Declares Third Quarter 2022 Distribution of

$0.29 Per Share

OFS Capital Corporation (NASDAQ: OFS) (“OFS Capital,” the

“Company,” “we,” “us,” or “our”) today announced its financial

results for the fiscal quarter ended June 30, 2022. On August 2,

2022, OFS Capital’s Board of Directors declared a distribution of

$0.29 per common share for the third quarter of 2022, payable on

September 30, 2022 to stockholders of record as of September 23,

2022.

SECOND QUARTER FINANCIAL HIGHLIGHTS

- Net investment income of $6.2 million, or $0.47 per common

share.

- Adjusted net investment income (“Adjusted NII”)(1) of $3.3

million, or $0.24 per common share.

- Net loss on investments of $1.12 per common share, primarily

comprised of unrealized losses of $1.11 per common share due to

widening of liquid credit market spreads.

- Net asset value (“NAV”) per common share of $14.57 as of June

30, 2022, a decrease from $15.52 at March 31, 2022, primarily due

to unrealized losses.

- As of June 30, 2022, based on fair value, 93% of our loan

portfolio consisted of floating rate loans and 98% of our loan

portfolio consisted of senior secured loans.

- As of June 30, 2022, 100% of our outstanding debt matures in

2025 and beyond, 63% of our outstanding debt has a fixed interest

rate and 49% of our outstanding debt is unsecured.

SELECTED FINANCIAL HIGHLIGHTS

(unaudited)

Three Months Ended

(Per common share)

June 30, 2022

March 31, 2022

Net Investment Income

Net investment income

$

0.47

$

0.22

Net Realized/Unrealized Gain

(Loss)

Net realized gain (loss) on

investments

$

(0.01

)

$

0.02

Net unrealized gain (loss) on

investments

(1.11

)

0.39

Net loss on extinguishment of debt

—

(0.01

)

Net gain (loss)

$

(1.12

)

$

0.40

Earnings (Loss)

Earnings (loss)

$

(0.66

)

$

0.62

Net Asset Value

Net asset value

$

14.57

$

15.52

Distributions paid

$

0.29

$

0.28

Adjusted NII (1) — Non-GAAP

Net investment income

$

0.47

$

0.22

Capital gain incentive fee accrual

(0.23

)

0.08

Adjusted NII — Non-GAAP

$

0.24

$

0.30

As of

(in millions, except per share data)

June 30, 2022

March 31, 2022

Balance Sheet Highlights

(unaudited)

Investment portfolio, at fair value

$

547.7

$

556.9

Total assets

567.3

571.7

Net asset value per common share

14.57

15.52

“We believe our balance sheet is well positioned to navigate

through an uncertain economic environment with rising interest

rates and a slow down in the economy,” said Bilal Rashid, OFS

Capital’s Chairman and Chief Executive Officer. “Approximately, 98%

of our loan portfolio is senior secured and 93% of our loans are

floating rate, with 63% of our outstanding debt being fixed

rate.”

(1)

On a supplemental basis, we disclose

Adjusted NII (including on a per share basis), which is a financial

measure calculated and presented on basis other than in accordance

with generally accepted accounting principles of the United States

of America (“GAAP”). Adjusted NII represents net investment income,

excluding the capital gains incentive fee, in periods in which such

expense occurs. GAAP requires recognition of a capital gains

incentive fee in our financial statements when aggregate net

realized and unrealized capital gains, if any, on a cumulative

basis from the date of the election to be a BDC through the

reporting date is positive. Such fees are subject to further

conditions specified in the investment advisory agreement with OFS

Capital Management, LLC, principally related to the realization of

such net gains, before OFS Capital Management, LLC is entitled to

payment, and such recognized fees are subject to the risk of

reversal should unrealized gains diminish to become losses.

Management believes that Adjusted NII is a useful indicator of

operations exclusive of any net capital gains incentive fee, as net

investment income does not include the net gains, realized or

unrealized, associated with the capital gains incentive fee.

Management believes Adjusted NII

facilitates analysis of our results of operations and provides

greater transparency into the determination of incentive fees.

Adjusted NII is not meant as a substitute for net investment income

determined in accordance with GAAP and should be considered in the

context of the entirety of our reported results of operations,

financial position and cash flows determined in accordance with

GAAP. A reconciliation of net investment income determined in

accordance with GAAP to Adjusted NII is set forth in Schedule I to

this press release.

PORTFOLIO AND INVESTMENT ACTIVITIES

($ in millions, except for per share data)

As of and for the Three Months

Ended

Portfolio Overview

June 30, 2022

March 31, 2022

Investment portfolio, at fair value

$

547.7

$

556.9

Weighted-average performing income yield -

interest-bearing investments (2)

9.1

%

9.0

%

Weighted-average realized yield -

interest-bearing investments (3)

8.6

%

8.6

%

Weighted-average realized yield on total

investments (4)

8.2

%

8.2

%

The weighted-average yield of our investments is not the same as

a return on investment for our stockholders, but rather relates to

our investment portfolio and is calculated before the payment of

all of our fees and expenses.

(2)

Income yield is calculated as (a) the

actual amount earned on performing investments, including interest

and prepayment fees and amortization of net loan fees, divided by

(b) the weighted-average of total performing investments amortized

cost.

(3)

Realized yield is computed as (a) the

actual amount earned on interest-bearing investments, including

interest, prepayment fees and net loan fees, divided by (b) the

weighted-average of total interest-bearing investments amortized

cost, in each case, including debt investments on non-accrual

status and non-income producing Structured Finance Notes.

(4)

Realized yield is computed as (a) the

actual amount earned on all investments including interest,

dividends and prepayment fees, amortization of net loan fees, and

dividends received divided by (b) the weighted-average of total

investments amortized cost or cost.

Three Months Ended

Portfolio Activity

June 30, 2022

March 31, 2022

Investments in new portfolio companies

$

26.9

$

33.0

Investments in existing portfolio

companies

4.4

15.1

Investments in structured finance

notes

21.1

22.1

As of June 30, 2022, based on fair value, our investment

portfolio was comprised of the following:

- Total investments of $547.7 million, which was equal to

approximately 108% of amortized cost;

- Debt investments of $356.0 million in 66 portfolio companies,

of which 98% and 2% were senior secured loans and subordinated

loans, respectively;

- Equity investments of $101.8 million;

- 23 structured finance note investments totaling $89.9 million;

and

- Unfunded commitments of $37.3 million to 17 portfolio

companies.

During the quarter ended June 30, 2022, two loans with an

aggregate fair value of $10.4 million were placed on non-accrual

status. One of those loans is a PIK loan where we stopped accruing

our PIK coupon due to a decline in its fair value; however, that

portfolio company remains current on another debt tranche that

requires cash interest payments.

RESULTS OF OPERATIONS

Investment Income

For the quarter ended June 30, 2022, total investment income of

$10.4 million decreased by $0.5 million compared to the quarter

ended March 31, 2022, primarily due to a decrease of $1.0 million

in dividend and fee income, offset by an increase of $0.5 million

in interest income. Interest income increased $0.5 million compared

to the prior quarter primarily due to a increase in our portfolio’s

weighted-average performing income yield to 9.1%.

Expenses

For the quarter ended June 30, 2022, total expenses of $4.2

million decreased by $3.8 million compared to the quarter ended

March 31, 2022, primarily due to a reversal of a previously accrued

capital gains fee due to a $14.9 million reduction in net

unrealized appreciation on the investment portfolio.

Net Gain (Loss) on Investments

Our portfolio experienced net losses of $15.1 million in the

second quarter of 2022, primarily as a result of unrealized

depreciation of $9.3 million and $6.7 million on our CLO

investments and broadly syndicated loan investments, respectively,

attributable to widening of liquid credit market spreads. These

losses were partially offset by net gains, primarily consisting of

unrealized appreciation on our common equity investments that were

primarily attributable to an increase in fair value of $7.8 million

on our equity investment in Pfanstiehl Holdings, Inc.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2022, we had $14.8 million in cash, which

includes $7.5 million held by our wholly owned small business

investment company, OFS SBIC I, LP (“SBIC I LP”), and $2.9 million

held by OFSCC-FS, LLC (“OFSCC-FS”), an indirect wholly owned

subsidiary. Our use of cash held by SBIC I LP and OFSCC-FS is

restricted by regulatory and contractual conditions, including

limitations on the amount of cash SBIC I LP and OFSCC-FS can

distribute to us.

As of June 30, 2022, we had an unused commitment of $35.0

million under our senior secured revolving credit facility with

Pacific Western Bank, as well as an unused commitment of $15.9

million under our revolving credit facility with BNP Paribas (“BNP

Facility”), both subject to borrowing base requirements and other

covenants. Based on fair values and equity capital at June 30,

2022, we could access all unused commitments under our credit

facilities and remain in compliance with the 1940 Act asset

coverage requirement.

On June 24, 2022, we amended the BNP Facility to, among other

things: (i) extend the reinvestment period under the BNP Facility

for three years from June 20, 2022 to June 20, 2025; (ii) extend

the maturity date under the BNP Facility from June 20, 2024 to June

20, 2027; (iii) convert the benchmark interest rate from LIBOR to

SOFR; (iv) increase the applicable margin by 0.40% on all classes

of loans; and (v) increase the applicable margin floor from 1.925%

to 2.65%.

CONFERENCE CALL

OFS Capital will host a conference call to discuss these results

on Friday, August 5, 2022, at 10:00 AM Eastern Time. Interested

parties may participate in the call via the following:

INTERNET: Go to www.ofscapital.com

at least 15 minutes prior to the start time of the call to

register, download, and install any necessary audio software. A

replay will be available for 90 days on OFS Capital’s website at

www.ofscapital.com.

TELEPHONE: Dial (877) 510-7674 (Domestic) or (412) 902-4139

(International) approximately 15 minutes prior to the call. A

telephone replay of the conference call will be available through

August 15, 2022 at 9:00 AM Eastern Time and may be accessed by

calling (877) 344-7529 (Domestic) or (412) 317-0088 (International)

and utilizing conference ID #3869035.

For more detailed discussion of the financial and other

information included in this press release, please refer to OFS

Capital’s Form 10-Q for the second quarter ended June 30, 2022.

OFS Capital Corporation and

Subsidiaries Consolidated Statement of Assets and Liabilities

(Dollar amounts in thousands, except per share data)

June 30, 2022

December 31,

2021

(unaudited)

Assets

Total investments, at fair value

(amortized cost of $507,484 and $457,312, respectively)

547,677

507,099

Cash

14,844

43,048

Interest receivable

1,883

1,475

Receivable for investments sold

—

14,893

Prepaid expenses and other assets

2,917

2,533

Total assets

$

567,321

$

569,048

Liabilities

Revolving lines of credit

$

134,100

$

100,000

SBA debentures (net of deferred debt

issuance costs of $319 and $555, respectively)

50,601

69,365

Unsecured notes (net of deferred debt

issuance costs of $4,155 and $4,554, respectively)

175,845

175,446

Interest payable

3,714

3,685

Payable to adviser and affiliates

2,672

6,217

Payable for investments purchased

3,905

8,788

Accrued professional fees

383

452

Other liabilities

389

1,351

Total liabilities

371,609

365,304

Commitments and contingencies

Net assets

Preferred stock, par value of $0.01 per

share, 2,000,000 shares authorized, -0- shares issued and

outstanding as of June 30, 2022 and December 31, 2021,

respectively

$

—

$

—

Common stock, par value of $0.01 per

share, 100,000,000 shares authorized, 13,429,777 and 13,422,413

shares issued and outstanding as of June 30, 2022 and December 31,

2021, respectively

134

134

Paid-in capital in excess of par

185,195

185,113

Total distributable earnings

10,383

18,497

Total net assets

195,712

203,744

Total liabilities and net

assets

$

567,321

$

569,048

Number of shares outstanding

13,429,777

13,422,413

Net asset value per share

$

14.57

$

15.18

OFS Capital Corporation and

Subsidiaries Condensed Consolidated Statements of Operations

(unaudited) (Dollar amounts in thousands, except per share

data)

Three Months Ended June

30,

Six Months Ended June

30,

2022

2021

2022

2021

Investment income

Interest income

$

10,345

$

10,638

$

20,188

$

20,794

Dividend income

5

195

763

242

Fee income

82

583

427

871

Total investment

income

10,432

11,416

21,378

21,907

Expenses

Interest expense

3,943

4,241

7,567

9,066

Management fee

2,056

1,876

4,076

3,710

Income Incentive Fee

—

809

—

809

Capital Gains Fee

(2,988

)

—

(1,916

)

—

Professional fees

352

489

759

876

Administration fee

423

439

874

1,007

Other expenses

398

327

765

654

Total expenses

4,184

8,181

12,125

16,122

Net investment

income

6,248

3,235

9,253

5,785

Net realized and unrealized gain (loss)

on investments

Net realized gain (loss), net

of taxes

(190

)

(10,841

)

27

(10,750

)

Net unrealized gain (loss), net

of taxes

(14,882

)

30,047

(9,599

)

33,879

Net gain (loss) on

investments

(15,072

)

19,206

(9,572

)

23,129

Loss on extinguishment of

debt

—

—

(144

)

(2,299

)

Net increase (decrease) in

net assets resulting from operations

$

(8,824

)

$

22,441

$

(463

)

$

26,615

Net investment income per common share –

basic and diluted

$

0.47

$

0.24

$

0.69

$

0.43

Net increase (decrease) in net assets

resulting from operations per common share – basic and diluted

$

(0.66

)

$

1.67

$

(0.03

)

$

1.98

Distributions declared per common

share

$

0.29

$

0.22

$

0.57

$

0.42

Basic and diluted weighted average shares

outstanding

13,425,477

13,411,998

13,423,970

13,410,524

ABOUT OFS CAPITAL

The Company is an externally managed, closed-end,

non-diversified management investment company that has elected to

be regulated as a business development company. The Company's

investment objective is to provide stockholders with both current

income and capital appreciation primarily through debt investments

and, to a lesser extent, equity investments. The Company invests

primarily in privately held middle-market companies in the United

States, including lower-middle-market companies, targeting

investments of $3 million to $20 million in companies with annual

EBITDA between $5 million and $50 million. The Company offers

flexible solutions through a variety of asset classes including

senior secured loans, which includes first-lien, second-lien and

unitranche loans, as well as subordinated loans and, to a lesser

extent, warrants and other equity securities. The Company's

investment activities are managed by OFS Capital Management, LLC,

an investment adviser registered under the Investment Advisers Act

of 19405, as amended, and headquartered in Chicago, Illinois, with

additional offices in New York and Los Angeles.

FORWARD-LOOKING STATEMENTS

Statements in this press release regarding management's future

expectations, beliefs, intentions, goals, strategies, plans or

prospects, including statements relating to: OFS Capital’s results

of operations, including net investment income, adjusted net

investment income, net asset value and net investment gains and

losses and the factors that may affect such results; management's

belief that the Company’s balance sheet is well positioned for the

future in a rising interest rate environment due to a high

percentage of floating rate loans in the portfolio and a majority

of liabilities that have a fixed rate of interest, when there can

be no assurance that such a composition will lead to future

success; and other factors may constitute forward-looking

statements for purposes of the safe harbor protection under

applicable securities laws. Forward-looking statements can be

identified by terminology such as “anticipate,” “believe,” “could,”

“could increase the likelihood,” “estimate,” “expect,” “intend,”

“is planned,” “may,” “should,” “will,” “will enable,” “would be

expected,” “look forward,” “may provide,” “would” or similar terms,

variations of such terms or the negative of those terms. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors including those risks,

uncertainties and factors referred to in OFS Capital’s Annual

Report on Form 10-K for the year ended December 31, 2021 filed with

the Securities and Exchange Commission under the section “Risk

Factors,” and in “Part II, Item 1A. Risk Factors” in our Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2022 and June

30, 2022, as well as other documents that may be filed by OFS

Capital from time to time with the Securities and Exchange

Commission. As a result of such risks, uncertainties and factors,

actual results may differ materially from any future results,

performance or achievements discussed in or implied by the

forward-looking statements contained herein. OFS Capital is

providing the information in this press release as of this date and

assumes no obligations to update the information included in this

press release or revise any forward-looking statements, whether as

a result of new information, future events or otherwise.

5

Registration does not imply a certain

level of skill or training

Schedule

1

Non-GAAP Financial Measure – Adjusted Net

Investment Income

On a supplemental basis, we disclose Adjusted NII (including on

a per share basis), which is a financial measure calculated and

presented on basis other than in accordance with GAAP. Adjusted NII

represents net investment income, excluding the capital gains

incentive fee, in periods in which such expense occurs. GAAP

requires recognition of a capital gains incentive fee in our

financial statements when aggregate net realized and unrealized

capital gains, if any, on a cumulative basis from the date of the

election to be a BDC through the reporting date is positive. Such

fees are subject to further conditions specified in the investment

advisory agreement with OFS Capital Management, LLC, principally

related to the realization of such net gains, before OFS Capital

Management, LLC is entitled to payment, and such recognized fees

are subject to the risk of reversal should unrealized gains

diminish to become losses. Management believes that Adjusted NII is

a useful indicator of operations exclusive of any net capital gains

incentive fee, as net investment income does not include the net

gains, realized or unrealized, associated with the capital gains

incentive fee. Management believes Adjusted NII facilitates

analysis of our results of operations and provides greater

transparency into the determination of incentive fees. Adjusted NII

is not meant as a substitute for net investment income determined

in accordance with GAAP and should be considered in the context of

the entirety of our reported results of operations, financial

position and cash flows determined in accordance with GAAP.

The following table provides a reconciliation from net

investment income (the most comparable GAAP measure) to Adjusted

NII for the three months ended June 30, 2022 and March 31, 2022 and

six months ended June 30, 2022 and 2021, respectively (dollar

amounts in thousands, except per share data) (unaudited):

Three Months Ended

Six Months Ended June

30,

June 30, 2022

March 31, 2022

2022

2021

(000's)

Per Share

(000's)

Per Share

(000's)

Per Share

(000's)

Per Share

Net investment income

$

6,248

$

0.47

$

3,005

$

0.22

$

9,253

$

0.69

$

5,785

$

0.43

Capital Gains Fee

(2,988

)

(0.23

)

1,072

0.08

(1,916

)

(0.15

)

—

—

Adjusted NII

$

3,260

$

0.24

$

4,077

$

0.30

$

7,337

$

0.54

$

5,785

$

0.43

Although these non-GAAP financial measures are intended to

enhance investors’ understanding of our business and performance,

these non-GAAP financial measures should not be considered an

alternative to GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220805005042/en/

INVESTOR RELATIONS CONTACT: Steve Altebrando 646-652-8473

saltebrando@ofsmanagement.com

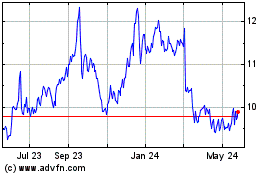

OFS Capital (NASDAQ:OFS)

Historical Stock Chart

From Jan 2025 to Feb 2025

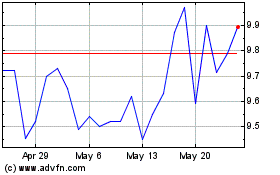

OFS Capital (NASDAQ:OFS)

Historical Stock Chart

From Feb 2024 to Feb 2025