false

--12-31

Q1

0001196298

Yes

Yes

0001196298

2024-01-01

2024-03-31

0001196298

2024-05-06

0001196298

2024-03-31

0001196298

2023-12-31

0001196298

2023-01-01

2023-03-31

0001196298

us-gaap:ProductMember

2024-01-01

2024-03-31

0001196298

us-gaap:ProductMember

2023-01-01

2023-03-31

0001196298

NEPH:RoyaltyAndOtherRevenuesMember

2024-01-01

2024-03-31

0001196298

NEPH:RoyaltyAndOtherRevenuesMember

2023-01-01

2023-03-31

0001196298

us-gaap:CommonStockMember

2023-12-31

0001196298

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001196298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001196298

us-gaap:RetainedEarningsMember

2023-12-31

0001196298

us-gaap:ParentMember

2023-12-31

0001196298

us-gaap:NoncontrollingInterestMember

2023-12-31

0001196298

us-gaap:CommonStockMember

2022-12-31

0001196298

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001196298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001196298

us-gaap:RetainedEarningsMember

2022-12-31

0001196298

us-gaap:ParentMember

2022-12-31

0001196298

us-gaap:NoncontrollingInterestMember

2022-12-31

0001196298

2022-12-31

0001196298

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001196298

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001196298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0001196298

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001196298

us-gaap:ParentMember

2024-01-01

2024-03-31

0001196298

us-gaap:NoncontrollingInterestMember

2024-01-01

2024-03-31

0001196298

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001196298

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001196298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001196298

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001196298

us-gaap:ParentMember

2023-01-01

2023-03-31

0001196298

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-03-31

0001196298

us-gaap:CommonStockMember

2024-03-31

0001196298

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001196298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001196298

us-gaap:RetainedEarningsMember

2024-03-31

0001196298

us-gaap:ParentMember

2024-03-31

0001196298

us-gaap:NoncontrollingInterestMember

2024-03-31

0001196298

us-gaap:CommonStockMember

2023-03-31

0001196298

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001196298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001196298

us-gaap:RetainedEarningsMember

2023-03-31

0001196298

us-gaap:ParentMember

2023-03-31

0001196298

us-gaap:NoncontrollingInterestMember

2023-03-31

0001196298

2023-03-31

0001196298

2023-01-01

2023-12-31

0001196298

NEPH:CustomerAMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001196298

NEPH:CustomerAMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001196298

NEPH:CustomerBMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001196298

NEPH:CustomerBMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001196298

NEPH:CustomerCMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001196298

NEPH:CustomerCMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001196298

NEPH:CustomerTotalMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001196298

NEPH:CustomerTotalMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001196298

NEPH:CustomerAMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001196298

NEPH:CustomerAMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001196298

NEPH:CustomerBMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001196298

NEPH:CustomerBMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001196298

NEPH:CustomerTotalMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-03-31

0001196298

NEPH:CustomerTotalMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001196298

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2024-03-31

0001196298

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2024-03-31

0001196298

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2024-03-31

0001196298

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001196298

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001196298

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001196298

us-gaap:CustomerRelationshipsMember

2024-03-31

0001196298

us-gaap:CustomerRelationshipsMember

2023-12-31

0001196298

NEPH:LicenseAndSupplyAgreementMember

2024-03-31

0001196298

NEPH:LicenseAndSupplyAgreementMember

2023-12-31

0001196298

NEPH:LicenseAndSupplyAgreementMember

2024-01-01

2024-03-31

0001196298

NEPH:LicenseAndSupplyAgreementMember

2023-01-01

2023-03-31

0001196298

2023-12-10

2023-12-11

0001196298

NEPH:AprilTwentyThreeTwoThousandFourteenThroughDecemberThirtyOneTwoThousandTwentyThreeMember

NEPH:LicenseAndSupplyAgreementMember

NEPH:MedicaMember

2024-01-01

2024-03-31

0001196298

us-gaap:CostOfSalesMember

2023-01-01

2023-03-31

0001196298

us-gaap:AccountsPayableAndAccruedLiabilitiesMember

2023-01-01

2023-03-31

0001196298

NEPH:SecuredPromissoryNoteAgreementMember

NEPH:TechCapitalLLCMember

2018-03-27

0001196298

NEPH:SecuredPromissoryNoteAgreementMember

NEPH:TechCapitalLLCMember

2024-01-01

2024-03-31

0001196298

NEPH:SecuredPromissoryNoteAgreementMember

NEPH:TechCapitalLLCMember

2024-03-31

0001196298

NEPH:SecuredNoteMember

2023-01-01

2023-03-31

0001196298

srt:MinimumMember

2024-03-31

0001196298

srt:MaximumMember

2024-03-31

0001196298

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-03-31

0001196298

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-03-31

0001196298

us-gaap:EmployeeStockOptionMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2024-01-01

2024-03-31

0001196298

us-gaap:EmployeeStockOptionMember

us-gaap:ResearchAndDevelopmentExpenseMember

2024-01-01

2024-03-31

0001196298

us-gaap:EmployeeStockOptionMember

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2023-01-01

2023-03-31

0001196298

us-gaap:EmployeeStockOptionMember

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-03-31

0001196298

us-gaap:RestrictedStockMember

2024-01-01

2024-03-31

0001196298

us-gaap:RestrictedStockMember

2023-01-01

2023-03-31

0001196298

us-gaap:RestrictedStockMember

NEPH:EmployeesMember

2023-01-01

2023-03-31

0001196298

us-gaap:RestrictedStockMember

NEPH:BoardMember

2022-01-01

2022-12-31

0001196298

us-gaap:RestrictedStockMember

NEPH:ContractorsMember

2023-01-01

2023-03-31

0001196298

NEPH:UnvestedRestrictedStockMember

2024-03-31

0001196298

NEPH:SRPEquityIncentivePlanMember

2019-05-07

0001196298

NEPH:SRPEquityIncentivePlanMember

2023-01-01

2023-03-31

0001196298

us-gaap:SeriesAPreferredStockMember

2018-09-01

2018-09-30

0001196298

us-gaap:SeriesAPreferredStockMember

2022-02-01

2022-02-28

0001196298

NEPH:SpecialtyRenalProductsIncMember

2022-02-01

2022-02-28

0001196298

NEPH:SpecialtyRenalProductsIncMember

2022-02-28

0001196298

NEPH:SRPPurchaseAgreementClosingAmendmentMember

2022-02-01

2022-02-28

0001196298

NEPH:SpecialtyRenalProductsIncMember

NEPH:LoanAgreementMember

2020-12-31

0001196298

NEPH:SpecialtyRenalProductsIncMember

NEPH:LoanAgreementMember

2020-01-01

2020-12-31

0001196298

NEPH:SpecialtyRenalProductsIncMember

2023-03-01

2023-03-31

0001196298

NEPH:SpecialtyRenalProductsIncMember

2023-01-01

2023-03-31

0001196298

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-03-31

0001196298

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-03-31

0001196298

NEPH:UnvestedRestrictedStockMember

2024-01-01

2024-03-31

0001196298

NEPH:UnvestedRestrictedStockMember

2023-01-01

2023-03-31

0001196298

NEPH:LicenseAndSupplyAgreementMember

NEPH:MedicaSpaMember

srt:ScenarioForecastMember

2024-01-01

2024-12-31

0001196298

NEPH:LicenseAndSupplyAgreementMember

NEPH:MedicaSpaMember

2024-01-01

2024-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

NEPH:Integer

xbrli:shares

iso4217:EUR

xbrli:shares

NEPH:Segment

iso4217:EUR

xbrli:pure

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended: March 31, 2024

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from: _______ to _______

Commission

File Number: 001-32288

NEPHROS,

INC.

(Exact

name of registrant as specified in its charter)

| delaware |

|

13-3971809 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

380

Lackawanna Place

South

Orange, NJ |

|

07079 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(201)

343-5202

Registrant’s

telephone number, including area code

N/A

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

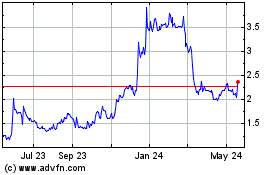

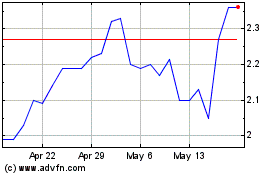

| Title

of each class |

|

Trading

symbol |

|

Name

of exchange on which registered |

| Common

stock, par value $0.001 per share |

|

NEPH |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒ YES ☐ NO

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☒ YES ☐ NO

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ YES ☒ NO

As

of May 6, 2024, 10,544,139 shares of the registrant’s common stock, $0.001 par value

per share, were outstanding.

NEPHROS,

INC. AND SUBSIDIARIES

TABLE

OF CONTENTS

PART

I - FINANCIAL INFORMATION

Item

1. Financial Statements.

NEPHROS,

INC. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

(In

thousands, except share and per share amounts)

(Unaudited)

| | |

March 31, 2024 | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,633 | | |

$ | 4,307 | |

| Accounts receivable, net | |

| 1,518 | | |

| 1,496 | |

| Inventory | |

| 2,779 | | |

| 2,470 | |

| Prepaid expenses and other current assets | |

| 200 | | |

| 132 | |

| Total current assets | |

| 8,130 | | |

| 8,405 | |

| Property and equipment, net | |

| 142 | | |

| 152 | |

| Lease right-of-use assets | |

| 1,680 | | |

| 1,807 | |

| Intangible assets, net | |

| 373 | | |

| 381 | |

| Goodwill | |

| 759 | | |

| 759 | |

| License and supply agreement, net | |

| 257 | | |

| 271 | |

| Other assets | |

| 75 | | |

| 86 | |

| TOTAL ASSETS | |

$ | 11,416 | | |

$ | 11,861 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 1,114 | | |

| 873 | |

| Accrued expenses | |

| 413 | | |

| 794 | |

| Current portion of lease liabilities | |

| 402 | | |

| 446 | |

| Total current liabilities | |

| 1,929 | | |

| 2,113 | |

| Lease liabilities, net of current portion | |

| 1,307 | | |

| 1,390 | |

| TOTAL LIABILITIES | |

| 3,236 | | |

| 3,503 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES (Note 13) | |

| - | | |

| - | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| | |

| | | |

| | |

| Preferred stock, $.001 par value; 5,000,000 shares authorized at March 31, 2024 and December 31, 2023; no shares issued and outstanding at March 31, 2024 and December 31, 2023 | |

| - | | |

| - | |

| Common stock, $.001 par value; 40,000,000 shares authorized at March 31, 2024 and December 31, 2023; 10,544,139 and 10,543,675 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | |

| 10 | | |

| 10 | |

| Additional paid-in capital | |

| 152,745 | | |

| 152,754 | |

| Accumulated deficit | |

| (144,575 | ) | |

| (144,406 | ) |

| TOTAL STOCKHOLDERS’ EQUITY | |

| 8,180 | | |

| 8,358 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 11,416 | | |

$ | 11,861 | |

The

accompanying notes are an integral part of these unaudited consolidated interim financial statements.

NEPHROS,

INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In

thousands, except share and per share amounts)

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Net revenue: | |

| | | |

| | |

| Product revenues | |

$ | 3,506 | | |

$ | 3,662 | |

| Royalty and other revenues | |

| 16 | | |

| 35 | |

| Total net revenues | |

| 3,522 | | |

| 3,697 | |

| Cost of goods sold | |

| 1,335 | | |

| 1,586 | |

| Gross margin | |

| 2,187 | | |

| 2,111 | |

| Operating expenses: | |

| | | |

| | |

| Selling, general and administrative | |

| 2,142 | | |

| 2,124 | |

| Research and development | |

| 212 | | |

| 239 | |

| Depreciation and amortization | |

| 33 | | |

| 54 | |

| Total operating expenses | |

| 2,387 | | |

| 2,417 | |

| Operating loss | |

| (200 | ) | |

| (306 | ) |

| Other (expense) income: | |

| | | |

| | |

| Interest expense | |

| (1 | ) | |

| (1 | ) |

| Interest income | |

| 25 | | |

| 12 | |

| Other (expense) income, net | |

| 7 | | |

| (11 | ) |

| Total other income: | |

| 31 | | |

| - | |

| Net loss | |

| (169 | ) | |

| (306 | ) |

| | |

| | | |

| | |

| Net loss per common share, basic and diluted | |

$ | (0.02 | ) | |

$ | (0.03 | ) |

| Weighted average common shares outstanding, basic and diluted | |

| 10,501,771 | | |

| 10,297,429 | |

| | |

| | | |

| | |

| Comprehensive loss | |

$ | (169 | ) | |

$ | (306 | ) |

The

accompanying notes are an integral part of these unaudited consolidated interim financial statements.

NEPHROS,

INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

(In

thousands, except share amounts)

(Unaudited)

| | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Subtotal | | |

Interest | | |

Equity | |

| | |

Three months ended March 31, 2024 | |

| | |

Common Stock | | |

Additional

Paid-in | | |

Accumulated Other Comprehensive | | |

Accumulated | | |

| | |

Noncontrolling | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Subtotal | | |

Interest | | |

Equity | |

| Balance, December 31, 2023 | |

| 10,501,508 | | |

$ | 10 | | |

$ | 152,754 | | |

$ | - | | |

$ | (144,406 | ) | |

$ | 8,358 | | |

$ | - | | |

$ | 8,358 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (169 | ) | |

| (169 | ) | |

| - | | |

| (169 | ) |

| Stock option exercises | |

| 464 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Stock-based compensation | |

| - | | |

| - | | |

| (9 | ) | |

| - | | |

| - | | |

| (9 | ) | |

| - | | |

| (9 | ) |

| Balance, March 31, 2024 | |

| 10,501,972 | | |

$ | 10 | | |

$ | 152,745 | | |

$ | - | | |

$ | (144,575 | ) | |

$ | 8,180 | | |

$ | - | | |

$ | 8,180 | |

| | |

Three months ended March 31, 2023 | |

| | |

Common Stock | | |

Additional

Paid-in | | |

Accumulated Other Comprehensive | | |

Accumulated | | |

| | |

Noncontrolling | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Subtotal | | |

Interest | | |

Equity | |

| Balance, December 31, 2022 | |

| 10,297,429 | | |

$ | 10 | | |

$ | 148,413 | | |

$ | - | | |

$ | (142,831 | ) | |

$ | 5,592 | | |

$ | 3,289 | | |

$ | 8,881 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (306 | ) | |

| (306 | ) | |

| - | | |

| (306 | ) |

| Change in non-controlling interest | |

| - | | |

| - | | |

| 3,262 | | |

| - | | |

| - | | |

| 3,262 | | |

| (3,262 | ) | |

| - | |

| Stock-based compensation | |

| - | | |

| - | | |

| 346 | | |

| - | | |

| - | | |

| 346 | | |

| (27 | ) | |

| 319 | |

| Balance, March 31, 2023 | |

| 10,297,429 | | |

$ | 10 | | |

$ | 152,021 | | |

$ | - | | |

$ | (143,137 | ) | |

$ | 8,894 | | |

$ | - | | |

$ | 8,894 | |

The

accompanying notes are an integral part of these unaudited consolidated interim financial statements.

NEPHROS,

INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In

thousands)

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (169 | ) | |

$ | (306 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation of property and equipment | |

| 11 | | |

| 10 | |

| Amortization of intangible assets, license and supply agreement and finance lease right-of-use asset | |

| 23 | | |

| 44 | |

| Stock-based compensation | |

| (9 | ) | |

| 319 | |

| Inventory impairments and writeoffs | |

| 73 | | |

| 91 | |

| Change in right of use asset | |

| 125 | | |

| 87 | |

| Gain on foreign currency transactions | |

| (3 | ) | |

| - | |

| Decrease (increase) in operating assets: | |

| | | |

| | |

| Accounts receivable | |

| (22 | ) | |

| (677 | ) |

| Inventory | |

| (382 | ) | |

| 714 | |

| Prepaid expenses and other current assets | |

| (69 | ) | |

| 10 | |

| Other assets | |

| 11 | | |

| (6 | ) |

| (Decrease) increase in operating liabilities: | |

| | | |

| | |

| Accounts payable | |

| 244 | | |

| (21 | ) |

| Accrued expenses | |

| (380 | ) | |

| 98 | |

| Lease liabilities | |

| (125 | ) | |

| (87 | ) |

| Net cash provided by (used in) operating activities | |

| (672 | ) | |

| 276 | |

| | |

| | | |

| | |

| INVESTING ACTIVITIES: | |

| | | |

| | |

| | |

| - | | |

| - | |

| FINANCING ACTIVITIES: | |

| | | |

| | |

| Principal payments on finance lease liability | |

| (2 | ) | |

| (2 | ) |

| Principal payments on equipment financing | |

| - | | |

| (1 | ) |

| Payments on secured note payable | |

| - | | |

| (71 | ) |

| Net cash provided by (used in) financing activities | |

| (2 | ) | |

| (74 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| (674 | ) | |

| 202 | |

| Cash and cash equivalents, beginning of period | |

| 4,307 | | |

| 3,634 | |

| Cash and cash equivalents, end of period | |

$ | 3,633 | | |

$ | 3,836 | |

| Supplemental disclosure of cash flow information | |

| | | |

| | |

| Cash paid for interest expense | |

$ | 1 | | |

$ | 1 | |

The

accompanying notes are an integral part of these unaudited consolidated interim financial statements.

NEPHROS,

INC. AND SUBSIDIARIES

NOTES

TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS (unaudited)

Note

1 – Organization and Nature of Operations

Nephros,

Inc. (“Nephros” or the “Company”) was incorporated under the laws of the State of Delaware on April 3, 1997.

The Company was founded by health professionals, scientists and engineers affiliated with Columbia University to develop advanced end

stage renal disease (“ESRD”) therapy technology and products.

Beginning

in 2009, Nephros introduced high performance liquid purification filters to meet the demand for water purification in certain medical

markets. The Company’s filters, generally classified as ultrafilters, are primarily used in hospitals for the prevention of infection

from waterborne pathogens, such as legionella and pseudomonas, and in dialysis centers for the removal of biological contaminants from

water and bicarbonate concentrate. The Company also develops and sells water filtration products for commercial applications, focusing

on the hospitality and food service markets. The water filtration business is a reportable segment, referred to as the Water Filtration

segment.

In

July 2018, the Company formed a subsidiary, Specialty Renal Products, Inc. (“SRP”), to drive the development of its second-generation

hemodiafiltration system and other products focused on improving therapies for patients with renal disease. After SRP’s formation,

the Company assigned to SRP all of the Company’s rights to three patents relating to the Company’s hemodiafiltration technology,

which were carried at zero book value. On March 9, 2023, the SRP Stockholders approved a plan of dissolution to wind down SRP’s

operations, liquidate SRP’s remaining assets and dissolve SRP, and SRP filed a certificate of dissolution with the State of Delaware

on April 13, 2023. As a result of the SRP Stockholders’ approval of the plan of dissolution and provisions therein and after satisfying

all of SRP’s liabilities, there are no assets available for distribution to the holders of any of SRP’s capital stock, including

its Series A Preferred Stock. As such, the value recorded to non-controlling interest was written to zero and the impact reclassified

to the Company’s additional paid-in capital as the Company retained control of SRP.

The

Company’s primary U.S. facility is located at 380 Lackawanna Place, South Orange, New Jersey 07079. This location along with our

Whippany, NJ facility, houses the Company’s corporate headquarters, research, manufacturing, and distribution facilities.

Note

2 – Basis of Presentation and Liquidity

Interim

Financial Information

The

accompanying unaudited consolidated interim financial statements have been prepared in accordance with generally accepted accounting

principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8 and Article 10

of Regulation S-X. The consolidated balance sheet as of December 31, 2023 was derived from the Company’s audited financial statements.

Accordingly, they do not include all of the information and footnotes required by GAAP for annual financial statements. Results as of

and for the three months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the year ending

December 31, 2024.

The

consolidated interim financial statements and notes thereto should be read in conjunction with the consolidated financial statements

and notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Segment

Reporting

The

Company operates in only one business segment from which the Company’s chief operating decision maker evaluates the financial performance

of the Company.

Consolidation

The

accompanying consolidated financial statements include the accounts of Nephros, Inc. and its subsidiary, SRP, which was dissolved pursuant

to a plan of dissolution adopted by its stockholders on March 9, 2023 and the subsequent filing of a certificate of dissolution with

the State of Delaware on April 13, 2023. All intercompany accounts and transactions were eliminated in the preparation of the accompanying

consolidated financial statements.

Use

of Estimates

The

preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of

America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities

and disclosure of contingent assets and liabilities, at the date of the financial statements, and the reported amount of revenues and

expenses, during the reporting period. Actual results could differ materially from those estimates. Included in these estimates are assumptions

about the collection of accounts receivable, value of inventories, useful life of fixed assets and intangible assets, the assessment

of expected cash flows used in evaluating goodwill and other long-lived assets, the assessment of the ability to continue as a going

concern and assumptions used in determining stock compensation such as expected volatility and risk-free interest rate.

Liquidity

In

connection with SRP’s plan of dissolution and pursuant to an agreement between the Company and SRP entered into on May 24, 2023,

SRP assigned substantially all of its remaining assets to the Company in satisfaction of the entire loan balance. See “Note 11

– Stockholders’ Equity – Noncontrolling Interest” Accordingly, as of March 31, 2024, there was no outstanding

balance of this loan.

The

Company has sustained operating losses every quarter through March 31, 2024, generating an accumulated deficit of $144.6

million as of March 31, 2024. However, in 2023, the Company’s operating cash flow was positive due to increased sales, improved

gross margins, careful expense management, a reduction in inventory, and the dispositions of the Pathogen Detection Systems and SRP

businesses. These actions resulted in the Company generating cash from operations of approximately $0.8

million for the twelve months ended December 31, 2023. Conversely, net cash from operations was negative for the three months ended

March 31, 2024 due to an operating loss, payment of prior year annual bonuses, and an increase in inventory. The Company continues

to focus on growth in sales and managing tight expenses in order to turn cash flow positive from operations. The investment in

inventory in the first quarter of 2024 is preparing for higher volumes in the future. The Company believes that the tight focus on operations and its current cash balances are sufficient to fund its

current operating plan through at least the next 12 months from the date of issuance of the accompanying consolidated financial

statements. However, in the event that the Company’s operating results do not meet its expectations, the Company may need to

further reduce discretionary expenditures such as headcount, R&D projects, and other variable costs.

Recent

Accounting Pronouncements, Not Yet Effective

In

March, the FASB issued ASU 2024-01, “ASC 718-Scope Application of Profits Interest and Similar Awards,” which provides guidance

to assist entities in determining whether profits interest and similar awards should be accounted for in accordance with Topic 718, Compensation—Stock

Compensation. The guidance is effective for the Company’s fiscal year 2025, including interim periods. Early adoption is permitted.

The Company is assessing the impact of adopting this guidance on its consolidated financial statements.

In

December 2023, the FASB issued ASU 2023-09, “Improvements to Income Tax Disclosures,” which enhances the transparency and

decision usefulness of income tax disclosures. The guidance is effective for the Company’s annual reporting period ending December

31, 2025. Early adoption is permitted. The Company is assessing the impact of adopting this guidance on its consolidated financial statements.

Concentration

of Credit Risk

The

Company deposits its cash in financial institutions. At times, such deposits may be in excess of insured limits. To date, the Company

has not experienced any impairment losses on its cash. The Company also limits its credit risk with respect to accounts receivable by

performing credit evaluations when deemed necessary.

Major

Customers

For

the three months ended March 31, 2024, and 2023, the following customers accounted for the following percentages of the Company’s

revenues, respectively:

Schedule of Revenues and Accounts Receivable Percentage of Major Customers

| Customer | |

2024 | | |

2023 | |

| A | |

| 31 | % | |

| 20 | % |

| B | |

| 7 | % | |

| 10 | % |

| C | |

| 2 | % | |

| 19 | % |

| Total | |

| 40 | % | |

| 49 | % |

As

of March 31, 2024 and December 31, 2023, the following customers accounted for the following percentages of the Company’s accounts

receivable, respectively:

| Customer | |

2024 | | |

2023 | |

| A | |

| 24 | % | |

| 12 | % |

| B | |

| 10 | % | |

| 6 | % |

| Total | |

| 34 | % | |

| 18 | % |

Accounts

Receivable

The

Company recognizes an allowance that reflects a current estimate of credit losses expected to be incurred over the life of a financial

asset, including trade receivables. The Company continuously monitors collections and payments from its customers and maintains a provision

for estimated credit losses. The Company determines its allowance for doubtful accounts by considering a number of factors, including

the length of time balances are past due, the Company’s previous loss history, the customer’s current ability to pay its

obligations to the Company and the expected condition of the general economy and the industry as a whole. The Company writes off accounts

receivable when they are determined to be uncollectible. The allowance for doubtful accounts was approximately $11,000 as of March

31, 2024, and December 31, 2023, respectively.

Depreciation

Expense

Depreciation

related to equipment utilized in the manufacturing process is recognized in cost of goods sold on the consolidated statements of operations

and comprehensive loss. For each of the three months ended March 31, 2024, and 2023, depreciation expense was approximately $1,000.

Note

3 – Revenue Recognition

The

Company recognizes revenue related to product sales when product is shipped via external logistics providers and the other criteria of

ASC 606 are met. Product revenue is recorded net of returns and allowances. There was no allowance for sales returns for the three months

ended March 31, 2024, or 2023. In addition to product revenue, the Company recognizes revenue related to sales of services to customers,

royalties, and other agreements in accordance with the five-step model in ASC 606. Other revenues recognized for the three months ended

March 31, 2024, and 2023 were approximately $16,000 and $35,000, respectively.

Note

4 – Fair Value Measurements

The

Company measures certain financial instruments and other items at fair value.

To

determine the fair value, the Company uses the fair value hierarchy for inputs used in measuring fair value that maximizes the use of

observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable

inputs are inputs market participants would use to value an asset or liability and are developed based on market data obtained from independent

sources. Unobservable inputs are inputs based on assumptions about the factors market participants would use to value an asset or liability.

To

measure fair value, the Company uses the following fair value hierarchy based on three levels of inputs, of which the first two are considered

observable and the last unobservable:

Level

1 – Quoted prices in active markets for identical assets or liabilities.

Level

2 – Inputs other than Level 1 that are observable for the asset or liability, either directly or indirectly, such as quoted

prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets

that are not active; or other inputs that are observable or can be corroborated by observable market data by correlation or other means.

Level

3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the

assets or liabilities. Value is determined using pricing models, discounted cash flow methodologies, or similar techniques and also includes

instruments for which the determination of fair value requires significant judgment or estimation.

Assets

and Liabilities Measured at Fair Value on a Recurring Basis

The

Company evaluates its financial assets and liabilities subject to fair value measurements on a recurring basis to determine the appropriate

level of classification for each reporting period.

At

March 31, 2024 and December 31, 2023, the Company’s cash equivalents consisted of money market funds. The Company values its cash

equivalents using observable inputs that reflect quoted prices for securities with identical characteristics and classify the valuation

techniques that use these inputs as Level 1.

At

March 31, 2024 and December 31, 2023, the fair value measurements of the Company’s assets and liabilities measured on a recurring

basis were as follows:

Schedule

of Assets and Liabilities Measured at Fair Value on Recurring Basis

| | |

Fair Value Measurements at Reporting Date Using | |

| | |

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1) | | |

Significant

Other

Observable

Inputs

(Level 2) | | |

Significant

Unobservable

Inputs

(Level 3) | |

| | |

(in thousands) | |

| March 31, 2024 | |

| | |

| | |

| |

| Cash | |

$ | 1,076 | | |

$ | | | |

$ | | |

| Money market funds | |

| 2,557 | | |

| | | |

| | |

| | |

| - | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,633 | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | |

| December 31, 2023 | |

| | | |

| | | |

| | |

| Cash | |

$ | 274 | | |

$ | | | |

$ | | |

| Money market funds | |

| 2,515 | | |

| | | |

| | |

| Certificate of deposit | |

| 1,518 | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,307 | | |

$ | - | | |

$ | - | |

Assets

and Liabilities Not Measured at Fair Value on a Recurring Basis

The

carrying amounts of accounts receivable, accounts payable and accrued expenses approximate fair value due to the short-term maturity

of these instruments.

The

carrying amounts of the secured long-term note payable, lease liabilities and equipment financing approximate fair value as of March

31, 2024 and December 31, 2023 because those financial instruments bear interest at rates that approximate current market rates for similar

agreements with similar maturities and credit.

Note

5 – Inventory

Inventory

is stated at the lower of cost or net realizable value using the first-in, first-out method and consists of raw materials and finished

goods. The Company’s inventory components as of March 31, 2024 and December 31, 2023, were as follows:

Schedule

of Inventory, Net

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

(in thousands) | |

| Finished goods | |

$ | 2,390 | | |

$ | 2,144 | |

| Raw materials | |

| 389 | | |

| 326 | |

| Total inventory | |

$ | 2,779 | | |

$ | 2,470 | |

Note

6 – Intangible Assets and Goodwill

Intangible

Assets

Intangible

assets as of March 31, 2024, and December 31, 2023 are set forth in the table below. Gross carrying values and accumulated amortization

of the Company’s intangible assets by type are as follows:

Schedule

of Intangible Assets

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

Cost | | |

Accumulated Amortization | | |

Net | | |

Cost | | |

Accumulated Amortization | | |

Net | |

| | |

(in thousands) | |

| Customer relationships | |

| 540 | | |

| (167 | ) | |

| 373 | | |

| 540 | | |

| (159 | ) | |

| 381 | |

| Total intangible assets | |

$ | 540 | | |

$ | (167 | ) | |

$ | 373 | | |

$ | 540 | | |

$ | (159 | ) | |

$ | 381 | |

The

Company recognized amortization expense of approximately $8,000 and $11,000 for the three months ended March 31, 2024 and March 31, 2023,

respectively. All were recognized in selling, general and administrative expenses on the accompanying condensed consolidated statement

of operations and comprehensive loss.

As

of March 31, 2024, future amortization expense for each of the next five years is (in thousands):

Schedule

of Future Amortization Expense

| Fiscal Years | |

| |

| 2024 (excluding the three months ended March 31, 2024) | |

| 24 | |

| 2025 | |

| 32 | |

| 2026 | |

| 32 | |

| 2027 | |

| 32 | |

| 2028 | |

| 32 | |

| 2029 | |

| 32 | |

Goodwill

Goodwill

had a carrying value on the Company’s consolidated balance sheets of $0.8 million at March 31, 2024 and December 31, 2023, respectively.

Note

7 – License and Supply Agreement, net

On

April 23, 2012, the Company entered into a License and Supply Agreement (as thereafter amended, the “License and Supply Agreement”)

with Medica S.p.A. (“Medica”), an Italy-based medical product manufacturing company, for the marketing and sale of certain

filtration products based upon Medica’s proprietary Medisulfone ultrafiltration technology in conjunction with the Company’s

filtration products, and for an exclusive supply arrangement for the filtration products. Under the License and Supply Agreement, Medica

granted to the Company an exclusive license, with right of sublicense, to market, promote, distribute, offer for sale and sell the filtration

products worldwide, with certain limitations on territory, during the term of the License and Supply Agreement. In addition, the Company

granted to Medica an exclusive license under the Company’s intellectual property to make the filtration products during the term

of the License and Supply Agreement. The filtration products covered under the License and Supply Agreement includes both certain products

based on Medica’s proprietary Versatile microfiber technology and certain filtration products based on Medica’s proprietary

Medisulfone ultrafiltration technology. In December 2023, the Company signed a new agreement with Medica which extends the term until

December 31, 2028, unless earlier terminated by either party in accordance with the terms of the License and Supply Agreement.

In

exchange for the license, the gross value of the intangible asset capitalized was $2.3 million. License and supply agreement, net, on

the consolidated balance sheet is $0.3 million as of March 31, 2024 and December 31, 2023, respectively. Accumulated amortization is

$2.0 million as of March 31, 2024 and December 31, 2023, respectively. The intangible asset is being amortized as an expense over the

life of the License and Supply Agreement. Amortization expense of approximately $14,000 and $33,000 was recognized in the three months

ended March 31, 2024 and 2023, respectively on the consolidated statement of operations and comprehensive loss.

As

of December 11, 2023, the Company contractually has agreed to pay interest per month at the EURIBOR 360-day rate plus 500 basis points

calculated on the principal amount of any outstanding invoices that are overdue by more than 15 days beyond the original payment terms.

There was no interest recognized for the three months ended March 31, 2024 or March 31, 2023.

In

addition, for the period beginning April 23, 2014 through December 31, 2023, the Company paid Medica a royalty rate of 3% of net sales

of the filtration products sold, subject to reduction as a result of a supply interruption pursuant to the terms of the License and Supply

Agreement. Approximately $96,000 for the three months ended March 31, 2023 was recognized as royalty expense and is included in cost

of goods sold on the consolidated statement of operations and comprehensive loss. Approximately $96,000 of this royalty expense was included

in accounts payable as of March 31, 2023.

Note

8 – Secured Note Payable

On

March 27, 2018, the Company entered into a Secured Promissory Note Agreement (the “Secured Note”) with Tech Capital for a

principal amount of $1.2 million. As of March 31, 2023, the principal balance of the Secured Note was paid off.

The

Secured Note had a maturity date of April 1, 2023. The unpaid principal balance accrued interest at a rate of 8% per annum. Principal

and interest payments were due on the first day of each month commencing on May 1, 2018. The Secured Note was subject to terms and conditions

of and was secured by security interests granted by the Company in favor of Tech Capital under the Loan and Security Agreement entered

into on August 17, 2017 and subsequently amended on December 20, 2019 (the “Loan Agreement”). An event of default under such

Loan Agreement was an event of default under the Secured Note and vice versa.

During

the three months ended March 31, 2023, the Company made payments under the Secured Note of approximately $71,000. Included in the total

payments made, approximately $1,000 was recognized as interest expense on the consolidated statement of operations and comprehensive

loss for the three months ended March 31, 2023.

Note

9 – Leases

The

Company has operating leases for corporate offices, warehouse space, an automobile, and office equipment. The leases have remaining lease

terms of 1 year to 5 years.

Lease

cost, as presented below, includes costs associated with leases for which right-of-use (“ROU”) assets have been recognized

as well as short-term leases.

The

components of total lease costs were as follows:

Schedule of Components of Lease Cost

| | |

Three months ended March 31, 2024 | | |

Three months ended March 31, 2023 | |

| | |

(in thousands) | |

| Operating lease cost | |

$ | 125 | | |

$ | 92 | |

| Finance lease cost: | |

| | | |

| | |

| Amortization of right-of-use assets | |

| 2 | | |

| 2 | |

| Interest on lease liabilities | |

| 1 | | |

| 1 | |

| Total finance lease cost | |

| 3 | | |

| 3 | |

| Variable lease cost | |

| 11 | | |

| 4 | |

| Total lease cost | |

$ | 139 | | |

$ | 99 | |

Supplemental

cash flow information related to leases was as follows:

Schedule of Supplemental Cash Flow Information Related to Leases

| |

Three months ended March 31, 2024 | | |

Three months ended March 31, 2023 | |

| | |

(in thousands) | |

| Cash paid for amounts included in the measurement of lease liabilities: | |

| | | |

| | |

| Operating cash flows from operating leases | |

$ | 158 | | |

$ | 87 | |

| Financing cash flows from finance leases | |

$ | 2 | | |

$ | 2 | |

Supplemental

balance sheet information related to leases was as follows:

Schedule of Supplemental Balance Sheet Information Related to Leases

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

(in thousands) | |

| Operating lease right-of-use assets | |

$ | 1,678 | | |

$ | 1,803 | |

| Finance lease right-of-use assets | |

$ | 2 | | |

$ | 4 | |

| | |

| | | |

| | |

| Current portion of operating lease liabilities | |

$ | 400 | | |

$ | 442 | |

| Operating lease liabilities, net of current portion | |

| 1,307 | | |

| 1,390 | |

| Total operating lease liabilities | |

$ | 1,707 | | |

$ | 1,832 | |

| | |

| | | |

| | |

| Current portion of finance lease liabilities | |

$ | 2 | | |

$ | 4 | |

| Finance lease liabilities, net of current portion | |

| - | | |

| - | |

| Total finance lease liabilities | |

$ | 2 | | |

$ | 4 | |

| | |

| | | |

| | |

| Weighted average remaining lease term | |

| | | |

| | |

| Operating leases | |

| 4.1 years | | |

| 4.3 years | |

| Finance leases | |

| 0.4 years | | |

| 0.6 years | |

| | |

| | | |

| | |

| Weighted average discount rate | |

| | | |

| | |

| Operating leases | |

| 8.0 | % | |

| 8.0 | % |

| Finance leases | |

| 8.0 | % | |

| 8.0 | % |

As

of March 31, 2024, maturities of lease liabilities were as follows:

Schedule of Maturities of Lease Liabilities

| | |

Operating Leases | | |

Finance Leases | |

| | |

(in thousands) | |

| 2024 (excluding the three months ended March 31, 2024) | |

$ | 404 | | |

$ | 2 | |

| 2025 | |

| 435 | | |

| - | |

| 2026 | |

| 450 | | |

| - | |

| 2027 | |

| 450 | | |

| - | |

| 2028 | |

| 251 | | |

| - | |

| Total future minimum lease payments | |

| 1,990 | | |

| 2 | |

| Less imputed interest | |

| (283 | ) | |

| - | |

| Total | |

$ | 1,707 | | |

$ | 2 | |

Note

10 – Stock Plans and Share-Based Payments

The

fair value of stock options and restricted stock is recognized as stock-based compensation expense in the Company’s consolidated

statement of operations and comprehensive loss. The Company calculates stock-based compensation expenses in accordance with ASC 718.

The fair value of stock-based awards is amortized over the vesting period of the award.

Stock

Options

During

the three months ended March 31, 2024, the Company did not grant stock options to purchase shares of common stock to employees.

Stock-based

compensation expense related to stock options was ($17,000)

and $179,000

for the three months ended March 31, 2024 and 2023, respectively. For the three months ended March 31, 2024, approximately ($18,000)

and $1,000

are included in selling, general and administrative expenses and research and development expenses, respectively, on the

accompanying consolidated statement of operations and comprehensive loss. The net credit to stock-based compensation expense for the

three months ended March 31, 2024 was due to the reversal of expense related to an immaterial error associated with the forfeiture

of unvested options for employee terminations that occurred in prior fiscal periods partially offset by stock based compensation

expense of approximately $58,000

related to unvested employee stock options. For the three months ended March 31, 2023, approximately $159,000

and $20,000

are included in selling, general and administrative expenses and research and development expenses, respectively, on the

accompanying consolidated statement of operations and comprehensive loss.

There

was no tax benefit related to expense recognized in the three months ended March 31, 2024 and 2023, as the Company is in a net operating

loss position. As of March 31, 2024, there was $579,000 of total unrecognized compensation expense related to unvested stock-based awards

granted under the equity compensation plans, which will be amortized over the weighted average remaining requisite service period of

2.8 years.

Restricted

Stock

Total

stock-based compensation expense for restricted stock on the Company’s consolidated statement of operations was approximately $8,000

and $13,000 for the three months ended March 31, 2024 and 2023, respectively. For the three months ended March 31, 2024 and 2023, approximately

$8,000 and $13,000, respectively, are included in selling, general and administrative expenses on the accompanying consolidated statement

of operations and comprehensive loss.

No

shares of restricted stock were issued during the three months ended March 31, 2024.During the three months ended March 31, 2023, 23,781

shares of restricted stock were issued to employees, 133,722 shares of restricted stock were issued to board members all related to services

rendered during the year ended December 31, 2022. In addition, 30,000 shares of restricted stock were issued to contractors during the

period ended March 31, 2023. All restricted shares issued during the three months ended March 31, 2023, have a vesting period of six

months.

As

of March 31, 2024, there was approximately $7,000 of unrecognized compensation expense related to unvested stock-based awards granted

under the equity compensation plans, which will be amortized over the weighted average remaining requisite service period of approximately

0.1 years.

The

aggregate shares of common stock legally issued and outstanding as of March 31, 2024 is greater than the aggregate shares of common stock

outstanding for accounting purposes by the amount of unvested restricted shares.

SRP

Equity Incentive Plan

SRP’s

2019 Equity Incentive Plan was approved on May 7, 2019 under which 150,000 shares of SRP’s common stock are reserved for the issuance

of options and other awards. This plan is no longer operational, due to the wind down of SRP’s operations and its April 2023 dissolution.

Due

to the Company’s acquisition of the non-controlling interest in SRP during the three months ended March 31, 2023, all remaining

equity-based awards have been forfeited and no further expense will be incurred related to these awards. There were no SRP stock options

or other equity awards granted during the three months ended March 31, 2023. For the three months ended March 31, 2023, a credit of approximately

($27,000) was recognized for expense related to the SRP equity-based awards. Stock-based compensation expense related to the SRP equity-based

awards is included in selling, general and administrative expenses on the accompanying consolidated statement of operations and comprehensive

loss.

Note

11 – Stockholders’ Equity

Noncontrolling

Interest

In

separate transactions in September 2018 and February 2022, SRP issued and sold an aggregate of 700,003 shares of its Series A Preferred

Stock for aggregate gross proceeds of approximately $3.5 million. Of such shares, the Company purchased 62,500 shares in the February

2022 transaction, maintaining a 62.5% ownership stake in SRP. Approximately $188,000 of the proceeds from the February 2022 sales were

recorded as an increase to the equity of the non-controlling interests. In addition to the Company’s purchase of Series A Preferred

Stock from SRP,, the Company also loaned to SRP the principal amount of $1.3 million, $1.0 million of which was advanced during the year

ended December 31, 2020.

In

March 2023, the board of directors of SRP adopted, and the stockholders of SRP approved, a plan to wind down SRP’s operations and

dissolve, and in April 2023, SRP filed a certificate of dissolution with the State of Delaware. In accordance with its plan of dissolution,

after SRP satisfied its other outstanding liabilities, SRP assigned to the Company all of its remaining assets, including its intellectual

property rights, in satisfaction of outstanding indebtedness owed to the Company in the approximate amount of $1.5 million. No other

assets are available for distribution to any of SRP’s stockholders, including the Company, in respect of their shares of SRP capital

stock, including the Series A Preferred. As a result of the dissolution described above, it was determined approximately $24,000 of inventory

likely had no value and was written off in the period ended March 31, 2023.

Note

12 – Net Loss per Common Share

Basic

loss per common share is calculated by dividing net loss available to common shareholders by the number of weighted average common shares

issued and outstanding. Diluted loss per common share is calculated by dividing net loss available to common shareholders by the weighted

average number of common shares issued and outstanding for the period, plus amounts representing the dilutive effect from the exercise

of stock options and warrants and unvested restricted stock, as applicable. The Company calculates dilutive potential common shares using

the treasury stock method, which assumes the Company will use the proceeds from the exercise of stock options and warrants to repurchase

shares of common stock to hold in its treasury stock reserves.

The

following potentially dilutive securities have been excluded from the computations of diluted weighted average shares outstanding as

they would be antidilutive:

Schedule

of Antidilutive Securities Excluded from Computation of Earnings Per Share

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Shares underlying options outstanding | |

| 1,591,622 | | |

| 1,420,564 | |

| Unvested restricted stock | |

| 42,167 | | |

| 187,503 | |

Note

13 – Commitments and Contingencies

Purchase

Commitments

In

exchange for the rights granted under the License and Supply Agreement with Medica (see Note 7 – License and Supply Agreement,

net), the Company agreed to make certain minimum annual aggregate purchases from Medica over the term of the License and Supply Agreement.

For the year ended December 31, 2024, the Company has agreed to make minimum annual aggregate purchases from Medica of €4.2 million

(approximately $4.6 million). As of March 31, 2024, the Company’s aggregate purchase commitments totaled €2.8 million (approximately

$3 million).

Contractual

Obligations

See

Note 9 – Leases for a discussion of the Company’s contractual obligations.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The

following discussion should be read in conjunction with our consolidated financial statements and notes thereto included in Item 1 of

Part I of this Quarterly Report on Form 10-Q. This discussion includes forward-looking statements about our business, financial condition

and results of operations including discussions about management’s expectations for our business. These statements represent projections,

beliefs and expectations based on current circumstances and conditions and in light of recent events and trends, and these statements

should not be construed either as assurances of performances or as promises of a given course of action. Instead, various known and unknown

factors are likely to cause our actual performance and management’s actions to vary, and the results of these variances may be

both material and adverse.

Business

Overview

We

are a commercial-stage company that develops and sells high performance water solutions to the medical and commercial markets.

Our

medical water filters, mostly classified as ultrafilters, are used primarily by hospitals for the prevention of infection from waterborne

pathogens, such as legionella and pseudomonas, and in dialysis centers for the removal of biological contaminants from water and bicarbonate

concentrate. Because our ultrafilters capture contaminants as small as 0.005 microns in size, they minimize exposure to a wide variety

of bacteria, viruses, fungi, parasites, and endotoxins.

Our

commercial water filters improve the taste and odor of water and reduce biofilm, cysts, particulates, and scale build-up in downstream

equipment. Our products are marketed primarily to the food service, hospitality, convenience store, and health care markets, and are

also sold into medical institutions to supplement our medical filters.

We

previously held a majority stake in Specialty Renal Products, Inc. (“SRP”), a development-stage medical device company that

was focused primarily on developing hemodiafiltration (“HDF”) technology. In May 2022, SRP received510(k) clearance from

the FDA for SRP’s second-generation model of the OLpūrH2H Hemodiafiltration System, which enables nephrologists to provide

HDF treatment to patients with end stage renal disease. In January 2023, SRP management began exploring strategic partnerships to support

a commercial launch of the HDF product but was unsuccessful in identifying a partner. By late February 2023, SRP had nearly exhausted

its capital resources and, due to its limited capital and lack of prospects for securing a strategic partnership or additional financing,

the board of directors of SRP adopted a plan on March 6, 2023 to wind down SRP operations, liquidate its remaining assets and dissolve

the company. That plan was approved by SRP’s stockholders on March 9, 2023, and on April 13, 2023, SRP filed a certificate of dissolution

with the State of Delaware. SRP’s cash resources were sufficient to satisfy all of its outstanding liabilities other than its obligations

to us under a loan with an outstanding balance of approximately $1.5 million. Accordingly, SRP assigned to Nephros all of its remaining

assets, including its intellectual property rights in the HDF2 device, in satisfaction of its outstanding loan balance. Although we have

no current plans to do so, we may re-evaluate opportunities for HDF in the future.

Our

Products

Water

Filtration Products

We

develop and sell water filtration products used in both medical and commercial applications. Our water filtration products employ multiple

filtration technologies, as described below.

In

medical markets, our primary filtration mechanism is to pass liquids through the pores of polysulfone hollow fiber. Our filters’

pores are significantly smaller than those of competing products, resulting in highly effective elimination of waterborne pathogens,

including legionella bacteria (the cause of Legionnaires disease) and viruses, which are not eliminated by most other microbiological

filters on the market. Additionally, the fiber structure and pore density in our hollow fiber enables significantly higher flow rates

than in other polysulfone hollow fiber.

Our

primary sales strategy in medical markets is to sell through value-added resellers (“VARs”). Leveraging VARs has enabled

us to rapidly expand our access to target customers with limited sales staff expansion. In addition, while we are currently focused on

medical markets, the VARs that support these customers also support a wide variety of commercial and industrial customers. We believe

that our VAR relationships have and will continue to facilitate growth in filter sales outside of the medical industry.

In

commercial markets, we develop and sell our filters, for which carbon-based absorption is the primary filtration mechanism. These products

allow us to improve water’s odor and taste, to reduce scale and heavy metals, and to reduce other water contaminants for customers

who are primarily in the food service, convenience store, and hospitality industries. These commercial products are also sold into medical

markets, as supplemental filtration to our medical filters.

In

commercial markets, our model combines both direct and indirect sales. Through our employee sales staff, have sold products directly

to a number of convenience stores, hotels, casinos, and restaurants. We have also signed an agreement with a partner to be the exclusive

distributor to resell select water filters and related products to customers in the commercial food and beverage markets subject to meeting

certain minimum thresholds.

Target

Markets

Our

ultrafiltration products currently target the following markets:

| |

● |

Hospitals

and Other Healthcare Facilities: Filtration of water for washing and drinking as an aid in infection control. The filters produce

water that is suitable for wound cleansing, cleaning of equipment used in medical procedures, and washing of surgeons’ hands. |

| |

● |

Dialysis

Centers and Home/Portable Dialysis Machines: Filtration of water or bicarbonate concentrate used in hemodialysis. |

| |

● |

Commercial

Facilities: Filtration and purification of water for consumption, including for use in ice machines and soft drink dispensers. |

| |

● |

Military

and Outdoor Recreation: Individual water purification devices used by soldiers and backpackers to produce drinking water in the field,

as well as filters customized to remote water processing systems. |

Hospitals

and Other Healthcare Facilities. Nephros filters are a leading tool used to provide proactive protection to patients in high-risk

areas (e.g., ice machines, surgical rooms, NICUs) and reactive protection to patients in broader areas during periods of water pathogen

outbreaks. Our products are used in hundreds of medical facilities to aid in infection control, both proactively and reactively.

As

of 2023, according to the American Hospital Association, there are approximately 6,129 hospitals in the U.S., with approximately 920,000

beds. Over 34 million patients were admitted to these hospitals. The U.S. Centers for Disease Control and Prevention (“CDC”)

estimates that healthcare associated infections (“HAI”) occur in approximately 1 out of every 31 hospital patients, which

calculates to over one million patients in 2023. HAIs affect patients in hospitals or other healthcare facilities and are not present

or incubating at the time of admission. They also include infections acquired by patients in the hospital or facility, but appearing

after discharge, and occupational infections among staff. Many HAIs are caused by waterborne bacteria and viruses that can thrive in

aging or complex plumbing systems often found in healthcare facilities.

In

January 2022, the Center for Clinical Standards and Quality at the Centers for Medicare and Medicaid Services (“CMS”) expanded

its requirements – originally implemented in 2017 – for facilities to develop policies and procedures that inhibit the growth

and spread of legionella and other opportunistic pathogens in building water systems. In this 2022 update, CMS requires teams to be assigned

to the development of formal water management plans (“WMPs”), as well as detailed documentation regarding the development

of the WMPs and their execution. CMS surveyors regularly review policies, procedures, and reports documenting water management implementation

results to verify that facilities are compliant with these requirements. We believe that these CMS regulations may have a positive impact

on the sale of our HAI-inhibiting ultrafilters.

We

currently have FDA 510(k) clearance on the following portfolio of medical device products for use in the hospital setting to aid in infection

control:

| ● |

The

DSU-H and SSU-H are in-line, 0.005-micron ultrafilters that provide dual- and single-stage protection, respectively, from waterborne

pathogens. They are primarily used to filter potable water feeding ice machines, sinks, and medical equipment, such as endoscope

washers and surgical room humidifiers. The DSU-H has an up to 6-month product life in a typical hospital setting, while the SSU-H

has an up to 3-month product life. |

| |

|

| ● |

The

S100 is a point-of-use, 0.01-micron microfilter that provides protection from waterborne pathogens. The S100 is primarily used to

filter potable water feeding sinks and showers. The S100 has an up to 3-month product life when used in a hospital setting. |

| |

|

| ● |

The

HydraGuardTM and HydraGuardTM - Flush are 0.005-micron cartridge ultrafilters that provide single-stage protection

from waterborne pathogens. The HydraGuard ultrafilters are primarily used to filter potable water feeding ice machines and medical

equipment, such as endoscope washers and surgical room humidifiers. The HydraGuard has an up to 6-month product life and the HydraGuard

- Flush has an up to 12-month product life when used in a hospital setting. |

Our

complete hospital infection control product line, including in-line, and point-of-use can be viewed on our website at https://www.nephros.com/infection-control/.

We are not including the information on our website as a part of, nor incorporating it by reference into, this Quarterly Report on Form

10-Q.

Dialysis

Centers - Water/Bicarbonate. In the dialysis water market, Nephros ultrafiltration products are among the highest performing

products on the market. The DSU-D, SSU-D and the SSUmini have become the standard endotoxin filter in many portable reverse osmosis systems.

The EndoPur®, our large-format ultrafilter targeted at dialysis clinic water systems, provides the smallest pore size

available.

To

perform hemodialysis, all dialysis clinics have dedicated water purification systems to produce water and bicarbonate concentrate, two

essential ingredients for making dialysate, the liquid that removes waste material from the blood. According to the National Institute

of Health, there are approximately 7,100 dialysis clinics in the United States servicing approximately 500,000 patients annually. We

estimate that there are over 100,000 hemodialysis machines in operation in the United States.

We

currently have FDA 510(k) clearance on the following portfolio of medical device products for use in the dialysis setting to aid in bacteria,

virus, and endotoxin retention:

| |

● |

The

DSU-D, SSU-D and SSUmini are in-line, 0.005-micron ultrafilters that provide protection from bacteria, viruses, and endotoxins. All

of these products have an up to 12-month product life in the dialysis setting and are used to filter water following treatment with

a reverse osmosis (“RO”) system, and to filter bicarbonate concentrate. These ultrafilters are primarily used in the

water lines and bicarbonate concentrate lines leading into dialysis machines, and as a polish filter for portable RO machines. |

| |

|

|

| |

● |

The

EndoPur is a 0.005-micron cartridge ultrafilter that provides single-stage protection from bacteria, viruses, and endotoxins. The

EndoPur has an up to 12-month product life in the dialysis setting and is used to filter water following treatment with an RO system.

More specifically, the EndoPur is used primarily to filter water in large RO systems designed to provide ultrapure water to an entire

dialysis clinic. The EndoPur is a cartridge-based, “plug and play” market entry that requires no plumbing at installation

or replacement. The EndoPur is available in 10”, 20”, and 30” configuration. |

Commercial

and Industrial Facilities. Our commercial NanoGuard® product line accomplishes ultrafiltration via small

pore size (0.005 micron) technology, filtering bacteria and viruses from water. In addition, our commercial filtration offerings include

technologies that are primarily focused on improving odor and taste and on reducing scale and heavy metals from filtered water.

Our

commercial market focus is on the hotel, restaurant, and convenience store markets. In March 2022, we entered into an agreement to provide

water filtration systems to an organization that services approximately 3,000 Quick Service Restaurants (“QSR”). Effective

January 1, 2023, we entered into a new supply agreement with this commercial partner, which superseded the March 2022 agreement. Under

the January 2023 agreement, we engaged this commercial partner to be our exclusive distributor to the food, beverage and hospitality

industries. We continue to pursue other national accounts, which, over time, may result in step-change increases in commercial market

revenue.

Over

time, we believe that the same water safety management programs currently underway at medical facilities may migrate to commercial markets.

As the epidemiology of waterborne pathogens expands, links to contamination sources will become more efficient and the data more readily

available. In cases where those sources are linked to restaurants, hotels, office buildings and residential complexes, the corporate

owners of those facilities will likely face increasing liability exposure. We expect that building owners will come to understand ASHRAE-188,

which outlines risk factors for buildings and their occupants, and provides water safety management guidelines. We believe, in time,

most commercial buildings will need to follow the basic requirements of ASHRAE-188: create a water management plan, perform routine testing,

and establish a plan to treat the building in the event of a positive test.

As

demand for water testing and microbiological filtration grows, we will be ready to deploy our expertise and solutions based on years

of experience servicing the medical market. We believe that we have an opportunity to offer unique expertise and products to the commercial

market, and that our future revenue from the commercial market could even surpass our infection control revenue.

We

currently market the following portfolio of proprietary products for use in the commercial, industrial, and food service settings:

| |

● |

The

NanoGuard set of products are in-line, 0.005-micron ultrafilter that provides dual-stage retention of any organic or inorganic particle

larger than 15,000 Daltons. NanoGuard products are designed to fit a variety of existing plumbing configurations, including 10”

and 20” standard housings, and Nephros and Everpure® manifolds. Included in the NanoGuard product line are both conventional

and flushable filters. |

| |

|

|

| |

● |

The