FALSE000107807500010780752024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

October 24, 2024

Date of Report (date of earliest event reported)

___________________________________

NETSCOUT SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 000-26251 (Commission File Number) | 04-2837575 (I.R.S. Employer Identification Number) |

310 Littleton Road Westford, MA 01886 |

(Address of principal executive offices and zip code) |

(978) 614-4000 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| CommonStock | NTCT | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

The following information and the Exhibit 99.1 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

On October 24, 2024, NetScout Systems, Inc. (the "Company") issued a press release regarding its financial results for the second quarter of fiscal year 2025 ended September 30, 2024, its expectations of future performance and its intention to hold a conference call regarding these topics. The Company's press release is furnished as Exhibit 99.1 to this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The Company hereby furnishes the following exhibit:

| | | | | |

Exhibit Number | Description |

| Press release dated October 24, 2024. |

104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 24th day of October, 2024.

| | | | | |

| NETSCOUT SYSTEMS, INC. |

| |

By: | /s/ Jean Bua |

Name: | Jean Bua |

Title: | Executive Vice President and Chief Financial Officer |

NETSCOUT Reports Second Quarter Fiscal Year 2025 Financial Results

WESTFORD, Mass., October 24, 2024 – NETSCOUT SYSTEMS, INC. (NASDAQ: NTCT), a leading provider of enterprise performance management, carrier service assurance, cybersecurity, and DDoS protection solutions, today announced financial results for its second quarter ended September 30, 2024.

Remarks by Anil Singhal, NETSCOUT’s President & Chief Executive Officer:

“We delivered Q2 fiscal year 2025 revenue and earnings results in line with our expectations and continued to position NETSCOUT to win in the market. During the quarter, we released several product enhancements aligned with key technology trends that help address our customers’ cybersecurity and service assurance needs, including our AI-ready data solution. We had a strong turnout and interest at our recent annual ENGAGE Technology and User Summit that we attribute to our customers’ enthusiasm for our current and upcoming portfolio of solutions.”

“Looking ahead, we remain focused on executing against our full fiscal year 2025 expectations as we navigate the opportunities and challenges of the current market environment. Our priorities remain enhancing our cybersecurity offerings to meet growing customer needs given the expanding cyber threat landscape and continuing to prudently manage costs. Longer term, we are committed to leveraging our ‘Visibility Without Borders’ platform to help customers address the performance, availability, and security challenges of the complex digital world.”

Q2 FY25 Financial Results

Total revenue (GAAP and non-GAAP) for the second quarter of fiscal year 2025 was $191.1 million, compared with $196.8 million (GAAP and non-GAAP) in the second quarter of fiscal year 2024. A reconciliation of all GAAP and non-GAAP results are included in the financial tables below.

Product revenue (GAAP and non-GAAP) for the second quarter of fiscal year 2025 was $81.0 million, or approximately 42% of total revenue in the period. This compares with product revenue (GAAP and non-GAAP) of $80.5 million in the second quarter of fiscal year 2024, which was approximately 41% of total revenue in the period.

Service revenue (GAAP and non-GAAP) for the second quarter of fiscal year 2025 was $110.1 million, or approximately 58% of total revenue in the period. This compares with service revenue (GAAP

and non-GAAP) of $116.3 million in the second quarter of fiscal year 2024, which was approximately 59% of total revenue for the period.

NETSCOUT’s income from operations (GAAP) was $14.1 million in the second quarter of fiscal year 2025, which included a restructuring charge of $2.4 million. This compares with income from operations (GAAP) of $26.3 million in the second quarter of fiscal year 2024. The Company’s operating margin (GAAP) was 7.4% in the second quarter of the fiscal year, versus 13.4% in the same period of fiscal year 2024. Non-GAAP income from operations was $44.1 million with a non-GAAP operating margin of 23.1% in the second quarter of fiscal year 2025. This compares to non-GAAP income from operations of $55.2 million and a non-GAAP operating margin of 28.0% in the second quarter of fiscal year 2024. Non-GAAP EBITDA from operations in the second quarter of fiscal year 2025 was $47.5 million, or 24.9% of non-GAAP quarterly revenue for the period. This compares to non-GAAP EBITDA from operations of $59.9 million in the second quarter of fiscal year 2024, or 30.5% of non-GAAP quarterly revenue for the period.

Net income (GAAP) for the second quarter of fiscal year 2025 was $9.0 million, or $0.13 per share (diluted), which included the restructuring charge mentioned above and an unrealized loss on a foreign investment, versus a net income (GAAP) of $21.5 million, or $0.29 per share (diluted), for the second quarter of fiscal year 2024. On a non-GAAP basis, net income for the second quarter of fiscal year 2025 was $33.6 million, or $0.47 per share (diluted), which includes the unrealized loss on a foreign investment mentioned above. This compares with $44.5 million, or $0.61 per share (diluted), for the second quarter of fiscal year 2024.

As of September 30, 2024, cash, cash equivalents, short and long-term marketable securities and investments were $401.9 million, compared with $424.1 million as of March 31, 2024. During the second quarter of fiscal year 2025, NETSCOUT repurchased a total of 14,305 shares of its common stock at an average price of $18.00 per share for an aggregate purchase price of approximately $0.3 million. At the end of the second quarter, NETSCOUT had $75.0 million outstanding on its revolving credit facility. On October 4, 2024, NETSCOUT leveraged the favorable financing market environment to amend and extend its revolving credit facility. The amended revolving credit facility reduces the facility size from $800 million to $600 million and extends the maturity from July 2026 to October 2029, maintaining financial flexibility and lowering financing costs.

First-Half FY25 Financial Results

•For the first half of fiscal year 2025, total revenue (GAAP and non-GAAP) was $365.7 million, versus total revenue (GAAP and non-GAAP) of $407.9 million in the first half of fiscal year 2024. A reconciliation of GAAP and non-GAAP results is included in the financial tables below.

•Product revenue (GAAP and non-GAAP) for the first half of fiscal year 2025 was $142.2 million, compared with $175.2 million in the first half of fiscal year 2024.

•Service revenue (GAAP and non-GAAP) for the first half of fiscal year 2025 was $223.5 million, compared with $232.7 million in the first half of fiscal year 2024.

•NETSCOUT’s loss from operations (GAAP) for the first half of fiscal year 2025 was $449.2 million, which includes a non-cash goodwill impairment charge of $427.0 million taken in the first quarter of fiscal year 2025 and restructuring charges of $19.0 million. This compared with income from operations (GAAP) of $21.6 million in the first half of fiscal year 2024. The Company’s operating margin (GAAP) for the first half of fiscal year 2025 was -122.8%, versus 5.3% in the first half of fiscal year 2024. The Company’s non-GAAP EBITDA from operations for the first half of fiscal year 2025 was $65.3 million, or 17.9% of non-GAAP total revenue, versus non-GAAP EBITDA from operations of $94.6 million, or 23.2% of non-GAAP total revenue, in the first half of fiscal year 2024. The Company’s non-GAAP income from operations for the first half of fiscal year 2025 was $58.1 million with a non-GAAP operating margin of 15.9%, compared with non-GAAP income from operations of $84.8 million and a non-GAAP operating margin of 20.8% for the first half of fiscal year 2024.

•For the first half of fiscal year 2025, NETSCOUT’s net loss (GAAP) was $434.3 million, or ($6.08) per share (diluted), which includes the non-cash goodwill impairment and restructuring charges mentioned above. This compared with net income (GAAP) of $17.3 million, or $0.24 per share (diluted), in the first half of fiscal year 2024. Non-GAAP net income for the first half of fiscal year 2025 was $54.1 million, or $0.75 per share (diluted), compared with non-GAAP net income of $67.3 million, or $0.92 per share (diluted), for the first half of fiscal year 2024.

Financial Outlook

The Company’s GAAP net loss per share outlook for fiscal year 2025 has been updated to reflect the latest restructuring charge related to the Company’s Voluntary Separation Program (VSP). The fiscal year 2025 outlook for revenue and non-GAAP net income per share remains unchanged from previous guidance. The Company’s outlook for fiscal year 2025 is as follows:

▪Revenue (GAAP and non-GAAP) expectations remain in the range of $800 million to $830 million.

▪GAAP net loss per share (diluted) is now expected to be in the range of ($5.22) to ($5.01), primarily attributable to goodwill impairment and restructuring charges taken in the first half of fiscal year 2025, as well as restructuring charges anticipated for the third quarter of fiscal year 2025. This compares to the previous GAAP net loss per share range of ($5.28) to ($5.03). Non-GAAP net income per share (diluted) expectations remain in the range of $2.10 to $2.30.

▪A reconciliation between GAAP and non-GAAP numbers for NETSCOUT’s fiscal year 2025 outlook is included in the financial tables below.

As previously announced in the first quarter of fiscal year 2025, NETSCOUT initiated a Voluntary Separation Program (VSP) as part of its restructuring efforts for fiscal year 2025. The VSP is expected to result in a net reduction of approximately 145 employees, which represents approximately 6.3% of its

workforce as of March 31, 2024. In conjunction with the VSP, the Company recorded a restructuring charge of $19.0 million in the first half of fiscal year 2025. The Company expects to record an additional restructuring charge of approximately $0.6 million in the third quarter of fiscal year 2025 primarily for severance costs associated with the remaining implementation of the VSP. The Company expects that these actions will generate net annual run-rate savings of approximately $25 million, of which $19 million will be realized in fiscal year 2025. The charges are factored into NETSCOUT's GAAP guidance provided above, and anticipated partial-year net benefits for fiscal year 2025 are included in both GAAP and non-GAAP expectations.

Recent Developments and Highlights

▪In early October 2024, NETSCOUT held its annual technology and user summit, ENGAGE 2024, in Arlington, TX, where event registration and attendance increased year over year. At the event, NETSCOUT showcased its "Visibility Without Borders" platform demonstrating its cybersecurity and service assurance capabilities, including new AI-ready data, and hosted a combination of presentations, panel discussions, and hands-on trainings.

▪In early October 2024, NETSCOUT released findings from its 1H2024 DDoS Threat Intelligence Report, citing a dramatic 43% increase in the number of application-layer attacks and a 30% increase in volumetric attacks, especially in Europe and the Middle East. The escalation of attacks involves a range of threat actors, including hacktivists targeting critical infrastructure in the banking and financial services, government, and utilities sectors. These key industries experienced a 55% increase in attacks over the past four years.

▪In late September 2024, NETSCOUT announced enhancements to its nGenius Enterprise Performance Management solution, which includes a new notification center that helps streamline and automate alerts and contextual workflows to identify and resolve problems faster. Secured Reliable Transport (SRT) was added to support live video streaming, and additional supervisory control and data acquisition (SCADA) protocols were added to support international utility networks.

▪In mid-September 2024, NETSCOUT announced updates to its advanced, scalable deep packet inspection-based Omnis Cyber Intelligence Network Detection and Response (NDR) platform. The new MITRE ATT&CK behavioral analytics enable earlier detection of advanced threats like ransomware, suspicious traffic, or unauthorized access attempts while improving remediation to help meet industry and country compliance requirements.

▪In mid-August 2024, NETSCOUT introduced its Omnis AI Insights solution to deliver precise, actionable network telemetry data to feed customer AI initiatives and enable critical outcomes without requiring data transformations and adaptations. Omnis AI Insights benefits include: identifying and correlating observability trends, streamlining and automating data analysis, uncovering historical operational patterns, and detecting unforeseen issues and security risks that could lead to future service outages and data breaches.

Conference Call Instructions:

NETSCOUT will host a conference call to discuss its second-quarter fiscal year 2025 financial results and financial outlook today at 8:30 a.m. ET. This call will be webcast live through NETSCOUT’s website at https://ir.netscout.com/investors/overview/default.aspx. Alternatively, investors can listen to the call by dialing (203) 518-9708. The conference call ID is NTCTQ225. A replay of the call will be available after 12:00 p.m. ET today, for approximately one week. The number for the replay is (800) 839-2457 for U.S./Canada and (402) 220-7217 for international callers.

Use of Non-GAAP Financial Information:

To supplement the financial measures presented in NETSCOUT's press release in accordance with accounting principles generally accepted in the United States (GAAP), NETSCOUT also reports the following non-GAAP measures: non-GAAP gross profit, non-GAAP income from operations, non-GAAP operating margin, non-GAAP net income, non-GAAP diluted net income per share, and non-GAAP earnings before interest and other expense, income taxes, depreciation, and amortization (Non-GAAP EBITDA) from operations. Non-GAAP gross profit removes expenses related to the amortization of acquired intangible assets, share-based compensation expense, and acquisition-related depreciation expense. Non-GAAP income from operations includes the aforementioned adjustments and also removes the legal (benefit) expense related to civil judgments, restructuring charges and goodwill impairment charges. Non-GAAP operating margin includes the foregoing adjustments related to non-GAAP income from operations. Non-GAAP net income includes the foregoing adjustments related to non-GAAP income from operations, and also removes change in fair value of derivative instruments, net of related income tax effects. Non-GAAP diluted net income per share includes the foregoing adjustments related to non-GAAP net income. Non-GAAP EBITDA from operations includes the aforementioned items related to non-GAAP income from operations and also removes non-acquisition related depreciation expense. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures included in the attached tables within this press release.

These non-GAAP measures are not in accordance with GAAP, should not be considered an alternative for measures prepared in accordance with GAAP (gross profit, operating margin, net income, and diluted net income per share), and may have limitations because they do not reflect all NETSCOUT’s results of operations as determined in accordance with GAAP. These non-GAAP measures should only be used to evaluate NETSCOUT’s results of operations in conjunction with the corresponding GAAP measures. The presentation of non-GAAP information is not meant to be considered superior to, in isolation from, or as a substitute for results prepared in accordance with GAAP. NETSCOUT believes these non-GAAP financial measures will enhance the reader’s overall understanding of NETSCOUT’s current financial performance and NETSCOUT's prospects for the future by providing a higher degree of transparency for certain financial measures and providing a level of disclosure that helps investors understand how the Company plans and measures its own business. NETSCOUT believes that providing these non-GAAP measures affords investors a view of NETSCOUT’s operating results that may be more easily compared to peer companies and also enables investors to consider NETSCOUT’s operating results on both a GAAP and non-GAAP basis during and following the integration period of NETSCOUT’s acquisitions. Presenting the GAAP measures on their own, without the supplemental non-GAAP disclosures, might not be indicative of NETSCOUT’s core operating results. Furthermore, NETSCOUT believes that the presentation of non-GAAP measures when shown in conjunction with the corresponding GAAP measures provides useful information to management and investors regarding present and future business trends relating to its financial condition and results of operations.

NETSCOUT management regularly uses supplemental non-GAAP financial measures internally to understand, manage and evaluate its business and to make operating decisions. These non-GAAP measures are among the primary factors that management uses in planning and forecasting.

About NETSCOUT SYSTEMS, INC.

NETSCOUT SYSTEMS, INC. (NASDAQ: NTCT) protects the connected world from cyberattacks and performance and availability disruptions through the company’s unique visibility platform and solutions powered by its pioneering deep packet inspection at scale technology. NETSCOUT serves the world’s largest enterprises, service providers, and public sector organizations. Learn more at www.netscout.com or follow @NETSCOUT on LinkedIn, Twitter, or Facebook.

Safe Harbor

Certain information provided in this press release includes forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Examples of forward-looking statements include statements regarding our future financial performance or position, results of operations, business strategy, plans and objectives of management for future operations, and other statements that are not historical fact. You can identify forward-looking statements by their use of forward-looking words such as “may,” “will,” “anticipate,” “expect,” “believe,” “estimate,” “intend,” “plan,” “should,” “seek,” or other comparable terms. Investors are cautioned that such forward-looking statements in this press release including, without limitation, statements regarding NETSCOUT’s financial results, its financial outlook and expectations, its position to win in the market, its increased focus on cybersecurity and AI-related initiatives, its intention to prudently manage costs, its commitment to leveraging its “Visibility Without Borders” platform to help customers address the performance, availability, and security challenges of the complex connected world, statements regarding charges and benefits resulting from the VSP, and statements relating to the potential benefit of a market for the Company’s products and regarding product releases, updates, and functionality all constitute forward looking statements that involve risks and uncertainties. Actual results could differ materially from the forward-looking statements due to known and unknown risks, uncertainties, assumptions, and other factors. Such factors include, but are not limited to, macroeconomic factors and slowdowns or downturns in economic conditions generally and in the market for advanced networks, service assurance and cybersecurity solutions specifically; the volatile foreign exchange environment; liquidity concerns at, and failures of, banks and other financial institutions; the Company’s relationships with strategic partners and resellers; dependence upon broad-based acceptance of the Company’s network performance management solutions; the presence of competitors with greater financial resources than the Company has, and their strategic response to the Company’s products; the Company’s ability to retain key executives and employees; the Company’s ability to realize the anticipated savings from recent restructuring actions and other expense management programs; lower than expected demand for the Company’s products and services; and the timing and magnitude of stock buyback activity based on market conditions, corporate considerations, debt agreements, and regulatory requirements. The risks included above are not exhaustive. We caution readers not to place undue reliance on any forward-looking statements included in this press release which speak only as to the date of this press release. We undertake no responsibility to update or revise any forward-looking statements, except as required by law. For a more detailed description of the risk factors associated with the Company, please refer to the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024, filed with the Securities and Exchange Commission. NETSCOUT assumes no obligation to update any forward-looking information contained in this press release or with respect to the announcements described herein.

©2024 NETSCOUT SYSTEMS, INC. All rights reserved. NETSCOUT and the NETSCOUT logo are registered trademarks or trademarks of NETSCOUT SYSTEMS, INC. and/or its subsidiaries and/or affiliates in the USA and/or other countries.

Contacts: Investors Media

Tony Piazza Chris Lucas

Deputy CFO AVP, Marketing & Corporate Communications

978-614-4000 978-614-4124

IR@netscout.com Chris.Lucas@netscout.com

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NETSCOUT SYSTEMS, INC. |

| Condensed Consolidated Statements of Operations |

| (In thousands, except per share data) |

| (Unaudited) |

| | | | | | |

| | | | Three Months Ended | | Six Months Ended |

| | | | September 30, | | September 30, |

| | | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | | |

| | Product | | $ | 81,033 | | | $ | 80,545 | | | $ | 142,202 | | | $ | 175,206 | |

| | Service | | 110,075 | | | 116,257 | | | 223,471 | | | 232,734 | |

| | | Total revenue | | 191,108 | | | 196,802 | | | $ | 365,673 | | | 407,940 | |

| Cost of revenue: | | | | | | | | |

| | Product | | 13,440 | | | 16,093 | | | 25,444 | | | 32,755 | |

| | Service | | 28,617 | | | 26,959 | | | 60,982 | | | 60,693 | |

| | | Total cost of revenue | | 42,057 | | | 43,052 | | | 86,426 | | | 93,448 | |

| Gross profit | | 149,051 | | | 153,750 | | | 279,247 | | | 314,492 | |

| Operating expenses: | | | | | | | | |

| | Research and development | | 35,909 | | | 35,112 | | | 78,374 | | | 80,632 | |

| | Sales and marketing | | 61,226 | | | 60,950 | | | 131,556 | | | 139,946 | |

| | General and administrative | | 23,742 | | | 22,652 | | | 49,323 | | | 50,866 | |

| | Amortization of acquired intangible assets | | 11,642 | | | 12,550 | | | 23,256 | | | 25,257 | |

| Restructuring charges | | 2,409 | | | — | | | 18,972 | | | — | |

| Goodwill impairment | | — | | | — | | | 426,967 | | | — | |

| Gain on divestiture of a business | | — | | | (3,806) | | | — | | | (3,806) | |

| | | | | | | | | |

| | | Total operating expenses | | 134,928 | | | 127,458 | | | 728,448 | | | 292,895 | |

| | | | | | | | | | |

| Income (loss) from operations | | 14,123 | | | 26,292 | | | (449,201) | | | 21,597 | |

| Interest and other income (expense), net | | (1,797) | | | 1,182 | | | 7,831 | | | 543 | |

| Income (loss) before income tax expense (benefit) | | 12,326 | | | 27,474 | | | (441,370) | | | 22,140 | |

| Income tax expense (benefit) | | 3,299 | | | 6,012 | | | (7,021) | | | 4,878 | |

| Net income (loss) | | $ | 9,027 | | | $ | 21,462 | | | $ | (434,349) | | | $ | 17,262 | |

| | | | | | | | | | |

| Basic net income (loss) per share | | $ | 0.13 | | | $ | 0.30 | | | $ | (6.08) | | | $ | 0.24 | |

| Diluted net income (loss) per share | | $ | 0.13 | | | $ | 0.29 | | | $ | (6.08) | | | $ | 0.24 | |

| Weighted average common shares outstanding used in computing: | | | | | | | | |

| | Net income (loss) per share - basic | | 71,447 | | | 72,112 | | | 71,457 | | | 71,828 | |

| | Net income (loss) per share - diluted | | 71,837 | | | 72,797 | | | 71,457 | | | 72,838 | |

| | | | | | | | | | | | |

| NETSCOUT SYSTEMS, INC. | |

| Consolidated Balance Sheets | |

| (In thousands) | |

| (Unaudited) | |

| September 30, | | March 31, | |

| 2024 | | 2024 | |

| Assets | | | | |

| Current assets: | | | | |

| Cash, cash equivalents, marketable securities and investments | $ | 400,867 | | | $ | 423,133 | | |

| Accounts receivable and unbilled costs, net | 118,632 | | | 192,096 | | |

| Inventories and deferred costs | 16,388 | | | 14,095 | | |

| Prepaid expenses and other current assets | 47,826 | | | 43,170 | | |

| | | | |

| Total current assets | 583,713 | | | 672,494 | | |

| | | | |

| Fixed assets, net | 23,244 | | | 26,487 | | |

| Operating lease right-of-use assets | 38,498 | | | 42,486 | | |

| Goodwill and intangible assets, net | 1,358,960 | | | 1,811,479 | | |

| Long-term marketable securities | 1,009 | | | 994 | | |

| Other assets | 65,248 | | | 41,362 | | |

| | | | |

| Total assets | $ | 2,070,672 | | | $ | 2,595,302 | | |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | $ | 13,911 | | | $ | 14,506 | | |

| Accrued compensation | 41,485 | | | 51,362 | | |

| Accrued other | 15,956 | | | 15,429 | | |

| Deferred revenue and customer deposits | 263,874 | | | 301,806 | | |

| Current portion of operating lease liabilities | 11,876 | | | 11,979 | | |

| | | | |

| Total current liabilities | 347,102 | | | 395,082 | | |

| | | | |

| Other long-term liabilities | 6,622 | | | 7,055 | | |

| Deferred tax liability | 3,955 | | | 4,374 | | |

| Accrued long-term retirement benefits | 29,253 | | | 28,413 | | |

| Long-term deferred revenue and customer deposits | 115,825 | | | 130,212 | | |

| Operating lease liabilities, net of current portion | 33,527 | | | 38,101 | | |

| Long-term debt | 75,000 | | | 100,000 | | |

| | | | |

| Total liabilities | 611,284 | | | 703,237 | | |

| | | | |

| Stockholders' equity: | | | | |

| Common stock | 133 | | | 131 | | |

| Additional paid-in capital | 3,221,213 | | | 3,181,366 | | |

| Accumulated other comprehensive income | 4,151 | | | 3,572 | | |

| Treasury stock, at cost | (1,654,239) | | | (1,615,483) | | |

| (Accumulated deficit) Retained earnings | (111,870) | | | 322,479 | | |

| | | | |

| Total stockholders' equity | 1,459,388 | | | 1,892,065 | | |

| | | | |

| Total liabilities and stockholders' equity | $ | 2,070,672 | | | $ | 2,595,302 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NETSCOUT SYSTEMS, INC. |

| Reconciliation of Current GAAP to Current and Historical Non-GAAP Financial Measures |

| (In thousands, except per share data) |

| (Unaudited) |

| | | | | | | | | | | | |

| | | | Three Months Ended | | Three Months Ended | | Six Months Ended |

| | | | September 30, | | June 30, | | September 30, |

| | | | 2024 | | 2023 | | 2024 | | 2024 | | 2023 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Revenue | | $ | 191,108 | | | $ | 196,802 | | | $ | 174,565 | | | $ | 365,673 | | | $ | 407,940 | |

| | | | | | | | | | | | |

| Gross Profit (GAAP) | | $ | 149,051 | | | $ | 153,750 | | | $ | 130,196 | | | $ | 279,247 | | | $ | 314,492 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Share-based compensation expense (1) | | 2,200 | | | 2,638 | | | 3,320 | | | 5,520 | | | 5,549 | |

| Amortization of acquired intangible assets (2) | | 996 | | | 1,638 | | | 995 | | | 1,991 | | | 3,276 | |

| | | | | | | | | | |

| Acquisition related depreciation expense (3) | | 2 | | | 4 | | | 2 | | | 4 | | | 9 | |

| | | | | | | | | | |

| Non-GAAP Gross Profit | | $ | 152,249 | | | $ | 158,030 | | | $ | 134,513 | | | $ | 286,762 | | | $ | 323,326 | |

| | | | | | | | | | | | |

| Income (Loss) from Operations (GAAP) | | $ | 14,123 | | | $ | 26,292 | | | $ | (463,324) | | | $ | (449,201) | | | $ | 21,597 | |

| GAAP Operating Margin | | 7.4 | % | | 13.4 | % | | (265.4) | % | | (122.8) | % | | 5.3 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Share-based compensation expense (1) | | 14,886 | | | 18,445 | | | 21,198 | | | 36,084 | | | 38,289 | |

| Amortization of acquired intangible assets (2) | | 12,638 | | | 14,188 | | | 12,609 | | | 25,247 | | | 28,533 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Restructuring charges | | 2,409 | | | — | | | 16,563 | | | 18,972 | | | — | |

| Goodwill impairment | | — | | | — | | | 426,967 | | | 426,967 | | | — | |

| Acquisition related depreciation expense (3) | | 11 | | | 37 | | | 12 | | | 23 | | | 96 | |

| Gain on divestiture of a business | | — | | | (3,806) | | | — | | | — | | | (3,806) | |

| Legal expense related to civil judgments (4) | | — | | | 44 | | | — | | | — | | | 85 | |

| Non-GAAP Income from Operations | | $ | 44,067 | | | $ | 55,200 | | | $ | 14,025 | | | $ | 58,092 | | | $ | 84,794 | |

| Non-GAAP Operating Margin | | 23.1 | % | | 28.0 | % | | 8.0 | % | | 15.9 | % | | 20.8 | % |

| | | | | | | | | | | | |

| Net Income (Loss) (GAAP) | | $ | 9,027 | | | $ | 21,462 | | | $ | (443,376) | | | $ | (434,349) | | | $ | 17,262 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Share-based compensation expense (1) | | 14,886 | | | 18,445 | | | 21,198 | | | 36,084 | | | 38,289 | |

| Amortization of acquired intangible assets (2) | | 12,638 | | | 14,188 | | | 12,609 | | | 25,247 | | | 28,533 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Restructuring charges | | 2,409 | | | — | | | 16,563 | | | 18,972 | | | — | |

| Goodwill impairment | | — | | | — | | | 426,967 | | | 426,967 | | | — | |

| Acquisition related depreciation expense (3) | | 11 | | | 37 | | | 12 | | | 23 | | | 96 | |

| Gain on divestiture of a business | | — | | | (3,806) | | | — | | | — | | | (3,806) | |

| | | | | | | | | | |

| Legal expense related to civil judgments (4) | | — | | | 44 | | | — | | | — | | | 85 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Change in fair value of derivative instrument (5) | | — | | | — | | | — | | | — | | | (206) | |

| Income tax adjustments (6) | | (5,409) | | | (5,829) | | | (13,395) | | | (18,804) | | | (13,000) | |

| Non-GAAP Net Income | | $ | 33,562 | | | $ | 44,541 | | | $ | 20,578 | | | $ | 54,140 | | | $ | 67,253 | |

| | | | | | | | | | | | |

| Diluted Net Income (Loss) Per Share (GAAP) | | $ | 0.13 | | | $ | 0.29 | | | $ | (6.20) | | | $ | (6.08) | | | $ | 0.24 | |

| Share impact of non-GAAP adjustments identified above | | 0.34 | | | 0.32 | | | 6.48 | | | 6.83 | | | 0.68 | |

| Non-GAAP Diluted Net Income Per Share | | $ | 0.47 | | | $ | 0.61 | | | $ | 0.28 | | | $ | 0.75 | | | $ | 0.92 | |

| | | | | | | | | | | | |

| Shares used in computing non-GAAP diluted net income per share | | 71,837 | | | 72,797 | | | 72,793 | | | 72,197 | | | 72,838 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NETSCOUT SYSTEMS, INC. |

| Reconciliation of Current GAAP to Current and Historical Non-GAAP Financial Measures - Continued |

| (In thousands) |

| (Unaudited) |

| | | | | | | | | | | | |

| | | | Three Months Ended | | Three Months Ended | | Six Months Ended |

| | | | September 30, | | June 30, | | September 30, |

| | | | 2024 | | 2023 | | 2024 | | 2024 | | 2023 |

| | | | | | | | | | | | |

| (1) | Share-based compensation expense included in these amounts is as follows: | | | | | | | | | | |

| | Cost of product revenue | | $ | 295 | | | $ | 349 | | | $ | 431 | | | $ | 726 | | | $ | 721 | |

| | Cost of service revenue | | 1,905 | | | 2,289 | | | 2,889 | | | 4,794 | | | 4,828 | |

| | Research and development | | 3,934 | | | 4,988 | | | 5,886 | | | 9,820 | | | 10,374 | |

| | Sales and marketing | | 5,275 | | | 6,675 | | | 7,504 | | | 12,779 | | | 13,959 | |

| | General and administrative | | 3,477 | | | 4,144 | | | 4,488 | | | 7,965 | | | 8,407 | |

| | Total share-based compensation expense | | $ | 14,886 | | | $ | 18,445 | | | $ | 21,198 | | | $ | 36,084 | | | $ | 38,289 | |

| (2) | Amortization expense related to acquired software and product technology, tradenames, customer relationships included in these amounts is as follows: | | | | | | | | | | |

| | | | | | | | | | | | |

| | Cost of product revenue | | $ | 996 | | | $ | 1,638 | | | $ | 995 | | | $ | 1,991 | | | $ | 3,276 | |

| | Operating expenses | | 11,642 | | | 12,550 | | | 11,614 | | | 23,256 | | | 25,257 | |

| | Total amortization expense | | $ | 12,638 | | | $ | 14,188 | | | $ | 12,609 | | | $ | 25,247 | | | $ | 28,533 | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| (3) | Acquisition related depreciation expense included in these amounts is as follows: | | | | | | | | | | |

| | Cost of product revenue | | $ | 2 | | | $ | 2 | | | $ | 2 | | | $ | 4 | | | $ | 5 | |

| | Cost of service revenue | | — | | | 2 | | | — | | | — | | | 4 | |

| | Research and development | | 7 | | | 25 | | | 8 | | | 15 | | | 66 | |

| | Sales and marketing | | 2 | | | 6 | | | 2 | | | 4 | | | 14 | |

| | General and administrative | | — | | | 2 | | | — | | | — | | | 7 | |

| | Total acquisition related depreciation expense | | $ | 11 | | | $ | 37 | | | $ | 12 | | | $ | 23 | | | $ | 96 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| (4) | Legal expense (benefit) related to civil judgments included in this amount is as follows: | | | | | | | | | | |

| | General and administrative | | $ | — | | | $ | 44 | | | $ | — | | | $ | — | | | $ | 85 | |

| | Total legal judgments expense | | $ | — | | | $ | 44 | | | $ | — | | | $ | — | | | $ | 85 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| (5) | Change in fair value of derivative instrument included in this amount is as follows: | | | | | | | | | | |

| | Interest and other (income) expense, net | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (206) | |

| | Total change in fair value of derivative instrument | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (206) | |

| (6) | Total income tax adjustment included in this amount is as follows: | | | | | | | | | | |

| | Tax effect of non-GAAP adjustments above | | $ | (5,409) | | | $ | (5,829) | | | $ | (13,395) | | | $ | (18,804) | | | $ | (13,000) | |

| | | | | | | | | | | | |

| | Total income tax adjustments | | $ | (5,409) | | | $ | (5,829) | | | $ | (13,395) | | | $ | (18,804) | | | $ | (13,000) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NETSCOUT SYSTEMS, INC. |

| Reconciliation of Current GAAP to Current and Historical Non-GAAP Financial Measures - |

| Non-GAAP EBITDA from Operations |

| (In thousands) |

| (Unaudited) |

| | | | | | | | | | |

| | Three Months Ended | | Three Months Ended | | Six Months Ended |

| | September 30, | | June 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2024 | | 2023 |

| | | | | | | | | | |

| Income (Loss) from operations (GAAP) | | $ | 14,123 | | | $ | 26,292 | | | $ | (463,324) | | | $ | (449,201) | | | $ | 21,597 | |

| Previous adjustments to determine non-GAAP income from operations | | 29,944 | | | 28,908 | | | 477,349 | | | 507,293 | | | 63,197 | |

| Non-GAAP Income from operations | | $ | 44,067 | | | $ | 55,200 | | | $ | 14,025 | | | $ | 58,092 | | | $ | 84,794 | |

| Depreciation excluding acquisition related-depreciation expense | | 3,451 | | | 4,749 | | | 3,784 | | | 7,235 | | | 9,781 | |

| Non-GAAP EBITDA from operations | | $ | 47,518 | | | $ | 59,949 | | | $ | 17,809 | | | $ | 65,327 | | | $ | 94,575 | |

| Non-GAAP EBITDA from operations as a % of revenue | | 24.9 | % | | 30.5 | % | | 10.2 | % | | 17.9 | % | | 23.2 | % |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| NETSCOUT SYSTEMS, INC. |

| Reconciliation of GAAP Financial Outlook to Non-GAAP Financial Outlook |

| (Unaudited) |

| (In millions, except net income per share - diluted) |

| | | | |

| FY'24 | | FY'25 | |

| Revenue | $ | 829.5 | | | ~ $800 million to ~$830 million | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| FY'24 | | FY'25 | |

| GAAP net income (loss) | $ | (147.7) | | | (~$374 million) to (~$359 million) | |

| | | | |

| | | | |

| Amortization of intangible assets | $ | 56.9 | | | ~$50 million | |

| Share-based compensation expenses | $ | 70.8 | | | ~$64 million | |

| Business development & integration expenses* | $ | 0.1 | | | ~Less than $1 million | |

| Gain on divestiture of a business | $ | (3.8) | | | — | |

| Change in fair value of derivative instrument | $ | (0.2) | | | — | |

| Legal (benefit) expense related to civil judgments | $ | (4.4) | | | — | |

| Restructuring charges | $ | — | | | ~$19 million to ~$20 million | |

| Goodwill impairment | $ | 217.3 | | | ~$427 million | |

| | | | |

| | | | |

| Total adjustments | $ | 336.7 | | | ~$561 million to ~$562 million | |

| Related impact of adjustments on income tax | $ | (29.8) | | | (~$34 million) | |

| Non-GAAP net income | $ | 159.1 | | | ~$153 million to ~$168 million | |

| | | | |

| GAAP net income (loss) per share (diluted) | $ | (2.07) | | | (~$5.22) to (~$5.01) | |

| Non-GAAP net income per share (diluted) | $ | 2.20 | | | ~$2.10 to ~$2.30 | |

| | | | |

| Average weighted shares outstanding (diluted GAAP) | 71.5 | | | ~72 million | |

| Average weighted shares outstanding (diluted Non-GAAP) | 72.3 | | | ~73 million | |

| *Business development & integration expenses include acquisition-related depreciation expense | |

| **Figures in table may not total due to rounding | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

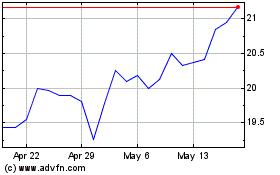

Netscout Systems (NASDAQ:NTCT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Netscout Systems (NASDAQ:NTCT)

Historical Stock Chart

From Dec 2023 to Dec 2024