Form 8-K - Current report

September 12 2023 - 5:02AM

Edgar (US Regulatory)

false000140170800014017082023-09-122023-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 12, 2023

_______________________________

NanoString Technologies, Inc.

(Exact name of registrant as specified in its charter)

________________________________

| | | | | | | | |

| Delaware | 001-35980 | 20-0094687 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

530 Fairview Avenue North

Seattle, Washington 98109

(Address of principal executive offices, including zip code)

(206) 378-6266

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | NSTG | The NASDAQ Stock Market LLC |

| | (The NASDAQ Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act). ¨

Item 7.01 Regulation FD Disclosure.

Starting on September 12, 2023, members of management of NanoString Technologies, Inc. (the “Company”) will be engaging in one-on-one discussions with analysts and investors and presenting at the Morgan Stanley Global Healthcare Conference and Baird Global Healthcare Conference. A copy of the Company’s corporate presentation to be used in these discussions and presentations is attached as Exhibit 99.1 to this report.

The Company announces material information to the public through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, the Company’s website (www.nanostring.com), its investor relations website (investors.nanostring.com), and its news site (investors.nanostring.com/press-releases). The Company uses these channels, as well as social media, including its Twitter account (@nanostringtech), LinkedIn account (www.linkedin.com/company/nanostring-technologies), and Facebook page (www.facebook.com/NanoStringTechnologies), to communicate with investors and the public about the Company, its products, and other matters. Therefore, the Company encourages investors, the media, and others interested in the Company to review the information it makes public in these locations, as such information could be deemed to be material information.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

The information furnished in this Current Report on Form 8-K and Exhibit No. 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | NanoString Technologies, Inc. |

| | | |

| Date: | September 12, 2023 | By: | /s/ R. Bradley Gray |

| | | R. Bradley Gray |

| | | President and Chief Executive Officer |

The image part with relationship ID rId2 was not found in the file. Morgan Stanley Global Healthcare Conference Baird Global Healthcare Conference September 12 and 13, 2023

This presentation and the accompanying oral commentary contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding expectations about the future of our business, including demand for our products and growth in our business, future revenue growth, future operating results, the outcome of litigation and the potential impact of litigation on our business, the impact of new and potential products and technology, our anticipated Q3 and 2023 full year operating results, and our ability to refinance our convertible debt. Such statements are based on current assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties, many of which are beyond our control, include market acceptance of our products; the extent and duration of adverse conditions in the general domestic and global economic markets; the effects of ongoing litigation; the availability of debt refinancing; the impact of competition; the impact of expanded sales, marketing, and product development activities on operating expenses; delays or other unforeseen problems with respect to manufacturing and product development; as well as the other risks set forth in our filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof. NanoString Technologies disclaims any obligation to update these forward-looking statements. Forward-Looking Statements 2

In addition to our results reported in accordance with U.S. generally accepted accounting principles (“GAAP”), we believe certain non-GAAP, or adjusted, measures are useful in evaluating our operating performance. We use adjusted financial measures to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that adjusted financial measures, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. However, adjusted financial information has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with U.S. GAAP. In particular, other companies, including companies in our industry, may calculate similarly titled non-GAAP or adjusted measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our adjusted financial measures as tools for comparison. Investors are cautioned that there are a number of limitations associated with the use of non-GAAP, or adjusted, financial measures as analytical tools. Investors are encouraged to review the related U.S. GAAP financial measures and the reconciliation of these adjusted financial measures to their most directly comparable U.S. GAAP financial measure, and not to rely on any single financial measure to evaluate our business. Notes Regarding Non-GAAP Financial Information 3

4 1. Business Trends 2. Patent Litigation 3. Financing Addressing Three Areas of Investor Focus Strong with FY23 revenue outlook independent of the outcome of ongoing UPC litigation Confident in the strengths of our legal defenses Progress toward refinancing convertible debt on terms that we expect will benefit shareholders

Business Trends: Momentum Remains Intact ● Continuing to receive numerous CosMx orders in Q3, with overwhelming majority of demand from North America and APAC ● CosMx order cancellation rate unchanged from Q2: <3% of order book ● Annual revenue guidance unchanged from guidance provided on August 3, 2023: $175 to $185 million o nCounter and Service: $75 to $80 million, positive Adjusted EBITDA (1) contribution o Spatial Biology: $100 to $105 million, over 100% year-over-year growth 5 (1) Adjusted EBITDA is a non-GAAP financial measure defined as GAAP net loss adjusted for stock-based compensation expense, depreciation and amortization, net interest expense, net other expense, provision for income tax, litigation expenses and other special items as may be determined by management. A reconciliation of certain adjusted measures, including Adjusted EBITDA, to corresponding GAAP measures is not available without unreasonable effort due to the uncertainty regarding certain expenses that may be incurred in the future, and we are also unable to predict the probable significance of such adjusted guidance measures. Accordingly, in reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, we have not provided a reconciliation for adjusted guidance measures provided in this presentation. For further information regarding why we believe that these adjusted measures provide useful information to investors, the specific manner in which management uses these measures and some of the limitations associated with the use of these measures, please refer to “Notes Regarding Non-GAAP Financial Information” at the beginning of this presentation.

Patent Litigation: Perspectives ● Multi-step process, playing out over months and years ● Variety of possible outcomes across diverse jurisdictions; not binary ● Multi-layered defense not reliant on a single issue with arguments as follows: o Non-infringement of asserted claims o Invalidity of asserted patents o Injunctive relief not appropriate o Unclean hands re: NIH grant and Harvard license o Antitrust claims and unfair competition violations being considered in U.S. 6

Patent Litigation: Sept 5th & 6th UPC Hearing Summary ● September 5 and 6 hearing: arguments heard before European Unified Patent Court (UPC) ● Focus: request by 10x and Harvard for preliminary injunction related to claims under European Patent 4108782B1 (the “782 Patent”) with respect to CosMx for RNA detection ● Issues considered: o Validity of 782 Patent claims o Claim interpretation o Appropriateness of injunctive relief: weighing of interests, risks that could result if granted ● Conclusion: we expect a decision to be issued regarding the 782 Patent following a hearing on September 19 to consider a preliminary injunction request by 10x and Harvard relating to European Patent 2794928B1 (the “928 Patent”) 7

Patent Litigation: Procedural Differences by Jurisdiction Germany UPC U.S Simultaneous invalidity and infringement proceedings? No. Infringement ruling may come ~1 year before a ruling on invalidity Yes. Infringement and invalidity are evaluated together Yes. Infringement and invalidity are evaluated together Technical Training of Judges / Use of Jury Technically trained judges not utilized for infringement proceeding, but are utilized for the invalidity proceeding Technically trained judges are utilized in the combined proceeding; panel of judges v. individual judge Jury trial, individual judge Approach to injunctive relief Injunction is the standard form of relief if infringement is found. No perceptible effect of courts’ more recent ability to apply “proportionality” analysis UPC has discretion to balance the potential harm to the parties from the granting or refusal of the injunction, but no precedent available yet Injunctions require plaintiff to show (1) monetary damages are insufficient, (2) balancing of hardships favors injunction, and (3) injunction not counter to public interest 8

65 60 14 11 North America APAC EMEA Total of ~150 CosMx Orders Representing ~$35M Revenue Patent Litigation: Limited Current Exposure in UPC Jurisdictions UPC Jurisdiction* Exposure ● ~ 7% of order backlog at Q2:23 ● ~ 3% of total NSTG H2:23 revenue 9 UPC* Non-UPC Regional Distribution of CosMx Instrument Order Backlog at End of Q2’23 Orders * Includes Germany

Financing: Convertible Debt and Key Business Metrics ● Active discussions to refinance Company’s convertible debt ● Parties assessing valuation, relative risk of NSTG product lines individually ● Credit foundation: stable, nCounter business with positive Adjusted EBITDA (1) ● Substantial upside potential: growth and market leadership of Spatial Biology franchise 10 (1) Adjusted EBITDA is a non-GAAP financial measure defined as GAAP net loss adjusted for stock-based compensation expense, depreciation and amortization, net interest expense, net other expense, provision for income tax, litigation expenses and other special items as may be determined by management. A reconciliation of certain adjusted measures, including Adjusted EBITDA, to corresponding GAAP measures is not available without unreasonable effort due to the uncertainty regarding certain expenses that may be incurred in the future, and we are also unable to predict the probable significance of such adjusted guidance measures. Accordingly, in reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, we have not provided a reconciliation for adjusted guidance measures provided in this presentation. For further information regarding why we believe that these adjusted measures provide useful information to investors, the specific manner in which management uses these measures and some of the limitations associated with the use of these measures, please refer to “Notes Regarding Non-GAAP Financial Information” at the beginning of this presentation.

Financing: nCounter is Profitable, Spatial Biology is High Growth 21.1 20.9 10.9 23.3 Q2'22 Q2'23 Revenue, Q2’23 vs. Q2’22 $ millions 32.0 nCounter Spatial 44.2 Anticipated Adjusted EBITDA(1) margin FY:23 Percent revenue +30% (90%) Growth Q2:23 Percent YOY (1%) +113% (40%)+37% 11 (1) Adjusted EBITDA is a non-GAAP financial measure defined as GAAP net loss adjusted for stock-based compensation expense, depreciation and amortization, net interest expense, net other expense, provision for income tax, litigation expenses and other special items as may be determined by management. A reconciliation of certain adjusted measures, including Adjusted EBITDA, to corresponding GAAP measures is not available without unreasonable effort due to the uncertainty regarding certain expenses that may be incurred in the future, and we are also unable to predict the probable significance of such adjusted guidance measures. Accordingly, in reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, we have not provided a reconciliation for adjusted guidance measures provided in this presentation. For further information regarding why we believe that these adjusted measures provide useful information to investors, the specific manner in which management uses these measures and some of the limitations associated with the use of these measures, please refer to “Notes Regarding Non-GAAP Financial Information” at the beginning of this presentation.

Financing: Comparison to Life Sciences Peer Companies $180 $78 $103 $97 $207 $212 $256 $101 $116 $195 $188 0 50 100 150 200 250 NSTG nCounter franchise Spatial franchise AKYA ADPT CTKB TWST LAB QTRX OLK PACB 2023E Revenue(1) ($M) 2.4 1.8 1.9 2.8 3.0 3.6 4.6 5.3 9.0 14.2 - 5.0 10.0 15.0 NSTG nCounter franshise alone Spatial franchise alone AKYA ADPT CTKB TWST LAB QTRX OLK PACB Ratio of TEV(2) / 2023E Revenue 12 1.0 (1) NSTG 2023E revenue equal to midpoint of guidance ranges. Peer company 2023E revenue represent current Wall Street consensus estimates. (2) Total Enterprise Value, or TEV, equals market capitalization, less cash, cash equivalents and short-term investments, plus the book value of debt, net non-operating liabilities and preferred stock as of 6/30/23. SOURCE: NSTG financial advisors, public filings and Wall Street consensus estimates for 2023E revenue.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

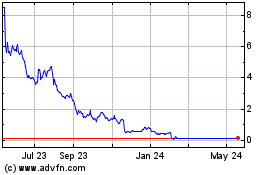

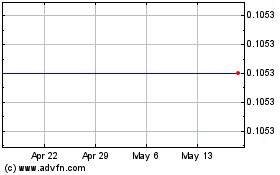

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From Apr 2024 to May 2024

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From May 2023 to May 2024