false0001821806Leslie's, Inc.00018218062023-07-132023-07-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 13, 2023 |

LESLIE’S, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39667 |

20-8397425 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2005 East Indian School Road |

|

Phoenix, Arizona |

|

85016 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (602) 366-3999 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.001 per share |

|

LESL |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 13, 2023, Leslie’s, Inc. (the “Company”) issued a press release that included the announcement of certain estimated preliminary financial results for the Company’s third quarter ended July 1, 2023 and updated its full year fiscal 2023 outlook. A copy of the press release is furnished as Exhibit 99.1 to this report. The estimated preliminary financial results are subject to the completion of the Company’s financial closing procedures and any adjustments that may result from the completion of the quarterly review of the Company’s consolidated financial statements. As a result, such preliminary estimates may differ from the actual results that will be reflected in the Company’s consolidated financial statements for the quarter when they are completed and publicly disclosed.

The information under Item 2.02 of this report, including Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information and the accompanying exhibit shall not be deemed to be incorporated by reference into filings with the U.S. Securities and Exchange Commission made by the Company, except as shall be expressly set forth by specific reference in such filing.

Item 5.02 Departure of Director or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 13, 2023, the Company announced that Steve Weddell will be stepping down from his position as Chief Financial Officer of the Company effective August 7, 2023, and will remain employed by the Company as Special Advisor to the CEO from that date through December 31, 2023 to facilitate a smooth and orderly transition.

The Board of Directors of the Company appointed Scott Bowman, age 56, as the Company’s Chief Financial Officer and Treasurer to succeed Mr. Weddell, effective August 7, 2023. Mr. Bowman will join the Company on July 17, 2023 and serve as Chief Financial Officer Designate through August 6, 2023.

Mr. Bowman most recently served as Chief Financial Officer for True Food Kitchen after serving as Chief Financial Officer for Dave & Buster’s (NASDAQ: PLAY), a restaurant and entertainment company, from 2019 to 2021 and Hibbett Sports (NASDAQ: HIBB), an athletic retail chain, from 2012 to 2019. Mr. Bowman previously served as a Divisional CFO at The Home Depot, where he held leadership positions in various corporate finance roles having started his career in the audit department of The Sherwin-Williams Company. Mr. Bowman is a CPA and holds an MBA from Emory Goizueta Business School and a B.S. in Accounting and Finance from Miami University (Ohio).

Mr. Bowman will receive an annual base salary of $550,000, subject to annual adjustment. Mr. Bowman will be eligible for an annual cash incentive under the Company’s Annual Incentive Plan, filed with the Company’s Quarterly Report on Form 10-Q on February 3, 2023 (“February 2023 Quarterly Report”), with a target of 100% of his annualized salary for 2023 and a maximum payout of 240% of target. The actual cash incentive will be based on 2023 performance results and Mr. Bowman will be eligible for a pro-rated incentive. Mr. Bowman will receive a one-time equity grant valued at $550,000. This award will be provided as restricted stock units on terms consistent with the Form of Restricted Stock Unit Award Agreement pursuant to 2020 Omnibus Incentive Plan filed with the Company’s February 2023 Quarterly Report. Mr. Bowman will be eligible for future equity grants as approved by the Company’s Compensation Committee. Mr. Bowman will also receive a sign-on bonus of $500,000. The initial portion of the sign-on bonus in an amount of $300,000 will be grossed-up to account for normal and customary payroll tax withholdings and will be paid on the first regular payroll processing date following 30 days of employment. The second bonus payment of $200,000 will be subject to normal and customary payroll tax withholdings and will be paid on the first payroll processing date in December 2023.

Mr. Bowman will participate in the Company’s Executive Severance Pay Plan consistent with other executives. The plan provides for payment of severance benefits to certain senior executives upon involuntary termination in specified circumstances. Mr. Bowman will also receive other benefits generally available to the Company’s salaried employees.

Mr. Bowman and his immediate family members are not party to any unrelated party transactions for which disclosure would be required pursuant to Item 404(a) of Regulation S-K. There is no family relationship between Mr. Bowman and any of the Company’s directors or executive officers and there are no arrangements or understandings with other persons pursuant to which Mr. Bowman was selected as an officer.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

LESLIE’S, INC. |

|

|

|

|

|

By: |

|

/s/ Steven M. Weddell |

|

Name: |

|

Steven M. Weddell |

|

Title: |

|

Executive Vice President and Chief Financial Officer |

Date: July 13, 2023

Exhibit 99.1

Leslie’s, Inc. Announces Preliminary Third Quarter

Fiscal 2023 Financial Results and CFO Transition

•Revises Fiscal 2023 outlook based on year-to-date performance and current trends

•Scott Bowman appointed Chief Financial Officer, effective August 7, 2023

PHOENIX, July 13, 2023 – Leslie’s, Inc. ("Leslie's" or the “Company”; NASDAQ: LESL), the largest and most trusted direct-to-consumer brand in the U.S. pool and spa care industry, today announced preliminary financial results for the third quarter of Fiscal 2023. The preliminary third quarter of Fiscal 2023 results are unaudited and subject to adjustment and finalization by the Company.

The Company expects preliminary sales for the third quarter of $611 million including a comparable sales decline of (12)%. Gross profit is expected to be $249 to $251 million and gross margin is expected to be approximately 41%. Net income is expected to be $70 to $73 million, Adjusted EBITDA is expected to be $124 to $128 million, Adjusted net income is expected to be $73 to $76 million, and Adjusted diluted earnings per share are expected to be $0.39 to $0.41.

In light of these results and the expectation that trends experienced in the third quarter will persist through the fiscal fourth quarter, the Company is revising its Fiscal 2023 outlook. Net sales are now expected to be $1,430 to $1,450 million, gross profit is expected to be $549 to $559 million, net income is expected to be $33 to $40 million, Adjusted EBITDA is expected to be $170 to $180 million, Adjusted net income is expected to be $52 to $59 million, and Adjusted diluted earnings per share are expected to be $0.28 to $0.32.

Mike Egeck, Chief Executive Officer, commented, “Our fiscal third quarter results were well below our expectations as low double digit traffic declines in our Residential and Pro businesses drove negative comps across both discretionary and non-discretionary categories. While abnormal weather continued to pressure traffic levels, customer surveys conducted towards the end of the quarter also indicated increased price sensitivity and that consumers entered the pool season with a greater than normal amount of chemicals leftover from last year.”

Mr. Egeck continued, “Our third quarter gross margins were down year-over-year due to higher product costs that we could not pass through to consumers, the impact of higher distribution-related expenses and capitalized costs as we reduce inventory from peak levels, and fixed cost deleverage. While our team navigates these dynamics, we also continue to focus on the levers in our control – delivering exceptional customer service, bringing innovative and energy-saving products to market, and managing costs. We also continue to aggressively manage our inventory balances and rigorously review our costs to further optimize our non-store headcount. While this year’s pool season has presented a unique confluence of challenges, we remain focused on driving long-term market share gains and shareholder value.”

1

Chief Financial Officer Transition

Leslie’s also announced today that Scott Bowman has been appointed Chief Financial Officer, effective August 7, 2023. Mr. Bowman will join the company on July 17, 2023 and serve as Chief Financial Officer Designate through August 6, 2023. Steve Weddell, who is stepping down as CFO effective August 7, 2023, will remain an advisor to the Company through December 31, 2023 to facilitate the transition.

Mr. Egeck commented, “I am very pleased to welcome Scott to our leadership team. Scott is a seasoned public company CFO who brings over thirty years of finance and accounting experience, as well as experience in areas including supply chain, manufacturing, M&A, and corporate strategy. Scott has built deep expertise developing and executing operating plans as well as enhancing financial processes and developing talent across the organizations he has served. He will be a strong addition to the Leslie’s team and I look forward to working with him closely to drive the business forward.”

Mr. Bowman is a veteran public and private company CFO with extensive experience at retail, manufacturing, and CPG companies. He most recently served as CFO for True Food Kitchen after serving as CFO for Dave & Buster’s (NASDAQ: PLAY) from 2019 to 2021 and Hibbett Sports (NASDAQ: HIBB) from 2012 to 2019. Mr. Bowman previously served as a Divisional CFO at The Home Depot, and held prior leadership positions in various corporate finance roles having started his career in the audit department of The Sherwin-Williams Company. Mr. Bowman is a CPA and holds an MBA from Emory Goizueta Business School and a B.S. in Accounting and Finance from Miami University (Ohio).

Scott Bowman said, “I admire Leslie’s and the impressive leadership position the company has built over its long history in the pool and spa care industry. I look forward to joining Mike and the rest of the team in executing on our strategic growth priorities, enhancing operational efficiencies and driving value for our shareholders.”

Mr. Egeck added, “I want to thank Steve for his leadership and contributions to Leslie’s over the past eight years. Steve was instrumental in leading our IPO process and has been a trusted partner as we transitioned to a public company. I am grateful that he will remain as an advisor through this transition and wish him all the best in his next chapter.”

Third Quarter Fiscal 2023 Earnings Results and Conference Call

The Company will release its full financial results for the third quarter of fiscal 2023 after market close on Wednesday, August 2, 2023. The Company will host a conference call at 4:30 p.m. Eastern time to discuss its final results and revised outlook in more detail. Investors and analysts interested in participating in the call are invited to dial 877-407-0784 (international callers please dial 1-201-689-8560) approximately 10 minutes prior to the start of the call. A live audio webcast of the conference call will be available online at https://ir.lesliespool.com.

A recorded replay of the conference call will be available within approximately three hours of the conclusion of the call and can be accessed, along with the associated slides, online at https://ir.lesliespool.com for 90 days.

2

About Leslie’s

Founded in 1963, Leslie’s is the largest and most trusted direct-to-consumer brand in the U.S. pool and spa care industry. The Company serves the aftermarket needs of residential and professional consumers with an extensive and largely exclusive assortment of essential pool and spa care products. The Company operates an integrated ecosystem of over 1,000 physical locations and a robust digital platform, enabling consumers to engage with Leslie’s whenever, wherever, and however they prefer to shop. Its dedicated team of associates, pool and spa care experts, and experienced service technicians are passionate about empowering Leslie’s consumers with the knowledge, products, and solutions necessary to confidently maintain and enjoy their pools and spas.

Use of Non-GAAP Financial Measures and Other Operating Measures

In addition to reporting financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), we use certain non-GAAP financial measures and other operating measures, including comparable sales growth and Adjusted EBITDA, Adjusted net income (loss), and Adjusted earnings per share, to evaluate the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against that of other peer companies using similar measures. These non-GAAP financial measures and other operating measures should not be considered in isolation or as substitutes for our results as reported under GAAP. In addition, these non-GAAP financial measures and other operating measures are not calculated in the same manner by all companies, and accordingly, are not necessarily comparable to similarly titled measures of other companies and may not be appropriate measures for performance relative to other companies.

Comparable Sales Growth

We measure comparable sales growth as the increase or decrease in sales recorded by the comparable base in any reporting period, compared to sales recorded by the comparable base in the prior reporting period. The comparable base includes sales through our locations and through our e-commerce websites and third-party marketplaces. Comparable sales growth is a key measure used by management and our board of directors to assess our financial performance.

Adjusted EBITDA

Adjusted EBITDA is defined as earnings before interest (including amortization of debt issuance costs), taxes, depreciation and amortization, management fees, equity-based compensation expense, loss on debt extinguishment, costs related to equity offerings, strategic project costs, executive transition costs, severance, losses (gains) on asset dispositions, merger and acquisition costs, and other non-recurring, non-cash or discrete items. Adjusted EBITDA is a key measure used by management and our board of directors to assess our financial performance. Adjusted EBITDA is also frequently used by analysts, investors, and other interested parties to evaluate companies in our industry, when considered alongside other GAAP measures. We use Adjusted EBITDA to supplement GAAP measures of performance to evaluate the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against that of other companies using similar measures.

3

Adjusted EBITDA is not a recognized measure of financial performance under GAAP but is used by some investors to determine a company’s ability to service or incur indebtedness. Adjusted EBITDA is not calculated in the same manner by all companies, and accordingly, is not necessarily comparable to similarly titled measures of other companies and may not be an appropriate measure for performance relative to other companies. Adjusted EBITDA should not be construed as an indicator of a company’s operating performance in isolation from, or as a substitute for, net income (loss), cash flows from operations or cash flow data, all of which are prepared in accordance with GAAP. We have presented Adjusted EBITDA solely as supplemental disclosure because we believe it allows for a more complete analysis of results of operations. Adjusted EBITDA is not intended to represent, and should not be considered more meaningful than, or as an alternative to, measures of operating performance as determined in accordance with GAAP. In the future, we may incur expenses or charges such as those added back to calculate Adjusted EBITDA. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these items.

Adjusted Net Income (Loss) and Adjusted Earnings per Share

Adjusted net income (loss) and Adjusted earnings per share are additional key measures used by management and our board of directors to assess our financial performance. Adjusted net income (loss) and Adjusted earnings per share are also frequently used by analysts, investors, and other interested parties to evaluate companies in our industry, when considered alongside other GAAP measures.

Adjusted net income (loss) is defined as net income (loss) adjusted to exclude management fees, equity-based compensation expense, loss on debt extinguishment, costs related to equity offerings, strategic project costs, executive transition costs, severance, losses (gains) on asset dispositions, merger and acquisition costs, and other non-recurring, non-cash, or discrete items. Adjusted diluted earnings per share is defined as Adjusted net income (loss) divided by the diluted weighted average number of common shares outstanding.

Note: A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty of expenses that may be incurred in the future, although it is important to note that these factors could be material to our results computed in accordance with GAAP.

Forward-Looking Statements

This press release contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical fact contained in this press release, including statements regarding our future results of operations or financial condition, business strategy, and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” or the negative of these words or other similar terms or expressions. Our actual results or outcomes could differ materially from those indicated in these forward-looking statements for a variety of reasons, including, among others:

•our ability to execute on our growth strategies;

•our ability to maintain favorable relationships with suppliers and manufacturers;

•competition from mass merchants and specialty retailers;

4

•impacts on our business from the sensitivity of our business to weather conditions, changes in the economy (including rising interest rates, recession fears, and inflationary pressures), geopolitical events or conflicts, and the housing market;

•disruptions in the operations of our distribution centers;

•our ability to implement technology initiatives that deliver the anticipated benefits, without disrupting our operations;

•our ability to attract and retain senior management and other qualified personnel;

•regulatory changes and development affecting our current and future products;

•our ability to obtain additional capital to finance operations;

•commodity price inflation and deflation;

•impacts on our business from epidemics, pandemics, or natural disasters;

•impacts on our business from cyber incidents and other security threats or disruptions;

•our ability to remediate the material weakness in our internal control over financial reporting or additional material weaknesses or other deficiencies in the future or to maintain effective disclosure controls and procedures and internal control over financial reporting; and

•other risks and uncertainties, including those listed in the section titled “Risk Factors” in our filings with the United States Securities and Exchange Commission (“SEC”).

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this press release primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors described above and in our filings with the SEC. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results or outcomes could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this press release, and while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this press release are based on events or circumstances as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments. Additionally, our expectations regarding the third quarter fiscal 2023 results are based on preliminary financial information about the third quarter and are subject to adjustment. Although the third quarter is now completed, we are still in the process of our standard financial reporting closing procedures.

5

GAAP to Non-GAAP Reconciliation of Preliminary Results

(Amounts in millions, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended July 1, 2023 |

|

|

|

Low |

|

|

High |

|

Net income |

|

$ |

70 |

|

|

$ |

73 |

|

Interest expense |

|

|

18 |

|

|

|

18 |

|

Income tax benefit |

|

|

23 |

|

|

|

24 |

|

Depreciation and amortization expense(1) |

|

|

8 |

|

|

|

8 |

|

Equity-based compensation expense(2) |

|

|

3 |

|

|

|

3 |

|

Strategic project costs(3) |

|

|

1 |

|

|

|

1 |

|

Executive transition costs and other(4) |

|

|

1 |

|

|

|

1 |

|

Adjusted EBITDA |

|

$ |

124 |

|

|

$ |

128 |

|

|

|

|

|

|

|

|

|

|

Three Months Ended July 1, 2023 |

|

|

|

Low |

|

|

High |

|

Net income |

|

$ |

70 |

|

|

$ |

73 |

|

Equity-based compensation expense(2) |

|

|

3 |

|

|

|

3 |

|

Strategic project costs(3) |

|

|

1 |

|

|

|

1 |

|

Executive transition costs and other(4) |

|

|

1 |

|

|

|

1 |

|

Tax effects of these adjustments(5) |

|

|

(2 |

) |

|

|

(2 |

) |

Adjusted net income |

|

$ |

73 |

|

|

$ |

76 |

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

0.37 |

|

|

$ |

0.39 |

|

Adjusted diluted earnings per share |

|

$ |

0.39 |

|

|

$ |

0.41 |

|

Weighted average shares outstanding |

|

|

|

|

|

|

Diluted |

|

|

185 |

|

|

|

185 |

|

(1)Includes depreciation related to our distribution centers and locations, which is reported in cost of merchandise and services sold in our condensed consolidated statements of operations.

(2)Represents charges related to equity-based compensation and the related Company payroll tax expense, which are reported in SG&A in our condensed consolidated statements of operations.

(3)Represents non-recurring costs, such as third-party consulting costs, which are not part of our ongoing operations and are incurred to execute differentiated, strategic projects, and are reported in SG&A in our condensed consolidated statements of operations.

(4)Includes executive transition costs, severance associated with corporate restructuring, losses (gains) on asset dispositions, merger and acquisition costs, and other non-recurring, non-cash, or discrete items as determined by management. Amounts are reported in SG&A in our condensed consolidated statements of operations.

(5)Represents the tax effect of the total adjustments based on our actual statutory tax rate. Amounts are reported in income tax expense in our condensed consolidated statements of operations.

Contact

Investors

Farah Soi/Caitlin Churchill

ICR

investorrelations@lesl.com

Media

FGS Global

Leslies@fgsglobal.com

6

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

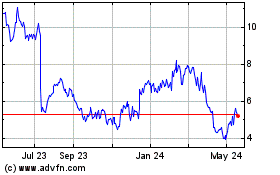

Leslies (NASDAQ:LESL)

Historical Stock Chart

From Oct 2024 to Nov 2024

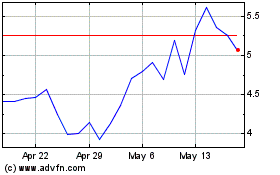

Leslies (NASDAQ:LESL)

Historical Stock Chart

From Nov 2023 to Nov 2024