UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material under §240.14a-12 |

OUTBRAIN INC.

__________________________________________________________

(Name of Registrant as Specified In Its Charter)

__________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

ý No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a‑6(i)(1) and 0‑11.

This Schedule 14A filing consists of various communication from Outbrain Inc., a Delaware corporation (the "Company"), relating to the definitive share purchase agreement, dated August 1, 2024, by and among the Company, Altice Teads S.A.(the "Seller"), a public limited liability company (société anonyme), incorporated and existing under the laws of the Grand Duchy of Luxembourg and the sole shareholder of Teads S.A., a public limited liability company (société anonyme), incorporated and existing under the laws of the Grand Duchy of Luxembourg ("Teads").

Transcript of the Q2 2024 Earnings Call, August 8, 2024

Presenters

Samantha Fawcett, IR

David Kostman, CEO

Jason Kiviat, CFO

Q&A Participants

Andrew Boone—JMP Securities

Max—Citi

Laura Martin—Needham

James Heaney—Jefferies

Zack Cummins—B. Riley

Operator

Good day and welcome to Outbrain Inc. second-quarter 2024 earnings conference call. At this time all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. As a reminder, this conference is being recorded. I'd like to turn the call over to Outbrain's Investor Relations. Please go ahead.

Samantha Fawcett

Good morning and thank you for joining us on today's conference call to discuss Outbrain's second-quarter 2024 results. Joining me on the call today we have Outbrain CEO David Kostman, and CFO Jason Kiviat. During this conference call management will make forward-looking statements based on current expectations and assumptions. These statements are subject to risks and uncertainties that may cause actual results to differ materially from our forward-looking statements. These risks factors are discussed in detail in our Form 10-K filed for the year ended December 31, 2023, as updated in a subsequent report filed with the Securities and Exchange Commission.

Forward-looking statements speak only as of the call's original date and we do not undertake any duty to update any such statements. Today's presentation also includes references to non-GAAP financial measures. You should refer to the information contained in the company's second-quarter earnings release for definitional informational on reconciliations of the non-GAAP measures to the comparable GAAP financial measures. Our (inaudible) can be found on the IR website, investors.outbrain.com, under News and Events. With that let me turn the call over to David.

David Kostman

Thank you, Sam. Good morning and thank you for joining us today for our second-quarter 2024 earnings call. Last Thursday, we announced the definitive agreement to acquire Teads, combining the two companies into a platform that we believe will define the next generation of open Internet advertising. This is a transformative merger that positions us as one of the largest open Internet advertising platforms. It dramatically changes our financial profile in terms of profitability and growth opportunity. We believe the combination will deliver significant accretion to our shareholders to synergies and the final financial leverage of that transaction.

The two companies have amazing teams of talented, innovative, driven people that have been instrumental in establishing our two companies as category creators and leaders, (inaudible) performance and Teads in branding. Together we believe we will create a scaled global platform that can deliver outcomes for advertisers currently only rivaled by walled gardens.

We've been clear that our vision is to become a true end-to-end full funnel platform for the open Internet, with a level of service and standard centered on serving brand needs. The news of our merger with Teads allows us to take a massive leap forward in executing this strategy. The reception we've seen from many industry players reinforces our confidence in the mergers rationale.

Many of our partners from media owners to brands and agencies expressed their excitement about the opportunities the new company would create. For example, Peter Wurtenberger, Executive Vice President at Axel Springer, wrote to us -- This is a significant milestone for both companies and we are thrilled to see your expanded capability. We look forward to seeing the positive impact this partnership will have on the industry and on our collaboration.

And another one, Alexandra Chabanne, CEO of GroupM France, one of our agency partners, wrote -- This merger of the leaders in performance marketing and video branding promises to be an exciting and transformative alliance. These statements are just two of many examples of the overwhelmingly positive feedback from so many of our clients, and I want to take this opportunity to thank them for that and for their continued partnership.

The two companies will continue to operate as stand-alone businesses as we prepare the post-merger integration plans. Closing, which is subject to regulatory approval, Outbrain's shareholder vote and other standard closing conditions, is expected by Q1 2025.

Now I want to provide an update on Q2 and the progress on our 2024 growth drivers. For Q2, I am pleased to report that we delivered extra gross profit of $56 million, towards the high-end of our guidance. We significantly exceeded our adjusted EBITDA guidance with $7.4 million, and we generated positive free cash flow for the fourth consecutive quarter. These results are driven by positive trends in our core business and the momentum in our growth drivers.

As you may recall, these growth drivers we talked about revolve around three pillars. The first pillar refers to expanding our share of wallet with advertisers across both brands and agencies as well as performance advertisers. Onyx direct sales continued to grow through the combination of new clients, new markets and with bookings. We successfully launched Onyx in

Israel in Spain and have several campaigns live in both countries, this is in addition to the US, UK, Germany, Italy, and Japan.

In addition, Onyx has continued to see strong rebooking rate of nearly 40% in Q2, reflecting the business impact Onyx has delivered for our clients. Notably, we secured multiple campaigns from enterprise partners such as Disney+, Purina, Nissan, including a great campaign promoting the Taylor Swift Eras tour -- sorry, I had to mention this campaign to get some credit with my daughter.

On the performance side, of our business, one of our main initiatives is shifting certain buyer profiles to our DSP Zemanta. Our DSP enables these clients to drive ROAS at a larger scale on the open Internet, allowing us to capture a larger share of wallet from these clients at a higher Ex-TAC margin. In the first half of 2024, we achieved remarkable growth on our DSP with advertiser spend growing by approximately 50% in comparison to the first half of 2023.

Moving on to our second pillar. We continue to expand our supply footprint outside of our traditional theme, enabling advertisers to reach consumers with a range of placement across the entirety of the open Internet. These revenues, which are on inventory beyond our traditional themes (ph), represented approximately 27% of our revenue in Q2 2024 versus 24% in Q2 2023.

Our third pillar, we continue to invest in deepening our partnerships with top premier media owners. We signed exclusive deep (ph) partnerships among others with EBRA in France and The Daily Beast in the US. We also renewed several partnerships including Ad Alliance in Germany and Vox in the US. This resulted in global retention of 99% in Q2. Also, Keystone so continued adoption by some of our top premium publishers.

Let me share a few highlights on our product and algo. We launched a new AI driven targeting solution, Predictive Demographics. Predictive Demographics enables our clients to reach relevant demographic audiences without relying on third-party cookies. Outbrain Predictive Demographics is establishing itself is a real option for demographic targeting among Zemanta buyers, with early data showing an adoption rate surpassing traditional third-party targeting segments by up to 40%.

For one of our recent clients, a public health campaign in the US, Predictive Demographics drove 2.7 times higher click-through rate in comparison to campaigns using third-party demographic segments. We are encouraged by these results which signal to us that advertisers are looking for privacy forward audience solutions that can drive results.

On the heels of Google's announcement to reverse their plans to deprecate third-party cookies in Chrome, we remain committed to driving results with contextual and privacy centric signals. The successful launch of Predictive Demographics is a reflection of this. On the algo side, our click-through rate has witnessed double-digit growth in the first half of 2024, and we've also witnessed our third consecutive quarter of year-over-year RPM growth, sustaining our upward momentum.

In conclusion, our second quarter has been marked by growth, new partnerships and innovative strides in improving campaign performance and user engagement. I'm confident that our

trajectory remains strong and that we are well-positioned for sustained success in the future. We are thrilled to embark on the next chapter with Teads and are focused on executing our strategy to build towards becoming the preferred full funnel platform for brands on the open Internet. With that I'll turn it over to Jason.

Jason Kiviat

Thanks, David. As David mentioned, we achieved our Q2 guidance for Ex-TAC gross profit and exceeded our Q2 guidance for adjusted EBITDA, generating positive free cash flow for the fourth consecutive quarter. Overall, we feel we have made updates to our revenue mix and cost structure that are having a positive impact on our profitability now and expect that to continue in the future.

Revenue in Q2 was approximately $214 million, reflecting a decrease of 5% year-over-year. New media partners in the quarter contributed 6 percentage points or approximately $14 million of revenue growth year-over-year. Net revenue retention of our publishers was 89%, which reflects continued headwinds from the impact of the demand environment on pricing as well as downward pressure of ad impressions from certain key supply partners, as noted in the prior quarter.

Consistent with recent quarters, logo retention was 99% for all partners that generated at least $10,000, and our five largest churns amounted to only 2 combined points of year-over-year headwind on NRR.

With respect to advertising demand, pricing remains low relative to our history and, while it remains down year-over-year, we have seen positive trends over the course of Q2 with improvement month over month. This, along with continued improvements in click-through rates, drove acceleration in RPMs, which have now seen growth year-over-year for the third consecutive quarter.

Ex-TAC gross profit was $56 million, an increase of 3% year-over-year, outpacing revenue for the fifth quarter in a row, driven primarily by net favorable change in our revenue mix and improved performance on certain deals. As noted previously, the investment areas we're focused on are largely areas that we expect will drive a higher Ex-TAC take rate, and these areas are helping bring that to fruition.

While Ex-TAC gross profit returned to year-over-year growth in Q2 on the strength of these accelerating growth areas, and the positive momentum of RPMs, over the past two quarters we've noted volatility from one of our key partners transitioning to a new bidding technology, Outbrain being one of the first partners to complete this transition in early May. The transition involved access to new supply opportunities for us and we remain focused on the optimization and rescaling of our demand.

This volatility impacted our Ex-TAC gross profit in Q2 by a high single-digit percentage. Our overall Q2 Ex-TAC gross profit would have grown double-digit percentage year-over-year excluding this one isolated headwind.

Moving to expenses, operating expenses decreased by approximately 1% year-over-year to $51.2 million in the quarter as we continue to balance investments in our strategic priorities with continued cost discipline. The OpEx decline year-over-year was driven by compensation and bad debt savings as well as timing benefits of expenses shifting from Q2 into H2, offset partially by the increased professional fees relating to our announced anticipated transaction with Teads. As a result, we doubled our adjusted EBITDA year-over-year to $7.4 million.

Moving to liquidity. Free cash flow, which, as a reminder, we define as cash from operating activities less CapEx and capitalized software cost, was approximately $300,000 in the second quarter as a result of offsetting impacts of profitability, strong collections of receivables, timing of income tax and other payments, and seasonality. As a result, we ended the quarter with $229 million of cash, cash equivalents, and investments in marketable securities on the balance sheet, and $118 million of long-term convertible debt.

In December 2022, the company's Board of Directors authorized a $30 million share repurchase program. And in Q2, we purchased approximately 0.5 million shares for $2 million. As of June 30, we have 6.6 million remaining under our current authorizations. Given the pending acquisition of Teads, we currently do not intend to continue repurchasing shares.

Turning to our outlook. In our guidance we have seen regular seasonality and, as noted in the prior quarter, continued execution of our growth drivers. Additionally, our guidance reflects Outbrain as a stand-alone business with the assumption that the announced transaction with Teads will not close before year-end. With that concept we have provided the following guidance.

For Q3, we expect Ex-TAC gross profit of $58 million to $62 million and we expect adjusted EBITDA of $8 million to $10.5 million. We maintain our previous full-year 2024 guidance for Ex-TAC gross profit of $238 million to $248 million and are increasing our guidance for adjusted EBITDA to $31.5 million to $36 million. Now I'll turn it back to the operator for Q&A.

Operator

Thank you. Ladies and gentlemen, the floor is now open for questions. If you do have a question, please press star one on your telephone keypad at this time. Again, that's star one if you do have a question or comment. And we will take our first question from Andrew Boone from JMP Securities. Please go ahead, Andrew.

Andrew Boone

Good morning and thanks much for taking my questions. You highlighted the growth in RPMs in the quarter. Can you talk about the drivers of that and your confidence that those can continue? And then Jason, can you wrap that into the implied guidance for 4Q and talk about your confidence just given the implied acceleration that full-year guidance implies for 4Q?

And then, (inaudible), just stepping back, can you talk about the conversations that you're having with advertisers just in the last week? I understand it's still very new, but what's the reception been to the announcement of the Teads acquisition? Thanks so much, guys.

Jason Kiviat

Sure. Thanks, Andrew. It's Jason and I'll take the first couple there. So, as far as what's driving RPMs, I mean, it's the third quarter in a row that we're seen yields or RPMs up year-over-year. One constant driver has been the click-through rates which we've been kind of each quarter breaking our previous records as far as just how high those click-through rates are.

There's a lot that goes into that, obviously algorithmic improvements, use of additional data signals, optimizations like some of our dynamic placements that we're using are helping drive higher click-through rates. So, click-through rates a been a good thing for a long time for us and is going to go in the right direction.

The one kind of new thing I'd say this quarter was we started to see just a better trend on cost-per-click on CPCs which have been a headwind and remain a headwind for us year-over-year in Q2. But over the course of the quarter, we started to see it going in the right direction as far as just narrowing the headwind year-over-year. So, that was a real positive. It comes with maybe some market dynamics and also some changes we made internally as well. So, good things on our RPMs and we obviously see it not only driving better revenue but also better margins.

And then as far as the confidence in the back half and Q4 -- we do expect acceleration in Q3 versus Q2 and also Q4 versus Q3 -- versus the 3% Ex-TAC growth we saw in Q2, we get to I think 6% in Q3 at the midpoint and 17% in Q4 at the midpoint. So, maybe just a lot of the good things that we see driving the success in Q2 and into Q3, we see continuing into Q4. So, that's definitely a piece of it.

But I think up a piece of it, and that step up from the 6% growth to 17%, the difference is -- a lot of it's coming from year-over-year comps actually. So, 8 points of eating (ph) comps in Q4 is one way to look at it. Last year we didn't have a normal Q4, obviously it started with the attacks on October 7, and the war and the impact on our war-related news page views and just advertising demand.

And also, just we talk about the key tech partner transition, we did start to see some headwinds on that really in Q4 of last year. So, two of those things combined ease the comps for Q4 and that's driving I think 8 points of improvement as compared to the Q3. And then continued success of the growth drivers that we are already seeing some success with, obviously. And yes, RPMs, election -- so just, those are more small items there flowing through our model, but all that combined.

David Kostman

Hey, Andrew, I'll take the second one. Thanks. So, it's been actually a very exciting week with overwhelmingly positive feedback from players in the industry, both advertisers and video owners, publishers. On the advertiser side specifically, they really do this as a huge opportunity to have one player that can provide the full funnel solution on the open Internet. When we talk about full funnel, that means branding consideration and conversions on an end-to-end basis, due (ph) the advantage of the data.

So, overwhelmingly both the Teads -- on the Teads side and on our side, really people are expecting as quickly as possible for us to close it and be able to bring them the value proposition we're talking about, which is really the combination of leaders in performance, which is us, and leaders in branding that is Teads. So, it's been great, and it's been very exciting week, as you can imagine.

Andrew Boone

Thank you.

Operator

Thank you. And we'll take our next question from Yigal Arounian from Citi. Please go ahead, Yigal.

Max

Hey, good morning, guys. You have Max on for Yigal. I guess first maybe just start with what you're seeing in the ad macro. It seems like it was -- maybe has been a little more mix, but what you're seeing now and how you see that playing out through the rest of the year. If there's anything maybe geographical or vertical to call out.

Jason Kiviat

Sure, I can start with that. So, like I said, we did see continued RPM and even CPC gains over the course of Q2, which is a combination of a lot of factors, so it's hard to know how much of it is macro versus internal or specific to us. But we did see positive things, so it's a good sign.

Geographically I'd say we see strength in Europe, particularly Germany, which is our second largest market, and Spain were couple of our small stronger markets throughout the quarter. And yeah, I mean going forward, I think it's hard to predict anything I guess macro-wise going forward, but we obviously hope to see continued acceleration of what we saw through Q2 is what we we're hoping for but not overly relying on, I'd say, in our guidance.

Max

Okay, thanks. Yeah, that's helpful. And then maybe just spending a little time on Zemanta. Obviously, you've seen good growth there. Is there anything maybe like specific you guys can call out on what's driving this? And then maybe just kind of like bigger picture, in the combined company, how do you see Zemanta fitting in with Teads? And maybe just would be (inaudible) too as you look to combine? Obviously early days but maybe just like any early thoughts on how you think about combining those going forward?

David Kostman

Sure. I'll take that, Max. On Zemanta being one of our growth drivers for this year and really we need to grow the share of wallet on from performance advertisers by just delivering superior ROAS to them, and also allowing them to spend more on the entirety of the open Internet,

again in line with our vision of becoming the main gateway for the open Internet for both brand advertisers and performance.

And we started last year to shift some type of clients that just had better performance on the Zemanta platform Internet, so that caused us to think they would spend more. Because they still spend on the outgoing publishing network but they also can spend on third-party platforms (inaudible). And then that grows the share of wallet. And also, we thought (ph) it's a margin enhancer. We've seen we said 50% growth in the spend on Zemanta and I think that will continue to be one of the main growth drivers for the company stand alone.

As to the combination that we keep, it's a little bit early days. We have not yet gone deeply into sort of product planning, etc., we just started -- I think we mentioned the post merger integration planning. And generally, I would say the Zemanta pipeline, we've been very, very focused on performance buyers. So, I believe it will continue to be part of our growth drivers in the future for those type of buyers.

Max

Okay, great. Thanks, guys.

Operator

Thank you. And we'll take our next question from Laura Martin from Needham. Please go ahead, Laura.

Laura Martin

Yeah, I also have two. The first one is, when you think about revenue synergies, is it a bigger upside driver that Teads will be able to sell in performance advertising from the Outbrain core business or the reverse -- Outbrain adds more upper funnel from the Teads client base?

David Kostman

Hey, Laura, it's actually on both sides. So, what we've heard and also throughout the process, is Teads was growing sort of to the mid-funnel and to conversions. But again, only with enterprise brand buyers. So, that's their focus in terms of the customer base. And that customer base also has different objectives on different things. So, we see a huge opportunity and also the Teads management sees a huge opportunity to just drive (ph) leveraging our prediction technology algorithms, just better conversions and no (ph) funnel business for the brand advertisers.

At the same time, we have about 40% of our business today is with brand and enterprises. They do mostly performance, I mentioned a few campaigns that we have. So, for example, if you look at an automotive client like all Audi, we mentioned it in the call, they can really have us as the partner for the entirety of the funnel. So, I think it's a both directions.

When we get the synergy number that we -- when we announced the deal, the $50 million to $60 million, that doesn't include minimal top-line synergies, it's mostly just around operating synergies and other opportunities across the two networks.

Laura Martin

Okay, thanks. And then, Jason, for you -- the gross revenue came in really light, but then net revenue, which is how we value, came in right in line sort of our estimate. So, is that related to this unique client that had an impact and it only had an impact on gross revenue but not net revenue? Is that how I should take your commentary about the one time disruption of I assume it's Microsoft?

Jason Kiviat

Yeah. So, the partner, yes, it definitely impacted both. It's not just one line or the other line. A lot of the things that we're focusing on right now are things that are higher margin segments or drivers. I think Zemanta DSP business is a good example of that in that the way that works is it's actually a net revenue business in that the fees that are charged for customers to use the platform and by media spend are recognized on a net revenue basis. So, it's just an accounting thing there, and we might see some trade-off in gross revenue in exchange for Ex-TAC when we're doing that.

David Kostman

Maybe I just want to add on the -- Laura, on the one partner. So, again, strategic partner, they made a transition. We are the first native partner to make a full transition, signed a new agreement with them that that transition also involves access to new types of supply within Microsoft like Outlook and Games and others. So, it's a transition, we were the first to complete it. We see also big upside opportunities potentially down the road, but I think we just need to be cautious with how we rescale up our bias (ph) on that.

Laura Martin

Thank you.

Operator

Thank you. And we'll take our next question from James Heaney from Jefferies. Please go ahead, James.

James Heaney

Great, thank you, guys. Can you just talk about the growth that you saw from Onyx in the quarter? And maybe if you could comment on your pivot from being more of a performance ad platform to servicing more upper funnel objectives. And I have another follow-up.

David Kostman

So, we're talking about Onyx, we had strong rebookings, we don't break it down specifically, but strong rebookings, good adoption, we launched it in more markets and (inaudible). Second half of it -- I think that's actually one part of the business that's in the segment (ph) that may get

somewhat impacted by the Teads merger. I mean, it is addressing sort of the upper funnel opportunities with large agencies. And so, that's Onyx.

James Heaney

Great. And then, Jason, just on your full-year EBITDA guide being raised, I'm just curious where you're seeing the majority of the cost savings in the business? And then just broadly speaking, how to think about the balanced growth and profitability? Thank you.

Jason Kiviat

Sure. Yeah, well we do -- we've been a bit focused on -- in the last couple years on just improving our just business model in general. And I think that we've done a lot of that both in terms of changing our revenue mix and our approach to these investment areas that tend to have higher margins and higher profit margins as well, which I think we've been pretty successful at if you look at the take right now versus where it was a year or two years ago. But also the cost structure.

And we've been pretty focused on that last year and the year before and we continue to focus on it this year. And so, we've been outperforming our plans on cost and some of that comes with just operating more efficiently, really being hard on ourselves with which areas to invest in and which not and really scrutinizing our spend on that.

We do expect a step up in this second half of the year on costs in some areas, obviously some of the hiring done for the investment areas happen during Q2. And so, we expect that to be a little bit higher in the second half of the year. But we think it's a nice setup for us to obviously deliver the higher level of EBITDA and remain prudent in our spending.

James Heaney

Thank you.

Operator

Thank you. And we'll take our next question from Zack Cummins from B. Riley. Please go ahead.

Zack Cummins

Hi, good morning. Thanks for taking my questions. Jason, I was curious, what are your assumptions that you're baking in for Microsoft in the second half of the year? Are you assuming you're relatively stable from these Q2 levels or any sort of improvement baked into the second half?

Jason Kiviat

Yes, so we obviously are looking at this very closely. Again, we believe we're the first native partner to complete this transition and we've been very focused on driving the rescaling as we said a few months ago. I think right now what we've seen is just volatility and that's really our

approach to the forecast for the second half of the year is accounting for it with just a greater range of variability in our H2 numbers. Because on one hand we do see upside, on the other hand we've seen volatility. And so, we thought the best approach was to just account for like a wider range of variability.

Zack Cummins

Understood. And in terms of just your overall footprint on the open Internet, I think metrics you shared was 27% on your nontraditional formats on the open Internet. Can you speak to the ideal mix as you go over time in terms of your footprint, just for stand-alone Outbrain? I'm curious how you're continuing to drive that strategy.

David Kostman

So, we are really trying to build ourselves in the main gateway to the entirety of the open Internet. We have a strong asset in the bidding technology that we acquired through Zemanta that allows us to really go way beyond just our publisher base. So, ideally, we grow both -- I mean, we've had some great wins on the premium publisher side this quarter. So again, we're very, very focused on our core supply base and brand and enterprises on premium (ph).

We believe that sort of premium supply drives premium demand and also going for performance on third parties where they're looking for pure ROAS and Zemanta is just a great platform to do that. Again, overall, we see ourselves in terms of the organic growth that we delivered to sort of these (inaudible) that sort of outperforming competition on organic growth. And that's what we're looking at in terms of, again, growing the entire budget base that we can deliver both on our foundational base and on others third-party suppliers.

Zack Cummins

Understood. Well, thanks for taking my questions and best of luck with the rest of the quarter.

Operator

And that will conclude the question-and-answer session. I'd like to turn the floor back to David Kostman for closing remarks.

David Kostman

Thank you, Karen. So, thank you all for joining us today, we appreciate your support and partnership and looking forward to the exciting journey ahead together with all our shareholders. Thank you very much.

Operator

Thank you. Ladies and gentlemen, this does conclude today's teleconference. We thank you for your participation. You may disconnect your lines at this time, and have a great day.

Communication of David Kostman interview with Beet.TV

Transcript of David Kostman Interview with Beet.TV

The following is a transcript of the interview between David Kostman, CEO of Outbrain Inc. (NASDAQ: OB) (“Outbrain”) and beet TV on August 1, 2024. While an effort has been made to provide accurate transcription, there may be typographical mistakes, inaudible statemnts, errors, omissions or inaccuracies in the transcript. Outbrain believe that none of these are material. The video recording is available at: https://www.beet.tv/2024/08/our-acquisition-of-teads-gives-marketers-full-funnel-reach-outbrains-david-kostman.html

beet TV

August 1, 2024

David Kostman

[ 00:00:00 ] So we announced today the merger of Outbrain and Teads. It's a real transformational deal which I believe will bring a tremendous amount of value for advertisers, media owners, publishers, and the industry in general. And it's also transformational for our company as a financial entity, as a public company. So on both dimensions it's a great event for us, very excited about it.

Rob Williams

[ 00:00:28 ] Well, maybe you can tell us a little bit about what each company brings to the table; Outbrain you have your specialty in native advertising, but Teads is also kind of in a similar field except maybe with more of a focus on video. Is that what I am to understand? Or how would you describe the key strengths to each company?

David Kostman

[ 00:00:49 ] So, the two companies are really best in class in what they do, so we bring what we believe is the best in performance, performance advertising, prediction capabilities and

engagement of audiences, and Teads really brings to the table. They created the sort of out-stream video category and they bringing today a broad omnichannel video branding platform that is unparalleled. They are bringing tremendous relationships with the top most premium advertisers in the world through their joint business partnerships. Both companies are bringing code on page, first-party data through the strategic relationships we have with publishers. So combining these two assets creates a real opportunity to build what people have been looking for, which is an end-to-end full-funnel platform on the open internet that could rival the performance and capabilities of walled gardens. So that's exciting to be part of it.

Rob Williams

[ 00:01:48 ] Now, I'm glad that you mentioned the open internet. Because more and more, it feels like there's less and less of an open internet with, as you mentioned, the walled gardens. So when you talk to advertisers, what are you telling them about what this deal will mean for them in terms of your capabilities and what kinds of services you can provide to media buyers and marketers?

David Kostman

[ 00:02:11 ] So I'm a big believer in the open internet. There's a tremendous amount of opportunity. Teads also has a relatively meaningful already business in the connected TV which is something that we were trying to do. I think the message for advertisers is one that you could find a partner that works at scale globally, we have about $1.7 billion of advertising revenues that flow through, through the two companies. So this is a partner that can deliver global campaigns at scale, and do it across the funnel. So you could build your brand awareness with us. Drive consideration down to a conversion. We use the example, for instance, of Audi, who's trying to create, for example, brand awareness on a new model that they want someone to engage, download a white paper about the engine. And then you want to get people to do a test drive. We want to be, we believe, the only company on the open internet, being able to deliver that in one place. And the key here is, at the end, is the data. So both companies have very rich sets of data that are way superior than other point solutions, as DSPs and SSPs. And if you look at sort of our industry, the ecosystem, everyone is trying to become end-to-end at this point. And we, both companies, have been built from the ground up as end-to-end platform. So our brand has direct, strategic, long-term relationships with most of the most premium publishers in the world. Teads has very similar strategic relationships with, most of the top enterprise brands of the world and combining that and being able to deliver value through the advertisers accessing our own platforms or the Teads Ad manager or our Amplify platform and connecting directly to media owners, publishers at CTV is unique and at large scale is something that is unrivaled at the open internet.

Rob Williams

[ 00:04:16 ] I'm glad you brought up data because nowadays so many companies are collecting first-party data and trying to figure out the best ways to use it; so when a brand comes to you and says, 'You know we have this database’, what do you tell them in terms do you work with clean rooms or something to help match audiences or how does that work?

David Kostman

[ 00:04:37 ] So, our core data capabilities are based on contextual data and superior signals and rich data that we get just by being code-on-page on most of publisher sites. So, when you look at normal impression data that's transmitted through a bit stream, that's pretty limited. We have

data around the time of engagement, how much you scrolled if you read an article about sports did you then go and read about something else? So we are able to create a real interest profile of a person without knowing the the user identity, and also combining that with a lot of contextual capabilities. This is the core element of the data we have. We do connect with many of the user ID solutions that are out there, so you can definitely integrate that into your campaign, but our ability to, as a standalone, the two companies are have been based primarily on contextual. So, privacy-friendly from day one combining those two data sets, we understand what it means that when you have an incremental data set, what it could bring in terms of yield and performance and return on ad spend, and building awareness and attention for your brand campaigns. So, we believe that and on a combined basis, we will be able to offer much stronger solutions as a standalone company that will deliver even superior value than both companies individually do today.

Rob Williams

[00:06:13]That's really fascinating! So now, looking at the publisher side, what do you think this combination means for publishers?

David Kostman

[00:06:20] I think for publishers just the ability to get more traction I mean you asked about the open internet before, as a combined company I think both companies have had the mission to really help publishing thrive and we're very significant partners of publishers and now of CTV and other and other platform outside of traditional publishers but the message for them is that high premium quality video campaigns at the run through Teads primarily combined with the performance capabilities that we bring will make their own properties much more attractive to advertisers than than ever before and it's about shifting the dollars into the open Internet and I think by delivering superior capabilities that deliver better results for advertisers, it will get us to be able to deliver bigger share of wallets from those advertisers to the open internet.

Rob Williams

[ 00:07:16 ] That's really interesting. Now, looking ahead, is there anything that you're really excited about or really keeps you up at night, or what's coming up that we should know about?

David Kostman

[ 00:07:27 ] I'm pretty excited about this combination I think that's enough excitement for one day and I'm looking forward to really we announced today this deal which is also from a financial profile really transformational for us and I'm very excited to sort of get to the next stage of really planning the integration in more detail and and going through the processes that we need to go until we close obviously we just announced a signing of the definitive agreement today it's gonna take a few months until we can combine so I'm looking forward to continuing to work the people at Teads that we met through this process are super strong I mean great we believe we can build a great team together many of our people also spend time with them during this deal creation process and I'm just very excited of working with their great team and having our people have the opportunity To work with them and sort of build the plans for the future company.

Cautionary Note About Forward-Looking Statements

These transcripts contains forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. These statements are based on current expectations, estimates, forecasts and projections about the industries in which Outbrain and Teads operate, and beliefs and assumptions of Outbrain’s management. Forward-looking statements may include, without limitation, statements regarding possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives, expected synergies and statements of a general economic or industry-specific nature. You can generally identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “guidance,” “outlook,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “foresee,” “potential” or “continue” or the negative of these terms or other similar expressions that concern our expectations, strategy, plans or intentions or are not statements of historical fact. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors including, but not limited to: the risk that the conditions to the consummation of the transaction will not be satisfied (or waived); uncertainty as to the timing of the consummation of the transaction and Outbrain and Teads’ ability to complete the transaction; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the stock purchase agreement; the failure to obtain, or delays in obtaining, required regulatory approvals or clearances; the risk that any such approval may result in the imposition of conditions that could adversely affect Outbrain or Teads, or the expected benefits of the transaction; the failure to obtain the necessary debt financing to complete the transaction; the effect of the announcement or pendency of the transaction on Outbrain’s or Teads’ operating results and business generally; risks that the transaction disrupts current plans and operations or diverts management’s attention from its ongoing business; the initiation or outcome of any legal proceedings that may be instituted against Outbrain or Teads, or their respective directors or officers, related to the transaction; unexpected costs, charges or expenses resulting from the transaction; the risk that Outbrain’s stock price may decline significantly if the transaction is not consummated; the effect of the announcement of the transaction on the ability of Outbrain and Teads to retain and hire key personnel and maintain relationships with their customers, suppliers and others with whom they do business; the ability of Outbrain to successfully integrate Teads’ operations, technologies and employees; the ability to realize anticipated benefits and synergies of the transaction, including the expectation of enhancements to Outbrain’s services, greater revenue or growth opportunities, operating efficiencies and cost savings; overall advertising demand and traffic generated by Outbrain and the combined company’s media partners; factors that affect advertising demand and spending, such as the continuation or worsening of unfavorable economic or business conditions or downturns, instability or volatility in financial markets, and other events or factors outside of Outbrain and the combined company’s control, such as U.S. and global recession concerns, geopolitical concerns, including the ongoing wars between Ukraine-Russia and Israel-Hamas, supply chain issues, inflationary pressures, labor market volatility, bank closures or disruptions, and the impact of unfavorable economic conditions and other factors that have and may further impact advertisers’ ability to pay; Outbrain and the combined company’s ability to continue to innovate, and adoption by Outbrain and the combined company’s advertisers and media partners of expanding solutions; the success of Outbrain and the combined company’s sales and marketing investments, which may require significant investments and may involve long sales cycles; Outbrain and the combined company’s ability to

grow their business and manage growth effectively; the ability to compete effectively against current and future competitors; the loss of one or more of large media partners, and Outbrain and the combined company’s ability to expand advertiser and media partner relationships; conditions in Israel, including the ongoing war between Israel and Hamas and other terrorist organizations, may limit Outbrain and the combined company’s ability to market, support and innovate their products due to the impact on employees as well as advertisers and advertising markets; Outbrain and the combined company’s ability to maintain revenues or profitability despite quarterly fluctuations in results, whether due to seasonality, large cyclical events, or other causes; the risk that research and development efforts may not meet the demands of a rapidly evolving technology market; any failure of Outbrain and the combined company’s recommendation engine to accurately predict attention or engagement, any deterioration in the quality of Outbrain and the combined company’s recommendations or failure to present interesting content to users or other factors which may cause us to experience a decline in user engagement or loss of media partners; limits on Outbrain and the combined company’s ability to collect, use and disclose data to deliver advertisements; Outbrain and the combined company’s ability to extend their reach into evolving digital media platforms; Outbrain and the combined company’s ability to maintain and scale their technology platform; the ability to meet demands on our infrastructure and resources due to future growth or otherwise; the failure or the failure of third parties to protect Outbrain and the combined company’s sites, networks and systems against security breaches, or otherwise to protect the confidential information of Outbrain and the combined company; outages or disruptions that impact Outbrain or the combined company or their service providers, resulting from cyber incidents, or failures or loss of our infrastructure; significant fluctuations in currency exchange rates; political and regulatory risks in the various markets in which Outbrain and the combined company operate; the challenges of compliance with differing and changing regulatory requirements; the timing and execution of any cost-saving measures and the impact on Outbrain and the combined company’s business or strategy; and the risks described in the section entitled “Risk Factors” and elsewhere in Outbrain’s Annual Report on Form 10-K filed for the year ended December 31, 2023 and in subsequent reports filed with the SEC.

Accordingly, you should not rely upon forward-looking statements as an indication of future performance. Outbrain cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or will occur, and actual results, events, or circumstances could differ materially from those projected in the forward-looking statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. Outbrain and the combined company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements and you should not place undue reliance on the forward-looking statements. Outbrain undertakes no obligation, and does not assume, any obligation to update any forward-looking statements, whether as a result of new information, future events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events or otherwise, except as required by law.

Additional Information About the Transaction and Where to Find It

These trascripts may be deemed to be solicitation material in respect of the stockholder approval (the “Stockholder Approval”) to authorize the issuance of certain equity securities of Outbrain as consideration for the proposed transaction. In connection with a special meeting of its shareholders for the Stockholder Approval, Outbrain intends to file relevant materials with the

SEC, including Outbrain’s proxy statement in preliminary and definitive form. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT MATERIALS CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT OUTBRAIN, TEADS AND THE TRANSACTION. Investors and stockholders may obtain a free copy of these materials (when available) and other documents filed by Outbrain with the SEC through the website maintained by the SEC at www.sec.gov. In addition, free copies of these materials will be made available free of charge through Outbrain’s website at https://www.Outbrain.com.

Participants in the Solicitation

Outbrain and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Outbrain in favor of the Stockholder Approval. Information regarding these directors and executive officers and a description of their direct and indirect interests, by security holdings or otherwise, is set forth in Outbrain’s proxy statement for its 2024 annual meeting of stockholders on Schedule 14A, which was filed with the SEC on April 26, 2024. To the extent holdings of Outbrain’s securities by its directors or executive officers have changed since the amounts set forth in such 2024 proxy statement, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information concerning the direct or indirect interests, by security holdings or otherwise, of Outbrain’s participants in the solicitation, which may, in some cases, be different than those of Outbrain’s shareholders generally, will be set forth in Outbrain’s proxy statement relating to the Stockholder Approval when it becomes available.

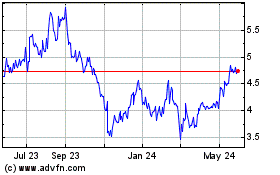

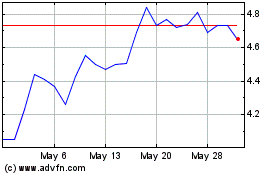

Outbrain (NASDAQ:OB)

Historical Stock Chart

From Oct 2024 to Oct 2024

Outbrain (NASDAQ:OB)

Historical Stock Chart

From Oct 2023 to Oct 2024