false

0000906709

0000906709

2025-03-12

2025-03-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

March 12, 2025

NEKTAR THERAPEUTICS

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

0-24006 |

|

94-3134940 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

455 Mission Bay Boulevard South

San Francisco, California 94158

(Address of Principal Executive Offices and

Zip Code)

Registrant’s telephone number, including

area code: (415) 482-5300

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

NKTR |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On

March 12, 2025, Nektar Therapeutics, a Delaware corporation (“Nektar”), issued a press release (the “Press Release”)

announcing its financial results for the quarter ended December 31, 2024. A copy of the Press Release is furnished herewith

as Exhibit 99.1.

The

information in this report, including the exhibit hereto, is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information

contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the Securities and Exchange

Commission made by Nektar, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

NEKTAR THERAPEUTICS |

| |

|

|

| Date: March 12, 2025 |

By: |

/s/ Mark A. Wilson |

| |

|

Mark A. Wilson |

| |

|

Chief Legal Officer and Secretary |

Exhibit 99.1

Nektar Therapeutics

Reports Fourth Quarter and Full Year 2024 Financial Results

SAN FRANCISCO, March 12, 2025 /PRNewswire/

-- Nektar Therapeutics (Nasdaq: NKTR) today reported financial results for the fourth quarter ended December 31, 2024.

Cash and investments in marketable securities

on December 31, 2024 were $269.1 million as compared to $329.4 million at December 31, 2023. Nektar’s cash and marketable securities

are expected to support strategic development activities and operations into the fourth quarter of 2026.

“The significant progress we made last year in advancing our immunology pipeline positions us for two value-creating data milestones

in 2025,” said Howard W. Robin, President and CEO of Nektar. “With enrollment now complete for the atopic dermatitis and alopecia

areata Phase 2b trials, we are on track to report topline data for rezpegaldesleukin in the second quarter and in the fourth quarter of

this year, respectively. This program is poised to emerge as the first T regulatory cell treatment option to help the millions of patients

battling these chronic autoimmune disorders.”

“We also made

progress on our preclinical immunology programs,” continued Robin. “We reported the first data for NKTR-0165, our novel antibody

targeting TNFR2, and unveiled a new bispecific antibody, NKTR-0166. We plan to submit the IND for NKTR-0165 in the second half of this

year.”

Summary of Financial Results

Revenue in the fourth quarter of 2024 was $29.2

million as compared to $23.9 million in the fourth quarter of 2023. Revenue for the year ended December 31, 2024 was $98.4

million as compared to $90.1 million in 2023.

Total operating costs and expenses in the

fourth quarter of 2024 were $14.8 million as compared to $57.4 million in the fourth quarter of 2023. Total operating

costs and expenses for the full year 2024 were $203.6 million as compared to $353.8 million in 2023. Operating costs

and expenses for both the fourth quarter and the full year 2024 decreased as compared to 2023 primarily due to a $40.4 million gain from

sale of the Huntsville manufacturing facility in 2024, as well as decreases in restructuring and impairment costs. Operating expenses

for the full year 2024 also decreased as compared to 2023 due to a one-time $76.5 million non-cash goodwill impairment recognized in the

first quarter of 2023.

R&D expense in the fourth quarter of 2024

was $28.7 million as compared to $29.9 million for the fourth quarter of 2023. R&D expense for the year ended December

31, 2024 was $120.9 million as compared to $114.2 million in 2023. R&D expense increased for full year 2024

primarily due to increases in development expenses for rezpegaldesleukin partially offset by decreases in employee and related facilities

costs, as well as development expenses for NKTR-255.

G&A expense was $17.1 million in

the fourth quarter of 2024 and $17.3 million in the fourth quarter of 2023. G&A expense for the full year 2024 was $76.8

million as compared to $77.4 million in 2023. G&A expense remained consistent for the full year 2024 as compared to

the full year 2023. Decreases in employee costs were offset by a reduction of facilities costs allocated to research and development expense

as well as an increase in commercial litigation expense.

Restructuring and impairment costs were $1.4

million in the fourth quarter of 2024 and $15.7 million in the full year 2024, as compared to $2.9 million in

the fourth quarter of 2023 and $52.0 million in the full year 2023. The full year 2024 amount includes $8.3 million in

non-cash lease impairment charges, and $7.4 million in other restructuring costs. The full year 2023 amount includes $7.9

million in severance expense, $35.3 million in non-cash lease impairment charges, and $8.8 million in other restructuring

costs.

Net income for the fourth quarter of 2024

was $7.3 million or $0.03 basic and diluted earnings per share as compared to a net loss of $42.1 million or $0.22

basic and diluted loss per share in the fourth quarter of 2023. Net loss for the year ended December 31, 2024 was $119.0

million or $0.58 basic and diluted loss per share as compared to a net loss of $276.1 million or $1.45 basic

and diluted loss per share in 2023. Excluding the $40.4 million gain from sale of the Huntsville manufacturing facility, and the $1.4

million in non-cash restructuring charges, net loss, on a non-GAAP basis, for the fourth quarter of 2024 was $31.8 million or $0.15 basic

and diluted loss per share. Excluding the $40.4 million gain from sale of the Huntsville manufacturing facility, and the $15.7 million in

non-cash restructuring and real estate impairment charges, net loss, on a non-GAAP basis, for the full year 2024 was $143.7 million or $0.70 basic

and diluted loss per share.

2024 and Recent Business Highlights

| ● | In

February 2025, Nektar announced completion of target enrollment in the REZOLVE-AA 84-patient

Phase 2b clinical trial of rezpegaldesleukin in severe-to-very severe alopecia areata. |

| ● | In

February 2025, Nektar announced a new clinical trial agreement with TrialNet, an international

clinical trial network at the forefront of diabetes research, to evaluate rezpegaldesleukin

in a 66-patient Phase 2 study with new onset type 1 diabetes mellitus. |

| ● | In

February 2025, the FDA granted Fast Track designation for rezpegaldesleukin for the treatment

of adult and pediatric patients 12 years of age and older with moderate-to-severe atopic

dermatitis whose disease is not adequately controlled with topical prescription therapies

or when those therapies are not advisable. |

| ● | In

January 2025, Nektar announced completion of target enrollment in the REZOLVE-AD 396-patient

Phase 2b clinical trial of rezpegaldesleukin in moderate-to-severe atopic dermatitis. |

| ● | At

the 66th Annual ASH Meeting in December 2024, Nektar presented proof-of-concept clinical

data showing that NKTR-255 following CD19-directed CAR-T therapy enhanced complete response

rates in patients with relapsed or refractory large B-cell lymphoma, with 73% of the NKTR-255

treatment group, compared to 50% of the placebo group, achieving a complete response at 6

months. |

| ● | At

the 2024 American College of Rheumatology (ACR) Convergence meeting in November 2024, Nektar

presented first preclinical data from its novel CSF-1 Program, NKTR-422. The program demonstrated

inflammation resolution and tissue repair in multiple preclinical models of chronic inflammatory

conditions. |

| ● | At

the Society for Immunotherapy of Cancer (SITC) Annual Meeting in November 2024, Nektar and

collaborators presented results from a planned interim analysis in the Phase 2 trial of NKTR-255

for the treatment of patients with radiation induced lymphopenia in locally advanced non-small

cell lung cancer. These results suggest that NKTR-255 effectively reversed radiation induced

lymphopenia in patients with locally advanced NSCLC receiving consolidation therapy with

durvalumab. The Phase 2 single-arm study is being conducted by MD Anderson. |

| ● | In

November 2024, Nektar announced a definitive agreement with Ampersand Capital Partners to

sell its commercial PEGylation manufacturing business in Huntsville, Alabama for $90 million

in enterprise value, which is comprised of $70 million in cash and $20 million in equity

ownership in the new portfolio company. Nektar and the new Ampersand portfolio company have

also entered into manufacturing supply agreements to meet Nektar’s PEG reagent needs

for rezpegaldesleukin and certain pipeline programs. |

| ● | In

October 2024, Nature Communications published results from Phase 1b studies of rezpegaldesleukin

in patients with moderate-to-severe atopic dermatitis or chronic plaque psoriasis. Data from

both trials demonstrate durable dose-dependent improvements in physician-assessed disease

activity and patient-reported outcomes. In the atopic dermatitis study, EASI improvement

of ≥75% and vIGA-AD responses were maintained for 36 weeks after treatment discontinuation

in 71% and 80% of week 12 responders. Biomarker analyses demonstrate plurality of Treg-mediated

pathways with potential effect on tissue resident memory T cell populations resulting in

sustained efficacy seen in the antigen challenged mouse model and in clinical trials. |

| ● | In

October 2024, Nektar announced publication in Blood of Phase 1 data showing that NKTR-255

in Combination with Autologous CD19-22 CAR-T cell therapy in patients with B-cell acute lymphoblastic

leukemia exhibited relapse-free/progression-free survival for 67% of patients at 12 months,

double that of historical controls. Eight of nine patients achieved complete remission, all

without detectable measurable residual disease. |

| ● | At

the European Alliance of Associations for Rheumatology (EULAR) in June 2024, Nektar presented

preclinical data on NKTR-0165, a TNFR2 agonist antibody, demonstrating selective enhancement

of Treg cell function through novel agonistic mechanism. IND-enabling studies are underway

for NKTR-0165 with first-in-human studies planned in first half of 2025. |

Conference Call to Discuss Fourth Quarter

2024 Financial Results

Nektar management will host a conference call

to review the results beginning at 5:00 p.m. Eastern Time/2:00 p.m. Pacific Time on March 12, 2025.

This press release and live audio-only webcast

of the conference call can be accessed through a link that is posted on the Home Page and Investors section of the Nektar website: http://ir.nektar.com/.

The web broadcast of the conference call will be available for replay through April 12, 2025.

To access the conference call, please pre-register

at Nektar Earnings Call Registration. All registrants will receive dial-in information and a PIN allowing them to access the live

call.

About Nektar

Therapeutics

Nektar Therapeutics is a clinical-stage

biotechnology company focused on developing treatments that address the underlying immunological dysfunction in autoimmune and chronic

inflammatory diseases. Nektar’s lead product candidate, rezpegaldesleukin (REZPEG, or NKTR-358), is a novel, first-in-class regulatory

T cell stimulator being evaluated in two Phase 2b clinical trials, one in atopic dermatitis and one in alopecia areata. Nektar’s pipeline

also includes a preclinical bivalent tumor necrosis factor receptor type II (TNFR2) antibody and bispecific programs, NKTR-0165 and NKTR-0166,

and a modified hematopoietic colony stimulating factor (CSF) protein, NKTR-422. Nektar, together with various partners, is also evaluating

NKTR-255, an investigational IL-15 receptor agonist designed to boost the immune system’s natural ability to fight cancer, in several

ongoing clinical trials. Nektar is headquartered in San Francisco, California. For further information, visit www.nektar.com and

follow Nektar on LinkedIn.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements which can be identified by words such as: “will,” “expect,” “develop,” “potential,”

“advance,” “plan,” and similar references to future periods. Examples of forward-looking statements include, among

others, statements regarding the therapeutic potential of, and future development plans for, rezpegaldesleukin, NKTR-0165, NKTR-0166,

NKTR-422, and NKTR-255. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are

based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, anticipated

events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control.

Our actual results may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any

of these forward-looking statements. Important factors that could cause our actual results to differ materially from those indicated in

the forward-looking statements include, among others: (i) our statements regarding the therapeutic potential of rezpegaldesleukin, NKTR-0165,

NKTR-0166, NKTR-422 and NKTR-255 are based on preclinical and clinical findings and observations and are subject to change as research

and development continue; (ii) rezpegaldesleukin, NKTR-0165, NKTR-0166, NKTR-422 and NKTR-255 are investigational agents and continued

research and development for these drug candidates is subject to substantial risks, including negative safety and efficacy findings in

future clinical studies (notwithstanding positive findings in earlier preclinical and clinical studies); (iii) rezpegaldesleukin, NKTR-0165,

NKTR-0166, NKTR-422 and NKTR-255 are in clinical development and the risk of failure is high and can unexpectedly occur at any stage prior

to regulatory approval; (iv) the timing of the commencement or end of clinical trials and the availability of clinical data may be delayed

or unsuccessful due to regulatory delays, slower than anticipated patient enrollment, manufacturing challenges, changing standards of

care, evolving regulatory requirements, clinical trial design, clinical outcomes, competitive factors, or delay or failure in ultimately

obtaining regulatory approval in one or more important markets; (v) a Fast Track designation does not increase the likelihood that rezpegaldesleukin

will receive marketing approval in the United States; (vi) patents may not issue from our patent applications for our drug candidates,

patents that have issued may not be enforceable, or additional intellectual property licenses from third parties may be required; and

(vii) certain other important risks and uncertainties set forth in our Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission on November 8, 2024. Any forward-looking statement made by us in this press release is based only on information

currently available to us and speaks only as of the date on which it is made. We undertake no obligation to update any forward-looking

statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or

otherwise.

For Investors:

Vivian Wu of Nektar Therapeutics

628-895-0661

For Media:

Madelin Hawtin

LifeSci Communications

603-714-2638

mhawtin@lifescicomms.com

NEKTAR THERAPEUTICS

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | |

December 31,

2024 | | |

December 31,

2023(1) | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 44,252 | | |

$ | 35,277 | |

| Short-term investments | |

| 210,974 | | |

| 268,339 | |

| Accounts receivable | |

| - | | |

| 1,205 | |

| Inventory, net | |

| - | | |

| 16,101 | |

| Other current assets | |

| 6,066 | | |

| 9,779 | |

| Total current assets | |

| 261,292 | | |

| 330,701 | |

| | |

| | | |

| | |

| Long-term investments | |

| 13,869 | | |

| 25,825 | |

| Property, plant and equipment, net | |

| 3,411 | | |

| 18,856 | |

| Operating lease right-of-use assets | |

| 8,413 | | |

| 18,007 | |

| Equity method investment in Gannet BioChem | |

| 12,218 | | |

| - | |

| Other assets | |

| 4,647 | | |

| 4,644 | |

| Total assets | |

$ | 303,850 | | |

$ | 398,033 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 11,560 | | |

| 9,848 | |

| Accrued expenses | |

| 29,972 | | |

| 22,162 | |

| Operating lease liabilities, current portion | |

| 19,868 | | |

| 19,259 | |

| Total current liabilities | |

| 61,400 | | |

| 51,269 | |

| | |

| | | |

| | |

| Operating lease liabilities, less current portion | |

| 82,696 | | |

| 98,517 | |

| Liabilities related to the sales of future royalties, net | |

| 91,776 | | |

| 112,625 | |

| Other long-term liabilities | |

| 7,241 | | |

| 4,635 | |

| Total liabilities | |

| 243,113 | | |

| 267,046 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock | |

| - | | |

| - | |

| Common stock | |

| 19 | | |

| 19 | |

| Capital in excess of par value | |

| 3,659,867 | | |

| 3,608,137 | |

| Treasury stock | |

| (3,000 | ) | |

| - | |

| Accumulated other comprehensive income (loss) | |

| 61 | | |

| 80 | |

| Accumulated deficit | |

| (3,596,210 | ) | |

| (3,477,249 | ) |

| Total stockholders’ equity | |

| 60,737 | | |

| 130,987 | |

| Total liabilities and stockholders’ equity | |

$ | 303,850 | | |

$ | 398,033 | |

| (1) | The consolidated balance sheet at December 31, 2023 has been

derived from the audited financial statements at that date but does not include all of the information and notes required by generally

accepted accounting principles in the United States for complete financial statements. |

NEKTAR THERAPEUTICS

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share information)

(Unaudited)

| | |

Three months ended

December 31, | | |

Year ended

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

| | |

| | |

| | |

| |

| Product sales | |

$ | 12,874 | | |

$ | 5,483 | | |

$ | 33,563 | | |

$ | 20,681 | |

| Non-cash royalty revenue related to the sales of future royalties | |

| 16,238 | | |

| 18,061 | | |

| 64,267 | | |

| 68,921 | |

| License, collaboration and other revenue | |

| 63 | | |

| 341 | | |

| 597 | | |

| 520 | |

| Total revenue | |

| 29,175 | | |

| 23,885 | | |

| 98,427 | | |

| 90,122 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 7,978 | | |

| 7,283 | | |

| 30,686 | | |

| 33,768 | |

| Research and development | |

| 28,744 | | |

| 29,942 | | |

| 120,908 | | |

| 114,162 | |

| General and administrative | |

| 17,135 | | |

| 17,320 | | |

| 76,751 | | |

| 77,417 | |

| Restructuring and impairment | |

| 1,360 | | |

| 2,851 | | |

| 15,670 | | |

| 51,958 | |

| Impairment of goodwill | |

| - | | |

| - | | |

| - | | |

| 76,501 | |

| Gain on sale of the Huntsville manufacturing facility | |

| (40,390 | ) | |

| - | | |

| (40,390 | ) | |

| - | |

| Total operating costs and expenses | |

| 14,827 | | |

| 57,396 | | |

| 203,625 | | |

| 353,806 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income/(Loss) from operations | |

| 14,348 | | |

| (33,511 | ) | |

| (105,198 | ) | |

| (263,684 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating income (expense): | |

| | | |

| | | |

| | | |

| | |

| Non-cash interest expense on liabilities related to the sales of future royalties | |

| (10,153 | ) | |

| (6,867 | ) | |

| (28,112 | ) | |

| (25,334 | ) |

| Interest income | |

| 2,942 | | |

| 4,617 | | |

| 14,500 | | |

| 19,009 | |

| Other income (expense), net | |

| (135 | ) | |

| (6,347 | ) | |

| (390 | ) | |

| (6,247 | ) |

| Total non-operating income (expense), net | |

| (7,346 | ) | |

| (8,597 | ) | |

| (14,002 | ) | |

| (12,572 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income/(Loss) before provision for income taxes | |

| 7,002 | | |

| (42,108 | ) | |

| (119,200 | ) | |

| (276,256 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision (benefit) for income taxes | |

| (259 | ) | |

| (29 | ) | |

| (239 | ) | |

| (200 | ) |

| Net Income/(loss) | |

$ | 7,261 | | |

$ | (42,079 | ) | |

$ | (118,961 | ) | |

$ | (276,056 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net income/(loss) per share | |

$ | 0.03 | | |

$ | (0.22 | ) | |

$ | (0.58 | ) | |

$ | (1.45 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding used in computing net income/(loss) per share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 209,737 | | |

| 191,040 | | |

| 205,661 | | |

| 190,001 | |

| Diluted | |

| 213,594 | | |

| 191,040 | | |

| 205,661 | | |

| 190,001 | |

7

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

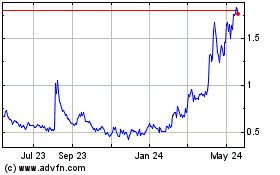

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Feb 2025 to Mar 2025

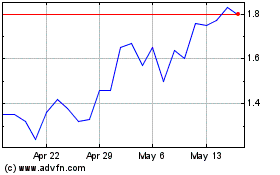

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Mar 2024 to Mar 2025