Second Quarter Revenue of $72.6 million and Net

loss of $2.6 million

Consolidated AEBITDA of $14.1 million

PLAYSTUDIOS, Inc. (NASDAQ: MYPS) (“PLAYSTUDIOS” or the

“Company”), an award-winning developer of free-to-play mobile and

social games and the developer of the playAWARDS loyalty platform,

today announced financial results for the second quarter ended June

30, 2024.

Second Quarter Financial Highlights

- Revenue was $72.6 million during the second quarter of 2024,

compared to $77.8 million during the second quarter of 2023.

- Net loss was $2.6 million during the second quarter of 2024,

representing a net loss margin of 3.6%, compared to net loss of

$0.8 million during the second quarter of 2023, representing a net

loss margin of 1.0%.

- Consolidated AEBITDA, a non-GAAP financial measure defined

below, was $14.1 million during the second quarter of 2024,

compared to $16.3 million during the second quarter of 2023.

Andrew Pascal, Chairman and Chief Executive Officer of

PLAYSTUDIOS, commented, “We had a busy and productive quarter

completing many strategic initiatives that better position our

company for future growth. While persistent industry weakness

continues to be a challenge for our Social Casino portfolio, I

believe we have opportunities in our portfolio that will eventually

override this pressure. We have been steadily making progress on

these efforts and continued to do so this quarter. Longer term, our

focus remains on building a strong and durable business that can

produce exceptional returns regardless of industry dynamics.”

He continued, “Quarterly revenues in our playGAMES division were

down 4.6% vs. last year. Weakness in the social casino industry was

the main driver of the shortfall with our core portfolio accounting

for the majority of the year over year decline. We expect industry

weakness to continue throughout the remainder of the year and have

adjusted our full year outlook to reflect this. Despite the

pressure, our focus remains on implementing structural changes

within our games to improve their results regardless of how the

industry performs. Our casual portfolio continued to perform

strongly this quarter, growing year over year revenues by over 10%.

The Tetris brand had its 40th anniversary in June and we celebrated

with a refresh of Tetris Mobile and the limited release of a brand

new game, Tetris Block Puzzle. Results at Brainium continue to

trend strongly with ARPDAU rising on the back of new advertising

initiatives.”

He added, “Consolidated AEBITDA and AEBITDA margins in the

quarter were lower than a year ago due to the deleveraging effect

of lower social casino revenues and the absence of a licensing deal

that benefited second quarter 2023 results. With the expiration of

the licensing agreement at the end of second quarter 2023, results

will not be impacted by this comparability issue going forward.

Consolidated AEBITDA and AEBITDA margins were higher in our growth

portfolio with notable gains at Brainium. As implied in our revised

guidance, we expect full year AEBITDA margins to be roughly flat

with 2023 levels.”

Pascal further noted, “For playAWARDS, the focus remains on a

full integration within our games. Where the platform is present,

we’ve seen a marked increase in player engagement, retention, and

monetization. The effect has further increased with the launch of

myVIP World Tournament of Slots. This exciting campaign is just the

latest way we are utilizing our industry leading loyalty platform

to drive player excitement in our games.”

He concluded, “It was a significant quarter on the capital front

as were able to purchase nearly 12 million of our shares from

Microsoft Corporation. We were able to buy our stock at a

meaningful discount to the average trading price and remove the

potential overhang of a prolonged share sale. Combined with our

open market purchases, we have bought back nearly 15% of our Class

A shares in the past six quarters. This reflects our confidence in

the intrinsic value of our company and highlights the

undervaluation of our shares in the public markets. We believe this

gap has never been higher than it is today. Despite the share

purchase and the acquisition of Pixode, our balance sheet remains

very strong with over $105 million in cash and no borrowings.”

Recent Business Highlights

- Purchased 11.7 million shares of Class A common stock from

Microsoft, or roughly 9% of our outstanding stock. The purchase was

made at a discount to the average trading price and funded with

available cash on hand.

- Announced and completed the acquisition of Pixode Games

Limited. Pixode is an Israeli based game studio that has developed

a block puzzle game incorporating a unique raid-and-defend

mechanic.

- Celebrated the 40th anniversary of the Tetris brand with the

refresh of our core Tetris game and the limited release of a new

Tetris game, Tetris Block Puzzle.

- Launched myVIP World Tournament of Slots, which will take place

October 24-27 at the Atlantis Paradise Island in the Bahamas. The

tournament will feature 500 dedicated players competing for a top

cash prize of $1.0 million.

Outlook

The company is revising its 2024 guidance to incorporate

continued weakness in the broader social casino category. Revenues

are projected to be in the range of $285 and $295 million compared

to the prior outlook of $315 to $325 million. Consolidated AEBITDA

is expected to be between $55 and $60 million vs. prior

expectations of $65 and $70 million.

We have not provided the most directly comparable GAAP measure

for our Consolidated AEBITDA outlook because certain items that are

part of the projected non-GAAP financial measure are outside of our

control or cannot be reasonably estimated without unreasonable

effort.

Conference Call Details

PLAYSTUDIOS will host a conference call at 5:00 p.m. Eastern

Time today, which will include a brief discussion of the results

followed by a question and answer session.

The call will be accessible via the Internet through

https://ir.playstudios.com or by calling (866) 405-1203 for

domestic callers and (201) 689-8432 for international callers.

A replay of the call will be archived at

https://ir.playstudios.com.

About PLAYSTUDIOS, Inc.

PLAYSTUDIOS (Nasdaq: MYPS) is the creator of the groundbreaking

playAWARDS loyalty platform is a publisher and developer of

award-winning mobile games, including the iconic Tetris® mobile

app, Pop! Slots, myVEGAS Slots, myVEGAS Blackjack, myKONAMI Slots,

myVEGAS Bingo, MGM Slots Live, Solitaire, Spider Solitaire and

Sudoku. The playAWARDS loyalty platform enables players to earn

real-world rewards from a global collection of iconic hospitality,

entertainment, and leisure brands. playAWARDS partners include MGM

Resorts International, Wolfgang Puck, Norwegian Cruise Line,

Resorts World, IHG, Bowlero, Gray Line Tours, and Hippodrome Casino

among others. Founded by a team of veteran gaming, hospitality, and

technology entrepreneurs, PLAYSTUDIOS apps combine the best

elements of popular casual games with compelling real-world

benefits. To learn more about PLAYSTUDIOS, visit

playstudios.com.

Performance Indicators

We manage our business by regularly reviewing several key

operating metrics to track historical performance, identify trends

in player activity, and set strategic goals for the future. Our key

performance metrics are impacted by several factors that could

cause them to fluctuate on a quarterly basis, such as platform

providers’ policies, seasonality, player connectivity, and the

addition of new content to games. We believe these measures are

useful to investors for the same reasons. The key performance

indicators may differ from similarly titled measures presented by

other companies. For more information on our key performance

indicators, please refer to the definitions below and the

“Supplemental Data—Key Performance Indicators” section of this

press release.

Daily Active Users (“DAU”): DAU is

defined as the number of individuals who played a game on a

particular day. We track DAU by the player ID, which is assigned

for each game installed by an individual. As such, an individual

who plays two different PLAYSTUDIOS games on the same day is

counted as two DAU while an individual who plays the same

PLAYSTUDIOS game on two different devices is counted as one DAU.

Brainium tracks DAU by app instance ID, which is assigned to each

installation of a game on a particular device. As such, an

individual who plays two different Brainium games on the same day

is counted as two DAU while an individual who plays the same game

on two different devices is counted as two DAU. The term “Average

DAU” is defined as the average of the DAU, determined as described

above, for each day during the period presented. We use DAU and

Average DAU as measures of audience engagement to help us

understand the size of the active player base engaged with our

games on a daily basis.

Monthly Active Users (“MAU”): MAU

is defined as the number of individuals who played a game in a

particular month. As with DAU, an individual who plays two

different PLAYSTUDIOS games in the same month is counted as two MAU

while an individual who plays the same game on two different

devices is counted as one MAU, and an individual who plays two

different Brainium games on the same day is counted as two MAU

while an individual who plays the same game on two different

devices is counted as two MAU. The term “Average MAU” is defined as

the average of the MAU, determined as described above, for each

calendar month during the period presented. We use MAU and Average

MAU as measures of audience engagement to help us understand the

size of the active player base engaged with our games on a monthly

basis.

Daily Paying Users (“DPU”): DPU is

defined as the number of individuals who made a purchase in a

mobile game during a particular day. As with DAU and MAU, we track

DPU based on account activity. As such, an individual who makes a

purchase on two different games in a particular day is counted as

two DPU while an individual who makes purchases in the same game on

two different devices is counted as one DPU. The term “Average DPU”

is defined as the average of the DPU, determined as described

above, for each day during the period presented. We use DPU and

Average DPU to help us understand the size of our active player

base that makes in-game purchases. This focus directs our strategic

goals in setting player acquisition and pricing strategy.

Daily Payer Conversion: Daily Payer

Conversion is defined as DPU as a percentage of DAU on a particular

day. Daily Player Conversion is also sometimes referred to as

“Percentage of Paying Users” or “PPU”. The term “Average Daily

Payer Conversion” is defined as the Average DPU divided by the

Average DAU for a given period. We use Daily Payer Conversion and

Average Daily Payer Conversion to help us understand the

monetization of our active players.

Average Daily Revenue Per DAU

(“ARPDAU”): ARPDAU is defined for a given period as the

average daily revenue per Average DAU, and is calculated as game

and advertising revenue for the period, divided by the number of

days in the period, divided by the Average DAU during the period.

We use ARPDAU as a measure of overall monetization of our active

players.

playAWARDS Platform Metrics

Available Rewards: Available

Rewards is defined as the monthly average number of unique rewards

available in our applications’ rewards stores. A reward appearing

in more than one application’s reward store is counted only once. A

reward is counted only once irrespective of the inventory available

through that reward. For example, one reward for a free night in a

hotel room with ten rooms available for such free night is counted

as one reward. Available Rewards only include real-world partner

rewards and exclude PLAYSTUDIOS digital rewards. We use Available

Rewards as a measure of the value and potential impact of the

program for an interested player. It is assumed that the greater

the variety and breadth of rewards offered, the more likely players

will be to ascribe value to the program.

Purchases: Purchases is defined as

the total number of rewards purchased for the period identified in

which a player exchanges loyalty points for a reward. Purchases are

net of refunds. Purchases only include purchases of real-world

partner rewards and exclude any PLAYSTUDIOS digital rewards.

Purchases are redeemed by the player directly with the rewards

partner within the specified terms and conditions of the reward.

The Company does not receive any compensation or revenue from

Purchases. We use Purchases as a measure of audience interest and

engagement with our playAWARDS platform.

Retail Value of Purchases: Retail

Value of Purchases is defined as the cumulative retail value of all

rewards listed as Purchases for the period identified. The retail

value of each reward listed as Purchases is the retail value as

determined by the partner upon creation of the reward. In the case

where the retail value of a reward adjusts depending on time of

redemption, the average retail value is used. Retail Value of

Purchases only include the retail value of real-world partner

rewards and exclude the cost of any PLAYSTUDIOS branded

merchandise. We use Retail Value of Purchases to help us understand

the real-world value of the rewards that are purchased by our

players.

Non-GAAP Financial Measures

To provide investors with information in addition to results as

determined by GAAP, the Company discloses Consolidated Adjusted

Earnings Before Interest Taxes Depreciation and Amortization

(“Consolidated AEBITDA”) as a non-GAAP measure that management

believes provides useful information to investors. This measure is

not a financial measure calculated in accordance with GAAP and

should not be considered as a substitute for revenue, net income or

any other operating performance measure calculated in accordance

with GAAP.

We define Consolidated AEBITDA as net income (loss) before

interest, income taxes, depreciation and amortization,

restructuring and related costs (consisting primarily of severance

and other restructuring related costs), stock-based compensation

expense, and other income and expense items (including special

infrequent items, foreign currency gains and losses, and other

non-cash items). We also present Consolidated AEBITDA margin, a

non-GAAP measure, which we calculate as Consolidated AEBITDA as a

percentage of net revenue.

We believe that the presentation of Consolidated AEBITDA

provides useful information to investors regarding the Company’s

results of operations because the measure assists both investors

and management in analyzing and benchmarking the performance and

value of our business. Consolidated AEBITDA provides an indicator

of performance that is not affected by fluctuations in certain

costs or other items. Accordingly, management believes that this

measure is useful for comparing general operating performance from

period to period, and management relies on this measure for

planning and forecasting of future periods. Additionally, this

measure allows management to compare results with those of other

companies that have different financing and capital structures.

However, other companies may define Consolidated AEBITDA

differently, and as a result, our measure of Consolidated AEBITDA

may not be directly comparable to that of other companies. For

further information regarding these non-GAAP measures, including

the reconciliation of these non-GAAP financial measures to their

most directly comparable GAAP financial measures, please refer to

the “Reconciliation of Net Loss to Consolidated AEBITDA” section of

this press release.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding our future financial and

operating performance (including statements regarding outlook or

guidance), our liquidity and capital resources, the development and

release plans of our games, our plans to commercialize the

playAWARDS platform as a stand-alone service for use by third

parties, our increased capacity and use of personnel in European

and Asian studios, and our mergers and acquisition strategy, all of

which involve risks and uncertainties. Actual results may differ

materially from the results predicted, and reported results should

not be considered as an indication of future performance.

Forward-looking statements include all statements that are not

historical facts and can be identified by terms such as “may,”

“might,” “will,” “should,” “expects,” “plans,” “anticipates,”

“intends,” “believes,” “goal,” “work towards,” “estimates,”

“predicts,” “potential” or “continue,” the negative of these terms

and other comparable terminology that conveys uncertainty of future

events or outcomes. These forward-looking statements involve known

and unknown risks, uncertainties, assumptions and other factors

that may cause actual results to differ materially from statements

made in this press release, including our ability to develop and

publish our games; risks related to defects, errors, or

vulnerabilities in our games and IT infrastructure; our ability to

attract new, and retain existing, players of our games; the failure

to timely develop and achieve market acceptance of new games and

maintain the popularity of our existing games; rapidly evolving

technological developments in the gaming market; competition in the

industry in which we operate; our financial performance; our

ability to execute merger and acquisition transactions; legal and

regulatory developments; risks associated with our international

operations; geopolitical events and conditions; and general market,

political, economic and business conditions. Other potential risks

and uncertainties that could cause actual results to differ from

the results predicted include, among others, those risks and

uncertainties included under the captions “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2023 filed with the Securities and

Exchange Commission (the “SEC”) on March 12, 2024, and in other

filings we make with the SEC from time to time. All information

provided in this release is based on information available to us as

of the date of this press release and any forward-looking

statements contained herein are based on assumptions that we

believe are reasonable as of this date. Undue reliance should not

be placed on the forward-looking statements in this press release,

which are inherently uncertain. We undertake no duty to update this

information unless required by law.

PLAYSTUDIOS, INC.

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS

(Unaudited and in thousands,

except per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenue

$

72,590

$

77,793

$

150,418

$

157,916

Operating expenses:

Cost of revenue(1)

18,068

18,887

37,019

38,414

Selling and marketing

17,064

18,431

35,640

36,497

Research and development

16,743

18,381

23,424

22,941

General and administrative

11,645

11,040

34,764

36,136

Depreciation and amortization

11,654

11,116

23,220

22,149

Restructuring and related

1,379

1,784

2,017

5,832

Total operating costs and expenses

76,553

79,639

156,084

161,969

Loss from operations

(3,963

)

(1,846

)

(5,666

)

(4,053

)

Other income (expense), net:

Change in fair value of warrant

liabilities

717

(1,777

)

653

(2,835

)

Interest income, net

1,374

1,262

2,794

2,157

Other (loss) income, net

(264

)

1,044

(370

)

1,104

Total other income, net

1,827

529

3,077

426

Loss before income taxes

(2,136

)

(1,317

)

(2,589

)

(3,627

)

Income tax (expense) benefit

(475

)

558

(589

)

298

Net loss

$

(2,611

)

$

(759

)

$

(3,178

)

$

(3,329

)

Net loss per share attributable to Class A

and Class B common stockholders:

Basic

$

(0.02

)

$

(0.01

)

$

(0.02

)

$

(0.03

)

Diluted

$

(0.02

)

$

(0.01

)

$

(0.02

)

$

(0.03

)

Weighted average shares of common stock

outstanding:

Basic

132,475

132,144

134,025

132,137

Diluted

132,475

132,144

134,025

132,137

(1)

Amounts exclude depreciation and

amortization.

PLAYSTUDIOS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited and in thousands,

except par value amounts)

June 30, 2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

106,304

$

132,889

Receivables

29,193

30,465

Prepaid expenses and other current

assets

11,502

11,529

Total current assets

146,999

174,883

Property and equipment, net

18,256

17,549

Operating lease right-of-use assets

10,746

9,369

Intangibles assets and internal-use

software, net

104,655

110,933

Goodwill

47,133

47,133

Deferred income taxes

2,666

2,764

Other long-term assets

2,992

3,690

Total non-current assets

186,448

191,438

Total assets

$

333,447

$

366,321

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

3,745

1,907

Warrant liabilities

433

1,086

Operating lease liabilities, current

3,278

4,236

Accrued and other current liabilities

28,034

38,796

Total current liabilities

35,490

46,025

Minimum guarantee liability

24,000

24,000

Deferred income taxes

1,326

1,198

Operating lease liability, non-current

7,865

5,699

Other long-term liabilities

1,203

1,048

Total non-current liabilities

34,394

31,945

Total liabilities

$

69,884

$

77,970

Stockholders’ equity:

Preferred stock, $0.0001 par value

(100,000 shares authorized, no shares issued and outstanding as of

June 30, 2024 and December 31, 2023)

—

—

Class A common stock, $0.0001 par value

(2,000,000 shares authorized, 126,069 and 122,923 shares issued,

and 108,132 and 118,200 shares outstanding as of June 30, 2024 and

December 31, 2023, respectively)

11

12

Class B common stock, $0.0001 par value

(25,000 shares authorized, and 16,457 and 16,457 shares issued and

outstanding as of June 30, 2024 and December 31, 2023,

respectively.

2

2

Additional paid-in capital

319,682

310,944

Retained earnings

(5,815

)

(2,637

)

Accumulated other comprehensive income

(1,554

)

124

Treasury stock, at cost, 17,937 and 4,723

shares at June 30, 2024 and December 31, 2023, respectively

(48,763

)

(20,094

)

Total stockholders’ equity

263,563

288,351

Total liabilities and stockholders’

equity

$

333,447

$

366,321

PLAYSTUDIOS, INC. RECONCILIATION OF

NET LOSS TO CONSOLIDATED AEBITDA (Unaudited and in thousands,

except percentages)

The following table sets forth the reconciliation of net loss

and net loss margin to Consolidated AEBITDA and Consolidated

AEBITDA margin, respectively, which we calculate as Consolidated

AEBITDA as a percentage of net revenue. Net loss and net loss

margin are the most directly comparable GAAP measures.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

$

72,590

$

77,793

$

150,418

$

157,916

Net loss

$

(2,611

)

$

(759

)

$

(3,178

)

$

(3,329

)

Net loss margin

(3.6

)%

(1.0

)%

(2.1

)%

(2.1

)%

Adjustments:

Depreciation & amortization

11,654

11,116

23,220

22,149

Income tax expense

475

(558

)

589

(298

)

Stock-based compensation expense

4,930

5,193

9,724

10,047

Change in fair value of warrant

liability

(717

)

1,777

(653

)

2,835

Change in fair value of contingent

consideration

—

(897

)

—

(950

)

Restructuring and related(1)

1,378

1,784

2,016

5,832

Other, net(2)

(971

)

(1,382

)

(2,266

)

(2,246

)

Consolidated AEBITDA

14,138

16,274

29,452

34,040

Consolidated AEBITDA Margin

19.5

%

20.9

%

19.6

%

21.6

%

(1)

Amounts reported during the three and six

months ended June 30, 2023 relate to non-cash impairment charges

related to certain investments and fees related to evaluating

various merger, acquisition and restructuring opportunities.

Amounts reported during the three and six months ended June 30,

2024 relate to internal reorganization costs, including

severance-related costs, fees related to evaluating and completing

various merger and acquisition opportunities, and legal fees and

other costs incurred in connection with litigation arising out of

the Acies Merger transaction.

(2)

Amounts reported in “Other, net” include

interest expense, interest income, gains/losses from equity

investments, foreign currency gains/losses, and non-cash

gains/losses on the disposal of assets.

PLAYSTUDIOS, INC. SUPPLEMENTAL DATA -

SEGMENT INFORMATION (Unaudited and in thousands, except

percentages)

The following table sets forth the financial data for our

reportable segments.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenue

playGAMES

72,588

76,122

150,416

153,745

playAWARDS

2

1,671

2

4,171

Reportable segment net revenue

72,590

77,793

150,418

157,916

AEBITDA

playGAMES

21,920

21,610

45,371

44,202

playAWARDS

(3,476

)

(1,706

)

(7,098

)

(2,337

)

Reportable segment AEBITDA

18,444

19,904

38,273

41,865

Other operating expense

Corporate and other

4,306

3,630

8,821

7,825

Restructuring expenses

1,379

1,784

2,017

5,832

Other reconciling items

138

26

157

65

Stock-based compensation

4,930

5,194

9,724

10,047

Depreciation and amortization

11,654

11,116

23,220

22,149

22,407

21,750

43,939

45,918

Non-operating income (expense)

Change in fair value of warrant

liabilities

717

(1,777

)

653

(2,835

)

Interest income, net

1,374

1,262

2,794

2,157

Other (expense) income, net

(264

)

1,044

(370

)

1,104

1,827

529

3,077

426

Loss before income taxes

(2,136

)

(1,317

)

(2,589

)

(3,627

)

Income tax (expense) benefit

(475

)

558

(589

)

298

Net loss

$

(2,611

)

$

(759

)

$

(3,178

)

$

(3,329

)

Segment AEBITDA margin:

playGAMES

30.2

%

28.4

%

30.2

%

28.8

%

playAWARDS

nm

(102.1

)%

nm

(56.0

)%

nm - not meaningful

PLAYSTUDIOS, INC.

SUPPLEMENTAL DATA – PLAYGAMES

KEY PERFORMANCE INDICATORS

(Unaudited and in thousands,

except percentages and ARPDAU)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

Change

% Change

2024

2023

Change

% Change

Average DAU

3,220

3,651

(431

)

(11.8

)%

3,357

3,608

(251

)

(7.0

)%

Average MAU

13,597

13,878

(281

)

(2.0

)%

14,174

13,482

692

5.1

%

Average DPU

24

26

(2

)

(7.7

)%

26

27

(1

)

(3.7

)%

Average Daily Payer Conversion

0.8

%

0.7

%

0.1 pp

14.3

%

0.8

%

0.7

%

0.1 pp

14.3

%

ARPDAU (in dollars)

$

0.25

$

0.23

$

0.02

8.7

%

$

0.25

$

0.23

$

0.02

8.7

%

pp = percentage points

PLAYSTUDIOS, INC.

SUPPLEMENTAL DATA – PLAYAWARDS

KEY PERFORMANCE INDICATORS

(Unaudited and in thousands,

except for available rewards)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

Change

% Change

2024

2023

Change

% Change

Available Rewards (in units)

561

602

(41

)

(6.8

%)

541

568

(27

)

(4.8

%)

Purchases (in units)

520

465

55

11.8

%

1,020

905

115

12.7

%

Retail Value of Purchases

$

31,405

$

26,640

$

4,765

17.9

%

$

71,997

$

53,980

$

18,017

33.4

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240805652073/en/

PLAYSTUDIOS: Investor

Relations Samir Jain, CFA

samir.jain@playstudios.com (917) 224-1058

Media Relations BerlinRosen media@playstudios.com

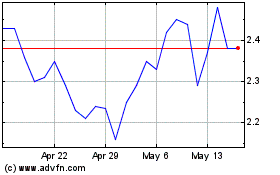

PLAYSTUDIOS (NASDAQ:MYPS)

Historical Stock Chart

From Dec 2024 to Jan 2025

PLAYSTUDIOS (NASDAQ:MYPS)

Historical Stock Chart

From Jan 2024 to Jan 2025