Q30001813814--12-31falseUnlimitedUnlimitedhttp://fasb.org/us-gaap/2023#ValuationTechniqueOptionPricingModelMemberhttp://fasb.org/us-gaap/2023#ValuationTechniqueOptionPricingModelMember0001813814us-gaap:CommonStockMember2022-01-012022-09-300001813814us-gaap:CommonStockMember2023-09-3000018138142022-01-012022-12-310001813814us-gaap:RestrictedStockUnitsRSUMembercurrency:USD2023-09-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMember2022-12-310001813814us-gaap:RetainedEarningsMember2022-01-012022-09-300001813814us-gaap:MeasurementInputRiskFreeInterestRateMembermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814us-gaap:AdditionalPaidInCapitalMember2023-09-300001813814mnmd:TermLoanMembersrt:MaximumMembermnmd:LoanAndSecurityAgreementMembermnmd:K2HealthventuresLlcMember2023-08-112023-08-110001813814us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-300001813814mnmd:AtTheMarketOfferingProgramMember2022-05-042022-05-040001813814us-gaap:DevelopedTechnologyRightsMember2022-12-310001813814us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814currency:USD2023-01-012023-09-3000018138142023-06-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814us-gaap:AdditionalPaidInCapitalMember2021-12-310001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001813814us-gaap:CommonStockMember2022-12-310001813814us-gaap:RestrictedStockUnitsRSUMembercurrency:CAD2023-01-012023-09-300001813814us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001813814us-gaap:RestrictedStockUnitsRSUMembercurrency:CAD2023-09-300001813814us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001813814currency:CAD2023-01-012023-09-300001813814us-gaap:RetainedEarningsMember2023-09-300001813814us-gaap:MeasurementInputExpectedTermMemberus-gaap:FairValueInputsLevel3Membermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-3100018138142021-12-310001813814mnmd:TermLoanMembermnmd:LoanAndSecurityAgreementMembermnmd:K2HealthventuresLlcMember2023-08-110001813814us-gaap:FairValueInputsLevel3Membermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814us-gaap:ResearchAndDevelopmentExpenseMember2022-07-012022-09-300001813814mnmd:TermLoanMembermnmd:LoanAndSecurityAgreementMembermnmd:FirstTrancheTermLoanMembermnmd:K2HealthventuresLlcMember2023-08-110001813814us-gaap:RetainedEarningsMember2023-07-012023-09-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMember2022-12-310001813814us-gaap:MeasurementInputSharePriceMembermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814mnmd:MindMedStockOptionPlanMember2023-01-012023-09-300001813814us-gaap:GeneralAndAdministrativeExpenseMembermnmd:DirectorsDeferredShareUnitPlanMember2023-09-300001813814us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001813814us-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814mnmd:TermLoanMemberus-gaap:PrimeRateMembermnmd:LoanAndSecurityAgreementMembermnmd:K2HealthventuresLlcMember2023-08-112023-08-110001813814us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001813814us-gaap:CommonStockMember2021-12-310001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMember2023-01-012023-09-300001813814us-gaap:RetainedEarningsMember2023-01-012023-09-300001813814us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001813814us-gaap:RestrictedStockUnitsRSUMember2022-07-012022-09-300001813814us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001813814us-gaap:DevelopedTechnologyRightsMember2023-09-3000018138142023-07-012023-09-300001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814mnmd:DirectorsDeferredShareUnitsLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814us-gaap:CommonStockMember2023-01-012023-09-300001813814mnmd:AtTheMarketOfferingProgramMember2023-07-012023-09-300001813814us-gaap:CommonStockMember2022-06-300001813814mnmd:UnderwrittenPublicOfferingMember2022-09-300001813814mnmd:DirectorsDeferredShareUnitsLiabilityMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814us-gaap:CommonStockMember2022-09-3000018138142022-09-302022-09-300001813814mnmd:TermLoanMembermnmd:LoanAndSecurityAgreementMembermnmd:K2HealthventuresLlcMembermnmd:SubsequentTrancheTermLoanMember2023-08-110001813814us-gaap:MeasurementInputExpectedTermMembermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814us-gaap:RestrictedStockUnitsRSUMembercurrency:CAD2022-12-310001813814us-gaap:CommonStockMember2022-07-012022-09-300001813814us-gaap:RestrictedStockUnitsRSUMember2022-12-310001813814us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001813814mnmd:CommonShareAndWarrantPublicOfferingMember2022-09-300001813814us-gaap:RetainedEarningsMember2022-12-310001813814us-gaap:RetainedEarningsMember2021-12-310001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001813814us-gaap:AdditionalPaidInCapitalMember2022-06-3000018138142023-10-190001813814us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001813814us-gaap:RetainedEarningsMember2022-06-3000018138142022-09-300001813814us-gaap:AdditionalPaidInCapitalMember2022-09-300001813814us-gaap:AdditionalPaidInCapitalMember2022-12-310001813814us-gaap:MeasurementInputSharePriceMembermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-3000018138142022-05-042022-05-040001813814mnmd:MindMedStockOptionPlanMember2020-02-272020-02-270001813814us-gaap:FairValueInputsLevel3Membermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMember2023-07-012023-09-300001813814us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-3000018138142023-01-012023-09-3000018138142022-07-012022-09-300001813814mnmd:TermLoanMembermnmd:AdditionalTrancheTermLoanMembermnmd:LoanAndSecurityAgreementMembermnmd:K2HealthventuresLlcMember2023-08-110001813814mnmd:TermLoanMembermnmd:LoanAndSecurityAgreementMembermnmd:K2HealthventuresLlcMember2023-08-112023-08-110001813814us-gaap:FairValueInputsLevel3Membermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814us-gaap:MeasurementInputRiskFreeInterestRateMembermnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814mnmd:DirectorsDeferredShareUnitsLiabilityMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814us-gaap:RestrictedStockUnitsRSUMembercurrency:USD2023-01-012023-09-300001813814us-gaap:CommonStockMember2023-07-012023-09-300001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001813814us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-3000018138142022-01-012022-09-300001813814us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-3000018138142022-06-300001813814us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001813814us-gaap:RestrictedStockUnitsRSUMember2023-09-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMember2022-09-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMember2023-01-012023-09-300001813814us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-09-300001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001813814us-gaap:AdditionalPaidInCapitalMember2023-06-300001813814us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001813814us-gaap:CommonStockMember2023-06-300001813814mnmd:AtTheMarketOfferingProgramMember2023-01-012023-09-300001813814us-gaap:FairValueMeasurementsRecurringMember2023-09-300001813814us-gaap:RetainedEarningsMember2023-06-300001813814mnmd:TermLoanMembermnmd:LoanAndSecurityAgreementMembersrt:MinimumMembermnmd:K2HealthventuresLlcMember2023-08-110001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMember2023-09-300001813814us-gaap:EmployeeStockOptionMember2022-07-012022-09-300001813814us-gaap:RetainedEarningsMember2022-09-300001813814mnmd:TwoThousandTwentyTwoUsdFinancingWarrantLiabilityMember2023-09-300001813814us-gaap:RetainedEarningsMember2022-07-012022-09-300001813814mnmd:DirectorsDeferredShareUnitsLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001813814us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-3000018138142023-09-3000018138142022-12-310001813814us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001813814us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-30iso4217:USDxbrli:sharesxbrli:pureiso4217:CADxbrli:sharesxbrli:sharesiso4217:CADiso4217:USD

`

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-40360

Mind Medicine (MindMed) Inc.

(Exact name of Registrant as specified in its Charter)

|

|

British Columbia, Canada |

98-1582538 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

One World Trade Center, Suite 8500 New York, New York |

10007 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 220-6633

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Shares, no par value per share |

|

MNMD |

|

The Nasdaq Stock Market LLC (The Nasdaq Global Select Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 19, 2023, the registrant had 40,094,708 Common Shares outstanding.

`

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including statements regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

•the timing, progress and results of our investigational programs for MM-120, a proprietary, pharmaceutically optimized form of lysergide D-tartrate, and MM-402, also referred to as R(-)-MDMA (together, our “lead product candidates”), MM-110, or zolunicant, and any other product candidates (together with our lead product candidates, our “product candidates”), including statements regarding the timing of initiation and completion of trials or studies and related preparatory work, the period during which the results of the trials will become available and our research and development programs;

•our reliance on the success of our investigational MM-120 product candidate;

•the timing, scope or likelihood of regulatory filings and approvals and our ability to obtain and maintain regulatory approvals for product candidates for any indication;

•our expectations regarding the size of the eligible patient populations for our lead product candidates;

•our ability to identify third-party treatment sites to conduct our trials and our ability to identify and train appropriate qualified healthcare practitioners ("HCPs") to administer our treatments;

•our ability to implement our business model and our strategic plans for our product candidates;

•our ability to identify new indications for our lead product candidates beyond our current primary focuses;

•our ability to identify, develop or acquire digital technologies to enhance our administration of our product candidates, if they should become approved and commercialized;

•our ability to achieve profitability and then sustain such profitability;

•our commercialization, marketing and manufacturing capabilities and strategy;

•the pricing, coverage and reimbursement of our lead product candidates, if approved and commercialized;

•the rate and degree of market acceptance and clinical utility of our lead product candidates, in particular, and controlled substances, in general;

•future investments in our business, our anticipated capital expenditures and our estimates regarding our capital requirements;

•our ability to establish or maintain collaborations or strategic relationships or to obtain additional funding;

•our expectations regarding potential benefits of our lead product candidates;

•our ability to maintain effective patent rights and other intellectual property protection for our product candidates or any future product candidates, and to prevent competitors from using technologies we consider important in our successful development and commercialization of our product candidates;

•infringement or alleged infringement on the intellectual property rights of third parties;

•legislative and regulatory developments in the United States, Canada, United Kingdom, and other jurisdictions;

•the effectiveness of our internal control over financial reporting;

•actions of activist shareholders against us have been and could be disruptive and costly and may result in litigation and have an adverse effect on our business and stock price;

•the impact of adverse global economic conditions, including public health crises (such as the COVID-19 pandemic), fluctuations in interest rates, supply-chain disruptions and inflation, on our financial condition and operations;

•our Loan and Security Agreement contains certain covenants that could adversely affect our operations and, if an event of default were to occur, we could be forced to repay any outstanding indebtedness sooner than planned and possibly at a time when we do not have sufficient capital to meet this obligation;

•our expectations regarding our revenue, expenses and other operating results;

•the costs and success of our marketing efforts, and our ability to promote our brand;

•our reliance on key personnel and our ability to identify, recruit and retain skilled personnel;

•our ability to effectively manage our growth; and

•our ability to compete effectively with existing competitors and new market entrants.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q (this "Quarterly Report") primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors” previously disclosed in Part I, Item 1A. in our Annual Report on Form 10-K, as filed with the U.S. Securities and Exchange Commission ("SEC") on March 9, 2023 (the “2022 Annual Report”) and in Part II, Item 1A in this Quarterly Report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report. And while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Quarterly Report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report to reflect events or circumstances after the date of this Quarterly Report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

We may announce material business and financial information to our investors using our investor relations website (https://mindmed.co/investor-resources/). We therefore encourage investors and others interested in our company to review the information that we make available on our website. Our website and information included in or linked to our website are not part of this Quarterly Report.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Mind Medicine (MindMed) Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023

(unaudited) |

|

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

117,699 |

|

|

$ |

142,142 |

|

Prepaid and other current assets |

|

|

2,387 |

|

|

|

3,913 |

|

Total current assets |

|

|

120,086 |

|

|

|

146,055 |

|

Goodwill |

|

|

19,918 |

|

|

|

19,918 |

|

Intangible assets, net |

|

|

1,317 |

|

|

|

3,689 |

|

Other non-current assets |

|

|

229 |

|

|

|

331 |

|

Total assets |

|

$ |

141,550 |

|

|

$ |

169,993 |

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

7,686 |

|

|

$ |

2,111 |

|

Accrued expenses |

|

|

9,957 |

|

|

|

5,877 |

|

2022 USD Financing Warrants |

|

|

13,511 |

|

|

|

9,904 |

|

Total current liabilities |

|

|

31,154 |

|

|

|

17,892 |

|

Credit facility, long-term |

|

|

14,068 |

|

|

|

— |

|

Other liabilities, long-term |

|

|

349 |

|

|

|

1,184 |

|

Total liabilities |

|

|

45,571 |

|

|

|

19,076 |

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 9) |

|

|

|

|

|

|

Shareholders' Equity: |

|

|

|

|

|

|

Common shares, no par value, unlimited authorized as of September 30, 2023 and December 31, 2022; 40,094,708 and 37,979,136 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively |

|

|

— |

|

|

|

— |

|

Additional paid-in capital |

|

|

361,538 |

|

|

|

344,758 |

|

Accumulated other comprehensive income |

|

|

777 |

|

|

|

627 |

|

Accumulated deficit |

|

|

(266,336 |

) |

|

|

(194,468 |

) |

Total shareholders' equity |

|

|

95,979 |

|

|

|

150,917 |

|

Total liabilities and shareholders' equity |

|

$ |

141,550 |

|

|

$ |

169,993 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

4

Mind Medicine (MindMed) Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited; in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended September 30, |

|

|

Nine Months

Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

13,203 |

|

|

$ |

7,772 |

|

|

$ |

40,578 |

|

|

$ |

27,339 |

|

General and administrative |

|

|

8,413 |

|

|

|

9,211 |

|

|

|

31,083 |

|

|

|

25,092 |

|

Total operating expenses |

|

|

21,616 |

|

|

|

16,983 |

|

|

|

71,661 |

|

|

|

52,431 |

|

Loss from operations |

|

|

(21,616 |

) |

|

|

(16,983 |

) |

|

|

(71,661 |

) |

|

|

(52,431 |

) |

Other income/(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

1,163 |

|

|

|

360 |

|

|

|

3,759 |

|

|

|

443 |

|

Foreign exchange (loss)/gain, net |

|

|

(439 |

) |

|

|

138 |

|

|

|

(244 |

) |

|

|

94 |

|

Change in fair value of 2022 USD Financing Warrants |

|

|

3,020 |

|

|

|

— |

|

|

|

(3,671 |

) |

|

|

— |

|

Other (expense)/income |

|

|

(51 |

) |

|

|

— |

|

|

|

(51 |

) |

|

|

1 |

|

Total other income/(expense), net |

|

|

3,693 |

|

|

|

498 |

|

|

|

(207 |

) |

|

|

538 |

|

Net loss |

|

|

(17,923 |

) |

|

|

(16,485 |

) |

|

|

(71,868 |

) |

|

|

(51,893 |

) |

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

Gain/(loss) on foreign currency translation |

|

|

415 |

|

|

|

(107 |

) |

|

|

150 |

|

|

|

(303 |

) |

Comprehensive loss |

|

$ |

(17,508 |

) |

|

$ |

(16,592 |

) |

|

$ |

(71,718 |

) |

|

$ |

(52,196 |

) |

Net loss per common share, basic and diluted |

|

$ |

(0.45 |

) |

|

$ |

(0.56 |

) |

|

$ |

(1.85 |

) |

|

$ |

(1.82 |

) |

Weighted-average common shares, basic and diluted |

|

|

39,720,007 |

|

|

|

29,296,333 |

|

|

|

38,798,374 |

|

|

|

28,566,161 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

5

Mind Medicine (MindMed) Inc.

Condensed Consolidated Statements of Shareholders’ Equity

(Unaudited; in thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated OCI |

|

|

Accumulated Deficit |

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2022 |

|

|

37,979,136 |

|

|

$ |

— |

|

|

$ |

344,758 |

|

|

$ |

627 |

|

|

$ |

(194,468 |

) |

|

$ |

150,917 |

|

Issuance of common shares, net of share issuance costs |

|

|

1,402,598 |

|

|

|

— |

|

|

|

4,943 |

|

|

|

— |

|

|

|

— |

|

|

|

4,943 |

|

Vesting of restricted share units |

|

|

672,641 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Exercise of 2022 USD Financing Warrants |

|

|

27,000 |

|

|

|

— |

|

|

|

178 |

|

|

|

— |

|

|

|

— |

|

|

|

178 |

|

Exercise of stock options |

|

|

13,333 |

|

|

|

— |

|

|

|

49 |

|

|

|

— |

|

|

|

— |

|

|

|

49 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

11,610 |

|

|

|

— |

|

|

|

— |

|

|

|

11,610 |

|

Net loss and comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

150 |

|

|

|

(71,868 |

) |

|

|

(71,718 |

) |

Balance, September 30, 2023 |

|

|

40,094,708 |

|

|

$ |

— |

|

|

$ |

361,538 |

|

|

$ |

777 |

|

|

$ |

(266,336 |

) |

|

$ |

95,979 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2021 |

|

|

28,126,414 |

|

|

$ |

— |

|

|

$ |

288,290 |

|

|

$ |

1,046 |

|

|

$ |

(137,672 |

) |

|

$ |

151,664 |

|

Issuance of common shares and warrants, net of share issuance costs |

|

|

9,014,371 |

|

|

|

— |

|

|

|

41,350 |

|

|

|

— |

|

|

|

— |

|

|

|

41,350 |

|

Exercise of warrants |

|

|

76,021 |

|

|

|

— |

|

|

|

708 |

|

|

|

— |

|

|

|

— |

|

|

|

708 |

|

Exercise of stock options |

|

|

38,276 |

|

|

|

— |

|

|

|

206 |

|

|

|

— |

|

|

|

— |

|

|

|

206 |

|

Settlement of restricted share unit awards |

|

|

286,033 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Withholding taxes paid on vested restricted share units |

|

|

— |

|

|

|

— |

|

|

|

(407 |

) |

|

|

— |

|

|

|

— |

|

|

|

(407 |

) |

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

12,268 |

|

|

|

— |

|

|

|

— |

|

|

|

12,268 |

|

Net loss and comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(303 |

) |

|

|

(51,893 |

) |

|

|

(52,196 |

) |

Balance, September 30, 2022 |

|

|

37,541,115 |

|

|

$ |

— |

|

|

$ |

342,415 |

|

|

$ |

743 |

|

|

$ |

(189,565 |

) |

|

$ |

153,593 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated OCI |

|

|

Accumulated Deficit |

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, June 30, 2023 |

|

|

38,807,159 |

|

|

$ |

— |

|

|

$ |

354,023 |

|

|

$ |

362 |

|

|

$ |

(248,413 |

) |

|

$ |

105,972 |

|

Issuance of common shares, net of share issuance costs |

|

|

800,700 |

|

|

|

— |

|

|

|

3,086 |

|

|

|

— |

|

|

|

— |

|

|

|

3,086 |

|

Vesting of restricted share units |

|

|

446,516 |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Exercise of 2022 USD Financing Warrants |

|

|

27,000 |

|

|

|

— |

|

|

|

178 |

|

|

|

— |

|

|

|

— |

|

|

|

178 |

|

Exercise of stock options |

|

|

13,333 |

|

|

|

— |

|

|

|

49 |

|

|

|

— |

|

|

|

— |

|

|

|

49 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

4,202 |

|

|

|

— |

|

|

|

— |

|

|

|

4,202 |

|

Net loss and comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

415 |

|

|

|

(17,923 |

) |

|

|

(17,508 |

) |

Balance September 30, 2023 |

|

|

40,094,708 |

|

|

$ |

— |

|

|

$ |

361,538 |

|

|

$ |

777 |

|

|

$ |

(266,336 |

) |

|

$ |

95,979 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, June 30, 2022 |

|

|

28,445,948 |

|

|

$ |

— |

|

|

$ |

296,734 |

|

|

$ |

850 |

|

|

$ |

(173,080 |

) |

|

$ |

124,504 |

|

Issuance of common shares and warrants, net of share issuance costs |

|

|

9,014,371 |

|

|

|

— |

|

|

|

41,350 |

|

|

|

— |

|

|

|

— |

|

|

|

41,350 |

|

Exercise of stock options |

|

|

8,762 |

|

|

|

— |

|

|

|

42 |

|

|

|

— |

|

|

|

— |

|

|

|

42 |

|

Settlement of restricted share unit awards |

|

|

72,034 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

4,289 |

|

|

|

— |

|

|

|

— |

|

|

|

4,289 |

|

Net loss and comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(107 |

) |

|

|

(16,485 |

) |

|

|

(16,592 |

) |

Balance, September 30, 2022 |

|

|

37,541,115 |

|

|

$ |

— |

|

|

$ |

342,415 |

|

|

$ |

743 |

|

|

$ |

(189,565 |

) |

|

$ |

153,593 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

6

Mind Medicine (MindMed) Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited; in thousands)

|

|

|

|

|

|

|

|

|

|

|

Nine Months

Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities |

|

|

|

|

|

|

Net loss |

|

$ |

(71,868 |

) |

|

$ |

(51,893 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Stock-based compensation |

|

|

11,818 |

|

|

|

12,331 |

|

Amortization of intangible assets |

|

|

2,372 |

|

|

|

2,390 |

|

Change in fair value of 2022 USD Financing Warrants |

|

|

3,671 |

|

|

|

— |

|

Issuance costs on liability classified warrants |

|

|

— |

|

|

|

1,500 |

|

Other non-cash adjustments |

|

|

128 |

|

|

|

30 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Prepaid and other current assets |

|

|

1,575 |

|

|

|

1,837 |

|

Other noncurrent assets |

|

|

60 |

|

|

|

— |

|

Accounts payable |

|

|

5,535 |

|

|

|

(3,329 |

) |

Accrued expenses |

|

|

3,742 |

|

|

|

622 |

|

Other liabilities, long-term |

|

|

(835 |

) |

|

|

(778 |

) |

Net cash used in operating activities |

|

|

(43,802 |

) |

|

|

(37,290 |

) |

Cash flows from financing activities |

|

|

|

|

|

|

Proceeds from credit facility |

|

|

15,000 |

|

|

|

— |

|

Payment of credit facility issuance costs |

|

|

(802 |

) |

|

|

— |

|

Proceeds from issuance of common shares, net of issuance costs |

|

|

4,943 |

|

|

|

41,567 |

|

Proceeds from issuance of 2022 USD Financing Warrants |

|

|

— |

|

|

|

17,747 |

|

Payment of 2022 USD Financing Warrants issuance costs |

|

|

— |

|

|

|

(1,186 |

) |

Proceeds from exercise of warrants |

|

|

114 |

|

|

|

708 |

|

Proceeds from exercise of options |

|

|

— |

|

|

|

206 |

|

Withholding taxes paid on vested restricted share units |

|

|

— |

|

|

|

(407 |

) |

Net cash provided by financing activities |

|

|

19,255 |

|

|

|

58,635 |

|

Effect of exchange rate changes on cash |

|

|

104 |

|

|

|

(365 |

) |

Net (decrease)/increase in cash and cash equivalents |

|

|

(24,443 |

) |

|

|

20,980 |

|

Cash and cash equivalents, beginning of year |

|

|

142,142 |

|

|

|

133,539 |

|

Cash and cash equivalents, end of year |

|

$ |

117,699 |

|

|

$ |

154,519 |

|

|

|

|

|

|

|

|

Supplemental Noncash Disclosures |

|

|

|

|

|

|

Unpaid issuance costs for credit facility |

|

$ |

170 |

|

|

$ |

- |

|

Conversion of 2022 USD Financing Warrants to common stock upon exercise of warrants |

|

$ |

64 |

|

|

$ |

- |

|

Proceeds from exercise of options in prepaid and other current assets |

|

$ |

49 |

|

|

$ |

- |

|

Unpaid issuance costs for common shares |

|

$ |

- |

|

|

$ |

217 |

|

Unpaid issuance costs for 2022 USD Financing Warrants |

|

$ |

- |

|

|

$ |

314 |

|

Right-of-use assets obtained in exchange of operating lease liabilities |

|

$ |

- |

|

|

$ |

194 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

7

Mind Medicine (MindMed) Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(In thousands, except share and per share amounts)

1.DESCRIPTION OF THE BUSINESS

Mind Medicine (MindMed) Inc. (the “Company” or “MindMed”) is incorporated under the laws of the Province of British Columbia. Its wholly owned subsidiaries, Mind Medicine, Inc. (“MindMed US”), HealthMode Inc., MindMed Pty Ltd., and MindMed GmbH are incorporated in Delaware, Delaware, Australia and Switzerland respectively. MindMed US was incorporated on May 30, 2019.

MindMed is a clinical stage biopharmaceutical company developing novel product candidates to treat brain health disorders. The Company’s mission is to be the global leader in the development and delivery of treatments for brain health disorders that unlock new opportunities to improve patient outcomes. The Company is developing a pipeline of innovative product candidates, with and without acute perceptual effects, targeting neurotransmitter pathways that play key roles in brain health disorders. This specifically includes pharmaceutically optimized product candidates derived from the psychedelic and empathogen drug classes, including MM-120 and MM-402, the Company’s lead product candidates.

As of September 30, 2023, the Company had an accumulated deficit of $266.3 million. Through September 30, 2023, all the Company’s financial support has primarily been provided by proceeds from the issuance of the Company’s common shares (the “Common Shares”) and warrants to purchase Common Shares and the credit facility.

As the Company continues its expansion, it may seek additional financing and/or strategic investments; however, there can be no assurance that any additional financing or strategic investments will be available to the Company on acceptable terms, if at all. If events or circumstances occur such that the Company does not obtain additional funding, it will most likely be required to reduce its plans and/or certain discretionary spending, which could have a material adverse effect on the Company’s ability to achieve its intended business objectives. The accompanying condensed consolidated financial statements do not include any adjustments that might be necessary if it were unable to continue as a going concern. Management believes that it has sufficient working capital on hand to fund operations through at least the next twelve months from the date of the issuance of these financial statements.

Emerging Growth Company Status

The Company is an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act until such time as those standards apply to private companies. The Company has elected to use the extended transition period for complying with new or revised accounting standards, and as a result of this election, the condensed consolidated financial statements may not be comparable to companies that comply with public company Financial Accounting Standards Board ("FASB") standards’ effective dates. The Company may take advantage of these exemptions up until the last day of the fiscal year following the fifth anniversary of an initial public offering or such earlier time that it is no longer an emerging growth company.

2.BASIS OF pRESENTATION AND Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and the related notes thereto for the year ended December 31, 2022, which are included in the Company’s 2022 Annual Report on Form 10-K filed with the SEC on March 9, 2023 (the “2022 Annual Report”). The Company’s significant accounting policies are disclosed in the audited financial statements for the periods ended December 31, 2022 and 2021, included in the 2022 Annual Report. Since the date of those financial statements, there have been no changes to the Company's significant accounting policies.

The accompanying condensed consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States (“U.S. GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative U.S. GAAP, as found in the Accounting Standards Codification and as amended by Accounting Standards Updates of FASB.

The preparation of financial statements in conformity with U.S. GAAP requires management to make a number of estimates and assumptions relating to the reporting of assets and liabilities and the disclosure of contingent assets and liabilities at the dates of the

8

financial statements and the reported amounts of expenses during the reporting periods. Actual results could differ from those estimates under different assumptions or conditions.

Intercompany balances and transactions, and any unrealized income and expenses arising from intercompany transactions, are eliminated in preparing the condensed consolidated financial statements.

Foreign Currency

The Company’s reporting currency is the U.S. dollar. The Company's functional currency is the Canadian dollar (“CAD”). The local currency of the Company’s foreign affiliates is generally their functional currency. Accordingly, the assets and liabilities of the foreign affiliates and the parent entity are translated from their respective functional currency to U.S. dollars using fiscal year-end exchange rates, income and expense accounts are translated at the average rates in effect during the fiscal year and equity accounts are translated at historical rates. Transactions denominated in currencies other than the functional currency are remeasured to the functional currency at the exchange rate on the transaction date. Monetary assets and liabilities denominated in currencies other than the functional currency are remeasured at period-end using the period-end exchange rate.

Cash and Cash Equivalents

The Company considers all investments with an original maturity date at the time of purchase of three months or less to be cash and cash equivalents. As of September 30, 2023, the Company’s cash equivalents consisted of U.S. government money market funds at a high-credit quality and federally insured financial institution. The Company’s accounts, at times, may exceed federally insured limits. The Company had cash equivalents of $115.3 million as of September 30, 2023, and $131.7 million as of December 31, 2022.

Recent Accounting Pronouncements

From time to time, new accounting pronouncements are issued by FASB or other standard setting bodies and adopted by the Company as of the specified effective date. Unless otherwise discussed, the impact of recently issued standards that are not yet effective will not have a material impact on the Company’s financial position, results of operations, or cash flows upon adoption.

3.FAIR VALUE OF FINANCIAL INSTRUMENTS

The following table presents information about the Company’s assets and liabilities measured at fair value on a recurring basis as of September 30, 2023 and December 31, 2022, and the fair value hierarchy of the valuation techniques utilized. The Company classifies its assets and liabilities as either short- or long-term based on maturity and anticipated realization dates.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Financial assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents |

|

$ |

115,339 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

115,339 |

|

Financial liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Directors' Deferred Share Unit Liability |

|

$ |

284 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

284 |

|

2022 USD Financing Warrant Liability |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

13,511 |

|

|

$ |

13,511 |

|

|

|

December 31, 2022 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Financial assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents |

|

$ |

131,702 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

131,702 |

|

Financial liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Directors' Deferred Share Unit Liability |

|

$ |

124 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

124 |

|

2022 USD Financing Warrant Liability |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

9,904 |

|

|

$ |

9,904 |

|

The Company evaluates transfers between fair value levels at the end of each reporting period. There were no transfers into or out of Level 1, Level 2, or Level 3 during the nine months ended September 30, 2023 and the year ended December 31, 2022.

9

The fair value of the warrant liability is measured at fair value on a recurring basis. The warrants to purchase 7,058,823 Common Shares issued in our underwritten public offering that closed on September 30, 2022 (the “2022 USD Financing Warrants”) are classified as Level 3 in the fair value hierarchy and are determined using the Black-Scholes option pricing model using the following assumptions:

|

|

|

|

|

|

|

As of September 30, 2023 |

|

As of December 31, 2022 |

Share price |

|

$3.13 |

|

$2.20 |

Expected volatility |

|

90.84% |

|

97.08% |

Risk-free rate |

|

4.59% |

|

3.94% |

Expected life |

|

4.00 years |

|

4.75 years |

4.GOODWILL AND INTANGIBLE ASSETS, NET

Goodwill

During the nine months ended September 30, 2023, the Company made no additions to its outstanding goodwill. There were no triggering events identified, no indication of impairment of the Company’s goodwill and long-lived assets, and no impairment charges recorded during the three and nine months ended September 30, 2023 and 2022.

Intangible assets, net

The following table summarizes the carrying value of the Company's intangible assets (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2023 |

|

|

Useful Lives

(in years) |

|

Gross Carrying

Value |

|

|

Accumulated

Amortization |

|

|

Net Carrying

Value |

|

Developed technology |

3 |

|

$ |

9,485 |

|

|

$ |

(8,168 |

) |

|

$ |

1,317 |

|

Total intangible assets, net |

|

|

$ |

9,485 |

|

|

$ |

(8,168 |

) |

|

$ |

1,317 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2022 |

|

|

Useful Lives

(in years) |

|

Gross Carrying

Value |

|

|

Accumulated

Amortization |

|

|

Net Carrying

Value |

|

Developed technology |

3 |

|

$ |

9,485 |

|

|

$ |

(5,796 |

) |

|

$ |

3,689 |

|

Total intangible assets, net |

|

|

$ |

9,485 |

|

|

$ |

(5,796 |

) |

|

$ |

3,689 |

|

As of September 30, 2023, developed technology has a remaining useful life of 0.4 years. Amortization expense included in research and development expense was $0.8 million for both the three months ended September 30, 2023 and 2022, and $2.4 million for both the nine months ended September 30, 2023 and 2022.

At September 30, 2023 and December 31, 2022, accrued expenses consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

|

December 31,

2022 |

|

Accrued compensation |

|

$ |

3,502 |

|

|

$ |

3,198 |

|

Accrued clinical and manufacturing costs |

|

|

2,347 |

|

|

|

605 |

|

Contribution payable |

|

|

2,540 |

|

|

|

1,566 |

|

Professional services |

|

|

1,132 |

|

|

|

436 |

|

Other accruals |

|

|

436 |

|

|

|

72 |

|

Total accrued expenses |

|

$ |

9,957 |

|

|

$ |

5,877 |

|

Common Shares

The Company is authorized to issue an unlimited number of Common Shares, which have no par value. As of September 30, 2023, the Company had issued and outstanding 40,094,708 Common Shares.

10

At-The-Market Facility

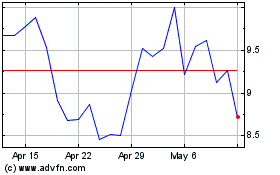

On May 4, 2022, the Company filed a shelf registration statement on Form S-3 (the “Registration Statement”). Pursuant to the Registration Statement, the Company may offer and sell securities having an aggregate public offering price of up to $200.0 million. In connection with the filing of the Registration Statement, the Company also entered into a sales agreement with Cantor Fitzgerald & Co. and Oppenheimer & Co. Inc. as sales agents (together, the “Sales Agents”), pursuant to which the Company may issue and sell Common Shares for an aggregate offering price of up to $100.0 million under an at-the-market offering program (the “ATM”). Pursuant to the ATM, the Company will pay the Sales Agents a commission rate equal to 3.0% of the gross proceeds from the sale of any Common Shares. The Company is not obligated to make any sales of its Common Shares under the ATM. During the three and nine months ended September 30, 2023, the Company sold 800,700 and 1,402,598 Common Shares for net proceeds of $3.1 million and $5.0 million under the ATM, respectively. As of September 30, 2023, the Company had raised an aggregate of $37.2 million under the ATM and may raise up to an additional $62.8 million.

CAD Financing Warrants and CAD Compensation Warrants

Between 2020 through 2021, in conjunction with equity offerings, the Company issued units at varying prices per unit in Canadian dollars (“CAD$”), with each unit comprised of one Common Share and one-half of one Common Share financing warrant (each whole warrant, a “CAD Financing Warrant”), and with each CAD Financing Warrant entitling the holder thereof to purchase a Common Share at a specified CAD$ exercise price. In connection with these equity offerings, the Company also issued compensation warrants to its underwriters (the “CAD Compensation Warrants”), with each Compensation Warrant entitling the holder thereof to purchase one unit at a specified CAD$ price per CAD Compensation Warrant, and with each unit purchased thereunder entitling the holder thereof to one Common Share and one-half CAD Financing Warrant. The outstanding CAD Financing Warrants and the CAD Compensation Warrants expire at various dates through March 9, 2024. There was no activity associated with the Company's outstanding CAD Financing Warrants and CAD Compensation Warrants for the nine months ended September 30, 2023.

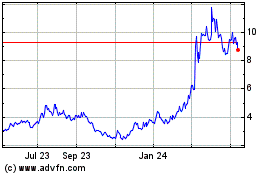

2022 USD Financing Warrants

On September 30, 2022, the Company closed an underwritten public offering of 7,058,823 Common Shares and accompanying 2022 USD Financing Warrants to purchase 7,058,823 Common Shares. Each 2022 USD Financing Warrant is immediately exercisable for one Common Share at an exercise price of $4.25 per Common Share, subject to certain adjustments, and will expire on September 30, 2027.

The below table represents the activity associated with the Company's outstanding liability classified 2022 USD Financing Warrants for the nine months ended September 30, 2023:

|

|

|

|

|

|

|

2022 USD Financing

Warrants |

|

Balance at December 31, 2022 |

|

|

7,058,823 |

|

Issued |

|

|

— |

|

Exercised |

|

|

(27,000 |

) |

Expired |

|

|

— |

|

Balance at September 30, 2023 |

|

|

7,031,823 |

|

|

|

|

|

The 2022 USD Financing Warrants are liability classified due to being denominated in USD and not the Company's functional currency. Accordingly, the 2022 USD Financing Warrants are recognized at fair value upon issuance and are adjusted to fair value at the end of each reporting period. Any change in fair value is recognized on the condensed consolidated statements of operations and comprehensive loss. The Company recognized a gain relating to the change in fair value of the warrant liability of $3.0 million for the three months ended September 30, 2023, and a loss relating to the change in fair value of the warrant liability of $3.7 million for the nine months ended September 30, 2023.

|

|

|

|

|

|

|

As of September 30, 2023 |

|

Balance at December 31, 2022 |

|

$ |

9,904 |

|

Warrant exercise |

|

|

(64 |

) |

Change in fair value of the warrant liability |

|

|

3,671 |

|

Balance at September 30, 2023 |

|

$ |

13,511 |

|

11

8.STOCK-BASED COMPENSATION

Stock Incentive Plans

Effective March 7, 2023, the Company amended the definition of "Market Value" under both the MindMed Stock Option Plan (the “Stock Option Plan”) and the Performance and Restricted Share Unit Plan (the “RSU Plan”) to be based upon the closing price of the Company's Common Shares as traded on the Nasdaq Stock Market (the “Amendments”). This change is only applicable for equity compensation awards granted subsequent to the Amendments. Accordingly, stock options granted after March 7, 2023 ("USD options") are denominated in USD, and the grant date fair value of restricted share units granted after March 7, 2023 ("USD RSUs") is denominated in USD. The fair value of both USD options and USD RSUs is based upon the closing price of the Company's Common Shares as traded on the Nasdaq Stock Market.

Stock Options

On February 27, 2020, the Company adopted the Stock Option Plan to advance the interests of the Company by providing employees, contractors and directors of the Company a performance incentive for continued and improved service with the Company. The Stock Option Plan sets out the framework for determining eligibility as well as the terms of any stock-based compensation granted. The Stock Option Plan was approved by the shareholders as part of the terms of an arrangement agreement (the “Arrangement”) entered into by the Company on October 15, 2019 in connection with the completion of its reverse acquisition, which completed on February 27, 2020 (the “Transaction”). The Company is authorized to issue 15% of the Company’s outstanding Common Shares under the terms of the Stock Option Plan.

The following table summarizes the Company’s stock option activity (excluding 178,006 USD options granted with an average exercise price of $3.38):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Options |

|

|

Weighted Average Exercise Price (CAD$) |

|

|

Weighted Average Remaining Contractual Life (Years) |

|

|

Aggregate Intrinsic

Value

(CAD$) |

|

Options outstanding at December 31, 2022 |

|

|

2,190,315 |

|

|

$ |

24.29 |

|

|

|

4.1 |

|

|

$ |

4,484 |

|

Issued |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Exercised |

|

|

(13,333 |

) |

|

|

4.95 |

|

|

|

— |

|

|

|

7,333 |

|

Forfeited |

|

|

(21,246 |

) |

|

|

16.39 |

|

|

|

— |

|

|

|

— |

|

Expired |

|

|

(99,454 |

) |

|

|

15.51 |

|

|

|

— |

|

|

|

— |

|

Options outstanding at September 30, 2023 |

|

|

2,056,282 |

|

|

$ |

24.92 |

|

|

|

3.5 |

|

|

$ |

24,960 |

|

Options vested and exercisable at September 30, 2023 |

|

|

1,134,101 |

|

|

$ |

25.82 |

|

|

|

3.1 |

|

|

$ |

1,453 |

|

The expense recognized related to options was $1.7 million and $2.0 million for the three months ended September 30, 2023 and 2022, respectively, and $5.0 million and $6.0 million for the nine months ended September 30, 2023 and 2022, respectively.

Restricted Share Units

The Company adopted the RSU Plan to advance the interests of the Company by providing employees, contractors and directors of the Company a performance incentive for continued and improved service with the Company. The RSU Plan sets out the framework for determining eligibility as well as the terms of any stock-based compensation granted. The RSU Plan was approved by the shareholders as part of the Arrangement. The fair value has been estimated based on the closing price of the Common Shares on the day prior to the grant.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(CAD$) |

|

|

(USD$) |

|

|

|

Number of RSUs |

|

|

Number of RSUs |

|

Weighted Average Grant Date Fair Value |

|

|

Number of RSUs |

|

Weighted Average Grant Date Fair Value |

|

Balance at December 31, 2022 |

|

|

1,522,793 |

|

|

|

1,522,793 |

|

$ |

17.75 |

|

|

|

— |

|

|

— |

|

Granted |

|

|

1,644,938 |

|

|

|

— |

|

|

— |

|

|

|

1,644,938 |

|

|

3.24 |

|

Vested, issued and unissued |

|

|

(634,165 |

) |

|

|

(412,124 |

) |

|

20.35 |

|

|

|

(222,041 |

) |

|

3.54 |

|

Cancelled |

|

|

(14,174 |

) |

|

|

(14,174 |

) |

|

3.20 |

|

|

|

— |

|

|

— |

|

Balance at September 30, 2023 |

|

|

2,519,392 |

|

|

|

1,096,495 |

|

$ |

16.78 |

|

|

|

1,422,897 |

|

$ |

3.20 |

|

12

The expense recognized related to restricted share units was $2.5 million and $2.3 million for the three months ended September 30, 2023 and 2022, respectively, and $6.6 million and $6.2 million for the nine months ended September 30, 2023 and 2022, respectively.

Directors' Deferred Share Unit Plan

On April 16, 2021 the Company adopted the MindMed Director's Deferred Share Unit Plan (the "DDSU Plan"). The DDSU Plan sets out a framework to grant non-executive directors DDSU's which are cash settled awards. Effective June 8, 2023, the Company amended the definition of “Fair Market Value” under the DDSU Plan to be based upon the closing price of the Company’s Common Shares as traded on the Nasdaq Stock Market. This change is only applicable for Directors Deferred Share Units (“DDSUs”) granted subsequent to June 8, 2023. Accordingly, DDSUs granted after June 8, 2023 are denominated in USD. The DDSU Plan states that the fair market value of one DDSU shall be equal to the volume weighted average trading price of a Common Share on the Nasdaq Stock Market for the five business days immediately preceding the valuation date. The DDSU's generally vest ratably over twelve months after grant and are settled within 90 days of the date the director ceases service to the Company.

For the three and nine months ended September 30, 2023, stock-based compensation expense of a nominal amount was recognized relating to the revaluation of the vested DDSUs, recorded in general and administrative expense in the accompanying condensed consolidated statements of operations and comprehensive loss. During the nine months ended September 30, 2023, the Company issued 13,131 DDSUs. There were 64,719 DDSUs vested as of September 30, 2023. The liability associated with the outstanding vested DDSU’s was $0.3 million as of September 30, 2023 and was recorded within accrued expenses in the accompanying condensed consolidated balance sheets.

Stock-based Compensation Expense

Stock-based compensation expense for all equity arrangements for the three and nine months ended September 30, 2023 and 2022 was as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Research and development |

|

$ |

2,023 |

|

|

$ |

1,424 |

|

|

$ |

5,600 |

|

|

$ |

5,208 |

|

General and administrative |

|

|

2,203 |

|

|

|

2,862 |

|

|

|

6,218 |

|

|

|

7,123 |

|

Total stock-based compensation expense |

|

$ |

4,226 |

|

|

$ |

4,286 |

|

|

$ |

11,818 |

|

|

$ |

12,331 |

|

As of September 30, 2023, there was approximately $11.0 million of total unrecognized stock-based compensation expense, related to unvested options granted to employees under the Stock Option Plan that is expected to be recognized over a weighted average period of 2.0 years for CAD options, and 2.1 years for USD options. As of September 30, 2023, there was approximately $17.3 million of total unrecognized stock-based compensation expense, related to restricted share units granted to employees under the RSU Plan that is expected to be recognized over a weighted average period of 2.0 years for CAD RSUs, and 3.4 years for USD RSUs.

9.COMMITMENTS AND CONTINGENCIES

As of September 30, 2023, the Company had obligations to make future payments, representing significant research and development contracts and other commitments that are known and committed in the amount of approximately $29.4 million. Most of these agreements are cancelable by the Company with notice. These commitments include agreements related to the conduct of the clinical trials, sponsored research, manufacturing and preclinical studies.

The Company enters into research, development and license agreements in the ordinary course of business where the Company receives research services and rights to proprietary technologies. Milestone and royalty payments that may become due under various agreements are dependent on, among other factors, clinical trials, regulatory approvals and ultimately the successful development of a new drug, the outcome and timing of which are uncertain.

13

The Company periodically enters into research and license agreements with third parties that include indemnification provisions customary in the industry. These guarantees generally require the Company to compensate the other party for certain damages and costs incurred as a result of claims arising from research and development activities undertaken by or on behalf of the Company. In some cases, the maximum potential amount of future payments that could be required under these indemnification provisions could be unlimited. These indemnification provisions generally survive termination of the underlying agreement. The nature of the indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential amount it could be required to pay. Historically, the Company has not made any indemnification payments under such agreements and no amount has been accrued in the condensed consolidated financial statements with respect to these indemnification obligations.

On August 11, 2023 (the “Closing Date”), the Company entered into a Loan and Security Agreement (the “Loan Agreement”) with K2 HealthVentures LLC (“K2HV”, together with any other lender from time to time, the "Lenders"), as administrative agent and Canadian collateral agent for the Lenders, and Ankura Trust Company, LLC, as collateral trustee for the Lenders. The Loan Agreement provides for up to an aggregate principal amount of $50.0 million in term loans (the “Term Loan”) consisting of a first tranche term loan of $15.0 million funded on the Closing Date, subsequent tranches of term loans totaling $20.0 million to be funded upon the achievement of certain time-based, clinical and regulatory milestones, and an additional tranche term loan of up to $15.0 million upon the Company’s request, subject to review by the Lenders of certain information from the Company and discretionary approval by the Lenders. On the Closing Date, the Company paid a facility fee of $0.3 million to K2HV.

The Term Loan matures on August 1, 2027, and the obligations of the Company under the Loan Agreement are secured by substantially all of the assets of the Company, excluding intellectual property.

The Term Loan bears a variable interest rate equal to the greater of (i) 10.95% and (ii) the sum of (a) the prime rate as reported in The Wall Street Journal plus (b) 2.95%. The Company may prepay, at its option, all, but not less than all, of the outstanding principal balance and all accrued and unpaid interest with respect to the principal balance being prepaid of the Term Loan, subject to certain prepayment notice requirements; provided that such prepayment notice may be conditioned upon the effectiveness of a refinancing or any other transaction, in which case such prepayment notice may be revoked by the Company.

The Lenders may elect at any time following the Closing Date and prior to the full repayment of the Term Loan to convert any portion of the principal amount of the term loans then outstanding, up to an aggregate principal amount of $4.0 million, into the Company’s Common Shares (the “Conversion Shares”), at a conversion price equal to $4.01 per Conversion Share, subject to certain limitations. The embedded conversion option qualifies for a scope exception from derivative accounting because it is both indexed to the Company’s own shares and meets the conditions for equity classification.

The Loan Agreement contains customary representations and warranties and affirmative and negative covenants, including covenants that limit or restrict the Company's ability to, among other things: dispose of assets; make changes to the Company's business, management, ownership or business locations; merge or consolidate; incur additional indebtedness, encumbrances or liens; pay dividends or other distributions or repurchase equity; make investments; and enter into certain transactions with affiliates, in each case subject to certain exceptions. The Company is in compliance with the Loan Agreement as of September 30, 2023.

The Company recorded $0.2 million in interest expense for the three and nine months ended September 30, 2023.

Future expected repayments of principal amount due on the credit facility as of September 30, 2023 are as follows (in thousands):

|

|

|

|

|