Microchip Technology Updates December 2024 Quarter Revenue Guidance, and Announces Manufacturing Restructuring Plans

December 02 2024 - 3:15PM

Microchip Technology Incorporated, a leading provider of smart,

connected, and secure embedded control solutions, provided lower

updated revenue guidance for the December 2024 quarter and

announced manufacturing restructuring plans.

"In the first two weeks of my newly appointed role as Interim

CEO and President, I have done a deep dive into the operations of

the Company and determined that certain actions are necessary. I

want to clarify for investors that I plan to stay in this role,

even though the title is interim, for as long as it is necessary,

so there is no definitive timeline for my successor," said Steve

Sanghi, Microchip's CEO, President and Chair of the Board. Mr.

Sanghi continued, "We indicated in our November 2, 2024 earnings

call that significant turns orders were required to achieve the

midpoint of our December 2024 quarter revenue guidance. Those turns

orders have been slower than anticipated and we now expect our

December 2024 revenue to be close to the low end of our original

guidance which is $1.025 billion."

Mr. Sanghi added, "With inventory levels high and having ample

capacity in place, we have decided to shut down our Tempe wafer

fabrication facility that we refer to as Fab 2. Many of the process

technologies that run in Fab 2 also run in our Oregon and Colorado

factories, which both have ample clean room space for expansion. We

expect to be able to shut down Fab 2 in the September 2025 quarter

at which time we expect that it will generate annual cash savings

of approximately $90 million. Due to the high inventory of the

products which are manufactured in Fab 2, we do not expect to see

P&L savings from the shutdown until the start of the June 2026

quarter based on a First-In First-Out basis. We expect that the Fab

2 closure will begin to help us moderate our inventory levels

beginning in the March 2025 quarter. We anticipate near-term

restructuring costs to be between $3 million and $8 million from

these actions, and it is possible that we could incur other

restructuring and shut-down costs in the future of up to an

additional $15 million. The estimates of the restructuring costs

will be refined over time as more information becomes

available."

Mr. Sanghi concluded, "I want to ensure investors of my

confidence in the long-term growth and profitability of Microchip.

Our design-in momentum continues to remain strong, driven by our

Total System Solutions strategy and key market megatrends. The fab

restructuring is a big step in right-sizing our manufacturing

footprint, and we will continue to evaluate any further actions

that are required to position Microchip for outsized growth and

financial performance."

Microchip will be participating in and presenting at the UBS

Global Technology and AI Conference on December 3 and 4, 2024.

Cautionary Statement:

The statements in this release relating to Mr. Sanghi planning

to stay in the CEO and President role for as long as it is

necessary, no definitive timeline for his successor, that turns

orders have been slower than anticipated and that we now expect our

December 2024 revenue to be close to the low end of our original

guidance which is $1.025 billion, that we have ample capacity in

place, that our Oregon and Colorado factories both have ample clean

room space for expansion, that we expect to be able to shut down

Fab 2 in the September 2025 quarter at which time it is expected to

generate annual cash savings of approximately $90 million, that we

do not expect to see P&L savings from the shutdown until the

start of the June 2026 quarter, that we expect that the Fab 2

closure will begin to help us moderate our inventory levels

beginning in the March 2025 quarter, that we anticipate near-term

restructuring costs to be between $3 million and $8 million, that

is is possible that we could incur other restructuring and

shut-down costs of up to an additional $15 million, ensuring

investors of my confidence in the long-term growth and

profitability of Microchip, that our design-in momentum continues

to remain strong driven by our Total System Solutions strategy and

key market megatrends, that the fab restructuring is a big step in

right sizing our manufacturing footprint, that we will continue to

evaluate any further actions that are required to position

Microchip for outsized growth and financial performance are

forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These statements involve risks and uncertainties that could cause

our actual results to differ materially, including, but not limited

to: any continued uncertainty, fluctuations or weakness in the U.S.

and world economies (including China and Europe) due to changes in

interest rates, high inflation, actions taken or which may be taken

by the Biden administration or the U.S. Congress or by the incoming

Trump administration and the incoming U.S. Congress, monetary

policy, political, geopolitical, trade or other issues in the U.S.

or internationally (including the military conflicts in

Ukraine-Russia and the Middle East), further changes in demand or

market acceptance of our products and the products of our customers

and our ability to respond to any increases or decreases in market

demand or customer requests to reschedule or cancel orders; the mix

of inventory we hold, our ability to satisfy any short-term orders

from our inventory and our ability to effectively manage our

inventory levels; the impact that the CHIPS Act will have on

increasing manufacturing capacity in our industry by providing

incentives for us, our competitors and foundries to build new wafer

manufacturing facilities or expand existing facilities; the amount

and timing of any incentives we may receive under the CHIPS Act,

the impact of current and future changes in U.S. corporate tax laws

(including the Inflation Reduction Act of 2022 and the Tax Cuts and

Jobs Act of 2017), foreign currency effects on our business;

changes in utilization of our manufacturing capacity and our

ability to effectively manage our production levels to meet any

increases or decreases in market demand or any customer requests to

reschedule or cancel orders; the impact of inflation on our

business; competitive developments including pricing pressures; the

level of orders that are received and can be shipped in a quarter;

our ability to realize the expected benefits of our long-term

supply assurance program; changes or fluctuations in customer order

patterns and seasonality; our ability to effectively manage our

supply of wafers from third party wafer foundries to meet any

decreases or increases in our needs and the cost of such wafers,

our ability to obtain additional capacity from our suppliers to

increase production to meet any future increases in market demand;

our ability to successfully integrate the operations and employees,

retain key employees and customers and otherwise realize the

expected synergies and benefits of our acquisitions; the impact of

any future significant acquisitions or strategic transactions we

may make; the costs and outcome of any current or future litigation

or other matters involving our acquisitions (including the acquired

business, intellectual property, customers, or other issues); the

costs and outcome of any current or future tax audit or

investigation regarding our business or our acquired businesses;

fluctuations in our stock price and trading volume which could

impact the number of shares we acquire under our share repurchase

program and the timing of such repurchases; disruptions in our

business or the businesses of our customers or suppliers due to

natural disasters (including any floods in Thailand), terrorist

activity, armed conflict, war, worldwide oil prices and supply,

public health concerns or disruptions in the transportation system;

and general economic, industry or political conditions in the

United States or internationally.

For a detailed discussion of these and other risk factors,

please refer to Microchip's filings on Forms 10-K and 10-Q. You can

obtain copies of Forms 10-K and 10-Q and other relevant documents

for free at Microchip's website (www.microchip.com) or the SEC's

website (www.sec.gov) or from commercial document retrieval

services.

Stockholders of Microchip are cautioned not to place undue

reliance on our forward-looking statements, which speak only as of

the date such statements are made. Microchip does not undertake any

obligation to publicly update any forward-looking statements to

reflect events, circumstances or new information after this

December 2, 2024 press release, or to reflect the occurrence of

unanticipated events.

About Microchip:

Microchip Technology Incorporated is a leading provider of

smart, connected and secure embedded control solutions. Its

easy-to-use development tools and comprehensive product portfolio

enable customers to create optimal designs, which reduce risk while

lowering total system cost and time to market. Our solutions serve

approximately 116,000 customers across the industrial, automotive,

consumer, aerospace and defense, communications and computing

markets. Headquartered in Chandler, Arizona, Microchip offers

outstanding technical support along with dependable delivery and

quality. For more information, visit the Microchip website at

www.microchip.com.

Note: The Microchip name and logo are registered

trademarks of Microchip Technology Incorporated in the U.S.A. and

other countries. All other trademarks mentioned herein are the

property of their respective companies.

INVESTOR RELATIONS CONTACT:J. Eric Bjornholt,

Senior Vice President and CFO (480) 792-7804

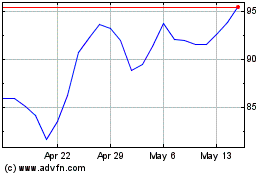

Microchip Technology (NASDAQ:MCHP)

Historical Stock Chart

From Jan 2025 to Feb 2025

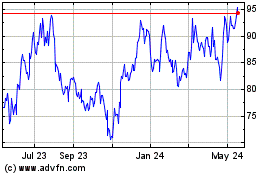

Microchip Technology (NASDAQ:MCHP)

Historical Stock Chart

From Feb 2024 to Feb 2025