Matterport, Inc. (Nasdaq: MTTR) (“Matterport” or the “Company”),

the leading spatial data company driving the digital transformation

of the built world, today announced financial results for the

quarter ended September 30, 2024.

“I’m pleased to share our third-quarter 2024

results, highlighting our continued success driving efficient

growth,” said RJ Pittman, Chairman and CEO of Matterport. “Total

square feet managed reached 47.3 billion, up 34% year-over-year,

with annual recurring revenue hitting a record $101.5 million, an

11% increase year-over-year,” Pittman added. “Our Fall 2024 Release

introduced groundbreaking AI-powered tools designed to elevate

digital twin applications and real estate listings. With one-click

defurnishing and automated property descriptions from a Matterport

digital twin, customers save time, streamline workflows, and

enhance their listings. Features like 3D model merge, field tags,

and bill-back processing bring unmatched speed, efficiency, and

precision to managing spaces at scale for agents, contractors, and

enterprise teams alike.”

“We believe our innovation pipeline is the

strongest it’s ever been, and with customers raving about our Fall

2024 Release, we’re setting the stage for more bold, product-led

growth in 2025,” Pittman concluded.

“Our strong third quarter performance propelled

the company to a new record for total revenue, $43.8 million, up 8%

year-over-year,” said JD Fay, Chief Financial Officer of

Matterport. “Further, our continued focus on operating expense

discipline helped deliver near break-even results, yielding a

non-GAAP loss per share of just $0.01. These results demonstrate

that customers continue to adopt Matterport while underscoring our

commitment to growth and profitability.”

Third Quarter 2024 Financial

Highlights

- Square feet under management reached 47.3 billion, up 34%

year-over-year

- Spaces under management reached 13.6 million, up 22%

year-over-year

- Total subscribers reached 1.1 million, up 25%

year-over-year

- Subscription revenue of $25.4 million, up 11%

year-over-year

- Annualized Recurring Revenue (ARR) was $101.5 million

- Total revenue was $43.8 million

- Net loss of $0.12 per share; Non-GAAP net loss of $0.01 per

share, which is a 75% improvement year-over-year

- Cash used in operating activities was $18.6 million for the

first nine months of 2024, a 61% improvement year-over-year

Recent Business Highlights

- Announced the Fall 2024 Release, a groundbreaking suite of new

tools designed to reshape the way professionals design, build, and

market properties. Through the power of generative AI, Matterport

users can now easily reimagine the potential of any space,

transforming digital twins from static replicas into dynamic

canvases for creativity.

- Announced that Matterport is contributing to the promotion of

digital twin use by Tokyu Construction Co., Ltd., an advanced

digital utilization company in civil engineering and infrastructure

construction. Matterport's digital twin solutions are used in a

wide range of phases of construction projects, including current

status surveys, completed form management, streamlining and

enhancing the scanning of point cloud data, and facilitating

consensus building and communication among construction-related

parties.

- In August, Matterport released its third Environmental, Social,

and Governance Report which sets ambitious targets for the

Company’s top ESG priorities, including reducing emissions and

fostering gender equality in the workplace. The new Report also

showcases the Company’s success helping its more than one million

subscribers reduce their own carbon emissions by using Matterport’s

digital twins to reduce travel to the more than 13 million spaces

that are on the Matterport digital twin platform.

Transaction with CoStar Group,

Inc.

Given the pending acquisition of Matterport by

CoStar Group, Inc. that was announced on April 22, 2024, Matterport

will not be holding a conference call or live webcast to discuss

quarterly financial results. Also, in light of the pending

transaction, the Company had previously suspended its financial

guidance for the full fiscal year 2024 and will not be providing

financial guidance for the upcoming fiscal quarter. At a special

meeting of stockholders held on July 26, 2024, Matterport

stockholders approved the transaction with CoStar Group, Inc. The

completion of the transaction remains subject to the expiration or

termination of the waiting period imposed by the Hart-Scott Rodino

Antitrust Improvements Act of 1976, as amended, and the

satisfaction or waiver of the other closing conditions specified in

Matterport’s agreement with CoStar Group, Inc. The transaction is

expected to close in the fourth quarter of 2024 or the first

quarter of 2025.

Non-GAAP Financial

Information

Matterport has provided in this press release

financial information that has not been prepared in accordance with

generally accepted accounting principles in the United States

(GAAP). We believe that the presentation of non-GAAP financial

information provides important supplemental information to

management and investors regarding financial and business trends

relating to Matterport’s financial condition and results of

operations.

The presentation of these non-GAAP financial

measures are not meant to be considered in isolation or as a

substitute for comparable GAAP financial measures and should be

read only in conjunction with the Company’s consolidated financial

statements prepared in accordance with GAAP. For further

information regarding these non-GAAP measures, including the

reconciliation of these non-GAAP financial measures to their most

directly comparable GAAP financial measures, please refer to the

financial tables below.

Non-GAAP Net Loss and Non-GAAP Net Loss Per Share,

Basic and Diluted. Matterport defines non-GAAP net loss as net

loss, adjusted to exclude stock-based compensation-related charges

(including share-based payroll tax expense), fair value change of

warrants liability, amortization of acquired intangible assets,

litigation expense, and acquisition-related transaction costs, in

order to provide investors and management with greater visibility

to the underlying performance of Matterport’s recurring core

business operations. We define non-GAAP net loss per share, as

non-GAAP net loss divided by the weighted-average shares

outstanding, which includes the dilutive effect of potentially

diluted common stock equivalents outstanding during the period if

any.

About Matterport

Matterport, Inc. (Nasdaq: MTTR) is leading the

digital transformation of the built world. Our groundbreaking

spatial data platform turns buildings into data to make nearly

every space more valuable and accessible. Millions of buildings in

more than 177 countries have been transformed into immersive

Matterport digital twins to improve every part of the building

lifecycle from planning, construction, and operations to

documentation, appraisal and marketing. Learn more at

matterport.com and browse a gallery of digital twins.

©2024 Matterport, Inc. All rights reserved.

Matterport is a registered trademark and the Matterport logo is a

trademark of Matterport, Inc. All other marks are the property of

their respective owners.

Investor Contact:

ir@matterport.com

Media Contact:

press@matterport.com

Forward-Looking Statements

This communication contains certain

forward-looking statements within the meaning of the federal

securities laws, including statements regarding the proposed

transaction, the products and services offered by Matterport and

the markets in which Matterport operates, business strategies, debt

levels, industry environment including the global supply chain,

potential growth opportunities, and the effects of regulations and

Matterport’s projected future results. These forward-looking

statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions (including the negative versions

of such words or expressions).

Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking

statements in this communication, including the inability to

consummate the proposed transaction with CoStar Group, Inc. (the

“proposed transaction”) within the anticipated time period, or at

all, due to any reason, including the failure to obtain required

regulatory approvals, or to satisfy the other conditions to the

consummation of the proposed transaction; the risk that the

proposed transaction disrupts Matterport’s current plans and

operations or diverts management’s attention from its ongoing

business; the effects of the proposed transaction on Matterport’s

business, operating results, and ability to retain and hire key

personnel and maintain relationships with customers, suppliers and

others with whom Matterport does business; the risk that

Matterport’s stock price may decline significantly if the proposed

transaction is not consummated; the nature, cost and outcome of any

legal proceedings related to the proposed transaction; Matterport’s

ability to grow market share in existing markets or any new markets

Matterport may enter; Matterport’s ability to respond to general

economic conditions; supply chain disruptions; Matterport’s ability

to manage growth effectively; Matterport’s success in retaining or

recruiting officers, key employees or directors, or changes

required in the retention or recruitment of officers, key employees

or directors; the impact of restructuring plans; the impact of the

regulatory environment and complexities with compliance related to

such environment; factors relating to Matterport’s business,

operations and financial performance, including the impact of

infectious diseases, health epidemics and pandemics; Matterport’s

ability to maintain an effective system of internal controls over

financial reporting; Matterport’s ability to achieve and maintain

profitability in the future; Matterport’s ability to access sources

of capital; Matterport’s ability to maintain and enhance

Matterport’s products and brand, and to attract customers;

Matterport’s ability to manage, develop and refine Matterport’s

technology platform; the success of Matterport’s strategic

relationships with third parties; Matterport’s history of losses

and whether Matterport will continue to incur continuing losses for

the foreseeable future; Matterport’s ability to protect and enforce

Matterport’s intellectual property rights; Matterport’s success in

defending or appealing any pending or future litigation, claims or

demands; Matterport’s ability to implement business plans,

forecasts, and other expectations and identify and realize

additional opportunities; Matterport’s ability to attract and

retain new subscribers; the size of the total addressable market

for Matterport’s products and services; the continued adoption of

spatial data; any inability to complete acquisitions and integrate

acquired businesses; general economic uncertainty and the effect of

general economic conditions in Matterport’s industry; environmental

uncertainties and risks related to adverse weather conditions and

natural disasters; the volatility of the market price and liquidity

of Matterport’s Class A common stock and other securities; the

increasingly competitive environment in which Matterport operates;

and other factors detailed under the section entitled “Risk

Factors” in Matterport’s Annual Report on Form 10-K and

subsequently filed Quarterly Reports on Form 10-Q. The foregoing

list of factors is not exhaustive. You should carefully consider

the foregoing factors and the other risks and uncertainties

described in documents filed by Matterport from time to time with

the SEC. These filings identify and address other important risks

and uncertainties that could cause actual events and results to

differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and Matterport assumes no obligation

and, except as required by law, does not intend to update or revise

these forward-looking statements, whether as a result of new

information, future events, or otherwise. Matterport does not give

any assurance that it will achieve its expectations.

|

MATTERPORT, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except per

share data)(Unaudited) |

|

|

|

|

|

|

Three Months Ended September30, |

|

Nine Months Ended September30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription |

$ |

25,365 |

|

|

$ |

22,878 |

|

|

$ |

73,535 |

|

|

$ |

63,647 |

|

|

|

Services |

|

11,085 |

|

|

|

9,936 |

|

|

|

31,069 |

|

|

|

29,324 |

|

|

|

Product |

|

7,343 |

|

|

|

7,828 |

|

|

|

21,277 |

|

|

|

25,232 |

|

|

|

Total revenue |

|

43,793 |

|

|

|

40,642 |

|

|

|

125,881 |

|

|

|

118,203 |

|

|

|

Costs of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription |

|

8,236 |

|

|

|

7,379 |

|

|

|

24,124 |

|

|

|

21,576 |

|

|

|

Services |

|

7,445 |

|

|

|

6,725 |

|

|

|

21,748 |

|

|

|

20,978 |

|

|

|

Product |

|

6,412 |

|

|

|

6,641 |

|

|

|

19,337 |

|

|

|

23,377 |

|

|

|

Total costs of revenue |

|

22,093 |

|

|

|

20,745 |

|

|

|

65,209 |

|

|

|

65,931 |

|

|

|

Gross profit |

|

21,700 |

|

|

|

19,897 |

|

|

|

60,672 |

|

|

|

52,272 |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

15,261 |

|

|

|

15,577 |

|

|

|

45,521 |

|

|

|

52,711 |

|

|

|

Selling, general, and administrative |

|

50,464 |

|

|

|

53,719 |

|

|

|

150,069 |

|

|

|

164,660 |

|

|

|

Litigation expense |

|

— |

|

|

|

— |

|

|

|

95,000 |

|

|

|

— |

|

|

|

Total operating expenses |

|

65,725 |

|

|

|

69,296 |

|

|

|

290,590 |

|

|

|

217,371 |

|

|

|

Loss from operations |

|

(44,025 |

) |

|

|

(49,399 |

) |

|

|

(229,918 |

) |

|

|

(165,099 |

) |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

3,211 |

|

|

|

1,573 |

|

|

|

8,098 |

|

|

|

4,525 |

|

|

|

Change in fair value of warrants liability |

|

169 |

|

|

|

513 |

|

|

|

(895 |

) |

|

|

564 |

|

|

|

Other income |

|

2,311 |

|

|

|

2,669 |

|

|

|

6,762 |

|

|

|

5,075 |

|

|

|

Total other income |

|

5,691 |

|

|

|

4,755 |

|

|

|

13,965 |

|

|

|

10,164 |

|

|

|

Loss before provision for income taxes |

|

(38,334 |

) |

|

|

(44,644 |

) |

|

|

(215,953 |

) |

|

|

(154,935 |

) |

|

|

Provision for income taxes |

|

67 |

|

|

|

110 |

|

|

|

162 |

|

|

|

197 |

|

|

|

Net loss |

$ |

(38,401 |

) |

|

$ |

(44,754 |

) |

|

$ |

(216,115 |

) |

|

$ |

(155,132 |

) |

|

|

Net loss per share, basic and diluted |

$ |

(0.12 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.68 |

) |

|

$ |

(0.52 |

) |

|

|

Weighted-average shares used in per share calculation, basic and

diluted |

|

321,151 |

|

|

|

303,432 |

|

|

|

317,002 |

|

|

|

298,226 |

|

|

|

|

|

|

MATTERPORT INC.CONDENSED CONSOLIDATED

BALANCE SHEETS(In

thousands)(Unaudited) |

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

63,358 |

|

|

$ |

82,902 |

|

|

|

Restricted cash |

|

95,182 |

|

|

|

— |

|

|

|

Short-term investments |

|

206,818 |

|

|

|

305,264 |

|

|

|

Accounts receivable, net |

|

14,918 |

|

|

|

16,925 |

|

|

|

Inventories |

|

7,582 |

|

|

|

9,115 |

|

|

|

Prepaid expenses and other current assets |

|

9,145 |

|

|

|

8,635 |

|

|

|

Total current assets |

|

397,003 |

|

|

|

422,841 |

|

|

|

Property and equipment, net |

|

30,356 |

|

|

|

32,471 |

|

|

|

Operating lease right-of-use assets |

|

226 |

|

|

|

625 |

|

|

|

Long-term investments |

|

39,824 |

|

|

|

34,834 |

|

|

|

Goodwill |

|

69,593 |

|

|

|

69,593 |

|

|

|

Intangible assets, net |

|

7,792 |

|

|

|

9,120 |

|

|

|

Other assets |

|

8,129 |

|

|

|

7,671 |

|

|

|

Total assets |

$ |

552,923 |

|

|

$ |

577,155 |

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

$ |

7,812 |

|

|

$ |

7,586 |

|

|

|

Deferred revenue |

|

26,885 |

|

|

|

23,294 |

|

|

|

Accrued expenses and other current liabilities |

|

108,308 |

|

|

|

13,354 |

|

|

|

Total current liabilities |

|

143,005 |

|

|

|

44,234 |

|

|

|

Warrants liability |

|

1,185 |

|

|

|

290 |

|

|

|

Deferred revenue, non-current |

|

1,969 |

|

|

|

3,141 |

|

|

|

Other long-term liabilities |

|

— |

|

|

|

206 |

|

|

|

Total liabilities |

|

146,159 |

|

|

|

47,871 |

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock |

|

32 |

|

|

|

31 |

|

|

|

Additional paid-in capital |

|

1,400,614 |

|

|

|

1,307,324 |

|

|

|

Accumulated other comprehensive income |

|

707 |

|

|

|

403 |

|

|

|

Accumulated deficit |

|

(994,589 |

) |

|

|

(778,474 |

) |

|

|

Total stockholders’ equity |

|

406,764 |

|

|

|

529,284 |

|

|

|

Total liabilities and stockholders’ equity |

$ |

552,923 |

|

|

$ |

577,155 |

|

|

|

|

|

|

MATTERPORT, INC.CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS(In thousands,

unaudited) |

|

|

|

|

|

|

Nine Months Ended September30, |

|

|

|

2024 |

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(216,115 |

) |

|

$ |

(155,132 |

) |

|

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

17,284 |

|

|

|

14,130 |

|

|

|

Accretion of discounts, net of amortization of investment

premiums |

|

(7,049 |

) |

|

|

(5,511 |

) |

|

|

Stock-based compensation, net of amounts capitalized |

|

84,821 |

|

|

|

90,674 |

|

|

|

Cease use of certain leased facilities |

|

— |

|

|

|

123 |

|

|

|

Change in fair value of warrants liability |

|

895 |

|

|

|

(564 |

) |

|

|

Deferred income taxes |

|

— |

|

|

|

(185 |

) |

|

|

Allowance for doubtful accounts |

|

525 |

|

|

|

150 |

|

|

|

Loss from excess inventory and purchase obligation |

|

— |

|

|

|

1,592 |

|

|

|

Other |

|

(61 |

) |

|

|

(60 |

) |

|

|

Changes in operating assets and liabilities, net of effects of

businesses acquired: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

1,482 |

|

|

|

3,489 |

|

|

|

Inventories |

|

1,532 |

|

|

|

(6,833 |

) |

|

|

Prepaid expenses and other assets |

|

656 |

|

|

|

2,491 |

|

|

|

Accounts payable |

|

226 |

|

|

|

263 |

|

|

|

Deferred revenue |

|

2,419 |

|

|

|

6,527 |

|

|

|

Accrued expenses and other liabilities |

|

94,750 |

|

|

|

529 |

|

|

|

Net cash used in

operating activities |

|

(18,635 |

) |

|

|

(48,317 |

) |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(170 |

) |

|

|

(112 |

) |

|

|

Capitalized software and development costs |

|

(6,846 |

) |

|

|

(7,528 |

) |

|

|

Purchase of investments |

|

(157,522 |

) |

|

|

(368,119 |

) |

|

|

Maturities of investments |

|

257,106 |

|

|

|

388,201 |

|

|

|

Business acquisitions, net of cash acquired |

|

— |

|

|

|

(4,116 |

) |

|

|

Net cash provided by

investing activities |

|

92,568 |

|

|

|

8,326 |

|

|

|

CASH FLOW FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Proceeds from the sales of shares through employee equity incentive

plans |

|

1,644 |

|

|

|

3,309 |

|

|

|

Payments for taxes related to net settlement of equity awards |

|

— |

|

|

|

(329 |

) |

|

|

Net cash provided by

financing activities |

|

1,644 |

|

|

|

2,980 |

|

|

|

Net change in cash, cash equivalents, and restricted cash |

|

75,577 |

|

|

|

(37,011 |

) |

|

|

Effect of exchange rate changes on cash |

|

61 |

|

|

|

25 |

|

|

|

Cash, cash equivalents, and restricted cash at beginning of

year |

|

82,902 |

|

|

|

117,128 |

|

|

|

Cash, cash equivalents, and restricted cash at end of period |

$ |

158,540 |

|

|

$ |

80,142 |

|

|

|

|

|

|

MATTERPORT, INC.RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES(In thousands, except

per share amounts)(unaudited) |

|

|

|

|

|

|

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

GAAP net loss |

$ |

(38,401 |

) |

|

$ |

(44,754 |

) |

|

$ |

(216,115 |

) |

|

$ |

(155,132 |

) |

|

|

Stock-based compensation related charges (1) |

|

31,445 |

|

|

|

29,721 |

|

|

|

93,793 |

|

|

|

97,281 |

|

|

|

Restructuring charges (2) |

|

— |

|

|

|

3,147 |

|

|

|

— |

|

|

|

3,147 |

|

|

|

Acquisition-related costs (3) |

|

4,271 |

|

|

|

— |

|

|

|

12,194 |

|

|

|

— |

|

|

|

Amortization expense of acquired intangible assets |

|

443 |

|

|

|

443 |

|

|

|

1,329 |

|

|

|

1,329 |

|

|

|

Change in fair value of warrants liability (4) |

|

(169 |

) |

|

|

(513 |

) |

|

|

895 |

|

|

|

(564 |

) |

|

|

Litigation expense (5) |

|

— |

|

|

|

— |

|

|

|

95,000 |

|

|

|

— |

|

|

|

Non-GAAP net loss |

$ |

(2,411 |

) |

|

$ |

(11,956 |

) |

|

$ |

(12,904 |

) |

|

$ |

(53,939 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss per share attributable to common stockholders, basic

anddiluted |

$ |

(0.12 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.68 |

) |

|

$ |

(0.52 |

) |

|

|

Non-GAAP net loss per share attributable to common stockholders,

basic anddiluted |

$ |

(0.01 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.18 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute net loss per share, basic

and diluted |

|

321,151 |

|

|

|

303,432 |

|

|

|

317,002 |

|

|

|

298,226 |

|

|

|

|

|

|

|

|

|

(1) Consists primarily of non-cash share-based compensation expense

related to our stock incentive plans, and the employer payrolltaxes

related to our stock options and restricted stock units. |

|

|

(2) Consists of severance and other employee separation costs, and

cease use charges for operating lease right-of-use assets due

toreduction of leased office spaces. |

|

|

(3) Consists of acquisition transaction costs incurred for the

proposed transaction with CoStar Group, Inc. |

|

|

(4) Consists of the non-cash fair value measurement change for

private warrants. |

|

|

(5) Represents charges associated with our litigation for the nine

months ended September 30, 2024. |

|

|

|

|

This press release was published by a CLEAR® Verified

individual.

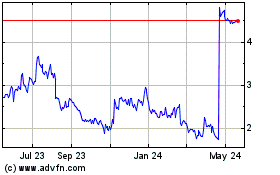

Matterport (NASDAQ:MTTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

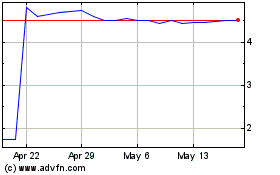

Matterport (NASDAQ:MTTR)

Historical Stock Chart

From Dec 2023 to Dec 2024