Playboy Enterprises, Inc. (the “Company” or “Playboy”), and

Mountain Crest Acquisition Corp (Nasdaq: MCAC) (“Mountain Crest”),

a publicly-traded special purpose acquisition corporation, today

announced that the two companies will participate in a webinar

hosted by SPACInsider and ICR on January 29, 2021 at 12:00 p.m. ET.

Learn more and register for the event

at:https://icrinc.zoom.us/webinar/register/1716027793907/WN_GKWqbHkeSyuWetJmLFkj4g

Participants in the webinar will include:

- Ben Kohn, CEO, Playboy

- Rachel Webber, Chief Brand &

Strategy Officer, Playboy

- Dr. Suying Liu, Chairman and CEO,

Mountain Crest Acquisition Corp

Playboy’s return to the public markets presents a transformed,

streamlined and high-growth business. The Company has over $400

million in cash flows contracted through 2029, sexual wellness

products available for sale online and in over 10,000 major retail

stores in the US, and a growing variety of clothing and branded

lifestyle and digital gaming products.

As previously announced, upon closing of the business

combination, Mountain Crest will be renamed “PLBY Group, Inc.” and

is expected to trade on the Nasdaq Stock Market under a new ticker

symbol, “PLBY.” As part of the deal, Playboy will retain its highly

experienced management team, led by CEO Ben Kohn, to lead the

Company’s strategic transformation.

About PlayboyPlayboy is one of the largest and

most recognizable global lifestyle platforms in the world, with a

strong consumer business focused on four categories comprising The

Pleasure Lifestyle: Sexual Wellness, Style & Apparel, Gaming

& Lifestyle and Beauty & Grooming. Under its mission of

Pleasure for All, the 67-year-old Playboy brand drives more than $3

billion in global consumer spend and sells products across 180

countries. Playboy is one of the most iconic brands in history.

About Mountain Crest Acquisition

Corp Mountain Crest Acquisition Corp is a blank check

company formed for the purpose of effecting a merger, share

exchange, asset acquisition, share purchase, reorganization or

similar business combination with one or more businesses. Visit

https://www.mcacquisition.com/.

About SPACInsiderSPACInsider is a trusted

intelligence and analysis provider specializing in the Special

Purpose Acquisition Corporation (SPAC) asset class. SPACInsider’s

mission is to be the best-in-class source for SPAC information

benefiting investors, SPAC teams, bankers and service providers.

The company provides comprehensive data covering the SPAC

transaction universe, along with detailed analysis and coverage of

IPO and acquisition events. SPACInsider is led by Kristi Marvin, a

career investment banker with over 15 years of experience in the

capital markets, who began working on SPACs in 2005.

About ICREstablished in 1998, ICR partners with

companies to execute strategic communications and advisory programs

that achieve business goals, build awareness and credibility, and

enhance long-term enterprise value. The firm’s

highly-differentiated service model, which pairs capital markets

veterans with senior communications professionals, brings deep

sector knowledge and relationships to more than 650 clients in

approximately 20 industries. ICR’s healthcare practice operates

under the Westwicke brand (www.westwicke.com). Today, ICR is one of

the largest and most experienced independent communications and

advisory firms in North America, maintaining offices in New York,

Norwalk, Boston, Baltimore, San Francisco, San Diego and Beijing.

ICR also advises on capital markets transactions through ICR

Capital, LLC. Learn more at www.icrinc.com. Follow us on Twitter at

@ICRPR.

Important Information About the Proposed

Business Combination and Where to Find ItIn connection

with the proposed business combination, Mountain Crest filed its

definitive proxy statement on Schedule 14A on January 21, 2021 with

the Securities and Exchange Commission (the “SEC”), and intends to

file additional relevant materials when available. . Mountain

Crest’s stockholders and other interested persons are advised to

read the definitive proxy statement filed in connection with the

proposed business combination, as these materials contain important

information about Playboy, Mountain Crest, and the proposed

business combination. Mountain Crest has mailed the definitive

proxy statement and a proxy card to each stockholder of record

entitled to vote at the special meeting on the business combination

and the other proposals. STOCKHOLDERS OF MOUNTAIN CREST ARE URGED

TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE

BUSINESS COMBINATION THAT MOUNTAIN CREST FILES WITH THE SEC BECAUSE

THEY CONTAIN IMPORTANT INFORMATION ABOUT MOUNTAIN CREST, PLAYBOY,

AND THE BUSINESS COMBINATION. Stockholders are also able to obtain

copies of the definitive proxy statement and other relevant

materials filed with the SEC, without charge, at the SEC’s website

at www.sec.gov, or by visiting the investor relations section of

https://www.mcacquisition.com/.

Participants in the

SolicitationMountain Crest and its directors and executive

officers may be deemed participants in the solicitation of proxies

from Mountain Crest’s stockholders with respect to the business

combination. A list of the names of those directors and executive

officers and a description of their interests in Mountain Crest are

included in the definitive proxy statement for the proposed

business combination and are available at www.sec.gov. Information

about Mountain Crest’s directors and executive officers and their

ownership of Mountain Crest common stock is set forth in Mountain

Crest’s prospectus, dated June 4, 2020 and in the definitive proxy

statement, as modified or supplemented by any Form 3 or Form 4

filed with the SEC since the date of such filings. Other

information regarding the interests of the participants in the

proxy solicitation is included in the definitive proxy statement

pertaining to the proposed business combination. These documents

can be obtained free of charge from the sources indicated

above.

Playboy and its directors and executive officers

may also be deemed to be participants in the solicitation of

proxies from the stockholders of Mountain Crest in connection with

the proposed business combination. A list of the names of such

directors and executive officers and information regarding their

interests in the proposed business combination is included in the

definitive proxy statement for the proposed business

combination.

Forward-Looking StatementsThis

press release includes “forward-looking statements” within the

meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Mountain Crest’s

and Playboy’s actual results may differ from their expectations,

estimates, and projections and, consequently, you should not rely

on these forward-looking statements as predictions of future

events. Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue,” and

similar expressions (or the negative versions of such words or

expressions) are intended to identify such forward-looking

statements. These forward-looking statements include, without

limitation, Mountain Crest’s and Playboy’s expectations with

respect to future performance and anticipated financial impacts of

the proposed business combination, the satisfaction of the closing

conditions to the proposed business combination, and the timing of

the completion of the proposed business combination.

These forward-looking statements involve

significant risks and uncertainties that could cause the actual

results to differ materially from those discussed in the

forward-looking statements. Factors that may cause such differences

include, but are not limited to: (1) the occurrence of any event,

change, or other circumstances that could give rise to the

termination of the definitive merger agreement (the “Agreement”) or

could otherwise cause the transaction to fail to close; (2) the

outcome of any legal proceedings that may be instituted against

Mountain Crest and Playboy following the announcement of the

Agreement and the transactions contemplated therein; (3) the

inability to complete the proposed business combination, including

due to failure to obtain approval of the stockholders of Mountain

Crest and certain regulatory approvals, or to satisfy other

conditions to closing in the Agreement; (4) the impact of COVID-19

pandemic on Playboy’s business and/or the ability of the parties to

complete the proposed business combination; (5) the inability to

obtain or maintain the listing of Mountain Crest’s shares of common

stock on Nasdaq following the proposed business combination; (6)

the risk that the proposed business combination disrupts current

plans and operations as a result of the announcement and

consummation of the proposed business combination; (7) the ability

to recognize the anticipated benefits of the proposed business

combination, which may be affected by, among other things,

competition, the ability of Playboy to grow and manage growth

profitably, and retain its key employees; (8) costs related to the

proposed business combination; (9) changes in applicable laws or

regulations; (10) the possibility that Mountain Crest or Playboy

may be adversely affected by other economic, business, and/or

competitive factors; (11) risks relating to the uncertainty of the

projected financial information with respect to Playboy; (12) risks

related to the organic and inorganic growth of Playboy’s business

and the timing of expected business milestones; (13) the amount of

redemption requests made by Mountain Crest’s stockholders; and (14)

other risks and uncertainties indicated from time to time in the

final prospectus of Mountain Crest for its initial public offering

and the definitive proxy statement relating to the proposed

business combination, including those under “Risk Factors” therein,

and in Mountain Crest’s other filings with the SEC. Mountain Crest

cautions that the foregoing list of factors is not exclusive.

Mountain Crest and Playboy caution readers not to place undue

reliance upon any forward-looking statements, which speak only as

of the date made. Mountain Crest and Playboy do not undertake or

accept any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements to reflect

any change in their expectations or any change in events,

conditions, or circumstances on which any such statement is

based.

No Offer or SolicitationThis

press release shall not constitute a solicitation of a proxy,

consent, or authorization with respect to any securities or in

respect of the proposed business combination. This press release

shall also not constitute an offer to sell or the solicitation of

an offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, or an exemption therefrom.

Contacts:InvestorsPlayboyIR@icrinc.comMediaPlayboyPR@icrinc.com

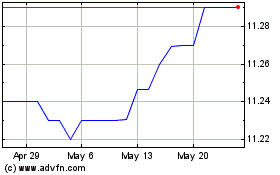

Monterey Capital Acquisi... (NASDAQ:MCAC)

Historical Stock Chart

From Feb 2025 to Mar 2025

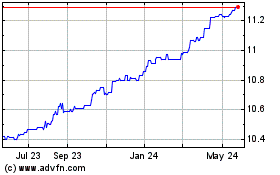

Monterey Capital Acquisi... (NASDAQ:MCAC)

Historical Stock Chart

From Mar 2024 to Mar 2025