Lumos Pharma, Inc. (NASDAQ:LUMO), a clinical-stage

biopharmaceutical company focused on therapeutics for rare

diseases, today announced financial results for the quarter ended

June 30, 2024 and provided a clinical programs update.

“Following our very positive and productive End

of Phase 2 Meeting with the FDA, we’ve made substantial progress

finalizing our proposal for a Phase 3 double-blinded,

placebo-controlled clinical trial with a 2:1 randomization in

approximately 150 subjects,” said Rick Hawkins, Chairman and CEO of

Lumos Pharma. “Our proposed trial design is informed by the FDA’s

prior feedback and recognition of LUM-201's mechanism of action as

a growth hormone secretagogue, as well as their acknowledgment that

a placebo-controlled clinical trial design is an appropriate option

for a LUM-201 Phase 3 trial. We expect to finalize design details

with the FDA in the fourth quarter. We are prudently managing our

current cash resources and evaluating all strategic opportunities

as we advance these plans and expect to be in a position to

initiate this trial in the second quarter of 2025.”

“During our second quarter we were also pleased

to present new analyses of data from our OraGrowtH212 Trial at ENDO

2024,” continued Mr. Hawkins. “These data further characterized

what we believe is LUM-201’s unique ability to augment the natural

pulsatile secretion of growth hormone and produce comparable growth

to injectable rhGH with significantly less exposure to circulating

growth hormone. Furthermore, with additional data, LUM-201

continues to demonstrate a durability of effect out to 24 months,

with a more sustainable annualized height velocity than injectable

growth hormone has shown in historical studies. We believe these

analyses provide additional support for our planned approach to a

placebo-controlled Phase 3 trial of LUM-201 in moderate PGHD.”

Strategic Update

The Company has engaged Piper Sandler & Co. to assist the

Board of Directors in evaluating strategic opportunities to

maximize stockholder value as the Company seeks to advance the

LUM-201 platform.

Q2 2024 Highlights

-

Company Advances Placebo-Controlled Phase 3 Trial Design

Suggested by FDA

-

At End-of-Phase 2 Meeting, FDA indicated that a placebo-controlled

trial design is an appropriate option for a Phase 3 trial for

LUM-201. We believe such a trial design would significantly improve

the probability of success and potential for commercialization of

the first oral therapy for moderate Pediatric GHD as compared to a

non-inferiority study

-

Placebo-controlled pivotal trial design supported by FDA’s

recognition of LUM-201’s mechanism of action as differentiated from

injectable growth hormone therapies

-

Company continues to advance planning for Phase 3 trial, with

initiation now anticipated in Q2 2025, allowing for manufacturing

and characterization of LUM-201-matched placebo capsule containing

mini-tablets

-

Finalization of Phase 3 trial design with FDA anticipated in Q4

2024

-

New Analyses of Phase 2 OraGrowtH212 Trial Presented in Two

Posters at ENDO 2024

-

Data from the posters further support the unique mechanism of

action of oral LUM-201 and shows a correlation between the pattern

of pulsatile growth hormone secretion and the growth response to

LUM-201

-

Oral LUM-201 Restores Pulsatile Growth Hormone Secretion and Growth

Response in Moderate Pediatric Growth Hormone Deficiency (PGHD):

Key Discoveries from Phase 2 of OraGrowtH212 Trial (Cassorla, et

al)

-

Growth Response to Oral Growth Hormone Secretagogue LUM-201 in

Children with Moderate GH Deficiency (GHD) is Dependent on the

Pattern of Pulsatile GH Secretion Stimulated by LUM-201 (Stevens,

et al)

Financial Results for Quarter Ended June

30, 2024

Cash Position – Lumos Pharma

ended the quarter on June 30, 2024, with cash, cash equivalents,

and short-term investments totaling $16.8 million, as compared to

$36.0 million on December 31, 2023. The Company is managing cash

conservatively and believes it has sufficient cash to support

operations into the first quarter of 2025.

R&D Expenses – Research and

development expenses were $4.6 million, a decrease of $1.4 million

for the quarter ended June 30, 2024, compared to the same period in

2023, primarily due to decreases of $1.1 million in contract

manufacturing expenses, $0.3 million in personnel-related expenses

and $0.2 million in clinical trial expenses, offset by an increase

of $0.2 million in consulting expenses.

G&A Expenses – General and

administrative expenses were $3.7 million, a decrease of $0.5

million compared to the same period in 2023, primarily due to

decreases of $0.2 million in personnel-related expenses, $0.1

million in travel expenses, $0.1 million in consulting expenses and

$0.1 million in other expenses.

Net Loss – The net loss for the

quarter ended June 30, 2024, was $7.6 million compared to a net

loss of $8.9 million for the same period in 2023.

Lumos Pharma ended Q2 2024 with 8,123,186 shares

outstanding.

Conference Call and Webcast Details

Date: Tuesday, August 1, 2024Time: 4:30PM ET

Dial-in: 1- 866-652-5200 or 1- 412-317-6060

(International)Conference ID: 10191274 Dial-in registration

(Available 15 minutes prior to scheduled start time): Click

HereDial-in registration passcode: 2835283Webcast: Click Here

Investors and the general public are invited to listen to the

conference call. To avoid delays, we encourage participants to dial

into the conference call ten minutes ahead of the scheduled start

time. The webcast link may also be found in the “Investors &

Media” section of the Lumos Pharma website, under “Events &

Presentations.” A replay will be available after the date of the

call and may be accessed through the same link above or found on

our website.

About Lumos Pharma

Lumos Pharma, Inc. is a clinical stage

biopharmaceutical company focused on the development and

commercialization of therapeutics for rare diseases. The Company

was founded and is led by a management team with longstanding

experience in rare disease drug development. Lumos Pharma’s lead

therapeutic candidate, LUM-201, is a novel, oral growth hormone

(GH) secretagogue, seeking to transform the ~$4.7B global

GH market from injectable to oral therapy. LUM-201 is currently

being evaluated in multiple Phase 2 clinical studies in Pediatric

Growth Hormone Deficiency (PGHD) and has received Orphan Drug

Designation in both the US and EU. For more information, please

visit https://lumos-pharma.com/.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements of Lumos Pharma, Inc. that involve substantial

risks and uncertainties. All such statements contained in this

press release are forward-looking statements within the meaning of

The Private Securities Litigation Reform Act of 1995. A law that,

in part, gives us the opportunity to share our outlook for the

future without fear of litigation if it turns out our predictions

were not correct.

We are passionate about our business - including

LUM-201 and the potential it may have to help patients in the

clinic. This passion feeds our optimism that our efforts will be

successful and bring about meaningful change for patients. Please

keep in mind that actual results or events could differ materially

from the plans, intentions and expectations disclosed in the

forward-looking statements that we make.

We have attempted to identify forward-looking

statements by using words such as “projected,” "upcoming," "will,"

“would,” "plan," “intend,” "anticipate," "approximate," "expect,"

“potential,” “imminent,” and similar references to future periods

or the negative of these terms. Not all forward-looking statements

contain these identifying words. Examples of forward-looking

statements include, among others, statements we make regarding our

finalization of design details for a Phase 3 clinical trial with

the FDA in the fourth quarter of 2024 and our positioning to

initiate this trial in the second quarter of 2025, that we believe

new analyses provide additional support for our planned approach to

a placebo-controlled Phase 3 trial of LUM-201 in moderate PGHD,

that we believe the trial design would improve the likelihood of

success when compared to a non-inferiority study, that cash on hand

is expected to support operations into Q1 2025, the potential for

LUM-201 to be the first oral therapeutic for PGHD, and any other

statements other than statements of historical fact.

We wish we were able to predict the future with

100% accuracy, but that just is not possible. Our forward-looking

statements are neither historical facts nor assurances of future

performance. You should not rely on any of these forward-looking

statements and, to help you make your own risk determinations, we

have provided an extensive discussion of risks that could cause

actual results to differ materially from our forward-looking

statements including risks related to the timing and ability of

Lumos Pharma to structure our Phase 3 trial in an effective and

timely manner, the ability to obtain FDA approval of, initiate and

advance a pivotal Phase 3 trial, as well as advance our clinical

and corporate strategy in general, our ability to obtain the

capital needed to fund a Phase 3 trial and other business

operations, our ability to forecast and manage future cash

utilization and reserves needed for contingent future liabilities

and business operations, the ability to successfully develop our

product candidate and other risks that could cause actual results

to differ materially from those matters expressed in or implied by

such forward-looking statements including information in the "Risk

Factors" section and elsewhere in Lumos Pharma’s Annual Report on

Form 10-K for the year ended December 31, 2023 and Quarterly

Reports on Form 10-Q for the periods ended March 31 and June

30, 2024, as well as other subsequent reports filed with

the SEC. All of these documents are available on our

website. Before making any decisions concerning our stock, you

should read and understand those documents.

We anticipate that subsequent events and

developments will cause our views to change. We may choose to

update these forward-looking statements at some point in the

future, however, we disclaim any obligation to do so. As a result,

you should not rely on these forward-looking statements as

representing our views as of any date subsequent to the date of

this press release.

Investor & Media Contact:

Lisa MillerLumos Pharma Investor

Relations512-792-5454ir@lumos-pharma.com

Source: Lumos Pharma, Inc.

|

Lumos Pharma, Inc. |

|

Condensed Consolidated Statements of Operations and

Comprehensive Loss |

|

(unaudited) |

|

(In thousands, except share and per share

amounts) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues: |

|

|

|

|

|

|

|

|

Royalty revenue |

$ |

488 |

|

|

$ |

527 |

|

|

$ |

653 |

|

|

$ |

1,218 |

|

| Total revenues |

|

488 |

|

|

|

527 |

|

|

|

653 |

|

|

|

1,218 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Research and development |

|

4,629 |

|

|

|

6,024 |

|

|

|

11,877 |

|

|

|

10,393 |

|

| General and

administrative |

|

3,682 |

|

|

|

4,146 |

|

|

|

7,461 |

|

|

|

8,503 |

|

| Total operating expenses |

|

8,311 |

|

|

|

10,170 |

|

|

|

19,338 |

|

|

|

18,896 |

|

| Loss from operations |

|

(7,823 |

) |

|

|

(9,643 |

) |

|

|

(18,685 |

) |

|

|

(17,678 |

) |

| Other income and expense: |

|

|

|

|

|

|

|

| Other income, net |

|

202 |

|

|

|

124 |

|

|

|

465 |

|

|

|

243 |

|

| Interest income |

|

70 |

|

|

|

559 |

|

|

|

228 |

|

|

|

1,129 |

|

|

Other income, net |

|

272 |

|

|

|

683 |

|

|

|

693 |

|

|

|

1,372 |

|

| Net loss before taxes |

$ |

(7,551 |

) |

|

$ |

(8,960 |

) |

|

$ |

(17,992 |

) |

|

$ |

(16,306 |

) |

| Income tax benefit |

|

— |

|

|

|

29 |

|

|

|

— |

|

|

|

29 |

|

| Net loss |

$ |

(7,551 |

) |

|

$ |

(8,931 |

) |

|

$ |

(17,992 |

) |

|

$ |

(16,277 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

| Basic and diluted |

$ |

(0.93 |

) |

|

$ |

(1.09 |

) |

|

$ |

(2.22 |

) |

|

$ |

(1.98 |

) |

| |

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

| Basic and diluted |

|

8,112,566 |

|

|

|

8,164,603 |

|

|

|

8,107,528 |

|

|

|

8,205,625 |

|

| |

|

|

|

|

|

|

|

| Other comprehensive

income: |

|

|

|

|

|

|

|

|

Unrealized loss on short-term investments |

|

— |

|

|

|

(6 |

) |

|

|

— |

|

|

|

(2 |

) |

| Total comprehensive loss |

$ |

(7,551 |

) |

|

$ |

(8,937 |

) |

|

$ |

(17,992 |

) |

|

$ |

(16,279 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lumos Pharma, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(In thousands, except share and per share

amounts) |

| |

June 30, |

|

December 31, |

| |

2024 |

|

2023 |

| |

(unaudited) |

|

|

| Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

16,799 |

|

|

$ |

35,078 |

|

|

Short-term investments |

|

— |

|

|

|

999 |

|

|

Prepaid expenses and other current assets |

|

3,925 |

|

|

|

3,748 |

|

|

Income tax receivable |

|

168 |

|

|

|

210 |

|

|

Total current assets |

|

20,892 |

|

|

|

40,035 |

|

| Non-current assets: |

|

|

|

|

Right-of-use asset |

|

463 |

|

|

|

603 |

|

| Total assets |

$ |

21,355 |

|

|

$ |

40,638 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

337 |

|

|

$ |

890 |

|

|

Accrued expenses |

|

4,294 |

|

|

|

5,858 |

|

|

Current portion of lease liability |

|

304 |

|

|

|

282 |

|

|

Total current liabilities |

|

4,935 |

|

|

|

7,030 |

|

| Long-term liabilities: |

|

|

|

|

Royalty obligation payable to Iowa Economic Development

Authority |

|

6,000 |

|

|

|

6,000 |

|

|

Lease liability |

|

145 |

|

|

|

303 |

|

| Total liabilities |

|

11,080 |

|

|

|

13,333 |

|

| Commitments and

contingencies: |

|

|

|

| Stockholders' equity: |

|

|

|

|

Undesignated preferred stock, $0.01 par value: Authorized shares -

5,000,000 at June 30, 2024 and December 31, 2023; issued

and outstanding shares - 0 at June 30, 2024 and

December 31, 2023 |

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value: Authorized shares - 75,000,000 at

June 30, 2024 and December 31, 2023; issued 8,151,900 and

8,125,728 at June 30, 2024 and December 31, 2023,

respectively and outstanding shares - 8,123,186 and 8,102,555 at

June 30, 2024 and December 31, 2023, respectively |

|

81 |

|

|

|

81 |

|

|

Treasury stock, at cost, 28,714 and 23,173 shares at June 30,

2024 and December 31, 2023, respectively |

|

(212 |

) |

|

|

(196 |

) |

|

Additional paid-in capital |

|

189,915 |

|

|

|

188,937 |

|

|

Accumulated deficit |

|

(179,509 |

) |

|

|

(161,517 |

) |

| Total stockholders'

equity |

|

10,275 |

|

|

|

27,305 |

|

| Total liabilities and

stockholders' equity |

$ |

21,355 |

|

|

$ |

40,638 |

|

| |

|

|

|

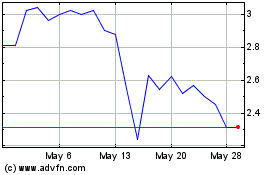

Lumos Pharma (NASDAQ:LUMO)

Historical Stock Chart

From Nov 2024 to Dec 2024

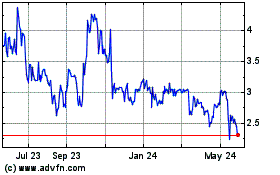

Lumos Pharma (NASDAQ:LUMO)

Historical Stock Chart

From Dec 2023 to Dec 2024