Outlook Therapeutics, Inc. (Nasdaq: OTLK), a biopharmaceutical

company that has achieved regulatory approval in the EU and UK for

the first authorized use of an ophthalmic formulation of

bevacizumab for the treatment of wet age-related macular

degeneration (wet AMD), today announced financial results for the

third quarter of fiscal year 2024 and provided a corporate update.

As previously announced, Outlook Therapeutics will host its

quarterly conference call and live audio webcast, today, Wednesday,

August 14, 2024, at 8:30 AM ET (details below).

“This quarter we achieved two major milestones

with receipt of Marketing Authorization in both the European Union

and the United Kingdom. Additionally, we made significant progress

with our primary focus, which remains the successful completion of

enrollment in our ongoing NORSE EIGHT clinical trial. Based on our

enrollment progress, we expect to report those results in the

fourth calendar quarter of 2024 with the anticipated resubmission

of our BLA in the first calendar quarter of 2025,” commented

Russell Trenary, President and Chief Executive Officer of Outlook

Therapeutics. “Meanwhile, we continue commercial preparations to

launch the first, and only, ophthalmic approved bevacizumab for the

treatment of wet AMD in the EU and UK, either directly or with a

partner, anticipated in the first half of calendar year 2025.”

Upcoming Anticipated

Milestones

- Full enrollment of NORSE EIGHT

clinical trial in the US expected in Q3 CY2024;

- Topline readout of NORSE EIGHT

clinical trial planned in Q4 CY2024;

- Resubmission of the ONS-5010 BLA

targeted for Q1 CY2025;

- Initial commercial launches in

Europe planned to commence in first half of CY2025; and

- Potential for US FDA approval of

ONS-5010 in second half of CY2025.

ONS-5010 / LYTENAVA™ (bevacizumab-vikg)

Clinical and Regulatory Update

As previously announced, following Type A

meetings with the US Food and Drug Administration (FDA) in Q4

CY2023 to address the ONS-5010 Complete Response Letter (CRL), the

FDA informed Outlook Therapeutics that it could conduct a

non-inferiority study evaluating ONS-5010 versus ranibizumab in a

12 week study of treatment naïve patients with a primary efficacy

endpoint at 8 weeks (NORSE EIGHT) to support the resubmission of

the ONS-5010 BLA to the FDA. In January 2024, Outlook Therapeutics

received written agreement on the NORSE EIGHT trial protocol and

statistical analysis plan from the FDA under a Special Protocol

Assessment (SPA) for NORSE EIGHT. The SPA also confirms in writing

that if the NORSE EIGHT trial is successful, it would satisfy the

FDA’s requirement for a second adequate and well-controlled

clinical trial to fully address the clinical deficiency identified

in the CRL. In addition, Outlook Therapeutics has completed Type C

and Type D meetings with the FDA to address the open CMC items in

the CRL and expects to resolve these comments prior to the expected

completion of NORSE EIGHT.

NORSE EIGHT is a randomized, controlled,

parallel-group, masked, non-inferiority study of approximately 400

newly diagnosed, wet AMD subjects randomized in a 1:1 ratio to

receive 1.25 mg ONS-5010 or 0.5 mg ranibizumab intravitreal

injections. Subjects will receive injections at Day 0

(randomization), Week 4, and Week 8 visits. The primary endpoint is

mean change in BCVA from baseline to week 8. As of the date of this

release, 359 subjects have been enrolled in the study. Outlook

Therapeutics remains on track for NORSE EIGHT enrollment completion

in Q3 CY2024, with topline results expected to be reported in Q4

CY2024. The resubmission of the ONS-5010 BLA is planned for Q1

CY2025.

In May 2024, the European Commission granted

Marketing Authorization for LYTENAVA™ (bevacizumab gamma) for the

treatment of wet AMD in the EU. Additionally, in July 2024, the UK

Medicines and Healthcare products Regulatory Agency (MHRA) granted

Marketing Authorization for LYTENAVA™ (bevacizumab gamma) for the

same indication in the UK.

LYTENAVA™ (bevacizumab gamma) is the first and

only authorized ophthalmic formulation of bevacizumab for use in

treating wet AMD in the EU and UK. Authorization may also be sought

in other European countries, Japan, and elsewhere. Outlook

Therapeutics expects its anticipated commercial launch of LYTENAVA™

(bevacizumab gamma) in the EU and UK in the first half of calendar

year 2025. As part of a multi-year planning process, Outlook

Therapeutics entered a strategic collaboration with Cencora

(formerly AmerisourceBergen) to support the commercial launch of

LYTENAVA™ globally following regulatory approvals.

Cencora will provide comprehensive launch

support in the EU and the UK including pharmacovigilance,

regulatory affairs, quality management, market access support,

importation, third-party logistics (3PL), distribution and field

solutions. The collaboration and integrated approach is designed to

support market access and efficient distribution of LYTENAVA™ to

benefit all stakeholders, including retina specialists, providers

and patients.

Additionally, if approved by the FDA, Outlook

Therapeutics plans to commercialize ONS-5010/LYTENAVA™

(bevacizumab-vikg) directly in the US, but is also assessing

partnering options for LYTENAVA™ (bevacizumab gamma) in the EU and

the UK and other regions outside of the US.

Financial Highlights for the Fiscal

Third Quarter Ended June 30, 2024

For the fiscal third quarter ended June 30,

2024, Outlook Therapeutics reported net income attributable to

common stockholders of $44.4 million, or $1.91 per basic share, and

net loss attributable to common stockholders of $0.89 per diluted

share, compared to a net loss attributable to common stockholders

of $20.7 million, or $1.61 per basic and diluted share, for the

same period last year. For the fiscal third quarter ended June 30,

2024, Outlook Therapeutics also reported an adjusted net loss

attributable to common stockholders1 of $19.2 million, or $0.83 per

basic and diluted share, as compared to an adjusted net loss

attributable to common stockholders of $17.8 million, or $1.38 per

basic and diluted share, for fiscal third quarter 2023.

Adjusted net loss attributable to common

stockholders for the fiscal third quarter ended June 30, 2024

includes $3.4 million of warrant related expenses, $59.5 million of

decrease in fair value of warrant liability and $7.6 million of

decrease in fair value of convertible promissory notes. Adjusted

net loss attributable to common stockholders for the fiscal third

quarter ended June 30, 2023 includes $2.9 million of increase in

fair value of convertible promissory notes.

In March and April 2024, Outlook Therapeutics

closed its previously announced private placements of common stock

and accompanying warrants. In addition to the upfront gross

proceeds of $65 million, Outlook Therapeutics has the potential to

receive additional gross proceeds of up to $107 million upon the

full cash exercise of the warrants issued in the private

placements, before deducting placement agent fees and offering

expenses.

As of June 30, 2024, Outlook Therapeutics had

cash and cash equivalents of $32.0 million.

Conference Call and Webcast

Outlook Therapeutics management will host its

quarterly conference call and live audio webcast for investors,

analysts, and other interested parties on Wednesday, August 14,

2024 at 8:30 AM ET.

Interested participants and investors may access

the conference call by dialing (877) 407-8291 (domestic) or (201)

689-8345 (international) and referencing the Outlook Therapeutics

Conference Call. The live webcast will be accessible on the Events

page of the Investors section of the Outlook Therapeutics website,

outlooktherapeutics.com, and will be archived for

90 days.

——————————————1 Adjusted net loss attributable

to common stockholders and adjusted net loss attributable to common

stockholders per share of common stock – basic and diluted are

non-GAAP financial measures. See “Non-GAAP Financial Measures”

below.

About ONS-5010 / LYTENAVA™

(bevacizumab-vikg, bevacizumab gamma)

ONS-5010/LYTENAVA™ is an ophthalmic formulation

of bevacizumab for the treatment of wet AMD. LYTENAVA™ (bevacizumab

gamma) is the subject of a centralized Marketing Authorization

granted by the European Commission in the European Union (EU) and

Marketing Authorization granted by the Medicines and Healthcare

products Regulatory Agency (MHRA) in the United Kingdom (UK) for

the treatment of wet age-related macular degeneration (wet

AMD).

In the United States, ONS-5010/LYTENAVA™

(bevacizumab-vikg) is investigational and is being evaluated in an

ongoing non-inferiority study for the treatment of wet AMD.

Bevacizumab-vikg (bevacizumab gamma in the EU

and UK) is a recombinant humanized monoclonal antibody (mAb) that

selectively binds with high affinity to all isoforms of human

vascular endothelial growth factor (VEGF) and neutralizes VEGF’s

biologic activity through a steric blocking of the binding of VEGF

to its receptors Flt-1 (VEGFR-1) and KDR (VEGFR-2) on the surface

of endothelial cells. Following intravitreal injection, the binding

of bevacizumab to VEGF prevents the interaction of VEGF with its

receptors on the surface of endothelial cells, reducing endothelial

cell proliferation, vascular leakage, and new blood vessel

formation in the retina.

About Outlook Therapeutics,

Inc.

Outlook Therapeutics is a biopharmaceutical

company focused on the development and commercialization of

ONS-5010/LYTENAVA™ (bevacizumab-vikg; bevacizumab gamma), for the

treatment of retina diseases, including wet AMD. LYTENAVA™

(bevacizumab gamma) is the first ophthalmic formulation of

bevacizumab to receive European Commission and MHRA Marketing

Authorization for the treatment of wet AMD. Outlook Therapeutics is

working to initiate its commercial launch of LYTENAVA™ (bevacizumab

gamma) in the EU and the UK as a treatment for wet AMD, expected in

the first half of calendar 2025. In the United States,

ONS-5010/LYTENAVA™ is investigational, is being evaluated in an

ongoing non-inferiority study for the treatment of wet AMD, and if

successful, the data may be sufficient for Outlook to resubmit a

BLA application to the FDA in the United States. If approved in the

United States, ONS-5010/LYTENAVA™, would be the first approved

ophthalmic formulation of bevacizumab for use in retinal

indications, including wet AMD.

Non-GAAP Financial Measures

Outlook Therapeutics prepares its consolidated

financial statements in conformity with accounting principles

generally accepted in the United States of America (U.S. GAAP) and

pursuant to accounting requirements of the Securities and Exchange

Commission (SEC). In an effort to provide investors with additional

information regarding the results and to provide a meaningful

period-over-period comparison of Outlook Therapeutics’ financial

performance, Outlook Therapeutics sometimes uses non-U.S. GAAP

financial measures (NGFM) as defined by the SEC. In this press

release, Outlook Therapeutics uses “adjusted net loss attributable

to common stockholders,” which is defined as net loss attributable

to common stockholders excluding warrant related expenses (i.e.,

the excess of the fair value of the warrants upon issuance over the

proceeds of the private placements that closed on March 18, 2024

and April 15, 2024) and changes in fair value of warrants and

convertible promissory notes, as well as “adjusted net loss

attributable to common stockholders per share of common stock –

basic and diluted,” which is defined as net loss attributable to

common stockholders per share of common stock – basic and diluted

excluding warrant related expenses and changes in fair value of

warrants and convertible promissory notes. Management uses these

NGFMs because they adjust for certain non-cash items that impact

financial results but not cash flows and that management believes

are not related to its core business. Management uses these NGFMs

to evaluate Outlook Therapeutics’ financial performance against

internal budgets and targets. Management believes that these NGFMs

are useful for evaluating Outlook Therapeutics’ core operating

results and facilitating comparison across reporting periods.

Outlook Therapeutics believes these NGFMs should be considered in

addition to, and not in lieu of, GAAP financial measures. Outlook

Therapeutics’ NGFMs may be different from the same NGFMs used by

other companies. Reconciliations to the closest U.S. GAAP financial

measures are provided in the tables below.

Forward-Looking Statements

This press release contains forward-looking

statements. All statements other than statements of historical

facts are “forward-looking statements,” including those relating to

future events. In some cases, you can identify forward-looking

statements by terminology such as “anticipate,” “believe,”

“continue,” “expect,” “may,” “plan,” “potential,” “target,” “will,”

or “would” the negative of terms like these or other comparable

terminology, and other words or terms of similar meaning. These

include, among others, expectations concerning decisions of

regulatory bodies and the timing thereof, expectations concerning

Outlook Therapeutics’ ability to remediate or otherwise resolve

deficiencies identified in the CRL issued by the FDA, including

with respect to an additional clinical trial and CMC issues,

expectations concerning NORSE EIGHT enrollment, the timing for

completion of NORSE EIGHT and resubmission of the BLA for ONS-5010,

plans for commercial launch of ONS-5010 in the UK and EU and the

timing thereof, including the potential to launch with a partner,

ONS-5010’s potential as the first and only European Commission,

MHRA or FDA-approved ophthalmic formulation of bevacizumab for use

in treating retinal diseases in the EU, UK, and United States, the

expected proceeds from the full exercise of warrants issued in

recent private placement transactions, expectations concerning the

relationship with Cencora and the benefits and potential expansion

thereof, and other statements that are not historical fact.

Although Outlook Therapeutics believes that it has a

reasonable basis for the forward-looking statements contained

herein, they are based on current expectations about future events

affecting Outlook Therapeutics and are subject to risks,

uncertainties and factors relating to its operations and business

environment, all of which are difficult to predict and many of

which are beyond its control. These risk factors include those

risks associated with developing and commercializing pharmaceutical

product candidates, risks of conducting clinical trials and risks

in obtaining necessary regulatory approvals, the content and timing

of decisions by regulatory bodies, the sufficiency of Outlook

Therapeutics’ resources, as well as those risks detailed in Outlook

Therapeutics’ filings with the Securities and Exchange

Commission (the SEC), including the Annual Report on Form

10-K for the fiscal year ended September 30, 2023, filed with

the SEC on December 22, 2023, and future quarterly

reports Outlook Therapeutics files with the SEC,

which include uncertainty of market conditions and future impacts

related to macroeconomic factors, including as a result of the

ongoing overseas conflicts, high interest rates, inflation and

potential future bank failures on the global business environment.

These risks may cause actual results to differ materially from

those expressed or implied by forward-looking statements in this

press release. All forward-looking statements included in this

press release are expressly qualified in their entirety by the

foregoing cautionary statements. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date hereof. Outlook Therapeutics does not

undertake any obligation to update, amend or clarify these

forward-looking statements whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities law.

Investor

Inquiries: Jenene

ThomasChief Executive OfficerJTC Team, LLCT:

833.475.8247 OTLK@jtcir.com

|

Outlook Therapeutics, Inc. |

|

|

Consolidated Statements of Operations |

|

|

(Amounts in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

Nine months ended June 30, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

11,202 |

|

|

$ |

11,101 |

|

|

$ |

29,240 |

|

|

$ |

21,509 |

|

|

|

General and administrative |

|

8,361 |

|

|

|

7,040 |

|

|

|

19,586 |

|

|

|

19,158 |

|

|

|

|

|

|

|

19,563 |

|

|

|

18,141 |

|

- |

|

48,826 |

|

- |

|

40,667 |

|

|

|

Loss from operations |

|

|

(19,563 |

) |

|

|

(18,141 |

) |

|

|

(48,826 |

) |

|

|

(40,667 |

) |

|

|

Income on equity method investment |

|

57 |

|

|

|

7 |

|

|

|

85 |

|

|

|

2 |

|

|

|

Interest income |

|

|

(404 |

) |

|

|

(395 |

) |

|

|

(666 |

) |

|

|

(665 |

) |

|

|

Interest expense |

|

|

— |

|

|

— |

|

|

3,157 |

|

|

|

2,531 |

|

|

|

Loss on extinguishment of debt |

|

— |

|

|

— |

|

|

— |

|

|

578 |

|

|

|

Change in fair value of promissory notes |

|

(7,563 |

) |

|

|

2,910 |

|

|

|

1,949 |

|

|

|

2,913 |

|

|

|

Warrant related expenses |

|

3,392 |

|

|

|

— |

|

|

37,490 |

|

|

|

— |

|

|

Change in fair value of warrant liability |

|

(59,454 |

) |

|

|

12 |

|

|

|

(9,786 |

) |

|

|

(37 |

) |

|

|

Loss before income taxes |

|

44,409 |

|

|

|

(20,675 |

) |

|

|

(81,055 |

) |

|

|

(45,989 |

) |

|

|

Income tax expense |

|

|

— |

|

|

— |

|

|

3 |

|

|

|

3 |

|

|

|

Net loss attributable to common stockholders |

$ |

44,409 |

|

|

$ |

(20,675 |

) |

|

$ |

(81,058 |

) |

|

$ |

(45,992 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share of common stock, basic |

$ |

1.91 |

|

|

$ |

(1.61 |

) |

|

$ |

(4.82 |

) |

|

$ |

(3.73 |

) |

|

|

Net loss per share of common stock, diluted |

$ |

(0.89 |

) |

|

$ |

(1.61 |

) |

|

$ |

(4.82 |

) |

|

$ |

(3.73 |

) |

|

|

Weighted average shares outstanding, basic |

|

23,227 |

|

|

|

12,844 |

|

|

|

16,823 |

|

|

|

12,344 |

|

|

|

Weighted average shares outstanding, diluted |

|

25,476 |

|

|

|

12,844 |

|

|

|

16,823 |

|

|

|

12,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheet Data |

|

(Amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

September 30, 2023 |

|

Cash and cash equivalents |

|

|

|

$ |

32,024 |

|

|

$ |

23,392 |

|

|

Total assets |

|

|

|

|

$ |

47,092 |

|

|

$ |

32,301 |

|

|

Current liabilities |

|

|

|

$ |

42,554 |

|

|

$ |

46,732 |

|

|

Total stockholders' deficit |

|

|

|

$ |

(83,673 |

) |

|

$ |

(14,438 |

) |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation Between Reported Net Income (Loss) (GAAP)

and Adjusted Net (Loss) (Non-GAAP), in each case |

|

|

|

Attributable to Common Stockholders |

|

|

|

(Amounts in thousands, except per share data) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended June 30, |

|

Nine months ended June 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

Net income (loss) attributable to common stockholders, as

reported (GAAP) |

$ |

44,409 |

|

$ |

(20,675 |

) |

$ |

(81,058 |

) |

$ |

(45,992 |

) |

|

|

Adjustments for reconciled items: |

|

|

|

|

|

|

|

|

|

| |

Warrant related expenses |

|

3,392 |

|

|

- |

|

|

37,490 |

|

|

- |

|

|

| |

Change in fair value of warrant liability |

|

(59,454 |

) |

|

12 |

|

|

(9,786 |

) |

|

(37 |

) |

|

| |

Change in fair value of promissory notes |

|

(7,563 |

) |

|

2,910 |

|

|

1,949 |

|

|

2,913 |

|

|

|

Adjusted net income (loss) attributable to common

stockholders (non-GAAP) |

$ |

(19,216 |

) |

$ |

(17,753 |

) |

$ |

(51,405 |

) |

$ |

(43,116 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders per

share of common stock - basic as reported (GAAP) |

$ |

1.91 |

|

$ |

(1.61 |

) |

$ |

(4.82 |

) |

$ |

(3.73 |

) |

|

|

Adjustments for reconciled items: |

|

|

|

|

|

|

|

|

|

| |

Warrant related expenses |

|

0.15 |

|

|

- |

|

|

2.23 |

|

|

- |

|

|

| |

Change in fair value of warrant liability |

|

(2.56 |

) |

|

- |

|

|

(0.58 |

) |

|

- |

|

|

| |

Change in fair value of promissory notes |

|

(0.33 |

) |

|

0.23 |

|

|

0.12 |

|

|

0.24 |

|

|

|

Adjusted net loss attributable to common stockholders per

share of common stock - basic (non-GAAP) |

$ |

(0.83 |

) |

$ |

(1.38 |

) |

$ |

(3.05 |

) |

$ |

(3.49 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders per share of

common stock - diluted as reported (GAAP) |

$ |

(0.89 |

) |

$ |

(1.61 |

) |

$ |

(4.82 |

) |

$ |

(3.73 |

) |

|

|

Adjustments for reconciled items: |

|

|

|

|

|

|

|

|

|

| |

Warrant related expenses |

|

0.15 |

|

|

- |

|

|

2.23 |

|

|

- |

|

|

| |

Change in fair value of warrant liability |

|

(0.06 |

) |

|

- |

|

|

(0.58 |

) |

|

- |

|

|

| |

Change in fair value of promissory notes |

|

(0.03 |

) |

|

0.23 |

|

|

0.12 |

|

|

0.24 |

|

|

|

Adjusted net loss attributable to common stockholders per

share of common stock - diluted (non-GAAP) |

$ |

(0.83 |

) |

$ |

(1.38 |

) |

$ |

(3.05 |

) |

$ |

(3.49 |

) |

|

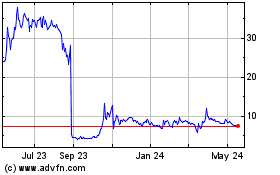

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Nov 2024 to Dec 2024

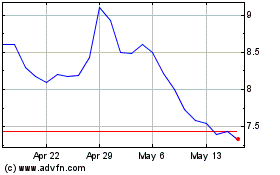

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Dec 2023 to Dec 2024