NeuroMetrix Reports Q1 2024 Business Highlights

May 15 2024 - 3:00PM

NeuroMetrix, Inc. (Nasdaq: NURO) today reported financial and

business highlights for the quarter ended March 31, 2024. The

Company's mission is to reduce the impact of neurological disorders

and pain syndromes through innovative non-invasive medical devices.

“We are focused on maximizing shareholder value,”

said Shai N. Gozani, M.D., Ph.D., Chief Executive Officer of

NeuroMetrix. “Shareholders have recently provided valuable insights

in addition to those of our financial advisor, Lucid Capital

Markets (formerly Ladenburg Thalmann & Co.). Our process to

evaluate strategic options has led to the expansion of our Board of

Directors, and a decision to curtail equity fundraising. In

addition, we decided to reduce operating expenses with a smaller

workforce.”

Dr. Gozani continued, "Quell® Fibromyalgia has

posted sequential revenue growth in each quarter since launch in

late 2022. We have two primary sales channels; commercial health

care providers which is cash pay and the Veterans Administration

(VA) which is reimbursed. Most of our sales in the current quarter

came from the commercial channel, as we just entered the VA in the

first quarter. Revenue in the current quarter also benefited from

higher electrode refill pricing.”

“Our DPNCheck® business continues to reflect

revenue erosion as the Medicare Advantage (MA) market enters the

second year of the Centers for Medicare and Medicaid Services (CMS)

three-year phase-out of compensation for patient screening for a

number of conditions, including peripheral neuropathy. The

environment is challenging; however, we continue to support our

existing accounts and explore value-based care opportunities

outside MA.”

Business Highlights:

- Quell Fibromyalgia operating metrics in Q1 2024 demonstrated

continuing growth. In the successive quarters of Q1 2024 versus Q4

2023, unique prescribers in our commercial channel were up to 221

(11% increase) and a total of 895 (54% increase) prescriptions were

written. A total of 454 (28% increase) devices were shipped between

the commercial and VA channels, The total number of electrode

refills increased to 666 months (26% increase).

- In March, the Company reported that over 2,000 patients with

fibromyalgia have been prescribed Quell Fibromyalgia since its

strategic commercial launch in December 2022.

- The Company noted the recent publication of a large study by

Professor Kamiya and his colleagues (Hayashi and colleagues)

demonstrating that DPNCheck combined with standard EKG or DPNCheck

alone accurately detects diabetic peripheral neuropathy. This study

adds to the already sizeable body of clinical validation for the

DPNCheck technology.

Financial Results:

Revenue in Q1 2024 of $1.1 million was lower by

$0.6 million or 37% from Q1, 2023 primarily due to reduced sales

volume for DPNCheck. The gross margin rate of 47% in Q1 2024

declined from 69% in Q1 2023 reflecting the reduction in

high-margin DPNCheck revenue, reduced absorption of indirect

manufacturing costs, and inventory reserve charges primarily for

excess parts. Operating expenses were $3.8 million in Q1 2024, an

increase of $0.9 million from the comparable period in 2023. This

increase included costs related to the reduction in employee

headcount of $0.6 million. In addition, professional services

costs, primarily related to the strategic review process, increased

by $0.3 million from Q1 2023. The Q1 2024 net loss was $3.0 million

($1.67 per share) versus a net loss of $1.6 million ($1.64 per

share) in Q1 2023.

About NeuroMetrix

NeuroMetrix is a commercial stage healthcare

company that develops and commercializes neurotechnology devices to

address unmet needs in the chronic pain and diabetes markets. The

Company's products are wearable or hand-held medical devices

enabled by proprietary consumables and software solutions that

include mobile apps, enterprise software and cloud-based systems.

The Company has two commercial brands. Quell® is a wearable

neuromodulation platform. DPNCheck® is a point-of-care screening

test for peripheral neuropathy. For more information, visit

www.neurometrix.com.

Safe Harbor Statement

The statements contained in this press release

include forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, including, without

limitation, statements regarding the company’s or management’s

expectations regarding the business, as well as events that could

have a meaningful impact on the company’s revenues and cash

resources. While the company believes the forward-looking

statements contained in this press release are accurate, there are

a number of factors that could cause actual events or results to

differ materially from those indicated by such forward-looking

statements, including, without limitation, estimates of future

performance, and the ability to successfully develop, receive

regulatory clearance, commercialize and achieve market acceptance

for any products. There can be no assurance that future

developments will be those that the company has anticipated. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors including those risks,

uncertainties and factors referred to in the company’s most recent

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, as well

as other documents that may be filed from time to time with the

Securities and Exchange Commission or otherwise made public. The

company is providing the information in this press release only as

of the date hereof, and expressly disclaims any intent or

obligation to update the information included in this press release

or revise any forward-looking statements.

Source: NeuroMetrix, Inc.

Thomas T. Higgins SVP and Chief Financial Officer

neurometrix.ir@neurometrix.com

|

|

|

NeuroMetrix, Inc. Statements of

Operations (Unaudited) |

|

|

|

|

Quarters Ended March

31, |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

Revenues |

$ |

1,093,556 |

|

|

$ |

1,724,771 |

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

576,539 |

|

|

|

526,372 |

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

517,017 |

|

|

|

1,198,399 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

943,552 |

|

|

|

699,425 |

|

|

Sales and marketing |

|

1,061,729 |

|

|

|

815,872 |

|

|

General and administrative |

|

1,765,727 |

|

|

|

1,393,171 |

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

3,771,008 |

|

|

|

2,908,468 |

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(3,253,991 |

) |

|

|

(1,710,069 |

) |

|

|

|

|

|

|

|

|

|

|

Other income |

|

224,417 |

|

|

|

135,895 |

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(3,029,574 |

) |

|

$ |

(1,574,174 |

) |

| |

|

|

|

|

|

|

|

|

NeuroMetrix, Inc. Condensed Balance

Sheets (Unaudited) |

|

|

|

|

March 31,

2024 |

|

December 31, 2023 |

|

|

|

|

|

|

|

|

Cash, cash equivalents and securities |

$ |

17,599,110 |

|

|

$ |

17,997,151 |

|

|

Other current assets |

|

2,552,823 |

|

|

|

2,857,291 |

|

|

Noncurrent assets |

|

512,195 |

|

|

|

569,999 |

|

|

Total assets |

$ |

20,664,128 |

|

|

$ |

21,424,441 |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

$ |

1,847,170 |

|

|

$ |

1,240,639 |

|

|

Lease obligation, net of current portion |

|

60,946 |

|

|

|

92,485 |

|

|

Stockholders’ equity |

|

18,756,012 |

|

|

|

20,091,317 |

|

|

Total liabilities and stockholders’ equity |

$ |

20,664,128 |

|

|

$ |

21,424,441 |

|

| |

|

|

|

|

|

|

|

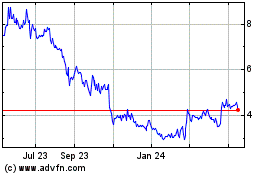

NeuroMetrix (NASDAQ:NURO)

Historical Stock Chart

From Dec 2024 to Jan 2025

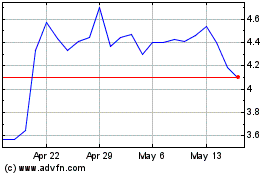

NeuroMetrix (NASDAQ:NURO)

Historical Stock Chart

From Jan 2024 to Jan 2025