0001412665false00014126652023-07-252023-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 25, 2023

MidWestOne Financial Group, Inc.

(Exact name of registrant as specified in its charter)

Commission file number 001-35968

| | | | | | | | |

| Iowa | | 42-1206172 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification Number) |

102 South Clinton Street

Iowa City, Iowa 52240

(Address of principal executive offices, including zip code)

(319) 356-5800

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

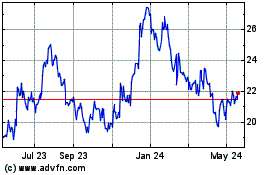

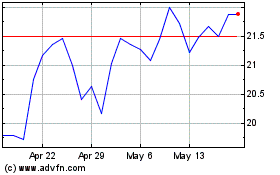

| Common stock, $1.00 par value | | MOFG | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 1, 2023, MidWestOne Financial Group, Inc. (the “Company”) issued a press release announcing its earnings for the three months and six months ended June 30, 2023. The press release is furnished herewith as Exhibit 99.1. In addition, the Company is providing a financial supplement furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this item and the attached press release and financial supplement shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filing.

Item 8.01. Other Events.

The Board of Directors of the Company declared a cash dividend of $0.2425 per common share on July 25, 2023. The dividend is payable September 15, 2023, to shareholders of record at the close of business on September 1, 2023.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | | | | |

| | |

| | MidWestOne Financial Group, Inc. press release dated August 1, 2023 |

| | MidWestOne Financial Group, Inc. financial supplement dated August 1, 2023 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | MIDWESTONE FINANCIAL GROUP, INC. | | |

| | | | | | |

| Dated: | August 1, 2023 | By: | | /s/ BARRY S. RAY | | |

| | | | Barry S. Ray | | |

| | | | Chief Financial Officer | |

| | | | | | |

| | | | | | | | | | | |

| FOR IMMEDIATE RELEASE | | August 1, 2023 | |

MIDWESTONE FINANCIAL GROUP, INC. REPORTS

FINANCIAL RESULTS FOR THE

SECOND QUARTER OF 2023

Iowa City, Iowa - MidWestOne Financial Group, Inc. (Nasdaq: MOFG) (“we”, “our”, or the "Company”) today reported results for the second quarter of 2023.

Second Quarter 2023 Highlights1

•Net income of $7.6 million, or $0.48 per diluted common share, compared to net income of $1.4 million, or $0.09 per diluted common share, for the linked quarter.

•Annualized loan growth of 10.6%.

•Expenses of $34.9 million included $1.4 million of costs stemming from a voluntary early retirement program and executive relocation.

•Nonperforming assets ratio improved 1 basis point ("bps") to 0.22%; net charge-off ratio was 0.09%.

Subsequent Events

•On July 25, 2023, the Board of Directors declared a cash dividend of $0.2425 per common share.

CEO COMMENTARY

Charles (Chip) Reeves, Chief Executive Officer of the Company, commented, “On our first quarter earnings call, we introduced a comprehensive strategic plan designed to transform our operations and become a higher performing bank over the medium term. Though we are facing a challenging operating environment driven by rising interest rates, we have made solid progress across the five pillars of our plan highlighted by 10% loan growth, annualized, that we achieved in the quarter. We have been adding bankers in our major markets of the Twin Cities, Denver, and Metro Iowa, which has been a major factor in this strong loan growth. So far this year, we have added bankers in the Twin Cities and we will continue to add bankers in our major markets as we continue to build scale and take market share. Late in the second quarter, as part of our specialty commercial loan growth initiative, we recruited an established agribusiness team from a regional bank as we strive to ‘up-tier’ in this attractive segment of the market. This team has already started to bring full relationship business to MidWestOne. We are also starting to see momentum in our governmental lending group, where we have improved our focus and execution. Lastly, we are seeing a nice increase in our wealth management assets under management and revenues, as compared to the first quarter, driven by the teams recruited in 2021 and 2022.”

Mr. Reeves concluded, “I'm very pleased with the early results that we are achieving as we execute our strategic plan. We are beginning to make investments in talent and our platform to drive growth, while keeping our noninterest expense relatively steady from the first quarter. We are driving significant change across our organization, and I would like to thank our employees for their hard work and dedication to our Company, customers, and communities. Our results would not be possible without their tireless efforts. I remain confident that we are on a strong path to significantly improved financial results.”

1 Second Quarter Summary compares to the first quarter of 2023 (the "linked quarter") unless noted.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of or for the quarter ended | | Six Months Ended |

| (Dollars in thousands, except per share amounts and as noted) | | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Financial Results | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Revenue | | $ | 45,708 | | | $ | 36,030 | | | $ | 52,072 | | | $ | 81,738 | | | $ | 101,052 | |

| Credit loss expense | | 1,597 | | | 933 | | | 3,282 | | | 2,530 | | | 3,282 | |

| Noninterest expense | | 34,919 | | | 33,319 | | | 32,082 | | | 68,238 | | | 63,725 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net income | | 7,594 | | | 1,397 | | | 12,621 | | | 8,991 | | | 26,516 | |

| Per Common Share | | | | | | | | | | |

| Diluted earnings per share | | $ | 0.48 | | | $ | 0.09 | | | $ | 0.80 | | | $ | 0.57 | | | $ | 1.69 | |

| Book value | | 31.96 | | | 31.94 | | | 31.26 | | | 31.96 | | | 31.26 | |

Tangible book value(1) | | 26.26 | | | 26.13 | | | 25.10 | | | 26.26 | | | 25.10 | |

| Balance Sheet & Credit Quality | | | | | | | | | | |

Loans In millions | | $ | 4,018.6 | | | $ | 3,919.4 | | | $ | 3,611.2 | | | $ | 4,018.6 | | | $ | 3,611.2 | |

Investment securities In millions | | 2,003.1 | | | 2,071.8 | | | 2,402.8 | | | 2,003.1 | | | 2,402.8 | |

Deposits In millions | | 5,445.4 | | | 5,555.2 | | | 5,537.4 | | | 5,445.4 | | | 5,537.4 | |

Net loan charge-offs In millions | | 0.9 | | | 0.3 | | | 0.3 | | | 1.2 | | | 2.5 | |

| Allowance for credit losses ratio | | 1.25 | % | | 1.27 | % | | 1.45 | % | | 1.25 | % | | 1.45 | % |

| Selected Ratios | | | | | | | | | | |

| Return on average assets | | 0.47 | % | | 0.09 | % | | 0.83 | % | | 0.28 | % | | 0.89 | % |

Net interest margin, tax equivalent(1) | | 2.52 | % | | 2.75 | % | | 2.87 | % | | 2.63 | % | | 2.83 | % |

| Return on average equity | | 6.03 | % | | 1.14 | % | | 10.14 | % | | 3.61 | % | | 10.44 | % |

Return on average tangible equity(1) | | 8.50 | % | | 2.70 | % | | 13.13 | % | | 5.65 | % | | 13.35 | % |

Efficiency ratio(1) | | 71.13 | % | | 62.32 | % | | 56.57 | % | | 66.56 | % | | 58.46 | % |

| | | | | | | | | | |

(1) Non-GAAP measure. See the Non-GAAP Measures section for a reconciliation to the most directly comparable GAAP measure. |

|

REVENUE REVIEW

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | Change | | Change |

| | | | | | | 2Q23 vs | | 2Q23 vs |

| (Dollars in thousands) | | 2Q23 | | 1Q23 | | 2Q22 | | 1Q23 | | 2Q22 |

| Net interest income | | $ | 36,962 | | | $ | 40,076 | | | $ | 39,725 | | | (8) | % | | (7) | % |

| Noninterest income (loss) | | 8,746 | | | (4,046) | | | 12,347 | | | n / m | | (29) | % |

| Total revenue, net of interest expense | | $ | 45,708 | | | $ | 36,030 | | | $ | 52,072 | | | 27 | % | | (12) | % |

| | | | | | | | | | |

| Results are not meaningful (n/m) |

Total revenue for the second quarter of 2023 increased $9.7 million from the first quarter of 2023 as a result of increased noninterest income, partially offset by lower net interest income. Compared to the second quarter of 2022, total revenue decreased $6.4 million due to lower net interest income and noninterest income.

Net interest income of $37.0 million for the second quarter of 2023 decreased from $40.1 million in the first quarter of 2023, due primarily to higher funding costs and volumes and lower interest earning asset volumes, partially offset by higher interest earning asset yields. Compared to the second quarter of 2022, net interest income decreased $2.8 million as a result of higher funding costs and volumes, partially offset by higher interest earning asset yields and volumes.

The Company's tax equivalent net interest margin was 2.52% in the second quarter of 2023 compared to 2.75% in the first quarter of 2023, as higher earning asset yields were more than offset by increased funding costs. The cost of interest bearing liabilities increased 39 bps to 1.98%, due to interest bearing deposit costs of 1.79%, short-term borrowing costs of 2.91%, and long-term debt costs of 6.38%, which increased 41 bps, 9 bps and 19 bps, respectively from the first quarter of 2023. Total interest earning assets yield increased 12 bps primarily as a result of an increase in loan yield of 10 bps, partially offset by a decrease in investment security yield of 5 bps, respectively. Our cycle-to-date interest bearing deposit beta was 31%.

The tax equivalent net interest margin was 2.52% in the second quarter of 2023 compared to 2.87% in the second quarter of 2022, driven by higher funding costs and volumes, partially offset by higher interest earning asset yields. The cost of interest bearing liabilities increased 153 bps to 1.98%, due to interest bearing deposit costs of 1.79%, short-term borrowing costs of 2.91%, and long-term debt costs of 6.38%, which increased 148 bps, 244 bps and 193 bps, respectively from the second quarter of 2022. Total interest earning assets yield increased 92 bps primarily as a result of an increase in loan and securities yields of 103 bps and 22 bps, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Income (Loss) | | | | | | | Change | | Change | | |

| | | | | | 2Q23 vs | | 2Q23 vs | | | | |

| (In thousands) | 2Q23 | | 1Q23 | | 2Q22 | | 1Q23 | | 2Q22 | | | | |

| Investment services and trust activities | $ | 3,119 | | | $ | 2,933 | | | $ | 2,670 | | | 6 | % | | 17 | % | | | | |

| Service charges and fees | 2,047 | | | 2,008 | | | 1,717 | | | 2 | % | | 19 | % | | | | |

| Card revenue | 1,847 | | | 1,748 | | | 1,878 | | | 6 | % | | (2) | % | | | | |

| Loan revenue | 909 | | | 1,420 | | | 3,523 | | | (36) | % | | (74) | % | | | | |

| Bank-owned life insurance | 616 | | | 602 | | | 558 | | | 2 | % | | 10 | % | | | | |

| Investment securities (losses) gains, net | (2) | | | (13,170) | | | 395 | | | n / m | | (101) | % | | | | |

| Other | 210 | | | 413 | | | 1,606 | | | (49) | % | | (87) | % | | | | |

| Total noninterest income (loss) | $ | 8,746 | | | $ | (4,046) | | | $ | 12,347 | | | n / m | | (29) | % | | | | |

Noninterest income for the second quarter of 2023 increased $12.8 million from the linked quarter due primarily to $13.2 million of investment security losses recognized in the linked quarter, partially offset by a $0.5 million unfavorable change in loan revenue. Loan revenue reflected an unfavorable quarter-over quarter change in the fair value of our mortgage servicing rights of $0.9 million, partially offset by a $0.5 million favorable change in loan sale gains generated by our governmental lending and mortgage origination businesses. Noninterest income decreased $3.6 million from the second quarter of 2022. The largest driver was a $0.6 million decrease in the fair value of our mortgage servicing rights in the current quarter compared to a $2.4 million increase in the second quarter of 2022.

EXPENSE REVIEW

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Expense | | | | | | | Change | | Change | | |

| | | | | | 2Q23 vs | | 2Q23 vs | | | | |

| (In thousands) | 2Q23 | | 1Q23 | | 2Q22 | | 1Q23 | | 2Q22 | | | | |

| Compensation and employee benefits | $ | 20,386 | | | $ | 19,607 | | | $ | 18,955 | | | 4 | % | | 8 | % | | | | |

| Occupancy expense of premises, net | 2,574 | | | 2,746 | | | 2,253 | | | (6) | % | | 14 | % | | | | |

| Equipment | 2,435 | | | 2,171 | | | 2,107 | | | 12 | % | | 16 | % | | | | |

| Legal and professional | 1,682 | | | 1,736 | | | 2,435 | | | (3) | % | | (31) | % | | | | |

| Data processing | 1,521 | | | 1,363 | | | 1,237 | | | 12 | % | | 23 | % | | | | |

| Marketing | 1,142 | | | 986 | | | 1,157 | | | 16 | % | | (1) | % | | | | |

| Amortization of intangibles | 1,594 | | | 1,752 | | | 1,283 | | | (9) | % | | 24 | % | | | | |

| FDIC insurance | 862 | | | 749 | | | 420 | | | 15 | % | | 105 | % | | | | |

| Communications | 260 | | | 261 | | | 266 | | | — | % | | (2) | % | | | | |

| Foreclosed assets, net | (6) | | | (28) | | | 4 | | | (79) | % | | (250) | % | | | | |

| Other | 2,469 | | | 1,976 | | | 1,965 | | | 25 | % | | 26 | % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total noninterest expense | $ | 34,919 | | | $ | 33,319 | | | $ | 32,082 | | | 5 | % | | 9 | % | | | | |

| | | | | | | | | | | | | | | | | |

| Merger-related Expenses | | | | | |

| | | | |

| (In thousands) | 2Q23 | | 1Q23 | | 2Q22 |

| Compensation and employee benefits | $ | — | | | $ | 70 | | | $ | 150 | |

| Occupancy expense of premises, net | — | | | — | | | 1 | |

| Equipment | — | | | — | | | 6 | |

| Legal and professional | — | | | — | | | 638 | |

| Data processing | — | | | 65 | | | 38 | |

| Marketing | — | | | — | | | 65 | |

| Communications | — | | | — | | | 2 | |

| Other | — | | | 1 | | | 1 | |

| Total merger-related expenses | $ | — | | | $ | 136 | | | $ | 901 | |

Noninterest expense for the second quarter of 2023 increased $1.6 million, or 4.8%, from the linked quarter with overall increases in all noninterest expense categories except occupancy, legal and professional, amortization of intangibles, and communications. The increase in compensation and employee benefits reflected severance expense of $1.2 million in the current period, as compared to $0.1 million in the first quarter of 2023. The largest driver in the increase in 'other' noninterest expense was executive relocation expenses of $0.2 million.

Noninterest expense for the second quarter of 2023 increased $2.8 million, or 8.8%, from the second quarter of 2022. The increase primarily reflected costs associated with the acquired operations of Iowa First Bancshares Corp. ("IOFB"), which closed in the second quarter of 2022. Partially offsetting the increases above was a decline of $0.8

million in legal and professional expenses, primarily due to a decrease in legal and professional merger-related expenses.

The Company's effective income tax rate decreased to 17.4% in the second quarter of 2023 compared to 21.4% in the linked quarter. The decrease reflected an adjustment to full-year 2023 estimated taxable income in the Company's annual effective tax rate calculation. The effective income tax rate for the full year 2023 is expected to be in the range of 18% - 20%.

BALANCE SHEET REVIEW

Total assets were $6.52 billion at June 30, 2023 compared to $6.41 billion at March 31, 2023 and $6.44 billion at June 30, 2022. The increase from March 31, 2023 was driven by higher loan balances from organic growth and an increase in cash and cash equivalents, partially offset by lower investment security balances. In comparison to June 30, 2022, the increase was primarily due to higher loan balances from organic growth and an increase in cash and cash equivalents, partially offset by lower security balances as a result of the balance sheet repositioning executed in the first quarter of 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans Held for Investment | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | |

| Balance | | % of Total | | Balance | | % of Total | | Balance | | % of Total | |

| (Dollars in thousands) | | | | | | |

| Commercial and industrial | $ | 1,089,269 | | | 27.1 | | % | $ | 1,080,514 | | | 27.6 | | % | $ | 986,137 | | | 27.3 | | % |

| Agricultural | 106,148 | | | 2.6 | | | 106,641 | | | 2.7 | | | 110,263 | | | 3.1 | | |

| Commercial real estate | | | | | | | | | | | | |

| Construction and development | 313,836 | | | 7.8 | | | 320,924 | | | 8.2 | | | 224,470 | | | 6.2 | | |

| Farmland | 183,378 | | | 4.6 | | | 182,528 | | | 4.7 | | | 181,820 | | | 5.0 | | |

| Multifamily | 305,519 | | | 7.6 | | | 255,065 | | | 6.5 | | | 239,676 | | | 6.6 | | |

| Other | 1,331,886 | | | 33.1 | | | 1,290,454 | | | 33.0 | | | 1,213,974 | | | 33.7 | | |

| Total commercial real estate | 2,134,619 | | | 53.1 | | | 2,048,971 | | | 52.4 | | | 1,859,940 | | | 51.5 | | |

| Residential real estate | | | | | | | | | | | | |

| One-to-four family first liens | 448,096 | | | 11.2 | | | 448,459 | | | 11.4 | | | 430,157 | | | 11.9 | | |

| One-to-four family junior liens | 168,755 | | | 4.2 | | | 162,403 | | | 4.1 | | | 148,647 | | | 4.1 | | |

| Total residential real estate | 616,851 | | | 15.4 | | | 610,862 | | | 15.5 | | | 578,804 | | | 16.0 | | |

| Consumer | 71,762 | | | 1.8 | | | 72,377 | | | 1.8 | | | 76,008 | | | 2.1 | | |

| Loans held for investment, net of unearned income | $ | 4,018,649 | | | 100.0 | | % | $ | 3,919,365 | | | 100.0 | | % | $ | 3,611,152 | | | 100.0 | | % |

| | | | | | | | | | | | |

| Total commitments to extend credit | $ | 1,296,719 | | | | | $ | 1,205,902 | | | | | $ | 1,117,754 | | | | |

Loans held for investment, net of unearned income, increased $99.3 million, or 2.5%, to $4.02 billion from $3.92 billion at March 31, 2023. This increase was driven by new loan production in the second quarter of 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Securities | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | |

| (Dollars in thousands) | Balance | | % of Total | | Balance | | % of Total | | Balance | | % of Total | |

| Available for sale | $ | 903,520 | | | 45.1 | | % | $ | 954,074 | | | 46.1 | | % | $ | 1,234,789 | | | 51.4 | | % |

| Held to maturity | 1,099,569 | | | 54.9 | | % | 1,117,709 | | | 53.9 | | % | 1,168,042 | | | 48.6 | | % |

| Total investment securities | $ | 2,003,089 | | | | | $ | 2,071,783 | | | | | $ | 2,402,831 | | | | |

Investment securities at June 30, 2023 were $2.00 billion, decreasing $68.7 million from March 31, 2023 and $399.7 million from June 30, 2022. The decrease from the first quarter of 2023 was primarily due to paydowns, calls, and maturities. The decrease from the second quarter of 2022 was primarily due to the balance sheet repositioning completed in the first quarter of 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | |

| (Dollars in thousands) | Balance | | % of Total | | Balance | | % of Total | | Balance | | % of Total | |

| Noninterest bearing deposits | $ | 897,923 | | | 16.5 | | % | $ | 989,469 | | | 17.8 | | % | $ | 1,114,825 | | | 20.1 | | % |

| Interest checking deposits | 1,397,276 | | | 25.7 | | | 1,476,948 | | | 26.6 | | | 1,749,748 | | | 31.7 | | |

| Money market deposits | 1,096,432 | | | 20.1 | | | 969,238 | | | 17.4 | | | 1,070,912 | | | 19.3 | | |

| Savings deposits | 585,967 | | | 10.8 | | | 631,811 | | | 11.4 | | | 715,829 | | | 12.9 | | |

| Time deposits of $250 and under | 648,586 | | | 11.9 | | | 599,302 | | | 10.8 | | | 547,427 | | | 9.9 | | |

| Total core deposits | 4,626,184 | | | 85.0 | | | 4,666,768 | | | 84.0 | | | 5,198,741 | | | 93.9 | | |

| Brokered time deposits | 365,623 | | | 6.7 | | | 366,539 | | | 6.6 | | | — | | | — | | |

| Time deposits over $250 | 453,640 | | | 8.3 | | | 521,846 | | | 9.4 | | | 338,700 | | | 6.1 | | |

| | | | | | | | | | | | |

Total deposits | $ | 5,445,447 | | | 100.0 | | % | $ | 5,555,153 | | | 100.0 | | % | $ | 5,537,441 | | | 100.0 | | % |

Total deposits declined $109.7 million, or 2.0%, to $5.45 billion from $5.56 billion at March 31, 2023. Brokered deposits decreased $0.9 million from $366.5 million at March 31, 2023. Total uninsured deposits were estimated to be $1.68 billion, which included $591.8 million of collateralized municipal deposits at June 30, 2023. Total uninsured deposits, excluding collateralized municipal deposits, represented approximately 20.0% of total deposits.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Borrowed Funds | June 30, 2023 | | March 31, 2023 | | June 30, 2022 | |

| (Dollars in thousands) | Balance | | % of Total | | Balance | | % of Total | | Balance | | % of Total | |

| Short-term borrowings | $ | 362,054 | | | 74.2 | | % | $ | 143,981 | | | 51.1 | | % | $ | 193,894 | | | 54.9 | | % |

| Long-term debt | 125,752 | | | 25.8 | | % | 137,981 | | | 48.9 | | % | 159,168 | | | 45.1 | | % |

| Total borrowed funds | $ | 487,806 | | | | | $ | 281,962 | | | | | $ | 353,062 | | | | |

Total borrowed funds were $487.8 million at June 30, 2023 an increase of $205.8 million from March 31, 2023 and $134.7 million from June 30, 2022. The increase was primarily due to Bank Term Funding Program borrowings of $225 million, as compared to no borrowings in the prior periods, and increased Federal Home Loan Bank overnight borrowings.

| | | | | | | | | | | | | | | | | |

| Capital | June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | 2023 (1) | | 2023 | | 2022 |

| Total shareholders' equity | $ | 501,341 | | | $ | 500,650 | | | $ | 488,832 | |

| Accumulated other comprehensive loss | (82,704) | | | (78,885) | | | (65,231) | |

MidWestOne Financial Group, Inc. Consolidated | | | | | |

| Tier 1 leverage to average assets ratio | 8.47 | % | | 8.30 | % | | 8.51 | % |

| Common equity tier 1 capital to risk-weighted assets ratio | 9.36 | % | | 9.39 | % | | 8.82 | % |

| Tier 1 capital to risk-weighted assets ratio | 10.15 | % | | 10.18 | % | | 9.61 | % |

| Total capital to risk-weighted assets ratio | 12.26 | % | | 12.31 | % | | 11.73 | % |

MidWestOne Bank | | | | | |

| Tier 1 leverage to average assets ratio | 9.42 | % | | 9.28 | % | | 9.70 | % |

| Common equity tier 1 capital to risk-weighted assets ratio | 11.31 | % | | 11.40 | % | | 10.99 | % |

| Tier 1 capital to risk-weighted assets ratio | 11.31 | % | | 11.40 | % | | 10.99 | % |

| Total capital to risk-weighted assets ratio | 12.22 | % | | 12.31 | % | | 11.90 | % |

(1) Regulatory capital ratios for June 30, 2023 are preliminary | | | | | |

Total shareholders' equity at June 30, 2023 increased $0.7 million from March 31, 2023, driven by the benefit of second quarter net income, partially offset by an increase in accumulated other comprehensive loss and dividends paid during the second quarter of 2023.

Accumulated other comprehensive loss at June 30, 2023 increased $3.8 million compared to March 31, 2023, primarily due to a decrease in available for sale securities valuations. Accumulated other comprehensive loss increased $17.5 million from June 30, 2022, driven by the impact of higher interest rates on available for sale securities valuations.

On July 25, 2023, the Board of Directors of the Company declared a cash dividend of $0.2425 per common share. The dividend is payable September 15, 2023, to shareholders of record at the close of business on September 1, 2023.

No common shares were repurchased by the Company during the period March 31, 2023 through June 30, 2023 or for the subsequent period through August 1, 2023. The current share repurchase program allows for the repurchase of up to $15.0 million.

CREDIT QUALITY REVIEW

| | | | | | | | | | | | | | | | | |

| Credit Quality | As of or For the Three Months Ended |

| June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | 2023 | | 2023 | | 2022 |

| Credit loss expense related to loans | $ | 1,497 | | | $ | 933 | | | $ | 3,060 | |

| Net charge-offs | 897 | | | 333 | | | 281 | |

| Allowance for credit losses | 50,400 | | | 49,800 | | | 52,350 | |

| Pass | $ | 3,769,309 | | | $ | 3,728,522 | | | $ | 3,402,508 | |

| Special Mention / Watch | 133,904 | | | 92,075 | | | 111,893 | |

| Classified | 115,436 | | | 98,768 | | | 96,751 | |

| | | | | |

| | | | | |

| Loans greater than 30 days past due and accruing | $ | 6,201 | | | $ | 4,932 | | | $ | 12,349 | |

| Nonperforming loans | $ | 14,448 | | | $ | 14,442 | | | $ | 27,337 | |

| | | | | |

| Nonperforming assets | 14,448 | | | 14,442 | | | 27,621 | |

| | | | | |

Net charge-off ratio(1) | 0.09 | % | | 0.03 | % | | 0.03 | % |

Classified loans ratio(2) | 2.87 | % | | 2.52 | % | | 2.68 | % |

Nonperforming loans ratio(3) | 0.36 | % | | 0.37 | % | | 0.76 | % |

Nonperforming assets ratio(4) | 0.22 | % | | 0.23 | % | | 0.43 | % |

Allowance for credit losses ratio(5) | 1.25 | % | | 1.27 | % | | 1.45 | % |

| | | | | |

Allowance for credit losses to nonaccrual loans ratio(6) | 355.03 | % | | 344.88 | % | | 201.52 | % |

| | | | | |

| | | | | |

(1) Net charge-off ratio is calculated as annualized net charge-offs divided by the sum of average loans held for investment, net of unearned income and average loans held for sale, during the period. |

(2) Classified loans ratio is calculated as classified loans divided by loans held for investment, net of unearned income, at the end of the period. |

|

(3) Nonperforming loans ratio is calculated as nonperforming loans divided by loans held for investment, net of unearned income, at the end of the period. |

(4) Nonperforming assets ratio is calculated as nonperforming assets divided by total assets at the end of the period. |

(5) Allowance for credit losses ratio is calculated as allowance for credit losses divided by loans held for investment, net of unearned income, at the end of the period. |

|

(6)Allowance for credit losses to nonaccrual loans ratio is calculated as allowance for credit losses divided by nonaccrual loans at the end of the period. |

|

Compared to the linked quarter, nonperforming loans and nonperforming assets ratios remained stable and improved from the prior year period. The nonperforming loans ratio declined 1 bps from the linked quarter and 40 bps from the prior year to 0.36%. The classified loans ratio increased 35 bps from the linked quarter and 19 bps from the prior year. The linked quarter increase in classified loans was primarily due to the deterioration of two non-owner occupied commercial real estate loans. Further, the net charge-off ratio increased 6 bps from the linked quarter and 6 bps from the prior year.

As of June 30, 2023, the allowance for credit losses was $50.4 million, or 1.25% of loans held for investment, net of unearned income, compared with $49.8 million, or 1.27% of loans held for investment, net of unearned income, at March 31, 2023. Credit loss expense of $1.6 million in the second quarter of 2023 was primarily attributable to loan growth.

| | | | | | | | | | | | | | | | | |

| Nonperforming Loans Roll Forward | Nonaccrual | | 90+ Days Past Due & Still Accruing | | Total |

| (Dollars in thousands) | | |

Balance at March 31, 2023 | $ | 14,440 | | | $ | 2 | | | $ | 14,442 | |

| Loans placed on nonaccrual or 90+ days past due & still accruing | 1,828 | | | 333 | | | 2,161 | |

| | | | | |

| Proceeds related to repayment or sale | (1,054) | | | — | | | (1,054) | |

| Loans returned to accrual status or no longer past due | (45) | | | — | | | (45) | |

| Charge-offs | (973) | | | (80) | | | (1,053) | |

| | | | | |

| | | | | |

| Transfer to nonaccrual | — | | | (3) | | | (3) | |

Balance at June 30, 2023 | $ | 14,196 | | | $ | 252 | | | $ | 14,448 | |

CONFERENCE CALL DETAILS

The Company will host a conference call for investors at 11:00 a.m. CT on Tuesday, August 1, 2023. To participate, you may pre-register for this call utilizing the following link: https://www.netroadshow.com/events/login?show=c7140c96&confId=51647. After pre-registering for this event you will receive your access details via email. On the day of the call, you are also able to dial 1-833-470-1428 using an access code of 231141 at least fifteen

minutes before the call start time. If you are unable to participate on the call, a replay will be available until October 26, 2023, by calling 1-866-813-9403 and using the replay access code of 868948. A transcript of the call will also be available on the Company’s web site (www.midwestonefinancial.com) within three business days of the call.

ABOUT MIDWESTONE FINANCIAL GROUP, INC.

MidWestOne Financial Group, Inc. is a financial holding company headquartered in Iowa City, Iowa. MidWestOne is the parent company of MidWestOne Bank, which operates banking offices in Iowa, Minnesota, Wisconsin, Florida, and Colorado. MidWestOne provides electronic delivery of financial services through its website, MidWestOne.bank. MidWestOne Financial Group, Inc. trades on the Nasdaq Global Select Market under the symbol “MOFG”.

Cautionary Note Regarding Forward-Looking Statements

This release contains certain “forward-looking statements” within the meaning of such term in the Private Securities Litigation Reform Act of 1995. We and our representatives may, from time to time, make written or oral statements that are “forward-looking” and provide information other than historical information. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement. These factors include, among other things, the factors listed below. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of our management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “should,” “could,” “would,” “plans,” “goals,” “intend,” “project,” “estimate,” “forecast,” “may” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, these statements. Readers are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Additionally, we undertake no obligation to update any statement in light of new information or future events, except as required under federal securities law.

Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors that could have an impact on our ability to achieve operating results, growth plan goals and future prospects include, but are not limited to, the following: (1) the risks of mergers (including with IOFB), including, without limitation, the related time and costs of implementing such transactions, integrating operations as part of these transactions and possible failures to achieve expected gains, revenue growth and/or expense savings from such transactions; (2) credit quality deterioration, pronounced and sustained reduction in real estate market values, or other uncertainties, including the impact of inflationary pressures on economic conditions and our business, resulting in an increase in the allowance for credit losses, an increase in the credit loss expense, and a reduction in net earnings; (3) the effects of actual and expected increases in inflation and interest rates, including on our net income and the value of our securities portfolio; (4) changes in the economic environment, competition, or other factors that may affect our ability to acquire loans or influence the anticipated growth rate of loans and deposits and the quality of the loan portfolio and loan and deposit pricing; (5) fluctuations in the value of our investment securities; (6) governmental monetary and fiscal policies; (7) changes in and uncertainty related to benchmark interest rates used to price loans and deposits; (8) legislative and regulatory changes, including changes in banking, securities, trade, and tax laws and regulations and their application by our regulators, including the new 1.0% excise tax on stock buybacks by publicly traded companies and any changes in response to the recent failures of other banks; (9) the ability to attract and retain key executives and employees experienced in banking and financial services; (10) the sufficiency of the allowance for credit losses to absorb the amount of actual losses inherent in our existing loan portfolio; (11) our ability to adapt successfully to technological changes to compete effectively in the marketplace; (12) credit risks and risks from concentrations (by geographic area and by industry) within our loan portfolio; (13) the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds, financial technology companies, and other financial institutions operating in our markets or elsewhere or providing similar services; (14) the failure of assumptions underlying the establishment of allowances for credit losses and estimation of values of collateral and various financial assets and liabilities; (15) volatility of rate-sensitive deposits; (16) operational risks, including data processing system failures or fraud; (17) asset/liability matching risks and liquidity risks; (18) the costs, effects and outcomes of existing or future litigation; (19) changes in general economic, political, or industry conditions, nationally, internationally or in the communities in which we conduct business, including the risk of a recession; (20) changes in accounting policies and practices, as may be adopted by state and federal regulatory agencies and the Financial Accounting Standards Board; (21) war or terrorist activities, including the war in Ukraine, widespread disease or pandemic, or other adverse external events, which may cause deterioration in the economy or cause instability in credit markets; (22) the occurrence of fraudulent activity, breaches, or failures of our information security controls or cyber-security related incidents, including as a result of sophisticated attacks using artificial intelligence and similar tools; (23) the imposition of tariffs or other domestic or international governmental policies impacting the value of the agricultural or other products of our borrowers; (24) effects of the ongoing COVID-19 pandemic, including its effects on the economic environment, our customers, employees and supply chain; (25) the concentration of large deposits from certain clients who have balances above current FDIC insurance limits; (26) the effects of recent developments and events in the financial services industry, including the large-scale deposit withdrawals over a short period of time at other banks that resulted in failure of those institutions; and (27) other risk factors detailed from time to time in Securities and Exchange Commission filings made by the Company.

MIDWESTONE FINANCIAL GROUP, INC. AND SUBSIDIARIES

FIVE QUARTER CONSOLIDATED BALANCE SHEETS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (In thousands) | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| ASSETS | | | | | | | | | |

| Cash and due from banks | $ | 75,955 | | | $ | 63,945 | | | $ | 83,990 | | | $ | 77,513 | | | $ | 60,622 | |

| Interest earning deposits in banks | 68,603 | | | 5,273 | | | 2,445 | | | 1,001 | | | 23,242 | |

| | | | | | | | | |

| Total cash and cash equivalents | 144,558 | | | 69,218 | | | 86,435 | | | 78,514 | | | 83,864 | |

| Debt securities available for sale at fair value | 903,520 | | | 954,074 | | | 1,153,547 | | | 1,153,304 | | | 1,234,789 | |

| Held to maturity securities at amortized cost | 1,099,569 | | | 1,117,709 | | | 1,129,421 | | | 1,146,583 | | | 1,168,042 | |

| Total securities | 2,003,089 | | | 2,071,783 | | | 2,282,968 | | | 2,299,887 | | | 2,402,831 | |

| Loans held for sale | 2,821 | | | 2,553 | | | 612 | | | 2,320 | | | 4,991 | |

| Gross loans held for investment | 4,031,377 | | | 3,932,900 | | | 3,854,791 | | | 3,761,664 | | | 3,627,728 | |

| Unearned income, net | (12,728) | | | (13,535) | | | (14,267) | | | (15,375) | | | (16,576) | |

| Loans held for investment, net of unearned income | 4,018,649 | | | 3,919,365 | | | 3,840,524 | | | 3,746,289 | | | 3,611,152 | |

| Allowance for credit losses | (50,400) | | | (49,800) | | | (49,200) | | | (52,100) | | | (52,350) | |

| Total loans held for investment, net | 3,968,249 | | | 3,869,565 | | | 3,791,324 | | | 3,694,189 | | | 3,558,802 | |

| Premises and equipment, net | 85,831 | | | 86,208 | | | 87,125 | | | 87,732 | | | 89,048 | |

| Goodwill | 62,477 | | | 62,477 | | | 62,477 | | | 62,477 | | | 62,477 | |

| Other intangible assets, net | 26,969 | | | 28,563 | | | 30,315 | | | 32,086 | | | 33,874 | |

| Foreclosed assets, net | — | | | — | | | 103 | | | 103 | | | 284 | |

| Other assets | 227,495 | | | 219,585 | | | 236,517 | | | 233,753 | | | 206,320 | |

| Total assets | $ | 6,521,489 | | | $ | 6,409,952 | | | $ | 6,577,876 | | | $ | 6,491,061 | | | $ | 6,442,491 | |

| LIABILITIES | | | | | | | | | |

| Noninterest bearing deposits | $ | 897,923 | | | $ | 989,469 | | | $ | 1,053,450 | | | $ | 1,139,694 | | | $ | 1,114,825 | |

| Interest bearing deposits | 4,547,524 | | | 4,565,684 | | | 4,415,492 | | | 4,337,088 | | | 4,422,616 | |

| Total deposits | 5,445,447 | | | 5,555,153 | | | 5,468,942 | | | 5,476,782 | | | 5,537,441 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Short-term borrowings | 362,054 | | | 143,981 | | | 391,873 | | | 304,536 | | | 193,894 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Long-term debt | 125,752 | | | 137,981 | | | 139,210 | | | 154,190 | | | 159,168 | |

| Other liabilities | 86,895 | | | 72,187 | | | 85,058 | | | 83,324 | | | 63,156 | |

| Total liabilities | 6,020,148 | | | 5,909,302 | | | 6,085,083 | | | 6,018,832 | | | 5,953,659 | |

| SHAREHOLDERS' EQUITY | | | | | | | | | |

| | | | | | | | | |

| Common stock | 16,581 | | | 16,581 | | | 16,581 | | | 16,581 | | | 16,581 | |

| Additional paid-in capital | 301,424 | | | 300,966 | | | 302,085 | | | 301,418 | | | 300,859 | |

| Retained earnings | 290,548 | | | 286,767 | | | 289,289 | | | 276,998 | | | 262,395 | |

| Treasury stock | (24,508) | | | (24,779) | | | (26,115) | | | (26,145) | | | (25,772) | |

| Accumulated other comprehensive loss | (82,704) | | | (78,885) | | | (89,047) | | | (96,623) | | | (65,231) | |

| Total shareholders' equity | 501,341 | | | 500,650 | | | 492,793 | | | 472,229 | | | 488,832 | |

| Total liabilities and shareholders' equity | $ | 6,521,489 | | | $ | 6,409,952 | | | $ | 6,577,876 | | | $ | 6,491,061 | | | $ | 6,442,491 | |

MIDWESTONE FINANCIAL GROUP, INC. AND SUBSIDIARIES

FIVE QUARTER AND YEAR TO DATE CONSOLIDATED STATEMENTS OF INCOME | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | December 31, | | September 30, | | June 30, | | June 30, | | June 30, |

| (In thousands, except per share data) | 2023 | | 2023 | | 2022 | | 2022 | | 2022 | | 2023 | | 2022 |

| Interest income | | | | | | | | | | | | | |

| Loans, including fees | $ | 49,726 | | | $ | 46,490 | | | $ | 43,769 | | | $ | 40,451 | | | $ | 32,746 | | | $ | 96,216 | | | $ | 64,064 | |

| Taxable investment securities | 9,734 | | | 10,444 | | | 10,685 | | | 10,635 | | | 9,576 | | | 20,178 | | | 17,699 | |

| Tax-exempt investment securities | 1,822 | | | 2,127 | | | 2,303 | | | 2,326 | | | 2,367 | | | 3,949 | | | 4,750 | |

| Other | 68 | | | 244 | | | — | | | 9 | | | 40 | | | 312 | | | 68 | |

| Total interest income | 61,350 | | | 59,305 | | | 56,757 | | | 53,421 | | | 44,729 | | | 120,655 | | | 86,581 | |

| Interest expense | | | | | | | | | | | | | |

| Deposits | 20,117 | | | 15,319 | | | 9,127 | | | 5,035 | | | 3,173 | | | 35,436 | | | 6,083 | |

| Short-term borrowings | 2,118 | | | 1,786 | | | 1,955 | | | 767 | | | 229 | | | 3,904 | | | 348 | |

| Long-term debt | 2,153 | | | 2,124 | | | 2,111 | | | 1,886 | | | 1,602 | | | 4,277 | | | 3,089 | |

| Total interest expense | 24,388 | | | 19,229 | | | 13,193 | | | 7,688 | | | 5,004 | | | 43,617 | | | 9,520 | |

| Net interest income | 36,962 | | | 40,076 | | | 43,564 | | | 45,733 | | | 39,725 | | | 77,038 | | | 77,061 | |

| Credit loss expense | 1,597 | | | 933 | | | 572 | | | 638 | | | 3,282 | | | 2,530 | | | 3,282 | |

| Net interest income after credit loss expense | 35,365 | | | 39,143 | | | 42,992 | | | 45,095 | | | 36,443 | | | 74,508 | | | 73,779 | |

| Noninterest income (loss) | | | | | | | | | | | | | |

| Investment services and trust activities | 3,119 | | | 2,933 | | | 2,666 | | | 2,876 | | | 2,670 | | | 6,052 | | | 5,681 | |

| Service charges and fees | 2,047 | | | 2,008 | | | 2,028 | | | 2,075 | | | 1,717 | | | 4,055 | | | 3,374 | |

| Card revenue | 1,847 | | | 1,748 | | | 1,784 | | | 1,898 | | | 1,878 | | | 3,595 | | | 3,528 | |

| Loan revenue | 909 | | | 1,420 | | | 966 | | | 1,722 | | | 3,523 | | | 2,329 | | | 7,816 | |

| Bank-owned life insurance | 616 | | | 602 | | | 637 | | | 579 | | | 558 | | | 1,218 | | | 1,089 | |

| | | | | | | | | | | | | |

| Investment securities (losses) gains, net | (2) | | | (13,170) | | | (1) | | | (163) | | | 395 | | | (13,172) | | | 435 | |

| Other | 210 | | | 413 | | | 2,860 | | | 3,601 | | | 1,606 | | | 623 | | | 2,068 | |

| Total noninterest income (loss) | 8,746 | | | (4,046) | | | 10,940 | | | 12,588 | | | 12,347 | | | 4,700 | | | 23,991 | |

| Noninterest expense | | | | | | | | | | | | | |

| Compensation and employee benefits | 20,386 | | | 19,607 | | | 20,438 | | | 20,046 | | | 18,955 | | | 39,993 | | | 37,619 | |

| Occupancy expense of premises, net | 2,574 | | | 2,746 | | | 2,663 | | | 2,577 | | | 2,253 | | | 5,320 | | | 5,032 | |

| Equipment | 2,435 | | | 2,171 | | | 2,327 | | | 2,358 | | | 2,107 | | | 4,606 | | | 4,008 | |

| Legal and professional | 1,682 | | | 1,736 | | | 1,846 | | | 2,012 | | | 2,435 | | | 3,418 | | | 4,788 | |

| Data processing | 1,521 | | | 1,363 | | | 1,375 | | | 1,731 | | | 1,237 | | | 2,884 | | | 2,468 | |

| Marketing | 1,142 | | | 986 | | | 947 | | | 1,139 | | | 1,157 | | | 2,128 | | | 2,186 | |

| Amortization of intangibles | 1,594 | | | 1,752 | | | 1,770 | | | 1,789 | | | 1,283 | | | 3,346 | | | 2,510 | |

| FDIC insurance | 862 | | | 749 | | | 405 | | | 415 | | | 420 | | | 1,611 | | | 840 | |

| Communications | 260 | | | 261 | | | 285 | | | 302 | | | 266 | | | 521 | | | 538 | |

| Foreclosed assets, net | (6) | | | (28) | | | 48 | | | 42 | | | 4 | | | (34) | | | (108) | |

| | | | | | | | | | | | | |

| Other | 2,469 | | | 1,976 | | | 2,336 | | | 2,212 | | | 1,965 | | | 4,445 | | | 3,844 | |

| Total noninterest expense | 34,919 | | | 33,319 | | | 34,440 | | | 34,623 | | | 32,082 | | | 68,238 | | | 63,725 | |

| Income before income tax expense | 9,192 | | | 1,778 | | | 19,492 | | | 23,060 | | | 16,708 | | | 10,970 | | | 34,045 | |

| Income tax expense | 1,598 | | | 381 | | | 3,490 | | | 4,743 | | | 4,087 | | | 1,979 | | | 7,529 | |

| Net income | $ | 7,594 | | | $ | 1,397 | | | $ | 16,002 | | | $ | 18,317 | | | $ | 12,621 | | | $ | 8,991 | | | $ | 26,516 | |

| | | | | | | | | | | | | |

| Earnings per common share | | | | | | | | | | | | | |

| Basic | $ | 0.48 | | | $ | 0.09 | | | $ | 1.02 | | | $ | 1.17 | | | $ | 0.81 | | | $ | 0.57 | | | $ | 1.69 | |

| Diluted | $ | 0.48 | | | $ | 0.09 | | | $ | 1.02 | | | $ | 1.17 | | | $ | 0.80 | | | $ | 0.57 | | | $ | 1.69 | |

| Weighted average basic common shares outstanding | 15,680 | | | 15,650 | | | 15,624 | | | 15,623 | | | 15,668 | | | 15,665 | | | 15,675 | |

| Weighted average diluted common shares outstanding | 15,689 | | | 15,691 | | | 15,693 | | | 15,654 | | | 15,688 | | | 15,688 | | | 15,703 | |

| Dividends paid per common share | $ | 0.2425 | | | $ | 0.2425 | | | $ | 0.2375 | | | $ | 0.2375 | | | $ | 0.2375 | | | $ | 0.4850 | | | $ | 0.4750 | |

MIDWESTONE FINANCIAL GROUP, INC. AND SUBSIDIARIES

FINANCIAL STATISTICS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of or for the Three Months Ended | | As of or for the Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (Dollars in thousands, except per share amounts) | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Earnings: | | | | | | | | | |

| Net interest income | $ | 36,962 | | | $ | 40,076 | | | $ | 39,725 | | | $ | 77,038 | | | $ | 77,061 | |

| Noninterest (loss) income | 8,746 | | | (4,046) | | | 12,347 | | | 4,700 | | | 23,991 | |

| Total revenue, net of interest expense | 45,708 | | | 36,030 | | | 52,072 | | | 81,738 | | | 101,052 | |

| Credit loss expense | 1,597 | | | 933 | | | 3,282 | | | 2,530 | | | 3,282 | |

| Noninterest expense | 34,919 | | | 33,319 | | | 32,082 | | | 68,238 | | | 63,725 | |

| Income before income tax expense | 9,192 | | | 1,778 | | | 16,708 | | | 10,970 | | | 34,045 | |

| Income tax expense | 1,598 | | | 381 | | | 4,087 | | | 1,979 | | | 7,529 | |

| Net income | $ | 7,594 | | | $ | 1,397 | | | $ | 12,621 | | | $ | 8,991 | | | $ | 26,516 | |

| Per Share Data: | | | | | | | | | |

| Diluted earnings | $ | 0.48 | | | $ | 0.09 | | | $ | 0.80 | | | $ | 0.57 | | | $ | 1.69 | |

| Book value | 31.96 | | | 31.94 | | | 31.26 | | | 31.96 | | | 31.26 | |

Tangible book value(1) | 26.26 | | | 26.13 | | | 25.10 | | | 26.26 | | | 25.10 | |

| Ending Balance Sheet: | | | | | | | | | |

| Total assets | $ | 6,521,489 | | | $ | 6,409,952 | | | $ | 6,442,491 | | | $ | 6,521,489 | | | $ | 6,442,491 | |

| Loans held for investment, net of unearned income | 4,018,649 | | | 3,919,365 | | | 3,611,152 | | | 4,018,649 | | | 3,611,152 | |

| | | | | | | | | |

| | | | | | | | | |

| Total securities | 2,003,089 | | | 2,071,783 | | | 2,402,831 | | | 2,003,089 | | | 2,402,831 | |

| Total deposits | 5,445,447 | | | 5,555,153 | | | 5,537,441 | | | 5,445,447 | | | 5,537,441 | |

| Short-term borrowings | 362,054 | | | 143,981 | | | 193,894 | | | 362,054 | | | 193,894 | |

| Long-term debt | 125,752 | | | 137,981 | | | 159,168 | | | 125,752 | | | 159,168 | |

| Total shareholders' equity | 501,341 | | | 500,650 | | | 488,832 | | | 501,341 | | | 488,832 | |

| Average Balance Sheet: | | | | | | | | | |

| Average total assets | $ | 6,465,810 | | | $ | 6,524,065 | | | $ | 6,078,950 | | | $ | 6,494,777 | | | $ | 5,997,231 | |

| Average total loans | 4,003,717 | | | 3,867,110 | | | 3,326,269 | | | 3,935,791 | | | 3,286,083 | |

| Average total deposits | 5,454,517 | | | 5,546,694 | | | 5,181,927 | | | 5,500,350 | | | 5,113,368 | |

| Financial Ratios: | | | | | | | | | |

| Return on average assets | 0.47 | % | | 0.09 | % | | 0.83 | % | | 0.28 | % | | 0.89 | % |

| Return on average equity | 6.03 | % | | 1.14 | % | | 10.14 | % | | 3.61 | % | | 10.44 | % |

Return on average tangible equity(1) | 8.50 | % | | 2.70 | % | | 13.13 | % | | 5.65 | % | | 13.35 | % |

Efficiency ratio(1) | 71.13 | % | | 62.32 | % | | 56.57 | % | | 66.56 | % | | 58.46 | % |

Net interest margin, tax equivalent(1) | 2.52 | % | | 2.75 | % | | 2.87 | % | | 2.63 | % | | 2.83 | % |

| Loans to deposits ratio | 73.80 | % | | 70.55 | % | | 65.21 | % | | 73.80 | % | | 65.21 | % |

| | | | | | | | | |

| Uninsured deposits excluding collateralized municipal deposits ratio | 20.05 | % | | 18.54 | % | | 24.11 | % | | 20.05 | % | | 24.11 | % |

| Common equity ratio | 7.69 | % | | 7.81 | % | | 7.59 | % | | 7.69 | % | | 7.59 | % |

Tangible common equity ratio(1) | 6.40 | % | | 6.48 | % | | 6.18 | % | | 6.40 | % | | 6.18 | % |

| Credit Risk Profile: | | | | | | | | | |

| Total nonperforming loans | $ | 14,448 | | | $ | 14,442 | | | $ | 27,337 | | | $ | 14,448 | | | $ | 27,337 | |

| Nonperforming loans ratio | 0.36 | % | | 0.37 | % | | 0.76 | % | | 0.36 | % | | 0.76 | % |

| Total nonperforming assets | $ | 14,448 | | | $ | 14,442 | | | $ | 27,621 | | | $ | 14,448 | | | $ | 27,621 | |

| Nonperforming assets ratio | 0.22 | % | | 0.23 | % | | 0.43 | % | | 0.22 | % | | 0.43 | % |

| | | | | | | | | |

| Net charge-offs | $ | 897 | | | $ | 333 | | | $ | 281 | | | $ | 1,230 | | | $ | 2,503 | |

| Net charge-off ratio | 0.09 | % | | 0.03 | % | | 0.03 | % | | 0.06 | % | | 0.15 | % |

| Allowance for credit losses | $ | 50,400 | | | $ | 49,800 | | | $ | 52,350 | | | $ | 50,400 | | | $ | 52,350 | |

| Allowance for credit losses ratio | 1.25 | % | | 1.27 | % | | 1.45 | % | | 1.25 | % | | 1.45 | % |

| | | | | | | | | |

| Allowance for credit losses to nonaccrual ratio | 355.03 | % | | 344.88 | % | | 201.52 | % | | 355.03 | % | | 201.52 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1) Non-GAAP measure. See the Non-GAAP Measures section for a reconciliation to the most directly comparable GAAP measure. |

|

MIDWESTONE FINANCIAL GROUP, INC. AND SUBSIDIARIES

AVERAGE BALANCE SHEET AND YIELD ANALYSIS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| (Dollars in thousands) | Average

Balance | | Interest

Income/

Expense | | Average

Yield/

Cost | | Average Balance | | Interest Income/ Expense | | Average

Yield/

Cost | | Average Balance | | Interest

Income/

Expense | | Average

Yield/

Cost |

| ASSETS | | | | | | | | | | | | | | | | | |

Loans, including fees (1)(2)(3) | $ | 4,003,717 | | | $ | 50,439 | | | 5.05 | % | | $ | 3,867,110 | | | $ | 47,206 | | | 4.95 | % | | $ | 3,326,269 | | | $ | 33,315 | | | 4.02 | % |

| Taxable investment securities | 1,698,003 | | | 9,734 | | | 2.30 | % | | 1,811,388 | | | 10,444 | | | 2.34 | % | | 1,923,155 | | | 9,576 | | | 2.00 | % |

Tax-exempt investment securities (2)(4) | 345,934 | | | 2,253 | | | 2.61 | % | | 397,110 | | | 2,649 | | | 2.71 | % | | 439,385 | | | 2,975 | | | 2.72 | % |

Total securities held for investment(2) | 2,043,937 | | | 11,987 | | | 2.35 | % | | 2,208,498 | | | 13,093 | | | 2.40 | % | | 2,362,540 | | | 12,551 | | | 2.13 | % |

| Other | 9,078 | | | 68 | | | 3.00 | % | | 24,848 | | | 244 | | | 3.98 | % | | 30,016 | | | 40 | | | 0.53 | % |

Total interest earning assets(2) | $ | 6,056,732 | | | $ | 62,494 | | | 4.14 | % | | $ | 6,100,456 | | | $ | 60,543 | | | 4.02 | % | | $ | 5,718,825 | | | $ | 45,906 | | | 3.22 | % |

| Other assets | 409,078 | | | | | | | 423,609 | | | | | | | 360,125 | | | | | |

| Total assets | $ | 6,465,810 | | | | | | | $ | 6,524,065 | | | | | | | $ | 6,078,950 | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | |

| Interest checking deposits | $ | 1,420,741 | | | $ | 1,971 | | | 0.56 | % | | $ | 1,515,845 | | | $ | 1,849 | | | 0.49 | % | | $ | 1,641,337 | | | $ | 1,189 | | | 0.29 | % |

| Money market deposits | 999,436 | | | 5,299 | | | 2.13 | % | | 930,543 | | | 3,269 | | | 1.42 | % | | 1,003,386 | | | 571 | | | 0.23 | % |

| Savings deposits | 603,905 | | | 288 | | | 0.19 | % | | 653,043 | | | 272 | | | 0.17 | % | | 662,449 | | | 287 | | | 0.17 | % |

| Time deposits | 1,490,332 | | | 12,559 | | | 3.38 | % | | 1,417,688 | | | 9,929 | | | 2.84 | % | | 836,143 | | | 1,126 | | | 0.54 | % |

| Total interest bearing deposits | 4,514,414 | | | 20,117 | | | 1.79 | % | | 4,517,119 | | | 15,319 | | | 1.38 | % | | 4,143,315 | | | 3,173 | | | 0.31 | % |

| Securities sold under agreements to repurchase | 159,583 | | | 423 | | | 1.06 | % | | 145,809 | | | 450 | | | 1.25 | % | | 154,107 | | | 111 | | | 0.29 | % |

| | | | | | | | | | | | | | | | | |

| Other short-term borrowings | 132,495 | | | 1,695 | | | 5.13 | % | | 111,306 | | | 1,336 | | | 4.87 | % | | 41,859 | | | 118 | | | 1.13 | % |

| Short-term borrowings | 292,078 | | | 2,118 | | | 2.91 | % | | 257,115 | | | 1,786 | | | 2.82 | % | | 195,966 | | | 229 | | | 0.47 | % |

| Long-term debt | 135,329 | | | 2,153 | | | 6.38 | % | | 139,208 | | | 2,124 | | | 6.19 | % | | 144,440 | | | 1,602 | | | 4.45 | % |

| Total borrowed funds | 427,407 | | | 4,271 | | | 4.01 | % | | 396,323 | | | 3,910 | | | 4.00 | % | | 340,406 | | | 1,831 | | | 2.16 | % |

| Total interest bearing liabilities | $ | 4,941,821 | | | $ | 24,388 | | | 1.98 | % | | $ | 4,913,442 | | | $ | 19,229 | | | 1.59 | % | | $ | 4,483,721 | | | $ | 5,004 | | | 0.45 | % |

| Noninterest bearing deposits | 940,103 | | | | | | | 1,029,575 | | | | | | | 1,038,612 | | | | | |

| Other liabilities | 78,898 | | | | | | | 82,501 | | | | | | | 57,157 | | | | | |

| Shareholders’ equity | 504,988 | | | | | | | 498,547 | | | | | | | 499,460 | | | | | |

| Total liabilities and shareholders’ equity | $ | 6,465,810 | | | | | | | $ | 6,524,065 | | | | | | | $ | 6,078,950 | | | | | |

Net interest income(2) | | | $ | 38,106 | | | | | | | $ | 41,314 | | | | | | | $ | 40,902 | | | |

Net interest spread(2) | | | | | 2.16 | % | | | | | | 2.43 | % | | | | | | 2.77 | % |

Net interest margin(2) | | | | | 2.52 | % | | | | | | 2.75 | % | | | | | | 2.87 | % |

| | | | | | | | | | | | | | | | | |

Total deposits(5) | $ | 5,454,517 | | | $ | 20,117 | | | 1.48 | % | | $ | 5,546,694 | | | $ | 15,319 | | | 1.12 | % | | $ | 5,181,927 | | | $ | 3,173 | | | 0.25 | % |

Cost of funds(6) | | | | | 1.66 | % | | | | | | 1.31 | % | | | | | | 0.36 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1) Average balance includes nonaccrual loans.

(2) Tax equivalent. The federal statutory tax rate utilized was 21%.

(3) Interest income includes net loan fees, loan purchase discount accretion and tax equivalent adjustments. Net loan fees were $79 thousand, $95 thousand, and $(31) thousand for the three months ended June 30, 2023, March 31, 2023, and June 30, 2022, respectively. Loan purchase discount accretion was $1.0 million, $1.2 million, and $528 thousand for the three months ended June 30, 2023, March 31, 2023, and June 30, 2022, respectively. Tax equivalent adjustments were $713 thousand, $716 thousand, and $569 thousand for the three months ended June 30, 2023, March 31, 2023, and June 30, 2022, respectively. The federal statutory tax rate utilized was 21%.

(4) Interest income includes tax equivalent adjustments of $431 thousand, $522 thousand, and $608 thousand for the three months ended June 30, 2023, March 31, 2023, and June 30, 2022, respectively. The federal statutory tax rate utilized was 21%.

(5) Total deposits is the sum of total interest-bearing deposits and noninterest bearing deposits. The cost of total deposits is calculated as annualized interest expense on deposits divided by average total deposits.

(6) Cost of funds is calculated as annualized total interest expense divided by the sum of average total deposits and borrowed funds.

MIDWESTONE FINANCIAL GROUP, INC. AND SUBSIDIARIES

AVERAGE BALANCE SHEET AND YIELD ANALYSIS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended |

| | June 30, 2023 | | June 30, 2022 |

| (Dollars in thousands) | Average Balance | | Interest Income/ Expense | | Average Yield/ Cost | | Average Balance | | Interest Income/ Expense | | Average Yield/ Cost |

| ASSETS | | | | | | | | | | | |

Loans, including fees (1)(2)(3) | $ | 3,935,791 | | | $ | 97,645 | | | 5.00 | % | | $ | 3,286,083 | | | $ | 65,173 | | | 4.00 | % |

| Taxable investment securities | 1,754,382 | | | 20,178 | | | 2.32 | % | | 1,879,773 | | | 17,699 | | | 1.90 | % |

Tax-exempt investment securities (2)(4) | 371,381 | | | 4,902 | | | 2.66 | % | | 444,936 | | | 5,973 | | | 2.71 | % |

Total securities held for investment(2) | 2,125,763 | | | 25,080 | | | 2.38 | % | | 2,324,709 | | | 23,672 | | | 2.05 | % |

| Other | 16,919 | | | 312 | | | 3.72 | % | | 42,983 | | | 68 | | | 0.32 | % |

Total interest earning assets(2) | $ | 6,078,473 | | | $ | 123,037 | | | 4.08 | % | | $ | 5,653,775 | | | $ | 88,913 | | | 3.17 | % |

| Other assets | 416,304 | | | | | | | 343,456 | | | | | |

| Total assets | $ | 6,494,777 | | | | | | | $ | 5,997,231 | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | |

| Interest checking deposits | $ | 1,468,030 | | | $ | 3,820 | | | 0.52 | % | | $ | 1,601,093 | | | $ | 2,250 | | | 0.28 | % |

| Money market deposits | 965,180 | | | 8,568 | | | 1.79 | % | | 978,801 | | | 1,070 | | | 0.22 | % |

| Savings deposits | 628,338 | | | 560 | | | 0.18 | % | | 652,134 | | | 566 | | | 0.18 | % |

| Time deposits | 1,454,210 | | | 22,488 | | | 3.12 | % | | 859,938 | | | 2,197 | | | 0.52 | % |

| Total interest bearing deposits | 4,515,758 | | | 35,436 | | | 1.58 | % | | 4,091,966 | | | 6,083 | | | 0.30 | % |

| Securities sold under agreements to repurchase | 152,734 | | | 873 | | | 1.15 | % | | 156,747 | | | 207 | | | 0.27 | % |

| | | | | | | | | | | |

| Other short-term borrowings | 121,959 | | | 3,031 | | | 5.01 | % | | 22,551 | | | 141 | | | 1.26 | % |

| Short-term borrowings | 274,693 | | | 3,904 | | | 2.87 | % | | 179,298 | | | 348 | | | 0.39 | % |

| Long-term debt | 137,258 | | | 4,277 | | | 6.28 | % | | 142,426 | | | 3,089 | | | 4.37 | % |

| Total borrowed funds | 411,951 | | | 8,181 | | | 4.00 | % | | 321,724 | | | 3,437 | | | 2.15 | % |

| Total interest bearing liabilities | $ | 4,927,709 | | | $ | 43,617 | | | 1.78 | % | | $ | 4,413,690 | | | $ | 9,520 | | | 0.43 | % |

| Noninterest bearing deposits | 984,592 | | | | | | | 1,021,402 | | | | | |

| Other liabilities | 80,690 | | | | | | | 50,054 | | | | | |

| Shareholders’ equity | 501,786 | | | | | | | 512,085 | | | | | |

| Total liabilities and shareholders’ equity | $ | 6,494,777 | | | | | | | $ | 5,997,231 | | | | | |

Net interest income(2) | | | $ | 79,420 | | | | | | | $ | 79,393 | | | |

Net interest spread(2) | | | | | 2.30 | % | | | | | | 2.74 | % |

Net interest margin(2) | | | | | 2.63 | % | | | | | | 2.83 | % |

| | | | | | | | | | | |

Total deposits(5) | $ | 5,500,350 | | | $ | 35,436 | | | 1.30 | % | | $ | 5,113,368 | | | $ | 6,083 | | | 0.24 | % |

Cost of funds(6) | | | | | 1.49 | % | | | | | | 0.35 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Average balance includes nonaccrual loans.

(2) Tax equivalent. The federal statutory tax rate utilized was 21%.

(3) Interest income includes net loan fees, loan purchase discount accretion and tax equivalent adjustments. Net loan fees were $0.2 million and $0.6 million for the six months ended June 30, 2023 and June 30, 2022, respectively. Loan purchase discount accretion was $2.2 million and $1.3 million for the six months ended June 30, 2023 and June 30, 2022, respectively. Tax equivalent adjustments were $1.4 million and $1.1 million for the six months ended June 30, 2023 and June 30, 2022, respectively. The federal statutory tax rate utilized was 21%.

(4) Interest income includes tax equivalent adjustments of $1.0 million and $1.2 million for the six months ended June 30, 2023 and June 30, 2022, respectively. The federal statutory tax rate utilized was 21%.

(5) Total deposits is the sum of total interest-bearing deposits and noninterest bearing deposits. The cost of total deposits is calculated as annualized interest expense on deposits divided by average total deposits.

(6) Cost of funds is calculated as annualized total interest expense divided by the sum of average total deposits and borrowed funds.

Non-GAAP Measures

This earnings release contains non-GAAP measures for tangible common equity, tangible book value per share, tangible common equity ratio, return on average tangible equity, net interest margin (tax equivalent), core net interest margin, loan yield (tax equivalent), core yield on loans, efficiency ratio, and adjusted earnings. Management believes these measures provide investors with useful information regarding the Company’s profitability, financial condition and capital adequacy, consistent with how management evaluates the Company’s financial performance. The following tables provide a reconciliation of each non-GAAP measure to the most comparable GAAP measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tangible Common Equity/Tangible Book Value | | | | | | | | | | |

| per Share/Tangible Common Equity Ratio | | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (Dollars in thousands, except per share data) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| Total shareholders’ equity | | $ | 501,341 | | | $ | 500,650 | | | $ | 492,793 | | | $ | 472,229 | | | $ | 488,832 | |

Intangible assets, net | | (89,446) | | | (91,040) | | | (92,792) | | | (94,563) | | | (96,351) | |

| Tangible common equity | | $ | 411,895 | | | $ | 409,610 | | | $ | 400,001 | | | $ | 377,666 | | | $ | 392,481 | |

| | | | | | | | | | |

| Total assets | | $ | 6,521,489 | | | $ | 6,409,952 | | | $ | 6,577,876 | | | $ | 6,491,061 | | | $ | 6,442,491 | |

Intangible assets, net | | (89,446) | | | (91,040) | | | (92,792) | | | (94,563) | | | (96,351) | |

| Tangible assets | | $ | 6,432,043 | | | $ | 6,318,912 | | | $ | 6,485,084 | | | $ | 6,396,498 | | | $ | 6,346,140 | |

| | | | | | | | | | |

| Book value per share | | $ | 31.96 | | | $ | 31.94 | | | $ | 31.54 | | | $ | 30.23 | | | $ | 31.26 | |

Tangible book value per share(1) | | $ | 26.26 | | | $ | 26.13 | | | $ | 25.60 | | | $ | 24.17 | | | $ | 25.10 | |

| Shares outstanding | | 15,685,123 | | | 15,675,325 | | | 15,623,977 | | | 15,622,825 | | | 15,635,131 | |

| | | | | | | | | | |

| Common equity ratio | | 7.69 | % | | 7.81 | % | | 7.49 | % | | 7.28 | % | | 7.59 | % |

Tangible common equity ratio(2) | | 6.40 | % | | 6.48 | % | | 6.17 | % | | 5.90 | % | | 6.18 | % |

(1) Tangible common equity divided by shares outstanding.

(2) Tangible common equity divided by tangible assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| Return on Average Tangible Equity | | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 7,594 | | | $ | 1,397 | | | $ | 12,621 | | | $ | 8,991 | | | $ | 26,516 | |

Intangible amortization, net of tax(1) | | 1,196 | | | 1,314 | | | 962 | | | 2,510 | | | 1,883 | |

| | | | | | | | | | |

| Tangible net income | | $ | 8,790 | | | $ | 2,711 | | | $ | 13,583 | | | $ | 11,501 | | | $ | 28,399 | |

| | | | | | | | | | |

| Average shareholders’ equity | | $ | 504,988 | | | $ | 498,547 | | | $ | 499,460 | | | $ | 501,786 | | | $ | 512,085 | |

Average intangible assets, net | | (90,258) | | | (92,002) | | | (84,540) | | | (91,125) | | | (83,159) | |

| Average tangible equity | | $ | 414,730 | | | $ | 406,545 | | | $ | 414,920 | | | $ | 410,661 | | | $ | 428,926 | |

| | | | | | | | | | |

Return on average equity | | 6.03 | % | | 1.14 | % | | 10.14 | % | | 3.61 | % | | 10.44 | % |

Return on average tangible equity(2) | | 8.50 | % | | 2.70 | % | | 13.13 | % | | 5.65 | % | | 13.35 | % |

(1) The combined income tax rate utilized was 25%.

(2) Annualized tangible net income divided by average tangible equity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Interest Margin, Tax Equivalent/

Core Net Interest Margin | | Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Net interest income | | $ | 36,962 | | | $ | 40,076 | | | $ | 39,725 | | | $ | 77,038 | | | $ | 77,061 | |

| Tax equivalent adjustments: | | | | | | | | | | |

Loans(1) | | 713 | | | 716 | | | 569 | | | 1,429 | | | 1,109 | |

Securities(1) | | 431 | | | 522 | | | 608 | | | 953 | | | 1,223 | |

| Net interest income, tax equivalent | | $ | 38,106 | | | $ | 41,314 | | | $ | 40,902 | | | $ | 79,420 | | | $ | 79,393 | |

| Loan purchase discount accretion | | (984) | | | (1,189) | | | (528) | | | (2,173) | | | (1,260) | |

| Core net interest income | | $ | 37,122 | | | $ | 40,125 | | | $ | 40,374 | | | $ | 77,247 | | | $ | 78,133 | |

| | | | | | | | | | |

| Net interest margin | | 2.45 | % | | 2.66 | % | | 2.79 | % | | 2.56 | % | | 2.75 | % |

Net interest margin, tax equivalent(2) | | 2.52 | % | | 2.75 | % | | 2.87 | % | | 2.63 | % | | 2.83 | % |

Core net interest margin(3) | | 2.46 | % | | 2.67 | % | | 2.83 | % | | 2.56 | % | | 2.79 | % |

| Average interest earning assets | | $ | 6,056,732 | | | $ | 6,100,456 | | | $ | 5,718,825 | | | $ | 6,078,473 | | | $ | 5,653,775 | |

(1) The federal statutory tax rate utilized was 21%.

(2) Annualized tax equivalent net interest income divided by average interest earning assets.

(3) Annualized core net interest income divided by average interest earning assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| Loan Yield, Tax Equivalent / Core Yield on Loans | | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Loan interest income, including fees | | $ | 49,726 | | | $ | 46,490 | | | $ | 32,746 | | | $ | 96,216 | | | $ | 64,064 | |

Tax equivalent adjustment(1) | | 713 | | | 716 | | | 569 | | | 1,429 | | | 1,109 | |

| Tax equivalent loan interest income | | $ | 50,439 | | | $ | 47,206 | | | $ | 33,315 | | | $ | 97,645 | | | $ | 65,173 | |

| Loan purchase discount accretion | | (984) | | | (1,189) | | | (528) | | | (2,173) | | | (1,260) | |

| Core loan interest income | | $ | 49,455 | | | $ | 46,017 | | | $ | 32,787 | | | $ | 95,472 | | | $ | 63,913 | |

| | | | | | | | | | |

| Yield on loans | | 4.98 | % | | 4.88 | % | | 3.95 | % | | 4.93 | % | | 3.93 | % |

Yield on loans, tax equivalent(2) | | 5.05 | % | | 4.95 | % | | 4.02 | % | | 5.00 | % | | 4.00 | % |

Core yield on loans(3) | | 4.95 | % | | 4.83 | % | | 3.95 | % | | 4.89 | % | | 3.92 | % |

| Average loans | | $ | 4,003,717 | | | $ | 3,867,110 | | | $ | 3,326,269 | | | $ | 3,935,791 | | | $ | 3,286,083 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

(1) The federal statutory tax rate utilized was 21%.

(2) Annualized tax equivalent loan interest income divided by average loans.

(3) Annualized core loan interest income divided by average loans.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| Efficiency Ratio | | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Total noninterest expense | | $ | 34,919 | | | $ | 33,319 | | | $ | 32,082 | | | $ | 68,238 | | | $ | 63,725 | |

| Amortization of intangibles | | (1,594) | | | (1,752) | | | (1,283) | | | (3,346) | | | (2,510) | |

| Merger-related expenses | | — | | | (136) | | | (901) | | | (136) | | | (1,029) | |

| | | | | | | | | | |

| Noninterest expense used for efficiency ratio | | $ | 33,325 | | | $ | 31,431 | | | $ | 29,898 | | | $ | 64,756 | | | $ | 60,186 | |

| | | | | | | | | | |

Net interest income, tax equivalent(1) | | $ | 38,106 | | | $ | 41,314 | | | $ | 40,902 | | | $ | 79,420 | | | $ | 79,393 | |

| Plus: Noninterest income | | 8,746 | | | (4,046) | | | 12,347 | | | 4,700 | | | 23,991 | |

| Less: Investment securities (losses) gains, net | | (2) | | | (13,170) | | | 395 | | | (13,172) | | | 435 | |

| Net revenues used for efficiency ratio | | $ | 46,854 | | | $ | 50,438 | | | $ | 52,854 | | | $ | 97,292 | | | $ | 102,949 | |

| | | | | | | | | | |

Efficiency ratio (2) | | 71.13 | % | | 62.32 | % | | 56.57 | % | | 66.56 | % | | 58.46 | % |

(1) The federal statutory tax rate utilized was 21%.

(2) Noninterest expense adjusted for amortization of intangibles and merger-related expenses divided by the sum of tax equivalent net interest income, noninterest income and net investment securities gains.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| Adjusted Earnings | | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (Dollars in thousands, except per share data) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 7,594 | | | $ | 1,397 | | | $ | 12,621 | | | $ | 8,991 | | | $ | 26,516 | |

After tax loss on sale of debt securities(1) | | — | | | 9,837 | | | — | | | 9,837 | | | — | |

| Adjusted earnings | | $ | 7,594 | | | $ | 11,234 | | | $ | 12,621 | | | $ | 18,828 | | | $ | 26,516 | |

| | | | | | | | | | |

| Weighted average diluted common shares outstanding | | 15,689 | | | 15,691 | | | 15,688 | | | 15,688 | | | 15,703 | |

| | | | | | | | | | |

| Earnings per common share | | | | | | | | | | |

| Earnings per common share - diluted | | $ | 0.48 | | | $ | 0.09 | | | $ | 0.80 | | | $ | 0.57 | | | $ | 1.69 | |

Adjusted earnings per common share - diluted (2) | | $ | 0.48 | | | $ | 0.72 | | | $ | 0.80 | | | $ | 1.20 | | | $ | 1.69 | |

(1) The income tax rate utilized was 25.3%.(2) Adjusted earnings divided by weighted average diluted common shares outstanding.

| | | | | | | | | | | |

| Contact: | | |

| Charles N. Reeves | | Barry S. Ray |

| Chief Executive Officer | | Chief Financial Officer |

| 319.356.5800 | | 319.356.5800 |

Second Quarter 2023 Earnings Conference Call August 1, 2023