Oconee Federal Financial Corp. Announces Annual Financial Results

August 21 2024 - 7:48AM

Business Wire

Oconee Federal Financial Corp. (OTCQX: OFED) (the “Company”),

the holding company for Oconee Federal Savings and Loan Association

(“Oconee Federal”), announced today net income of $6.3 million, or

$1.10 per diluted share, for the year ended June 30, 2024, which

was more than the net income of $3.3 million, or $0.60 per diluted

share, for the year ended June 30, 2023.

June 30, 2024 Year End Summary:

- Fifty-one consecutive quarterly dividends of $0.10 per share

since the quarter ended December 2011.

- Total assets were $665.6 million, an increase of 11.8% from

$595.4 million at June 30, 2023.

- Total loans outstanding were $469.7 million, up from $411.5

million at June 30, 2023.

“The year ended June 30, 2024 presented both challenges and

opportunities for Oconee Federal. The current higher interest rate

environment has compressed the net interest margin resulting in a

decline in net interest income to $12.3 million from $14.6 million

when compared to the year ended June 30, 2023,” stated Curtis T.

Evatt, President and Chief Executive Officer. However, with the

completion of our acquisition of Mutual Savings Bank in Hartsville,

SC in January 2024 we have offset some of this decline and been

able to boost our assets to $665.6 million as of year end and

increase our earnings by $4.9 million from the bargain purchase

gain. Furthermore, the transaction is expected to remain accretive

going forward. Our capital ratios remain among some of the highest

in the industry. We are looking forward to the opportunity of

providing the best products and services to our customers in the

coming year.”

Cash Dividend Declared

Total dividends paid during the year ended June 30, 2024 were

$2.3 million. On July 23, 2024, the Board of Directors of the

Company declared a quarterly cash dividend of $0.10 per share of

the Company’s common stock payable to stockholders of record as of

August 8, 2024, which is payable on August 22, 2024.

About Oconee Federal

Oconee Federal Financial Corp. (OTCQX: OFED) is the holding

company of Oconee Federal Savings and Loan Association. Oconee

Federal Savings and Loan Association is a federally chartered

savings and loan association founded in 1924 and headquartered in

Seneca, South Carolina. Oconee Federal Savings and Loan Association

is a community oriented financial institution operating nine

full-service branch locations in Oconee County, South Carolina,

Pickens County, South Carolina, Darlington County, South Carolina,

Stephens County, Georgia and Rabun County, Georgia.

For future financial information, please access our investor

information page on our website at www.oconeefederal.com.

Forward-Looking Statements

This release contains certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that are based on current expectations, estimates and projections

about the Company’s and the Association’s industry, and

management’s beliefs and assumptions. Words such as anticipates,

expects, intends, plans, believes, estimates and variations of such

words and expressions are intended to identify fiscal year

forward-looking statements. Such statements are not guarantees of

future performance and are subject to certain risks, uncertainties

and assumptions that are difficult to forecast. Therefore, actual

results may differ materially from those expressed or forecast in

such forward-looking statements. The Company undertakes no

obligation to update publicly any forward-looking statements,

whether as a result of new information or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821204528/en/

Investor/Media: Curtis T. Evatt President & Chief Executive

Officer Oconee Federal Financial Corp. 201 East North Second Street

Seneca, South Carolina 864-882-2765

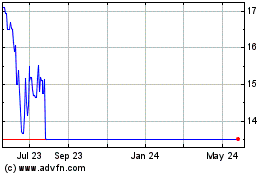

Oconee Federal Financial (NASDAQ:OFED)

Historical Stock Chart

From Oct 2024 to Oct 2024

Oconee Federal Financial (NASDAQ:OFED)

Historical Stock Chart

From Oct 2023 to Oct 2024