The pioneering initiative leverages blockchain for greater

transparency in ESG reporting, and is part of MAS’ Project

Guardian

The National University of Singapore (NUS), Northern Trust and

UOB are proud to announce a groundbreaking collaboration to launch

a first-in-market initiative aimed at tokenising green bond

credentials. NUS is the first university in Singapore to implement

blockchain technology for environmental, social, and governance

(ESG) reporting.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250112348353/en/

This initiative, a key milestone in green finance innovation,

will leverage blockchain technology to enhance transparency, data

integrity, and investor confidence in sustainable investment

practices.

Based on the market best practice, issuers of green bonds

provide regular updates to investors regarding the use of funds. On

their part, investors may require such data for their own

sustainability reporting obligations and to assess their progress

towards their ESG goals.

Under the initiative, Northern Trust will utilise its

cutting-edge digital assets platform, Northern Trust Matrix

Zenith™, to mint and hold a green bond reporting token. The token

will hold the environmental impact reporting data from NUS’ third

green bond, issued in 2023. UOB, as the lead arranger of the bond

issuance, will solicit and provide crucial feedback on how the

tokenised data can enhance investors’ sustainability reporting

practices.

The tokenisation process will focus on ensuring data integrity,

providing investors with confidence that the environmental impact

reporting data is secure, immutable, and reliable for their own

sustainability reporting obligations. Investors of the bond will

receive the same complete set of information which will remain

unchanged even as the bond changes hands. This initiative marks a

significant step toward aligning green finance practices with

global transparency and regulatory standards.

The tokenisation of NUS’ green bond credentials is part of

Project Guardian, a global collaboration between policymakers and

key industry players, led by the Monetary Authority of Singapore to

enhance liquidity and efficiency of financial markets through asset

tokenisation. It falls under the fixed income workstream of Project

Guardian, which focuses on demonstrating the benefits of tokenising

bonds and other fixed income securities.

Collaborative expertise

Mr. Tan Kian Woo, Senior Vice President and Chief Finance

Officer at NUS, said: “We are proud to be leading this

first-in-market green bond reporting tokenisation initiative in

partnership with Northern Trust and UOB. This project is a

significant milestone in our ongoing commitment to advancing green

finance innovation. By creating a token that enhances the integrity

and transparency of our environmental data, we aim to provide

greater confidence to investors, helping them meet their

sustainability reporting goals. This is only the beginning, as we

continue to push boundaries in sustainable financial

practices.”

Mr. Koh Yan Leng, Vice President (Campus Infrastructure) at NUS,

said: “In our pursuit of driving campus decarbonisation, we are

equally committed to reporting the sustainability performance of

our green buildings in a transparent, timely and reliable manner.

Through this project, investors and stakeholders will get access to

prompt updates to support their sustainability reporting needs. It

also reflects NUS’ ongoing efforts to optimise energy use and

reduce carbon emissions across our campuses.”

Mr. Justin Chapman, Global Head of Digital Assets and Financial

Markets at Northern Trust, said: “This initiative is a testament to

the transformative potential of blockchain technology in green

finance. By leveraging our Matrix Zenith™ platform, we are ensuring

the integrity and transparency of green bond reporting data,

addressing critical needs for investors while paving the way for a

more sustainable financial ecosystem.”

Mr. Edmund Leong, Head of Group Investment Banking at UOB, said:

“At UOB, we are committed to driving sustainable finance solutions

that meet the evolving needs of our clients. By participating in

this data tokenisation initiative, we aim to provide real-world

feedback on the usability of tokenised data, ensuring that it meets

the standards required for transparent and reliable sustainability

reporting.”

Driving green finance

innovation

The green bond reporting token is the first step in NUS’ broader

strategy to explore how blockchain technology can enhance green

finance practices through a three-year Memorandum of Understanding

(MoU) signed with Northern Trust in November 2024. The

collaboration will focus on fostering cutting-edge research and

developing actionable solutions to address the challenges of ESG

finance.

As part of its commitment to lead green finance innovation, NUS

will continue to explore opportunities for leveraging tokenisation

to improve transparency, accountability, and impact in the

sustainable finance sector.

For more information about NUS’ green finance initiatives, visit

https://sustainability.nus.edu.sg/campus/green-finance/.

About National University of Singapore (NUS)

The National University of Singapore (NUS) is Singapore’s

flagship university, which offers a global approach to education,

research and entrepreneurship, with a focus on Asian perspectives

and expertise. We have 16 colleges, faculties and schools across

three campuses in Singapore, with more than 40,000 students from

100 countries enriching our vibrant and diverse campus community.

We have also established more than 20 NUS Overseas Colleges

entrepreneurial hubs around the world.

Our multidisciplinary and real-world approach to education,

research and entrepreneurship enables us to work closely with

industry, governments and academia to address crucial and complex

issues relevant to Asia and the world. Researchers in our

faculties, research centres of excellence, corporate labs and more

than 30 university-level research institutes focus on themes that

include energy; environmental and urban sustainability; treatment

and prevention of diseases; active ageing; advanced materials; risk

management and resilience of financial systems; Asian studies; and

Smart Nation capabilities such as artificial intelligence, data

science, operations research and cybersecurity.

For more information on NUS, please visit nus.edu.sg.

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has a global presence

with offices in 24 U.S. states and Washington, D.C., and across 22

locations in Canada, Europe, the Middle East and the Asia-Pacific

region. As of September 30, 2024, Northern Trust had assets under

custody/administration of US$17.4 trillion, and assets under

management of US$1.6 trillion. For more than 135 years, Northern

Trust has earned distinction as an industry leader for exceptional

service, financial expertise, integrity and innovation. Visit us on

northerntrust.com. Follow us on X (formerly Twitter) @NorthernTrust

or Northern Trust Corporation on LinkedIn.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/terms-and-conditions.

About UOB

UOB is a leading bank in Asia. Operating through its head office

in Singapore and banking subsidiaries in China, Indonesia,

Malaysia, Thailand and Vietnam, UOB has a global network of around

500 offices in 19 countries and territories in Asia Pacific, Europe

and North America. Since its incorporation in 1935, UOB has grown

organically and through a series of strategic acquisitions. Today,

UOB is rated among the world’s top banks: Aa1 by Moody’s Investors

Service and AA- by both S&P Global Ratings and Fitch

Ratings.

For nearly nine decades, UOB has adopted a customer-centric

approach to create long-term value by staying relevant through its

enterprising spirit and doing right by its customers. UOB is

focused on building the future of ASEAN – for the people and

businesses within, and connecting with, ASEAN.

The Bank connects businesses to opportunities in the region with

its unparalleled regional footprint and leverages data and insights

to innovate and create personalised banking experiences and

solutions catering to each customer’s unique needs and evolving

preferences. UOB is also committed to forging a sustainable future

through working with its stakeholders to create positive

environmental impact, fostering social inclusiveness and pursuing

economic progress. UOB believes in being a responsible financial

services provider and is steadfast in its support of art, social

development of children and education, doing right by its

communities and stakeholders.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250112348353/en/

For media enquiries, please contact:

For NUS Gayathri DE SILVA Office of

University Communications National University of Singapore DID: +65

6601 1341 Email: gayathri.desilva@nus.edu.sg

For Northern Trust John O’Connell

Northern Trust DID: +1 847-510-3334 Email:

John_O’Connell@ntrs.com

For UOB Jonathan KWOK Group

Strategic Communications and Brand UOB DID: +65 6539 4062 Email:

Jonathan.Kwok@UOBGroup.com

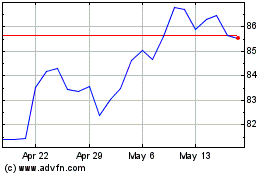

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Jan 2025 to Feb 2025

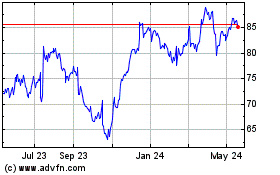

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Feb 2024 to Feb 2025