Northern Trust Forecasts Moderate Global Equity Returns, Solid High Yield Bond Performance and Strength in Private Credit

February 06 2025 - 3:00AM

Business Wire

Trends in AI, energy and globalization cited as

key elements affecting economic growth globally during next

decade

Northern Trust today issued its Capital Market Assumptions 2025

Edition, forecasting moderate global equity performance, improving

high yield bond returns and strength in private credit.

The CMA also identifies three key trends likely to affect

markets and the global economy over the next decade – AI-Enabled

Productivity, Navigating the Energy Transition and

Globalization: Bent, Not Broken – that provide the

foundation for returns of stocks, bonds, real assets and

alternatives.

“The next 10 years will present investors with a complex

landscape of market and economic trends to navigate,” Northern

Trust Asset Management (NTAM) Global Chief Investment Officer

Angelo Manioudakis said. “As economic growth moderates, we

think investors will look to uncover future drivers of growth. We

believe the adoption of AI, new energy sources and trends in global

trade will cause divergent paths in economic growth globally.”

Over the coming decade, Northern Trust forecasts the following

long-term average annualized return expectations for a wide range

of asset classes:

- Equities: 7.5% annualized return for U.S. equities and

5.8% annualized return for developed markets ex-U.S. equities, as

we expect U.S. stocks to continue to outperform European stocks,

and 6.4% annualized return for emerging markets.

- Fixed Income: 4.7% annualized return for U.S. investment

grade bonds and 5.6% annualized return for U.S. high yield bonds,

with strong fundamentals supporting high yield securities.

- Real Assets: 6.6% annualized return for global listed

infrastructure, where utilities could benefit from a surge in

electricity demand from AI.

- Alternatives: 8.4% annualized return for private credit

and 10.1% annualized return for private equity, supported by AI

opportunities and potentially more mergers and acquisitions.

“Over the next decade, we expect equity returns to moderate from

the highs of the last couple of years. In the bond market, we

believe credit spreads will increase from current low levels but

stay below the long-term average, supported by stable economic

growth and solid credit fundamentals,” NTAM Chief Investment

Officer of Global Asset Allocation Anwiti Bahuguna said.

“Private investments may prove to offer even more attractive

returns relative to the public equity and bond markets. Declining

interest rates will drive demand for private credit to boost

M&A activity, while AI and other technology advances will push

low double-digit growth in private equity and venture capital.”

The CMA’s asset class forecasts are driven by three key themes

that Northern Trust investment experts see affecting markets and

the economy over the next 10 years:

- AI-Enabled Productivity: As companies invest in

artificial intelligence, AI-enabled productivity will enhance

economic growth. This should help countries combat shifting

demographic trends that potentially damage productivity, while also

boosting economic growth.

- Navigating the Energy Transition: Global energy demand

continues to increase, along with a desire for energy independence.

Global economies must navigate policy, technological innovations

and finance mechanisms to meet those demands. How energy is

generated or accessed over the next decade will be critical to

long-term economic, climate and investment impacts.

- Globalization: Bent, Not Broken: Globalization may have

slowed but it has not reversed. Geopolitical tensions are morphing

supply chains and trade pacts, which will lead to risks and

opportunities over the next decade. This may present investors with

the opportunity to be increasingly selective.

Rooted in deep capital market analysis, the CMA is an annual

report of long-term average annualized return expectations for a

range of asset classes, including fixed income, equities, real

assets and alternatives. The CMA informs Northern Trust’s

investment decisions and strategic asset allocation

recommendations. The full report, including detailed 10-year asset

class forecasts, is available at

https://www.northerntrust.com/insights-research/2025/investment-managment/capital-markets-assumption-2025.

About Northern Trust Asset Management

Northern Trust Asset Management is a global investment manager

that helps investors navigate changing market environments in

efforts to realize their long-term objectives. Entrusted with $1.3

trillion in assets under management as of December 31, 2024, we

understand that investing ultimately serves a greater purpose and

believe investors should be compensated for the risks they take —

in all market environments and any investment strategy. That’s why

we combine robust capital markets research, expert portfolio

construction and comprehensive risk management in an effort to

craft innovative and efficient solutions that seek to deliver

targeted investment outcomes. As engaged contributors to our

communities, we consider it a great privilege to serve our

investors and our communities with integrity, respect and

transparency.

Northern Trust Asset Management is composed of Northern Trust

Investments, Inc., Northern Trust Global Investments Limited,

Northern Trust Fund Managers (Ireland) Limited, Northern Trust

Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South

Capital Advisors, LLC, Northern Trust Asset Management Australia

Pty Ltd, and investment personnel of The Northern Trust Company of

Hong Kong Limited and The Northern Trust Company.

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has a global presence

with offices in 24 U.S. states and Washington, D.C., and across 22

locations in Canada, Europe, the Middle East and the Asia-Pacific

region. As of December 31, 2024, Northern Trust had assets under

custody/administration of US$16.8 trillion, and assets under

management of US$1.6 trillion. For more than 135 years, Northern

Trust has earned distinction as an industry leader for exceptional

service, financial expertise, integrity and innovation. Visit us on

northerntrust.com. Follow us on Instagram @northerntrustcompany or

Northern Trust on LinkedIn.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/terms-and-conditions.

The publisher’s sale of this reprint does not constitute or

imply any endorsement or sponsorship of any product, service or

organization.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206595195/en/

Europe, Middle East, Africa & Asia-Pacific Contacts: Camilla

Greene +44 (0) 207 982 2176 Camilla.Greene@ntrs.com

Simon Ansell +44 (0) 207 982 1016 Simon.Ansell@ntrs.com

US & Canada Contact: Joanne Zalatoris +1 (312) 900-3462

Joanne.Zalatoris@ntrs.com

http://www.northerntrust.com

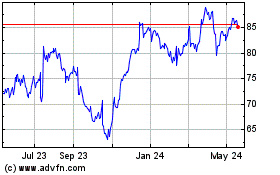

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Jan 2025 to Feb 2025

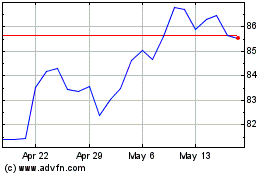

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Feb 2024 to Feb 2025