false

0001473334

0001473334

2024-01-23

2024-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 23, 2024

Nova

LifeStyle, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-36259 |

|

90-0746568 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

6565

E. Washington Blvd., Commerce, CA 90040

(Address

of Principal Executive Office) (Zip Code)

(323)

888-9999

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

NVFY |

|

Nasdaq

Stock Market |

Item

1.01. Entry into a Material Definitive Agreement.

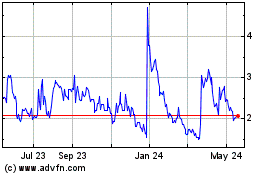

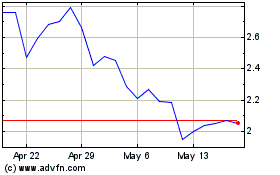

On

January 23, 2024, Nova LifeStyle, Inc. (the “Company”), Nova Living (M) Sdn Bhd, a wholly owned subsidiary of the Company

(“Nova Malaysia”) and ATS Brand Sdn Bhd (“ATS Brand”), a company incorporated in Malaysia entered into a Sale

and Purchase Agreement (the “Agreement”). Pursuant to the Agreement, the parties agree: (i) Nova Malaysia will purchase an

AI-Calculation Engine System from ATS Brand for $750,000 (the “Purchase Price”) and (ii) the Purchase Price shall be paid

in 300,000 shares of common stock (“Shares”) of the Company at $2.5 per share. The AI-Calculation Engine includes Commission

Management Calculation Module, Compiled and Encrypted Calculation Engine, Membership Module, Sales Module and Maintenance and Support,

etc. The Shares will be issued pursuant to the exemption from registration provided by Regulation S promulgated under the Securities

Act of 1933, as amended.

The

Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K. The foregoing summary of the terms of the Agreement is subject

to, and qualified in its entirety by, the Agreement, which is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

information contained above in Item 1.01 related to the Shares is hereby incorporated by reference into this Item 3.02.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

Nova

LifeStyle, Inc. |

| |

|

|

| |

By:

|

/s/

Thanh H. Lam |

| |

|

Thanh

H. Lam |

| |

|

Chairperson,

President and Chief Executive Officer |

Date:

January 26, 2024

Exhibit

10.1

Dated

23 January, 2024

SALE

AND PURCHASE AGREEMENT

relating

to the NOVA AI CALCULATION ENGINE

between

ATS

BRAND SDN BHD

(Registration

No. 202201019945 (1465642-V))

and

NOVA

LIVING (M) SDN BHD

(Registration

No. 201901026513 (1335842-W))

and

NOVA

LIFESTYLE, INC

(Neveda

Business Identification No. NV20091105529-2)

TABLE

OF CONTENTS

| Contents |

|

Page |

| |

|

|

| 1. |

Interpretation

and Definitions |

|

2 |

| 2. |

Sale

and Purchase of IT System |

|

6 |

| 3. |

Purchase

Consideration |

|

7 |

| 4. |

Pre-Closing

Covenants |

|

10 |

| 5. |

Closing |

|

11 |

| 6. |

Warranties |

|

11 |

| 7. |

Indemnification |

|

13 |

| 8. |

Claims |

|

14 |

| 9. |

Termination |

|

14 |

| 10. |

Costs

and Expenses |

|

16 |

| 11. |

Notices |

|

17 |

| 12. |

Confidentiality |

|

18 |

| 13. |

Other

Provisions |

|

19 |

| Schedule

1 Particulars of the IT System |

|

22 |

| Schedule

2 Pre-Closing Covenants |

|

23 |

| Schedule

3 Closing Obligations |

|

24 |

| Schedule

4 Warranties Given by the Seller |

|

25 |

| Appendix-A |

|

27 |

THIS

AGREEMENT is made on 23 January, 2024

Between:

| (1) | ATS

BRAND SDN BHD (Registration No. 202201019945 (1465642-V)), a company incorporated in

Malaysia (the “Seller”); |

| (2) | NOVA

LIVING (M) SDN BHD (Registration No. 201901026513 (1335842-W)), a company incorporated

in Malaysia (the “Purchaser”); and |

| (3) | NOVA

LIFESTYLE, INC (Neveda Business Identification No. NV20091105529-2), a company incorporated

in Neveda (the “Issuer”). |

(the

Seller, the Purchaser and the Issuer are, collectively, the “Parties” and, individually, a “Party”).

Whereas:

| (A) | As

at the date of this Agreement and Closing Date, the Seller is the registered and beneficial

owner of an IT System, the particulars of which (as at the date of this Agreement and Closing

Date) are set out in Appendix-A (Particulars of the IT System). |

| (B) | The

Seller has agreed to sell to the Purchaser, and the Purchaser has agreed to purchase from

the Seller, the IT System (as defined below) upon the terms and subject to the conditions

of this Agreement. |

| (C) | The

Parties have agreed to assume the obligations imposed on them under this Agreement. |

It

is agreed as follows:

| 1. | Interpretation

and Definitions |

| 1.1 | In

this Agreement, unless the subject or context otherwise requires, the following words and

expressions shall have the following meanings respectively ascribed to them: |

“Agreement”

means this Sale and Purchase Agreement among Seller, Purchaser and Issuer dated 23 January, 2024;

“Authorisations”

means any consent, registration, filing, notarisation, licence, approval, permit, authority or exemption from, by or with any Governmental

Authority and all corporate, creditors’, shareholders’ and third-party approvals or consents;

“Business

Day” means a day which is not a Saturday, a Sunday or a public holiday in Malaysia;

“Claims”

shall have the meaning ascribed to it in Clause 7.1;

“Closing”

means the completion of the sale and purchase of the IT System pursuant to Clause 5;

“Closing

Date” means such date as may be agreed upon between the Parties upon which Closing is to take place;

“Closing

Obligations” shall have the meaning ascribed to it in Clause 5.2;

“Confidential

Information” shall have the meaning ascribed to it in Clause 12.1;

“Consideration

Shares” shall have the meaning ascribed to it in Clause 3.1.2;

“Encumbrances”

means (a) any mortgage, charge (whether fixed or floating), pledge, lien, hypothecation, assignment, deed of trust, security interest

or other encumbrance of any kind securing, or conferring any priority of payment in respect of, any obligation of any person, including

any right granted by a transaction which, in legal terms, is not the granting of security but which has an economic or financial effect

similar to the granting of security under the Law, (b) any voting agreement, interest, option, right of first offer, refusal or transfer

restriction in favour of any person and (c) any adverse claims as to title, possession or use, infringement claims;

“Governmental

Authority” means any relevant governmental or quasi-governmental authority, statutory authority or quasi-statutory or regulatory

authority, administrative, monetary, fiscal or judicial body, department, commission, authority, tribunal, agency or stock exchange or

Tax Authority or anybody entitled to exercise executive power or power of any nature or body or other organisation to the extent that

the rules, regulations, standards, requirements, procedures or orders of such authority, body or other organisation have the force of

Law;

“Issuer”

means NOVA LIFESTYLE, INC (Nevada Business Identification No. NV20091105529-2), a company incorporated in Neveda with its

business address at 6565 East Washington Boulevard, Commerce, 90040 California, United States.

“IT

System” means shall have the meaning ascribed to it in Appendix A;

“Law”

or “Laws” shall mean and include all applicable statutes, enactments, acts of legislature or Parliament, laws, ordinances,

rules, by-laws, regulations, notifications, guidelines, policies, directions, directives and orders of any Governmental Authority, tribunal,

board and court of competent jurisdiction;

“Material

Adverse Change” means any event, change, circumstance, effect (including change in applicable Laws) or other matter, whether

known or unknown at the time of this Agreement and notwithstanding any other provision of this Agreement or the course of dealings between

the Parties in connection with this Agreement, that has or is reasonably likely to have either individually or in aggregate, with or

without notice, lapse of time or both, a short term or long term material adverse effect on:

| (i) | the

ability of the Seller to perform their obligations under this Agreement or to consummate

in a timely manner the transactions contemplated by this Agreement; or |

| (ii) | the

validity, legality or enforceability of the rights or remedies of the Purchaser under this

Agreement; |

“Notice

of Termination” means a notice, given by any Party to the other Parties, stating that the first Party wishes to terminate this

Agreement and specifying the clause under which, and the facts (with sufficient details) which, entitle the first Party to issue the

notice;

“Ordinary

Course of Business” means, with respect to an action taken by any person, an action that (a) is consistent with the past practices

of such person and is taken in the ordinary course of the normal day-to-day operations of the business of such person; (b) is not required

to be authorised by the board of directors of such person (or by any person or group of persons exercising similar authority) and is

not required to be specifically authorised by the parent company (if any) or the holders of the capital stock or other equity interests

of such person; and (c) is similar in nature and magnitude to actions customarily taken, without any Authorisation by the board of directors

(or by any person or group of persons exercising similar authority), in the ordinary course of the normal day-to-day operations of other

persons that are in the same line of business as such person;

“Parties”

means collectively, the Seller, the Purchaser and the Issuer, and “Party” means each of them;

“Pre-Closing

Covenants” shall have the meaning ascribed to it in Clause 4.1.1;

“Purchase

Consideration” shall have the meaning ascribed to it in Clause 3.1.1;

“Purchaser”

means NOVA LIVING (M) SDN BHD (Registration No. 201901026513 (1335842-W)), a company incorporated in Malaysia;

“Seller”

means ATS BRAND SDN BHD (Registration No. 202201019945 (1465642-V)), a company incorporated in Malaysia;

“Tax”

or “Taxation” means all forms of taxation whether direct or indirect and whether levied by reference to income, profits,

gains, net wealth, asset values, turnover, added value or other reference and statutory, governmental, state, provincial, local governmental

or municipal impositions, duties, contributions, rates and levies, whenever and wherever imposed (whether imposed by way of a withholding

or deduction for or on account of tax or otherwise) and in respect of any person and all fines, penalties, charges, costs and interest

relating thereto;

“Tax

Authority” means any taxing or other authority competent to impose any liability in respect of Taxation or responsible for

the administration and/or collection of Taxation or enforcement of any Law in relation to Taxation;

“Transaction”

means the transaction contemplated by this agreement or any part of that transaction.

“United

States Dollar” or the sign “USD” means the lawful currency of the United States of America; and

“Warranties”

means the representations and warranties on the part of the Seller as set out in Clause 6 and Schedule 4, and “Warranty”

means any of them.

| 1.2.1 | unless

the context requires otherwise, a reference to: |

| (i) | a

gender shall include the other genders and references to the singular shall include the plural

and vice versa; |

| (ii) | natural

persons shall include bodies corporate and vice versa; |

| (iii) | this

Agreement includes any Recitals and Schedules to it and references to Clauses, Recitals,

and Schedules are to the clauses and recitals of, and schedules to, this Agreement. References

to paragraphs are to paragraphs of the Schedules; |

| (iv) | a

person (which for the purposes of this Agreement means any individual, corporation, partnership,

association, limited liability company, trust, governmental or quasi-governmental authority

or body or other entity or organisation (whether or not having a separate legal personality))

shall include its successors in title; |

| (v) | a

“day”, “week”, “month” or “year”

is a reference to a day, week, month or year respectively in the Gregorian calendar; |

| (vi) | this

Agreement or any other document or any specified provision of this Agreement or any other

document are to this Agreement, that document or that provision as in force for the time

being and as amended from time to time in accordance with the terms of this Agreement or

that document or, as the case may be, with the agreement of the relevant Party; and |

| (vii) | a

statute or statutory provision is a reference to it as it is in force from time to time,

taking account of any change, extension, consolidation or re-enactment and includes any subordinate

legislation for the time being in force made under it; |

| 1.2.2 | “control”

means including, with correlative meaning, the terms “controlling”, “controlled

by” and “under common control with”, as used with respect to

any person (whether natural or legal), shall mean, with respect to a corporation, the authority,

whether exercised or not, to control its business and affairs, which authority shall be presumed

to exist upon possession of the right to exercise, directly or indirectly, more than fifty

per cent. (50%) of the voting rights attributable to the shares of the controlled corporation

or to control the composition of the board of directors and, with respect to any person other

than a corporation, the possession, directly or indirectly, of the power to direct or cause

the direction of the management or policies of such person; |

| 1.2.3 | any

phrase introduced by the terms “including”, “include”,

“in particular” or any similar expression shall be construed as illustrative

and shall not limit the sense of the words preceding those terms; |

| 1.2.4 | general

words are not given a restrictive meaning: |

| (i) | if

they are introduced by the word “other” by reason of the fact that they

are preceded by words indicating a particular class of act, matter or things; or |

| (ii) | by

reason of the fact that they are followed by particular examples intended to be; |

| 1.2.5 | the

headings in this Agreement are inserted for convenience only and shall not affect the interpretation

of this Agreement; |

| 1.2.6 | no

provision of this Agreement will be construed adversely to a Party solely on the ground that

the Party was responsible for the preparation of this Agreement or that provision; and |

| 1.2.7 | if

any period of time is specified from a given day, or the day of a given act or event, it

is to be calculated exclusive of that day and if any period of time falls on a day, which

is not a Business Day, then that period is to be deemed to only expire on the next Business

Day. |

| 2. | Sale

and Purchase of IT System |

Seller

agrees to sell and the Purchaser agrees to purchase the IT System on the terms and subject to the conditions of this Agreement.

The

IT System shall be sold by the Seller to the Purchaser:

| 2.2.1 | free

from all Encumbrances and with full legal and beneficial title; and |

| 2.2.2 | with

all rights including but not limited to copyrights and advantages attaching thereto (including

all dividends and distributions (if any) declared, made or paid in respect thereof) with

effect from the Closing Date. |

| 2.3 | No

Rights of Pre-Emption |

| 2.3.1 | Without

prejudice to Clause 2.2 above, the Seller represents, confirms and warrants that there

are no rights of pre-emption or any other similar rights over any of the IT System in favour

of any third party. |

| 2.3.2 | In

the event that there are such rights of pre-emption or other similar rights subsisting in

respect of the IT System, the Seller shall procure that such rights of pre-emption or other

similar rights shall be waived by the relevant party or parties having the benefit of such

rights unconditionally prior to the Closing Date. |

| 3. | Purchase

Consideration for IT System |

| 3.1 | Purchase

Consideration |

| 3.1.1 | The

sale and purchase consideration for the IT System is United States Dollar Seven Hundred

and Fifty Thousand (USD750,000.00) only (the “Purchase Consideration”). |

| 3.1.2 | The

Parties agree that the Purchase Consideration shall be satisfied by way of allotment and

issuance to the Seller of 300,000 new shares of common stock of the Issuer at the issue price

of USD2.50 per share (“Consideration Shares”), the total value of which

is equivalent to the Purchase Consideration. |

| 3.2 | Issuance

of Consideration Shares |

| 3.2.1 | Subject

to fulfilment by the Seller of all the Closing Obligations, the Consideration Shares shall

be issued by the Issuer to the Seller on the Closing Date. |

| 3.2.2 | The

Consideration Shares shall be issued free from all Encumbrances and with full legal and beneficial

title. |

| 3.2.3 | The

Parties agree and acknowledge that issuance of the Consideration Shares by the Issuer to

the Seller on the Closing Date shall constitute a full and final discharge of the Purchaser’s

payment obligation in respect of the Purchase Consideration under this Agreement. |

| 3.3 | Investment

Representations |

| |

3.3 1 |

The Seller hereby acknowledges that the Consideration Shares

are not registered with SEC and shall be restricted and may not be sold, transferred, exchanged, pledged, redeemed or otherwise disposed

of for the holding period required in accordance with the requirement of Regulation S and Rule 144. The Consideration Shares will be

acquired hereunder by the Seller solely for the account of the Seller, for investment, and not with a view to the resale or distribution

thereof. |

| |

3.3 2 |

The Seller is aware that an investment in the Issuer is highly

speculative and that there can be no assurance as to what, if any, return the Seller may realize in connection with the Transaction.

The Seller is aware of the Issuer’s business affairs, business plans and financial condition, and has made its own evaluation of

the merits and risks of the proposed Transaction and of the advisability of the Transaction. The Seller is aware that the Issuer is subject

to a high degree of risk that could result in the loss of the Seller’s investment in part or in whole. |

| |

3.3 3 |

The Seller has experience as an investor in securities of companies

and acknowledges that the Seller is able to fend for itself, can bear the economic risk of its investment in the Consideration Shares

and has such knowledge and experience in financial or business matters that the Seller is capable of evaluating the merits and risks

of, and protecting the Seller’s own interests in connection with, the Transaction and its investment in the Consideration Shares. |

| |

3.3 4 |

The Seller has had full access to all of the information it

considers necessary or appropriate to make an informed investment decision with respect to the Consideration Shares to be acquired under

this Agreement. The Seller further has had an opportunity to ask questions and receive answers from the Issuer and to obtain additional

information necessary to verify any information furnished to the Seller or to which the Seller had access. The Seller has had access

to the Issuer’s publicly filed reports with the SEC and has been furnished during the course of the transactions contemplated by

this Agreement with all other public information regarding the Issuer that the Seller has requested and all such public information is

sufficient for such person or entity to evaluate the risks of investing in the Consideration Shares. |

| |

3.3 5 |

The Seller is not acquiring the Consideration Shares in a transaction

(or an element of a series of transactions) that is part of any plan or scheme to evade the registration provisions of the United States

Securities Act of 1933, as amended (“1933 Act”), as amended. |

| |

3.3 6 |

The Seller’s principal residence or place of business

is located at the address indicated on the signature page hereto. |

| |

3.3 7 |

Seller represents and warrants that (1) the Seller is not a

“U.S. Person” and (2) the Seller was not in the United States at the time the Seller was offered the Consideration Shares

or on the date hereof. |

For

the purpose of this Agreement, a “U.S. Person” means:

| (A) | Any

natural person resident in the United States; |

| (B) | Any

partnership or corporation organized or incorporated under the laws of the United States; |

| (C) | Any

estate of which any executor or administrator is a U.S. person; |

| (D) | Any

trust of which any trustee is a U.S. person; |

| (E) | Any

agency or branch of a foreign entity located in the United States; |

| (F) | Any

non-discretionary account or similar account (other than an estate or trust) held by a dealer

or other fiduciary for the benefit or account of a U.S. person; |

| (G) | Any

discretionary account or similar account (other than an estate or trust) held by a dealer

or other fiduciary organized, incorporated, or (if an individual) resident of the United

States; or |

| (H) | Any

partnership or corporation if (i) organized or incorporated under the laws of any foreign

jurisdiction and (ii) formed by a U.S. person principally for the purpose of investing in

securities not registered under the 1933 Act, unless it is organized or incorporated, and

owned, by accredited investor(s) (as defined in Rule 501(a) of Regulation D promulgated under

the 1933 Act) who are not natural persons, estates or trusts. |

“United

States” or “U.S.” means the United States of America, its territories and possessions, any State of the

United States, and the District of Columbia.

| (i) | The

Seller understands that no action has been or will be taken in any jurisdiction by the Issuer

that would permit the public offering or resale of the Consideration Shares in any country

or jurisdiction where action for that purpose is required. |

| (ii) | If

the Seller is not a U.S. Person, the Seller represents and warrants that it is not purchasing

the Consideration Shares for the account or benefit of any U.S. Person, except in accordance

with one or more available exemptions from the registration requirements of the 1933 Act

or in a transaction not subject thereto. |

| (iii) | If

the Seller is not a U.S. Person, the Seller will make all subsequent offers and sales of

the Consideration Shares either (x) outside of the United States in compliance with Regulation

S; (y) pursuant to a registration under the 1933 Act; or (z) pursuant to an available exemption

from registration under the 1933 Act. Specifically, the Seller will not resell the Consideration

Shares to any U.S. person or within the United States prior to the expiration of a period

commencing on the Closing Date and ending on the date that is one year thereafter (the “Distribution

Compliance Period”), except pursuant to registration under the 1933 Act or an exemption

from registration under the 1933 Act. |

| (iv) | Neither

the Seller nor any person acting on behalf of the Seller, has entered into, has the

intention of entering into, or will enter into any put option, short position or other similar

instrument or position in the U.S. with respect to the Consideration Shares at any time after

the Closing Date through the Distribution Compliance Period except in compliance with the

1933 Act. |

| (v) | The

Seller agrees not to resell the Consideration Shares except in accordance with the provisions

of Regulation S (Rule 901 through 905 and Preliminary Notes thereto), pursuant to a registration

statement under the 1933 Act, or pursuant to an available exemption from registration. |

| |

3.3 8 |

The Seller hereby agrees that the Consideration Shares, upon

issuance, shall bear the following or similar legend, if applicable at the time: |

“THE

SECURITIES REPRESENTED HEREBY HAVE BEEN OFFERED IN AN OFFSHORE TRANSACTION TO A PERSON WHO IS NOT A U.S. PERSON (AS DEFINED HEREIN) PURSUANT

TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”). NONE OF THE SECURITIES REPRESENTED

HEREBY HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, MAY NOT BE OFFERED OR SOLD,

DIRECTLY OR INDIRECTLY, IN THE UNITED STATES (AS DEFINED HEREIN) OR TO U.S. PERSONS EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION

S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM,

OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE

STATE SECURITIES LAWS. IN ADDITION, HEDGING TRANSACTIONS INVOLVING THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE

1933 ACT. “UNITED STATES” AND “U.S. PERSON” ARE AS DEFINED BY REGULATION S UNDER THE 1933 ACT.”

| |

3.3 9 |

Brokers’

Fees. The Seller has no liability to pay any fees or commissions or other consideration to any broker, finder, or agent with

respect to the transactions contemplated by this Agreement. |

| 4.1 | Undertakings

of the Seller |

| 4.1.1 | Except

so far as may be necessary to give effect to this Agreement, the Seller undertakes to procure

and ensure that, between the date of this Agreement and Closing, except with the prior written

consent of the Purchaser (which consent shall not be unreasonably withheld or delayed), the

Seller shall comply with the pre-closing covenants as set out in Schedule 2 (“Pre-Closing

Covenants”). |

| 4.2 | Breach

of Pre-Closing Covenants |

Without

prejudice to Clause 4.3, if prior to Closing the Seller is in breach of any of its undertakings in Clause 4.1, the Purchaser

shall be entitled (in addition to and without prejudice to all other rights and remedies available including the right to claim damages

or compensation from the Seller by reason of any such breach or non-fulfilment):

| 4.2.1 | to

give a Notice of Termination to the Seller to terminate this Agreement without any liability

whatsoever on its part. Upon giving of a Notice of Termination by the Purchaser to the Seller

pursuant to this Clause 4.2, this Agreement shall terminate and the provisions of

Clause 9.6.2 shall apply; or |

| 4.2.2 | to

proceed to effect Closing so far as practicable having regard to the defaults which have

occurred. |

| 4.3 | Breach

or Material Adverse Change |

| 4.3.1 | Notwithstanding

Clause 4.2 above and in addition to any other rights of the Purchaser to terminate

this Agreement, the Purchaser may, at Closing or any time prior to Closing, give a Notice

of Termination to the Seller to terminate this Agreement without any liability whatsoever

on its part if any fact, matter or event (whether existing or occurring on or before the

date of this Agreement or arising or occurring afterwards) comes to the notice or knowledge

of the purchaser at Closing or at any time prior to Closing which: |

| (i) | constitutes

or would constitute a breach by the Seller of this Agreement (including a breach of the covenants

or other obligations of the Seller contained in this Agreement or a breach of any of the

Warranties); or |

| (ii) | constitutes

or would constitute a Material Adverse Change, |

and

that particular breach or Material Adverse Change (if capable of being rectified), is not rectified within seven (7) days of notification

in writing by the Purchaser to the Seller. For the avoidance of doubt, if there is less than seven (7) days between the date of the Purchaser’s

notification of the breach or Material Adverse Change and the Closing Date, the Parties shall defer Closing to such other date that will

allow the Seller seven (7) days to rectify such breach or Material Adverse Change.

| 4.3.2 | Upon

giving of a Notice of Termination by the Purchaser to the Seller pursuant to this Clause

4.3, this Agreement shall terminate and the provisions of Clause 9.6.2 shall apply.

The rights conferred upon the Purchaser this Clause 4.3 is in addition to and without

prejudice to any other rights or remedies of the Purchaser (including any rights to claim

damages or compensation from the Seller by reason of any such breach or Material Adverse

Change) and failure to exercise any such rights shall not constitute a waiver of any such

rights. |

Closing

shall take place on the Closing Date at such time and place as may be agreed in writing between the Seller and the Purchaser.

On

the Closing Date:

| 5.2.1 | the

Seller shall comply with all of their obligations as specified in Schedule 3 (“Closing

Obligations”); and |

| 5.2.2 | subject

to the Seller’ compliance with the Closing Obligations to the satisfaction of the Purchaser,

the Issuer shall issue the Consideration Shares to the Seller and shall enter the name of

the Seller in the register of shareholders of the Issuer as the registered holder of the

Consideration Shares. |

| 5.2.3 | the

Purchaser may, at its sole discretion, waive all or any of the Closing Obligations unless

it is mandatorily required by laws. |

| 5.3 | Breach

of Closing Obligations |

If

the Seller shall fail to comply with any of the Closing Obligations, the Purchaser shall be entitled (in addition to and without prejudice

to all other rights or remedies available including the right to claim damages or compensation from the Seller by reason of any such

breach or non-fulfilment):

| 5.3.1 | to

give a Notice of Termination to the Seller to terminate this Agreement without liability

on its part. Upon giving of a Notice of Termination by the Purchaser to the Seller pursuant

to this Clause 5.3.1, this Agreement shall terminate and the provisions of Clause

9.6.2 shall apply; |

| 5.3.2 | to

proceed to effect Closing so far as practicable having regard to the defaults which have

occurred; or |

| 5.3.3 | to

fix a new date for Closing (not being more than twenty (20) Business Days from the agreed

date for Closing) in which case the provisions of this Clause 5 shall apply to Closing

as so deferred but provided that such deferral may only occur once. |

| 5.4 | Post-Closing

Obligations of the Seller |

Following

the Closing Date, each of the Seller agrees and undertakes that he or she shall do or cause to be done all acts and things and execute

or cause to be executed all documentation, and obtain or cause to be obtained all approvals and consents required (if any), which are

necessary to effect the registration of the transfer of the IT System in the name of the Purchaser.

| 6.1 | The

Parties’ Warranties |

The

Seller represents and warrants to and for the benefit of the Purchaser and the Issuer, and the Purchaser and the Issuer each represent

and warrant to and for the benefit of the Seller, that the following warranties are true and correct in all respects as at the date of

this Agreement and shall be true and correct throughout the subsistence of this Agreement with the same force and effect as if they had

been made as at that later date in the circumstances then existing:

| 6.1.1 | it

has the full power, authority and capacity to execute, deliver and lawfully perform the terms

of this Agreement; |

| 6.1.2 | all

necessary actions, conditions and things have been or will be taken, fulfilled and done (including

the obtaining of any necessary consents) in order to enable it to lawfully exercise its rights

and perform and comply with its obligations under this Agreement; |

| 6.1.3 | this

Agreement will when executed constitute legally valid and binding obligations on it, enforceable

in accordance with their respective terms; |

| 6.1.4 | the

execution, delivery and performance of this Agreement will not exceed the power granted to

it or violate the provisions of any Law or regulation or any order or decree of any Governmental

Authority, agency or court to which it is subject to; |

| 6.1.5 | there

are no pending or threatened actions or proceedings before any court or administrative tribunal

which may materially and adversely affect its ability to discharge its obligations under

this Agreement; and |

| 6.1.6 | in

negotiating and executing this Agreement, it has at all times sought and followed the advice

of competent legal counsel and, based on that advice, has entered into this Agreement based

on its own free will. |

| 6.2 | The

Seller’ Warranties |

| 6.2.1 | The

Seller represents and warrant to each of the Purchaser and the Issuer that the statements

set out in Schedule 4 are true and accurate and not misleading as of the date of this

Agreement and shall be deemed to be repeated as at the Closing Date only as if they were

made and given afresh as of the Closing Date. |

| 6.2.2 | The

Seller acknowledges and agrees that each of the Purchaser and the Issuer is entering into

this Agreement in reliance upon each of the Warranties set out in Schedule 4, and

therefore, the Parties shall treat the Warranties as conditions of this Agreement. The aforesaid

Warranties are not affected or limited in any way by information gathered by the Purchaser,

its advisers, consultants, agents and/or representatives. |

| 6.2.3 | The

Seller acknowledges that each of the Purchaser and the Issuer relies on the warranties, representations

and undertakings by the Seller that the sale of the IT System is free from all Encumbrances,

liabilities, claims and liens of whatever nature, which may materially affect the value of

the IT System. The Seller shall also provide warranty and maintenance to the Purchaser, free

of charge, for a period of 36 months from the date of this Agreement. |

| 6.2.4 | The

Warranties and all other provisions in this Clause 6 shall survive the Closing Date

and shall remain in full force and effect notwithstanding the Closing Date and shall not

be extinguished in any respect upon the Closing Date. |

| 6.2.5 | Each

of the Warranties shall be separate and independent and save as expressly provided shall

not be limited by reference to any other provision or anything in this Agreement. |

| 6.2.6 | In

the event that any of the Warranties has not been complied with or carried out or is otherwise

untrue or misleading in any respect, Claims may be made by either of the Purchaser or the

Issuer where the Purchaser or the Issuer knew or ought to be discovered or in fact discovered

(whether by any investigation made by or on behalf of the Purchaser or the Issuer into the

affairs of IT System or otherwise) prior to or after signing this Agreement. |

| 6.3.1 | If

prior to or as at the Closing Date it shall be found that any of the Warranties on the part

of the Seller have not been carried out or complied with or is otherwise untrue or misleading

in any respect, each of the Purchaser and the Issuer shall be entitled (in addition to and

without prejudice to all other rights or remedies available to it including the right to

claim damages), at its sole and absolute discretion, by giving a Notice of Termination to

the Seller to terminate this Agreement or to elect to proceed with Closing having regard

to the breach. Notwithstanding the foregoing, failure of the Purchaser or the Issuer to exercise

any right under this Clause 6.3 shall not constitute a waiver of any other rights

of the Purchaser or the Issuer arising out of any breach of a Warranty. |

| 6.3.2 | Upon

giving of a Notice of Termination by the Purchaser to the Seller pursuant to Clause 6.3.1

this Agreement shall terminate and the provisions of Clause 9.6.2 shall apply. |

The

Warranties of the Seller are subject to the matters which are fully and fairly disclosed pursuant to this Agreement provided that such

matters are disclosed in sufficient detail to enable the Purchaser to assess their impact on the IT System.

If

after signing of this Agreement:

| 6.5.1 | the

Seller shall become aware that any of the Warranties was untrue, inaccurate or misleading

as of the signing of this Agreement; or |

| 6.5.2 | any

event shall occur or matter shall arise of which any of the Seller become aware of which

results or may result in any of the Warranties being untrue, inaccurate or misleading at

Closing, had the Warranties been repeated as at Closing, |

the

Seller shall immediately notify the Purchaser and the Issuer in writing as soon as practicable and, in any event prior to Closing, setting

out full details of the matter and the Seller shall make any investigation concerning the event or matter and take such action, at its

own costs and expenses, as the Purchaser or the Issuer may require.

The

Seller undertake to irrevocably and unconditionally fully indemnify and keep indemnified and hold harmless the Purchaser and the Issuer

from and against any and all losses, liabilities, obligations, damages, judgments, deficiencies, claims, demands, suits, proceedings,

arbitration, assessments, costs and expenses (including expenses of investigation and enforcement of this indemnity and reasonable solicitors’

fees and expenses) (collectively, “Claims”), sustained, incurred, suffered or paid by the Purchaser and/or the Issuer

directly or indirectly, as a result of or arising out of:

| 7.1.1 | any

breach of any Pre-Closing Covenants set out in Schedule 2; |

| 7.1.2 | any

breach of any Warranty; or |

| 7.1.3 | any

Claims involving fraud or misconduct involving dishonesty on the part of the Seller and/or

misrepresentation which results in a breach of the Warranties or otherwise, |

provided

that the indemnity contained in this Clause 7.1 shall be without prejudice to any other rights or remedies of the Purchaser and/or

the Issuer and all such other rights or remedies are hereby expressly reserved to the Purchaser and/or the Issuer. For the avoidance

of doubt, the Claims shall include an amount that would be necessary to put the Purchaser in the same position as if no breach had occurred.

| 7.2 | Separate

and Independent Obligation |

Each

of the indemnities in this Agreement constitutes a separate and independent obligation from the other obligations in this Agreement,

shall give rise to a separate and independent cause of action, shall apply irrespective of any indulgence granted by the Purchaser and/or

the Issuer and shall continue in full force and effect despite any judgment, order, Claims or proof for a liquidated amount in respect

of any sum due under this Agreement or any other judgment or order.

| 8.1 | Notification

of Potential Claims |

If

the Purchaser and/or the Issuer becomes aware of any fact, matter or circumstance that may give rise to a Claim against the Seller under

this Agreement, the Purchaser and/or the Issuer shall, as soon as reasonably practicable, give a notice in writing to the Seller setting

out such information as is reasonably necessary to enable the Seller to assess the merits of the Claim, to act to preserve evidence and

to make such provision as the Seller may consider necessary. Failure to give such notice shall not affect the rights of the Purchaser

and/or the Issuer in any way whatsoever.

| 8.2 | Notification

of Claims under this Agreement |

Notices

of Claims against the Seller under this Agreement shall be given by the Purchaser and/or the Issuer to the Seller specifying in reasonable

detail the legal and factual basis of the Claim and the evidence on which the Purchaser and/or the Issuer relies and, if practicable,

an estimate of the amount of losses which are, or are to be, the subject of the Claim (including any losses which are contingent on the

occurrence of any future event).

| 9.1 | Agreement

to Continue in Full Force and Effect |

This

Agreement shall continue and remain in full force and effect unless terminated pursuant to the provisions of this Agreement.

| 9.2 | Termination

by Mutual Agreement |

Without

prejudice to any of the Parties’ rights to terminate under the relevant provisions of this Agreement, this Agreement may only be

terminated by mutual agreement of the Parties.

| 9.3 | Seller’

Right to Terminate |

Prior

to Closing, the Seller may, at any time while a default subsists, give a Notice of Termination to the Purchaser and the Issuer in the

event the Purchaser and the Issuer fails, neglects or refuses to pay the Purchase Consideration to the Seller by way of issuance of the

Consideration Shares in accordance with the provisions of Clause 3.2 or is otherwise in material breach of its obligations under

this Agreement and which, if capable of rectification, has not been rectified by the Purchaser and/or the Issuer within seven (7) days,

or such longer period as may be unanimously agreed among the Parties, of being so requested to do by the Seller, the Seller may issue

a Notice of Termination to the Purchaser and the Issuer.

| 9.4 | Purchaser

and Issuer’s Right to Terminate |

Prior

to Closing, the Purchaser and/or the Issuer may, at any time while a default subsists and if capable of rectification, has not been rectified

by the Seller within seven (7) days of being so requested to do by the Purchaser and/or the Issuer, give a Notice of Termination to the

Seller in the event that:

| 9.4.1 | the

Seller fails, neglects or refuses to complete the sale and purchase of the IT System in accordance

with the provisions of this Agreement; or |

| 9.4.2 | the

Seller fails, neglects or refuses to perform or comply with any of its obligations, undertakings

and covenants on its part herein to be performed. |

| 9.5 | Termination

in Event of Insolvency |

Prior

to Closing, any Party may, at any time, give a Notice of Termination to the other Parties if:

| 9.5.1 | another

Party is or becomes, or is adjudicated or found to be, bankrupt or insolvent or suspends

payment of its debts or is (or is deemed to be) unable to or admits inability to pay its

debts as they fall due or proposes or enters into any composition or other arrangement for

the benefit of its creditors generally or proceedings are commenced in relation to that Party

under any Law or procedure relating to the reconstruction or adjustment of debts; or |

| 9.5.2 | an

administrator or receiver or receiver and manager is appointed over, or distress, attachment

or execution is levied or enforced upon, any part of the assets or undertaking of another

Party. |

| 9.6 | Consequences

of Termination |

| 9.6.1 | In

the event of a Notice of Termination being duly given by the Seller under the provisions

of Clause 9.3, then within three (3) Business Days from the date of the Seller’

Notice of Termination, all documents, records and other information delivered by any Party

to the other Parties pursuant to or in connection with this Agreement shall be returned to

the relevant Parties. |

| 9.6.2 | In

the event of a Notice of Termination being duly given by the Purchaser and/or the Issuer

under the provisions of Clause 4.2.1, 4.3.1, 5.3.1, 6.3.1 or 9.4 (as the case may

be), then within three (3) Business Days from the date of the Purchaser and/or the Issuer’s

Notice of Termination: |

| (i) | all

documents, records and other information delivered by any Party to the other Parties pursuant

to or in connection with this Agreement shall be returned to the relevant Party; and |

| (ii) | the

Seller shall pay a sum equivalent to ten per cent. (10%) of the Purchase Consideration to

the Purchaser as agreed liquidated damages. |

| 9.6.3 | In

the event of a Notice of Termination being duly given under the provisions of Clause 9.2

or 9.5 (as the case may be), then within three (3) Business Days from the date of the

Notice of Termination, all documents, records and other information delivered by any Party

to the other Parties pursuant to or in connection with this Agreement shall be returned to

the relevant Party. |

Following

the termination of this Agreement pursuant to this Clause 9, none of the Parties shall have any further obligations under this

Agreement to the other Parties, except in respect of:

| 9.7.1 | the

Parties’ respective obligations under Clause 9.6; |

| 9.7.2 | any

obligations under this Agreement which are expressed to apply after the termination of this

Agreement; and |

| 9.7.3 | any

rights or obligations which have accrued in respect of any antecedent breach of any of the

provisions of this Agreement to any other Party prior to such termination. |

Notwithstanding

the foregoing provisions of this Clause 9, the Purchaser and/or the Issuer shall be at liberty to take such action in Law as may

be necessary to compel the Seller by way of specific performance to complete the transactions contemplated in this Agreement (in which

respect the alternative remedy of monetary compensation shall not be regarded as compensation or sufficient compensation for any default

of the Seller in the performance of the terms and conditions herein) or to claim damages for the breach of the Seller.

| 10.1 | Each

Party shall bear its legal costs and other ancillary costs related to the negotiations, preparation,

finalisation, execution of this Agreement and any other agreement or document entered into

or signed under this Agreement and Closing thereof. |

| 11.1 | All

notices, demands or other communications required or permitted to be given or made hereunder

shall be in writing and in English and delivered personally or sent by prepaid registered

post with recorded delivery, or by courier or email addressed to the intended recipient thereof

at its address or at its email address set out hereunder (or to such other address or email

address as a Party to this Agreement may from time to time duly notify the other Parties).

Any such notice, demand or communication shall be deemed to have been duly served (if delivered

personally or given or made by email) immediately or (if given or made by registered post

or courier) forty-eight (48) hours after posting, and in proving the same it shall be sufficient

to show that personal delivery was made or that the envelope containing such notice was properly

addressed as a prepaid registered letter or that the email was properly addressed and sent. |

| 11.2 | The

addresses and email addresses of the Parties for the purposes of Clause 11.1 are as

follows: |

| 11.2.1 | in

the case of service on the Seller, to: |

| Company |

: |

ATS

Brand Sdn Bhd (Registration No. 202201019945(1465642-V) |

| |

|

|

| Email

Address |

: |

|

| |

|

|

| Attention |

: |

Ban

Soon Hoe |

| 11.2.2 | in

the case of service on the Purchaser, to: |

| Company |

: |

Nova

Living (M) Sdn Bhd (Registration No. 201901026513(1335842-W) |

| |

|

|

| Email

Address |

: |

|

| |

|

|

| Attention

|

: |

Lau

Bee Lay |

| 11.2.3 | in

the case of service on the Issuer, to: |

| Company |

: |

Nova

Lifestyle, INC (Nevada Business Identification No. NV20091105529-2) |

| |

|

|

| Email

Address |

: |

info@novalifestyle.com |

| |

|

|

| Attention

|

: |

Tawny

Lam |

| 11.3 | In

this Clause 11, if deemed receipt occurs before 9am on a Business Day the notice shall

be deemed to have been received at 9am on that day, and if deemed receipt occurs after 5pm

on a Business Day, or on a day which is not a Business Day, the notice shall be deemed to

have been received at 9am on the next Business Day. |

| 12.1 | The

Parties hereto must treat as strictly confidential all information, trade secrets or confidential

knowledge received or obtained as a result of entering into or performing this Agreement

which relates to the provisions or subject matter of this Agreement to the other Parties

or the negotiations relating to this Agreement, including the contents, terms and conditions

of this Agreement, list of employees and their terms and benefits thereof to be furnished

by any Party to the other Parties, any disclosures pursuant to this Agreement as well as

anything delivered to a Party pursuant to this Agreement or that relates to or any transactions

contemplated in this Agreement (“Confidential Information”), except that

the Issuer may disclosure and file this Agreement with SEC in its interim, quarterly and

annual reports. |

| 12.2 | All

Parties must use their reasonable endeavours to cause all of their directors, officers, employees

and/or agents who have or are likely to have access to any Confidential Information to observe

all the obligations of confidentiality under this Clause 11.3. |

| 12.3 | The

Parties shall not at any time: |

| 12.3.1 | disclose

the Confidential Information to any person; |

| 12.3.2 | use

the Confidential Information for their own purposes or for any purposes; or |

| 12.3.3 | through

failure to exercise all due care and diligence, cause or permit any unauthorised disclosure

of any Confidential Information. |

| 12.4 | A

Party may disclose Confidential Information which would otherwise be confidential if and

to the extent: |

| 12.4.1 | it

is required to do so by Law or any Governmental Authority to which it is subject wherever

situated; |

| 12.4.2 | it

considers it necessary to disclose the Confidential Information to its professional advisers,

auditors and bankers on terms that such professional advisers, auditors and bankers undertake

to comply with the provisions of this Clause 11.3 in respect of such information as

if they were a party to this Agreement; |

| 12.4.3 | the

Confidential Information was lawfully available to that Party on a non-confidential basis

from a source other than the other Parties prior to any disclosure thereof by any of the

other Parties, as evidenced by competent proof thereof; |

| 12.4.4 | the

Confidential Information has come into the public domain through no fault of that Party; |

| 12.4.5 | the

other Parties have given prior written approval to the disclosure or use; |

| 12.4.6 | the

disclosure or use is required to vest the full benefit of this Agreement (or any agreement

entered into pursuant to this Agreement) in any other Party; |

| 12.4.7 | the

information is required to be disclosed under written agreements with existing or future

financiers, lenders, suppliers or other contractual counterparties of the Parties; or |

| 12.4.8 | the

information is independently developed after Closing. |

For

purposes of this Agreement, Confidential Information shall not be deemed to be in the public domain merely because individual elements

thereof are separately found in the public domain.

| 12.5 | Prior

to any disclosure of Confidential Information pursuant to Clause 12.4.1, the disclosing

Party shall give the other Parties no less than seven (7) Business Days prior written notice

(unless less time is permitted or required by the Law or Governmental Authority) and, in

making such disclosure, the disclosing Party shall disclose only that portion of Confidential

Information agreed by the other Parties and required to be disclosed, and shall take all

reasonable steps to preserve the confidentiality thereof. |

| 12.6 | The

provisions of this Clause 11.3 shall continue to apply after the expiration or sooner

termination of this Agreement without limit in point of time but shall cease to apply to

information or knowledge which may properly come into public domain through no fault of the

Party so restricted. |

| 12.7 | None

of the Parties shall make or permit or authorise the making of any press release or other

public statement or disclosure concerning this Agreement or its contents without the prior

written consent of the other Parties, other than any announcement or circular as required

by Law, SEC rules or the rules of any recognised stock exchange or an order of court of competent

jurisdiction or a Governmental Authority to which it is subject wherever situated provided

that the other Parties shall be notified prior to any such announcement or circular. |

Each

Party has entered into this Agreement in good faith and shall give all such assistance and information to the other Parties and execute

and do and procure all other necessary person or companies, if any, to execute and do all such further acts, deeds, assurance and things

as may be reasonably required by the other Parties from time to time in order to carry out, evidence and perform their obligations and

the intended purpose of this Agreement.

| 13.2 | Successors

and Assigns |

| 13.2.1 | This

Agreement shall be binding on the Parties to this Agreement and their respective successors

and permitted assigns. |

| 13.2.2 | None

of the Parties shall be entitled to transfer or otherwise assign its rights and obligations

under this Agreement to a third party without the prior written consent of the other Parties

and any assignment, transfer or delegation which is made without such prior written approval

shall constitute a breach of this Agreement. |

This

Agreement contains the whole agreement between the Parties relating to the subject matter of this Agreement to the exclusion of any terms

implied by the Law which may be excluded by contract and supersedes any previous written or oral agreement between the Parties in relation

to the matters dealt with in this Agreement.

| 13.4 | Variation,

Waiver, etc. |

Save

as otherwise expressly provided, no modification, amendment or waiver of any of the provisions of this Agreement shall be effective unless

made in writing specifically referring to this Agreement and duly signed by the Parties to this Agreement.

If

any term or provision of this Agreement is held to be illegal, invalid or unenforceable, in whole or in part, under any enactment or

rule of law, such term or provision or part shall to that extent be deemed not to form part of this Agreement but the legality, validity

or enforceability of the remainder of this Agreement shall not be affected.

| 13.6 | No

Partnership or Agency |

The

provisions of this Agreement shall not be construed or taken to constitute:

| 13.6.1 | a

partnership between the Parties; |

| 13.6.2 | any

Party to be the agent of any of the other Parties; or |

| 13.6.3 | an

authority to any Party to represent or bind or pledge the credit of any of the other Parties

in any way. |

Notwithstanding

anything herein contained, none of the Parties will be liable to any of the other Parties for any breach or failure to perform any of

their respective obligations under this Agreement where such breach or failure is caused directly or indirectly by war, civil commotion,

hostilities, strikes, lockouts, acts of God, pandemic, epidemic, governmental regulations or directions or the action or omission or

purported action or omission of any Governmental Authority, or any other cause or causes beyond that Party’s reasonable control,

whether similar to any of the foregoing or not, but if any Party is or is likely to be, affected by any such cause it shall as soon as

is reasonably practicable notify the other Parties of the occurrence of the relevant event and will use all reasonable endeavours to

overcome or mitigate the effects thereof.

Time

wherever mentioned shall be of the essence of this Agreement, both as regards the dates and periods specifically mentioned and as to

any dates and periods which may be agreed in writing between the Parties to be substituted for them.

| 13.9 | Knowledge

and Acquiescence |

Knowledge

or acquiescence by any Party of, or in, any breach of any of the provisions of this Agreement shall not operate as, or be deemed to be,

a waiver of such provisions and, notwithstanding such knowledge or acquiescence, such Party shall remain entitled to exercise its rights

and/or remedies under this Agreement, and at Law, and to require strict performance of all of the provisions of this Agreement.

The

rights and remedies provided in this Agreement are cumulative, and are not exclusive of any rights or remedies of the Parties provided

at Law, in equity, by statute or otherwise and no failure or delay in the exercise or the partial exercise of any such right or remedy

or the exercise of any other right or remedy shall affect or impair any such right or remedy.

This

Agreement may be entered into in any number of counterparts, all of which taken together and when delivered to the Parties to this Agreement

shall constitute one and the same instrument. The Parties to this Agreement may enter into this Agreement by executing any such counterpart.

This

Agreement, may be accepted, executed or agreed to, through the use of an electronic signature, whether digital or encrypted, in accordance

with the applicable Laws. Any document accepted, executed or agreed to in conformity with such law will be binding on each Party and

shall have the same legal effect, validity or enforceability as if it were physically executed.

Each

Party acknowledges and confirms that it has sought independent legal advice from professional legal advisors with regards to all the

matters provided for in this Agreement and agrees that the provisions of this Agreement (including all documents entered into pursuant

to this Agreement) are fair and reasonable.

| 13.14 | Governing

Law and Jurisdiction |

| 13.14.1 | This

Agreement shall be governed by, and construed in accordance with, the Laws of Malaysia. |

| 13.14.2 | The

Parties irrevocably agree that the courts of Malaysia are to have exclusive jurisdiction

to settle any disputes which may arise out of or in connection with this Agreement and that,

accordingly, any legal action or proceedings arising out of or in connection with this Agreement

shall be brought in those courts and the Parties irrevocably submit to the jurisdiction of

those courts. |

Schedule

1

Particulars of the IT System

| No. |

|

Item |

|

Particulars |

| 1. |

|

Name

and description of the Seller |

|

ATS

BRAND SDN BHD (Registration No. 202201019945 (1465642V)), a company incorporated in Malaysia |

| |

|

|

|

|

| 2. |

|

Name

and description of the Purchaser |

|

NOVA

LIVING (M) SDN BHD (Registration No. 201901026513 (1335842-W)), a company incorporated in Malaysia |

| |

|

|

|

|

| 3. |

|

Name

and description of the Issuer |

|

NOVA

LIFESTYLE, INC (Neveda Business Identification No. NV20091105529-2), a company incorporated in Neveda |

| |

|

|

|

|

| 4. |

|

Description

of the IT System |

|

Refer

to Appendix-A |

| |

|

|

|

|

| 5. |

|

Purchase

Consideration of the IT System |

|

United

States Dollar Seven Hundred and Fifty Thousand (USD750,000.00) only |

| |

|

|

|

|

| 6. |

|

No.

of Consideration Shares to be received by the Seller |

|

300,000

new ordinary shares of the Issuer at the issue price of USD2.50 per ordinary share. |

[the

remainder of this page is intentionally left blank]

Schedule

2

Pre-Closing Covenants

| 1.1 | The

Seller undertakes to procure and ensure that, between the date of this Agreement and Closing,

the Seller: |

| 1.1.1 | shall

not dispose of any of the IT System to any other third party; |

| 1.1.2 | shall

not create any Encumbrance over any of the IT System; |

| 1.1.3 | shall

consult with the Purchaser in relation to all material matters concerning the IT System;

and |

| 1.1.4 | shall

consult with such representatives and advisers of the Purchaser with respect to any action

which may materially affect the IT System. |

| 1.2 | The

Seller further undertakes to procure and ensure that IT System shall comply with all terms,

conditions and requirements of the licences, Law and/or any other obligations. |

| 1.3 | The

Seller covenants and undertakes with the Purchaser to keep Purchaser fully indemnified against

all liabilities, actions, proceedings, costs which may be imposed on the IT System. |

[the

remainder of this page is intentionally left blank]

Schedule

3

Closing Obligations

| 1.1 | On

Closing, the Seller shall deliver, procure the delivery of, or make available to the Purchaser,

the following documents: |

| 1.1.1 | a

certified true copy or extract of the resolution passed by the board of directors of the

Company, approving the sale of the IT System from the Seller to the Purchaser; |

| 1.1.2 | a

certified true copy of the Seller’s latest Forms 24, 44, 49 & Memorandum and Articles

of Association/Constitution or equivalent notification forms under Companies Act 2016; |

| 1.1.3 | a

certified true copy of the Certificate of Incorporation and the Certification of Incorporation

on Change of Name of Company (if any) of the Seller; |

| 1.1.4 | a

certified true copy each of the Identity Cards of the Directors who executed the sale of

IT System for and on behalf of the Seller as contained in the resolution of the Board of

Directors of the Seller; and |

| 1.1.5 | such

other documents which may require in order to effect the sale of IT System and register in

favour of the Purchaser. |

[the

remainder of this page is intentionally left blank]

Schedule

4

Warranties Given by the Seller

The

Seller hereby covenants, undertakes, warrants and represents to the Purchaser that:

| 1. | The

IT System is not in anyway whatsoever affected by interests (if any) claimed by any third

party and is free from all encumbrances save for those made known in this Agreement and no

impediment exists which would impede or obstruct the sale of the said IT System to the Purchaser; |

| 2. | The

Seller has not and shall not do any act or thing in relation to the said IT System by which

the Purchaser may suffer or be exposed to any liability, claim, suit, damages, fines or compensation

including but not limited to infringement claims from third party; |

| 3. | There

is no agreement or arrangement, whether in writing entered into by the Seller with any other

person or company to sell the said IT System nor granted any option or the right of refusal,

whether written or otherwise in favour of any party for the purchase of the said IT System

nor granted any lease, option licence, easement or any other right whatsoever in respect

of the said IT System to any person/company as at the date of this Agreement and Closing

Date; |

| 4. | There

is no power of attorney granted to any party in respect of the said IT System as at the date

of this Agreement and Closing Date; |

| 5. | The

Seller shall take all necessary steps to preserve his proprietorship, rights and interest

in the said IT System to enable the same to be transferred to the Purchaser unencumbered

and without defect. |

| 6. | All

conditions affecting the said IT System whether expressed or implied under any act, ordinance,

enactment, order, rules regulations, by-laws and directive have been duly complied with by

the Seller and the Seller shall not at any time hereafter do or suffer to be done or omitted

any matter or thing in or in respect of the said IT System which may render the said IT or

any part thereof liable to forfeiture or attachment; |

| 7. | The

Seller is not bankrupts or wound up, as the case may be and that there is no bankruptcy or

winding up proceedings, as the case may be that is pending or threatened suit, legal proceedings,

claims against the Seller which may affect in any way the right of the Seller in relation

to the said IT System or any part thereof; |

| 8. | The

Seller agrees and acknowledges that the Purchaser is entering into this Agreement and agreeing

to purchase the said IT System in reliance upon the declarations, representations, warranties

and covenants set forth hereinabove and the Purchaser may treat the same as conditions of

this Agreement and none of the said declarations, representations, warranties and covenants

shall be deemed in any way modified or discharged by the completion of this sale and purchase

hereunder. |

[the

remainder of this page is intentionally left blank]

This

Agreement has been entered into on the date stated at the beginning.

| THE

SELLER |

|

|

|

|

|

| |

|

|

|

|

|

| SIGNED

by |

|

|

|

|

| ATS

BRAND SDN BHD |

|

|

|

|

| (Registration

No. 202201019945 (1465642-V)) |

|

|

/s/ Ban

Soon Hoe |

| |

|

|

Name: |

Ban

Soon Hoe |

| |

|

|

Designation: |

Director |

| |

|

|

|

|

|

| THE

PURCHASER |

|

|

|

|

|

| |

|

|

|

|

| SIGNED

by |

|

|

|

|

| for

and on behalf of |

|

|

|

|

| NOVA

LIVING (M) SDN BHD |

|

|

|

|

| (Registration

No. 201901026513 (1335842-W)) |

|

|

/s/ Lau

Bee Lay |

| |

|

|

Name: |

Lau

Bee Lay |

| |

|

|

Designation: |

Director |

| |

|

|

|

|

|

| THE

ISSUER |

|

|

|

|

|

| |

|

|

|

|

|

| SIGNED

by |

|

|

|

|

|

| for

and on behalf of |

|

|

|

|

| NOVA

LIFESTYLE, INC |

|

|

|

|

| (Neveda

Business Identification No. |

|

|

|

|

| NV20091105529-2) |

|

|

/s/ Thah

Lam |

| |

|

|

Name: |

Thah

H. Lam |

| |

|

|

Designation: |

Chairperson and CEO |

APPENDIX-A

| NOVA AI CALCULATION ENGINE |

| Commission Management Calculation Module |

|

● |

Integrated calculation engine for agency commissions Bonus calculation module provided for post-data update/import |

| |

● |

Bonus reports generated based on the purchased calculation engine |

| |

● |

Instructions provided for exporting bonus data |

| |

|

|

|

| Compiled and Encrypted Calculation Engine |

|

● |

Precise calculation of sales volumes, commissions, and bonuses. |

| |

● |

Integration of member hierarchy and structure for seamless operation. |

| |

● |

Downline tracking and reporting features for comprehensive insights. |

| |

● |

Transparent and compliant calculations to ensure accuracy and adherence to regulations. |

| |

● |

Flexibility and scalability designed for easy future modifications. |

| |

|

|

|

| Membership Module |

|

● |

Membership/agent management system utilizing a multi-tiered database. |

| |

● |

Calculation method system integrating a clear representation of the hierarchical structure, including identification of levels, ranks, and qualifications required for advancement. |

| |

● |

Optional empty table with description provided if the module is not required. |

| |

● |

Instructions available for importing data from another system if needed. |

| |

|

|

|

| Sales Module |

|

● |

Sales management system structured on a multi-tier database. |

| |

● |

Multi-tiered compensation plans centered around sales volume, determining commissions, bonuses, and qualifications. |

| |

● |

Accurate calculation of sales volume for each member and their downline, considering factors like product prices, personal sales, group sales, and overall team performance. |

| |

● |

Optional empty table with description provided if the module is not required. |

| |

● |

Instructions available for importing data from another system if needed. |

| |

|

|

|

| Maintenance and Support |

|

● |

Consistent application of updates and patches. |

| |

● |

Optimization of system performance. |

| |

● |

Implementation of robust backup and disaster recovery measures. |

| |

● |

Conducting security audits and vulnerability assessments. |

| |

● |

Continuous monitoring and alerting for proactive management. |

| |

● |

Efficient incident management and ongoing support. |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |