0001425355false--12-31FY2024false0.0011111111116385255falsefalsefalsefalse60000000014253552024-01-012024-12-310001425355us-gaap:SubsequentEventMember2025-01-220001425355us-gaap:SubsequentEventMembermcvt:ExecutiveEmploymentAgreementsMember2025-01-312025-02-010001425355us-gaap:SubsequentEventMembermcvt:ExecutiveEmploymentAgreementsMember2025-01-240001425355us-gaap:SubsequentEventMember2025-01-240001425355us-gaap:SubsequentEventMember2025-01-012025-01-2200014253552020-01-012020-12-3100014253552021-01-012021-12-3100014253552022-01-012022-12-3100014253552019-12-3100014253552020-12-3100014253552021-12-310001425355mcvt:TwoShareholdersMember2024-12-310001425355mcvt:TwoZeroTwoTwoStockIncentivePlanMember2024-12-310001425355mcvt:OptionsMember2024-01-012024-12-310001425355mcvt:OptionsMember2024-12-310001425355us-gaap:RevolvingCreditFacilityMembermcvt:EastmanInvestmentIncMembermcvt:LoanAndSecurityAgreementMember2024-12-310001425355mcvt:AttributableToLevelThreePortfolioInvestmentMember2024-01-012024-12-310001425355mcvt:AttributableToLevelThreePortfolioInvestmentMember2023-01-012023-12-310001425355us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMembermcvt:TopMembermcvt:ShortTermBankingLoansMember2024-12-310001425355us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMembermcvt:BottomMembermcvt:ShortTermBankingLoansMember2024-12-310001425355us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMembermcvt:TopMembermcvt:ShortTermBankingLoansMember2023-12-310001425355us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMembermcvt:BottomMembermcvt:ShortTermBankingLoansMember2023-12-310001425355mcvt:PreferredStockSharesMember2024-12-310001425355mcvt:PreferredStockSharesMember2023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:OtherEquityMember2023-01-012023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:OtherEquityMember2022-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:OtherEquityMember2024-01-012024-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:CommonStockSharesMember2024-01-012024-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:PreferredStocksSharesMember2024-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:PreferredStocksSharesMember2022-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:PreferredStocksSharesMember2023-01-012023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:PreferredStocksSharesMember2024-01-012024-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:ShortTermBankingLoansMember2024-01-012024-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:ShortTermBankingLoansMember2023-01-012023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:ShortTermBankingLoansMember2022-12-310001425355us-gaap:FairValueInputsLevel1Member2023-12-310001425355us-gaap:FairValueInputsLevel1Member2024-12-310001425355us-gaap:FairValueInputsLevel1Membermcvt:OtherEquityMember2023-12-310001425355us-gaap:FairValueInputsLevel1Membermcvt:OtherEquityMember2024-12-310001425355us-gaap:FairValueInputsLevel1Membermcvt:WarrantsMember2023-12-310001425355us-gaap:FairValueInputsLevel1Membermcvt:PreferredStocksSharesMember2023-12-310001425355us-gaap:FairValueInputsLevel1Membermcvt:CommonStockSharesMember2023-12-310001425355us-gaap:FairValueInputsLevel1Membermcvt:CommonStockSharesMember2024-12-310001425355us-gaap:FairValueInputsLevel1Membermcvt:ShortTermBankingLoansMember2023-12-310001425355us-gaap:FairValueInputsLevel1Membermcvt:ShortTermBankingLoansMember2024-12-310001425355us-gaap:FairValueInputsLevel2Member2024-12-310001425355us-gaap:FairValueInputsLevel2Member2023-12-310001425355us-gaap:FairValueInputsLevel2Membermcvt:OtherEquityMember2024-12-310001425355us-gaap:FairValueInputsLevel2Membermcvt:OtherEquityMember2023-12-310001425355us-gaap:FairValueInputsLevel2Membermcvt:WarrantsMember2023-12-310001425355us-gaap:FairValueInputsLevel2Membermcvt:PreferredStocksSharesMember2023-12-310001425355us-gaap:FairValueInputsLevel2Membermcvt:CommonStockSharesMember2024-12-310001425355us-gaap:FairValueInputsLevel2Membermcvt:CommonStockSharesMember2023-12-310001425355us-gaap:FairValueInputsLevel2Membermcvt:ShortTermBankingLoansMember2024-12-310001425355us-gaap:FairValueInputsLevel2Membermcvt:ShortTermBankingLoansMember2023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:OtherEquityMember2024-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:OtherEquityMember2023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:WarrantsMember2023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:PreferredStocksSharesMember2023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:CommonStockSharesMember2024-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:CommonStockSharesMember2023-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:ShortTermBankingLoansMember2024-12-310001425355us-gaap:FairValueInputsLevel3Membermcvt:ShortTermBankingLoansMember2023-12-310001425355us-gaap:FairValueInputsLevel3Member2024-12-310001425355us-gaap:FairValueInputsLevel3Member2023-12-310001425355mcvt:RealEstatesSectorMember2023-01-012023-12-310001425355mcvt:RealEstatesSectorMember2024-01-012024-12-310001425355mcvt:RealEstatesSectorMember2023-12-310001425355mcvt:RealEstatesSectorMember2024-12-310001425355mcvt:TechnologySectorsMember2023-01-012023-12-310001425355mcvt:TechnologySectorsMember2024-01-012024-12-310001425355mcvt:TechnologySectorsMember2023-12-310001425355mcvt:TechnologySectorsMember2024-12-310001425355mcvt:FinancialServicesSectorsMember2023-01-012023-12-310001425355mcvt:FinancialServicesSectorsMember2024-01-012024-12-310001425355mcvt:FinancialServicesSectorsMember2023-12-310001425355mcvt:FinancialServicesSectorsMember2024-12-310001425355mcvt:CommercialsAndIndustrialSectorMember2023-01-012023-12-310001425355mcvt:CommercialsAndIndustrialSectorMember2024-01-012024-12-310001425355mcvt:CommercialsAndIndustrialSectorMember2023-12-310001425355mcvt:CommercialsAndIndustrialSectorMember2024-12-310001425355mcvt:BusinessServicesServicesSectorsMember2023-01-012023-12-310001425355mcvt:BusinessServicesServicesSectorsMember2024-01-012024-12-310001425355mcvt:BusinessServicesServicesSectorsMember2024-12-310001425355mcvt:BusinessServicesServicesSectorsMember2023-12-310001425355mcvt:OtherEquityMember2023-01-012023-12-310001425355mcvt:WarrantsMember2023-01-012023-12-310001425355mcvt:CommonStockSharesMember2023-01-012023-12-310001425355mcvt:CommonStockSharesMember2024-01-012024-12-310001425355mcvt:PreferredStocksSharesMember2023-01-012023-12-310001425355mcvt:ShortTermBankingLoansMember2023-01-012023-12-310001425355mcvt:OtherEquityMember2024-01-012024-12-310001425355mcvt:ShortTermBankingLoansMember2024-01-012024-12-310001425355mcvt:OtherEquityMember2023-12-310001425355mcvt:WarrantsMember2023-12-310001425355mcvt:CommonStockSharesMember2023-12-310001425355mcvt:OtherEquityMember2024-12-310001425355mcvt:UnderwriterFiveYearsMember2022-08-1100014253552022-08-012022-08-110001425355mcvt:BasicMember2023-01-012023-12-310001425355mcvt:DilutedMember2024-01-012024-12-310001425355mcvt:DilutedMember2023-01-012023-12-310001425355mcvt:BasicMember2024-01-012024-12-310001425355mcvt:RealEstateInformationMembermcvt:FifteenPercentSecuredLoansInformationMembermcvt:ShortTermBankingLoansMember2024-12-310001425355mcvt:CommonStockSharesMember2024-12-310001425355mcvt:FinancialMembermcvt:CommonStockSharesMember2024-12-310001425355mcvt:FinancialServicesInformationMembermcvt:OtherEquityMember2024-12-310001425355mcvt:FinancialServicesInformationMembermcvt:OtherEquityMember2023-12-310001425355mcvt:WarrantOneMembermcvt:HealthCareServicesMember2023-12-310001425355mcvt:ConsumerMembermcvt:CommonStockSharesMember2023-12-310001425355mcvt:ConsumerMembermcvt:CommonStockSharesMember2024-12-310001425355mcvt:PreferredStocksSharesMember2023-12-310001425355mcvt:TechnologyesSectorsMembermcvt:PreferredStocksSharesMember2024-12-310001425355mcvt:TechnologyesSectorsMembermcvt:PreferredStocksSharesMember2023-12-310001425355mcvt:WisdomGamingIncMembermcvt:PreferredStocksSharesMember2023-12-310001425355mcvt:ShortTermBankingLoansMember2024-12-310001425355mcvt:ShortTermBankingLoansMember2023-12-310001425355mcvt:AlatusDevelopmentCorpInformationMembermcvt:RealEstatesInformationMembermcvt:FifteenPercentSecuredLoansInformationMembermcvt:ShortTermBankingLoansMember2024-12-310001425355mcvt:AlatusDevelopmentCorpInformationMembermcvt:RealEstatesInformationMembermcvt:FifteenPercentSecuredLoansInformationMembermcvt:ShortTermBankingLoansMember2023-12-310001425355mcvt:RealEstatesInformationMembermcvt:EighteenPercentSecuredLoansInformationMembermcvt:ShortTermBankingLoansMember2023-12-310001425355mcvt:FifteenPercentconvertiblenoteInformationMembermcvt:InformationTechnologySectorsMember2023-12-310001425355mcvt:TwelvePercentSecuredLoansInformationMembermcvt:FinancialServicesLoansMembermcvt:ShortTermBankingLoansMember2023-12-310001425355mcvt:TwentyThreePercentSecuredLoansSecuredLoansInformationMembermcvt:CommercialAndIndustrialConsumerMember2023-12-310001425355mcvt:EighteenPercentSecuredLoansSecuredLoansInformationMembermcvt:CommercialAndIndustrialConsumerMember2023-12-310001425355mcvt:EighteenPercentSecuredLoansSecuredLoansInformationMembermcvt:CommercialAndIndustrialConsumerMember2024-12-310001425355mcvt:FifteenPercentSecuredLoansInformationMembermcvt:CommercialAndIndustrialConsumerMembermcvt:ShortTermBankingLoansMember2024-12-310001425355mcvt:FifteenPercentSecuredLoansInformationMembermcvt:CommercialAndIndustrialConsumerMembermcvt:ShortTermBankingLoansMember2023-12-310001425355mcvt:NetUnrealizedAppreciationDepreciationInValueOfInvestmentsMember2024-12-310001425355mcvt:AccumulatedUndistributedNetRealizedGainOnInvestmentsTransactionMember2024-12-310001425355mcvt:AccumulatedUndistributedNetInvestmentLossMember2024-12-310001425355us-gaap:RetainedEarningsMember2024-12-310001425355us-gaap:AdditionalPaidInCapitalMember2024-12-310001425355us-gaap:CommonStockMember2024-12-310001425355mcvt:NetUnrealizedAppreciationDepreciationInValueOfInvestmentsMember2024-01-012024-12-310001425355mcvt:AccumulatedUndistributedNetRealizedGainOnInvestmentsTransactionMember2024-01-012024-12-310001425355mcvt:AccumulatedUndistributedNetInvestmentLossMember2024-01-012024-12-310001425355us-gaap:RetainedEarningsMember2024-01-012024-12-310001425355us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001425355us-gaap:CommonStockMember2024-01-012024-12-310001425355mcvt:NetUnrealizedAppreciationDepreciationInValueOfInvestmentsMember2023-12-310001425355mcvt:AccumulatedUndistributedNetRealizedGainOnInvestmentsTransactionMember2023-12-310001425355mcvt:AccumulatedUndistributedNetInvestmentLossMember2023-12-310001425355us-gaap:RetainedEarningsMember2023-12-310001425355us-gaap:AdditionalPaidInCapitalMember2023-12-310001425355us-gaap:CommonStockMember2023-12-310001425355mcvt:NetUnrealizedAppreciationDepreciationInValueOfInvestmentsMember2023-01-012023-12-310001425355mcvt:AccumulatedUndistributedNetRealizedGainOnInvestmentsTransactionMember2023-01-012023-12-310001425355mcvt:AccumulatedUndistributedNetInvestmentLossMember2023-01-012023-12-310001425355us-gaap:RetainedEarningsMember2023-01-012023-12-310001425355us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001425355us-gaap:CommonStockMember2023-01-012023-12-3100014253552022-12-310001425355mcvt:NetUnrealizedAppreciationDepreciationInValueOfInvestmentsMember2022-12-310001425355mcvt:AccumulatedUndistributedNetRealizedGainOnInvestmentsTransactionMember2022-12-310001425355mcvt:AccumulatedUndistributedNetInvestmentLossMember2022-12-310001425355us-gaap:RetainedEarningsMember2022-12-310001425355us-gaap:AdditionalPaidInCapitalMember2022-12-310001425355us-gaap:CommonStockMember2022-12-3100014253552023-01-012023-12-3100014253552023-12-3100014253552025-03-3100014253552024-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended December 31, 2024 |

| |

| or |

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from ______________________ to ______________________ |

Commission File Number 001-41472

MILL CITY VENTURES III, LTD. |

(Exact name of registrant as specified in its charter) |

Minnesota | | 90-0316651 |

(State of incorporation) | | (I.R.S. Employer Identification No.) |

| | |

1907 Wayzata Blvd #205 Wayzata, Minnesota | | 55391 |

(Address of principal executive offices) | | (Zip Code) |

Former name, former address and former fiscal year, if changed since last report

Registrant’s telephone number, including area code: (952) 479-1923

Securities registered pursuant to Section 12(b) of the Act:

Common stock, $0.001 par value per share

The Nasdaq Stock Market, LLC

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☐ | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the voting stock held by persons other than officers, directors and more than 5% shareholders of the registrant as of December 31, 2024 was approximately $3,499,000 based on the closing sales price of $1.95 per share as reported by the Nasdaq Capital Market. As of March 31, 2025, there were 6,385,255 shares of the registrant’s common stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

None.

Mill City Ventures III, Ltd.

Form 10-K

Table of Contents

PART I

ITEM 1 BUSINESS

Overview

Mill City Ventures III, Ltd. is a Minnesota corporation that was incorporated in January 2006. From our inception until December 13, 2012, we were a development-stage company involved in the gaming and entertainment industry. In 2013, we elected to become a business development company (“BDC”) under the Investment Company Act of 1940 (the “1940 Act”). We operated as a BDC until we withdrew our BDC election on December 27, 2019. Since that time, we have engaged in the business of providing short-term specialty finance solutions primarily to private businesses, micro- and small-cap public companies and high-net-worth individuals. To avoid again becoming subject to regulation under the 1940 Act, we generally seek to structure our short-term loans such that they do not constitute “securities” under federal securities law, and we monitor our holdings as a whole to ensure that no more than 40% of our total assets may consist of “investment securities,” as that term is defined and understood under the 1940 Act.

The principal specialty finance solutions we provide are high-interest short-term lending arrangements. Typically, these lending arrangements involve us obtaining collateral as security for the borrower’s repayment of funds to us, the right to seek and obtain such collateral, or personal guarantees from the principals or affiliates of the borrower. In some circles, short-term high-interest collateralized lending is referred to as “hard-money lending.”

We believe we are generally able to charge high interest for our specialty finance solutions because: (i) banks and other traditional providers of credit may have neither the expertise nor the infrastructure needed to evaluate creditworthiness and risks in a timeframe suitable for a potential borrower, preferring instead to process transactions and structures that present few novel issues or risks; and (ii) we will often be able to devote time and attention to transactions involving a smaller dollar amount than an institutional lender will view as worthwhile. These beliefs essentially explain why we refer to our business as “specialty finance”— financing that may involve structures that are unique, creative, and often bespoke; and that may involve dollar amounts that are not suitable for institutional lenders.

We generally seek to provide specialty finance solutions that are short-term in nature. By this, we mean lending arrangements that mature or come due within nine months of the lending date. We view the provision of short-term finance as desirable for two principal reasons: (i) it helps minimize the risk of non-performance; and (ii) it helps minimize regulatory risk.

In terms of non-performance risk, short-term lending requires us to focus upon, and a potential borrower to identify to us, a near-term source of liquidity for repayment of the funds they borrow from us. This permits us to evaluate that source of repayment clearly and carefully, thus helping identify the potential risks involved in a particular transaction and how we may be able to include structural terms, such as specific collateral and collateral-related arrangements, guarantees, or other types of covenants or arrangements that mitigate those risks.

In terms of regulatory risk, we believe that short-term lending permits us to avail ourselves of a court-recognized exception for treating promissory notes (evidencing a loan) as “securities” under federal securities law. This exception generally applies to promissory notes with short-term maturities of nine months or less. Our ability to avail ourselves of this exception, and to more generally structure our transactions in such a way to avoid them being properly considered as “securities” under federal securities laws, is important because we believe that it enables us to avoid once again becoming subject to regulation under the 1940 Act. Below we discuss in further detail our process for evaluating transactional terms and structures with a view to remaining outside of the regulatory regime of the 1940 Act (please refer to “Investment Process” below).

Examples of the kinds of the specialty finance solutions we have considered or provided to date, and may continue to provide in the future, include:

| · | Short-term secured loans for real estate development; |

| · | Short-term unsecured loans (with an option to acquire collateral security) to a business; |

| · | Short-term secured loans to a business for operating capital; and |

| · | Short-term secured loans to an individual owed a forthcoming tax refund |

In addition, we occasionally explore and evaluate our ability to enter into other kinds of short-term specialty finance transactions. Examples include the expansion of our efforts to purchase adjudicated settlements, the purchase (at discounted rates) of receivables owing to professionals on account of certain workers’ compensation claim, and short-term consumer finance lending.

Sourcing Transactions

We believe that our management’s strong combination of experience and contacts in the securities and investment finance sector, including the experience and contacts of our independent directors, should be sufficient to continue attracting suitable prospective investment opportunities. To date, the network of contacts of our management and directors has been successful in sourcing all of the transactions in which we have participated. Accordingly, we presently do not have any plans to hire any business development professionals to assist us with transactional volume.

Competition

The market for specialty finance is competitive, largely as a result of the participation of various types of professionally managed pooled investment funds such as private equity and private credit funds, including secured, non-secured debt and mezzanine-debt funds, and other types of professional finance companies seeking the high returns that are possible in specialty finance and hard-money lending. Nevertheless, we believe we are well positioned to compete successfully in this market because of our entrepreneurial, creative and flexible approach to specialty finance opportunities, and our management’s experience in entrepreneurial ventures and finance.

Throughout our history and in particular after ceasing to be a BDC, we have approached investment opportunities flexibly and creatively in terms of transactional structures and terms. In part, we are able to be flexible and creative because we are not subject to many of the regulatory restrictions that govern our other more traditional or institutional competitors. Those competitors are often subject to limitations on the type transactions they undertake, the amount that may be invested in a specific transaction or a particular type of transaction, the markets in which they operate, the maturity or time horizon of their investment, uses of proceeds, or otherwise. These limitations are often imposed by the agreements and documents governing the pooled investment vehicles, or otherwise self-imposed in order to facilitate the investment vetting and due-diligence process, and the documentation and structuring process. More rarely, these limitations may arise from governing regulations or interpretations thereof. For our part, we believe that approaching investment opportunities flexibly expands our overall transactional opportunities, diversifies our risk by avoiding dependence in any material way on a particular borrower, type of transaction, or market or industry niche, and permits us to avail ourselves of the maximum number of relationships from which we source investment opportunities. Moreover, we believe that this flexible approach to structuring our transactions and investments will facilitate the development of positive long-term relationships with our borrowers.

We believe that the only significant limitation on our ability to flexibly structure transactions arises from our desire to remain outside the regulation of the 1940 Act. In order to meet this goal, we intend and aim to structure the vast majority of our transactions (by dollar amount) in ways such that they are not properly considered “securities” under federal securities laws, including the 1940 Act.

For our investors, the freedom afforded to us through the lack of substantive regulation governing the types of transactions we enter into and our methods of operation permits us to allocate our resources, at any given point in time, to those types of transactions that we believe may lead to the highest risk-adjusted returns or the steadiest stream of such returns.

Our management team and Board of Directors has significant experience in a variety of entrepreneurial ventures, including service as management and directors for small and large public companies, private businesses, start-up and development-stage businesses, and the securities and finance industries. As a result of this diverse general experience and particular experience in transactional finance, we believe we are able to manage the evaluation and due-diligence process involved in our investment opportunities swiftly and efficiently, by collaborating with our professional advisers and focusing on high-level and material issues.

Other Matters

In general, we do not believe that we are dependent in any material way on any particular borrower, type of specialty finance transaction, or industry. At this time, however, we have a significant amount invested in a particular borrower, Mustang Funding, LLC (a provider of litigation finance), as a result of a potential strategic combination transaction that was ultimately abandoned in August 2024. The failure of this combination transaction to occur resulted in our need to restructure our loan to Mustang Funding in a way that ensured the maximum collateral security we could reasonably obtain, consistent with prevailing market-based commercial lending terms, while acceding to the requirements of their senior lender in respect of a subordination and intercreditor agreement and an extension of the maturity date for our loan.

We do not own or use through license any patents, trademarks, or other intellectual properties and we do not believe that any such assets would be material to our business.

Sometimes the types of transactions we engage in are governed by particular laws, regulations, or rules. For example, lending transactions in which high-net-worth individuals (as opposed to entities) are the borrower will nearly always involve state law usury limitations. Transactions in which we seek and obtain collateral as security for obligations owed to us involve legal issues arising under the Uniform Commercial Code or its various state law iterations. To date, we have not engaged in transactions that require us to obtain licensure or a permit prior to entering into the transaction—e.g., brokering transactions or engaging in licensed consumer finance activities.

Pending the consummation of transactions and deployment of cash, we generally keep the majority of our assets in cash, cash equivalents such as money-market investments, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment.

Our Investment Process

We have identified several criteria that we believe are important general guidelines for us to meet our financial objectives. These criteria are, however, only general guidelines for our investment decisions and, in the case of some transactions in which we invest, fewer than all—or even none—of these criteria will be met.

| · | Existing Liquidity Source. Because the vast majority of our transactions involve short-term maturities, we typically seek to identify a liquidity source for the borrower to repay us. Examples of sources of potential liquidity may include accounts receivable, another valuable asset, or a pending payment (e.g., a tax refund, or a litigation judgment or settlement payment) or pending transaction, that is reasonably expected to close and pay out prior to the maturity of the credit we provide. |

| | |

| · | Collateral Value. We will often, but not always, seek to collateralize the obligations owing to us. Our ability to identify valuable collateral is a significant factor in our credit analysis and determination of the attractiveness of a potential transaction. This analysis will often involve legal counsel, both to assist in the identification of potential collateral assets, and to better understand the ease with a security interest in the collateral may be granted, perfected and, if necessary, foreclosed upon and the relevant jurisdiction(s) involved. |

| | |

| · | Experienced and Capable Management. In transactions involving business borrowers, we seek businesses that have an experienced, knowledgeable and capable management team. |

| | |

| · | Competitive Position. In transactions involving business borrowers, we will seek to invest in transactions with businesses that have developed, or appear poised to develop, a strong competitive position within their respective industry sector or niche. |

| | |

| · | Cash Flow. In transactions involving business borrowers, we will seek to invest in businesses that are profitable or nearly profitable on an operating cash flow basis, principally so that the business’ operating cash flow may serve as another source of liquidity from which we may ultimately be repaid. |

If we believe a potential transaction generally meets the characteristics described above or if we otherwise determine that a potential transaction may be desirable to enter into, we may perform a more rigorous due-diligence examination of the prospective borrower, the likely source or sources of liquidity for their repayment to us, and other aspects of the borrower or its assets (e.g., assets of the borrower that may serve as collateral security for the obligations that may be owing to us). Our due-diligence examination for each transaction will necessarily be unique and tailored to the specific transaction, but will generally be undertaken in light of the following facts and circumstances:

| · | our familiarity with the borrower (or, in the case of a business borrower, our familiarity with management or other persons such as directors involved with the borrower); |

| | |

| · | in the case of a business borrower, our review and assessment of the potential borrower’s financing history, overall capitalization, existing senior and secured lending positions, existing affiliated lending positions, as well as the likely need for additional financings after our transaction; |

| | |

| · | the industry in which the borrower operates, our knowledge and familiarity with that industry, our assessment of the complexity of the business, any regulatory matters or other unique aspects presenting special risks, and the competitive landscape faced by the borrower; |

| | |

| · | the amount of dollars involved in the potential transaction; |

| | |

| · | where the borrower is located, how it is organized as an entity, as well as its management and ownership structure and profile; |

| | |

| · | whether we might have been involved with a transaction of the same or similar kind before; |

| | |

| · | the ease with which we can evaluate the borrower’s source or sources of liquidity; |

| | |

| · | the ease with which we can apprehend the process involved with taking collateral security in some or all of the borrower’s assets; and |

| | |

| · | the ease with which we could realize on that collateral if repayment were not otherwise forthcoming. |

The assessments described above outlines our general approach for our investment decisions, although not all of such activities will be followed in each instance, or some may be stressed more so than others depending on facts and circumstances. Upon successful completion of this preliminary evaluation, we will typically (1) evaluate our own regulatory concerns (i.e., to what extent the potential transaction may properly be considered an investment in a “security” for purposes of the 1940 Act and, if necessary, consider alternative structures to alleviate any risks to our company relating thereto), and (2) decide whether to move forward towards negotiating a letter of intent and, thereafter, definitive documentation for our transaction. Depending on timing, we may not use a letter of intent and will instead proceed directly to definitive documentation.

As indicated above, to avoid becoming subject to the regulatory requirements of the 1940 Act, we monitor our investment holdings as a whole with a view towards ensuring that investments and other holdings which may be considered “investment securities” do not comprise more than 40% of our total assets. We undertake this analysis (1) at least on a quarterly basis and in connection with the review and preparation of our financial statements filed as part of our quarterly and annual reports with the SEC, and (2) at other times when we are considering how to structure a new transaction that is of a significant size—with “significance” largely based on the outcome of our most recent quarterly review. This review is generally undertaken by our Chief Financial Officer and may involve our outside legal counsel, in particular in a case where we are considering the structure of a potential new transaction.

In general, our analysis starts with the length or duration of a potential new transaction. Although federal securities laws generally define “securities” in such a way as to include promissory notes, the U.S. Supreme Court held in Reves v. Ernst & Young, 110 S. Ct. 945 (1990), that certain kinds of promissory notes are not properly considered securities. Over time, court precedent has developed to identify these kinds of promissory notes as generally not constituting securities:

| · | notes that mature in nine months or less; |

| | |

| · | notes secured by a mortgage or lien on a home; |

| | |

| · | notes secured by a small business or business assets; |

| | |

| · | so-called “character loans” made to a bank customer; |

| | |

| · | notes delivered or borrowings entered into through consumer finance; |

| | |

| · | commercial loans made to businesses; |

| | |

| · | loans secured by accounts receivable (e.g., factoring); |

In addition to the “types” of financing arrangements noted above, court precedent indicates that there may be facts and circumstances surrounding a transaction that may cause a promissory note to not be considered a “security” under federal securities laws. For example, while it is presumed that a promissory note that matures in more than nine months is a “security,” this presumption may be rebutted (with the conclusion that such a promissory note is not a properly considered a security) upon an evaluation of the following factors:

| · | whether the borrower’s motivation is to raise money for general business use, and whether the lender’s motivation is to make a profit, including interest; |

| | |

| · | whether the borrower’s plan of distribution for the promissory note resembles the plan of distribution of a security; |

| | |

| · | whether the investing public, or the parties to the transaction, reasonably expects that the note is a security; and |

| | |

| · | whether there is a regulatory scheme that protects the investor other than the securities laws (e.g., Federal Deposit Insurance). |

While the application of these factors can be helpful in some instances, often the factors and the proper manner of weighting them are unclear. As a result, the analyses we periodically undertake focuses on the more bright-line types of lending arrangements enumerated above—i.e., promissory notes maturing in nine months or less, etc.

Our Management and Employees

Currently, Mr. Douglas M. Polinsky, the Chief Executive Officer and Chairman of our Board of Directors, and Joseph A. Geraci, II, our Chief Financial Officer and a director of the company, serve as our senior management team. These are also the only two persons employed by our company that have a management role. There are three persons in total employed by our company.

ITEM 1A RISK FACTORS

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and any investment decision relating to our securities.

We have a relatively short operating history upon which to evaluate our current business.

We withdrew our election to be treated as a BDC under the 1940 Act at the end of 2019, and during the years since that time have refocused our business on providing short-term specialty finance solutions to private businesses, small-cap public companies and high-net-worth individuals. Given that our current business has been developed and pursued over the five years prior to this filing, investors have a relatively limited means to evaluate our performance, its evolution, and the likelihood of our future success.

We may need to raise additional capital to fund our operations, and such capital may not be available to us in sufficient amounts or on acceptable terms.

For the time being, management believes that our current cash is sufficient to continue operations for the foreseeable future. Nevertheless, various future developments may cause us to seek or require additional financing. In addition, we may determine to seek additional financing in order to avail ourselves of additional opportunities to provide specialty finance solutions to borrowers. Alternatively, we may seek additional financing in the event that a material portion of our investments default, leaving us with diminished means to pay for our operations and continue making investments.

In any event, additional financing could be sought from a number of sources, including but not limited to sales of additional equity or debt securities, or loans from financial institutions or our affiliates. We cannot, however, be certain that any such financing will be available on terms favorable or acceptable to us if at all. If additional funds are raised by the issuance of our equity securities, such as through the issuance of stock, convertible securities, or the issuance and exercise of warrants, then the ownership interest of our existing shareholders will be diluted. If additional funds are raised by the issuance of debt or other equity instruments, we may become subject to certain operational limitations, and such securities may have rights senior to the rights of our common shareholders. If adequate funds are not available on acceptable terms, we may be unable to consummate acquisitions or investments desired by our management and board.

If we are unable to maintain diverse and robust sources of capital, our growth prospects, business, financial condition and results of operations could be adversely affected.

Our business depends in part on maintaining diverse and robust sources of capital to originate our short-term loans. In January 2022, we entered into a Loan and Security Agreement (the “Loan Agreement”) with Eastman Investment, Inc., a Nevada corporation, and Lyle A. Berman, as trustee of the Lyle A. Berman Revocable Trust (collectively, the “Lenders”). Mr. Berman is a director of our company. Under the Loan Agreement, the Lenders made available to us a $5 million revolving line of credit for us to use in the ordinary course of our short-term specialty finance business. Amounts drawn under the Loan Agreement accrued interest at the per annum rate of 8%, and all our obligations under the Loan Agreement were secured by a grant of a collateral security interest in substantially all of our assets. As a Lender, Mr. Berman was obligated to furnish only one-half of the aggregate $5 million available under the Loan Agreement. The Loan Agreement had a five-year term ending on January 3, 2027, at which time all amounts owing under the Loan Agreement were to become due and payable; subject, however, to each Lender’s right, including Mr. Berman, to terminate the Loan Agreement, solely with respect to such Lender’s obligation to provide further credit, at any time after January 3, 2023. See “Certain Relationships and Related Transactions.” In January 2024, we terminated the Loan Agreement having earlier satisfied all of our obligations thereunder.

If we were to borrow money in the future, events of default or breaches of financial, performance or other covenants, or worse than expected performance of one or more of our short-term loans, could reduce or terminate our future access to funding. The availability and capacity of sources of capital also depends on many factors that are outside of our control, such as credit market volatility and regulatory reforms. In the event that we do not maintain adequate sources of capital, we may not be able to maintain the necessary levels of funding to retain current loan volume, which could adversely affect our business, financial condition and results of operations.

Although we have identified general guidelines that we believe are important in evaluating prospective investment opportunities, we may enter into transactions with borrowers that do not meet such guidelines, increasing the risk that the price of our common stock could be volatile.

Although we have identified general guidelines for evaluating prospective investment opportunities, it is possible that a borrower with which we enter into a transaction will not have all, or any, of the attributes outlined in those guidelines. If we complete transactions with borrowers that do not meet some or any of these guidelines, it is possible that such an investment may not be as successful as an alternative opportunity that were to satisfy some or all of those guidelines. Investments that do not perform as well as imagined, or as well as they otherwise might have, in combination with the public knowledge that we may stray, or have strayed, from strict implementation of our investment guidelines, could affect the volatility of the trading price of our common stock.

We may provide specialty finance solutions to early-stage companies, financially unstable businesses, or a borrower lacking an established record of revenue or earnings, which could adversely affect the price of our common stock.

While we believe that being entrepreneurial in our approach to specialty finance is a strength, we may complete investments with an early-stage company, a financially unstable business or an entity lacking an established record of revenues, cash flows or earnings. These kinds of transactions present numerous risks associated with investing in a business without a proven business model and with limited historical financial data, volatile revenues, cash flows or earnings and difficulties in obtaining and retaining key personnel. Although our management endeavors to evaluate the risks inherent in each particular investment we consider and make, we may not be able to properly ascertain or assess all of the significant risk factors and we may not have adequate time to complete a full evaluation of those risks. Furthermore, some of these risks may be outside of our control and leave us with no ability to control or reduce the chances that those risks will adversely impact a borrower or our likelihood of repayment. The manifestation of any of these risks could adversely affect the trading price of our common stock.

Many of our specialty finance investment transactions involve borrowers about which little, if any, information is publicly available, which may impair our ability to identify borrowers able to repay our loans and adversely affect the price of our common stock.

In pursuing our business, we often interact with a privately held companies about which very little public information exists. As a result, we are often required to make our investment decision on the basis of limited information, nearly all of which is obtained from the business itself, which may result in our consummating an investment with a borrower that is not as solvent or profitable as we suspected, if at all. These risks could affect our results of operations and, ultimately, the trading price of our common stock.

If we are deemed to be an investment company under the 1940 Act, we may be required to institute burdensome compliance requirements and our activities may be restricted. In such an event, our business would likely be materially and adversely affected.

If we are deemed to be an investment company under the 1940 Act, then our activities may be restricted or complicated, including through:

| · | restrictions on the nature of our investments; |

| · | restrictions on our issuance of securities; |

| · | a requirement to register as an investment company; |

| · | adoption of a specific form of corporate structure and changes in corporate governance; |

| · | the hiring of a chief compliance officer, and adoption and implementation of various policies and requirements; and |

| · | compliance with additional reporting, record-keeping, voting, proxy and disclosure requirements, together with other rules and regulations. |

In order not to be regulated as an investment company under the 1940 Act, unless we can qualify for an exclusion, we must ensure that we are engaged primarily in a business other than investing, reinvesting or trading of “securities” and that our activities do not include investing, reinvesting, owning, holding or trading “investment securities” constituting more than 40% of our assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis.

We do not believe that our principal activities will subject us to the 1940 Act. To this end, we hold reserve un-invested assets in cash and United States “government securities” within the meaning of Section 2(a)(16) of the Act having a maturity of 185 days or less or in money market funds meeting certain conditions under Rule 2a-7 promulgated under the 1940 Act, which invest only in direct U.S. government treasury obligations. Furthermore, we periodically monitor our investment holdings as a whole with a view towards ensuring that investments and other holdings which may be considered “investment securities” do not comprise more than 40% of our total assets. We undertake this analysis (1) on a quarterly basis and in connection with the review and preparation of our financial statements filed as part of our quarterly and annual reports with the SEC, and (2) at other times when we are considering how to structure a new transaction that is of a significant size—with “significance” largely based on the outcome of our most recent quarterly review. This review is generally undertaken by our Chief Financial Officer and may involve outside legal counsel, in particular in a case where we are considering the structure of a potential new transaction.

If, however, we do not invest as discussed above or are otherwise unsuccessful in ensuring that no more than 40% of our total assets consist of “investment securities,” then we may be deemed to be subject to the 1940 Act. It is also possible that regulatory authorities, such as the SEC, may disagree with our analysis of whether certain investment holdings constitute “investment securities,” and may more broadly disagree with our position that the short-term promissory notes we receive in exchange for our short-term loans, are not properly considered “investment securities” under federal securities law and the 1940 Act in particular. If that were to be the case, we would likely incur significant costs and be required to spent significant time restructuring parts of our operations and/or complying with the additional regulatory burdens imposed under the 1940 Act. Any restructuring or additional regulatory requirements would surely hinder our ability to operate as profitably as we have since the withdrawal of our BDC election, and would of course adversely affect the trading price of our common stock.

Our $10 million in principal amount loan to Mustang Funding, LLC is subordinated to senior lenders in right of payment, in respect of our exercise of rights and remedies, and in right of collateral, with the result that our investment portfolio and results of operations will for the foreseeable future be highly concentrated in and dependent upon the operational and financing success of Mustang Funding.

On December 12, 2022, contemporaneously with our entry into a non-binding letter of intent with Mustang Funding, LLC (“Mustang”) contemplating a combination or merger transaction, we entered into a lending agreement with Mustang pursuant to which we loaned Mustang the principal amount of $5 million maturing in September 2023. Among other things, our related loan agreement with Mustang requires us to consent to any additional indebtedness Mustang may incur, subject to certain limitations and exceptions.

Although our loan to Mustang was not secured at the time that it was made, we negotiated for and obtained the right in the governing documents to seek and obtain collateral in the event that there were a default by Mustang or our negotiations for a combination transaction were to break down. At that time, we believed it was important to obtain this right because (i) Mustang was contemporaneously seeking a senior secured lending facility with whom we had no previous working experience, and (ii) a breakdown in combination negotiations, combined with our anticipated subordination (discussed below) could mean that we would need to extend the terms of this loan beyond nine months. In sum, as a creditor we believed that we need to secure our loan on more traditional commercial lending terms in order to better protect our investment.

On December 28, 2022, we entered into a subordination agreement with Orion Pip LLC, in its capacity as administrative and collateral agent for itself and other senior lenders under a senior secured lending agreement with Mustang (collectively, the “Senior Lenders”), pursuant to which we subordinated our right to payment (subject to certain exceptions) and our right to exercise rights and remedies, to Mustang’s prior repayment in full of all amounts owing to the Senior Lenders. The subordination agreement prohibited the Senior Lenders or Mustang from extending the stated maturity of amounts owing under the senior secured lending agreement beyond December 2026. The Senior Lenders are owed $15.675 million in principal amount under the senior secured lending agreement.

In June, August and September 2023, we advanced additional principal to Mustang as we continued working with them on a potential definitive merger agreement and related deliverables. These additional principal advances resulted in the loan principal growing to an aggregate of $10 million. In connection with these advances, the maturity date of our loan was ultimately extended to June 2024. In April 2024, we agreed to a final extension of the maturity date to the earlier of December 31, 2024, or 90 days after the termination of negotiations for our combination transaction with Mustang.

On August 20, 2024, we terminated the non-binding letter of intent with Mustang. As a result, amounts owing under our $10 million loan to Mustang were to mature on November 18, 2024. Nevertheless, the subordination agreement with the Senior Lenders effectively worked to prohibit Mustang’s payment, and our collection, of our loan. Accordingly, at that time we invoked our right to obtain collateral security from Mustang for our loan for the purpose of protecting our investment and essentially converting our loan position from a short-term unsecured loan to a longer-term loan involving standard commercial lending terms, including terms relating to collateral security. Ultimately, in late January 2025 we were able to enter into an amendment to our loan agreement with Mustang that extended the maturity date of our loan to March 2027 and increased the interest rate on our loan principal to 20% per annum (with 15% per annum remaining payable in cash on a monthly basis, and the additional 5% per annum being payable upon maturity), and also enter into an amended and restated subordination agreement with Orion Pip LLC that subordinated our right to collateral on customary and negotiated terms and conditions. Presently and for the foreseeable future, we expect that we will receive interest payments as required by our loan agreement with Mustang.

In light of all of the foregoing, a significant and material amount of our assets are now invested in Mustang through March 2027. Given the size of the investment relative to our balance sheet, Mustang’s payment of interest and repayment of principal owed under that loan will likely materially contribute to our results of operation and may affect the trading price of common stock. Furthermore, while we believe that the addition of collateral security and the termination of our combination negotiations permits us to classify our investment in Mustang as a “commercial lending transaction” that will not be considered an “investment security” for purposes of the 1940 Act, we cannot be certain that regulatory authorities will concur with our analysis and conclusion. For more information and context for these risks, please see “Business — Our Investment Process” and “Risk Factors — If we are deemed to be an investment company under the 1940 Act ….”

A limited number of shareholders control a significant majority of our voting stock and, as a result, control the election of our Board of Directors. As a result, these shareholders may exert an influence on actions requiring a shareholder vote, potentially in a manner that you do not support.

Nine shareholders (five of whom are presently officers and directors) beneficially own shares representing a majority of our issued and outstanding common stock. As a result, investors in our common stock cannot reasonably expect to have any significant influence over the election of our directors or other matters submitted to a vote of our shareholders. Instead, our existing significant shareholders will exert a substantial influence on the election of our directors and any actions requiring or otherwise put to a shareholder vote, potentially in a manner that you do not support. Examples of such voting matters, apart from the election of our directors, includes amendments to our articles of incorporation, bylaws, and approval of major corporate transactions. The concentrated amount of control over our affairs held by a relatively few number of significant investors could serve to reduce the attractiveness or liquidity of our common stock, and thereby depress its trading price.

Changes in laws or regulations, or a failure to comply with laws and regulations, whether by us or by our borrowers, may adversely affect our business, including our results of operations and ultimately the price of our common stock.

Both we and our borrowers are typically subject to various local, state and federal laws and regulations. Compliance with, and monitoring of, applicable laws and regulations may be difficult, time consuming and costly. Those laws and regulations and their interpretation and manner of application or enforcement may also change from time to time and those changes could have a material adverse effect on our business, investments and results of operations. In addition, a failure to comply with applicable laws or regulations, as interpreted and applied, could have a material adverse effect on our business and results of operations. Any of these outcomes would likely adversely affect the trading price of our common stock.

Changes in consumer finance and other applicable laws and regulations, as well as changes in government enforcement policies and priorities, may negatively impact the management of our business, results of operations, ability to offer certain kinds of specialty finance solutions or the terms and conditions upon which they are offered, and our ability to compete.

Consumer finance regulation is constantly changing, and new laws or regulations, or new interpretations of existing laws or regulations, could have a materially adverse impact on our ability to operate as currently intended or as we may intend to expand in the future, and cause us to incur significant expense in order to ensure compliance. Federal and state financial services regulators are also enforcing existing laws, regulations, and rules aggressively and enhancing their supervisory expectations regarding the management of legal and regulatory compliance risks. These regulatory changes and uncertainties make our business planning more difficult and could result in changes to our business model and potentially adversely impact our results of operations. Because we operate as a non-bank lender, we are sometimes subject to state usury laws and other laws and regulations. Furthermore, to the extent applicable, these laws can impose specific statutory liabilities upon creditors who fail to comply with their provisions and may affect the enforceability of a loan. If the application of consumer protection laws were to cause our loans, or any of the terms of our loans, to be unenforceable against the relevant borrowers, our business may be materially adversely affected. Even if we seek to comply with licensing and other requirements that we believe may be applicable to us, if we are found to not have complied with applicable laws, we could lose one or more of our licenses or authorizations or face other sanctions or penalties or be required to obtain a license in one or more such jurisdictions, which may have an adverse effect on our business.

New laws, regulations, policy or changes in enforcement of existing laws or regulations applicable to our business, or reexamination of current practices, could adversely impact our profitability, limit our ability to continue existing or pursue new business activities, require us to change certain of our business practices, affect retention of key personnel, or expose us to additional costs, including compliance costs. These changes also may require us to invest significant resources, and devote significant management attention, to make any necessary changes and could adversely affect our business.

We may engage in transactions with businesses that may be affiliated with our officers, directors or significant shareholders, and which may involve actual or potential conflicts of interest.

We may decide to make investments in one or more businesses affiliated with our officers, directors or significant shareholders. Such investment opportunities may compete with other opportunities for our investment dollars. Although we are not specifically focusing on, or targeting, any particular transaction with any affiliates or affiliated entities, we would pursue such a transaction if we determined that such an affiliated investment were attractive from a risk-adjusted return perspective, and such transaction were approved by a majority of our independent and disinterested directors. Any such activity would involve actual or potential conflicts of interest. Although we are confident that we can navigate these conflicts consistent with best practices and applicable law, the existence or appearance of such conflicts of interest could make our common stock less attractive and thereby reduce its trading price.

Our ability to identify and consummate investment opportunities, and any need we may have for additional capital, will almost certainly be affected by general economic conditions.

General economic conditions will almost certainly impact our ability to (i) identify, pursue and consummate investment opportunities, and (ii) if necessary, seek and obtain additional financing on terms acceptable or favorable to us, if at all. Therefore, a deterioration in general economic conditions may adversely affect our business or slow the growth of our business.

Our reputation and brand are important to our success, and if we are unable to continue developing our reputation and brand, our ability to retain existing capital sources, and to attract borrowers could be adversely affected.

We believe that maintaining a strong brand and trustworthy reputation is critical to our success and our ability to attract borrowers, attract new capital sources and maintain existing capital sources. Factors that we believe affect our brand and reputation include:

| · | the non-bank lending industry generally; |

| · | our company specifically, including the quality and reliability of our investment process, our ability to effectively manage and resolve issues with our borrowers, our collection practices, our privacy and security practices, any litigation in which we may become involved; any regulatory activity to which we may become involved; and the overall experience of our borrowers. |

Negative publicity or negative public perception of these factors, even if inaccurate, could adversely affect our brand and reputation. Any negative publicity or negative public perception of the loans we make, or similar loans made by similar lenders or our competitors, may also result in negative publicity that is adverse to our reputation. If we are unable to protect our reputation, our business, financial condition and results of operations could be adversely affected.

We are highly dependent on the services provided by certain executives and key personnel.

Our success depends in significant part upon the continued service of our senior management personnel. In particular, we are materially dependent upon the services of Douglas M. Polinsky, our Chief Executive Officer and Chairman, and Joseph A. Geraci, II, our Chief Financial Officer and a director of our company. Practically, we cannot prevent the departure of these executives, whether due to death, disability, retirement or otherwise. Any loss of the services provided by these executives would likely have a material and adverse effect on our operations and ability to execute our business plans.

Our articles of incorporation grant our Board of Directors the power to designate and issue additional shares and classes of common and preferred stock.

Our authorized capital consists of 111,111,111 shares of capital stock. Pursuant to authority granted by our articles of incorporation, our Board of Directors, without any action by our shareholders, may designate and issue shares in such classes or series (including other classes or series of preferred stock) as it deems appropriate, and may establish the rights, preferences and privileges of such shares, including dividends, liquidation and voting rights. The rights of holders of new classes or series of stock that may be so designated and issued could be superior to the rights of holders of our common shares. The designation and issuance of shares of capital stock having preferential rights could adversely affect other rights appurtenant to shares of our common stock. Furthermore, any issuances of additional stock—common or preferred—will dilute the ownership interest of then-current holders of our common stock and may dilute our book value per share.

We may issue additional common stock or preferred shares without the approval of our shareholders. Any such issuances would dilute the interest of our shareholders and likely present other risks.

Our articles of incorporation authorize the issuance of up to 111,111,111 shares of capital stock. Because we presently have only 6,385,255 shares of common stock issued and outstanding, our Board of Directors has the power and authority to issue a substantial number of additional shares of common stock or preferred shares. The issuance of additional common stock or preferred shares:

| · | may significantly dilute the equity interest of our then-current shareholders; |

| · | may subordinate the rights of holders of common stock if preferred shares are issued with rights senior to those afforded our common stock; |

| · | could cause a change in control if a substantial number of common stock are issued, which could result in the resignation or removal of our present officers and directors; and |

| · | may adversely affect prevailing market price for our common stock. |

Cyber incidents or attacks directed at us could result in information theft, data corruption, operational disruption and/or financial loss.

We depend on digital technologies, including information systems, infrastructure and cloud applications and services, including those belonging to third parties with whom we deal. Sophisticated and deliberate attacks on, or security breaches in, our systems or infrastructure, or the systems or infrastructure of third parties or the cloud, could lead to corruption or misappropriation of our assets, proprietary information and sensitive or confidential data. We have not made a significant investment in data security protection (preferring instead to rely upon the data-security know-how and investments made by the third parties with whom we deal and upon whom we rely), and we may not be sufficiently protected against such occurrences. We may not have sufficient resources to adequately protect against, or to investigate and remediate any vulnerability to, cyber incidents. It is possible that any of these occurrences, or a combination of them, could have adverse consequences on our business and lead to financial loss.

Our stock price may be volatile, or may decline regardless of our operating performance, and you could lose all or part of your investment as a result.

You should consider an investment in our common stock to be risky, and you should invest in our common stock only if you can withstand a significant loss and wide fluctuation in the market value of your investment. The market price of our common stock could be subject to significant fluctuations in response to the factors described in this section and other factors, many of which are beyond our control. Among the many factors that could affect our stock price are:

| · | The historically limited trading volume of our common stock; |

| · | Actual or anticipated variations in our quarterly and annual operating results or those of companies perceived to be similar to us; |

| · | Changes in expectations as to our future financial performance, including financial estimates by securities analysts and investors, or differences between our actual results and those expected by investors and securities analysts; |

| · | Fluctuations in the market valuations of companies perceived by investors to be comparable to us; |

| · | The public’s response to our or our competitors’ filings with the SEC or announcements regarding, significant transactions, acquisitions, strategic investments, litigation, or other significant matters; |

| · | Speculation about our business in the press or the investment community; |

| · | Future sales of our shares; |

| · | Actions by our competitors; |

| · | Additions or departures of members of our senior management or other key personnel; and |

| · | The passage of legislation or other regulatory developments affecting us or our industry. |

In addition, the securities markets have experienced significant price and volume fluctuations that have affected and continue to affect market price of equity securities of many companies. These fluctuations have often been unrelated or disproportionate to the operating performance of particular companies. These broad market fluctuations, as well as general economic, systemic, political and market conditions, such as recessions, loss of investor confidence, interest rate changes, or international currency fluctuations, may negatively affect the market price of our shares.

If any of the foregoing occurs, it could cause our stock price to fall and may expose us to securities class action litigation that, even if unsuccessful, could be costly to defend and a distraction to management.

We do not intend to pay dividends on our common stock.

We intend to retain all of our earnings, if any, for the foreseeable future to finance the operation and expansion of our business and do not anticipate paying cash dividends. Any future determination to pay dividends will be at the discretion of our Board of Directors, subject to compliance with applicable law and any contractual provisions, and will depend on, among other factors, our results of operations, financial condition, capital requirements and other factors that our Board of Directors deems relevant. As a result, investors in our common shares should expect to receive a return on investment only if the market price of the common shares increases, which may never occur.

One of the manners in which we may seek to grow our company is through acquisition or combination transactions. It is possible that, even after our announcement of a potential acquisition or combination transaction, such transactions may not ultimately close and occur. Our announcement of these potential transactions, and the occasional failure of them to occur, may cause the price of our common stock to be volatile.

In prior reports, we have publicly announced our intention to grow our company both organically, including by expanding our specialty finance operations into new markets or niches, and through acquisition or combination transactions such as mergers or similarly structured transactions. In the past, we have announced our execution of non-binding letters of intent for these kinds of acquisition or combination transactions. These announcements may create volatility in the trading volume and price of our common stock, in particular when there is not significant publicly available information about the counterparty to such a transaction. Moreover, the failure of the transactions contemplated in these announcements to close could similarly create volatility in the trading volume and price of our common stock. This volatility could ultimately mean that there are fewer buyers or sellers of our common stock at particular times, which creates the risk that you might not be able to sell any common stock of our company that you own at a time or a price that you believe is fair or desirable.

An historical example of the foregoing is our December 2022 announcement of a non-binding letter of intent with Mustang Funding, LLC, a private litigation-funding business, in which letter we contemplated a merger transaction. Although we negotiated the terms of a definitive agreement with Mustang Funding, we were unable to finalize that agreement and enter into it. Ultimately, we determined to abandon the transaction and to terminate the non-binding letter of intent in August 2024. The volatility in the trading volume and price of our common stock that occurred contemporaneously with our related public announcements of having entered into the non-binding letter of intent, and then having terminated it, together with certain related announcements touching upon amendments to our prior loans made to Mustang Funding, was not insignificant from a comparative standpoint.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock, including the general volume of transactions in our common stock, will depend in part on the research and reports that securities or industry analysts publish about us or our business. Securities and industry analysts do not currently, and may never, publish research on our company. If no securities or industry analysts commence coverage of our company, the trading price for our stock may be negatively impacted. In the event securities or industry analysts initiate coverage, if one or more of the analysts who covers us downgrades our stock or publishes inaccurate or unfavorable research about our business, our stock price may decline. If one or more of these analysts ceases coverage of our company or fails to publish reports on us regularly, demand for our stock could decrease, which might cause our stock price and trading volume to decline.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

ITEM 1C. CYBERSECURITY

Our risk management strategy for cybersecurity generally includes:

| · | Assessment: We periodically assess our risks relating to cybersecurity threats, including risks relating to our reliance on third parties, as part of our overall risk-management efforts and program. In so doing, we consider the likelihood and impact that could result from the manifestation of such risks, together with the sufficiency of existing policies, procedures, systems, and safeguards to manage such risks. |

| | |

| · | Identification: We aim to proactively identify the manners in which our business could be materially impacted by cybersecurity risks. |

| | |

| · | Management: If deemed appropriate, we would design and implement reasonable safeguards to address any identified gaps in our existing processes and procedures. |

We presently do not engage third parties to assist us with the assessment, identification or management of cybersecurity risks, or in evaluating the effectiveness of our existing approaches.

We are unaware of any material cybersecurity breaches during the year ended December 31, 2024, and given that we rely on relatively few and well known well capitalized larger third-party enterprises for certain of our data and information storage and communication needs, we do not believe that an overall material cybersecurity risk presently exists for our business. Our criteria for determining the materiality of cybersecurity incidents includes assessing potential or actual financial impacts, reputational damage, and operational disruptions.

The Audit Committee of our Board of Directors is the governance body involved in, and ultimately responsible for, cybersecurity oversight. They will generally coordinate with our Chief Financial Officer in this regard, with management alerting the committee members to any specific concerns of which management may be aware. In the event of a cybersecurity concern or event, our Chief Financial Officer would report the events or his or her concerns to our Audit Committee and full Board of Directors, as well as legal counsel. None of our directors on the Audit Committee nor our Chief Financial Officer have particular experience in cybersecurity matters.

ITEM 2 PROPERTIES

Our executive offices are located at 1907 Wayzata Boulevard, Suite 205, Wayzata, Minnesota 55391, and our telephone number is: (952) 479-1923. We are party to an operating lease for office space expiring May 31, 2025. The lease does not have significant lease escalations, rent abatements or concessions, leasehold improvements, or other build-out clauses; and they do not contain contingent-rent provisions. The lease does not include options to renew. We consider our current office space adequate for our current operations.

ITEM 3 LEGAL PROCEEDINGS

There is no material litigation, arbitration or governmental proceeding currently pending against us or any members of our management team in their capacity as such.

PART II

ITEM 5 MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

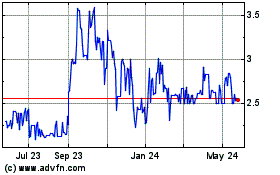

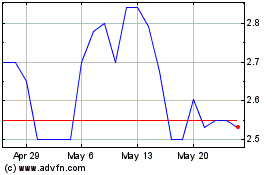

Our common stock is listed for trading on the Nasdaq under the symbol “MCVT”. The transfer agent and registrar for our common stock is Pacific Stock Transfer Company, 6725 Via Austi Parkway, Suite 300, Las Vegas, NV 89119. The following table sets forth the high and low bid prices for our common stock as reported on the Nasdaq Capital Market.

Period | | | Market Price (High/Low) 2024 | | Market Price (High/Low) 2023 | |

| | | | | | | | |

First Quarter | | | $ | 2.27 – 3.01 | | $ | 2.54-2.02 | |

Second Quarter | | | $ | 2.50 - 3.01 | | $ | 2.44 – 2.17 | |

Third Quarter | | | $ | 2.25 – 3.56 | | $ | 3.58 – 2.09 | |

Fourth Quarter | | | $ | 1.79 – 2.26 | | $ | 3.59 – 2.22 | |

Holders

As of the date of this filing, we had approximately 180 holders of record of our common stock and shares held in street name by approximately 655 non-objecting beneficial owners.

Dividends

We do not expect that the Board of Directors will declare any cash dividends in the foreseeable future.

Securities Authorized for Issuance Under Equity Compensation Plans

Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| | (a) | | | (b) | | | (c) | |

Equity compensation plans approved by security holders | | | 670,000 | | | $ | 2.11 | | | | 30,000 | |

Equity compensation plans not approved by security holders | | | — | | | | — | | | | — | |

Total | | | 670,000 | | | $ | 2.11 | | | | 30,000 | |

The securities reflected in column (a) above were issued pursuant to the company’s 2022 Stock Incentive Plan.

Recent Sales of Unregistered Securities

In November and December 2022, the Company issued options for the purchase of an aggregate of 870,000 shares of common stock to officers, directors and employees of, and consultants to, the Company contemporaneously with the adoption of a 2022 Stock Incentive Plan. These option grants were made subject to subsequent shareholder approval of the 2022 Stock Incentive Plan in accordance with Nasdaq rules. The options were granted pursuant to Section 4(a)(2) of the Securities Act of 1933 and other applicable exemptions. The shareholders of the company subsequently approved the 2022 Stock Incentive Plan on January 20, 2023 at a special meeting of shareholders called for that purpose. Options for 200,000 of these common shares were subsequently exercised, and the common shares issued, in September 2023. No options were exercised in 2024.

ITEM 7 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth below should be read in conjunction with our audited financial statements, and notes thereto, filed together with this Form 10-K.