OFS Credit Company Declares Monthly All-Cash Common Stock Distributions for Each of the Three Months in the Quarter Ending January 31, 2024

November 28 2023 - 3:00PM

Business Wire

Amended Dividend Reinvestment Plan permits DRIP

shares to be Issued at 95% of Market Price

OFS Credit Company, Inc. (NASDAQ: OCCI) (“OFS Credit,” the

“Company,” “we,” “us” or “our”), an investment company that

primarily invests in collateralized loan obligation (“CLO”) equity

and debt securities, today announced that, on November 28, 2023,

its board of directors (the “Board”) declared monthly all-cash

distributions for common stockholders for each of the three months

in the quarter ending January 31, 2024.

The following schedule applies to the distributions for common

stockholders of record on the close of business of each specific

record date:

Month

Record Date

Payment Date

Cash Distribution Amount

November 2023

December 22, 2023

December 29, 2023

$0.10

December 2023

December 22, 2023

December 29, 2023

$0.10

January 2024

January 24, 2024

January 31, 2024

$0.10

The monthly distribution rate of $0.10 per common share equates

to an approximate 19.4% annualized distribution rate based on

closing price of the Company’s common stock of $6.18 on the Nasdaq

Capital Market on October 31, 2023. Our Board intends to declare

future distributions in cash, payable monthly.

“We believe our previous cash and stock distributions enabled us

to strengthen our balance sheet by preserving capital,” said Bilal

Rashid, Chief Executive Officer. “We believe the current strength

of our balance sheet allows us to convert to an all-cash

distribution.”

Dividend Reinvestment Plan – DRIP Shares Issued at 95% of Market

Price

On June 1, 2023, our Board approved an amended and restated

dividend reinvestment plan (the “Amended DRIP”). For stockholders

participating in the Amended DRIP, the number of shares to be

issued to a stockholder in connection with any distribution will be

determined by dividing the total dollar amount of the distribution

payable to such stockholder by an amount equal to ninety five

percent (95%) of the market price per share of common stock at the

close of regular trading on the Nasdaq Capital Market on the

valuation date fixed by the Board for such distribution.

About OFS Credit Company, Inc.

OFS Credit is a non-diversified, externally managed closed-end

management investment company. The Company’s investment objective

is to generate current income, with a secondary objective to

generate capital appreciation primarily through investment in CLO

equity and debt securities. The Company’s investment activities are

managed by OFS Capital Management, LLC, an investment adviser

registered under the Investment Advisers Act of 19401, as amended,

and headquartered in Chicago with additional offices in New York

and Los Angeles.

Forward-Looking Statements

Statements in this press release regarding management’s future

expectations, beliefs, intentions, goals, strategies, plans or

prospects, including statements relating to: the Board’s intention

to declare future distributions in cash, when there can be no

guarantee that will be the case or, if declared, that such

distributions will be sustained; management’s belief that the

current strength of the Company’s balance sheet allows the Company

to convert to an all-cash distribution; and other factors may

constitute forward-looking statements. Forward-looking statements

can be identified by terminology such as “anticipate,” “believe,”

“could,” “could increase the likelihood,” “estimate,” “expect,”

“intend,” “is planned,” “may,” “should,” “will,” “will enable,”

“would be expected,” “look forward,” “may provide,” “would” or

similar terms, variations of such terms or the negative of those

terms. Such forward-looking statements involve known and unknown

risks, uncertainties and other factors including those risks,

uncertainties and factors referred to in documents that may be

filed by OFS Credit from time to time with the Securities and

Exchange Commission, rising interest rates and elevated inflation

rates, the ongoing war between Russia and Ukraine, the current

conflict in Israel, instability in the U.S. and international

banking systems, the risk of recession or a shutdown of U.S.

government services and significant market volatility on our

business, our portfolio companies, our industry and the global

economy. As a result of such risks, uncertainties and factors,

actual results may differ materially from any future results,

performance or achievements discussed in or implied by the

forward-looking statements contained herein. OFS Credit is

providing the information in this press release as of this date and

assumes no obligations to update the information included in this

press release or revise any forward-looking statements, whether as

a result of new information, future events or otherwise.

1 Registration does not imply a certain level of skill or

training.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231128562203/en/

INVESTOR RELATIONS: Steve Altebrando 646-652-8473

saltebrando@ofsmanagement.com

MEDIA RELATIONS: Bill Mendel 212-397-1030

bill@mendelcommunications.com

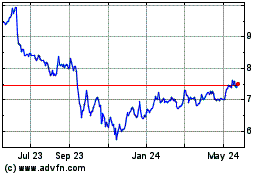

OFS Credit (NASDAQ:OCCI)

Historical Stock Chart

From Dec 2024 to Jan 2025

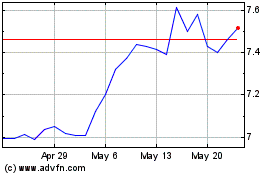

OFS Credit (NASDAQ:OCCI)

Historical Stock Chart

From Jan 2024 to Jan 2025