false000159097600015909762024-07-222024-07-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 18, 2024

MALIBU BOATS, INC.

(Exact Name of Registrant as specified in its charter)

Commission file number: 001-36290

| | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 5075 Kimberly Way, | Loudon, | Tennessee | 37774 | | 46-4024640 |

(State or other jurisdiction of

incorporation or organization) | | (Address of principal executive offices,

including zip code) | | (I.R.S. Employer

Identification No.) |

| | | | | |

| (865) | 458-5478 |

(Registrant’s telephone number,

including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 | MBUU | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 18, 2024, the Board of Directors (the “Board”) of Malibu Boats, Inc. (the “Company”) appointed Mr. Steven D. Menneto as the Company’s Chief Executive Officer, effective August 5, 2024 (the “Effective Date”). The Board increased the size of the Board from nine to ten members and also appointed, effective as of the Effective Date, Mr. Menneto to the Board as a Class II director, to serve until the Company’s 2024 annual meeting of stockholders and until his successor is duly elected and qualified. Mr. Menneto will not serve on any committees of the Board. Mr. Menneto will perform the functions of the Company’s principal executive officer.

Steven Menneto, 59, previously served in various positions at Polaris, Inc., a manufacturer of powersports vehicles, since 1997, most recently as President of the Off-Road Vehicle Division from December 2019 to July 2024. From May 2009 to December 2019, Mr. Menneto was President of the Motorcycle Division of Polaris, and prior to May 2009, he held various roles in sales at Polaris. Mr. Menneto previously served on the boards of directors of Polaris Acceptance Inc., a floor plan financing joint venture with Wells Fargo Bank, N.A., and Motorcycle Industry Council, a not-for profit trade association. Mr. Menneto received a B.S. in Business Administration from Northeastern University and received an M.B.A. from Rensselaer Polytechnic Institute.

In connection with Mr. Menneto’s appointment, effective as of the Effective Date, the Board of Directors terminated the position of the Office of Chief Executive Officer, comprised of Michael K. Hooks, the Chair of the Board, and Ritchie Anderson, President of the Company. Mr. Hooks will remain as Chair of the Board, but in the capacity as a non-executive chair, effective as of the Effective Date. Mr. Anderson will continue as President of the Company. Mr. Hooks will also become a member of the Nominating and Governance Committee of the Board upon the Effective Date.

Employment Arrangements with New Chief Executive Officer

Pursuant to his employment agreement with the Company, Mr. Menneto is entitled to receive a base salary of $920,000. For fiscal year 2025, Mr. Menneto will receive a cash bonus of 55% of his annual base salary, or $506,000, for fiscal year 2025, subject to Mr. Menneto being continuously and actively employed through the end of fiscal year 2025. Beginning in fiscal year 2026, Mr. Menneto will be eligible for a target annual cash bonus of not less than 110% of his annual base salary and a maximum annual cash bonus opportunity of not less than 200% of his target annual cash bonus, based upon the achievement of performance criteria established, in its sole discretion, by the Board or the Compensation Committee of the Board.

The employment agreement also provides that, on or as soon as practicable following the Effective Date, Mr. Menneto will be granted under the Company’s Long Term Incentive Plan (“LTIP”) restricted stock units with respect to 14,363 shares of the Company’s common stock (the “Bonus RSUs”) and an additional grant of restricted stock units with respect to 44,064 shares of the Company’s common stock (the “Sign-On RSUs”). The Bonus RSUs will vest on the first anniversary of the Effective Date and the Sign-On RSUs will vest in substantially equal annual installments over a three-year period, subject to Mr. Menneto’s continuous and active service with the Company. In addition, Mr. Menneto will receive an equity grant under the LTIP on the same basis as the Company’s other senior executive officers with a grant date value equal to $800,000 in November 2024 and with a target amount for Mr. Menneto’s equity grant in November 2025 equal to $2.7 million. Mr. Menneto is also eligible to participate in all employee benefit plans and vacation programs and is eligible for the use of a company-owned boat from each of the Company’s brands and reimbursement of certain relocation costs.

Under the employment agreement with Mr. Menneto, in the event the Board terminates his employment without “cause” or he resigns for “good reason” (as such terms are defined in the employment agreement), Mr. Menneto will be entitled to receive, subject to certain limitations including his execution of a release, a lump sum cash payment equal to 100% (or 200% if such termination occurs on or within 24 months after a change of control as defined in the LTIP) of the sum of (i) his highest salary during the one-year period prior to termination of employment plus (ii) his annual bonus earned with respect to the most recently completed fiscal year prior to termination or employment. In addition, in the event the Board terminates his employment without “cause” or he resigns for “good reason” or due to death or disability (as such terms are defined in the employment agreement), any unvested Bonus RSUs and Sign-On RSUs will become fully vested on the date of such termination. Further, if

the Board terminates Mr. Menneto’s employment without “cause” or he resigns for “good reason” within 24 months following a “change in control” (as such terms are defined in the employment agreement), Mr. Menneto’s unvested equity awards subject to time-based vesting will become fully vested and payable and his unvested equity awards subject to performance-based vesting will become vested and payable at target performance, in each case as of the termination date. In the event of a “qualified retirement” (as defined in the employment agreement), Mr. Menneto’s unvested equity awards subject to time-based vesting will become fully vested and payable and his unvested equity awards subject to performance-based vesting will vest based on actual performance at the end of each applicable performance period as if Mr. Menneto had remained actively employed by the Company through such date.

Mr. Menneto’s employment agreement also includes certain restrictive covenants, including a confidentiality clause, post-termination non-competition clause, a post-termination non-solicitation clause, and a non-disparagement clause. In addition, under the employment agreement, the Company has agreed to indemnify and make Mr. Menneto whole with respect to certain actions that may be taken by his prior employer.

The foregoing description of the Employment Agreement is qualified in its entirety by reference to the full text of the employment agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Mr. Menneto is also expected to enter into an indemnification agreement with the Company in the form previously approved by the Board and filed with the Securities and Exchange Commission (“SEC”) as Exhibit 10.12 to the Company’s Annual Report on Form 10-K for the year ended June 30, 2023, filed with the SEC on August 29, 2023.

There are no arrangements or understandings between Mr. Menneto and any other persons pursuant to which he was selected as an officer or director of the Company. There are also no family relationships between Mr. Menneto and any director or executive officer of the Company and Mr. Menneto has no direct or indirect material interest in any related party transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 7.01. Regulation FD Disclosure.

On July 22, 2024, the Company issued a press release announcing, amongst other things, the appointment of Mr. Menneto as Chief Executive Officer of the Company and as a member of the Board, a copy of which is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is being furnished as part of this report:

| | | | | | | | |

Exhibit No. | | Description |

| | |

| | Press Release dated July 22, 2024 |

Exhibit 104 | | The Cover Page from this Current Report on Form 8-K formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| MALIBU BOATS, INC. | |

| | | |

| | | |

| | | |

| By: | /s/ Bruce Beckman | |

| Date: July 22, 2024 | | | Bruce Beckman | |

| | Chief Financial Officer | |

MALIBU BOATS, INC. ANNOUNCES APPOINTMENT OF STEVEN D. MENNETO AS CEO

LOUDON, Tenn., July 22, 2024 (GLOBE NEWSWIRE) -- Malibu Boats, Inc. (Nasdaq: MBUU) today announced the appointment of Steven D. Menneto as its new Chief Executive Officer (“CEO”), effective August 5, 2024. Mr. Menneto will also join Malibu Boats’ Board of Directors (the “Board”), which will increase from nine to ten members. In connection with Mr. Menneto’s appointment, the Office of the CEO, consisting of Ritchie Anderson, the Company’s President, as well as Michael K. Hooks, the Chair of the Board, will end. Mr. Hooks will remain Board Chair and Mr. Anderson will remain President of the Company.

Mr. Menneto joins Malibu Boats from Polaris, where he was most recently President of the Off-Road Vehicle Division. In that role he nearly doubled the division’s revenue to $7 billion over the course of four years while overseeing a large global manufacturing footprint. Mr. Menneto previously ran Polaris’ Motorcycle Division, during which time he drove significant growth including building the Indian Motorcycle business from $3 million to approximately $500 million in revenue. Early in his career, Mr. Menneto owned his own Polaris dealership.

Mr. Hooks stated, “We are thrilled to welcome Steve as our new CEO. The Board conducted a comprehensive search process that included discussions with multiple highly qualified candidates who were attracted by the opportunity to lead a premier manufacturer with premium brands across multiple segments. Steve emerged as the clear choice given the direct alignment of his experience, skill set and track record with our business needs and strategic priorities. He brings a well-rounded background with experience across functional areas and especially sales and managing distribution. Steve has a demonstrated history of leading organizations through periods of growth and is the ideal candidate to build on our strong foundation and drive further value creation.”

Mr. Menneto stated, “I am honored and excited to be named Malibu Boats’ next CEO. I have long admired the company’s stellar track record, history of innovation and top of the line products. As I take on this role, I look forward to helping the company leverage its excellent growth opportunities. With the support of Malibu Boats’ tremendous team, I believe there is a great deal we can achieve to build an even better business while continuing to provide the highest quality boats on the market and delivering for all our stakeholders.”

Steven Menneto Biography

Mr. Menneto, 59, previously served in various positions at Polaris, Inc., a manufacturer of powersports vehicles, since 1997, most recently as President of the Off-Road Vehicle Division from December 2019 to July 2024. From May 2009 to December 2019, Mr. Menneto was

President of the Motorcycle Division of Polaris, and prior to May 2009, he held various roles in sales at Polaris.

Mr. Menneto previously served on the boards of directors of Polaris Acceptance Inc., a floor plan financing joint venture with Wells Fargo Bank, N.A., and Motorcycle Industry Council, a not-for-profit trade association. Mr. Menneto received a B.S. in Business Administration from Northeastern University and received an M.B.A. from Rensselaer Polytechnic Institute.

Cautionary Statement Concerning Forward Looking Statements

This press release includes forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). Forward-looking statements can be identified by such words and phrases as “believes,” “anticipates,” “expects,” “intends,” “estimates,” “may,” “will,” “should,” “continue” and similar expressions, comparable terminology or the negative thereof, and includes statements in this press release regarding the ability to build a better business and deliver value to stockholders of the Company. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, including, but not limited to: general industry, economic and business conditions; the Company’s large fixed cost base; increases in the cost of, or unavailability of, raw materials, component parts and transportation costs; disruptions in the Company’s suppliers’ operations; the Company’s reliance on third-party suppliers for raw materials and components and any interruption of the Company’s informal supply arrangements; the Company’s reliance on certain suppliers for our engines and outboard motors; the Company’s ability to meet its manufacturing workforce needs; the Company’s ability to grow its business through acquisitions and integrate such acquisitions to fully realize their expected benefits; the Company’s growth strategy which may require it to secure significant additional capital; the Company’s ability to protect its intellectual property; disruptions to the Company’s network and information systems; risks inherent in operating in foreign jurisdictions; a natural disaster, global pandemic or other disruption at the Company’s manufacturing facilities; increases in income tax rates or changes in income tax laws; the Company’s dependence on key personnel; the Company’s ability to enhance existing products and market new or enhanced products; the continued strength of the Company’s brands; the seasonality of the Company’s business; intense competition within the Company’s industry; increased consumer preference for used boats or the supply of new boats by competitors in excess of demand; competition with other activities for consumers’ scarce leisure time; changes in currency exchange rates; inflation and increases in interest rates; an increase in energy and fuel costs; the Company’s reliance on its network of independent dealers and increasing competition for dealers; the financial health of the Company’s dealers and their continued access to financing; the Company’s obligation to repurchase inventory of certain dealers; the Company’s exposure to claims for product liability and warranty claims; any failure to comply with laws and regulations including environmental, workplace safety and other regulatory requirements; the Company’s variable rate indebtedness which subjects it to interest rate risk; the Company’s obligation to make certain payments under a tax receivables agreement; and other factors affecting us detailed from time to time in the Company’s filings with the Securities and Exchange Commission. Many of these risks and uncertainties are outside the Company’s control, and there may be other risks and uncertainties which the Company does not currently anticipate because they relate to events and depend on

circumstances that may or may not occur in the future. Although the Company believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions at the time made, the Company can give no assurance that its expectations will be achieved. Undue reliance should not be placed on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation (and the Company expressly disclaims any obligation) to update or supplement any forward-looking statements that may become untrue because of subsequent events, whether because of new information, future events, changes in assumptions or otherwise.

About Malibu Boats, Inc.

Based in Loudon, Tennessee, Malibu Boats, Inc. (MBUU) is a leading designer, manufacturer and marketer of a diverse range of recreational powerboats, including performance sport, sterndrive and outboard boats. Malibu Boats, Inc. is the market leader in the performance sport boat category through its Malibu and Axis boat brands, the leader in the 20’ - 40’ segment of the sterndrive boat category through its Cobalt brand, and in a leading position in the saltwater fishing boat market with its Pursuit and Cobia offshore boats and Pathfinder, Maverick, and Hewes flats and bay boat brands. A pre-eminent innovator in the powerboat industry, Malibu Boats, Inc. designs products that appeal to an expanding range of recreational boaters, fisherman and water sports enthusiasts whose passion for boating is a key component of their active lifestyles. For more information, visit www.malibuboats.com, www.axiswake.com, www.cobaltboats.com, www.pursuitboats.com, or www.maverickboatgroup.com.

Contacts

Malibu Boats, Inc. InvestorRelations@MalibuBoats.com

v3.24.2

Cover Page

|

Jul. 22, 2024 |

| Cover [Abstract] |

|

| City Area Code |

(865)

|

| Entity Registrant Name |

MALIBU BOATS, INC.

|

| Amendment Flag |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.01

|

| Written Communications |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36290

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 18, 2024

|

| Entity Address, Address Line One |

5075 Kimberly Way,

|

| Entity Address, City or Town |

Loudon,

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37774

|

| Entity Tax Identification Number |

46-4024640

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

MBUU

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001590976

|

| Local Phone Number |

458-5478

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

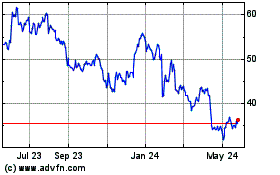

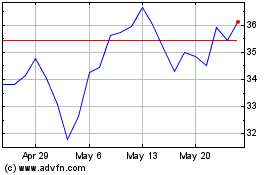

Malibu Boats (NASDAQ:MBUU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Malibu Boats (NASDAQ:MBUU)

Historical Stock Chart

From Feb 2024 to Feb 2025