threatening diseases.

Headquartered in Somerset, New Jersey, we are developing advanced

cell therapies across a diverse array of technology platforms,

including autologous and allogeneic chimeric antigen receptor

T-cell, gamma-delta T cell and natural killer (NK) cell-based

immunotherapy. From our three R&D sites around the world, we

apply these innovative technologies to pursue the discovery of

cutting-edge therapeutics for patients worldwide.

Learn more at https://legendbiotech.com/ and follow us on

Twitter and LinkedIn.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, constitute “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements include, but are not limited

to, statements relating to Legend Biotech’s strategies and

objectives; statements relating to CARVYKTI®, including Legend

Biotech’s expectations for

CARVYKTI®, including manufacturing expectations for CARVYKTI®;

expected results and timing of clinical trials; Legend Biotech’s

expectations for LB2102 and its potential benefits; Legend

Biotech’s ability to close the licensing transaction with Novartis

and potential benefits of the transaction; Legend Biotech’s

expectations on advancing their pipeline and product portfolio; and

the potential benefits of Legend Biotech’s product candidates. The

words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “target,” “will,” “would” and similar

expressions are intended to identify forward- looking statements,

although not all forward-looking statements contain these

identifying words. Actual results may differ materially from those

indicated by such forward-looking statements as a result of various

important factors. Legend Biotech’s expectations could be affected

by, among other things, uncertainties involved in the development

of new pharmaceutical products; unexpected clinical trial results,

including as a result of additional analysis of existing clinical

data or unexpected new clinical data; unexpected regulatory actions

or delays, including requests for additional safety and/or efficacy

data or analysis of data, or government regulation generally;

unexpected delays as a result of actions undertaken, or failures to

act, by our third party partners; uncertainties arising from

challenges to Legend Biotech’s patent or other proprietary

intellectual property protection, including the uncertainties

involved in the U.S. litigation process; competition in general;

government, industry, and general product pricing and other

political pressures; the duration and severity of the COVID-19

pandemic and governmental and regulatory measures implemented in

response to the evolving situation; as well as the other factors

discussed in the “Risk Factors” section of Legend Biotech’s Annual

Report on Form 20-F filed with the Securities and Exchange

Commission (SEC) on March 30, 2023 and Legend Biotech’s other

filings with the SEC. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

in this press release as anticipated, believed, estimated or

expected. Any forward-looking statements contained in this press

release speak only as of the date of this press release. Legend

Biotech specifically disclaims any obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

LEGEND BIOTECH

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF PROFIT OR LOSS

Three Months Ended September

30,

Nine months ended September

30,

2023

2022

2023

2022

US$’000, except per share data

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

REVENUE

License revenue

20,057

—

35,172

50,000

Collaboration revenue

75,937

27,299

170,369

39,236

Other revenue

19

62

138

136

Total revenue

96,013

27,361

205,679

89,372

Collaboration cost of revenue

(43,479

)

(25,460

)

(111,764

)

(42,399

)

Other income and gains

35,838

3,924

49,812

4,693

Research and development expenses

(95,855

)

(104,517

)

(276,535

)

(254,892

)

Administrative expenses

(28,104

)

(23,243

)

(78,062

)

(53,950

)

Selling and distribution expenses

(21,098

)

(18,852

)

(60,481

)

(67,594

)

Other expenses

(134

)

(1,969

)

(231

)

(9,496

)

Fair value gain/(loss) of warrant

liability

—

61,200

(85,750

)

30,200

Finance costs

(5,676

)

(3,248

)

(15,974

)

(5,935

)

LOSS BEFORE TAX

(62,495

)

(84,804

)

(373,306

)

(310,001

)

Income tax benefit/(expense)

288

(152

)

(130

)

(472

)

LOSS FOR THE PERIOD

(62,207

)

(84,956

)

(373,436

)

(310,473

)

Attributable to:

Ordinary equity holders of the parent

(62,207

)

(84,956

)

(373,436

)

(310,473

)

LOSS PER SHARE ATTRIBUTABLE TO ORDINARY

EQUITY HOLDERS OF THE PARENT

Basic

(0.17

)

(0.26

)

(1.07

)

(0.99

)

Diluted

(0.17

)

(0.26

)

(1.07

)

(0.99

)

ORDINARY SHARES USED IN LOSS PER SHARE

COMPUTATION

Basic

363,075,209

323,641,010

348,293,363

314,094,019

Diluted

363,075,209

323,641,010

348,293,363

314,094,019

LEGEND BIOTECH

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

September 30, 2023

December 31, 2022

US$’000

US$’000

(Unaudited)

(Audited)

NON-CURRENT ASSETS

Property, plant and equipment

109,503

105,168

Advance payments for property, plant and

equipment

419

914

Right-of-use assets

74,811

55,590

Time deposits

4,268

—

Intangible assets

4,009

3,409

Collaboration prepaid leases

135,997

65,276

Other non-current assets

1,531

1,487

Total non-current assets

330,538

231,844

CURRENT ASSETS

Collaboration inventories

18,014

10,354

Trade receivables

20

90

Prepayments, other receivables and other

assets

66,569

61,755

Financial assets at fair value through

profit or loss

185,792

185,603

Pledged deposits

356

1,270

Time deposits

274,575

54,016

Cash and cash equivalents

963,470

786,031

Total current assets

1,508,796

1,099,119

Total assets

1,839,334

1,330,963

CURRENT LIABILITIES

Trade payables

17,173

32,893

Other payables and accruals

144,651

184,109

Government grants

630

451

Lease liabilities

2,915

3,563

Tax payable

9,853

9,772

Warrant liability

—

67,000

Total current liabilities

175,222

297,788

NON-CURRENT LIABILITIES

Collaboration interest-bearing advanced

funding

275,906

260,932

Lease liabilities long term

41,687

20,039

Government grants

6,764

7,659

Other non-current liabilities

119

233

Total non-current liabilities

324,476

288,863

Total liabilities

499,698

586,651

EQUITY

Share capital

36

33

Reserves

1,339,600

744,279

Total ordinary shareholders’ equity

1,339,636

744,312

Total equity

1,339,636

744,312

Total liabilities and equity

1,839,334

1,330,963

LEGEND BIOTECH

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOW

Three Months Ended September

30,

Nine months ended September

30,

US$’000

2023

2022

2023

2022

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

LOSS BEFORE TAX

(62,495

)

(84,804

)

(373,306

)

(310,001

)

CASH FLOWS USED IN OPERATING

ACTIVITIES

(60,848

)

(72,112

)

(297,631

)

(151,539

)

CASH FLOWS (USED IN)/FROM INVESTING

ACTIVITIES

(209,072

)

127,891

(314,723

)

(102,024

)

CASH FLOWS FROM FINANCING ACTIVITIES

961

377,725

790,565

378,759

NET (DECREASE)/INCREASE IN CASH AND CASH

EQUIVALENTS

(268,959

)

433,504

178,211

125,196

Effect of foreign exchange rate changes,

net

(784

)

(547

)

(772

)

(1,401

)

Cash and cash equivalents at beginning of

the period

1,233,213

379,776

786,031

688,938

CASH AND CASH EQUIVALENTS AT END OF THE

PERIOD

963,470

812,733

963,470

812,733

ANALYSIS OF BALANCES OF CASH AND CASH

EQUIVALENTS

Cash and bank balances

1,242,669

1,031,334

1,242,669

1,031,334

Less: Pledged deposits

356

1,851

356

1,851

Time deposits

278,843

216,750

278,843

216,750

Cash and cash equivalents as stated in the

statement of financial position

963,470

812,733

963,470

812,733

Cash and cash equivalents as stated in the

statement of cash flows

963,470

812,733

963,470

812,733

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231120553735/en/

Press contact: Alexandra Ventura, Corporate

Communications & Investor Relations, Legend Biotech

alex.ventura@legendbiotech.com 732-850-5598 Investor

contact: Jessie Yeung, Head of Investor Relations & Public

Relations, Legend Biotech jessie.yeung@legendbiotech.com

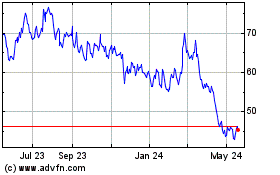

Legend Biotech (NASDAQ:LEGN)

Historical Stock Chart

From Feb 2025 to Mar 2025

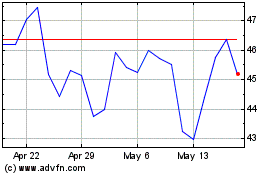

Legend Biotech (NASDAQ:LEGN)

Historical Stock Chart

From Mar 2024 to Mar 2025