UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934 (Amendment No. 1)

| My

Size, Inc. |

| (Name

of Issuer) |

| Common

Stock, $0.001 par value per share |

| (Title

of Class of Securities) |

Ronen

Luzon

c/o

My Size, Inc.

HaYarden

POB

1026

Airport

City, Israel

7010000

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

With

copies to:

Or

Kles

c/o

My Size, Inc.

HaYarden

POB

1026

Airport

City, Israel

7010000

February

14, 2024

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7(b)

for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE

13D

| 1 |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| Ronen Luzon |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

(a)

☐

(b)

☐ |

| 3 |

SEC USE ONLY |

| |

| 4 |

SOURCE OF FUNDS (See Instructions) |

| AF |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| ☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| Israel |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER |

| |

| 8 |

SHARED VOTING POWER |

| 588,095

(1) |

| 9 |

SOLE DISPOSITIVE POWER |

| |

| 10 |

SHARED DISPOSITIVE POWER |

| 588,095

(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 588,095

(1) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

| ☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 12.7%

(2) |

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

| IN |

| (1) |

Consists

of (i) 400,000 shares of restricted stock, (ii) options to purchase up to 8,001 shares of common stock that may be

exercised within 60 days of the reporting date, (iii) 174,000 shares of restricted stock which are held by the Reporting Person’s

spouse, and (iv) options to purchase

up to 6,094 shares of common stock, which are held by the Reporting Person’s spouse, that may be exercised within 60

days of the reporting date. |

| (2) |

Based

upon 4,622,792 shares of common stock outstanding on February 16, 2024 which amount was provided to the Reporting Person

by the Issuer and assumes the issuance of restricted stock awards granted on February 14, 2024. |

| 1 |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| Billy Pardo |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

(a)

☐

(b)

☐ |

| 3 |

SEC USE ONLY |

| |

| 4 |

SOURCE OF FUNDS (See Instructions) |

| AF |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| ☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| Israel |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER |

| |

| 8 |

SHARED

VOTING POWER |

| 588,095

(1) |

| 9 |

SOLE

DISPOSITIVE POWER |

| |

| 10 |

SHARED

DISPOSITIVE POWER |

| 588,095

(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 588,095

(1) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

| ☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 12.7%

(2) |

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

| IN |

| (1) |

Consists

of (i) 174,000 shares of restricted stock, (ii) options to purchase up to 6,094 shares of common stock that may be

exercised within 60 days of the reporting date, (iii) 400,000 shares of restricted stock which are held by the Reporting Person’s

spouse, and (iv) options to purchase up to 8,001 shares of common stock, which are held by the Reporting Person’s

spouse, that may be exercised within 60 days of the reporting date. |

| (2) |

Based

upon 4,622,792 shares of common stock outstanding on February 16, 2024 which amount was provided to the Reporting Person by the Issuer and assumes the issuance of restricted stock awards granted on February 14, 2024. |

| Item

1. | Security

and Issuer |

This statement relates to the common stock,

$0.001 par value per share (the “Shares”), of My Size, Inc., a Delaware corporation (the “Issuer”). The address

of the principal executive offices of the Issuer is HaYarden 4, POB 1026, Airport City, Israel 7010000.

On December 8, 2022, the Issuer implemented

a 1-for-25 reverse stock split (the "Reverse Stock Split") of the Company's common stock. All amounts have been adjusted to

give effect to the Reverse Stock Split.

| Item

2. | Identity

and Background |

| (a) | This

statement is filed by: |

| (b) | The

principal business address of each Reporting Person is HaYarden 4, POB 1026, Airport City,

Israel 701000. |

| (c) | The

principal occupation of Mr. Luzon is serving as the Chief Executive Officer and a Director

of the Issuer. The principal occupation of Ms. Pardo is serving as the Chief Product Officer

and Chief Operating Officer of the Issuer. |

| (d) | No

Reporting Person has, during the last five years, been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors). |

| (e) | No

Reporting Person has, during the last five years, been party to a civil proceeding of a judicial

or administrative body of competent jurisdiction and as a result of such proceeding was or

is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation

with respect to such laws. |

| (f) | Each

of the Reporting Persons are citizens of Israel. |

| Item

3. | Source

and Amount of Funds or Other Considerations |

On

February 14, 2024, the Issuer granted 300,000 restricted Shares and 150,000 restricted Shares to Mr. Luzon and Ms.

Pardo, respectively, which vest in three equal installments on January 1, 2025, January 1, 2026 and January 1, 2027,

subject to continuous employment with the Issuer, and accelerated vesting upon a change in control of the Issuer.

On November 29, 2023, the Mr. Luzon sold 4,683

Shares at a price per share of $0.6838 pursuant to a Rule 10b5-1 trading plan adopted by the Reporting Person on August 31, 2023.

| Item

4. | Purpose

of Transaction |

Item

3 above is hereby incorporated into this Item 4 by reference. Each Reporting Person serves as an executive officer of the Issuer and,

in such capacity, may be involved in reviewing transactions involving the Issuer and may have influence over the corporate activities

of the Issuer, including activities which may relate to items described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

As

of the date hereof, each Reporting Person in their individual capacities do not have any present plans or proposals that relate

to, or would result in, any actions or events specified in clauses (a) through (j) of Item 4 to Schedule 13D. Each Reporting Person may,

at any time and from time to time, (i) review or reconsider his or her position in the Issuer or change his or her purpose or formulate

plans or proposals with respect thereto or (ii) propose or consider one or more of the actions described in clauses (a) through (j) of

Item 4 to Schedule 13D.

From

time to time, each Reporting Person may also acquire beneficial ownership of additional Shares or other securities of the Issuer as compensation

from the Issuer, by purchase or otherwise, including, including, but not limited to, awards of restricted Shares, options to purchase

Shares, and restricted stock units for Shares, or dispose of some or all of the Shares beneficially owned by such Reporting Person

in the open market or in privately negotiated transactions (which may be with the Issuer or with third parties) on such terms

and at such times as such Reporting Person may deem advisable.

| Item

5. | Interest

in Securities of the Issuer |

| (a)

– (b) | The

information contained in rows 7, 8, 9, 10, 11 and 13 on the cover pages of this Schedule

13D (including the footnotes thereto) is incorporated by reference herein. |

| (c) | No

transactions in the Issuer’s Shares were effected during the past 60 days by the Reporting

Person except as set forth in Item 3 above. |

| Item

6. | Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

The

Reporting Persons have entered into a Joint Filing Agreement, a copy of which is filed as Exhibit A to the Schedule 13D filed

by the Reporting Persons with the SEC on November 21, 2022, pursuant to which the Reporting Persons agreed to file such Schedule

13D and any amendments thereto jointly in accordance with the provisions of Rule 13d-1(k)(1) of the Securities Exchange Act of

1934, as amended.

| Item

7. | Material

to Be Filed as Exhibits |

Signature

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Dated:

February 16, 2024 |

By: |

/s/

Ronen Luzon |

| |

|

Ronen

Luzon |

| Dated:

February 16, 2024 |

By: |

/s/

Billy Pardo |

| |

|

Billy

Pardo |

Exhibit

B

SECTION

102 CAPITAL GAIN RESTRICTED STOCK AWARD AGREEMENT

MY

SIZE, INC.

2017

EQUITY INCENTIVE PLAN

1.

Grant of Award. Pursuant to the My Size, Inc. 2017 Equity Incentive Plan, and the Israel Grantees Sub-plan thereto (together the

“Plan”) for key employees, key contractors, and outside directors of My Size, Inc., a Delaware corporation

(the “Company”), and its Subsidiaries (collectively, the “Group”) and in consideration

of your service to the Company,

[●]

(the

“Participant”)

has

been granted a Restricted Stock Award (the “Award”) in accordance with Section 9(a) of the Plan. The number

of shares of Common Shares awarded under this Section 102 Capital Gain Restricted Stock Award Agreement (this “Agreement”)

is [●] shares (the “Awarded Shares”). The “Date of Grant” of this Award is [●]. By signing this Agreement, the Participant

agrees to be bound by the terms and conditions herein, the Plan and any and all conditions established by the Company in connection with

Awards issued under the Plan, and the Participant further acknowledges and agrees that this Award does not confer any legal or equitable

right (other than those rights constituting the Award itself) against the Company directly or indirectly, or give rise to any cause of

action at law or in equity against the Company. The Company has designated the Awarded Shares as approved 102 incentives (i.e. shares

of Common Shares issued pursuant to Section 102(b) of the Israeli Income Tax Ordinance (New Version), 5721-1961 (the “Ordinance”)

and held in trust by a trustee for the benefit of the Participant (“Approved 102 Incentives”)), and has classified

them as Capital Gain Incentives that qualify for tax treatment in accordance with the provisions of Section 102(b)(3) of the Ordinance.

Capitalized terms used but not defined herein shall have the respective meanings given to them in the Plan.

2.

Subject to Plan. This Agreement is subject to the terms and conditions of the Plan, and the terms of the Plan shall control to

the extent not otherwise inconsistent with the provisions of this Agreement. To the extent the terms of the Plan are inconsistent with

the provisions of this Agreement, this Agreement shall control. The capitalized terms used herein that are defined in the Plan shall

have the same meanings assigned to them in the Plan. This Agreement is subject to any rules promulgated pursuant to the Plan by the Administrator

and communicated to the Participant in writing.

3.

Vesting. Except as specifically provided in this Agreement and subject to certain restrictions and conditions set forth in the

Plan, the Awarded Shares shall vest as follows:

a.

One-third (1/3) of the total Awarded Shares (rounded down to the nearest whole share) shall vest on [●], provided that the Participant has continuously provided services to the Group as an employee through that date.

b.

An additional one-third (1/3) of the total Awarded Shares (rounded down to the nearest whole share) shall vest on [●], provided that the Participant has continuously provided services to the Group as an employee through that

date.

c.

The remaining Awarded Shares shall vest on [●], provided that the Participant has continuously provided services to the Group

as an employee through that date.

Notwithstanding

the foregoing, upon a Change in Control (as defined in the Plan), the total Awarded Shares

not previously vested shall thereupon immediately become fully vested as of the Termination Date.

For

purposes hereof, the following capitalized terms shall have the meanings set forth below:

“Termination

of Service” occurs when a Participant who is (i) an employee of the Company or any Subsidiary ceases to serve as an employee

of the Company and its Subsidiaries, for any reason; (ii) an outside director of the Company or a Subsidiary ceases to serve as a director

of the Company and its Subsidiaries for any reason; or (iii) a contractor of the Company or a Subsidiary ceases to serve as a contractor

of the Company and its Subsidiaries for any reason. Except as may be necessary or desirable to comply with applicable federal or state

law, a “Termination of Service” shall not be deemed to have occurred when a Participant who is an employee becomes an outside

director or contractor or vice versa. Notwithstanding the foregoing provisions of this definition of “Termination of Service”,

in the event an Award issued under the Plan is subject to Section 409A of the Code, then, in lieu of the foregoing definition and to

the extent necessary to comply with the requirements of Section 409A of the Code, the definition of “Termination of Service”

for purposes of such Award shall be the definition of “separation from service” provided for under Section 409A of the Code

and the regulations or other guidance issued thereunder.

4.

Forfeiture of Awarded Shares. Awarded Shares that are not vested in accordance with Section 3 shall be forfeited on the

date of the Participant’s Termination of Service with the Group (the “Termination Date”). Upon forfeiture,

all of the Participant’s rights with respect to the forfeited Awarded Shares shall cease and terminate, without any further obligations

on the part of the Company or the Group.

5.

Restrictions on Awarded Shares. Subject to the provisions of the Plan and the terms of this Agreement, from the Date of Grant

until the date the Awarded Shares are vested in accordance with Section 3 and are no longer subject to forfeiture in accordance

with Section 4 (the “Restriction Period”), the Participant shall not be permitted to sell, transfer,

pledge, or assign any of the Awarded Shares or to grant any right thereto. Except for these limitations, the Administrator may in its

sole discretion, remove any or all of the restrictions on such Awarded Shares whenever it may determine that, by reason of changes in

Applicable Laws or other changes in circumstances arising after the date of this Agreement, such action is appropriate.

6.

Legend. Awarded Shares electronically registered in a Participant’s name or a trustee’s name for the benefit of the

Participant shall note that such shares are Restricted Stock. If certificates for Awarded Shares are issued, the following legend shall

be placed on all such certificates:

On

the face of the certificate:

“Transfer

of this stock is restricted in accordance with conditions printed on the reverse of this certificate.”

On

the reverse:

“The

shares of stock evidenced by this certificate are subject to and transferable only in accordance with that certain My Size, Inc. 2017

Equity Incentive Plan, a copy of which is on file at the principal office of the Company in Tel-Aviv, Israel and that certain Restricted

Stock Award Agreement by and between the Company and [●]. No transfer or pledge of the shares evidenced hereby may be

made except in accordance with and subject to the provisions of said Plan and Award Agreement. By acceptance of this certificate, any

holder, transferee or pledgee hereof agrees to be bound by all of the provisions of said Plan and Award Agreement.”

The

following legend shall be inserted on a certificate, if issued, evidencing Common Shares issued under the Plan if the shares were not

issued in a transaction registered under the applicable federal and state securities laws:

“Shares

of stock represented by this certificate have been acquired by the holder for investment and not for resale, transfer or distribution,

have been issued pursuant to exemptions from the registration requirements of applicable state and federal securities laws, and may not

be offered for sale, sold or transferred other than pursuant to effective registration under such laws, or in transactions otherwise

in compliance with such laws, and upon evidence satisfactory to the Company of compliance with such laws, as to which the Company may

rely upon an opinion of counsel satisfactory to the Company.”

All

Awarded Shares owned by the Participant or registered in the trustee’s name for the benefit of the Participant shall be subject

to the terms of this Agreement and shall be represented by a certificate or certificates bearing the foregoing legend.

7.

Israeli Tax Ordinance.

a.

The Company has designated the Awarded Shares as Approved 102 Incentives and held in trust by a trustee for the benefit of the Participant),

and has classified them as Capital Gain Incentives that qualify for tax treatment in accordance with the provisions of Section 102(b)(3)

of the Ordinance.

b.

The Awarded Shares including all rights attaching thereto, and other shares received with respect thereto (including cash dividends,

stock dividends, and bonus shares), will be allocated or issued to a trustee nominated by the Company and approved in accordance with

the provisions of Section 102 of the Ordinance (the “Trustee”), and will be held by the Trustee for the benefit

of the Participant for a period of, and will not be delivered to the Participant prior to the expiration of, at least twenty four (24)

months from the Date of Grant (the “Trust Period”). Notwithstanding, any cash dividend attributed to the Awarded

Shares shall be paid to the Participant subject to the applicable full withholding tax which will be deducted by the Company and/or Trustee.

c.

All rights attaching to the Awarded Shares and all rights or shares received by the Participant with respect thereto (including, cash

dividends, stock dividends, or bonus shares), will be subject to the same taxation treatment applicable to the Awarded Shares.

d.

The Trustee shall not sell or transfer to the Participant any of the Awarded Shares or any right or share received by the Participant

with respect thereto prior to the full payment by the Participant of his/her tax liabilities arising from or relating to the Awarded

Shares or any right or share related thereto.

8.

Delivery of Certificates. Subject to other provisions of the Plan, including those of the Israeli Plan regarding the Israeli tax

laws applicable to the Awarded Shares being Approved 102 Incentives, the Company shall deliver certificates for the Awarded Shares free

of restriction under this Agreement promptly after, and only after, the Restriction Period has expired without forfeiture pursuant to

Section 5. In connection with the issuance of a certificate for Restricted Stock, the Participant shall endorse such certificate

in blank or execute a stock power in a form satisfactory to the Company in blank and deliver such certificate and executed stock power

to the Company.

9.

Clawback. Notwithstanding Section 3, if the Participant is an executive officer (as defined under U.S. Securities and Exchange

Commission rules) of the Company at any time after the Date of Grant and the Company is required to restate its financial statements,

then the Committee may, in its sole and absolute discretion, at any time within two years following such restatement, require the Participant

to, and the Participant shall immediately upon notice of such Committee determination, return to the Company any Awarded Shares and pay

to the Company in cash the amount of any proceeds received by the Participant from the disposition or transfer of, and any dividends

or other distributions of cash or property received by the Participant with respect to, any Awarded Shares, in each case during the period

commencing two years before the beginning of the restated financial period and ending on the date of such Committee determination. In

addition, any portion of the Awarded Shares that is not vested or has not been exercised by the Participant on the date that the Committee

makes such determination shall be immediately and irrevocably forfeited. The Committee shall have the authority and discretion to make

any determination regarding the specific implementation of this Section 9 with respect to the Participant. In addition to this

Section 9, this Agreement, the Awarded Shares shall be fully subject to the terms and conditions of any “clawback”

or compensation recovery policy that may later be adopted by the Company in its discretion or imposed under Applicable Laws, each as

may be amended and in effect from time to time.

10.

Rights of a Stockholder. Except as provided in Sections 5 and 6 above and the provisions of the Israeli Plan regarding

the Israeli tax laws applicable to the Awarded Shares being Approved 102 Incentives, the Participant shall have, with respect to his

Awarded Shares, all of the rights of a stockholder of the Company, including the right to vote the shares, and the right to receive any

dividends thereon. Without derogating from Section 7(c) above and subject to any law, any stock dividends paid with respect to Awarded

Shares shall at all times be treated as Awarded Shares and shall be subject to all restrictions placed on Awarded Shares.

11.

Adjustment to Number of Awarded Shares. The number of Awarded Shares shall be subject to adjustment in accordance with Section

12 of the Plan.

12.

Participant’s Representations. Notwithstanding any of the provisions hereof, the Participant hereby agrees that he or she

will not acquire any Awarded Shares, and that the Company will not be obligated to issue any Awarded Shares to the Participant hereunder,

if the issuance of such shares shall constitute a violation by the Participant or the Company of any provision of any law or regulation

of any governmental authority. Any determination in this connection by the Company shall be final, binding, and conclusive. The rights

and obligations of the Company and the rights and obligations of the Participant are subject to all Applicable Laws, rules, and regulations.

13.

Participant’s Acknowledgments.

a.

The Participant acknowledges that copies of the Plan and the agreement between the Company and the Trustee have been made available for

his or her review by the Company, and represents that he or she is familiar with the terms and provisions thereof, and hereby accepts

this Award subject to all the terms and provisions thereof; and

b.

The Participant shall comply with all terms and conditions set forth in Section 102(b) of the Ordinance the applicable rules and regulations

promulgated thereunder, as amended from time to time; and

c.

The Participant is familiar with, and understands the provisions of, Section 102 of the Ordinance in general, and the tax arrangement

under the Section 102(b)(3) in particular, and its tax consequences; the Participant agrees that the Restricted Stock Award and the Awarded

Shares (or otherwise in relation to the Restricted Stock Award), will be held by a trustee appointed pursuant to Section 102 of the Ordinance

for at least the duration of the Trust Period. The Participant understands that any release of the Restricted Stock Award and the Awarded

Shares from trust, or any sale of such share prior to the termination of the Trust Period, will result in taxation at marginal tax rates,

in addition to deductions of appropriate social security, health tax contributions or other compulsory payments; and

d.

The Participant agrees to the trust agreement signed between the Company, and the Trustee appointed pursuant to Section 102 of the Ordinance

and shall sign all documents requested by the Company or the Trustee, in accordance with and under the trust agreement; and

e.

The Participant hereby agrees to accept as binding, conclusive, and final all decisions or interpretations of the Administrator, as appropriate,

upon any questions arising under the Plan or this Agreement.

14.

Law Governing. This Agreement shall be governed by, construed, and enforced in accordance with the laws of the State of Israel

(excluding any conflict of laws rule or principle of Israeli law that might refer the governance, construction, or interpretation of

this Agreement to the laws of another state).

15.

No Right to Continue Service or Employment. Nothing herein shall be construed to confer upon the Participant the right to continue

in the employ or to provide services to the Company or the Group, whether as an employee, or interfere with or restrict in any way the

right of the Company or the Group to discharge the Participant as an employee at any time.

16.

Legal Construction. In the event that any one or more of the terms, provisions, or agreements that are contained in this Agreement

shall be held by a court of competent jurisdiction to be invalid, illegal, or unenforceable in any respect for any reason, the invalid,

illegal, or unenforceable term, provision, or agreement shall not affect any other term, provision, or agreement that is contained in

this Agreement and this Agreement shall be construed in all respects as if the invalid, illegal, or unenforceable term, provision, or

agreement had never been contained herein.

17.

Covenants and Agreements as Independent Agreements. Each of the covenants and agreements that is set forth in this Agreement shall

be construed as a covenant and agreement independent of any other provision of this Agreement. The existence of any claim or cause of

action of the Participant against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the

enforcement by the Company of the covenants and agreements that are set forth in this Agreement.

18.

Entire Agreement. This Agreement together with the Plan supersede any and all other prior understandings and agreements, either

oral or in writing, between the parties with respect to the subject matter hereof and constitute the sole and only agreements between

the parties with respect to the said subject matter. All prior negotiations and agreements between the parties with respect to the subject

matter hereof are merged into this Agreement. Each party to this Agreement acknowledges that no representations, inducements, promises,

or agreements, orally or otherwise, have been made by any party or by anyone acting on behalf of any party, which are not embodied in

this Agreement or the Plan and that any agreement, statement or promise that is not contained in this Agreement or the Plan shall not

be valid or binding or of any force or effect.

19.

Parties Bound. The terms, provisions, and agreements that are contained in this Agreement shall apply to, be binding upon, and

inure to the benefit of the parties and their respective heirs, executors, administrators, legal representatives, and permitted successors

and assigns, subject to the limitation on assignment expressly set forth herein. No person shall be permitted to acquire any Awarded

Shares without first executing and delivering an agreement in the form satisfactory to the Company making such person or entity subject

to the restrictions on transfer contained herein.

20.

Modification. The Company may amend or modify this Award in any manner to the extent that the Company would have had the authority

under the Plan initially to grant such Award, provided that no such amendment or modification shall materially and adversely impair the

Participant’s rights under this Agreement without the Participant’s written consent. Other than as provided in the preceding

sentence, this Agreement may be amended, modified or supplemented only by an instrument in writing signed by both parties hereto.

21.

Headings. The headings that are used in this Agreement are used for reference and convenience purposes only and do not constitute

substantive matters to be considered in construing the terms and provisions of this Agreement.

22.

Gender and Number. Words of any gender used in this Agreement shall be held and construed to include any other gender, and words

in the singular number shall be held to include the plural, and vice versa, unless the context requires otherwise.

23.

Notice. Any notice required or permitted to be delivered hereunder shall be deemed to be delivered only when actually received

by the Company or by the Participant, as the case may be, at the addresses set forth below, or at such other addresses as they have theretofore

specified by written notice delivered in accordance herewith:

a.

Notice to the Company shall be addressed and delivered as follows:

My

Size, Inc.

HaYarden

4

POB

1026

Airport

City, Israel 7010000

Attn:

Or Kles

b.

Notice to the Participant shall be addressed and delivered as set forth on the signature page.

24.

Tax Requirements. The Participant is hereby advised to consult immediately with his or her own tax advisor regarding the tax

consequences of this Agreement. Notwithstanding anything to the contrary, the Company shall be under no duty to ensure, and no representation

or commitment is made, that the Restricted Stock Award qualify or will qualify under any particular tax treatment (such as Section 102(b)

or any other treatment), nor shall the Company be required to take any action for the qualification of any Restricted Stock Award under

such tax treatment. If the Participant do not qualify under any particular tax treatment it could result in adverse tax consequences

to the Participant. By signing below, the Participant agrees that the Company and its respective employees, directors, officers and shareholders

shall not be liable for any tax, penalty, interest or cost incurred by the Participant as a result of such determination, nor will any

of them have any liability of any kind or nature in the event that, for any reason whatsoever, a Restricted Stock Award does not qualify

for any particular tax treatment. The Company or, if applicable, any Subsidiary (for purposes of this Section 24, the term “Company”

shall be deemed to include any applicable Subsidiary), shall have the right to deduct from all amounts paid in cash or other form in

connection with the Plan, any federal, state, local, or other taxes required by the Israeli law and other applicable laws to be withheld

in connection with this Award. The Participant may elect to have the Company withhold an additional amount up to the maximum statutory

amount in accordance with Company procedures, provided such withholding does not trigger liability accounting under applicable accounting

rules. The Company may, in its sole discretion, also require the Participant receiving shares of Common Shares issued under the Plan

to pay the Company the amount of any taxes that the Company is required to withhold in connection with the Participant’s income

arising with respect to this Award. Such payments shall be required to be made when requested by Company and may be required to be made

prior to the delivery of any certificate representing shares of Common Shares. Such payment may be made by (i) the delivery of cash to

the Company in an amount that equals or exceeds (to avoid the issuance of fractional shares under (iii) below) the required tax withholding

obligations of the Company; (ii) if the Company, in its sole discretion, so consents in writing, the actual delivery by the Participant

to the Company of shares of Common Shares that the Participant has not acquired from the Company within six (6) months prior thereto,

which shares so delivered have an aggregate Fair Market Value that equals or exceeds (to avoid the issuance of fractional shares under

(iii) below) the required tax withholding payment; (iii) if the Company, in its sole discretion, so consents in writing, the Company’s

withholding of a number of shares to be delivered upon the vesting of this Award, which shares so withheld have an aggregate Fair Market

Value that equals (but does not exceed) the required tax withholding payment; or (iv) any combination of (i), (ii), or (iii). The Company

may, in its sole discretion, withhold any such taxes from any other cash remuneration otherwise paid by the Company to the Participant.

*

* * * * * * * * *

[Remainder

of Page Intentionally Left Blank.

Signature

Page Follows]

IN

WITNESS WHEREOF, the Company has caused this Agreement to be executed by its duly authorized officer, and the Participant, to evidence

his or her consent and approval of all the terms hereof, has duly executed this Agreement, as of the date specified in Section 1

hereof.

| COMPANY: |

| |

| MY SIZE, INC. |

| |

| By: |

|

| Name: |

|

| Title: |

|

| PARTICIPANT: |

| |

| [●] |

| |

| Signature |

| Name: |

|

| |

|

| Address: |

|

| |

|

| |

|

| Date

of Signature |

| |

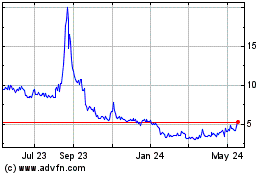

My Size (NASDAQ:MYSZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

My Size (NASDAQ:MYSZ)

Historical Stock Chart

From Jan 2024 to Jan 2025