Natera, Inc. (NASDAQ: NTRA), a global leader in cell-free DNA

and genetic testing, today reported its financial results for the

second quarter ended June 30, 2024.

Recent Strategic and Financial Highlights

- Generated total revenues of $413.4 million in the second

quarter of 2024, compared to $261.4 million in the second quarter

of 2023, an increase of 58.1%. Product revenues grew 59.3% over the

same period.

- Generated a gross margin of 58.8% in the second quarter of

2024, compared to a gross margin of 45.2% in the second quarter of

2023.

- Processed approximately 760,300 tests in the second quarter of

2024, compared to approximately 617,200 tests in the second quarter

of 2023, an increase of 23.2%.

- Performed approximately 125,400 oncology tests in the second

quarter of 2024, compared to approximately 83,500 in the second

quarter of 2023, an increase of 50.2%.

- Achieved positive cash flow of approximately $3.3 million1 in

the second quarter of 2024.

- Launched a new feature for ProsperaTM Heart, enhancing

detection of rejection in heart transplant patients.

- Published several peer-reviewed papers on SignateraTM in top

journals.

- Presented new data at the American Society of Clinical Oncology

(ASCO) 2024 Annual Meeting across a variety of indications,

including breast cancer, colorectal cancer, lung cancer, melanoma,

esophageal cancer, and urothelial cancer.

“Our second quarter financial results exceeded our expectations

with incredibly strong performance in volume, revenue and gross

margin,” said Steve Chapman, chief executive officer of Natera. “We

look forward to continuing this positive momentum in the second

half of 2024 and supporting our patients with cutting-edge science,

an innovative product portfolio, and excellent service that is core

to our mission.”

Second Quarter Ended June 30, 2024 Financial Results

Total revenues were $413.4 million in the second quarter of 2024

compared to $261.4 million in the second quarter of 2023, an

increase of 58.1%. The increase in total revenues was driven

primarily by a 59.3% increase in product revenues, which were

$411.4 million in the second quarter of 2024 compared to $258.3

million in the second quarter of 2023. The increase in product

revenues was primarily driven by an increase in volume, average

selling price improvements, as well as cash receipts during the

quarter related to tests delivered in prior periods that were fully

collected.

Natera processed approximately 760,300 tests in the second

quarter of 2024, including approximately 744,000 tests accessioned

in its laboratory, compared to approximately 617,200 tests

processed, including approximately 599,000 tests accessioned in its

laboratory, in the second quarter of 2023.

In the second quarter of 2024, Natera recognized revenue on

approximately 725,200 tests for which results were reported to

customers in the period (tests reported), including approximately

709,800 tests reported from its laboratory, compared to

approximately 594,900 tests reported, including approximately

578,200 tests reported from its laboratory, in the second quarter

of 2023, an increase of 21.9% from the prior period.

Gross profit2 for the three months ended June 30, 2024 and 2023

was $243.2 million and $118.3 million, respectively, representing a

gross margin of 58.8% and 45.2%, respectively. Natera had higher

gross margin in the second quarter of 2024 primarily as a result of

higher revenues, continuous progress in reducing cost of goods sold

associated with tests processed, as well as incremental cash

receipts during the quarter associated with tests delivered in

prior periods that were fully collected. Total operating expenses,

representing research and development expenses and selling, general

and administrative expenses, for the second quarter of 2024 were

$287.1 million, compared to $230.7 million in the same period of

the prior year, an increase of 24.4%. The increase was primarily

driven by headcount growth to support new product offerings as well

as increases in consulting and legal expenses.

Loss from operations for the second quarter of 2024 was $43.9

million compared to $112.4 million for the same period of the prior

year.

Natera reported a net loss for the second quarter of 2024 of

$37.5 million, or ($0.30) per diluted share, compared to a net loss

of $110.8 million, or ($0.97) per diluted share, for the same

period in 2023. Weighted average shares outstanding were

approximately 122.9 million in the second quarter of 2024 compared

to 113.7 million in the second quarter of the prior year.

At June 30, 2024, Natera held approximately $887.1 million in

cash, cash equivalents, short-term investments and restricted cash,

compared to $879.0 million as of December 31, 2023. As of June 30,

2024, Natera had a total outstanding debt balance of $364.0

million, comprised of $80.4 million including accrued interest

under its line of credit with UBS at a variable interest rate of

30-day SOFR plus 50 bps and a net carrying amount of $283.6 million

under its seven-year convertible senior notes issued in April 2020.

The gross principal balance outstanding for the convertible senior

notes was $287.5 million as of June 30, 2024.

Financial Outlook

Natera anticipates 2024 total revenue of $1.49 billion to $1.52

billion; 2024 gross margin to be approximately 54% to 56% of

revenues; selling, general and administrative costs to be

approximately $700 million to $750 million; research and

development costs to be $350 million to $375 million; and net cash

(outflow) inflow to be ($25) million to $25 million3.

Test Volume Summary

Unit

Q2 2024

Q2 2023

Definition

Tests processed

760,300

617,200

Tests accessioned in our laboratory plus

units processed outside of our laboratory

Tests accessioned

744,000

599,000

Test accessioned in our laboratory

Tests reported

725,200

594,900

Total tests reported

Tests reported in our laboratory

709,800

578,200

Total tests reported in our laboratory

less units reported outside of our laboratory

About Natera

Natera™ is a global leader in cell-free DNA and genetic testing,

dedicated to oncology, women’s health, and organ health. We aim to

make personalized genetic testing and diagnostics part of the

standard of care to protect health and enable earlier, more

targeted interventions that help lead to longer, healthier lives.

Natera’s tests are validated by more than 200 peer-reviewed

publications that demonstrate high accuracy. Natera operates ISO

13485-certified and CAP-accredited laboratories certified under the

Clinical Laboratory Improvement Amendments (CLIA) in Austin, Texas

and San Carlos, California. For more information, visit

www.natera.com.

Conference Call Information

Event:

Natera’s Second Quarter 2024

Financial Results Conference Call

Date:

Thursday, August 8, 2024

Time:

1:30 p.m. PT (4:30 p.m. ET)

Live Dial-In:

1-888-596-4144 (Domestic)

1-646-968-2525 (International)

Conference ID:

7684785

Webcast Link:

https://events.q4inc.com/attendee/455235752

Forward-Looking Statements

This press release contains forward-looking statements under the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical facts, including

the company’s financial guidance for fiscal 2024, its market

opportunity, anticipated products and launch schedules,

reimbursement coverage and product costs, commercial and strategic

partnerships and acquisitions, user experience, clinical trials and

studies, and its strategies, goals and general business and market

conditions, are forward-looking statements. Any forward-looking

statements contained in this press release are based upon Natera’s

current plans, estimates, and expectations, as of the date of this

release, and are not a representation that such plans, estimates,

or expectations will be achieved.

These forward-looking statements are subject to known and

unknown risks and uncertainties that may cause actual results to

differ materially, including: we face numerous uncertainties and

challenges in achieving our financial projections and goals; we may

be unable to further increase the use and adoption of our products

through our direct sales efforts or through our laboratory

partners; we have incurred losses since our inception and we

anticipate that we will continue to incur losses for the

foreseeable future; our quarterly results may fluctuate from period

to period; our estimates of market opportunity and forecasts of

market growth may prove to be inaccurate; we may be unable to

compete successfully with existing or future products or services

offered by our competitors; we may engage in acquisitions,

dispositions or other strategic transactions that may not achieve

our anticipated benefits and could otherwise disrupt our business,

cause dilution to our stockholders or reduce our financial

resources; we may not be successful in commercializing our

cloud-based distribution model; our products may not perform as

expected; the results of our clinical studies, including our

SNP-based Microdeletion and Aneuploidy Registry, or SMART, Study,

may not be compelling to professional societies or payors as

supporting the use of our tests, particularly for microdeletions

screening, or may not be able to be replicated in later studies

required for regulatory approvals or clearances; if either of our

primary CLIA-certified laboratories becomes inoperable, we will be

unable to perform our tests and our business will be harmed; we

rely on a limited number of suppliers or, in some cases, single

suppliers, for some of our laboratory instruments and materials and

may not be able to find replacements or immediately transition to

alternative suppliers; if we are unable to successfully scale our

operations, our business could suffer; the marketing, sale, and use

of Panorama and our other products could result in substantial

damages arising from product liability or professional liability

claims that exceed our resources; we may be unable to expand,

obtain or maintain third-party payer coverage and reimbursement for

our tests, and we may be required to refund reimbursements already

received; third-party payers may withdraw coverage or provide lower

levels of reimbursement due to changing policies, billing

complexities or other factors; we could incur substantial costs and

delays associated with trying to obtain premarket clearance or

approval, and incur costs associated with complying with

post-market controls, if and when the FDA begins actively

regulating our tests pursuant to recently enacted FDA regulations;

litigation or other proceedings, resulting from either third party

claims of intellectual property infringement or third party

infringement of our technology, is costly, time-consuming and could

limit our ability to commercialize our products or services; any

inability to effectively protect our proprietary technology could

harm our competitive position or our brand; and we cannot guarantee

that we will be able to service and comply with our outstanding

debt obligations or achieve our expectations regarding the

conversion of our outstanding convertible notes.

Additional risks and uncertainties that could affect our

financial results are included under the captions, "Risk Factors"

and "Management’s Discussion and Analysis of Financial Condition

and Results of Operations" in our most recent filings on Forms 10-K

and 10-Q and in other filings that we make with the SEC from time

to time. These documents are available on our website at

www.natera.com under the Investor Relations section and on the

SEC’s website at www.sec.gov.

In light of the significant uncertainties in these

forward-looking statements, you should not regard these statements

as a representation or warranty by us or any other person that we

will achieve our objectives and plans in any specified time frame,

or at all. Natera assumes no obligation to, and does not currently

intend to, update any such forward-looking statements after the

date of this release.

References

- Positive cash flow for the quarter ended June 30, 2024, is

derived from the GAAP Statement of Cash Flows as follows: net cash

provided by operating activities of $4.0 million, net cash provided

by financing activities of $11.0 million, offset by net cash used

in investing activities for purchases of property and equipment and

acquisition of an asset of $11.7 million.

- Gross profit is calculated as GAAP total revenues less GAAP

cost of revenues. Gross margin is calculated as gross profit

divided by GAAP total revenues.

- Cash (outflow) inflow is calculated as the sum of GAAP net cash

provided by (used in) operating activities, GAAP net cash provided

by (used in) financing activities, and GAAP net cash provided by

(used in) investing activities for purchases of property and

equipment and acquisition of assets.

Natera, Inc.

Consolidated Balance

Sheets

(Unaudited)

(in thousands, except shares)

June 30,

December 31,

2024

2023

(1)

Assets

Current assets:

Cash, cash equivalents and restricted

cash

$

796,798

$

642,095

Short-term investments

90,299

236,882

Accounts receivable, net of allowance of

$7,021 and $6,481 at June 30, 2024 and December 31, 2023,

respectively

335,936

278,289

Inventory

40,985

40,759

Prepaid expenses and other current assets,

net

37,798

60,524

Total current assets

1,301,816

1,258,549

Property and equipment, net

133,280

111,210

Operating lease right-of-use assets

52,582

56,537

Other assets

29,311

15,403

Total assets

$

1,516,989

$

1,441,699

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

33,100

$

14,998

Accrued compensation

41,487

45,857

Other accrued liabilities

141,231

149,405

Deferred revenue, current portion

18,367

16,612

Short-term debt financing

80,389

80,402

Total current liabilities

314,574

307,274

Long-term debt financing

283,604

282,945

Deferred revenue, long-term portion and

other liabilities

21,066

19,128

Operating lease liabilities, long-term

portion

61,225

67,025

Total liabilities

680,469

676,372

Commitments and contingencies

Stockholders’ equity:

Common stock (2)

12

11

Additional paid-in capital

3,320,365

3,145,837

Accumulated deficit

(2,482,499

)

(2,377,436

)

Accumulated other comprehensive loss

(1,358

)

(3,085

)

Total stockholders’ equity

836,520

765,327

Total liabilities and stockholders’

equity

$

1,516,989

$

1,441,699

(1)

The consolidated balance sheet at December

31, 2023 has been derived from the audited consolidated financial

statements at that date included in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2023.

(2)

As of June 30, 2024 and December 31, 2023,

there were approximately 123,365,000 and 119,581,000 shares of

common stock issued and outstanding, respectively.

Natera, Inc.

Consolidated Statements of

Operations and Comprehensive Loss

(Unaudited)

(in thousands, except per share

data)

Three months ended

Six months ended

June 30,

June 30,

2024

2023

2024

2023

Revenues

Product revenues

$

411,364

$

258,256

$

776,036

$

496,053

Licensing and other revenues

1,987

3,148

5,056

7,107

Total revenues

413,351

261,404

781,092

503,160

Cost and expenses

Cost of product revenues

169,850

142,808

328,683

290,562

Cost of licensing and other revenues

329

341

636

711

Research and development

89,109

78,173

177,746

160,479

Selling, general and administrative

197,965

152,508

392,243

302,135

Total cost and expenses

457,253

373,830

899,308

753,887

Loss from operations

(43,902

)

(112,426

)

(118,216

)

(250,727

)

Interest expense

(3,127

)

(3,177

)

(6,251

)

(6,238

)

Interest and other income, net

10,457

4,518

20,724

9,103

Loss before income taxes

(36,572

)

(111,085

)

(103,743

)

(247,862

)

Income tax (expense) benefit

(892

)

282

(1,320

)

122

Net loss

$

(37,464

)

$

(110,803

)

$

(105,063

)

$

(247,740

)

Unrealized gain on available-for-sale

securities, net of tax

834

2,595

1,727

7,159

Comprehensive loss

$

(36,630

)

$

(108,208

)

$

(103,336

)

$

(240,581

)

Net loss per share:

Basic and diluted

$

(0.30

)

$

(0.97

)

$

(0.86

)

$

(2.20

)

Weighted-average number of shares used in

computing basic and diluted net loss per share:

Basic and diluted

122,853

113,690

121,834

112,734

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808269305/en/

Investor Relations Mike Brophy,

CFO, Natera, Inc., 510-826-2350

Media Lesley Bogdanow, VP of

Corporate Communications, Natera, Inc., pr@natera.com

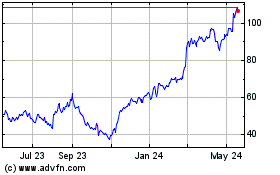

Natera (NASDAQ:NTRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

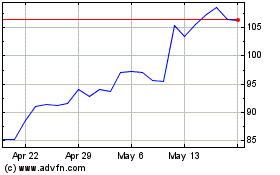

Natera (NASDAQ:NTRA)

Historical Stock Chart

From Jan 2024 to Jan 2025