UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of May, 2024

Commission

File Number: 333-275242

| Neo-Concept

International Group Holdings Ltd |

| (Registrant’s

Name) |

10/F,

Seaview Centre

No.139-141

Hoi Bun Road

Kwun

Tong

Kowloon,

Hong Kong

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

On

May 29, 2024, Neo-Concept International Group Ltd (the “Company”) entered into an asset purchase agreement (the “Purchase

Agreement”) with Neo-Concept (Holdings) Company Limited (“Neo-Concept (Holdings)”), a company under common control

of Ms. Eva Yuk Yin Siu, the controlling shareholder of the Company.

Pursuant

to the Purchase Agreement, the Company will acquire all rights and goodwill associated with certain intellectual properties from Neo-Concept

(Holdings) for a consideration of US$1,978,308. Certain R&D employees of Neo-Concept (Holdings) will also be transferred to the Company

upon the completion date of the Purchase Agreement.

The

Purchase Agreement and the transaction contemplated thereunder was reviewed and approved by the audit committee of the Company, and the

consideration was based on an independent valuation commissioned by the parties to the Purchase Agreement.

On

May 29, 2024, the Company issued a press release (the “Press Release”) announcing the Purchase Agreement.

The

foregoing description of the Purchase Agreement is not complete and is qualified in its entirety by reference to the full text of the

Purchase Agreement, which is filed as Exhibit 99.1 hereto and incorporated by reference herein. A copy of the Press Release is attached

as Exhibit 99.2 to this Report on Form 6-K.

Financial

Statements and Exhibits.

The

following exhibits are being filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Neo-Concept

International Group Holdings Ltd |

| |

|

|

| Date:

May 29, 2024 |

By: |

/s/

Eva Yuk Yin Siu |

| |

Name:

|

Eva

Yuk Yin Siu |

| |

Title:

|

Chief

Executive Officer, Chairlady of the Board and Director |

2

Exhibit 99.1

NEO-CONCEPT

(hOLDINGS) COMPANY LIMITED

AND

NEO-CONCEPT INTERNATIONAL GROUP HOLDINGS LIMITED

ASSETS PURCHASE AGREEMENT

DATE: 29th May 2024

Contents

| 1 |

Definitions |

1 |

| 2 |

Sale and Purchase of the Assets |

5 |

| 3 |

Consideration |

6 |

| 4 |

Conditions Precedent |

7 |

| 5 |

Completion |

8 |

| 6 |

Specified Trademarks |

9 |

| 7 |

Transferring Employees |

10 |

| 8 |

Representations and Warranties |

11 |

| 9 |

Conduct of Business Pending Completion |

12 |

| 10 |

Post-Completion Matters |

14 |

| 11 |

Indemnity and Remedies |

15 |

| 12 |

Termination |

16 |

| 13 |

Confidentiality |

16 |

| 14 |

Further Assurance |

17 |

| 15 |

Costs and Expenses |

18 |

| 16 |

Public Communications |

18 |

| 17 |

Miscellaneous |

18 |

| 18 |

Notices |

19 |

| 19 |

Governing Law |

20 |

| Schedule 1 Buyer Representations and Warranties |

23 |

| Schedule 2 Seller Representations and Warranties |

24 |

| Schedule 3 Specified Trademarks |

30 |

| |

Part A Trademark filed in Hong Kong |

30 |

| |

Part B Trademark filed in the People’s Republic

of China |

31 |

| |

Part C Trademark filed in the European Union |

32 |

| |

Part D Trademark filed in the International Registration

Designated in the United States |

33 |

| |

Part E Trademark application filed in Qatar |

34 |

| |

Part F Trademark application filed in the United Arab

Emirates |

35 |

| Schedule 4 Names of Transferring Employees |

36 |

THIS

ASSET PURCHASE AGREEMENT (“Agreement”) is made on 29th May 2024 BETWEEN

| (1) | NEO-CONCEPT (HOLDINGS) COMPANY LIMITED, a company incorporated in accordance with the laws of Hong

Kong, with its registered office situated at 10/F, Seaview Centre, 139-141 Hoi Bun Road, Kwun Tong, Kowloon, Hong Kong (the “Seller”);

and |

| (2) | NEO-CONCEPT INTERNATIONAL GROUP HOLDINGS LIMITED, a company incorporated in accordance with the

laws of the Cayman Islands, with its registered office situated at Suite #4-210, Governors Square, 23 Lime Tree Bay Avenue, PO Box 32311,

Grand Cayman KY1-1209, Cayman Islands (the “Buyer”). |

The Seller and the Buyer are collectively referred

to as the “Parties” and each a “Party”.

Whereas

| (A) | The Seller is a company incorporated in Hong Kong and controlled by the controlling shareholder of the

Buyer. |

| (B) | The Buyer is a company incorporated in the Cayman Islands. The ordinary shares of the Buyer is listed

on the Nasdaq Capital Market in the United States of America. |

| (C) | The Seller agrees to sell and transfer some of its assets (the “Assets” as defined

below) to the Buyer, and the Buyer agrees to purchase and accept the Assets from the Seller on the terms and conditions set forth herein. |

Now,

THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

| 1.1 | The following terms shall have the meanings ascribed to them

below, unless this Agreement or the Schedules hereto otherwise stipulate: |

Affiliate means, in respect

of a party, any company, partnership, trust or other entity directly or indirectly controlling or controlled by or under direct or indirect

common control with that party (control, for the purpose of this definition, being taken to mean direct or indirect ownership of

at least 50% of the registered capital or at least 50% of the voting rights of said entity) or any company, partnership, trust or other

entity over which that party possesses, whether directly or indirectly, the power to direct the management and policies of any such company,

partnership, trust or other entity (regardless of that party’s ownership interest in the registered capital of such company, partnership,

trust or other entity).

Assets means those assets of

the Seller to be sold and purchased by the Buyer pursuant to Clause 2.1, and excluding the Excluded Assets and Excluded Liabilities as

set out in Clause 2.3.

Business Days means a day on

which banks in Hong Kong are open for business (excluding Saturdays, Sundays and public holidays).

Buyer Warranties means the representations

and warranties and undertakings of Buyer set out in Clause 8 and Schedule 1.

Claim means any claim (whether

in contract, tort or operation of law or otherwise) by a Party in respect of breach of any of the Warranties or any provisions of this

Agreement.

Completion means the completion

of the sale and purchase of the Assets.

Completion Date means the date

of completion of the sale and purchase of the Assets, which shall be a date that falls on the tenth (10th) Business Day immediately

following the date when all the Conditions have been fulfilled or waived by the Party in accordance with Clause 4.2 or any other date

agreed by the Parties.

Conditions means the conditions

set out in Clause 4.

Confidential Information has

the meaning ascribed to it in Clause 13.1.

Consideration has the meaning

ascribed to it in Clause 3.1.

Effective Time means 1800 hours

on the Completion Date.

Employee Termination Letter means

a letter issued by the Seller in the form and substance reasonably satisfactory to the Buyer and acknowledged and signed by each of the

Transferring Employees to (a) confirm that their employment contracts with the Seller have been terminated and any and all compensation

and other entitlements accrued in respect of the Prior Service due to the Transferring Employees have been paid by the Seller, and (b)

authorise the transfer to the Buyer of personal data (as defined by the Personal Data (Privacy) Ordinance, Cap. 486 of the Laws of Hong

Kong, held by the Seller in respect of the Transferring Employees.

Encumbrance means any mortgage,

pledge, lien, lease, option, restriction, charge, claim, assignment, priority, warrant, trust, arrangement, right of first refusal, right

of pre-emption, third party right or interest, any other encumbrance or security interest of any kind, and any other type of preferential

arrangement (including, without limitation, title transfer and retention arrangements) having a similar effect, and any legal actions

or arbitration or administrative proceedings which are in progress or threatened or pending or any other claims or proceeding whatsoever.

Excluded Assets has the meaning

ascribed to it in Clause 2.3.

Excluded Liabilities has the

meaning ascribed to it in Clause 2.3.

Existing Contracts means the

contracts and commitments, entered into by Seller in connection with the Specified Business prior to the entering into of this Agreement,

which remain to be fully performed by the Seller after the Completion Date where applicable.

HKIAC has the meaning ascribed

to it in Clause 19.3 below.

Licensing Agreement means the

Trade Mark Licensing Agreement dated 1 January 2022 in respect of certain Specified Trademarks signed between the Seller (as licensor)

and the Buyer (as licensee).

Licensing Termination Agreement

has the meaning ascribed to it in Clause 5.3.4;

Longstop Date means 1800 hours

on a date that falls on the one hundred and eightieth (180th) day immediately following the date of this Agreement or such

later time and date as may be agreed in writing by the Buyer and the Seller. In the event that the one hundred and eightieth (180th)

day immediately following the date of this Agreement is a non-Business Day, the Longstop Date will be deferred automatically to the next

Business Day.

Material Adverse Change means

any event, circumstance, occurrence, fact, condition, change or effect, or series thereof, which has a material adverse effect on the

condition (financial, legal, regulatory or otherwise), affairs, operations, prospects of the Assets as currently owned by the Seller,

individually or taken as a whole.

Notice of Completion has the

meaning ascribed to it in Clause 4.3.

P.R.C. or People’s

Republic of China means the People’s Republic of China, which for the purposes of this Agreement, does not include Taiwan, the

Hong Kong Special Administrative Region, and the Macau Special Administrative Region.

Prior Service means a Transferring

Employee’s service with the Seller up to the Effective Time including any period of service with another employer that is deemed

by law to be service with the Seller.

Receipts of Application to Transfer

has the meaning ascribed to in Clause 4.1.1;

Release Letter means a letter

issued by the Buyer and acknowledged and signed by each of the Transferring Employees, by which the Transferring Employee understands

and confirms he/she releases the Buyer from any obligations and liabilities of any kind in relation to any and all salaries and any other

due payments to the Transferring Employee arising from and/or relating to the employment relationship between the Seller and the Transferring

Employee and/or the termination thereof, moreover he/she will not take any action or proceeding against the Buyer in terms of such obligations

or liabilities.

Seller Warranties means the

representations and warranties and undertakings of the Seller set out in Clause 8 and Schedule 2.

Specified Business means the

business operated by the Seller which relate or are attributable to or arise as a result of the Assets set out in Clause 2.1.

Specified Trademarks means all

trademarks owned by and all trademark applications filed by the Seller or its Affiliates before the Completion Date as set out in Schedule

3.

Tax or Taxes means all

forms of taxation, including tax, estate duties, deductions, withholdings, duties, imports, levies, fees, charges, social security contributions

and rates imposed, levied, collected, withheld or assessed by any local, municipal, regional, urban, governmental, state, federal or other

body in Hong Kong or elsewhere and any interest, additional taxation, penalty, surcharge or fine in connection therewith.

Transferring Employees means

the employees working for the Seller in Hong Kong on the date of this Agreement (including employees with whom the Seller has signed employment

contracts and employees with whom the Seller has a de facto labour relationship), pursuant to the Buyer’s selection, to be transferred

to and enter into new employment relationship with the Buyer. The names of the Transferring Employees are set out in Schedule 4.

U.S.A or United States means

the United States of America.

US$ or US dollars means

United States dollars, the lawful currency of the United States of America.

Warranties means the Seller

Warranties or the Buyer Warranties.

| 1.2 | For the purposes of this Agreement, references to a Clause,

paragraph or Schedule are references to a Clause, paragraph or Schedule to this Agreement and the Schedules form part of and are deemed

to be incorporated into this Agreement and references to this “Agreement” are to be construed accordingly. |

| 1.3 | The headings used in this Agreement are inserted for convenience

only and shall be ignored in construing this Agreement. |

| 1.4 | The word “include” or “including”

shall be deemed as followed by “without limitation”. |

| 1.5 | Where the term “law” is used, it means any law,

regulation, statute, ordinance, rule, standard, requirement, order, injunction, policy, decree, circular, interpretation, decision, judgment,

award, administrative ruling or agency, license or permit requirement of or by any authority, as amended, supplemented or otherwise modified

from time to time. |

| 1.6 | Where the term “authority” is used, it means

any governmental, quasi-governmental, legislative, judicial or other regulatory body, any central, state, provincial, municipal, autonomous

region, local or other political subdivision thereof, any political party, any department, ministry, agency, commission, entity, court,

tribunal or other body exercising administrative, legislative, judicial or other regulatory or public functions or functions relating

to any public interest, any agency, department or instrumentality thereof and, without limiting the generality of the foregoing, all

persons that are directly or indirectly owned or otherwise controlled by any of the foregoing. |

| 1.7 | Words importing the singular include the plural thereof,

and vice versa. |

| 1.8 | Words importing a gender include every gender. |

| 1.9 | Reference to any document (including this Agreement) is reference

to that document as amended, supplemented or otherwise modified from time to time. |

| 1.10 | Shareholder(s) of an entity stipulated in this Agreement

includes the direct and ultimate shareholder(s) of the said entity. |

| 1.11 | The expressions of “Seller” and the “Buyer”

shall, where the context permits, include their respective successors and permitted assigns. |

| 2 | Sale and Purchase of the Assets |

| 2.1 | Subject to the terms of this Agreement, and in reliance upon the representations and warranties contained

herein, at Completion, the Seller agrees to sell and the Buyer agrees to buy the Assets as set out below, free from all Encumbrance, together

with all existing and future rights attaching or accruing to them with effect from the Effective Time: |

| 2.1.1 | all Specified Trademarks ; and |

| 2.1.2 | all rights (including intellectual property rights) and goodwill associated with the Specified Trademarks

prior to the Completion Date. |

| 2.2 | The Buyer shall not be obliged to complete the purchase of any of the Assets unless the purchase of all

the Assets is completed simultaneously. |

| 2.3 | Subject to the terms of this Agreement, and in reliance upon the representations and warranties contained

herein, at Completion, the Assets to be purchased by the Buyer shall not include any of the following under this Agreement: |

Excluded Assets

| 2.3.1 | all inventories, including without limitation all finished goods, work in progress, raw materials, processed

materials, purchased parts and supplies in respect of the Assets whose contracts, arrangements or agreements are entered into between

the Seller and third parties before the Effective Time, irrespective of whether the delivery by the Seller of such products or services

is before or after the Completion Date; |

| 2.3.2 | all accounts receivable in respect goods or services in respect of the Assets whose contracts, arrangements

or agreements are entered into between the Seller and third parties before the Effective Time, irrespective of whether the delivery by

the Seller of such products or services is before or after the Completion Date; |

Excluded Liabilities

| 2.3.3 | all claims, actions, proceedings, demands, costs and expenses which arise in respect of the Assets whose

contracts, arrangements or agreements are entered into between the Seller and third parties before the Effective Time; |

| 2.3.4 | all liabilities and obligations (both ascertained and contingent) of any nature due or owing from the

Seller in respect of the Assets whose contracts, arrangements or agreements are entered into between the Seller and third parties before

the Effective Time; |

| 2.3.5 | any liability for Tax on profits or chargeable gains arising from transactions, contracts, arrangements

or agreements that are entered into between the Seller and third parties before the Effective Time; and |

| 2.3.6 | all payments required to be made to the Transferring Employees under their respective terms and conditions

of employment including wages, salaries, commissions, bonuses, and other remuneration or expenses on or prior to the Completion Date. |

| 3.1 | The Seller and the Buyer agree that the aggregate consideration (the “Consideration”)

for the sale of the Assets shall be US$1,978,308.00, that is based on an independent valuation commissioned by the Parties. |

| 3.2 | The payment of the Consideration shall be made in US dollars by electronic transfer of immediately available

funds to such account of the Seller as is notified to the Buyer by or on behalf of the Seller. Payment in accordance with this Clause

shall constitute a good and valid discharge of the obligations of the Buyer to pay the sum in question to the Seller. |

| 3.3 | Each Party shall bear its own Taxes arising from execution and performance of this Agreement and the contemplated

transactions hereunder. |

| 4.1 | Completion shall be conditional upon all of the following Conditions having been fulfilled or waived by

the Party in accordance with Clause 4.2, before 1800 hours on the Longstop Date, supported by documentary evidence: |

Conditions to be satisfied by the

Seller

| 4.1.1 | trademark assignment agreement in respect of the Specified Trademarks has been signed between the Seller

and the Buyer, and the Seller has delivered or procured the delivery to the Buyer: |

| (a) | a copy of the respective receipts of application to transfer issued by the competent authorities in the

various jurisdictions in respect of the Specified Trademarks as listed in Parts A to D of Schedule 3 (the “Receipts of Application

to Transfer”); and |

| (b) | original certificate(s) of registration of the Specified Trademarks as listed in Parts E to F of Schedule

3 upon due registration of such Specified Trademarks at the respective trademark registries (to the extent the original certificate(s)

has/have been issued); |

| 4.1.2 | the Seller has given to the Transferring Employees notice of termination of their current employment contracts; |

| 4.1.3 | all the necessary approvals and authorisations to sell the Assets in accordance with the relevant incorporation

documents of the Seller and relevant laws and regulations, which include without limitation, a certified copy of each of the respective

written board resolutions and shareholders’ resolutions of the Seller approving, among others, the entering into of this Agreement

and the contemplated transactions hereunder; |

| 4.1.4 | there is no Material Adverse Change in respect of the Assets from the date of this Agreement to the Completion

Date; and |

| 4.1.5 | the Seller Warranties in Schedule 2 are true and correct in all respects and not misleading in any respect

as of this Agreement date and the Completion Date. |

Conditions to be satisfied by the

Buyer

| 4.1.6 | the Buyer being reasonably satisfied in all material respects with the results of its investigations on

the Assets, in the form of a due diligence report prepared by the Buyer’s professional advisers in respect of the Assets prior to

Completion; |

| 4.1.7 | all the necessary approvals and authorisations to purchase the Assets in accordance with the relevant

incorporation documents of the Buyer and relevant laws and regulations, which include without limitation, a certified copy of the respective

written board resolutions of the Buyer approving, among others, the entering into of this Agreement and the contemplated transactions

hereunder; |

| 4.1.8 | the Buyer Warranties in Schedule 1 are true and correct in all respects and not misleading in any respect

as of this Agreement date and the Completion Date. |

| 4.2 | The Buyer may waive in writing with respect to the Conditions to be satisfied by the Seller, and the Seller

may waive in writing with respect to the Conditions to be satisfied by the Buyer. |

| 4.3 | Each Party shall send a written notice, supported by documentary evidence, to the other Party confirming

that all the Conditions have either been satisfied or waived in accordance with Clause 4.2 (the “Notice of Completion”).

Such notice shall state the date and time that Completion shall take place. |

| 5.1 | Either Party may initiate Completion by giving to the other Party a Notice of Completion. |

| 5.2 | Unless this Agreement is terminated in accordance with its terms, Completion shall take place remotely

by electronic exchange of documents and signatures, on the tenth (10th) Business Day following satisfaction or waiver (in accordance with

Clause 4.2) of all the Conditions, or at such other place and date as the Parties may agree. |

| 5.3 | On the Completion Date, the Seller shall deliver or procure the delivery to the Buyer of the following: |

| 5.3.1 | all the necessary approvals and authorisations to sell the Assets in accordance with the relevant incorporation

documents of the Seller and relevant laws and regulations, which include without limitation, a certified copy of each of the respective

written board resolutions and shareholders’ resolutions of the Seller approving, among others, the entering into of this Agreement

and the contemplated transactions hereunder; |

| 5.3.2 | the original Receipts of Application to Transfer as referred to in Clause 4.1.1(a) issued by the competent

authorities in the various jurisdictions; |

| 5.3.3 | the original certificate(s) of registration of the Specified Trademarks as referred to in Clause 4.1.1(b)

(to the extent the original certificate(s) has/have been issued); |

| 5.3.4 | the duly executed counterpart originals of the termination agreement (which takes effect from the Completion

Date) in respect of the current Licensing Agreement of the Specified Trademarks (the “Licensing Termination Agreement”); |

| 5.3.5 | all title documents, certificates, instruments, specifications, drawings, data, manuals, and other related

documentation in respect of the Specified Trademarks; |

| 5.3.6 | copies of bank statements or bank transfer advices showing that full payment by the Seller of all compensation

and other entitlements accrued in respect of the Prior Service has been made to the Transferring Employees; |

| 5.3.7 | certified copies of the Employee Termination Letters; |

| 5.3.8 | the counterpart originals of the new employment contracts between the Buyer and the Transferring Employees

(effective upon Completion) duly executed by the Transferring Employees; |

| 5.3.9 | the counterpart originals of the Release Letters duly executed by the Transferring Employees; and |

| 5.3.10 | all personal data and records of the Transferring Employees as referred to in the respective duly executed

Release Letters. |

| 5.4 | At Completion, subject to the Seller having complied with Clause 5.3, the Buyer shall pay the Consideration

to the Seller in the manner specified in Clause 3.2. |

| 5.5 | If the Seller fails to comply with Clause 5.3 on the Completion Date, the Buyer may, without prejudice

to any other rights it may have: |

| 5.5.1 | proceed to Completion as far as practicable; |

| 5.5.2 | on the mutual understanding of the Parties, defer Completion to a date on which Completion would take

place; or |

| 5.5.3 | elect to terminate this Agreement without liability on the part of the Buyer.. |

| 6.1 | Except as specified under Clause 6.2 below, risk in and title of the Assets which are capable of transfer

by delivery, shall pass from the Seller to the Buyer at the Effective Time. |

| 6.2 | With effect from the Effective Time and until such time as a Specified Trademark whose assignment as referred

to in Clause 4.1.1 is successfully recorded at the respective trademark registries in the relevant jurisdictions pursuant to this Agreement,

the Seller shall hold the legal title in the Specified Trademarks on trust for the Buyer and shall procure that the Buyer shall be entitled

to the benefit, use and enjoyment of those Specified Trademarks as against the Seller, and, if necessary, to enforce rights or claims

against third parties in relation to the Specified Trademarks arising after the Effective Time; |

| 6.3 | The burden and benefit of contracts, arrangements or agreements entered into before the Effective Time

between the Seller (as one party) and third parties including customers or suppliers of the Seller (as the other party) in respect of

the Specified Business, shall remain with the Seller. The Seller shall remain responsible for performing its respective obligations arising

from such contracts, arrangements or agreements. |

| 6.4 | As from the Effective Time, regardless of whether: (a) the transfer of full legal titles of the Specified

Trademarks set out in Parts A to Part D of Schedule 3 has been duly recorded at the respective registries, and (b) the Specified Trademark

applications set out in Parts E and F of Schedule 3 have been duly registered in the name of the Seller and transfer of full legal titles

from the Seller to the Buyer of such Specified Trademarks have subsequently been duly recorded at the respective registries, the Buyer

shall have the exclusive right to own, utilise, control, dispose, encumber, operate and/or manage the Specified Trademarks . |

| 7.1 | The Seller shall give notice to terminate the employment contracts of each of the Transferring Employees,

in each case on proper notice according to their respective contracts of employment, and the notices so given shall expire prior to the

Completion Date. |

| 7.2 | The Buyer or its Affiliates must offer employment to each of the Transferring Employees. The Buyer’s

offer of employment to the Transferring Employees must: |

| 7.2.1 | be conditional on and take effect from the Effective Time; |

| 7.2.2 | be on terms no less favourable than those in their employment contracts with the Seller immediately prior

to the Completion Date; |

| 7.2.3 | be on terms that the Buyer will recognise the Transferring Employee’s Prior Service and assume liability

for the employee’s leave entitlements and service related benefit accrued in respect of the Prior Service; and |

| 7.2.4 | provide that if the Transferring Employee accepts the offer their employment with the Seller will cease

by agreement on the Completion Date. |

| 7.3 | The Buyer agrees that, for the purpose of calculating any leave entitlements and service related benefit

of a Transferring Employee: |

| 7.3.1 | each Transferring Employee’s Prior Service is to be taken as service with the Buyer; and |

| 7.3.2 | the continuity of each of the Transferring Employee’s employment is to be taken as not broken because

they cease to be an employee of the Seller and become an employee of the Buyer. |

| 7.4 | This Clause 7.4 does not require the Buyer to provide a Transferring Employee with credit for a period

of Prior Service when calculating a particular benefit to the extent that the Transferring Employee’s entitlement to that particular

benefit has been paid or discharged by the Seller as referred to in Clause 5.3.6 or otherwise. |

| 7.5 | The Seller shall indemnify and keep the Buyer indemnified from and against all claims, demands, actions,

damages, losses (including loss of profit), liabilities, penalties and expenses sustained by the Buyer in respect of any breach by the

Seller of any of the above provisions of this Clause 7. |

| 7.6 | The Buyer shall be solely responsible for all compensation, benefits and other entitlements due to the

Transferring Employees in respect of service with the Buyer from the Effective Time. |

| 8 | Representations and Warranties |

| 8.1 | The Seller warrants, represents and undertakes to the Buyer that the Seller Warranties, representations

and undertakings set out in Schedule 2 is, true and accurate in all respects and not misleading in any respect as at the date of this

Agreement, and each of the Seller Warranties shall continue to be true and accurate as at the Completion Date with respect to facts and

circumstances then existing. |

| 8.2 | The Buyer warrants, represents and undertakes to the Seller that the Buyer Warranties, representations

and undertakings set out in Schedule 1 is, true and accurate in all respects and not misleading in any respect as at the date of this

Agreement, and each of the Buyer Warranties shall continue to be true and accurate as at the Completion Date with respect to facts and

circumstances then existing. |

| 8.3 | Each of the Warranties shall be construed as a separate and independent warranty and save as expressly

provided shall not be limited by reference to any other. |

| 8.4 | The Seller acknowledges that the Buyer has entered into, and shall carry out the provisions of, this Agreement

in reliance upon the Seller Warranties. Save as otherwise provided in this Agreement, no other knowledge relating to the Seller (actual,

constructive or imputed) prevents or limits a Claim on the Seller Warranties by the Buyer. Save as otherwise provided in this Agreement,

the Seller shall not invoke the Buyer’s knowledge (actual, constructive or imputed) of a fact or circumstance which might make a

Seller Warranty untrue, incorrect or misleading as a defence to a Claim on any of the Seller Warranties by the Buyer. |

| 8.5.1 | that it will procure that neither it nor any of its officers or employees shall do, allow or procure any

act or omission in the period up to and including the Completion Date, the occurrence of which would be inconsistent with any of the Seller

Warranties, would breach any Seller Warranty or make any Seller Warranty untrue, inaccurate or misleading in any respect at any time up

to and including the Completion Date; and |

| 8.5.2 | to disclose to the Buyer in writing immediately upon becoming aware of any matter, event or circumstances

(including any omission to act) which may arise or become known to the Seller and the Seller’s shareholders after the date of this

Agreement and before Completion which: |

| (a) | constitutes a breach of or is inconsistent with any of the Seller Warranties if given at any time up to

and including the Completion Date or which might make them untrue, inaccurate or misleading in any respect; or |

| (b) | might otherwise be material if known by a purchaser for value of the Assets. |

| 8.6 | The Seller agrees to indemnify the Buyer in respect of all its costs (including all its legal costs) or

expenses which the Buyer may incur either before or after the commencement of any action, arising out of or relating to the Specified

Trademarks and/or any business which relate or are attributable to or arise as a result of the Specified Trademarks, in connection with: |

| 8.6.1 | the settlement of any such claim; or |

| 8.6.2 | the enforcement of any such settlement, judgment or award. |

| 8.7 | The rights of the Buyer pursuant to this Clause 8 shall not restrict any of its rights or its ability

to pursue a remedy on any basis available to it in the event of a breach of any of the Seller Warranties or any of them proving to be

untrue, inaccurate or misleading. |

| 9 | Conduct of Business Pending Completion |

| 9.1 | From the date of this Agreement until Completion, the Seller undertakes with the Buyer that it shall take

all steps necessary to ensure that the Specified Business is carried on in the ordinary and usual course and the following requirements

are complied with: |

| 9.1.1 | The Seller shall not effect any change in any of the Assets and shall act in good faith to use and maintain

the Assets; and |

| 9.1.2 | The Seller shall carry on its Specified Business as a going concern, consistent with past practice prior

to the date of this Agreement, including to: |

| (a) | continue to preserve the present operations and goodwill of the Specified Business; |

| (b) | pay its suppliers and agents, collect any receivables from customers of the Specified Business in a way

consistent with its prior practice; and |

| (c) | preserve the goodwill of suppliers, employees, customers and others having business relationships with

the Seller in respect of the Specified Business. |

| (a) | give to the Transferring Employees notice of termination as referred to in Clause 4.1.2, and |

| (b) | subject to Clause 7.2.3, make payments for all compensation and other entitlements accrued in respect

of the Prior Service to the Transferring Employees. |

| 9.2 | Before Completion, the Seller shall not, without the prior written consent of the Buyer: |

| 9.2.1 | dispose of, or agree to dispose of, any of the Assets, or enter into or amend any agreement or incur any

commitment to do so; |

| 9.2.2 | pass any directors or shareholders' resolutions inconsistent with the provisions of this Agreement; |

| 9.2.3 | alter or change the scope of Specified Business of the Seller; |

| 9.2.4 | cause or result in decline or deterioration of standards or performance of the Specified Business; |

| 9.2.5 | amend or modify any terms of employment of any of the Transferring Employees or adopt any stock option

plan or employee share ownership plan; |

| 9.2.6 | enter into any guarantee (other than those to customer or end-users for the sole purpose of product quality

performance), indemnity or other agreement to secure any obligation of a third party or create any Encumbrance over any of the Assets; |

| 9.2.7 | grant any licence, assignment or other right or interest in respect of the Specified Trademarks; |

| 9.2.8 | except for the purpose of implementing this agreement dismiss any Transferring Employees; or |

| 9.2.9 | take any action which would reasonably be expected to adversely affect the ability of the Parties to consummate

the transactions contemplated by this Agreement. |

| 9.3 | The Seller undertakes that, to the extent legally permissible, after the date of this Agreement and until

the Completion Date, it shall fully cooperate and make necessary arrangements for the Buyer to get access to records, documents and personnel

relating to the Assets for business awareness from time to time, and shall provide and update Buyer and their advisors with all information

and documentation in any respect of the Seller. |

| 10 | Post-Completion Matters |

| 10.1 | On the Completion Date or as soon as practicable after the Completion Date, the Seller and the Buyer shall

issue jointly: |

| 10.1.1 | a notice to the each of the suppliers and agents of the Specified Business informing them of the transfer

of the Assets to the Buyer (where applicable); and |

| 10.1.2 | a letter to each of the Transferring Employees informing them that their employment has been transferred

to the Buyer. |

| 10.2 | The Seller undertakes to promptly refer to the Buyer all enquiries relating to the Specified Business

which the Seller receives (including but not limited to passing to the other all correspondence, information, orders, enquiries and other

documentation, items relating to or connected with the Specified Business) at any time after the Completion Date. |

| 10.3 | The Seller shall give the Buyer such reasonable access to the books, accounts, records and returns of

the Seller relating to or in connection with the Specified Business as the Buyer may require (including the right to take copies and extracts

on reasonable advance notice). |

| 11.1 | If the Buyer becomes aware that the Seller and/or Seller’s shareholders is in breach of any of the

Warranties, and/or obligations under this Agreement, the Buyer may serve a notice to the Seller detailing the terms of the breach and,

if the Seller does not take action to rectify the breach within fourteen (14) days after receipt of such notice, the Buyer may at its

option (but without prejudice to any other right or other remedy Buyer may have), demand damages to be payable by the Seller within ten

(10) days of such a demand being served in writing by the Buyer to the Seller. |

| 11.2 | Should any Party breach any terms of this Agreement, including but not limited to unilateral termination

of this Agreement without due reasons (except that the Buyer may unilaterally terminate this Agreement in accordance with Clauses 5.5.3

and 12.1), it shall compensate the non-breaching Party for the direct (not consequential) damages sustained by the non-breaching Party

as a direct consequence of such breach, and shall continue to be bound to carry out the terms of this Agreement. |

| 11.3 | The Seller undertakes to indemnify and hold the Buyer and any of Buyer’s legal successor(s) harmless

from and against all legal and contractual liabilities with respect to any non-compliance with law, regulations, rules, violation of contractual

obligations and/or any other kind of third party claims for damages arising out of or relating to any part and/or the entirety of the

Specified Business not caused by the Buyer. For the avoidance of doubt, the Seller undertakes to indemnify and hold the Buyer and any

of its legal successor(s) harmless for Buyer’s possession, ownership and/or use of the Specified Trademarks after the Completion

Date from and against all legal and contractual liabilities, claims, damages and costs etc. as a result of or in connection with any intellectual

property rights infringement activities conducted by the Seller or its Affiliates prior to the Completion Date. |

| 11.4 | Notwithstanding any of the foregoing provisions, the Seller shall have no liability for any Claim for

any breach of any of the Seller Warranties and/or obligations under this Agreement unless the Buyer shall have given to the Seller a written

notice of the Claim (stating in reasonable detail the nature of the Claim and the matter giving rise to it and, so far as practicable,

an estimate of the amount claimed) on or before a date falling 24 months after the Completion Date. |

| 11.5 | Notwithstanding any of the foregoing provisions, the Buyer shall have no liability for any Claim for any

breach of any of the Buyer Warranties and/or obligations under this Agreement unless the Seller shall have given to the Buyer a written

notice of the Claim (stating in reasonable detail the nature of the Claim and the matter giving rise to it and, so far as practicable,

an estimate of the amount claimed) on or before a date falling 24 months after the Completion Date. |

| 11.6 | The Seller shall not be liable for any breach of the Seller Warranties: |

| 11.6.1 | which arises as a result of legislation which comes into force after the date hereof and which is retrospective

in effect; or |

| 11.6.2 | to the extent that specific disclosure has been made to Buyer in Schedule 2 against the relevant Seller

Warranty. |

| 11.7 | The total liability payable by the Seller to the Buyer with respect to all aggregate Claims is limited

to the actual consideration monies received by the Seller from the Buyer under this Agreement. |

| 11.8 | The total liability payable by the Buyer to the Seller with respect to all aggregate Claims is limited

to the actual consideration monies paid by the Buyer to the Seller under this Agreement. |

| 12.1 | Without limitation to the Buyer’s right of termination as provided elsewhere in this Agreement,

the Buyer may at any time renegotiate any terms under this Agreement or terminate this Agreement, if there is any fact, matter or event

whether existing or occurring at any time on or prior to the Completion Date (including those occur on or before the date of this Agreement)

which: |

| 12.1.1 | constitutes a breach by the Seller under this Agreement (including, without limitation, any breach of

the pre-completion undertakings in Clause 9); |

| 12.1.2 | would constitute a breach of any Seller Warranty before Completion Date by reference to the facts and

circumstances then existing and which cannot be remedied prior to or at Completion; or |

| 12.1.3 | constitutes a Material Adverse Change in relation to the Assets of the Seller. |

| 12.2 | For the purpose of clarification, in case this Agreement is terminated by the Buyer pursuant to Clauses

5.5.3 and 12.1, the Buyer is not obliged to pay any compensation and/or indemnification to the Seller. |

| 12.3 | In the event of termination under Clauses 5.5.3 and 12.1, the Parties agree to, and undertake to sign

and procure all their Affiliate(s) to sign all necessary documents and take all necessary actions to reverse the transactions contemplated

under this Agreement (to the extent that it has occurred or completed on or prior to the date of termination and to the extent practicable)

at the costs of the Seller. |

| 13.1 | Each Party shall maintain the secrecy and confidentiality of, and not disclose to any third party or person,

any proprietary, secret or confidential data and information belonging to the other Party, or information disclosed to a Party by the

other Party at any time during or for the purpose of negotiation, as well as the existence and content of this Agreement (“Confidential

Information”). |

| 13.2 | Notwithstanding the provisions of Clause 13.1, each Party may disclose Confidential Information: |

| 13.2.1 | if and to the extent required by applicable law; |

| 13.2.2 | if and to the extent required by any securities exchange or regulatory or governmental body to which that

Party or its holding company is subject or submits, wherever situated, whether or not the requirement for information has the force of

law; |

| 13.2.3 | to its professional advisers, auditors and bankers for the purpose of execution and implementation of

this Agreement so long as such parties are required to keep all information in strict confidence; |

| 13.2.4 | if and to the extent the information is already in the public domain or has come into the public domain

through no fault of that Party; or |

| 13.2.5 | if and to the extent the other Parties have given prior written consent to the disclosure. |

| 13.3 | No Party shall use any Confidential Information of the other Party for any purpose other than those set

out in this Agreement. |

| 13.4 | The confidentiality and non-use restrictions contained in this Clause 13 shall continue to apply notwithstanding

the termination of this Agreement. |

| 13.5 | The Seller shall not, and shall procure that its shareholders refrain from using and/or disclosing to

any third party any information defined as Specified Business in this Agreement during the term of this Agreement and thereafter. |

| 13.6 | The Seller shall compensate the Buyer and any of the Buyer’s legal successor(s) from and against

any and all losses incurred by the Buyer as a consequence of a breach by the Seller or the Seller’ shareholders of its or their

confidentiality. |

| 13.7 | Each of the covenants in this Clause 13 is a separate undertaking by the Seller in relation to itself

and its interests and shall be enforceable by the Buyer separately and independently of its right to enforce any one or more of the other

covenants contained in this Clause 13. |

| 14.1 | Each Party agrees with and undertakes to the other Party that at any time and from time to time upon the

written request of the other Party, it will promptly and duly execute and deliver any and all such further instruments and documents and

do or procure to be done any and all of such acts or things as the other Party may reasonably require for the purpose of carrying out

and giving effect to the provisions of and the matters contemplated by this Agreement. |

| 15.1 | Unless otherwise provided in this Agreement, each Party shall bear and pay its own costs and expenses

in connection with the negotiation, preparation and implementation of this Agreement and any documents referred to in or incidental to

this Agreement, including without limitation, legal, due diligence, valuation, and accounting costs. |

| 16.1 | Neither Party shall make any declarations, announcements, or disclosures to the public with respect to

this Agreement or the relationship between the Parties without first obtaining the written consent of the other Party. However, the Buyer

may make announcements to the public with respect to this Agreement and the relationship between the Parties, if and only to the extent

required by the rules and regulations of relevant stock exchanges where Neo-Concept International Group Holdings Limited or its legal

successor is publicly listed. |

| 17.1 | A Party’s failure or delay to exercise any right, power or interest under this Agreement shall not

operate as a waiver of it, and any single or partial exercise of any right, power or interest shall not preclude any further exercise

thereof or exercise of any other right, power or interest. Any waiver by one Party at any time of a breach of any provision of this Agreement

by the other Party shall not be construed as a waiver by such non-breaching Party of any subsequent breach, its rights under such provision,

or any of its other rights hereunder. |

| 17.2 | This Agreement shall be binding upon and enure for the benefit of the successors and permitted assigns

of the Parties. The rights and obligations of the Buyer under this Agreement may be assigned wholly or in part to any of its Affiliates

at the Buyer’s absolute discretion without the prior consent of the Seller. |

| 17.3 | But for Clause 17.2, no Party may assign any right or benefit under this Agreement or transfer any of

its obligations under this Agreement to any third party without the prior consent of the other Party (such consent not to be unreasonably

withheld). |

| 17.4 | This Agreement shall, notwithstanding Completion, remain in full force and effect as regards any of the

provisions remaining to be performed or carried into effect and (without prejudice to the generality of the foregoing) as regards all

undertakings, warranties, representations and indemnities. |

| 17.5 | The illegality, invalidity or unenforceability of any part of this Agreement shall not affect the legality,

validity or enforceability of any other part of this Agreement. |

| 17.6 | This Agreement together with the documents referred to in it constitutes the entire agreement and understanding

between the Parties in connection with the subject matter of this Agreement and supersede all previous proposals, letters of intent, representations,

warranties, agreements or undertakings relating thereto, whether oral, written or otherwise, all of which shall be deemed terminated and

of no effect as from the date of signing of this Agreement, and none of the Parties has relied on any such proposals, letters of intent,

representations, warranties, agreements or undertakings which are not expressly set out herein. |

| 17.7 | No variation or amendment of this Agreement shall be binding on the Parties unless made in writing and

duly executed as a deed by the duly authorised representatives of the Buyer and the Seller. |

| 17.8 | This Agreement may be executed in one or more counterparts each of which shall be binding on each Party

by whom or on whose behalf it is so executed, but which together shall constitute a single instrument. For the avoidance of doubt, this

Agreement shall not be binding on any Party unless and until it shall have been executed and delivered by or on behalf of all persons

expressed to be Parties. |

| 17.9 | Nothing in this Agreement and no act or omission of the Parties pursuant to this Agreement shall constitute

or be deemed to constitute a partnership, unincorporated association, co-operative entity or any relationship other than that of seller

and buyer in respect of the Assets. |

| 17.10 | No term of this Agreement is enforceable under the Contracts

(Rights of Third Parties Ordinance (Cap. 623 of the Laws of Hong Kong) by a person who is not a party to this Agreement. |

| 18.1 | All notices between the Parties shall be written in English and delivered, either by courier, registered airmail, or fax, to the following

addresses: |

For Seller:

| |

Name: |

NEO-CONCEPT (HOLDINGS) COMPANY LIMITED |

| |

|

|

| |

Address: |

10/F, Seaview Centre, 139-141 Hoi Bun Road, Kwun Tong, Kowloon, Hong Kong |

| |

|

|

| |

Attention: |

Siu Yuk Yin Eva |

| |

|

|

| |

Fax: |

+852 2798 8639 |

| |

For Buyer: |

|

| |

|

|

| |

Name: |

NEO-CONCEPT INTERNATIONAL GROUP HOLDINGS LIMITED |

| |

|

|

| |

Address: |

10/F, Seaview Centre, 139-141 Hoi Bun Road, Kwun Tong, Kowloon, Hong Kong |

| |

|

|

| |

Attention: |

Patrick Lau |

| |

|

|

| |

Fax: |

+852 2798 8639 |

| 18.2 | Notice shall be deemed delivered on the following dates: |

| 18.2.1 | by courier, on the date of delivery; |

| 18.2.2 | by registered airmail, seven (7) days after it is mailed (as indicated by the postmark); and |

| 18.2.3 | by fax, on the first Business Day after the date of sending. |

| 18.3 | Either Party may change its address for receiving notices at any time by giving other Party written notice

of such change pursuant to this Clause 18. |

| 19.1 | This Agreement shall be governed by and construed in accordance with the laws of Hong Kong. |

| 19.2 | In the event any dispute arises in connection with the validity, interpretation or implementation of this

Agreement, the Parties shall attempt in the first instance to resolve such dispute through friendly consultations. |

| 19.3 | If the dispute cannot be resolved through friendly consultations within sixty (60) days after the date

on which one Party has served written notice on the other Party for the commencement of consultations, then the dispute shall be referred

to and finally resolved by arbitration administered by the Hong Kong International Arbitration Centre (the “HKIAC”)

under the UNCITRAL Arbitration Rules in force when the Notice of Arbitration is submitted, as modified by the HKIAC Procedures for the

Administration of Arbitration under the UNCITRAL Arbitration Rules. The law of this arbitration clause shall be Hong Kong law. The place

of arbitration shall be Hong Kong. The number of arbitrators shall be three (3). The award shall be given by majority decision. The arbitration

proceedings shall be conducted in English. |

IN WITNESS WHEREOF, this Agreement has

been duly executed by the Parties the day and year first before written.

Seller

For and on behalf of

Neo-Concept (Holdings) COMPANY Limited

| |

|

| Name: |

Wai Man Chi |

|

| Title: |

Director in the presence of |

|

Buyer

For and on behalf of

NEO-CONCEPT INTERNATIONAL GROUP HOLDINGS LIMITED

| |

|

| Name: |

Siu Yuk Yin Eva |

|

| Title: |

Director in the presence of |

|

Schedule 1

Buyer Representations and Warranties

| 1. | The Buyer has full power, authority and legal capacity to enter

into, deliver and perform the terms of this Agreement. This Agreement, when executed and delivered by the Buyer, will constitute valid

and legally binding obligations of the Buyer, enforceable in accordance with their terms. The execution, delivery and performance by

the Buyer of this Agreement does not and will not contravene, breach or violate the terms of any agreement, document or instrument to

which the Buyer is a party or by which any of the Buyer’s assets or properties are bound. |

| 2. | No action by or against the Buyer is pending or, to the knowledge

of the Buyer after due inquiry, threatened, which could affect the legality, validity or enforceability of this Agreement or any other

document or the consummation of the transactions herein. |

Schedule 2

Seller Representations and Warranties

| 1.1 | The Seller is a company duly incorporated and existing under the laws of Hong Kong. |

| 2 | Power to sell the Assets |

| 2.1 | The Seller has taken all necessary action and has all requisite power, authority and legal capacity to

enter into and perform this Agreement and all other documents to be executed by it pursuant to, and ancillary to, this Agreement, without

obtaining the consent or approval of any third party. |

| 2.2 | This Agreement constitutes (or shall constitute when executed) valid, legal and binding obligations on

the Seller in the terms of this Agreement. |

| 2.3 | Compliance with the terms of this Agreement shall not breach or constitute a default under any of the

following: |

| (a) | any agreement or instrument to which the Seller is a party or by which it is bound; or |

| (b) | any order, judgment, decree or other restriction applicable to the Seller; or |

| (c) | any provision of the articles of association or equivalent constitutional documents of the Seller. |

| 3.1 | The Seller has the legal and beneficial ownership of, and good title to, the Assets free and clear of

all Encumbrance and all such assets are in the possession and control of the Seller respectively. |

| 3.2 | The Seller has all the corporate power and authority, has taken all necessary corporate actions, and obtained

all governmental approvals, if required, to transfer the Assets to the Buyer. Upon the transfer of the Assets, the Buyer will have full

title, right and interest to the Assets free from any Encumbrance. |

| 3.3 | None of the Assets is subject to any contracts of lease, hire purchase, hire, conditional sale, title

retention and similar contracts or arrangements to which the Seller is a party. The Seller has not acquired or agreed to acquire any Asset

on terms that title to such Asset does not pass to the Seller until full payment is made. |

| 3.4 | There are no actual or contingent liabilities in relation to the Assets. |

| 3.5 | There is no Encumbrance over or affecting any of the Assets and that there is no guarantee given by the

Seller or loan or liability incurred by the Seller under which Encumbrance has been created over any of the Assets. |

| 3.6 | No receiver or administrative receiver has been appointed over the Assets. No application has been made

to the court for any such appointment, and no power of sale or power to appoint a receiver or administrative receiver under the terms

of any charge, mortgage or security over the Assets has become exercisable. |

| 4 | Constitutional and corporate documents |

| 4.1 | The copies of the articles of association or other constitutional and corporate documents of the Seller

are true, accurate and complete in all respects. |

| 5 | Conduct of business and compliance with laws |

| 5.1 | The Seller and all of its respective directors, officers, executives and employees (during the course

of their duties in relation the Assets) have conducted the Specified Business in full compliance in all material respects with all applicable

legislation (including regulations, statutory instruments, bye-laws, local and central government orders, notices and decisions). |

| 6.1 | The Seller has all necessary licences, consents, permits and authorities necessary to carry on the Specified

Business or hold and/or operate the Assets in the places and in the manner in which the Specified Business is now carried on, or the Assets

reside, all of which are valid and subsisting in all material respects. |

| 6.2 | No notice has been received by the Seller to suggest that any of the licences, consents, permits and authorities

referred to in paragraph 6.1 above should be suspended, cancelled, revoked or not renewed on the same terms. |

| 7 | Disputes and investigations |

| (a) | is not engaged in any litigation, administrative, mediation or arbitration proceedings or other proceedings

or hearings before any statutory or governmental body, department, board or agency (except for debt collection in the normal course of

business); or |

| (b) | is not the subject of any investigation, inquiry or enforcement proceedings by any governmental, administrative

or regulatory body. |

| 7.2 | No such proceedings, investigation or inquiry in respect of the Specified Trademarks have been threatened

or are pending. |

| 7.3 | The Seller has not been engaged or involved in any litigation, administrative, enforcement or other legal

proceedings in respect of the Specified Trademarks in the last five (5) years. |

| 8.1 | All Existing Contracts are valid and in full force and effect. The Existing Contracts have been negotiated

and concluded on fair market terms and conditions and in full compliance with all applicable laws and regulations. All such Existing Contracts

are not freely transferrable to the Buyer without the consent of the respective contractual parties. |

| 8.2 | The Seller is not a party to or subject to any contract or agreement or arrangement in respect of the

Specified Business which: |

| (a) | is not in the ordinary and usual course of business of such company; or |

| (b) | is not wholly on an arm’s length basis; or |

| (c) | restricts the freedom of any such company to carry on the whole or any part of its business in any part

of the world in such manner as it thinks fit; or |

| (d) | involves any unusual or onerous terms or conditions; or |

| (e) | involves agency or distributorship; or |

| (f) | involves partnership, joint venture, consortium, joint development, shareholders or similar arrangements. |

| 8.3 | Each Existing Contract is binding on the parties to it, and, as far as the Seller is aware, the Seller

has not defaulted under or breached an Existing Contract and no other party to an Existing Contract has defaulted under or breached such

a contract. |

| 8.4 | No notice of termination of an Existing Contract has been received or served by the Seller. None of the

suppliers and other contractors of the Seller has indicated that they will terminate an Existing Contract or reduce their supplies or

change their terms of supply as a consequence or in the course of the transfer of the Assets from the Seller to the Buyer. |

| 8.5 | Other than the Existing Contracts, the Seller is not a party to any other contract or arrangement relating

to the provision of services similar to the Specified Business. |

| 9.1 | No significant supplier of the Seller has ceased or indicated an intention to cease, or might prior to

or as a result of Completion cease to contract with or supply to the Buyer as the operator of the Specified Business (where applicable),

or might substantially reduce its business with the Buyer as the operator of the Specified Business, that, in case of any of the above

events, may result in a Material Adverse Change. |

| 9.2 | No notice has been given or received by the Seller of any adverse price or other changes in trading terms

with any supplier of the Specified Business. No such change is intended or likely and no adverse change has occurred in the course of

completing, or providing the services sold or supplied by the Seller or any such company. |

| 9.3 | The Seller has not received any notice of actual or potential disputes, complaints or claims from any

supplier of the Specified Business. The Seller has not and is not engaged or involved in any litigation, administrative, enforcement or

other legal proceedings with any supplier of the Specified Business in respect of the Specified Business in the last five (5) years. |

| 10.1 | The Seller has sufficient working capital for its present requirements and for the purpose of performing

in accordance with its terms all Existing Contracts, orders, projects and obligations which have been placed with or undertaken by it. |

| 10.2 | The Seller has no outstanding mortgage, debenture, charge or other Encumbrance affecting the Assets, nor

has the Seller guaranteed, mortgaged, charged, pledged, assigned or granted securities in respect of any of the Assets for any third parties’

debts. |

| 11.1 | The Seller is not insolvent. There are no proceedings instituted by or against the Seller seeking to adjudicate

any such company bankrupt or insolvent, or seeking liquidation, winding up or reorganisation, arrangement, adjustment, protection, relief

or composition of its debts under any law related to bankruptcy, insolvency or reorganisation. |

| 11.2 | No order has been made or petition presented or resolution passed for winding up of the Seller, and no

distress, execution or other process has been levied on any of its assets (including the Assets). No administrator or receiver has been

appointed by any person over the Specified Business or assets (including the Assets) of the Seller, or any part thereof, nor has any order

been made or petition presented for the appointment of an administrator or receiver in respect of the Specified Business or assets of

the Seller. |

| 11.3 | The Seller is not a party to any transaction as a result of which any asset owned or used by such company

is liable to be transferred or re-transferred pursuant to any legislation concerning insolvency nor is it party to any transaction which

may otherwise be liable to be set aside or avoided for any reason. |

| 12.1 | The Specified Trademarks used or required by the Seller for the Specified Business are set out in Schedule

3. |

| 12.2 | All the intellectual property rights in respect of the Specified Trademarks that are used or required

by the Seller for the Specified Business are valid, enforceable, in full force and effect, registered or being registered (so far as is

capable of registration) in the sole name of the Seller, are each in the sole and exclusive legal and beneficial ownership of the Seller

without the requirement for any licence, consent or permission from or payment to any person (other than the competent authorities or

trademark registries), are each individually transferable by the Seller free from any Encumbrance of any kind and there are no defects

in the title of the Seller to any of them. |

| 12.3 | The Seller has taken all necessary steps to obtain and maintain the registration of the the Specified

Trademarks where applicable and to protect and defend such Specified Trademarks. |

| 12.4 | The Seller has not granted any licences or assignments under or in respect of any of the Specified Trademarks

or disclosed or provided to any person (other than an employee under enforceable obligations of confidence) any confidential or secret

material in which any of such intellectual property right exists, including without limitation, know-how, trade secrets, technical assistance,

confidential information or lists of customers or suppliers and is not obliged so to grant or disclose any of the same. |

| 12.5 | The Seller is entitled to carry on the Specified Business in the ordinary and usual course as at present

carried on and does not thereby infringe any intellectual property rights of any third party nor is it liable to pay any commission, royalty

or like fee or obtain any consent or licence. |

| 12.6 | The Seller is not aware of any unauthorised use of any of the Specified Trademarks owned or used by the

Seller, or of any activity or proposed activity which does or may infringe, invalidate or dilute any right comprised in any such Specified

Trademarks. |

| 12.7 | All fees for the grant or renewal (where applicable) of the Specified Trademarks, owned or used by the

Seller have been paid promptly and no circumstances exist which might lead to the cancellation, forfeiture or modification of any of such

Specified Trademarks owned or used by the Seller. |

| 12.8 | No pledge or mortgage on the any of the Specified Trademarks has ever existed. |

| 13.1 | The definitions in this paragraph apply in this Agreement. |

Employment Legislation: legislation

applying in Hong Kong affecting contractual or other relations between employers and their employees or workers, including but not limited

to any legislation and any amendment, extension or re-enactment of such legislation and any claim arising under any regulations, secondary

legislation, bye-laws, guidance or directives enforceable against the Seller by any employee or worker.

| 13.2 | The Seller is not under any obligation (whether legally enforceable or not) to increase any such remuneration

or alter any other terms of the employment or engagement of the Transferring Employees. |

| 13.3 | All contracts between the Seller and the Transferring Employees are terminable at any time on not more

than three (3) months' notice without compensation (other than for unfair dismissal or a statutory redundancy or long service payment

or any liability on the part of the Seller other than wages, commission or pension). |

| 13.4 | The Seller has not incurred any liability for failure to provide information or to consult with Transferring

Employees under any Employment Legislation. |

| 13.5 | The acquisition of the Assets by the Buyer and compliance with the terms of this Agreement will not entitle

any directors, officers or employees of the Seller to terminate his or her employment or receive any payment or other benefit. |

| 13.6 | Other than the statutory entitlements to the Transferring Employees under the applicable law, no Transferring

Employee of the Seller has ceased to be employed by or to be under contract to the Seller in circumstances in which he or she could claim

damages or compensation or has given or is under notice of resignation, dismissal or termination or is under threat of dismissal or termination,

or is contemplating leaving the Seller. |

| 13.7 | There is no share incentive, share option or profit sharing scheme or similar arrangement entered into

by the Seller. |

| 13.8 | There are no amounts owing to any Transferring Employee of the Seller other than for remuneration and

mandatory provident fund contributions accrued due (in each case) in respect of the current month. |

| 13.9 | Each of the Transferring Employees who is by law subject to immigration control has been granted leave

to remain in Hong Kong and has a valid work permit issued in relation to his/her employment with the Seller and has obtained all necessary

extensions to his/her leave to remain in Hong Kong and there are in existence no grounds upon which any such leave to remain or work permit

might be curtailed or the Transferring Employee may be required to leave Hong Kong. |

| 13.10 | The Seller takes and has taken all appropriate precautions to ensure that its Transferring Employees have

a working environment and working practices (whether or not on such company's premises) which are not injurious to their health and safety

and complies with all applicable Employment Legislation in all material respects. |

| 13.11 | The Seller is not involved in any industrial or trade dispute or negotiation regarding a claim with any

trade union, group or organisation of employees or their representatives representing the Transferring Employees. |

| 13.12 | The Seller has not agreed to any future variation to the terms of any contract with any of its Transferring

Employees. |

| 13.13 | No Transferring Employee is subject to a current disciplinary warning or procedure. |

| 14.1 | All information, documents and materials (including without limitation that contained herein) given to

the Buyer or any of its advisers in connection with the Seller and/or the Assets and/or the Specified Business was when given and remains

true and accurate in all material respects and there is no fact or matter relevant to the Seller and/or the Assets and/or the Specified

Business which has not been disclosed to the Buyer or which might render any of the information referred to above misleading or inaccurate

or might affect the willingness of the Buyer to purchase the Assets on the terms herein set out. |

| 14.2 | All the information contained in Schedule 3 is true and accurate in all respects. |

| 15.1 | The Seller confirms and acknowledges that it has obtained independent legal advice in connection with

the negotiation of, and the entering into, of this Agreement and the transactions contemplated hereof and thereof. |

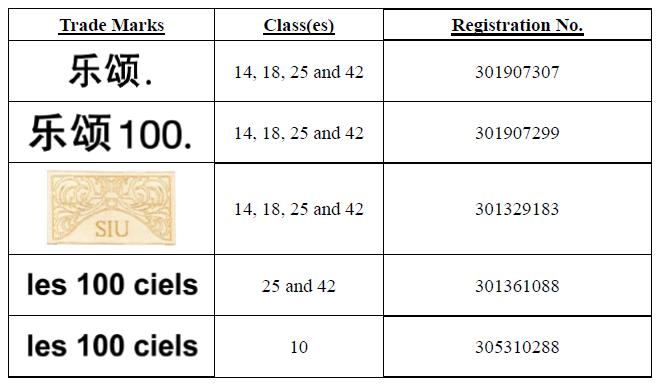

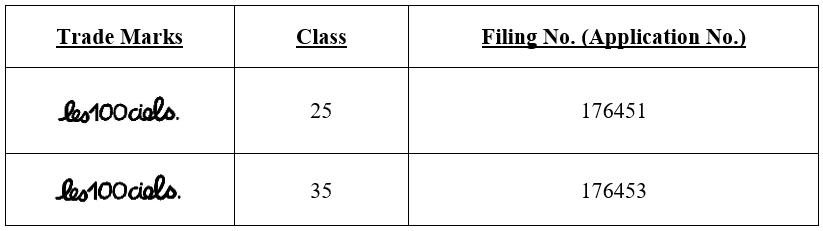

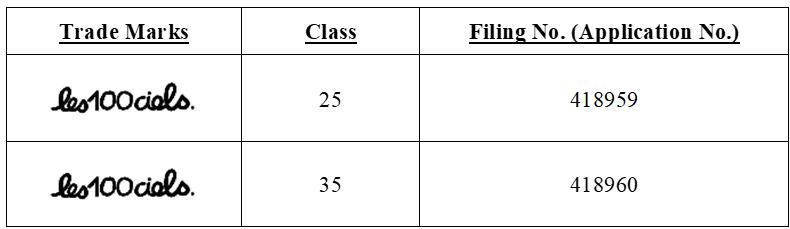

Schedule 3

Specified Trademarks

Part A

Trademark filed in Hong Kong

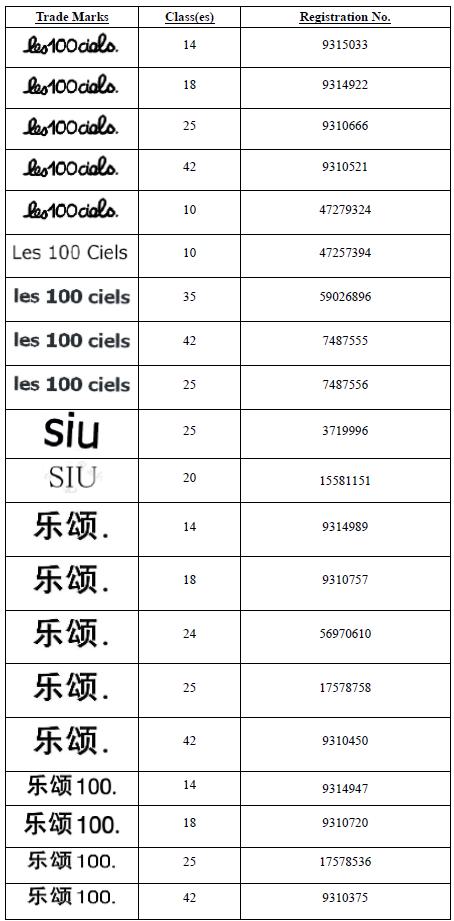

Part B

Trademark filed in the People’s Republic of China

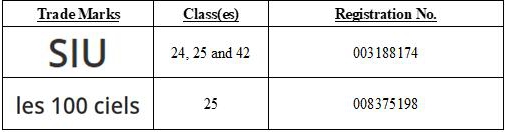

Part C

Trademark filed in the European Union

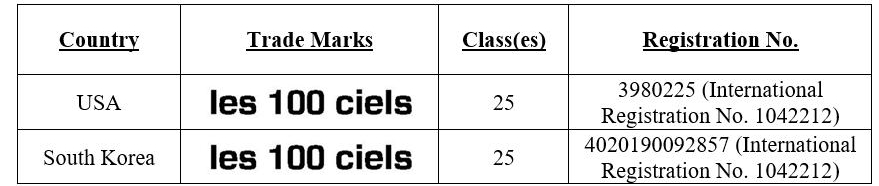

Part D

Trademark filed in the International Registration Designated in the United States

Part E

Trademark application filed in Qatar

Part

F

Trademark application filed in the United Arab Emirates

Schedule 4

Names of Transferring Employees

| 1 | Leung Wing Shuen Ella (梁穎旋)

|

- 36 -

Exhibit

99.2

NCI

Announces Game-Changing Acquisition Turbocharges Retail Expansion

HONG KONG, May 29, 2024 (GLOBE NEWSWIRE) -- Neo-Concept

International Group Holdings Limited (Nasdaq: NCI) (the “Company”), a one-stop apparel solution services provider, today announced

a game-changing acquisition. The company has signed an Asset Purchase Agreement (“APA”) to acquire the intellectual property

(“IP) and R&D capabilities of its affiliated company, Neo-Concept (Holdings) Company Limited (“NCH”).

Under the deal, NCI will take full ownership

of the highly-valuable “Les100Ciels” and “SIU” brands, including all associated trademarks and trade names. Crucially,

this includes the transfer of the R&D teams responsible for these in-demand labels.

“This strategic move turbocharges our retail

expansion, especially in the booming Middle East markets,” declared Miss Eva Siu, Chairlady and CEO of NCI. “The current licensing

model simply doesn’t give us the control we need. Now, with full IP ownership, we can supercharge our growth plans.”

NCI’s CFO, Mr. Patrick Lau, echoed this sentiment:

“Owning these prized assets outright eliminates potential costly royalties and end licensing uncertainties once and for all. It’s

a game-changer that will maximize shareholder value as we scale up our retail footprint worldwide.”

The asset transfer is expected to be completed

within 6 months, setting the stage for NCI’s next phase of dynamic growth.

- END

-

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release

are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements reflect the Company’s current expectations or beliefs concerning future events and actual

events may differ materially from current expectations. Any such forward-looking statements are subject to various risks and uncertainties,

including the strength of the economy, changes to the market for securities, political or financial instability and other factors which

are set forth in the Company’s Registration Statement on Form F-1 (File No. 333-275242), as amended, and in all filings with the

SEC made by the Company subsequent to the filing thereof. The Company does not undertake to publicly update or revise its forward-looking

statements, whether as a result of new information, future events or otherwise.

About Neo-Concept International Group Holdings Limited

Neo-Concept International Group Holdings Limited

(“NCI”) is a one-stop apparel solution services provider. It offers a full suite of services in the apparel supply chain,

including market trend analysis, product design and development, raw material sourcing, production and quality control, and logistics

management serving customers located in the European and North American markets. It also sells its own branded apparel products under

the licensed brand “Les100Ciels” through retail stores in UK as well as the e-commerce platform www.les100ciels.com.

NCI is dedicated to minimizing its environmental

footprint by implementing various eco-friendly practices. It prioritizes recycling, clean processes, and traceable sourcing as part of

its commitment to reducing environmental impact. Additionally, NCI actively seeks sustainable solutions throughout the garment production

process, aiming to meet the needs of its customers in an environmentally responsible manner.

Enquiries:

Neo-Concept International Group Holdings Limited Investor Relations

Contact:

10/F, Seaview Centre

No.139-141 Hoi Bun Road

Kwun Tong, Kowloon, Hong Kong

(+852) 2798-8639

Email: ir@neo-ig.com

Neo Concept (NASDAQ:NCI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Neo Concept (NASDAQ:NCI)

Historical Stock Chart

From Dec 2023 to Dec 2024